Press Release

MetaPay-Open the Era of Meta Payment

Since the birth of mankind, we seem to have never experienced lasting peace and prosperity. We have tried our best to build one civilization after another, but because of lack of trust and coordination, it always disappeared immediately. In the evolution of the universe, humans have walked for millions of years, but even though they have faced countless difficulties together, they still cannot understand each other in the end.

Just when we were about to lose confidence, the emergence of blockchain relighted our hopes. The greatness of decentralized consensus is that code is more reliable than human nature, and “Code is Law” can last the development of civilization. Decentralization allows independent thoughts to shine like stars, and at the same time allows trillions of individuals to reach a commendable consensus on the identification of rules and trends, and enable the collaboration between humans to reach an unprecedented height and breadth.

In the collaboration between many humans, MetaPay shines with the brightest light, guiding us towards eternity.

Why is MetaPay followed by the public?

We know that the existing global payment system relies on the establishment of various centralized governments, central banks and some third-party payment institutions. There seems to be no problem with the existing payment system, it has very fatal flaws.

Firstly, the fully centralized governance system makes the system very easy to be attacked by hackers, and once it is attacked, it will cause catastrophic consequences. Secondly, the high transfer fees and management fees have seriously harmed the interests of users. Thirdly, when it comes to cross-border transfers and payments, the speed and efficiency will be greatly reduced, which is not conducive to the development of commercial trade.

Based on these market pain points, the founding team of MetaPay put forward the idea of meta-financial payment.

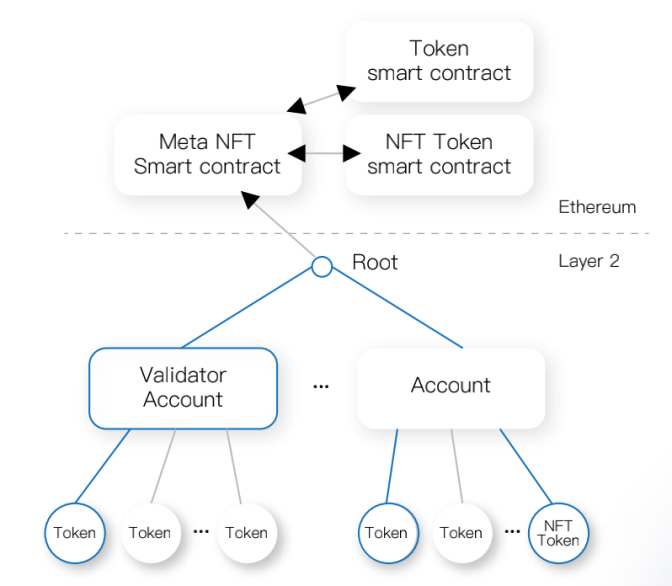

Meta Finance, derived from Metaverse, is committed to the construction of virtual and real payment infrastructure,is a safe and efficient Meta financial payment ecosystem based on the Ethereum Layer 2 expansion protocol developed by genius blockchain technology geeks. The main direction is cross-chain payment and ecological construction of virtual assets, including decentralized payment , pledge, liquidity mining, NFT aggregator, etc.

The reason why MetaPay can carry the efficient and complicated payment requirements is because of its strong cryptographic algorithm. It uses the discrete logarithm encryption and elliptic curve encryption which are commonly used in modern public key crypto systems. At the same time, it uses the non-interactive zk-SNARKs zero-knowledge proof system to completely address the issue of transactions being traced to expose user privacy.

MetaPay adopts the Layer 2 technology based on Ethereum, and achieves a flash payment experience comparable to Internet products through expansion of the off-chain channel. In addition to the extremely fast payment experience, there is no handling fee in the off-chain channel, which effectively solves the problems of slow speed and high gas fee of the Ethereum.

It is mainly achieved through the following three aspects:

Two-way payment channel

Two participants create a ledger entry on the blockchain, which requires the two participants to sign any fund expenditures. Both parties create transactions that return ledger entries to their respective allocations, but do not broadcast them to the blockchain. They can update the personal distribution of ledger entries by creating many transaction expenditures from the current ledger entry output. Only the latest version is valid, which is enforced by smart contract scripts that can be analyzed by the blockchain. By broadcasting the latest version to the blockchain, any party can close the entry at any time without any trust or custody.

