Press Release

Nebula Brands – China’s native Amazon aggregator to challenge Thrasio in China

The Amazon marketplace roll-up play is getting even bigger. Since the beginning of 2021, Aggregators have raised another 7 billion dollars. Dozens of acquisitions are happening every week in major Amazon markets including North America, Europe, Japan, and India. Although Amazon has a very limited ecommerce presence in China, aggregators are building up interest in Chinese sellers given over 60% of products sold on Amazon are sourced from China.

Investors have been expecting Chinese aggregators to join the game given nearly half of third-party sellers on Amazon are from China. It would be a strategic play for a local aggregator to consolidate Amazon business in China given the country is famous for its global supply chain network. Recently, Nebula Brands, the first Chinese aggregator joined the game with over 100 million dollars in the war chest. Started from supply chain financing and fintech, Nebula Brands is well prepared and financed to join the race.

Nebula Brands was established in Shenzhen, the world factory in 2019. It started as a fintech company and has financed over 3,000 cross-border ecommerce businesses so far under partnerships with leading financial institutions including Bank of China, Webank, and CICC. Nebula collects operational and financial data from customers and develops risk management models specifically targeting Amazon sellers. The data-driven investment process enables the company to analyze and evaluate a large batch of sellers in a short period. The Company maintains an active pipeline of over 100 targets and can screen and evaluate over 400 transactions every month. Despite being the first aggregator in China, Nebula has been able to launch fast thanks to its Chinese heritage. The team is working closely with business owners, financial institutions, technology companies, and big ecommerce companies to reshape the landscape of Chinese cross-border ecommerce.

Nebula Brands believes China is a promising land for cross-border ecommerce. Despite a recent wave of shop closure by Amazon, there is an abundant supply of talents. Nebula has the vision to build international brands by utilizing local talents and conduct operations through compliant and quality middle offices. Guided by a brand strategy team based in New York, Nebula is on track to become an international brand manager. In the Amazon Marketplace 2.0, an integrated supply chain network connecting Chinese factories and the global market would be necessary to support Nebula’s Multi-Channel and Multi-Brand strategy. SHEIN, a Chinese ecommerce brand valued at $15BN and leads online fashion in the US, leveraged the Chinese supply chain to gain sufficient competitive advantage over its peers. Nebula is planning to follow suit by investing in the integration of supply chain and factory.

Nebula is more than a Chinese aggregator. Besides growing operations in China, Nebula is also eyeing overseas targets. It just launched its New York team with a focus on brand strategy and product management. The local team will follow the US consumer market closely and elevate the business from Made in China to Brands from China.

Nebula is raising capital from international investors. Besides the 100 million equity investment, it has also received interest from credit investors and is exploring financing on a global level. The goal is to use global financing to build an international brand management company.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Allbridge Announces The New Hybrid Cross-Chain Architecture Combining Native Rails, Liquidity, and Privacy

January 2026 – Allbridge has announced a new cross-chain architecture, designed to unify multiple bridging models into a single routing system that selects the most efficient transfer method per asset, chain pair, and market condition.

After years of operating traditional bridge infrastructure, the team says the industry’s main failures were not technical but user-facing: fragmented assets, unreliable arrival experiences, and dependence on liquidity that introduced hidden costs.

“Users don’t just want to move tokens – they want to move value and be able to act immediately on the destination chain,” said Allbridge’s founder. “The new architecture will be designed around that reality.”

A Hybrid Model Instead of a Single Rail

The new architecture integrates multiple existing transfer models rather than committing to a single architecture:

- Native rails, such as Circle’s CCTP for USDC and USDT’s OFT model, are used where available.

- Liquidity pools and intent-based fulfillment serve as fallbacks for routes where native rails do not yet exist.

- A routing engine dynamically selects the optimal path based on asset type, supported chains, and current market conditions.

According to the company, this approach avoids forcing users into a single ecosystem or stablecoin universe and preserves access across both EVM and non-EVM chains.

Focus on UX

Beyond transfer mechanics, the next Allbridge architecture emphasizes what the company calls the “arrival experience,” including:

- destination gas provisioning,

- fee abstraction,

- automated finalization, and

- routing that avoids dead ends.

“These features are no longer differentiators – they’re requirements,” the team stated. “Without them, multichain still feels like a sequence of technical rituals rather than a single experience.”

Privacy as a Built-In Option

Allbridge new architecture also introduces optional privacy routing inspired by emerging Privacy Pool designs, aimed at improving user protection while remaining compatible with compliance frameworks

Transfers can be routed through dedicated pools with cryptographic commitments, allowing users to reduce public transaction traceability while preserving compliance options through relayer-based context handling.

The company describes this as a “user protection layer” rather than a separate product or a fully opaque system.

Roadmap for the Next Six Months

Allbridge outlined several priorities for the next development phase:

- native-feeling stablecoin routing,

- guaranteed transfer reliability via fallback mechanisms,

- default integration of swap + bridge flows,

- privacy as an opt-in routing mode, and

- continued first-class support for non-EVM chains.

Positioning

Allbridge frames its strategy as “and, not or” – combining architectures rather than replacing them.

“If you think the future of bridging is one rail or one ecosystem, we disagree,” the company said. “Our goal is a system that chooses the right primitive per route, per asset, and per moment – without asking users to become liquidity engineers.”

Media contact:

Company Name: Allbridge

Contact Person: Andrii Velykyi

E-mail: av@allbridge.io

Website: allbridge.io

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Coinfari Introduces a Unified Digital Platform for Crypto Trading and Market Engagement

New York, Ny – Coinfari, a digital asset trading and financial technology platform, today announced the launch of its unified ecosystem designed to support cryptocurrency trading, market monitoring, and community engagement within a single, streamlined environment. The platform has been developed to address increasing demand for accessible trading infrastructure and transparent market tools as global participation in digital assets continues to expand.

