Press Release

When Pain Points in Cross-Border Payment Brings Payment Changes, How Can Hypercard Lead the Trend

Throughout the evolving history of global cross-border payment, cross-border payment is rising with the continuous development of the international division of labor and international exchanges. In the early days, people use precious metals for cross-border payment and clearing, then followed by paper money, and today’s modern electronic transfer and clearing. Cross-border payment is developing gradually towards a rapid, safe and economical trend as the entire international community is engaging in the activities more frequently and science and technology are changing and progressing.

The change of cross-border payment

According to the data, the total amount of global cross-border payment reached $125 trillion in 2018 and is expected to reach $218 trillion in 2022, promising huge profits.

In the existing transfer and remittance system, the transaction is slow and the cost is high with much margin for error; institutions have to coordinate the value transfer between different internal databases, which makes it extremely difficult to settle transactions quickly. This process not only slows down the transaction progress but also requires large working capital, which has a negative impact on the balance sheet of the institution.

As cryptoassets are gradually accepted by traditional finance, digital currency payment is also implementing and applying quickly. The competition around digital currency has just begun across the globe. In 2019, the emergence of Libra has triggered the catfish effect, and legal currency is discussed more enthusiastically all over the world. Countries have taken precautions and speeded up the research on sovereign digital currency. Even the European Central Bank, which did not seem interested before, recently began to discuss the necessity of developing a unified digital currency. According to a report released by the International Monetary Fund in July of the same year, nearly 70% of the world’s central banks are studying sovereign digital currency.

Some fear that Libra may become a strong currency once in circulation. It can be exchanged with the currencies of countries and erodes the fiat currency. If the weak countries make mistakes in regulation, hyperinflation or even de-monetization will likely happen. In the past, a typical example is Zimbabwe who abolished its local currency and was forced to use the US dollar and other currencies.

Traditional payment giants are fostering digital currency payment

Bitcoin was born to destroy the existing monetary system, which many people think is too expensive and exclusive. Given this, it has a much broader value proposition than a deflationary policy and a hard cap of 21 million coins. The new application of blockchain technology also allows anyone to remit money to counterparties around the world in minutes at a low cost.

This function makes bitcoin directly target the existing payment platforms (such as credit card networks and inter-bank messaging systems). While some companies shrug off these concerns, others see the potential and are looking for ways to create value for partners and shareholders.

According to news on February 20, Visa, an international payment giant, has cooperated with 35 leading digital currency platforms or digital wallets.

These institutions are digital currency platforms licensed by the state or regulated by relevant departments, such as the digital payment platform WireX, the digital currency trading platform Coinbase and Fold, cryptoasset lending platform BlockFi, Austria encryption trading platform Bitpanda, Encrypted debit card platform Crypto.com, etc.

Industry insiders said that the cooperation between Visa and digital currency service providers enables consumers to exchange digital currency more quickly and easily. Users can also deposit this money into their Visa certificates in real-time.

When asked why Visa chose the cryptoasset payment, Visa’s executives clearly expressed their optimism about the payment method in his talks with Forbes: “we saw significant innovation in new financial services for consumers holding digital currency. One example is the growth in demand for digital money lending. We are delighted to work with fintech companies like Cred. The company develops new products in this ecosystem and finds new ways for Visa to improve the entrance of fiat currency associated with these products. “

At present, in addition to Visa, MasterCard, Paypal and other international payment tycoons are also fostering digital currency.

Recently, MasterCard stated that it has cooperated with the Central Bank of The Bahamas to launch the world’s first Bahamas prepaid card. The prepaid card allows people to immediately exchange digital currency into traditional Bahamas dollars and pay for goods and services anywhere MasterCard supports. PayPal also claimed to provide cryptocurrency services to the UK market in the coming months.

Cryptoasset service providers speed up the participation in payment

Not only the traditional payment giants are paying attention to cryptoassets payment, but also the asset service providers in the encryption industry are exploring the possibility of payment. HyperBC, a well-known encrypted asset service provider, has launched a comprehensive consumer card HyperCard. After being deposited with digital currency, the card is available in more than 176 countries and more than 50 million merchants worldwide.

As a global standard credit card, HyperCard supports the binding consumption with third-party payment companies by users

Every payment made by HyperCard is secure and consumer privacy is protected by law. HyperCard can transfer money beyond the geographical limit in a second at a low commission, yet with 24/7 service. It is traceable with clear information of all parties. No matter which city you are in, you can use it at all merchants accepting Visa, Master and UnionPay.