Lightning Network

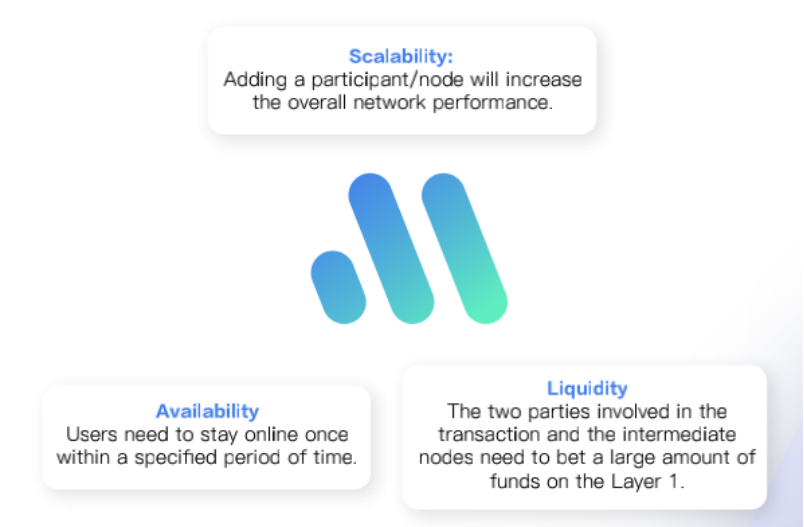

By creating a network of two-party ledger entries, you can find a path across the network, similar to routing data packets on the Internet. The nodes on the path are not trusted because the payment is executed through a script that enforces atomicity (the entire payment succeeds or fails) by decrementing the time lock. In order to expand Lightning Network in Layer 2, MetaPay incorporates two basic protocols, RSMC (Revocable Sequential Maturity Contract) and HTLC (Hash Clocked Contract) in the transaction verification process of the underlying protocol which is to build the Fund pool on Layer 2 and the establishment of payment channels.

The Lightning Network on Layer 2 has many advantages. The first is instant determinism. As long as the signatures of all parties pass the status update, the status will be “confirmed” without waiting for block confirmation on the blockchain; Secondly, The status update is off-chain, and peer-to-peer communication can guarantee privacy. Only the final status will be submitted to the blockchain. Finally, there is a low gas fee. The Lightning Network only needs to settle and clear the fees on the blockchain when the channel is opened and closed. At other times, no matter how the two parties update in the channel, the transaction is free.

Blockchain arbitration mechanism

It is possible to conduct transactions outside the blockchain without restrictions. It is also possible to conduct off-chain transactions with the confidence that it is executable on the blockchain. This is similar to the way one person enters into many legal contracts with others, but there is no arbitration every time a contract is signed. By making transactions and scripts parseable, smart contracts can be executed on the blockchain. Only in the case of non-cooperation, arbitration will be intervened. But for blockchain, the result is certain.

There is no doubt that the technical team of MetaPay understands the pain points of the current market very well. Through the above three points, MetaPay can completely break the congestion of existing Ethereum network transactions and achieve the best transaction speed in the entire network.

The MetaPay system with advantages such as instant payment, high scalability, low cost and cross-chain will help mankind get rid of the shackles of the existing payment system and realize the ultimate dream of payment freedom.

If you think MetaPay’s planning stops at payment, then you are wrong. After completes the payment infrastructure, it will use Meta NFT as the starting point to fully deploy the metaverse ecology.

Let’s first look at the layout of Meta NFT. It aims to build the world’s largest NFT asset and financial derivatives trading platform with the richest ecology and the strongest technical strength.

Therefore, Meta NFT is integrating more than 100 animation IP and 1,000 global artists and collecting more than 5,000 contemporary artworks as a reserve. Users will be free to trade NFT assets including artwork and real estate in Meta NFT.

In addition to NFT asset trading, Meta NFT allows users to mint their custom NFT assets.

