Press Release

ADS creates the strongest PoS equity proof mechanism

In 2010, in the early days of Bitcoin’s creation, BM challenged Satoshi Nakamoto and believed that Bitcoin’s consensus mechanism must be changed and proposed improvements.

However, the arrogant Satoshi Nakamoto did not adopt it. After emphasizing the importance and necessity of Bitcoin decentralization, he responded aggressively: If you don’t believe me or don’t get it, I don’ t have time to try to convince you, sorry.

Several years later, BM founded EOS and realized his own consensus mechanism.

Since it is a rumor, let’s just listen to it. But when it comes to consensus mechanisms, there are many things to explore. With the development and evolution of technology, the current mainstream consensus is PoW, PoS and PoS variants. Which consensus is better has always been a hot topic for discussion.

As we all know, the “impossible triangle” problem has become one of the important constraints in the development of blockchain. Therefore, whoever can better solve the problem can become the most ideal consensus mechanism.

So, who is the “ideal country” of consensus?

PoW gradually deviating from the spirit of Satoshi Nakamoto

In Bitcoin mining, Satoshi Nakamoto designed PoW (Proof of Work Mechanism).

Every 10 minutes, along with the generation of new blocks, the Bitcoin network will issue a certain amount of Bitcoin and reward it to the selected bookkeeping node.

From the surface of this mechanism, PoW is a model that pays more for more work. With higher computing power and time spent, the more digital currencies you can obtain.

However, it needs to consume a lot of energy to calculate the result of the hash function during its operation, which is easy to cause a waste of computing resources, because these operations themselves are not related to the value of the blockchain itself. Moreover, the confirmation time of the block is difficult to shorten, and it is prone to fork, and it is necessary to wait for multiple confirmations.

The new blockchain must find a different hashing algorithm, otherwise it will face a computing power attack. At the same time, each time a consensus is reached, the entire network needs to participate in the calculation, and the performance efficiency is low.

In addition, with the decrease of Bitcoin, the demand for computing power is getting higher and higher. In order to accelerate the speed of acquiring Bitcoin, a new method of mining resistance in mining pools has been born. The emergence of mining pools has disrupted the balance of Bitcoin and other encrypted digital currency systems to a certain extent, and the Matthew effect has gradually emerged.

So far, the pure PoW mechanism has no SHD completeness at all, and it deviates from the original intention of Satoshi Nakamoto.

“Perfect Alternative” PoS

So PoS (Proof of Stake Mechanism), which is considered to be able to replace PoW, appeared.

The main difference between PoW and PoS is how to determine the voting rights in the blockchain consensus. In PoW, the voting power is proportional to the computing power of the node; in PoS, the voting power of the system is proportional to the proportion of equity held. Once PoS was proposed, it was favored by people.

Compared with PoW, PoS will have a great improvement in performance, but it is also limited. And limited by defects such as the issue of TOKEN and the difficulty in determining the number of accounting nodes, it still cannot be a perfect alternative to PoW.

Secondly, the PoS system requires a highly secure network to resist hacker attacks. Currently, there is no public chain with such strength. What’s more deadly is that in the PoS public chain, the block-producing rights of the blockchain can only be determined by the head player, which makes the PoS public chain a network that is essentially monopolized and dominated by giants.

From this point of view, PoS cannot be a perfect alternative to PoW, so people began to think about whether the original mechanism can be changed, including BM, which was originally taken by Satoshi Nakamoto.

Fortunately, those who still have “consensus ideals” have never stopped exploring. Among them is the original VDS development team. The APoS mechanism they proposed may be a fire of hope that ignites our consensus ideals.

APoS: the original intention of the regression algorithm

Looking back at the evolutionary law of the consensus mechanism, we found that there is no consensus mechanism that can solve the problem of SHD completeness. Can the two types of consensus be mixed so as to integrate the advantages of the two while avoiding some drawbacks?

When the VDS development team encountered a bottleneck in the VDS public chain 2.0, they were inspired by Polkadot and proposed a ring resonance proof of stake algorithm (Λ Proof of Stake, APoS), also known as the cosmic constant algorithm Λ-Dimension.

The VDS development team creatively improved and combined PoS and PoW algorithms to form a resonance APoS consensus mechanism.

On the one hand, APoS returns to the original spiritual core of Bitcoin-decentralization. On the other hand, it solves the “impossible triangle” problem based on game theory mechanism design and Nash equilibrium thinking, and achieves security, efficiency, and decentralization. Compatible, and finally constructed a “blockchain technology system that is more in line with the current economic and financial structure needs than the original Bitcoin algorithm mechanism.”

