Press Release

XRP and BTC Trends Resonate: Average Daily Returns for Users Reach $7777 – Why Are High-Net-Worth Individuals Paying Attention to Moon Hash?

When Elon Musk’s Grok AI gave an aggressive long-term prediction for XRP, the market’s excitement was no accident. The assetization of computing power and structural reshaping are pushing the crypto world into a new “efficiency-first” cycle.

London, UK, 6th February 2026, Smart capital doesn’t chase emotions; it positions itself strategically in advance. It is against this backdrop that Moon Hash is frequently mentioned—it doesn’t gain popularity by touting returns, but rather by presenting a near-textbook example of transforming Proof-of-Work (PoW) computing power into a configurable, manageable, and replicable long-term tool. Industry insiders have even exaggeratedly described it as compressing traditional energy funds, computing power scheduling, and compliant finance into a single button.

2.png)

Principles and Advantages:

Moon Hash’s logic is not complex: users don’t need a technical background; they can participate in PoW computing power scheduling through the platform to access the cyclical allocation of mainstream assets such as BTC and XRP. The platform manages computing power uniformly using a commercial-grade cluster, with revenue automatically settled according to the contract structure. Its advantages are clear and restrained—no hardware required, zero maintenance, compatibility with mainstream cryptocurrencies, and stable returns. More importantly, it has a strong institutional foundation: Moon Hash is headquartered in the UK, adheres to the MiCA and MiFID II framework, operates long-term with transparent processes, aligning with the preference of high-end US investors for “structure and order.”

Returning to the macro narrative: When computing power is considered a new type of infrastructure, financial security and energy costs determine its ceiling. Moon Hash’s announced $300 million in liquid reserves, coupled with bank-grade encryption, cold wallet storage, and multi-layered risk control, form the foundation for stable operation. The platform builds a long-term energy cost advantage through green renewable energy sources such as tidal energy, which is not just an environmental narrative, but also an economic solution for policy adaptation and scalable operation. Add to this PwC audit, Lloyd’s of London insurance, and Cloudflare and McAfee cloud security, and transparency and credibility are naturally established.

Operation Steps

—1) Register an Account: Receive a $15 welcome bonus immediately (register directly if needed)

—2) Browse Platform Data and Contract Structure(click here for contract details)

Contract Examples (Mechanism Explanation):

Bitcoin Beginner Basic Contract: $100 | 2 Days | Daily Profit $4

Antminer S19j XP (BTC): $500 | 7 Days | Daily Profit $6.5

WhatsMiner M60 (BCH): $1500 | 10 Days | Daily Profit $21

Antminer T21 (BTC/BCH): $5000 | 20 Days | Daily Profit $80

Avalon Air Box (40 ft | BTC): $30000 | 33 Days | Daily Profit $570

—3) Select Contract Period and Logic (Profits are automatically credited after purchase)

—4) Principal is automatically returned upon maturity; profits can be withdrawn or reinvested; records are fully traceable.

User Feedback

Daniel Moore, 45, is a New York-based private equity partner. During a closed-door roundtable discussion on energy structure transformation, he discussed a question with a hedge fund manager who has long studied the assetization of computing power: “When computing power begins to possess long-term cash flow attributes, should it be professionally managed like infrastructure?” It was after this discussion that he began systematically observing Moon Hash. What attracted him was not short-term performance, but the platform’s overall design in terms of compliance framework, energy structure, and computing power scheduling—making participation feel more like a structural allocation rather than an emotionally driven attempt. After participating for a full cycle, he told his peers who were also focused on the long-term trends of BTC and XRP that this approach “made computing power into an asset that can be rationally treated for the first time.” His monthly participation results were stable in the range of $5,800 to $7,600. More importantly, the pace was clear and the management costs were controllable.