Coinfari brings together trading functionality, real-time market data, and user engagement features through a web-based and mobile-responsive interface. The platform supports multiple digital asset pairs and offers tools intended to accommodate a broad range of user experience levels, from individuals entering the crypto market for the first time to participants seeking more advanced trading capabilities. Its design emphasizes usability, performance stability, and operational clarity.

The launch reflects a broader industry trend toward platforms that integrate execution, analytics, and user interaction rather than relying on fragmented services. By consolidating these elements, Coinfari aims to reduce complexity for users while maintaining the technical depth required for active market participation. Platform development has focused on system reliability, efficient order execution, and clear presentation of market information.

Key components of the Coinfari platform include spot trading functionality, real-time pricing data, and order management tools designed to support informed decision-making. In addition, the platform incorporates engagement features such as user programs and activity-based incentives, which are structured to encourage consistent participation while maintaining a neutral, non-advisory framework. Coinfari does not position its services as financial advice and emphasizes user responsibility and informed participation.

Security and operational integrity remain central considerations in the platform’s architecture. Coinfari employs industry-standard practices related to system monitoring, access controls, and risk management processes to support platform resilience. Ongoing updates and infrastructure enhancements are planned as part of its long-term development roadmap.

Coinfari is structured to serve an international user base and is focused on expanding its operational reach in line with regional market requirements and regulatory considerations. Future updates are expected to include additional market tools, expanded asset coverage, and refinements to user experience based on platform performance and feedback.

More information about Coinfari, its platform features, and ongoing updates is available on the company’s official website.

About Coinfari

Coinfari is a digital finance and cryptocurrency trading platform offering market access, trading tools, and user engagement features within a unified ecosystem. The platform is designed to support transparent market participation and efficient digital asset interaction for a global audience.

Website: https://coinfari.com/

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

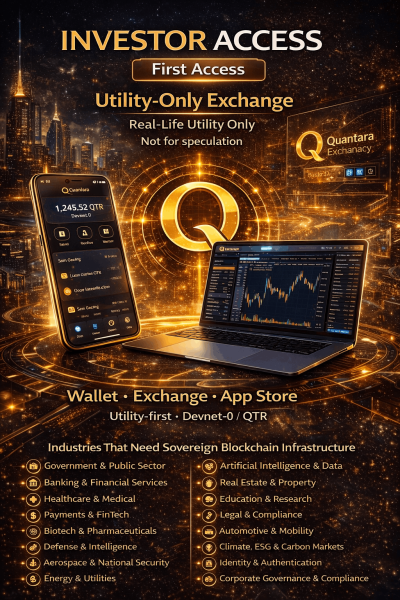

Quantara Announces Availability of Blockchain Infrastructure for Institutional and Public-Sector Applications

United States, 28th Jan 2026, – Quantara has announced the availability of its blockchain infrastructure platform designed for use in institutional, enterprise, and public-sector environments. The platform is intended to support applications that require data integrity, auditability, and long-term operational stability.

The Quantara infrastructure includes a secure digital wallet, an application layer for enterprise and public-sector systems, and a blockchain network designed for extended operational lifecycles. The platform is structured to support settlement processes, system-level transactions, and application-driven economic activity.

According to the company, the infrastructure has been developed for organizations that require predictable system behavior, verifiable records, and cryptographic validation across distributed environments. The platform is designed to operate independently of trading-focused mechanisms and is not positioned as a speculative exchange.

Quantara stated that the infrastructure is intended for use across sectors including government and public administration, banking and financial services, healthcare, energy and utilities, legal and compliance systems, education and research, and data-driven industries.

The company indicated that security and system integrity are central to the platform’s design. The infrastructure incorporates deterministic system architecture and cryptographic verification methods, with a development roadmap that includes support for post-quantum security standards.

Quantara’s platform is being positioned as a foundational technology layer for organizations seeking blockchain-based systems with long-term operational requirements.

Media Contact

Organization: Money Records LLC

Contact

Person: Jay Anthony

Website:

https://www.quantarablockchain.com/

Email:

moneyrecordsllc@gmail.com

Contact Number: 17812520801

Country:United States

The post

Quantara Announces Availability of Blockchain Infrastructure for Institutional and Public-Sector Applications appeared first on

Brand News 24.

It is provided by a third-party content

provider. Brand News 24 makes no

warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 week ago

CVMR at the Future Minerals Forum FMF 2026

-

Press Release4 days ago

Knybel Network Launches Focused Growth Campaign to Help Southeast Michigan Buyers and Homeowners Win in a Competitive Housing Market

-

Press Release6 days ago

Valencia Scientology Mission Highlights Volunteer Humanitarian Work in La Llum

-

Press Release6 days ago

Highly Recommended by GoodNight New York: Zeagoo Patterned Shirt Becomes the Focal Point of Early Spring Outfits

-

Press Release4 days ago

New Findings Reveal a Hidden Indoor Air Quality Crisis Linked to Aging HVAC Systems and Fiberglass Ductwork Across South Florida

-

Press Release4 days ago

Stockity Arrives in Indonesia, Bringing Global Markets Closer to Local Traders

-

Press Release4 days ago

Karviva Selected to Meet with Costco Wholesale Southern California Merchants at Upcoming Local Summit

-

Press Release4 days ago

GOD55 Sports Announced as Gold Partner and Official Sports Media Partner for WPC Malaysia Series 2025-26