The consensus algorithm itself is beautiful, but we increasingly lose sight of its true colors.

The reliability of mathematical algorithms is based on its preconditions. The accuracy of mathematics is conditional. Every theorem has certain preconditions and assumptions, and these preconditions cannot be proved by mathematics itself but need to be established and verified through analysis of the real world. These preconditions will also be tested in the constantly changing real world.

Today, ADS based on the APoS consensus mechanism has conducted multiple internal and public testing of the code, and has made corresponding optimizations and improvements in response to the problems that have arisen. According to the official report, ADS will be global on March 1, 2021, Singapore time 17: 00 is open for registration and subscription. In the kernel period, about 15,000 internal testers in the 123 ring will open the exchange to mix and trade about 10 days after the ring is full.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

300 Scientology Volunteers Distribute 500,000 Drug-Prevention Booklets during Winter Olympics

MILAN, Italy — 12 February 2026 — A volunteer network of around 300 people (and increasing) has been active since January in a nationwide drug-prevention initiative in Italy, distributing educational materials titled “The Truth About Drugs”. Reports show that more than 500,000 informational booklets have already been handed out, with Milan leading the effort and additional Italian cities increasingly involved.

The outreach is supported by the European Office of the Church of Scientology as part of its long-running backing for community-based drug education and prevention initiatives inspired by L. Ron Hubbard.

The campaign is a prevention-through-information effort: providing clear, accessible explanations of commonly abused substances, their short- and long-term effects, and the risks to physical and mental health. The aim is to place fact-based information in everyday settings—streets, public areas and community environments—so that teenagers and families can recognise risks early and make informed choices before a first “experiment” becomes a habit.

The booklets, published under the “Truth About Drugs” programme, describe different substances in circulation and the harms they can cause. Many volunteers have witnessed that the materials are written to be understood without specialist knowledge and are used as conversation starters—particularly where young people may face peer pressure or encounter misleading narratives that minimise risk.

Across Europe, prevention is frequently discussed not only as a health policy issue but also as a social one: drug markets often thrive by targeting vulnerability, normalising first use, and drawing adolescents into cycles of dependence and exploitation. In this context, organisers argue that community-level distribution of verified information supports youth safeguarding and strengthens social resilience—especially when it helps teenagers identify manipulation and resist pressure.

Athletes and prevention messaging: sport as a symbol of healthy choices

Organisers also point to growing athlete participation in the outreach. Julie Delvaux, a Belgian volunteer who has been helping, stated that more than 100 athletes connected to the Milano Cortina 2026 Winter Olympics have signed the Foundation for a Drug-Free World’s Honorary Register, signalling support for drug-prevention messaging aimed at youth.

In a broader policy context, European Parliament Vice-President Antonella Sberna highlighted the importance of sustained investment in grassroots sport and civic participation during a European Parliament debate in Strasbourg on 6 October 2025: “European policies must continue to invest in local sports infrastructure, volunteering and the participation of young people and women.(English translation)” Organisers say the campaign’s reliance on local volunteers and youth engagement reflects that same emphasis on community-level involvement.

In the organisers’ framing, sport provides a natural platform for prevention conversations because it is closely associated with discipline, performance, recovery, mental focus and long-term wellbeing. Volunteers add that athletes’ willingness to be publicly associated with prevention messaging can help counter the idea that drug use is “normal” or consequence-free—particularly for young people who look to elite sport as a reference point for healthy living.

One of the most intensive distribution days took place on 6 February 2026, the date of the Milano Cortina 2026 Olympic Opening Ceremony. Around 100 volunteers gathered and distributed over 100,000 booklets in a single day, leveraging the concentration of visitors and public attention in the city.

Distribution launched in January and has now surpassed 500,000 booklets. This as the early phase of a longer-term programme that will continue over the coming months, with volunteers maintaining a presence in multiple cities and expanding into additional neighbourhoods as local capacity grows.

Recent reporting underscores why prevention remains a persistent policy concern. A Reuters report (25 June 2024), based on an annual government report to Italy’s Parliament, stated that 39% of Italians aged 15 to 19 had consumed illegal substances at least once. The same report noted figures on youth exposure to cocaine and cannabis-related products and described trends returning toward pre-pandemic levels.

