Press Release

West Red Lake Gold Bulk Sample Program Produced Gold worth CAD $11.7 million

Delivering tonnes and grade from the mine that align almost exactly with expectations validates all the work WRLG has done to unlock the tremendous value in the Madsen Mine.

Canada, 8th May 2025 – Sponsored content disseminated on behalf of West Red Lake Gold. On May 7, 2025, West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) published reconciliation results from the bulk sample program at its 100% owned Madsen Mine located in the Red Lake Gold District of Northwestern Ontario, Canada.

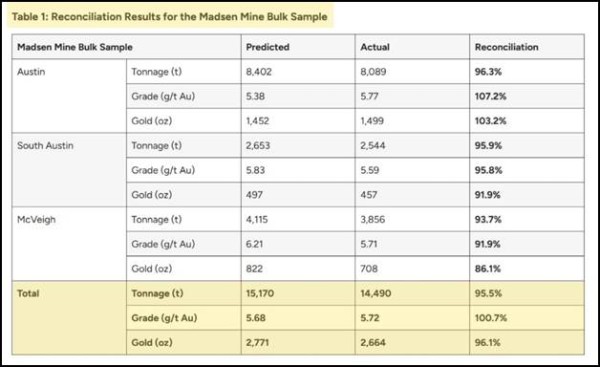

WRLG bulk sampled 14,490 tonnes of ore @ 5.72 grams/tonne Gold, generating 2,498 ounces of gold worth CAD $11.7 million at CAD $4,700/ounce. The Madsen Mill has a permitted throughput of 800 tonnes/day.

West Red Lake Gold is one of only four single-asset companies putting a new gold mine into production in 2025.

West Red Lake Gold Bulk Sampling Highlights:

- The bulk sample carried an average grade of 5.72 grams per tonne (“g/t”) gold (“Au”), 0.7% above the average predicted grade of 5.68 g/t Au for six stopes across three areas.

- 14,490 tonnes of bulk sample produced 2,498 ounces of gold

- Gold recovery in the Madsen Mill averaged 95%

“Delivering tonnes and grade from the mine that align almost exactly with expectations validates all the work we have done to unlock the tremendous value in the Madsen Mine,” stated Shane Williams, President and CEO, in the May 7, 2025 press release.

“This achievement underlines that Madsen is on track to become a new high-grade gold mine in 2025.”

In the May 7, 2025 video below, WRLG explains why “West Red Lake Gold is Ready to Perform and Built for Today’s Gold Bull Market.”

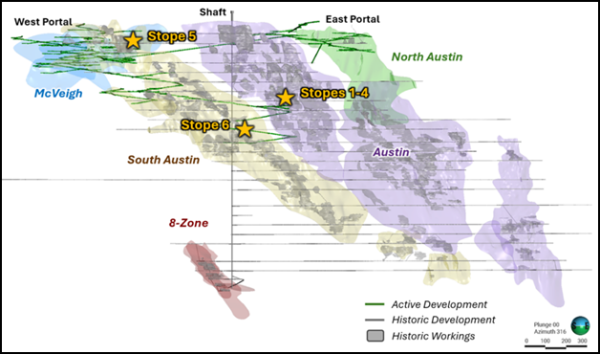

The bulk sample included material from three main resource zones at Madsen – Austin, South Austin, and McVeigh.

Close reconciliation between predicted and actual grades and tonnages highlights the effectiveness of definition drilling and detailed stope design in informing accurate modelling of gold mineralization.

West Red Lake Gold has completed over 90,000 metres of definition drilling since October 2023, and the high-confidence tonnes resulting from this ongoing program currently make up approximately 90% of the 18-month detailed mine plan.

Six stopes were drilled, engineered, and mined using the same workflow that the Company plans to implement during regular mine operations at Madsen.

“We design stopes to maximize economic benefit in today’s gold price environment. This differs from the Pre-Feasibility Study (“PFS”), which used a gold price of US$1,680 per ounce when designing stopes,” stated Williams.

“Using a gold price just below the long-term consensus gold price of US$2,350 per oz. unlocks significant opportunity at Madsen because, in many areas, a halo of lower-grade mineralization can be profitable to include in the stope design when it surrounds targeted high-grade tonnes.”

“In addition, mining larger stopes can lower mining costs by enabling long-hole stoping instead of cut-and-fill methods. We used long-hole stoping exclusively in the bulk sample.

We are excited by the opportunity to mine additional tonnes and ounces at Madsen, potentially lowering operational costs, increasing production, and enhancing overall economics relative to the PFS mine plan,” stated Williams in the May 7, 2025 press release.

“In a note published on Wednesday, the precious metals team [at Bank of America] led by Michael Widmer said it sees growing potential for gold to hit $4,000 an ounce in the second half of this year,” reported Kitco News.

