Press Release

Welcome to VOX AI: Redefining Crypto Management

INTRODUCTION

VOX AI is a cutting-edge platform revolutionizing crypto management by merging voice-powered artificial intelligence with advanced trading and portfolio tools. Whether engaging through Telegram or the dedicated VOX AI app, users can seamlessly track, trade, and analyze their crypto portfolios with unprecedented ease. From the VOX DEX for seamless trading to a sophisticated charting tool for market analysis, VOX AI is leading the evolution of the crypto ecosystem.

What is VOX AI?

VOX AI is designed to simplify cryptocurrency management by integrating intuitive AI technology with powerful trading and analytical tools. Through voice and text commands, users can interact with VOX AI to execute trades, monitor market trends, and receive actionable insights. With the launch of VOX DEX and a next-generation charting tool, VOX AI is set to surpass competitors like DEXTools and DEX Screener by leveraging advanced AI capabilities to redefine the user experience.

Key Features of VOX AI

- AI-Driven Portfolio Management: VOX AI allows users to connect multiple wallets securely via private keys, enabling seamless balance tracking, transaction monitoring, and personalized performance insights. Interact with VOX using voice or text commands to execute trades, analyze trends, or retrieve portfolio updates in real-time.

- VOX DEX: The VOX DEX introduces an integrated decentralized exchange, empowering users to trade tokens effortlessly. VOX AI optimizes trading by offering market insights, timing recommendations, and exclusive discounts for VOX token holders.

- Comprehensive Charting Tool: This feature sets a new standard for market analysis, providing live price charts, historical data, and AI-powered trade signals. Unlike traditional platforms, VOX AI’s charting tool integrates seamlessly with its AI interface, allowing users to explore token performance and identify opportunities effortlessly.

- Trading Automation: VOX AI simplifies trading with automation tools, enabling users to set personalized strategies and receive instant market alerts.

Tokenomics: Driving the VOX Ecosystem

At the core of VOX AI is its native VOX token, designed to enhance user engagement and ecosystem growth. With a total supply of 1 billion tokens, VOX provides access to premium features, staking rewards, and governance voting. A transparent token distribution strategy, powered by Sablier’s streaming protocol, ensures long-term sustainability and user trust. Transaction taxes, including a 5% buy and sell fee, are allocated to liquidity, ecosystem development, and marketing.

Why Choose VOX AI?

VOX AI stands out for its user-friendly design, blending the power of AI and voice interaction to make crypto management intuitive. Users no longer need to juggle multiple platforms—VOX AI consolidates portfolio tracking, trading, and market analysis into one unified interface. Whether you’re at home or on the go, VOX AI ensures efficient and secure crypto management.

The Future of VOX AI

VOX AI is committed to continuous innovation. Future plans include expanded wallet integrations, advanced trading tools, and personalized financial insights. By Q4 2025, users can expect a comprehensive charting tool rollout, enhanced with real-time AI-driven analytics.

Conclusion

VOX AI is transforming the crypto landscape by delivering advanced tools powered by voice-driven AI. With features like the VOX DEX, automated trading, and a comprehensive charting system, VOX AI simplifies and enhances the crypto experience. This innovative platform represents the future of cryptocurrency management, bringing intelligence, efficiency, and accessibility to all.

Important Links

Website: www.vox-ai.online

Website: www.vox-ai.online

Telegram: https://t.me/voxportal

Telegram: https://t.me/voxportal

Twitter: X.com/projectvoxai

Twitter: X.com/projectvoxai

Email: info@vox-ai.online

Email: info@vox-ai.online

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

MOKiN Reframes the Role of Technology Human-Centered Design at the Core

United States, 1st Jan 2026, – As digital tools continue to evolve, the relationship between people and technology is becoming increasingly complex. Devices are more powerful and interconnected at an unprecedented scale, yet countless users report growing challenges around distraction, fragmented attention, and digital environments that feel difficult to manage. Efficiency has improved, but clarity and focus have become harder to maintain.

Technology brand MOKiN is rooted in its own origins.

The company starts from the desk: a space where modern work, creativity, and decision-making converge. In its early days, MOKiN focused on a practical and widely shared problem: overcrowded desks, insufficient ports, tangled cables, and inefficient workflows caused by fragmented device connections. Early MOKiN products, including hubs and docking stations, were designed to restore order to everyday workspaces by simplifying connections, reducing visual clutter, and helping users regain control over their working environment.

As work patterns evolved and technology became more deeply embedded in daily life, MOKiN extended this philosophy beyond the desk. Chargers were developed to deliver stable, dependable energy without interruption, while power banks enabled continuity from workspace to commute. Together, these products formed a seamless flow, supporting transitions between locations, tasks, and moments without adding friction or complexity.

However, as digital ecosystems expanded, MOKiN observed that efficiency alone was no longer enough. While streamlined connections and reliable power focused on functional challenges, users increasingly faced a different kind of friction: cognitive overload, constant context switching, and tools that demanded attention rather than supporting it.

