Press Release

West Red Lake Gold Bulk Sample Program Produced Gold worth CAD $11.7 million

Delivering tonnes and grade from the mine that align almost exactly with expectations validates all the work WRLG has done to unlock the tremendous value in the Madsen Mine.

Canada, 8th May 2025 – Sponsored content disseminated on behalf of West Red Lake Gold. On May 7, 2025, West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) published reconciliation results from the bulk sample program at its 100% owned Madsen Mine located in the Red Lake Gold District of Northwestern Ontario, Canada.

WRLG bulk sampled 14,490 tonnes of ore @ 5.72 grams/tonne Gold, generating 2,498 ounces of gold worth CAD $11.7 million at CAD $4,700/ounce. The Madsen Mill has a permitted throughput of 800 tonnes/day.

West Red Lake Gold is one of only four single-asset companies putting a new gold mine into production in 2025.

West Red Lake Gold Bulk Sampling Highlights:

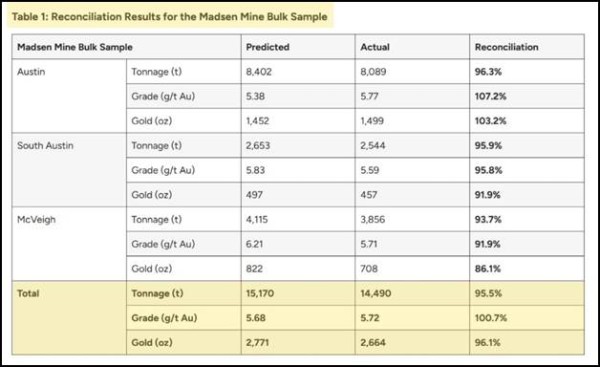

- The bulk sample carried an average grade of 5.72 grams per tonne (“g/t”) gold (“Au”), 0.7% above the average predicted grade of 5.68 g/t Au for six stopes across three areas.

- 14,490 tonnes of bulk sample produced 2,498 ounces of gold

- Gold recovery in the Madsen Mill averaged 95%

“Delivering tonnes and grade from the mine that align almost exactly with expectations validates all the work we have done to unlock the tremendous value in the Madsen Mine,” stated Shane Williams, President and CEO, in the May 7, 2025 press release.

“This achievement underlines that Madsen is on track to become a new high-grade gold mine in 2025.”

In the May 7, 2025 video below, WRLG explains why “West Red Lake Gold is Ready to Perform and Built for Today’s Gold Bull Market.”

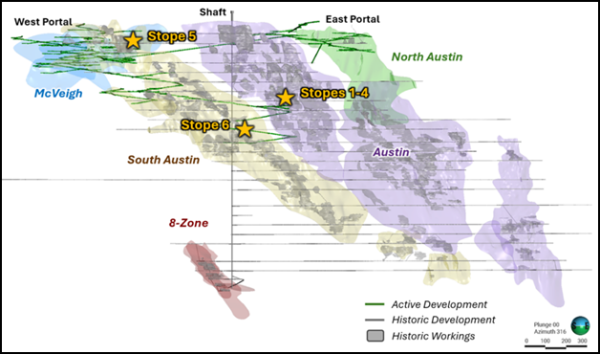

The bulk sample included material from three main resource zones at Madsen – Austin, South Austin, and McVeigh.

Close reconciliation between predicted and actual grades and tonnages highlights the effectiveness of definition drilling and detailed stope design in informing accurate modelling of gold mineralization.

West Red Lake Gold has completed over 90,000 metres of definition drilling since October 2023, and the high-confidence tonnes resulting from this ongoing program currently make up approximately 90% of the 18-month detailed mine plan.

Six stopes were drilled, engineered, and mined using the same workflow that the Company plans to implement during regular mine operations at Madsen.

“We design stopes to maximize economic benefit in today’s gold price environment. This differs from the Pre-Feasibility Study (“PFS”), which used a gold price of US$1,680 per ounce when designing stopes,” stated Williams.

“Using a gold price just below the long-term consensus gold price of US$2,350 per oz. unlocks significant opportunity at Madsen because, in many areas, a halo of lower-grade mineralization can be profitable to include in the stope design when it surrounds targeted high-grade tonnes.”

“In addition, mining larger stopes can lower mining costs by enabling long-hole stoping instead of cut-and-fill methods. We used long-hole stoping exclusively in the bulk sample.

We are excited by the opportunity to mine additional tonnes and ounces at Madsen, potentially lowering operational costs, increasing production, and enhancing overall economics relative to the PFS mine plan,” stated Williams in the May 7, 2025 press release.