“In March, Widmer and his team predicted that gold prices would hit $3,500 by 2027—a target the precious metal reached in less than a month.”

“In the commodities market, timing is critical. I’m betting current macro trends will boost the value of gold,” wrote WRLG Co-Founder, Major Shareholder, Strategic Advisor Frank Giustra in 2024.

Giustra was instrumental in the development and growth of several significant gold producers. Gold Corp (Wheaton River) grew from US $17 million to a $21.8 billion market capitalization in a little over five years. Endeavour Mining grew from $180 million to $8 billion in under 7 years.

“It begins with one well-executed mine acquisition, like we are proving with Madsen. It expands through smart deals and leadership,” added Giustra.

“We acquired Madsen because we believed an accurate geological model, detailed engineering design, and disciplined mining practices would enable exactly this – a mine that delivers to plan. I am extremely pleased to deliver these bulk sample results, and I look forward to ramping up operations at the Madsen Mine in the coming months,” stated Williams.

The Madsen deposits presently host an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [1 .] [2.] [3.]

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for technical disclosure at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events.

References:

- “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada”, prepared by SRK Consulting (Canada) Inc. and dated January 7, 2025 (the “Madsen Report ”). A full copy of the Madsen Report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- The Madsen Mine deposit presently hosts a National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) Indicated resource of 1.65 million ounces (“Moz”) of gold grading 7.4 g/t Au and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t Au. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US$1,800/oz. Mineral resources as stated are inclusive of mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the updated report. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- The Madsen Mine also contains Probable reserves of 478 thousand ounces (“koz”) of gold grading 8.16 g/t Au. Mineral reserve estimates are based on a gold price of US$1,680/oz. Please refer to the technical report “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada” available on the Company’s website and on SEDAR+ at www.sedarplus.ca

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:27481

The post West Red Lake Gold Bulk Sample Program Produced Gold worth CAD $11.7 million appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Jack Botanicals Sets New Industry Standard with Premium Quality Kratom and Best Kratom Vendor

Las Vegas, NV, 6 Dec 2025, ZEX PR WIRE, Jack Botanicals, a premier kratom vendor serving over 60,000 enthusiasts worldwide, continues to distinguish itself as an industry leader through its unwavering commitment to quality, transparency, and exceptional customer experience.

Quality That Speaks for Itself

Jack Botanicals maintains rigorous third-party lab testing for all products to ensure potency, purity, and safety. The company follows Good Manufacturing Practice (GMP) guidelines, setting a benchmark that few competitors can match.

“We don’t just sell kratom—we deliver a promise of consistency and quality with every order,” said Eric Larson, CEO of Jack Botanicals. “Our customers deserve nothing less than products they can trust, backed by transparent testing and ethical sourcing practices.”

Comprehensive Product Selection

Jack Botanicals offers an extensive catalog of over 45 kratom varieties spanning multiple categories:

Premium Kratom Powders – Including Green, Red, White, Yellow, and Gold vein varieties sourced directly from Southeast Asian farmers, with prices starting at just $39

Convenient Capsules – Pre-measured dosages for on-the-go convenience without the mess of loose powder

Specialty Strains – Including popular options like Maeng Da, Bali, and Borneo, each carefully selected for unique characteristics

All products undergo multiple rounds of testing for heavy metals, microbes, and alkaloid content, ensuring customers receive only the purest, most potent kratom available.

Lightning-Fast Shipping and Customer-Centric Service

What truly sets Jack Botanicals apart is its operational excellence. Most orders arrive within one to three business days, with same-day shipping available. All packages are shipped discreetly to ensure customer privacy.

Customer testimonials consistently highlight the company’s responsive support team, with many noting response times under one hour. The personalized, human-based customer service approach has earned the trust of thousands of repeat customers.

Risk-Free Shopping Experience

Demonstrating confidence in product quality, Jack Botanicals offers a hassle-free 30-day money-back guarantee, provided 75% of the product remains. This customer-first policy allows buyers to shop with complete confidence.

New customers can take advantage of a special offer using promo code JACK30 for 30% off their first order.

Commitment to Sustainability and Ethics

Jack Botanicals prioritizes sustainable sourcing practices and maintains direct relationships with Southeast Asian farmers. The company’s enhanced packaging uses airtight, moisture-resistant containers that preserve freshness while minimizing environmental impact.

“We believe in doing business the right way—treating our customers, our suppliers, and the environment with respect,” Larson added. “That’s what makes Jack Botanicals different.”

About Jack Botanicals

Based in Las Vegas, Nevada, Jack Botanicals is a trusted source for premium kratom products dedicated to enhancing natural wellness and balance. The company carefully sources and rigorously tests its kratom to ensure purity, potency, and consistency, providing customers with reliable options for their wellbeing needs. Committed to transparency and sustainable practices, Jack Botanicals offers a range of kratom strains to support diverse wellness goals.