In response, the brand began to shift its perspective: from optimizing performance to understanding behavior. For MOKiN, modern technology must do more than boost productivity; it must recognize how people think, focus, and move between tasks across devices and environments. In this context, understanding becomes a functional capability: shaping how tools interact with users rather than simply how they operate.

This evolution reflects MOKiN’s broader commitment to human-centered design of technology. The brand emphasizes that effective technology must listen, anticipate common pain points, and adapt naturally to real-world usage behaviors. By reducing friction and simplifying interaction, digital tools can support smoother workflows, clearer thinking, and more balanced experiences in increasingly dense digital environments.

MOKiN also highlights the growing influence technology has on modern lifestyles: from how ideas are captured to how attention is sustained throughout the day. When products are designed with empathy and insight into these interactions, technology can contribute not only to productivity but also to continuity, calm, and a more intuitive relationship between people and their devices.

Looking ahead, MOKiN reaffirms its commitment to building technology guided by empathy, professionalism, and a strong sense of responsibility toward users. The brand’s direction signals an ongoing transition: from tools that merely enable efficiency to systems that foster more considerate and human-aligned collaboration between people and technology.

As digital ecosystems continue to expand, MOKiN envisions user awareness, calm, and human-centered thinking not as optional values, but as essential foundations for the next stage of technological progress. In this vision, technology works with people, not against them.

Media Contact

Organization: Xulian Technology

Contact

Person: Media Relations

Website:

https://mokinglobal.com/

Email:

mokin@mokinofficial.com

Contact Number: 8618810868909

Country:United States

The post

MOKiN Reframes the Role of Technology Human-Centered Design at the Core appeared first on

Brand News 24.

It is provided by a third-party content

provider. Brand News 24 makes no

warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Brigitte Bardot, Gia Skova, and the Timeless Power of Iconic Presence

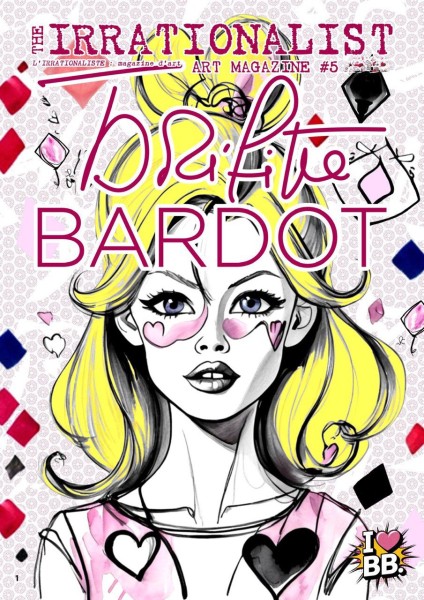

Russia, 1st Jan 2026 – Brigitte Bardot remains one of the most enduring cultural figures of the 20th century – not only for her film work, but for the way her image reshaped ideas of femininity, autonomy, and visual power. Long after her most iconic performances, Bardot’s presence continues to circulate across fashion, photography, and contemporary art, functioning less as nostalgia and more as a living visual language.

That language has recently resurfaced in a contemporary context through the work of artist JP.Simon, whose Brigitte Bardot–inspired collection draws on the graphic repetition and bold iconography associated with Andy Warhol. Rather than revisiting Bardot as a cinematic figure, the project reframes her as a cultural symbol – one capable of being reinterpreted through modern artistic systems. The collection was featured in Irrationalist, a magazine known for examining cultural icons through a conceptual and contemporary lens.

JP.Simon’s work sits within a broader trend in visual culture: the reexamination of feminine archetypes not as historical artifacts, but as ongoing forces. His practice extends beyond the Bardot series into a larger body of work — including more than 150 paintings – that explores themes of power, beauty, and resistance through recurring female imagery.

A parallel exploration of feminine iconography can be found in the work of actress and filmmaker Gia Skova, whose comic book universe Lucinda has attracted attention for its unconventional approach to female heroism. Unlike traditional franchise protagonists, Lucinda is constructed less as a narrative explanation and more as a visual and symbolic presence – autonomous, uncompromising, and resistant to simplification.

Industry observers have noted that characters like Lucinda reflect a broader shift in contemporary storytelling, particularly in film, comics, and transmedia IP, where presence and memorability increasingly outweigh traditional character exposition. In this sense, the lineage from figures such as Bardot to modern creations is not one of imitation, but of continuity – a shared emphasis on immediacy, visual authority, and cultural imprint.

Both Bardot and Lucinda operate through a similar mechanism of recognition. Their impact is not driven by overt sexuality or spectacle, but by a form of screen and visual presence that lingers. It is an effect that resists explanation yet remains instantly legible – a quality often cited by critics as one of the most difficult to manufacture within contemporary entertainment industries.