For readers seeking original documentation, Italy’s official reporting on the drug phenomenon is published through the national anti-drug policy structures; an English-language version of the annual report to Parliament includes data and context on youth patterns and substance categories.

At the European level, wider monitoring points to shifting patterns among younger teenagers, even as risks remain significant and uneven across countries. The EU Drugs Agency (EUDA) overview of the latest ESPAD survey results highlights longer-term trends among 15–16-year-old students across participating European countries, illustrating how prevention strategies must adapt to changing behaviours and new risks.

Organisers’ perspective: prevention as disruption of the first step

In statements circulated in connection with the Italian campaign, Foundation for a Drug-Free World Executive Director Jessica Hochman argues that drug markets depend on first use becoming normalised and repeatable. She frames prevention as the most direct way to disrupt that pathway: when young people understand what drugs do to the body, she says, curiosity often diminishes. (See: the campaign statement distributed via PR Newswire.)

The focus is not on moralising, but on making information available in a form that young people will read. The objective is to reduce the space in which myths thrive—particularly myths that portray drugs as a harmless experiment rather than a pathway into health damage, dependency and, in some cases, criminal exploitation.

The initiative is prompted by the Foundation for a Drug-Free World, a non-profit public benefit organisation (recognized the UN ECOSOC with consultative status) that produces and distributes factual drug-education materials. In its published programme description, the Foundation states that, through a worldwide network of volunteers, 100 million drug prevention booklets have been distributed, with drug awareness events held in some 180 countries, and public service announcements aired by numerous broadcasters.

Organisers of the Italian outreach say that this infrastructure—standardised materials, translations and volunteer coordination—supports rapid scaling when local communities decide to prioritise prevention. They also emphasise that the Italian effort is designed to be practical: short, repeatable distribution activities, paired with materials that can be used by families, educators and community groups as reference points.

The support from the Church of Scientology has helped make the educational materials widely available. Within Scientology’s public accounts of its community work, drug education is visible as part of a broader set of social and humanitarian initiatives inspired by L. Ron Hubbard, the founder of Scientology.

In that framework, local volunteer distributions are presented as one element of ongoing community activity—alongside other prevention and education initiatives—intended to strengthen neighbourhood-level support systems and reduce the harms associated with illicit markets.

Public health, youth safeguarding and social resilience: a European civic lens

According to church representative Ivan Arjona, “drug prevention is not simply a matter of individual behaviour but also one of social environment. Illicit drug markets frequently intersect with violence, recruitment, intimidation and forms of coercion that can pull teenagers into harmful networks”. In that context, “accessible information is a protective tool: it supports informed choice, reduces the likelihood of first use, and can help communities limit the space in which exploitation takes root”.

Arjona, the Church of Scientology’s representative to the European Union, OSCE, the Council of Europe and the United Nations, connected the initiative to European civic priorities such as protecting young people, strengthening social cohesion, and resisting criminal exploitation:

“Across Europe, protecting young people is not only a health objective but a civic duty. Drug markets thrive where vulnerability can be exploited and where misinformation lowers the perceived risk of ‘trying’. Providing verified, understandable information strengthens autonomy and informed choice, and it helps communities reduce the social space in which criminal networks operate.”

Distributions will continue in additional Italian cities over the weeks ahead, with volunteers maintaining a focus on public spaces and community settings where young people can be reached with straightforward, factual materials.

The Church of Scientology, its churches, missions, groups and members are present across the European continent. Scientology has a continent-wide presence through more than 140 churches, missions and affiliated groups in all the 27 European Union nations and more, alongside thousands of community-based social betterment and reform initiatives focused on education, prevention and neighbourhood-level support, inspired by the work of Scientology founder L. Ron Hubbard.

Within Europe’s diverse national frameworks for religion, the Church’s recognitions continue to expand, with administrative and judicial authorities in Spain, Portugal, Sweden, the Netherlands, Italy, Germany Slovakia and others, as well as the European Court of Human Rights, having addressed and acknowledged Scientology communities as protected by the national and international provisions of Freedom of Religion or belief.