Conclusion · Judgment Window

As the narrative of BTC and XRP shifts from price speculation to infrastructure and computing power allocation, opportunities often belong to those who upgrade their understanding earlier. Moon Hash doesn’t offer emotional stimulation, but rather a structural entry point that aligns with the cycle. At this stage, such a window is quiet yet clear enough—whether to participate depends on whether you’re willing to stand on the side of the trend.

Visit the official platform https://moonhash.com/ now to explore new ways to engage with digital assets.

(Click here to download the app)

Contact us: info@moonhash.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Xepeng Presents Conversion-First Approach for Digital Asset Use in Indonesia

Conversion models enable merchants to support global digital preferences while maintaining Rupiah-based operations and regulatory compliance.

Denpasar, Bali, Indonesia, 6th Feb 2026 — Cryptocurrencies are often discussed as the future of payments, but for many Indonesian merchants, direct crypto payments introduce more complexity than benefit. The challenge lies not in demand, but in how digital assets fit within existing legal and operational frameworks.

Merchants in Indonesia operate within systems designed around Rupiah, from pricing and invoicing to tax reporting and bank settlement. Accepting crypto directly requires businesses to manage asset custody, monitor volatility, and reconcile transactions across separate systems, adding significant operational complexity. Direct cryptocurrency use as payment encounters regulatory restrictions in Indonesia, where Rupiah serves as the legal tender. Practical challenges include volatility exposure and operational complexities for merchants.

Regulatory considerations further complicate direct crypto acceptance. As Rupiah is the sole legal tender for domestic transactions, crypto-as-payment models raise concerns over compliance and consumer protection

A conversion-first model addresses these concerns by separating the customer’s source of value from the merchant’s settlement currency. Digital assets can be converted into Rupiah before funds reach the merchant, allowing businesses to maintain familiar workflows while expanding payment accessibility for international customers.

Penke Pancapuri, CEO of Xepeng, stated, “Conversion models provide a practical bridge between global digital preferences and local regulatory realities. Platforms like Xepeng facilitate this process, allowing merchants to capture international opportunities while operating fully within Rupiah-based systems.”

For tourism-heavy markets such as Bali, the model is particularly relevant. International visitors who hold digital assets can complete a simple, guided flow; merchants receive a clean Rupiah settlement accompanied by reconciliation details for accounting and audits. The result: tourists use the instruments they prefer, while merchants keep familiar, Rupiah-native operations.

By keeping settlements in Rupiah, merchants avoid handling digital assets altogether. Accounting remains straightforward, tax obligations are clearer, and operational risk is reduced. For many businesses, this approach offers a practical path to supporting cross-border payments without disrupting existing processes.

With the rise of digital asset adoption, platforms such as Xepeng facilitate the use of preferred digital instruments for international visitors while ensuring merchants receive compliant Rupiah settlements.

International travellers planning a trip to Bali who hold digital assets and want to know how they can use them locally can learn more at https://www.xepeng.com or contact hello@xepeng.com for more details.

About Xepeng

Xepeng develops a conversion platform tailored for Indonesian merchants, focusing on enabling Rupiah settlement for the merchants while maintaining compliance and operational simplicity. The system integrates sector-specific tools, backend processing, and compliance measures to support efficient and trustworthy operations.

Media Contact

Organization: Xepeng

Contact Person: Budi Satrya

Website: https://xepeng.com/

Email: Send Email

Contact Number: +6287862024247

Address:Jl. Cut Nyak Dien No.1, Renon

Address 2: Denpasar Selatan, Bali

City: Denpasar

State: Bali

Country:Indonesia

Release id:41086

The post Xepeng Presents Conversion-First Approach for Digital Asset Use in Indonesia appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

NYC Wheelchair Transportations Expands Reliable Wheelchair Transportation Services Across New York City

United States, 6th Feb 2026 – NYC Wheelchair Transportations, a trusted provider of wheelchair and mobility transportation services, proudly announces the expansion of its comprehensive wheelchair transportation solutions throughout New York City. Serving Manhattan, Brooklyn, Queens, the Bronx, and Staten Island, the company continues its mission to deliver safe, comfortable, and respectful transportation for individuals with mobility challenges.