Users can directly create NFTs in Meta NFT Layer 2, and the changes in the state of the world in the system are similar to recharging NFTs. Web, Mobile App and API-based user interfaces to the Mint smart contract will be developed to make asset creation and management a simple process. The following parameters define a new custom asset:

Currently, MetaPay has completed the construction of the development team, the internal structure of the functional prototype, and is focusing on the development of the first version of MetaPay. Although the development work is still in progress, MetaPay has completed the internal angel round of fundraising and is in the process of private sales. At present, it has received preliminary investment intentions from global leading institutions such as CMS, AU21, DFG, NGC, Rarestone, LinkPad, etc.

As of press time, the MetaPay team is still intensively developing. It is believed that users will be able to directly use MetaPay and NFT asset trading shortly. We are very much to see it soon.

If you want to know lates news about MetaPay, please check following links:

MetaPay Twitter:https://twitter.com/Metapay1/

MetaPay Telegram:https://t.me/metapaygroup

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Funinexchange Brings Cricket Fans Closer to the Action as IPL 2026 Season Excitement Builds

Vadodara, Gujarat- As the excitement builds for the upcoming Indian Premier League season, cricket fans across India and around the world are preparing for weeks of high-intensity matches, thrilling finishes, and unforgettable performances.

The IPL has consistently delivered some of the most exciting moments in modern cricket. From explosive batting displays to nail-biting last-over finishes, the tournament creates an atmosphere that keeps fans glued to their screens. In such a high-energy cricket environment, online platforms such as funexchange and funinexchange allow fans to stay even more connected to the game while following match developments in real time.

The Growing Popularity of Cricket Exchange Platforms

In recent years, online cricket exchange platforms have seen a significant rise in popularity, particularly during major tournaments like IPL. Cricket lovers today seek more than just watching matches—they want to analyze team strategies, predict match outcomes, and engage with the sport on a deeper level.

This is where funinexchange stands out. The platform provides cricket enthusiasts with a streamlined and user-friendly interface designed specifically for sports engagement. Whether it’s predicting match outcomes, tracking team performances, or following live odds updates, funexchange creates an environment where fans can experience cricket in a more dynamic way.

Why IPL Season Drives Massive Online Engagement

The IPL is one of the most followed cricket tournaments in the world, bringing together international stars and domestic talents. Each match carries enormous excitement, and fan engagement peaks during the tournament.

Platforms like funinexchange benefit from this surge in cricket enthusiasm because fans are constantly searching for insights, predictions, and interactive experiences. The fast-paced nature of T20 cricket, combined with the unpredictability of the IPL format, creates the perfect environment for platforms that allow users to engage with match outcomes and strategies.

From opening matches to the final showdown, every IPL game brings fresh opportunities for cricket fans to test their understanding of the sport. With features designed for quick navigation and easy participation, funexchange aims to make the experience simple even for new users.

A Platform Designed for Modern Cricket Fans

One of the biggest strengths of funinexchange is its focus on accessibility and real-time engagement. The platform is built for cricket lovers who want quick access to match information, simple account setup, and smooth functionality across devices.

Users can easily create their funexchange ID and begin exploring the platform’s cricket-focused features. With the IPL season attracting massive viewership every year, having a reliable and responsive platform is crucial for fans who want to stay involved throughout the tournament.

The Future of Digital Cricket Engagement

As cricket continues to grow in the digital era, platforms like funinexchange are shaping how fans interact with the sport. The combination of live match excitement, strategic predictions, and interactive experiences ensures that cricket lovers remain deeply connected to every moment of the game.

With the upcoming IPL2026 season set to deliver another round of thrilling matches, funexchange is positioning itself as a platform where cricket fans can amplify their excitement

ngaged with the world’s most entertaining T20 league.