Media Contact

Organization: European Office Church of Scientology for Public Affairs and Human Rights

Contact Person: Ivan Arjona

Website: https://www.scientologyeurope.org

Email: Send Email

Address:Boulevard de Waterloo 103

City: Brussels

State: Brussels

Country:Belgium

Release id:41341

The post 300 Scientology Volunteers Distribute 500,000 Drug-Prevention Booklets during Winter Olympics appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

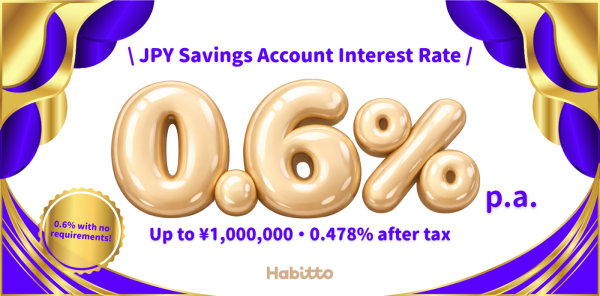

Habitto to Raise Savings Account Interest Rate to 0.6% Effective February 1, 2026

Habitto Announces Savings Account Interest Rate Revision Effective February 1, 2026

Tokyo, Japan, 12th Feb 2026 – Habitto today announced a revision to the interest rates on its Habitto Savings Account, effective February 1, 2026. With this update, Habitto continues to support customers in building healthier savings habits and long term financial stability.

Updated interest rates

- Balances up to JPY 1,000,000: 0.6 percent per annum (0.478 percent after tax)

- Portion exceeding JPY 1,000,000: 0.3 percent per annum (0.239 percent after tax)

The revised interest rates are automatically applied to all existing Habitto account holders from the effective date. Customers opening a new account will receive the updated rates immediately upon account activation.

Comment from Habitto leadership

Liam McCance, Co-founder and Chief Creative Officer of Habitto, commented:

“By raising our savings rate, we are making it easier for customers to grow everyday funds while building toward future goals. As Japan’s first Savings Shop, Habitto brings together savings, simple cash management, and free, unbiased financial guidance so customers can develop money habits that feel practical and sustainable.”

Designed for clearer money habits

Habitto’s tiered interest rate structure is intended to make saving feel simpler and more deliberate. Customers can keep funds accessible for daily needs while allowing money set aside for future goals to grow steadily. The Habitto app supports this approach through a straightforward banking experience and access to human support when needed.

This Savings Shop model combines saving, spending organization, and personalized guidance without tying financial advice to specific products.

Additional Habitto services

In addition to its savings account, Habitto provides access to licensed financial planners at no cost, matched to each customer’s situation. The service also includes a debit card offering a 0.8 percent cash back rate, helping customers manage daily spending while staying focused on long term goals.

About Habitto

Habitto is Japan’s first Savings Shop, a digital banking platform that combines savings accounts, cash management, and access to licensed financial planners through its mobile application. Habitto’s financial guidance is independent and not linked to specific financial products. The company is headquartered in Tokyo and serves customers across Japan.

Company details

Company name: Habitto Inc.

City: Tokyo (Shibuya-ku)

Official website: https://www.habitto.com/

X (formerly Twitter): https://x.com/habitto_jp

Instagram: https://www.instagram.com/habitto_japan/

TikTok: https://www.tiktok.com/@habitto_japan

Media Contact

Organization: Habitto Inc.

Contact Person: Liam McCance

Website: https://habitto.com

Email:

press@habitto.com

Contact Number: +81359367315

Address:3-19-7 Jingumae, Shibuya-ku, Tokyo 150-0001

Country:Japan

Release id:40946

The post Habitto to Raise Savings Account Interest Rate to 0.6% Effective February 1, 2026 appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

ECOBANK BACKS MEYA MINING WITH USD 25 MILLION FACILITY

Windhoek, Khomas, Namibia, 12th Feb 2026 – Trustco Group Holdings Ltd (“Trustco”) confirms that Meya Mining Limited (“Meya”), in which Trustco holds a minority interest, has secured a USD 25 million (NAD 400 million) financing facility with Ecobank Sierra Leone Limited, supported by Ecobank Ghana Plc. The funding marks a significant milestone as Meya advances toward full commercial diamond production under its 25-year exclusive mining license in Sierra Leone’s Kono District.

The signing ceremony took place on the opening day of the Africa Mining Indaba 2026 in Cape Town, South Africa. According to Meya, the facility will be deployed toward advanced diamond processing equipment, mining vehicles and supporting infrastructure.

Meya’s shareholders have to date invested in excess of USD 100 million in the development of the resource and initial establishment of the mine. The financing represents a significant vote of confidence by a leading pan-African banking group in the quality, scale, and long-term geo-economic potential of the Meya diamond asset.