Specializing in wheelchair taxi services, handicap transportation, ambulette services, stretcher transportation, and non-emergency medical transportation (NEMT), NYC Wheelchair Transportations is dedicated to ensuring that every passenger experiences dependable, stress-free travel regardless of destination or mobility needs.

“Transportation should never be a barrier to healthcare, independence, or quality of life,” said Michael, spokesperson for NYC Wheelchair Transportations. “Our goal is to provide reliable wheelchair transportation in New York City that prioritizes dignity, safety, and personalized care for every rider.”

Comprehensive Wheelchair Transportation in NYC

NYC Wheelchair Transportations operates a modern fleet of ADA-compliant vehicles designed specifically for wheelchair accessibility. Each vehicle is equipped with ramps or lifts, secure tie-down systems, spacious interiors, and climate control to ensure a comfortable ride. All drivers are professionally trained, CPR-certified, and experienced in assisting passengers with mobility limitations.

The company supports transportation needs for a wide range of destinations, including:

- Hospitals, clinics, and rehabilitation centers

- Dialysis and therapy appointments

- Hospital discharge transfers

- Family gatherings and community events

- Shopping, errands, and daily activities

- Airports including JFK, LaGuardia, and Newark

With door-to-door assistance, passengers receive help from their pickup location through arrival at their destination, ensuring a smooth and worry-free experience.

Ambulette and Stretcher Transportation Services

For individuals who need additional support but do not require emergency medical care, NYC Wheelchair Transportations offers professional ambulette services in New York City. These services are ideal for non-emergency hospital visits, nursing home transfers, rehabilitation appointments, and senior transportation. Healthcare facilities across NYC rely on the company for punctual, professional NEMT solutions.

The company also provides stretcher transportation services in NYC for passengers who must remain in a lying position during transit. Each stretcher transport is handled by two trained attendants who coordinate closely with hospitals, discharge planners, and family members to ensure gentle, secure, and well-organized transfers between locations.

Wheelchair Accessible Taxi and Airport Transportation

NYC Wheelchair Transportations operates dependable wheelchair accessible taxis in NYC, offering a convenient solution for everyday city travel. These vehicles meet ADA standards and include secure wheelchair locking systems and comfortable seating for caregivers or family members traveling alongside passengers.

In addition, the company provides reliable airport wheelchair transportation to and from JFK, LaGuardia, and Newark airports. Services include assistance with luggage, terminal coordination, and timely pickups and drop-offs to ensure smooth airport transfers.

Handicap and Senior Transportation Solutions

Through its handicap transportation services in NYC, the company empowers passengers to maintain independence and mobility. NYC Wheelchair Transportations also assists with stairs and challenging building access, ensuring safe navigation in older or less accessible New York properties.

Group transportation options are available for senior centers, assisted-living facilities, and community organizations, allowing passengers to travel together comfortably and safely.

For more information visit https://nyctransportations.com/ .

About NYC Wheelchair Transportations

NYC Wheelchair Transportations is a New York-based mobility transportation provider offering wheelchair-accessible taxis, ambulette services, stretcher transportation, non-emergency medical transportation, and handicap transportation across all five boroughs of New York City. The company is committed to providing safe, affordable, and compassionate transportation services that enhance independence and peace of mind for passengers and their families.

Media Contact

Organization: NYC Wheelchair Transportations

Contact Person: Michael

Website: https://nyctransportations.com/

Email: Send Email

Contact Number: +17182070511

Address:Manhattan, New York, USA

Country:United States

Release id:41078

The post NYC Wheelchair Transportations Expands Reliable Wheelchair Transportation Services Across New York City appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