“In a note published on Wednesday, the precious metals team [at Bank of America] led by Michael Widmer said it sees growing potential for gold to hit $4,000 an ounce in the second half of this year,” reported Kitco News.

“In March, Widmer and his team predicted that gold prices would hit $3,500 by 2027—a target the precious metal reached in less than a month.”

“In the commodities market, timing is critical. I’m betting current macro trends will boost the value of gold,” wrote WRLG Co-Founder, Major Shareholder, Strategic Advisor Frank Giustra in 2024.

Giustra was instrumental in the development and growth of several significant gold producers. Gold Corp (Wheaton River) grew from US $17 million to a $21.8 billion market capitalization in a little over five years. Endeavour Mining grew from $180 million to $8 billion in under 7 years.

“It begins with one well-executed mine acquisition, like we are proving with Madsen. It expands through smart deals and leadership,” added Giustra.

“We acquired Madsen because we believed an accurate geological model, detailed engineering design, and disciplined mining practices would enable exactly this – a mine that delivers to plan. I am extremely pleased to deliver these bulk sample results, and I look forward to ramping up operations at the Madsen Mine in the coming months,” stated Williams.

The Madsen deposits presently host an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [1 .] [2.] [3.]

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for technical disclosure at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events.

References:

- “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada”, prepared by SRK Consulting (Canada) Inc. and dated January 7, 2025 (the “Madsen Report ”). A full copy of the Madsen Report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- The Madsen Mine deposit presently hosts a National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) Indicated resource of 1.65 million ounces (“Moz”) of gold grading 7.4 g/t Au and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t Au. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US$1,800/oz. Mineral resources as stated are inclusive of mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the updated report. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- The Madsen Mine also contains Probable reserves of 478 thousand ounces (“koz”) of gold grading 8.16 g/t Au. Mineral reserve estimates are based on a gold price of US$1,680/oz. Please refer to the technical report “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada” available on the Company’s website and on SEDAR+ at www.sedarplus.ca

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:27481

The post West Red Lake Gold Bulk Sample Program Produced Gold worth CAD $11.7 million appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Empire State SEO Launches Comprehensive Digital Marketing Suite to Empower Tri-State Small Businesses in Hyper-Competitive Online Landscape

New York, United States, 8th Dec 2025 – Empire State SEO, a full-service digital marketing agency rooted in the heart of the Empire State, today announced the expansion of its end-to-end solutions designed exclusively for small businesses across New York, New Jersey, and Connecticut. With a focus on affordable, results-driven strategies, the agency is equipping local enterprises with the tools to dominate search rankings, enhance online visibility, and convert digital traffic into lasting revenue streams.

In the New York-Newark-Jersey City metro area—home to over 2.6 million small firms, representing more than 99% of all businesses (U.S. Small Business Administration, 2025)—small business owners face skyrocketing digital ad costs, cutthroat local competition, and constantly shifting search algorithms. Empire State SEO’s expanded suite tackles these challenges head-on, delivering end-to-end digital solutions that fuse hyper-local insight with proven global strategies. Standout features include advanced SEO for hyper-local dominance, AI-powered web design for frictionless user experiences, and integrated social media campaigns that spark authentic audience connection.

Under the leadership of Sid Gandotra—an experienced marketing consultant, strategist, branding expert, and SEO specialist with over 10 years of proven success in driving business growth, strengthening brands, and achieving market dominance—Empire State SEO leverages expert operational, market, and SEO analysis to develop strategies that seamlessly align marketing, branding, and search initiatives with core business objectives. The agency designs data-driven campaigns, cohesive brand narratives, and optimized digital content that engage target audiences, elevate brand equity, increase online visibility, and generate sustainable revenue growth.

Sid Gandotra founded Empire State SEO after witnessing a persistent gap in the market: small businesses were being priced out of effective digital marketing and overwhelmed by agencies that overpromised, oversold, and under-delivered. After a decade of consulting for companies across multiple industries, he saw entrepreneurs struggling with rising ad costs, weak organic visibility, and fragmented branding that diluted their growth potential. Determined to create an agency that offered transparency, affordability, and measurable results, he launched Empire State SEO with a clear purpose.

“Our mission has always been to level the playing field for small businesses that don’t have massive marketing budgets but deserve big results,” said Sid Gandotra, Founder of Empire State SEO. “Most small businesses get buried on page 2 of Google. We get them to page 1—and keep them there. Online visibility isn’t a luxury—it’s survival. Whether propelling a Manhattan startup to the top of Google or crafting a cohesive brand identity for a Hudson Valley enterprise, we are here to turn digital challenges into growth opportunities.”