In fact, in addition to payment, the most intuitive appealing of digital currency credit cards is it makes encrypted assets purchasing easy and cash out of cryptoassets. In this context, digital currency payment is still a very new track, and the choice of such products is still limited. The main problems are as follows:

1. Only single-currency payment is supported, such as bitcoin

2. Only available in a small number of areas

3. Users have to buy cryptocurrency issued by the card providers before paying

4. Charge a certain percentage of the annual fee

HyperBC also takes this situation into consideration. It is convenient to apply for HyperCard. The digital currency, deposited into HyperCard, can be exchanged into fiat currency in real-time, eliminating the tedious process and the trouble of cash payment, and significantly improving the user-friendliness of digital currency. HyperCard does not charge for KYC verification and only charges a very low commission for each deposit.

How to apply for HyperCard?

a Download the HyperPay App(https://www.hyperpay.tech/app_down) and register

b Apply for HyperCard

c Submit KYC documents and pass the certification

d HyperCard received

Conclusion

With the rapid development of digital currency and the increasing global acceptance of digital currency, the boundary between fiat currency and digital currency will become narrower. At the same time, digital currency credit card reduces the threshold for traditional users to access digital currency. The selective digital currency assets also avoid their risk in holding digital currency to a certain extent, Whether for investment, quick cash-out, or regular consumption, HyperCard, as a mature digital currency credit card, can enable cardholders to enjoy more convenient services.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