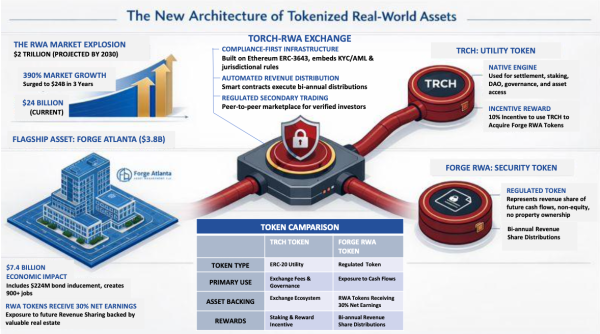

Torch-RWA to Debut TRCH-Powered RWA Marketplace with $3.8 Billion Forge Atlanta as First Listing

Torch, LLC is preparing to launch Torch-RWA, a regulated digital marketplace for tokenized real-world assets. The exchange will debut with the $3.8B Forge Atlanta, offering compliant token issuance, automated revenue distribution, and identity-verified trading. TRCH token holders gain unique ecosystem access, including a 10% reward for Forge participation.

“The tokenized real-world asset market has grown roughly 380% in three years to about $24 billion, and analysts project tokenized assets could reach around $2 trillion by 2030.” (1)

“Tokenized real-world assets have already crossed the $20 billion mark, and major incumbents like the NYSE’s parent company are now building 24/7 platforms for blockchain-based securities.” (2)

Atlanta, GA – February 4, 2026 – Torch, LLC announces a digital infrastructure exchange, Torch-RWA (https://torch-rwa.com/), to support the issuance and lifecycle management of tokenized real-world assets (“RWAs”), a regulated, TRCH-powered institutional-grade marketplace anchored by Forge Atlanta, a $3.8 billion multi-phase mixed-use development in downtown Atlanta sponsored by Webstar Technology Group (https://webstartechgroupinc.com/) (OTCPK: WBSR). Upon launch, the Torch-RWA marketplace is expected to enable eligible, KYC/AML-verified investors to gain fractional, on-chain exposure to a defined portion of Forge Atlanta’s future distributable cash flows through regulated security tokens, while the TRCH utility token is designed to power access, fee, and rewards functionality across the exchange. The Forge Atlanta tokenization listing is the latest example of digital capital markets evolving beyond traditional finance and development structures, enabling direct investor participation in projects once limited and inaccessible to most investors.

Torch-RWA will be a regulated digital infrastructure for the compliant tokenization of Forge Atlanta’s development, and other RWAs and does not act as a developer, owner, or financial sponsor of the underlying real estate project. Positioned as a compliant crypto-economic infrastructure, Torch-RWA integrates security token standards, automated compliance enforcement, and programmable revenue distribution, enabling real-world assets to operate within a legally enforceable blockchain framework.

Institutional-Grade Blockchain Infrastructure for Real-World Assets

Torch-RWA is built on Ethereum using ERC-3643 security token standards, embedding investor identity, jurisdictional eligibility, and transfer restrictions directly into smart contracts. This design enables full regulatory alignment across issuance, custody, settlement, and secondary trading.

Core infrastructure layers include:

- On-chain identity verification (ERC-734/735)

- Automated KYC/AML enforcement via Identity Registries

- Modular compliance and jurisdictional rule engines

- Third-party custodial wallets and escrow-based settlement, as applicable

- Automated on-chain revenue distribution

- Regulated peer-to-peer secondary marketplace

This architecture enables programmable ownership, auditable cash flows, and legally enforceable asset settlement within a single unified system.

“Torch-RWA is being deployed as regulated digital asset infrastructure—not as an experimental marketplace,” said Eric McClendon, CEO of Torch, LLC. “Our goal is to provide a compliant, auditable framework where real-world assets can transition onto public blockchains without compromising legal integrity, investor protection, or institutional standards.”

“Launching with a multi-billion-dollar institutional-scale tokenized real estate development like Forge Atlanta demonstrates the scale of real-world value this platform is designed to support,” the CEO added.