Key offering includes:

• Search Engine Optimization (SEO) – Precision strategies to secure top Google rankings and attract qualified local traffic.

• Web Design & Development – Custom, responsive websites engineered as revenue-generating digital storefronts.

• Social Media Content – Dynamic, platform-specific campaigns that build authentic audience engagement and drive conversions.

• Logo Design & Branding – Distinctive visual identities that resonate with Tri-State customers and foster lasting loyalty.

• Printing & Marketing Solutions – High-impact print materials that amplify digital efforts with tangible, real-world presence.

Empire State SEO’s flexible, scalable partnerships ensure businesses can start small and grow alongside their success, with dedicated support from consultation to continuous optimization.

Small business owners in the Tri-State area are invited to schedule a complimentary consultation to explore how Empire State SEO can transform their digital presence. Visit https://empirestateseo.com/ or call +1 (646) 761-3499 to get started.

About Empire State SEO

Headquartered in New York, Empire State SEO specializes in SEO, web design, social media, branding, and print solutions for small businesses across NY, NJ, and CT. With a results-oriented approach and deep roots in the local market, the agency empowers entrepreneurs to thrive in a digital-first economy.

Media Contact

Organization: Empire State SEO

Contact Person: Empire State SEO

Website: https://empirestateseo.com/

Email: Send Email

Contact Number: +16467613499

City: New York

State: New York

Country:United States

Release id:38668

The post Empire State SEO Launches Comprehensive Digital Marketing Suite to Empower Tri-State Small Businesses in Hyper-Competitive Online Landscape appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

JAF Executive Travel Sets a New Benchmark in Luxury Chauffeur Services in London

JAF Executive Travel is a leading luxury chauffeur company based in London, providing first-class transportation across the UK. The company offers tailored travel solutions for airport and cruise port transfers, business travel, private jet connections, major sports and entertainment events, and VIP occasions.

United Kingdom, 8th Dec 2025 — Travel in London has always been about more than simply getting from one place to another. It is about first impressions at the airport, confidence on the way to a meeting, and the comfort of knowing every detail has been taken care of. With that purpose in mind, JAF Executive Travel has spent years building a service that feels less like a ride and more like a trusted partnership—one built on reliability, hospitality, and outstanding vehicles.

JAF Executive Travel now proudly introduces an enhanced selection of chauffeur services, supporting clients travelling for airport and cruise port connections, high-profile business trips, exclusive events, sports hospitality, and private jet transfers. Whether it’s a solo traveller arriving at Heathrow or a VIP group heading to Wembley, the company ensures each journey is as smooth and stress-free as the destination ahead.

A Fleet That Reflects Modern Luxury

Every great chauffeur experience starts with the car. JAF Executive Travel offers a carefully chosen range of vehicles that suit every style of travel:

- Mercedes-Benz S-Class for those who expect nothing less than executive comfort

- Mercedes-Benz V-Class, when groups want space without losing sophistication

- Range Rover for guests who appreciate refined presence and performance

- Rolls-Royce models for moments that demand elegance and prestige

- Limousines, making celebrations and glamorous arrivals unforgettable

- Electric vehicles, including Tesla and BMW i7, for guests who want luxury and sustainability to work hand-in-hand

The company has placed a strong focus on expanding its green fleet to help reduce emissions within London and major UK cities. The aim is simple: offer luxury with a smaller environmental footprint.

Airport & Private Jet Transfers Designed Around You

Flights can be unpredictable, and delays are part of modern travel. JAF Executive Travel removes the anxiety by closely tracking every arrival and departure. Chauffeurs greet passengers at the terminal, assist with luggage, and ensure the final stage of the journey is comfortable and easy.

Coverage includes Heathrow, Gatwick, Luton, Stansted, London City Airport, and Birmingham. Private jet clients are equally supported with transfers to Farnborough, Biggin Hill, Luton Private Jet Centre, and other premium aviation hubs where discretion and timing are essential.

Supporting Business Where It Happens

Business doesn’t wait, and neither does JAF Executive Travel. The company works closely with corporate teams, PAs, and executive offices to ensure punctual travel to:

- Board meetings

- Financial roadshows

- Corporate hospitality events

- International delegate visits

The privacy inside each vehicle allows passengers to work, prepare, or relax before a major presentation. Onboard Wi-Fi, charging ports, and comfortable interiors help turn travel time into productive time.