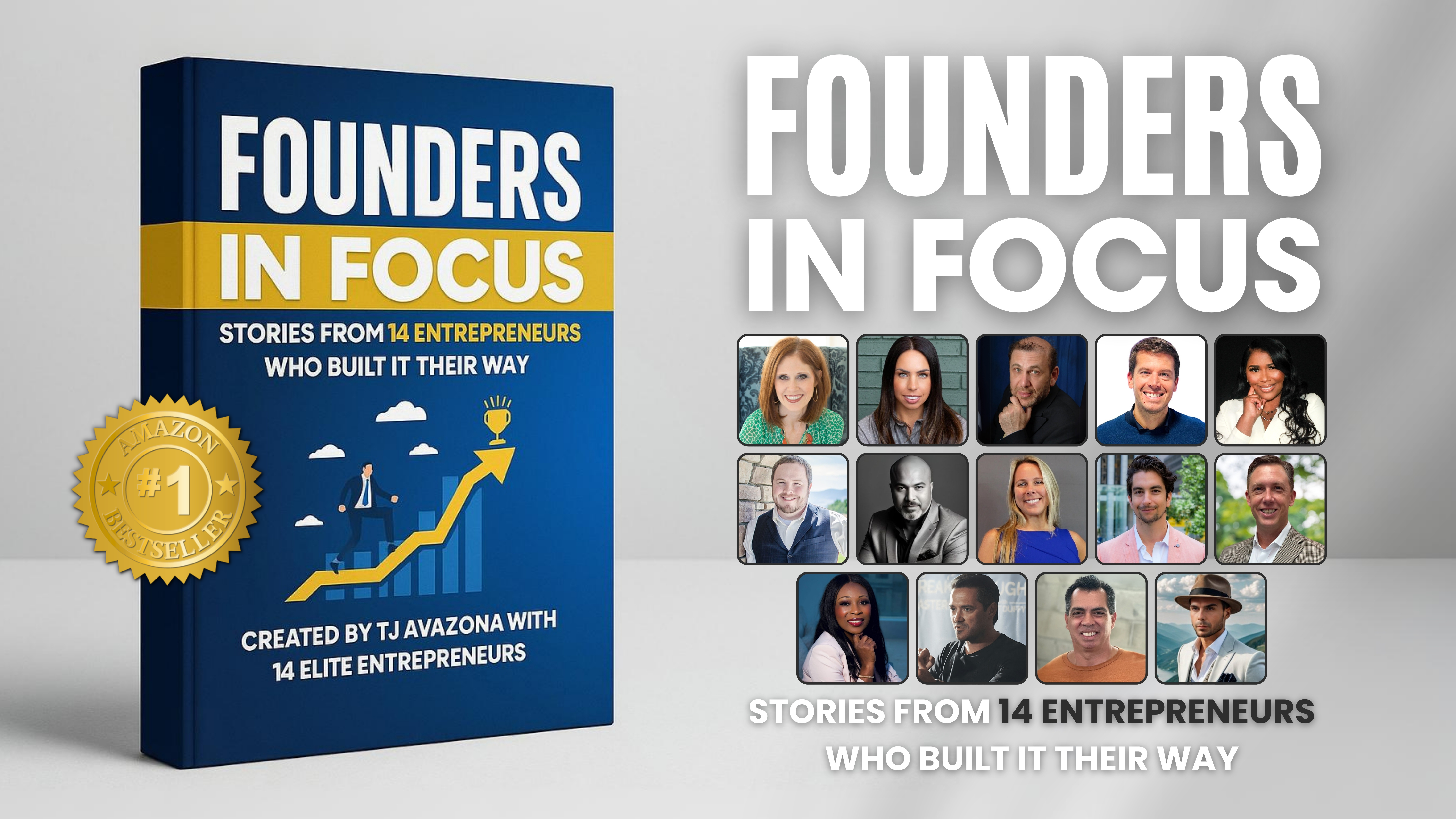

Avazona Ltd.’s ‘Founders in Focus’ Hits #1 Best-Seller on Amazon, Celebrating 14 Elite Entrepreneurs Who Built It Their Way

“Founders in Focus: Stories from 14 Entrepreneurs Who Built It Their Way,” the debut anthology by Avazona Ltd., has officially hit #1 on Amazon in multiple categories. The book captures the raw, real, and radically different journeys of 14 visionary entrepreneurs across diverse industries.

Edinburgh, UK, 2nd July 2025, ZEX PR WIRE, Avazona Ltd., the powerhouse behind some of today’s most visible personal brands, has made a major splash in the publishing world with the launch of Founders in Focus: Stories from 14 Entrepreneurs Who Built It Their Way. Since its release, the book has become an Amazon #1 bestseller, topping charts in Global Marketing, Commerce, Shopping & Commerce Reference, and Business Franchises. Featuring real, unfiltered narratives from entrepreneurs in sectors like healthcare, real estate, tech, coaching, and education, the anthology highlights the grit, detours, and defining moments behind modern success.

Founders in Focus by Avazona Ltd.

The book was born out of a need to separate entrepreneurial hype from what it’s really like, what the book’s creator, TJ Avazona, describes as the “pitfalls.” “We’re drowning in hustle quotes, but what people really need are raw blueprints and unedited maps of what it looks like to fall and get back up,” said TJ. “I wrote this because I wish I had it ten years ago. These are the stories I needed to hear when I was struggling.”

Each chapter offers a lived lesson plan, earned through trial, error, and relentless belief. The book doesn’t promise a straight path, but it does offer guidance. These founders may come from different industries, but their stories echo a shared truth: that persistence, adaptability and courage are the real foundations of success.

TJ’s own evolution reflects the message at the heart of the anthology. His path was not a red carpet to success, it was lined with failed YouTube channels, ghosted pitches, painful rejections and constant reinvention. From roadside penny hunts to leading a million-dollar marketing agency, his story is just one of many that prove success isn’t about getting it right the first time, it’s about continuing anyway.

“Founders in Focus: Stories from 14 Entrepreneurs Who Built It Their Way” is now available on Amazon.

About Avazona Ltd.

Avazona Ltd. is a global PR and marketing agency known for helping entrepreneurs and businesses build credibility and visibility through strategic media placements and personal branding. With a presence in multiple countries, the company leverages its strong network of media contacts to deliver impactful storytelling and elevate client profiles across industries.

About Book Authors

- Amy Goodson, an award-winning sports dietitian and founder of “The Sports Nutrition Playbook,” shares how pauses in her career, like the 2020 slowdown, became launchpads for her greatest work, reminding us that unconventional paths often lead to unexpected wins.

- Hillary Seiler, known as “Coach Hill,” turned years of financial struggle and medical debt into a renowned business, “Financial Footwork,” which teaches professional athletes and everyday people how to manage money. Her experience proves that pain can be the blueprint for purpose.

- Dr. David Kenneth Waldman, education advocate, reveals how failing in pre-med led him to create “To Love Children Educational Foundation International,” which empowers girls through education. His story highlights how the worst setbacks can lead to the most impactful missions.

- Nick Day, founder of “JGA Recruitment,” took a bold leap during the 2008 economic crisis by specializing in payroll. He shows that niche focus and timely action, even in crises, can lead to big wins.

- Kenya Lee, a nurse and founder of “Faith In Girls,” turned the stillbirth of her daughter into a movement that empowers women. Her chapter proves that emotional intelligence is the foundation of independence.