Contact Information

Eric Larson

CEO, Jack Botanicals

Website: https://jackbotanicals.com

Note: The United States Food and Drug Administration (FDA) has not evaluated kratom products. Customers should verify the legal status of kratom in their state before purchasing or using this product.

Contact:

For inquiries, product samples, or interview requests:

social@jackbotanicals.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

The Attic Insulation Specialists Inc. Expands Full-Service Home Energy and Safety Solutions Across Southern California

United States, 6th Dec 2025 – Homeowners across Los Angeles, Orange, Ventura, Riverside, and San Bernardino Counties now have access to a complete solution for attic insulation, crawl space cleaning, mold remediation, and home energy efficiency through The Attic Insulation Specialists Inc. With decades of combined service experience, the company continues to set the standard for residential home performance, safety, and energy savings in Southern California.

As licensed, bonded, and insured experts, The Attic Insulation Specialists provide a full range of professional services designed to protect homes, improve indoor air quality, and increase long-term energy efficiency. Their offerings include attic insulation installation and removal, radiant barrier insulation, crawl space cleaning and waterproofing, HVAC ductwork services, mold remediation, rodent proofing, ventilation solutions, disaster recovery cleaning, and drill-and-fill wall insulation.

“Our mission is to provide long-lasting solutions that improve the safety, comfort, and energy efficiency of every home we work on,” said Sergey Or, RMO at The Attic Insulation Specialists Inc. “By combining high-grade materials, expert craftsmanship, and code-compliant practices, we deliver results homeowners can depend on for years.”

Proper insulation is one of the most effective ways to reduce energy costs and maintain indoor comfort. The company installs top-quality insulation materials that prevent heat loss, reduce moisture buildup, and protect against rodent damage. Their crawl space services—including vapor barriers, waterproofing, and dehumidifier installation—address moisture, mold, and structural concerns that commonly affect Southern California homes.

The company’s mold remediation services eliminate harmful spores and restore safe indoor air quality, while their attic and roof ventilation systems reduce condensation, lower energy usage, and prevent mold growth. Homeowners experiencing fire, smoke, or environmental damage rely on their deep cleaning and disaster recovery services for fast, thorough restoration.

Every project is completed under direct supervision of a Licensed Contractor and RMO, ensuring compliance with all California state laws and building codes. The Attic Insulation Specialists have earned the trust of more than 28,900 households and received over 1,500 positive reviews, reflecting an unwavering commitment to customer satisfaction.

Homeowners also benefit from a 10-year service warranty and lifetime insulation warranty, reinforcing the company’s dedication to long-term value, durability, and performance.

Why Homeowners Across Southern California Choose The Attic Insulation Specialists

- Experienced Experts with decades of combined knowledge in attic and crawl space solutions

- Comprehensive Protection: Insulation, ventilation, rodent control, mold remediation, and more

- Licensed, Bonded & Insured for complete homeowner peace of mind

- Code-Compliant Work meeting all California state requirements

- Fast & Reliable Local Service across Los Angeles, Orange, Ventura, Riverside & San Bernardino Counties

- Long-Term Warranties ensuring unmatched value and reliability

“We treat every home like our own,” said RMO Sergey Or. “Our goal is to create safer, cleaner, more energy-efficient environments for families throughout Southern California.”

Homeowners looking to improve home comfort, efficiency, and protection can contact The Attic Insulation Specialists today at 800-778-3765 or visit www.theatticspecialist.com to schedule a free inspection with a Licensed Contractor.

About The Attic Insulation Specialists Inc.

Based in Los Angeles, CA, The Attic Insulation Specialists Inc. is a leading insulation and home performance company serving Los Angeles, Orange, Ventura, Riverside, and San Bernardino Counties. Offering attic insulation, crawl space services, mold remediation, ventilation solutions, rodent proofing, and more, the company is dedicated to providing safe, efficient, and durable home improvement services backed by expert supervision and state-compliant standards.

Contact:

RMO

The Attic Insulation Specialists

Tel: 800-778-3765 | 213-258-0354

Email: theatticspecialist@gmail.com

Website: www.theatticspecialist.com

Media Contact

Organization: The Attic Insulation Specialists

Contact Person: RMO

Website: http://www.theatticspecialist.com/

Email: Send Email

Country:United States

Release id:38646

The post The Attic Insulation Specialists Inc. Expands Full-Service Home Energy and Safety Solutions Across Southern California appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

NUICC Launches South India Regional Chamber in Bengaluru to Propel U.S.–India Trade and Innovation

Celebrating 20 Years of Fostering Economic Ties, the Chamber Targets the Dynamic Tech and Industrial Hub of South India

Denver, Denver, United States, 6th Dec 2025 – The National U.S.–India Chamber of Commerce (NUICC) today announced the inauguration of its South India Regional Chamber in Bengaluru, a strategic expansion designed to deepen economic collaboration between the United States and India’s vibrant southern states. The launch event, held on December 3, 2025, marks a pivotal milestone in NUICC’s 20th-anniversary year, underscoring its commitment to fostering bilateral trade, investment, and innovation.