A Reliable Partner for Events and Sports Experiences

From Royal Ascot to Premier League match days and international concerts at the O2, London’s most prominent venues depend on precision timing. JAF Executive Travel ensures guests arrive without the hassle of traffic or parking. The service is particularly popular with travellers heading to major cruise ports such as Southampton, Dover, and Tilbury, offering door-to-ship convenience that eliminates any rush or stress.

Families, global visitors, and hospitality groups value the reassurance that every detail is handled, including luggage space and coordinated multi-vehicle travel.

Chauffeurs With a Reputation for Excellence

The drivers are the heart of the company. Each chauffeur is chosen not only for advanced driving ability but also for thoughtful service. Their training covers:

- Professional etiquette for VIP and corporate clients

- Discretion and respect for privacy at all times

- Safety, security, and guest assistance

- Local knowledge for the best routes and a smooth ride

Many travellers return specifically because of the London chauffeurs who looked after them. That personal loyalty reflects the company’s belief that people remember how they were treated more than anything else.

Smart Booking. Honest Pricing. Real People.

Luxury should feel effortless. JAF Executive Travel makes booking simple, whether you arrange it personally or have an assistant do it. Quotes are clear from the start—no hidden extras and no unexpected additions after the trip.

Clients receive real-time updates, immediate support when plans change, and a human team who understands that travel doesn’t always go perfectly, but service always should.

Looking Ahead

JAF Executive Travel has grown gradually, client by client, through word-of-mouth and repeat bookings. The company is now investing in new technology and more eco-friendly vehicles as it prepares for continued growth across the UK.

“We want every person who steps into one of our cars to feel looked after,” says the Managing Director of JAF Executive Travel. “Luxury travel shouldn’t feel complicated. It should feel reassuring and enjoyable from the moment you book to the moment we drop you off.”

As London continues to welcome international travellers, corporate visitors, and those celebrating life’s most significant moments, JAF Executive Travel promises to remain a name people can depend on.

About JAF Executive Travel

JAF Executive Travel is a London-based chauffeur company specialising in luxury private transportation across the UK. Providing airport and cruise port transfers, corporate travel, private jet connections, and event chauffeuring, the company is recognised for its exceptional service standards, experienced chauffeurs, and a distinguished fleet of premium and electric vehicles.

Media Contact

Organization: JAF Executive Travels

Contact Person: JAF Executive Travels

Website: https://jafexecutivetravels.com/

Email: Send Email

Address:450 Bath Rd, London UB7 0EB, United Kingdom

Country:United Kingdom

Release id:38664

The post JAF Executive Travel Sets a New Benchmark in Luxury Chauffeur Services in London appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

McCullough Tree Service Delivers Expert Tree Removal Service in Maitland, FL for Safer and Cleaner Landscapes

McCullough Tree Service announces its specialized tree removal service in Maitland, FL, offering expert care from Certified Arborists to ensure property safety. The company provides comprehensive solutions, including hazardous tree removal and storm cleanup, for residential and commercial clients.

Longwood, FL, United States, 8th Dec 2025 – McCullough Tree Service, a premier authority in arboriculture across Central Florida, is proud to announce an expanded focus on providing top-tier tree removal solutions for homeowners and businesses in Maitland. With a reputation built on integrity, safety, and a commitment to customer satisfaction, the company is helping the local community maintain thriving landscapes through professional, science-based tree care practices.

Maitland is renowned for its lush canopy, historic oaks, and scenic lakes, which define the city’s unique charm. However, managing such a verdant environment requires rigorous attention to detail. Dead, diseased, or structurally unstable trees can pose significant risks to property and personal safety, particularly during Florida’s unpredictable storm seasons. Recognizing these unique local challenges, McCullough Tree Service has tailored its operations to meet the specific needs of Maitland residents, offering a seamless blend of technical precision and aesthetic sensitivity.

“Tree removal is often a necessary step to protect a property’s value and the safety of its inhabitants,” says Shelby McCullough, owner of McCullough Tree Service. “In a community as beautiful as Maitland, we understand that removing a tree is a significant decision. Our goal is to make that process as smooth and stress-free as possible, ensuring that every job is done with the highest standards of safety and care.”

The Importance of Professional Assessment

Tree removal is a complex task that requires more than just heavy machinery; it demands a deep understanding of tree biology and physics. McCullough Tree Service distinguishes itself by having three Certified Arborists on staff. This level of expertise ensures that every project is evaluated critically. Before a tree is removed, the team conducts a thorough assessment to determine if the tree can be saved through restorative trimming or demossing.

If removal is the only viable option, the team executes the plan using state-of-the-art equipment to dismantle the tree piece by piece. This surgical approach is vital for minimizing impact on the surrounding environment. Residents looking for a reliable tree removal service in Maitland, FL, can rely on McCullough’s ability to handle complex removals, including trees located near power lines, over rooftops, or in tight, hard-to-access spaces where precision is paramount.

