Press Release

Trust Wallet Launches First Launchpool Project With WHY Token

Trust Wallet Launchpool offers users and TWT holders access to rewards and exclusive project tokens in a secure, decentralized environment.

DUBAI, UAE — Trust Wallet, the world’s leading self-custody Web3 wallet trusted by over 140 million users, has launched its newest feature, Trust Wallet Launchpool and the first projects and tokens users can explore: TWT, $WHY and slisBNB.

Trust Wallet Launchpool allows TWT holders and other token holders who are Trust Wallet users to earn rewards by discovering and engaging with promising projects in a secure and user-friendly way. By locking tokens like TWT or any partner tokens designated for each campaign, users can acquire new tokens or rewards from both pre-launch and launched token projects, diversifying their portfolios and supporting innovative ventures with minimal risk.

With this feature addition, Trust Wallet becomes the first self-custody wallet to offer launchpool opportunities – providing its users with exclusive access to rewards and tokens from emerging projects, while supporting the growth of Web3 communities.

“Trust Wallet Launchpool aligns perfectly with our mission to build a more inclusive Web3 ecosystem while giving back to the community, including TWT holders and partner token holders. It provides our users with unique opportunities to engage with innovative projects and earn rewards, all without the risks typically associated with centralized platforms.” said Eowyn Chen, CEO of Trust Wallet.

How Trust Wallet Launchpool Works

Trust Wallet Launchpool is part of the app’s “Earn” section, designed to provide users with a simple and secure way to engage with early-stage crypto opportunities. Users can select projects they are interested in and lock TWT or other tokens in specific pools to earn new tokens as rewards. This offering is fully supported by on-chain smart contracts and open-source protocols, ensuring transparency and security, and setting it apart from centralized alternatives.

First Project On Trust Wallet Launchpool

For the first launchpool project, Trust Wallet users can lock their tokens in 2 pools and earn rewards. The locked tokens are:

- TWT – Trust Wallet Token, an integral component of the Trust Wallet ecosystem, exhibiting versatility across multiple blockchain networks. It exists in various formats: as a BEP-20 asset on the BNB Smart Chain and also as an SPL token on the Solana network. TWT’s primary utility lies in its governance function. It empowers token holders with the ability to influence key decisions regarding the development and evolution of Trust Wallet. And from today, TWT can be used as part of Trust Wallet Launchpool.

- slisBNB – slisBNB unleashes the full potential of BNB, allowing users multiple layers of yield such as Launchpools, Liquidity Staking, DeFi rewards.

The reward token for this launchpool project is $WHY, a top meme coin on BNB chain. WHY is a bipolar elephant in a bipolar crypto market. Skyrocketing in popularity with a unique story, worldwide community, and commitment to fairness and longevity. $WHY is an exciting project embodying everything we love about meme culture! As part of the campaign 4.2 Trillion WHY tokens (worth $1.2+ Million) are available for rewards.

Locking & Reward Structure:

- Campaign Duration: 7 days

- Locking Tokens Amount: No minimum or maximum limit

- Reward Distribution: Every 8 hours. Users can claim rewards at any time after distribution.

- Withdrawal Rules: Locked tokens cannot be withdrawn until the campaign ends

After the campaign ends, any unclaimed TWT will automatically roll over to the next session, ensuring continued participation and early access to future rewards.

Additional Details:

- Users need to hold TWT or slisBNB in their wallet to participate.

- A small amount of BNB is required to cover gas fees for locking and claiming rewards

Benefits for Users and Web3 Projects

Trust Wallet Launchpool benefits both users and projects by creating a mutually supportive environment. This feature provides a safe, decentralized way to earn project tokens, empowering users to engage with the evolving Web3 landscape while supporting the growth of promising ventures. For Web3 projects, Trust Wallet Launchpool offers a unique platform to increase visibility and build a solid community base. By connecting with Trust Wallet’s extensive user base, projects can attract more users and gain momentum in a competitive market.

Nate Zou, Head of Product at Trust Wallet, added: “Trust Wallet Launchpool is a natural evolution of our commitment to our community. We want to provide our users with more ways to engage with Web3 opportunities while offering our partners a sustainable method to grow their user base and strengthen their community.”

Trust Wallet Launchpool is now available on the latest version of the Trust Wallet app. Be among the first to explore exclusive rewards and project tokens. Download Trust Wallet now.

About Trust Wallet

Trust Wallet is the secure, self-custody Web3 wallet and gateway for people who want to fully own, control, and leverage the power of their digital assets. From beginners to experienced users, Trust Wallet makes it easier, safer, and convenient for millions of people around the world to experience Web3, access dApps securely, store and manage their crypto and NFTs, as well as buy, sell, and stake crypto to earn rewards — all in one place and without limits.