Company Information

Company: funinexchange

Contact Person: Alpa Ramson

Email: funexchange@yopmail.com

Website: https://funinexchange.vip/

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency, Casino investments carry risk, including total loss of capital. All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

A.M.A Selections Unveils Expanded 2026 Collection of Luxury Holiday Villas Across the French Riviera

From Saint-Tropez to Monaco, the luxury villa rental platform introduces its largest ever portfolio of private holiday homes on the Cote dAzur

Portugal, 13th Mar 2026 – A.M.A Selections, the luxury vacation rental company redefining private villa holidays across Europe and the Caribbean, has announced a significant expansion of its French Riviera portfolio for summer 2026. The curated collection now spans five of the most sought-after destinations on the Cote dAzur, giving discerning travellers unprecedented access to handpicked holiday villas in Saint-Tropez, Cannes, Antibes, and Monaco.

The French Riviera has been a magnet for luxury travellers for more than a century, and the region continues to set the standard for Mediterranean glamour. Recognising the growing demand for private, fully serviced accommodation over traditional five-star hotels, A.M.A Selections has invested heavily in sourcing exceptional holiday villas in the South of France that combine architectural character with contemporary comfort across every major destination on the coast.

Holiday Villas Saint-Tropez – Timeless Glamour Meets Private Luxury

The A.M.A Selections collection of holiday villas in Saint-Tropez features a carefully curated portfolio of private estates in and around the legendary Riviera town. Properties range from contemporary seafront retreats in Ramatuelle, within walking distance of the iconic Pampelonne beach, to restored Provençal bastides surrounded by private vineyards and Mediterranean gardens. Each villa is professionally managed and comes with access to A.M.A Selections’ dedicated concierge team, who can arrange everything from private yacht charters and helicopter transfers to Michelin-starred private chef experiences. Saint-Tropez remains the quintessential summer destination for those seeking a blend of celebrity culture, world-class dining, and the relaxed sophistication that defines the Riviera lifestyle.

Holiday Villas Cannes – Where Film Festival Glamour Meets Year-Round Elegance

For travellers drawn to the city synonymous with the world’s most prestigious film festival, A.M.A Selections offers an outstanding range of holiday villas in Cannes. The portfolio includes grand Belle Époque residences perched above La Croisette with panoramic views of the Mediterranean, as well as sleek modern properties in the surrounding hills of Super-Cannes and Mougins. Beyond the red carpet, Cannes offers a thriving cultural scene, Michelin-starred restaurants, and easy access to the charming hilltop village of Grasse, the perfume capital of the world. A.M.A Selections’ local knowledge ensures guests can experience the authentic Cote dAzur beyond the headlines, with personalised restaurant bookings, private tours, and bespoke excursions arranged through the in-house concierge service.

Holiday Villas Antibes – Old-World Charm and Coastal Sophistication

Situated between Cannes and Nice, the walled town of Antibes and the exclusive peninsula of Cap d’Antibes have attracted royalty, artists, and industrialists for generations. A.M.A Selections’ collection of holiday villas in Antibes encompasses properties ranging from intimate maisons de maître within the old town walls to sprawling waterfront estates on the Cap, many with private beach access and mature landscaped gardens. Antibes combines the authentic Provençal atmosphere of its daily market and medieval ramparts with the exclusive allure of Cap d’Antibes, home to the legendary Hotel du Cap-Eden-Roc. The town’s proximity to the Picasso Museum, Port Vauban – Europe’s largest marina – and the Juan-les-Pins jazz quarter makes it an exceptionally well-rounded destination for luxury villa guests.

Holiday Villas Monaco – The Pinnacle of Riviera Prestige

Completing the French Riviera collection, A.M.A Selections presents an exclusive selection of holiday villas in Monaco and the surrounding communes of Roquebrune-Cap-Martin and Beausoleil. Monaco represents the apex of Riviera luxury, and the properties in this collection reflect that standing – expect private terraces overlooking the Monte Carlo harbour, state-of-the-art wellness facilities, and proximity to the principality’s legendary casino, Grand Prix circuit, and haute couture boutiques. For guests seeking the ultimate in privacy and prestige, A.M.A Selections’ Monaco portfolio delivers an experience that rivals the finest hotels in the world, with the added freedom and exclusivity of a private residence.