Mitigating Risks with a Certified Tree Removal Company

For property owners, the stakes are high when selecting a contractor. Improper removal techniques can lead to significant property damage, personal injury, or long-term liability issues. McCullough Tree Service mitigates these risks by being fully insured and strictly adhering to the best practices set forth by the International Society of Arboriculture (ISA).

Safety is the cornerstone of their operation. From the moment the crew arrives to the final haul-away, safety protocols are strictly followed to protect both the workers and the client’s property. This commitment extends to their “drug-free workplace” policy, ensuring that every crew member is alert, professional, and reliable. This dedication to professionalism has cemented their status as a trusted tree removal company in Maitland, FL, where reputation is essential.

Comprehensive Care for Maitland Landscapes

While removing a hazardous tree is often the primary objective, McCullough Tree Service provides a holistic approach to landscape management. Once a tree is removed, the job isn’t finished until the property is restored. The team offers professional stump grinding and root removal to ensure the ground is ready for future planting or landscaping projects. This attention to detail prevents the eyesore of leftover stumps and eliminates potential tripping hazards or pest infestations, such as termites or ants, which can spread to nearby structures.

Furthermore, the company emphasizes the importance of storm preparedness. By proactively identifying weak or compromised trees—such as those with root rot or heavy moss infestation—they help property owners avoid the devastation of falling branches during high winds.

Residents can easily locate their tree removal service in Maitland, FL, via online maps to check service areas and schedule a consultation. The company prioritizes rapid response times for the Maitland area, understanding that some tree issues require immediate attention to prevent damage.

A Customer-Centric and Eco-Friendly Approach

McCullough Tree Service is not just about cutting trees; it is about cultivating relationships and respecting the environment. As a family-owned and operated business, they take pride in delivering a personal touch that national chains often lack. They have also implemented eco-friendly practices, such as paperless billing to reduce waste and a commitment to recycling tree debris. Wood chips and logs are often repurposed rather than sent to landfills, aligning with the community’s desire for sustainability.

“We treat every property as if it were our own,” adds McCullough. “From the initial consultation to the final cleanup, our team is dedicated to delivering an experience that exceeds expectations. We want our clients to feel confident that they have chosen the best partner for their tree care needs.”

With free estimates available, property owners can fully understand the scope and cost of the work before any commitment is made. This transparency, combined with flexible financing options, ensures that essential tree care is accessible to all residents of Maitland.

About McCullough Tree Service

McCullough Tree Service is a premier tree care provider serving Central Florida, including Orlando, Winter Park, and Maitland. Specializing in residential and commercial tree services, the company offers tree trimming, removal, demossing, storm cleanup, and land clearing. With a team of Certified Arborists and a commitment to excellence, McCullough Tree Service is dedicated to revolutionizing the tree care industry through superior service and affordable pricing.

For more information or to schedule a free estimate, please contact:

Website: https://mcculloughtreeservice.com/

Media Contact

Organization: McCullough Tree Service

Contact Person: Shelby McCullough

Website: https://mcculloughtreeservice.com/

Email: Send Email

Contact Number: +14077345854

Address:948 Ferne Drive

City: Longwood

State: FL

Country:United States

Release id:38626

The post McCullough Tree Service Delivers Expert Tree Removal Service in Maitland, FL for Safer and Cleaner Landscapes appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release7 days ago

New Digital Philanthropy Initiative Launched at Asia Philanthropy Forum in Boao

-

Press Release6 days ago

Global Manufacturing Innovation Forum 2025 and Saudi–Dongguan Businesses Announced 17 Billion SAR Collaboration

-

Press Release6 days ago

Lumixus Canada Securities Ltd Officially Launched: Becomes Group’s North American Investment Management and Research Headquarters with $10 Million CAD Registered Capital

-

Press Release2 days ago

Author of Journey to Forever Meets with Film Producer to Discuss Screen Potential

-

Press Release7 days ago

Gastro Center of Maryland Expands Footprint, Bringing Expert Digestive Care to More Communities Across the DMV

-

Press Release2 days ago

The Attic Insulation Specialists Inc. Expands Full-Service Home Energy and Safety Solutions Across Southern California

-

Press Release3 days ago

Operational Police Protective Services Introduces Elite Security Solutions for High-Profile Corporate and Entertainment Events

-

Press Release2 days ago

Jack Botanicals Sets New Industry Standard with Premium Quality Kratom and Best Kratom Vendor