- Ryan Crittenden, a U.S. Army veteran, Ph.D. in Industrial and Organizational Psychology, and founder of “XL Coaching and Development,” explains how naming his self-doubt helped him transform it into a tool for growth. He emphasizes outshining flaws with what works and the importance of making people feel seen and valued for long-term wins.

- Shailesh Poddar, founder of “Habitat28,” changed the housing industry by making modular homes high-quality. From facing stigma to winning municipal approval, his journey demonstrates how innovation and evidence can change minds and markets.

- Jessica Coffield, psychologist turned coach, offers a valuable story on turning passion into a business like “Endless Possibilities Life and Business Coaching Services.” She shows how purpose, combined with structure and knowledge, can take flight and create lasting breakthroughs.

- Michael Holt, luxury real estate expert and co-founder of “The Holt Team,” combines high-quality service with deep client empathy. His approach reveals how relationships fuel long-term success.

- Henry Criss, a Marine Corps veteran and CEO of “Fraum Health,” left behind government bureaucracy to pursue healthcare. His work in non-surgical pain and wellness care reminds us that risks, not routines, lead towards revolutionary leadership.

- Dr. Adebola Ajao, an FDA epidemiologist and leadership coach, found her calling after career burnout. Through “Empowering Initiatives,” she mentors women to rise beyond professional stagnation, showing that science-backed purpose is a powerful force for reinvention.

- Philip Shalala, founder of “The Critical Co.” and the branding mastermind behind a major hospitality brand’s entertainment empire, built businesses by following his gut. From launching a top-selling energy drink to selling his entertainment company to a national sports organization, Philip’s story is proof that innovation succeeds when you trust your instincts and dare to disrupt.

- Rich Funk, CEO of “BOOM Chaga” and a veteran of leading global consumer goods companies, turned COVID-era grief into a mission for wellness. His chapter proves how tragedy and personal loss can awaken world-changing innovation.

- Christian Cassarly, founder of “SuperpowerThinking.org,” combines trading, mindset mastery, and faith to help others achieve financial and spiritual freedom. He proves that vision and belief can transform uncertainty into impact and profit into purpose.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Kiran Biotech Advances Site-Specific Delivery Research with AvidinOX Platform

Kiran Biotech is developing AvidinOX®, a protein-based platform designed to improve site-specific localization of biotinylated compounds. The technology enables covalent anchoring at targeted sites, supporting precision research in molecular imaging, diagnostics, and tissue engineering.

Italy, 1st Jul 2025, Grand Newswire – The Italian biotech startup is exploring a new approach to molecular localization based on covalent anchoring of biotin-tagged compounds.

Kiran Biotech, an Italian research-based company operating in the field of molecular delivery technologies, is developing a novel platform aimed at improving the localization of biotinylated compounds through a proprietary protein-based anchoring mechanism called AvidinOX®.

The platform is designed to explore new ways of enhancing the site-specific retention of molecules, with the goal of improving selectivity and reducing unwanted dispersion in preclinical research and diagnostic settings.

AvidinOX® is a chemically modified avidin derivative that forms stable covalent interactions with tissue proteins at the site of application.

Once anchored, the treated site can selectively bind biotinylated agents delivered systemically.

This concept supports the investigation of modular delivery strategies, where localization and compound activity are decoupled.

Kiran biotech is studying the potential use of this approach in different research domains, including molecular imaging, tissue engineering, and site-preparation for systemically delivered probes or cells.

Initial results from preclinical studies and early-stage research programs suggest promising opportunities for further development.

AvidinOX® has been the subject of publications in peer-reviewed journals, including Oncotarget, Oncology Letters, and Bioorganic & Medicinal Chemistry Letters, where its anchoring behavior and molecular compatibility were explored under experimental conditions.

According to Kiran Biotech’s team, the modularity of AvidinOX® may allow future integration with a range of compatible technologies, including biotin-labeled molecules or probes developed by third-party research groups or pharmaceutical companies.

Its anchoring mechanism, once validated and scaled, could serve as a platform to support localized strategies in various investigational frameworks.

Kiran biotech holds a portfolio of intellectual property protecting the AvidinOX® molecule, its production process, and a broad range of research applications involving localization, targeting, and detection.

The company was recently recognized as one of Italy’s emerging innovators in the biotech sector, and it has received support under Italy’s national innovation funding programs.

The company is currently focused on advancing its R&D pipeline, establishing production scale-up protocols under controlled conditions, and initiating collaborative studies with institutions and private partners.