The A.M.A Selections Difference

Every property listed on the A.M.A Selections platform is personally vetted to meet rigorous standards of quality, design, and service. Unlike mass-market booking platforms, A.M.A Selections operates a high-touch model in which each guest is assigned a dedicated concierge from the moment of booking through to departure. Services include pre-arrival planning, private chef arrangements, restaurant reservations, yacht and helicopter charters, spa treatments, and curated excursions – all tailored to the guest’s preferences.

The company’s proprietary platform and mobile app allow guests to browse properties, communicate with their concierge, manage itineraries, and share trip details with travel companions, combining the warmth of personal service with the convenience of modern technology.

“The French Riviera is where A.M.A Selections began, and it remains at the heart of everything we do. Our 2026 collection represents our deepest commitment yet to this extraordinary coastline – we’ve handpicked properties across Saint-Tropez, Cannes, Antibes, and Monaco that embody the very best of Riviera living. Our guests expect perfection, and we’re proud to deliver it.” – A.M.A Selections

About A.M.A Selections:

A.M.A Selections is a luxury vacation rental company offering a curated portfolio of private villas and chalets across more than 100 destinations in Europe, the Caribbean, and the United States. The company combines a rigorously vetted property collection with a dedicated concierge service and proprietary booking platform. A.M.A Selections operates across the French Riviera, Provence, Tuscany, Amalfi Coast, Puglia, Sardinia, Ibiza, Mallorca, Costa del Sol, Mykonos, the French Alps, St. Barts, Turks and Caicos, and California, among other destinations.

Media Contact

Organization: A.M.A Selections

Contact Person: A.M.A Selections

Website: https://amaselections.com/

Email: Send Email

Country:Portugal

Release id:42598

The post A.M.A Selections Unveils Expanded 2026 Collection of Luxury Holiday Villas Across the French Riviera appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

A.M.A Selections Unveils Expanded 2026 Collection of Luxury Holiday Villas Across Greece

From the Cyclades to the Ionian Islands and Crete, the luxury villa rental platform introduces its most comprehensive Greek portfolio to date.

Portugal, 13th Mar 2026 – A.M.A Selections, the luxury vacation rental company redefining private villa holidays across Europe and the Caribbean, has announced a significant expansion of its Greek portfolio for summer 2026. The curated collection now features handpicked properties across five of the country’s most sought-after island destinations, offering discerning travellers unprecedented access to holiday villas in Corfu, Mykonos, Paros, Santorini, and Crete.

Greece has long captivated luxury travellers with its extraordinary combination of ancient history, crystalline Aegean waters, and a culinary tradition that ranks among the finest in the Mediterranean. Recognising the growing demand for private, fully serviced accommodation across the Greek islands, A.M.A Selections has invested heavily in sourcing exceptional holiday villas in Greece that combine authentic Cycladic and Ionian architecture with contemporary luxury.

Holiday Villas Corfu – Lush Ionian Beauty and Venetian Grandeur

The A.M.A Selections collection of holiday villas in Corfu showcases the Ionian island’s distinctive character – a lush, green landscape quite unlike anything found in the Cyclades. Properties range from grand Venetian-influenced estates with sweeping coastal views to contemporary waterfront retreats with private beach access, heated infinity pools, and spa facilities. Corfu’s Old Town, a UNESCO World Heritage Site, offers a rich blend of Byzantine, Venetian, French, and British architecture, while the island’s rugged northern coastline and tranquil southern beaches provide an extraordinary diversity of scenery within a single destination.

Holiday Villas Mykonos – The Queen of the Greek Islands

For travellers drawn to the most glamorous island in the Aegean, A.M.A Selections offers an outstanding range of holiday villas in Mykonos. The portfolio includes contemporary clifftop estates with panoramic views of the Aegean, whitewashed retreats within walking distance of Mykonos Town’s iconic windmills, and exclusive beachfront properties near Psarou, Ornos, and Ftelia. Although famous for its vibrant nightlife and world-renowned beach clubs, Mykonos offers far more than the party scene – hidden coves with crystal-clear waters, award-winning restaurants, and a thriving art gallery scene that continues to attract a discerning international crowd.