According to Meya, the facility is expected to stimulate local supply chains by routing payments through Sierra Leonean accounts, creating and sustaining over 400 direct jobs with more than 90% of employees sourced locally, and strengthening Sierra Leone’s position in the global diamond industry through traceable, responsibly mined stones. The transaction is also expected to encourage further investment in beneficiation, including cutting and polishing, to maximise national value capture.

Quinton Z van Rooyen, Deputy Group CEO of Trustco

As previously disclosed, Trustco’s exposure to Meya comprises an indirect equity interest and a loan receivable of approximately USD 46 million. Trustco therefore remains both a long-term stakeholder in the project and a significant creditor with a direct economic interest in the sustainable advancement, value preservation, and orderly commercialisation of the mine.

Quinton Z van Rooyen, Deputy Group CEO of Trustco, commented: “The decision by Ecobank to commit USD 25 million to Meya is a powerful external validation of what we have long maintained – that the Meya asset is of exceptional quality with multi-generational potential. For Trustco, as both equity holder and significant creditor, this facility de-risks the path to commercial production and brings us closer to realising the full value of our investment. It also sends a clear signal to the broader market that serious institutional capital is now flowing into this project.”

Shareholders are advised that the facility has not been concluded at Trustco level. Trustco has not approved the facility at board, shareholder, subsidiary, or group level, and has not provided any guarantees, sureties, undertakings, consents, or security in respect thereof. The facility does not constitute a transaction by Trustco requiring categorisation or approval under the JSE Listings Requirements.

The full press release issued by Meya Mining and Ecobank is available for viewing at the following link: https://www.facebook.com/share/p/1F4B2GR4Tk/?mibextid=wwXIfr

Shareholders will be kept informed of any further developments that are price-sensitive or otherwise require disclosure.

About Trustco:

Trustco Group Holdings Limited is a holding company headquartered in Windhoek, Namibia, that owns subsidiaries engaged in diverse business activities spanning the real estate, mining, insurance, micro-finance, and education sectors.

About Namibia:

Namibia is a Southern African country with a population of approximately three million and a GDP per capita of USD 4 413 in 2025 (IMF). The country is endowed with rich natural resources, with recent major discoveries of oil and gas reserves, lithium deposits and rare earth minerals that are vital for technology demand globally, with developments also underway in its green hydrogen projects. The Namibian government has heralded these discoveries as a transformative period, holding the potential to double the nation’s GDP by 2040.

The country’s economy is projected to have expanded by 3.6% in 2025 and is projected to expand by 3.8% in 2026 (IMF). With its wealth of natural resources, pro-business environment, political stability and increasingly skilled workforce, Namibia offers attractive investment prospects across all sectors.

Forward-Looking Statements:

All statements made in this media release with respect to Trustco’s current plans, estimates, strategies beliefs and other statements that are not historical facts, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would,” or the negative of these words or other similar terms or expressions. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. The Company may not actually achieve the plans, intentions or expectations disclosed in its forward-looking statements, and you should not place undue reliance on these forward-looking statements. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

Media Contact

Organization: Trustco Group Holdings

Contact Person: Neville Basson

Website: https://www.tgh.na

Email: Send Email

Contact Number: +264612754501

Address:2 Keller Street, Trustco House

Address 2: Windhoek

City: Windhoek

State: Khomas

Country:Namibia

Release id:41277

The post ECOBANK BACKS MEYA MINING WITH USD 25 MILLION FACILITY appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release6 days ago

WEIVA Strengthens China’s Enterprise Storage Supply Chain With Advanced Huawei and SSD Solutions

-

Press Release7 days ago

Flying Dresses International Solidifies Global Presence, Setting a New Standard for Experiential Luxury on the World’s Most Iconic Stages

-

Press Release6 days ago

From Ben Srour to Global Recognition: The Inspiring Journey of Mohamed Benmagri

-

Press Release6 days ago

ElectionBuddy Receives Capterra Best Value Award

-

Press Release6 days ago

Maids in Brown Earns Best of Arlington Award for House Cleaning Excellence

-

Press Release6 days ago

WEIVA Strengthens China’s Enterprise Storage Supply Chain With Advanced Huawei and SSD Solutions

-

Press Release7 days ago

Elysium and Spotex Launch Integrated Front-to-Back Digital Asset Trading Platform for Institutional Markets

-

Press Release7 days ago

Elysium and Spotex Launch Integrated Front-to-Back Digital Asset Trading Platform for Institutional Markets