The new chamber will serve as a dedicated hub for businesses, entrepreneurs, and thought leaders across Karnataka, Tamil Nadu, Telangana, Kerala, and Andhra Pradesh. It aims to leverage South India’s renowned strengths in technology, R&D, aerospace, biotechnology, renewable energy, and advanced manufacturing to create new pathways for U.S.–India commercial partnerships.

“For two decades, NUICC has been at the forefront of building bridges between the world’s largest economies,” said Dr Purnima Voria, Founder & CEO of NUICC. “The inauguration of our South India Regional Chamber in Bengaluru—the ‘Silicon Valley of India’—is a natural and strategic evolution. This region is a powerhouse of innovation and entrepreneurship, and we are here to connect its dynamism with opportunities across the United States, driving growth and shared prosperity.”

The launch event featured keynote addresses from senior government officials from India and the United States, alongside leaders from global corporations and pioneering startups. Panel discussions focused on critical themes such as “Semiconductors and Supply Chain Resilience,” “Cross-Border Venture Capital in Deep Tech,” and “Sustainable Infrastructure and Clean Energy Partnerships.”

Key Objectives of the South India Regional Chamber Include:

- Facilitating Market Access: Providing U.S. companies with on-the-ground intelligence and networks to navigate and thrive in South India’s diverse markets, and vice versa.

- Accelerating Innovation: Creating a collaborative ecosystem where U.S. and Indian tech firms, research institutions, and startups can co-develop solutions for global challenges.

- Advocating for Policy: Engaging with stakeholders at the state and national levels to promote a conducive regulatory environment for trade and investment.

- Building Sector-Specific Alliances: Developing focused initiatives in priority sectors such as IT/ITeS, aerospace & defence, fintech, healthcare, and smart infrastructure.

- Nurturing Leadership: Offering executive programs and networking forums to strengthen people-to-people ties and cultivate the next generation of business leaders.

“Bengaluru is not just a location; it’s a statement of intent,” said Dr Purnima Voria. “Our chamber will be proactive, project-driven, and results-oriented. We are excited to work hand-in-hand with the local business community to turn potential into tangible projects and partnerships.”

The launch coincides with NUICC’s year-long 20th-anniversary observance, which highlights two decades of achievements in strengthening the U.S.–India economic corridor. The establishment of the South India Chamber is seen as a cornerstone for the organisation’s next decade of growth.

About the National U.S.–India Chamber of Commerce (NUICC):

Founded in 2005, the National U.S.–India Chamber of Commerce (NUICC) is a premier non-profit business advocacy organisation dedicated to enhancing bilateral trade, investment, and commercial relations between the United States and India. With chapters across the United States and now in India, NUICC provides its members with policy advocacy, strategic insights, business matchmaking, and a powerful network to succeed in both markets.

Media Contact

Organization: NUICC

Contact Person: Satish Kumar Seena

Website: https://nuicc.org/

Email: Send Email

Contact Number: +13033253094

Address:1099 17th St, Suite 2150, Denver,

Address 2: CO 80202 United States

City: Denver

State: Denver

Country:United States

Release id:38606

The post NUICC Launches South India Regional Chamber in Bengaluru to Propel U.S.–India Trade and Innovation appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release7 days ago

New Digital Philanthropy Initiative Launched at Asia Philanthropy Forum in Boao

-

Press Release6 days ago

Global Manufacturing Innovation Forum 2025 and Saudi–Dongguan Businesses Announced 17 Billion SAR Collaboration

-

Press Release6 days ago

Lumixus Canada Securities Ltd Officially Launched: Becomes Group’s North American Investment Management and Research Headquarters with $10 Million CAD Registered Capital

-

Press Release2 days ago

Author of Journey to Forever Meets with Film Producer to Discuss Screen Potential

-

Press Release7 days ago

Gastro Center of Maryland Expands Footprint, Bringing Expert Digestive Care to More Communities Across the DMV

-

Press Release2 days ago

The Attic Insulation Specialists Inc. Expands Full-Service Home Energy and Safety Solutions Across Southern California

-

Press Release3 days ago

Operational Police Protective Services Introduces Elite Security Solutions for High-Profile Corporate and Entertainment Events

-

Press Release3 days ago

Bougainville Launches Offshore Gaming and Financial Authorities