Holiday Villas Paros – The Authentic Heart of the Cyclades

Paros has rapidly emerged as one of the most desirable islands in the Aegean, and the A.M.A Selections collection of holiday villas in Paros reflects the island’s irresistible blend of traditional charm and understated sophistication. Properties range from contemporary beachfront estates near the fashionable port town of Naousa to secluded waterfront retreats overlooking Golden Beach on the island’s eastern coast. The slow-paced way of life is the real luxury of Paros – whitewashed villages draped in bougainvillea, family-run tavernas serving the freshest grilled fish, and unspoilt coves with emerald-coloured water that feel a world away from the busier neighbouring islands.

Holiday Villas Santorini – Volcanic Drama and World-Famous Sunsets

No Greek island portfolio would be complete without Santorini, and A.M.A Selections’ collection of holiday villas in Santorini captures the volcanic island at its most spectacular. Properties perch along the caldera rim in Oia and Fira, offering uninterrupted views of the legendary sunset over the submerged crater, while others are set among the island’s renowned vineyards and dramatic red and black sand beaches. Santorini’s unique terroir has produced an increasingly celebrated wine scene, and the island’s ancient archaeological sites – including the remarkably preserved Minoan settlement of Akrotiri – add a layer of cultural depth that sets it apart from any other Mediterranean destination.

Holiday Villas Crete – Where Mythology Meets the Mediterranean

Completing the Greek collection, A.M.A Selections presents an exceptional selection of holiday villas in Crete, the largest and most diverse of all the Greek islands. Properties span the island’s dramatic northern coastline, from contemporary eco-chic retreats near Heraklion with infinity pools and direct sea access to restored stone farmhouses in the olive groves of the western interior. Crete’s extraordinary depth of history – from the Minoan palace of Knossos to Venetian harbour towns such as Chania and Rethymno – is matched by a vibrant food scene rooted in one of the world’s oldest culinary traditions.

The A.M.A Selections Difference

Every property listed on the A.M.A Selections platform is personally vetted to meet rigorous standards of quality, design, and service. Each guest is assigned a dedicated concierge from booking through to departure, with services including private chef arrangements, restaurant reservations, yacht charters, spa treatments, and curated excursions – all tailored to individual preferences.

“Greece occupies a truly special place in our portfolio – from the cosmopolitan energy of Mykonos to the timeless tranquillity of Paros and the dramatic beauty of Santorini, these islands offer an extraordinary range of experiences. Our 2026 collection is our most ambitious Greek offering yet, and we’re proud to share it with travellers who demand the very best.” – Co-Founder, A.M.A Selections

Media Contact

Organization: A.M.A Selections

Contact Person: A.M.A Selections

Website: https://amaselections.com/

Email: Send Email

Country:Portugal

Release id:42602

The post A.M.A Selections Unveils Expanded 2026 Collection of Luxury Holiday Villas Across Greece appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release6 days ago

Tony Swantek Expands His Entrepreneurial Legacy Across Finance, Blockchain, and National Business Services

-

Press Release1 week ago

CVMR and BITEC Establish Joint Venture CVMR R.D. Congo S.A.R.L. to Advance Exploration and In-Country Refining of Strategic Minerals

-

Press Release1 week ago

Cancos Tile and Stone Introduces the CTS Pro plus Collection: A New Professional-Grade Porcelain Tile Series Designed for Builders, Contractors, and Designers

-

Press Release6 days ago

Usethebitcoin (UTB) Strengthens Position as a Leading Guide for Sending Crypto Remittances Globally

-

Press Release6 days ago

Techysquad Highlights Shift Toward Long-Term SEO to Combat Rising Customer Acquisition Costs

-

Press Release1 week ago

Sonoma Manufactured Homes Expands Turnkey Small Home and ADU Installation Services Across Sonoma County

-

Press Release1 week ago

Industry Disruption – IKAPE Unveils K2 PRO Defining Professional Standards for the Mobile Cafe

-

Press Release6 days ago

Indian Contemporary Artist Gautam Mazumdar Stranded in Dubai Amid Escalating War Tensions