Forge Atlanta – Torch-RWAs First Flagship Institutional-Scale Asset

The exchange’s inaugural listing will be Forge Atlanta, a multi-phase downtown mixed-use Mega-Asset backed by Webstar Technology Group and designed by Nelson Worldwide. Forge Atlanta is being advanced by Webstar Technology Group and its subsidiary Forge Atlanta Asset Management within a multi-pronged capital structure that includes traditional institutional financing, a $223.7 million bond inducement approved by the Development Authority of Fulton County (3), and future project-level debt and equity. Torch-RWA is intended to sit alongside this conventional capital stack as a digital infrastructure layer that brings fractional access and programmable distributions to compliant investors.

Within the Torch-RWA framework:

- RWA Tokens Receiving 30% Net Earnings will be represented via regulated on-chain security tokens (These security tokens do not represent equity or ownership in any land, buildings, or real property associated with the development)

- Bi-annual revenue distributions will be executed through audited smart contracts (Payouts to token holders occur automatically according to pre-programmed rules, providing transparency and reducing administrative overhead)

- Tokens will be tradable exclusively between verified, compliant investors

- All ownership transfers and payouts will be immutably recorded on-chain

Public projections associated with the development estimate:

- $7.3 billion in total economic impact

- 900+ permanent full-time jobs

- Long-term regional tax base expansion

Additionally, the Forge Atlanta tokenization structure includes net token proceeds allocation to a professionally managed portfolio of investment-grade fixed-income instruments, subject to market conditions and final documentation. This reserve framework is intended to provide an additional financial buffer to support project obligations and future phases of development.

Core Platform Modules Available at Initial Deployment

At launch, Torch-RWA will activate the following production modules:

- Primary Issuance Engine – Regulated security token issuance with immutable token supply and pricing, designed to integrate with registered broker-dealers, ATSs, and centralized exchanges, subject to regulatory approvals

- Secondary P2P Trading Layer – Infrastructure for compliant, escrow-backed investor-to-investor settlement and connectivity to regulated secondary trading venues

- Governance and Oversight – Torch-RWA is being built with regulated intermediaries, and institutional-grade audit and reporting processes to support issuer and investor protection

- Automated Revenue Distribution Engine – Smart-contract–controlled income payouts

- Staking and DAO Governance Framework – TRCH-powered voting and ecosystem governance

- Institutional, Retail, and Administrator Control Panels – Role-segregated operational dashboards

- Integrated Compliance & Audit Layer – Continuous synchronization between on-chain and off-chain records

Future roadmap phases include multi-chain expansion, RWA-backed lending, and cross-jurisdictional governance frameworks.

TRCH Utility Token and Forge Allocation Mechanism

Torch-RWA is powered by TRCH, an ERC-20 utility token used for:

- Marketplace settlement

- Governance participation

- Staking and yield incentives

- Platform-native asset access

Forge Investment Advantage: Investors who use TRCH to acquire Forge RWA security tokens receive a single, integrated 10% token reward, available exclusively within the Torch ecosystem and subject to compliance eligibility. (This reward is provided in TRCH utility tokens within the Torch ecosystem and does not constitute yield, an interest rate, or a guaranteed return).

Referral Reward Program Supporting Ecosystem Adoption

As part of its launch strategy, Torch-RWA will introduce a structured referral reward program for the TRCH utility token initial coin offering, which will subsequently be extended to the Forge RWA security token launch, designed to support responsible token distribution and platform adoption.

The referral program enables KYC-verified and compliance-approved users to invite new eligible participants to the Torch-RWA ecosystem. When referred users’ complete identity verification and engage in approved activities—such as TRCH acquisition or participation in Forge RWA offerings—referrers may receive token-based rewards, subject to predefined program terms and regulatory requirements.

The referral framework operates entirely within Torch-RWA’s compliance architecture and is intended to:

- Encourage verified user onboarding

- Support organic network growth

- Increase distribution efficiency of platform-native tokens

- Strengthen long-term ecosystem engagement

All referral rewards are issued in TRCH utility tokens and do not constitute yield, interest, profit-sharing, or guaranteed returns. Participation is subject to jurisdictional eligibility, platform policies, and ongoing compliance review.