This concept of presence has become increasingly relevant as studios and creators search for IP that can transcend platforms. In an era of rapid content turnover, figures that function as icons rather than mere characters offer a different kind of longevity. They exist not only within stories, but within visual memory.

Irrationalist has notably featured both Brigitte Bardot and Gia Skova on separate covers, creating an unintended but telling dialogue between generations. Seen side by side within the magazine’s editorial history, the images highlight how cultural iconography evolves while retaining its core language.

For Skova, whose work spans film, comics, and visual art collaborations, the Lucinda universe represents an attempt to build an IP anchored not in trend cycles, but in archetypal continuity. While Bardot once embodied a rupture in 20th-century ideas of femininity through presence alone, contemporary creators are now translating similar codes into modern formats – graphic novels, serialized storytelling, and cross-platform franchises.

As the industry continues to reassess the value of icon-driven IP, the enduring relevance of figures like Bardot offers a reminder: icons do not disappear when their era ends. They adapt, reemerge, and find new expression through artists and creators who understand their language.

In this context, Lucinda does not function as a replacement or a comparison, but as a contemporary expression of a familiar cultural force — one that has traveled through decades of visual history and continues to shape how audiences recognize power, beauty, and autonomy on screen and beyond.

Media Contact

Organization: Gia Skova

Contact Person: Gia Skova

Website: https://www.instagram.com/giaskovareal/

Email: Send Email

Country:Russia

Release id:39768

The post Brigitte Bardot, Gia Skova, and the Timeless Power of Iconic Presence appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Sid Gandotra Joins FIND Real Estate to Advance Client- Centered Brokerage Mission in NYC

New York, NY – January 1, 2026 – Sid Gandotra has joined FIND Real Estate as a Licensed Real Estate Salesperson. An innovative, agent-owned brokerage dedicated to empowering both clients and agents, FIND Real Estate is thrilled to welcome Sid to its growing New York City team.

Sid brings extensive expertise in real estate, driven by an unwavering work ethic and commitment to excellence, resulting in an exceptional track record of successful transactions. Renowned for his attentive client service, thorough market education, and skilled negotiation, Sid ensures every client feels confident and fully supported throughout the process. Navigating the complexities of the industry with strategic foresight, Sid adapts seamlessly to market shifts and resolves challenges with efficiency.

“Our mission is simple: make every step in real estate a positive one. All FIND agents complete a thorough certification program that sets them apart as trusted experts in their markets,” said Jules Borbely, Chief Operating Officer at FIND Real Estate. “Founded on the belief that real estate should be empowering for everyone involved, FIND combines innovative tools, a client-centered approach, and an agent-owned model to redefine what a modern brokerage can be. Today, we are proud to support our growing team of agents and countless clients on their journeys.”

With a deep appreciation for NYC’s architectural diversity—from historic pre-war residences to cutting-edge luxury developments—Sid delivers tailored, results-oriented strategies. He specializes in translating complex market insights into actionable recommendations, ensuring optimal outcomes for buyers and investors alike.

“I find the greatest fulfillment in guiding clients through the meaningful milestone of homeownership,” says Sid. “Joining FIND Real Estate allows me to leverage innovative tools and a collaborative culture to provide even greater value to the people I serve.”

About FIND Real Estate

FIND is an agent-owned brokerage committed to client-centered service, innovation, and agent empowerment. By putting agents first, the company creates better outcomes for clients through trusted expertise and modern resources. Learn more at https://findrealestate.com.

Media Contact

Organization: FIND Real Estate

Contact Person: Sid Gandotra

Website: https://findrealestate.com/

Email: Send Email

Contact Number: +12123006412

Address:5 West 37th Street, FL 12

City: New York

State: NY

Country:United States

Release id:39529

The post Sid Gandotra Joins FIND Real Estate to Advance Client- Centered Brokerage Mission in NYC appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release6 days ago

CBD Movers Plans to Lead Australia’s Moving Industry Toward Carbon-Neutral Operations with Innovative Green Technology

-

Press Release5 days ago

Tree & Snow Removal Services Encourage Preventive Checks Ahead of Winter

-

Press Release5 days ago

CGTN: How China Steadily Steered Through a Turbulent 2025

-

Press Release6 days ago

Create Tron Token: New Generation TRC20 Token Creator Revolutionizes the Blockchain Ecosystem with No-Code Deployment

-

Press Release1 week ago

Young Chinese Runners Stand Out Performers at UTMB Asia, Powered by Outopia

-

Press Release5 days ago

$livebear The Chillest Bear On The Internet, Going Worldwide

-

Press Release7 days ago

Artramedia Redefines The Creator Economy By Connecting Storytellers, Musicians, And Filmmakers With Global Audiences Through Innovative Distribution And Partnership Opportunities

-

Press Release6 days ago

Taxinexo Advances Large-Scale Commercial Deployment of Level 4 Autonomous Vehicles Across the United States