“We see AvidinOX® as an enabling technology.” says Rita De Santis, CEO of Kiran Biotech.

“Our goal is to provide researchers with tools to better explore localization and selective delivery in a wide range of experimental applications.”

About Kiran Biotech

Kiran Biotech is a privately held Italian company focused on the development of protein-based tools and delivery platforms for use in preclinical research, diagnostics, and biotechnological innovation.

Its mission is to contribute to the evolution of precision strategies through site-specific anchoring technologies.

Media Contact

Organization: IMISEST

Contact person: Stefano Manzotti

Website: https://imisest.com

Email: amministrazione@imisest.com

Country: Italy

Release id: 19214

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

CJS&S Japan has Announced Project DAO & RWA as Its Official Second Blockchain Project After the Success of Its G2E Game in 2025

The new project will expand the Web3 ecosystem built with Titan’s Tap, enhancing multi-chain strategies and upgrading user-centric architecture.

Building on the success of its first project, CJS&S JAPAN, the developer behind the global Web3 platform Titan’s Tap has initiated the preparations for its second blockchain initiative, ‘Project DAO & RWA’, aiming to strengthen the multi-chain ecosystem and accelerate the mainstream adoption of Web3 through a more intuitive user experience.

In its previous project, Titan’s Tap gained industry attention for its TON-based user participation reward structure, community-led decentralized operation model, and streamlined onboarding experience. In particular, its intuitive UX/UI, accessible to all participants, was praised for significantly lowering the barrier to entry into the Web3 space.

‘Project DAO & RWA’ will be developed with a multi-chain architecture that ensures compatibility with various blockchain networks such as Solana and Ethereum. While maintaining the community’s autonomy and trust-based model, the project will enhance tokenomics and utility to maximize tangible benefits for users.

DAO refers to a system where all participants hold decision-making power and operations are automatically executed via smart contracts. By integrating RWA (Real World Assets), the platform enables all votes and transactions to be recorded on the blockchain, and only participants who meet specific criteria are automatically rewarded. Moreover, the system allows for investment in RWAs with small amounts and enables a fair, intermediary- free operational structure.

A Titan’s Tap spokesperson commented, “Web3 remains a fast-evolving market, and to integrate into everyday life, ‘simplicity’ and ‘reward’ are key,” adding, “Through this second project, we aim to provide more users with easy access to blockchain and a structure that allows them to directly create value within the ecosystem.”

Meanwhile, Titan’s Tap was listed on one of the most prominent global exchanges in record time and continues to maintain smooth trading activity. The second project is currently in its early planning phase, with teaser releases and community testing scheduled for the second half of the year.

To learn more and get started visit:

Website: https://titanstap.io/

CoinMarketCap: https://coinmarketcap.com/currencies/titans-tap/ Telegram: https://t.me/titanstapio

X (formerly Twitter): https://x.com/Titan_s_Tap

Medium: https://medium.com/@moojidevelopment

Media Contact

Organization: CJ S&S JAPAN

Contact Person: KONDO/MIHO MS

Website: https://cjjapan.com/

Email: Send Email

City: Nagoya

Country:Japan

Release id:30141

The post CJS&S Japan has Announced Project DAO & RWA as Its Official Second Blockchain Project After the Success of Its G2E Game in 2025 appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 week ago

Calling All Competitive Eaters: Florida’s Premier Hot Dog Eating Contest Opens Registration

-

Press Release5 days ago

Petsy Place Unveils Enhanced Online Experience Reinforcing Commitment to Pet Well-being

-

Press Release5 days ago

Essential Treasures Bazaar Opens its Virtual Gates Offering a Wealth of Daily Necessities and Unique Finds

-

Press Release5 days ago

Essential Treasures Bazaar Opens its Virtual Gates Offering a Wealth of Daily Necessities and Unique Finds

-

Press Release4 days ago

Cloud mining giant FansHash Launches free and efficient cloud mining applications to easily improve mining efficiency and achieve simple operation

-

Press Release1 week ago

Tony Deoleo Visionary Philanthropist and Entrepreneur Visits Manny Pacquiaos LA Training Camp as June Aquino Unveils Masterpiece Honoring the Boxing Legend and Visionary Couple Tony and Lorie Deoleo

-

Press Release4 days ago

AIDAv2 The Future of Investment in the Age of AI and How Its Shaping a New Financial Paradigm

-

Press Release5 days ago

PES Solar Now Offering High-Efficiency Blow-In Insulation in Orlando FL