Launch Timeline and Network Expansion

Torch-RWA is currently in its final pre-launch phase, with:

- Initial deployment on Ethereum

- Progressive rollout of primary issuance, secondary trading, staking, and governance

- Planned expansion to Ethereum Layer-2s, Polygon, and Solana

Private access phases will precede full public activation (Private phases will be limited to identity-verified institutional and accredited investors, with broader access introduced as regulatory requirements are satisfied).

(**All security token offerings and marketplace functions are subject to applicable regulatory approvals and ongoing compliance requirements.**)

About Torch-RWA

Torch-RWA, operated by Torch, LLC, is a blockchain-based marketplace for the compliant issuance, trading, and revenue automation of real-world assets. The exchange integrates regulated security token standards, automated compliance enforcement, decentralized governance, and programmable finance to enable scalable, global access to institutional-grade real-world investments.

For more information, visit their website – https://torch-rwa.com/

Contact them via

Email: Jason@jmfcommunications.com

Visit Torch-RWA through

X (Twitter): https://x.com/Torchrwa

Telegram: https://t.me/torch_rwa

Instagram: https://www.instagram.com/torch_rwa/

Media Contact

Organization: Torch-RWA

Contact Person: Jason Feldman

Forge Atlanta

Media & Communications

Website: https://torch-rwa.com/

Email: Jason@jmfcommunications.com

1100 Peachtree Street Northeast STE 200

Atlanta

State: Georgia, USA

Corporate Office

Torch, LLC

1050 Crown Pointe Parkway

Suite 500

Atlanta, GA 30338

United States

Disclaimer(s)

This press release is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities, tokens, or other financial instruments in any jurisdiction. Any future offering of securities or digital assets will be made only by means of applicable offering documents, and only to investors who meet all eligibility and regulatory requirements.

TRCH is a platform utility token that does not represent an ownership interest in Forge Atlanta or any other underlying asset; economic exposure to Forge Atlanta’s cash flows will be offered, if at all, only through separately issued, regulated security tokens.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially due to risks and uncertainties including regulatory approvals, financing conditions, construction timelines, and market adoption of emerging technologies.

References

(2) https://www.marketsmedia.com/tokenized-real-world-assets-cross-20bn/

(3) https://www.developfultoncounty.com/about-us-news.php

Media Contact

Organization: Torch, LLC

Contact Person: Jason Feldman

Website: https://torch-rwa.com/

Email: Send Email

Address:1050 Crown Pointe Parkway

Address 2: Suite 500

City: Atlanta, GA 30338

State: Georgia

Country:United States

Release id:41038

The post Torch-RWA to Debut TRCH-Powered RWA Marketplace with $3.8 Billion Forge Atlanta as First Listing appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release5 days ago

Five Global Megatrends Highlighted at Open Dialogue Expert Forum at the Russia National Centre

-

Press Release2 days ago

GISEC Global to Launch Cyber Diplomacy Forum in 2026 as Cybersecurity Moves Centre-Stage in Global Trade and Foreign Policy

-

Press Release7 days ago

CMS (867.HK/8A8.SG): Ruxolitinib Phosphate Cream Obtained China NDA Approval, Becoming The First and Only Targeted Drug for Vitiligo in China

-

Press Release1 week ago

Med Consumer Watch Study Identifies CoreAge Rx as High-Value Provider in GLP-1 Telehealth Sector

-

Press Release7 days ago

Roger Haenke Connects Healthcare and Faith in a Career Centered on Presence and Support

-

Press Release7 days ago

Cloudbet Academy Launches World Cup 2026 Betting Guide: Crypto Strategies and Tournament Insights

-

Press Release7 days ago

Gabriel Malkin Florida Completes 120-Mile Camino Walk with Focus, Patience, and Preparation

-

Press Release6 days ago

Broadway Polaroids Advocates for Authentic Access and Creative Preservation in Theatre