For media enquiries, contact: Dami Odufuwa, Head of Communications press@trustwallet.com

Media Contact:

Dubai, UAE

Dami Odufuwa, Head of Communications

press@trustwallet.com

https://trustwallet.com/

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

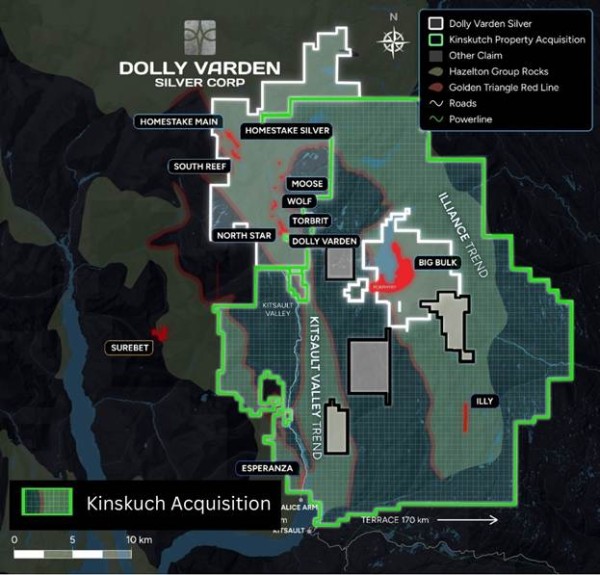

Dolly Varden Silver Acquires Hecla Mining’s Kinskuch Property For $5 Million In Stock

The acquisition of the Kinskuch property from Hecla will triple the total strike length of favorable Jurassic-age Hazelton-group volcanic rocks and associated “Red Line” by adding the Illiance trend to the Kitsault Valley trend.

Canada, 8th May 2025 – Sponsored content disseminated on behalf of Dolly Varden Silver. On May 5, 2025 Dolly Varden Silver (TSXV:DV) (OTC:DOLLF) (FSE: DVQ1) announced that is has signed a definitive agreement to acquire 100% of Hecla Mining Company’s Kinskuch property in northwest BC’s Golden Triangle.

The acquisition of the Kinskuch property will increase Dolly Varden’s tenure area by 400% to consolidate a district scale, contiguous claim package that includes the Kitsault Valley, Big Bulk and Kinskuch projects.

The consolidated land package will be about 77,000 hectares, which is 225 X bigger than New York City’s Central park.

The Kinskuch acquisition allows Dolly Varden Silver (an explorer) and Hecla Mining (a producer) to focus on their respective core strengths.

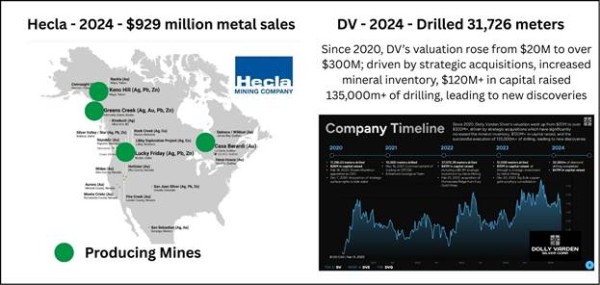

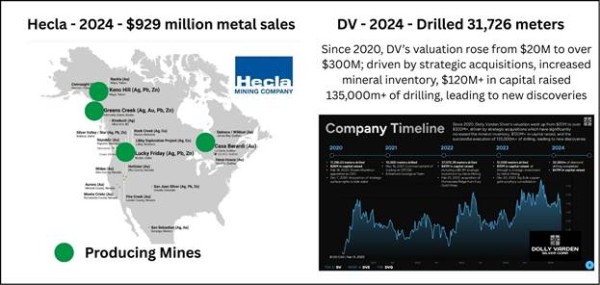

Hecla has a market cap of USD $3.03 billion. According to Hecla’s SEC Year-end Financial Filings, in 2024 it delivered 16.2 million ounces of silver, 141,923 ounces of gold, generating record sales of $929 million.

Hecla’s 2024 Capital Expenditures on existing mines (Greens Creek, Lucky Friday, Casa Berardi, Keno Hill) totaled $214.5 million.

Hecla has ten exploration projects on the books in the USA, Canada and Mexico. The company’s total 2024 exploration and pre-development spend was $27.3 million, less than 1% of its market cap.

Dolly Varden has a market cap of CND of $291 million. The company does not have an operating mine, therefore does not generate metal sales.

According to DV’s 2024 consolidated financial statements, DV spent $9.8 million on drilling, $1.6 million on geoscience and $1.1 million on sample analytics.

Its total 2024 exploration spend was $17.8 million, about 6% of its market cap.

HL is a producer first. DV is an explorer first.

“Consolidating Dolly Varden’s Kitsault Valley Project with our major shareholder Hecla’s large and underexplored claims covering prospective Hazelton Group rocks will allow for more efficient exploration and enable us to unlock value on our path to be a premier precious metals company.” stated Shawn Khunkhun, President and CEO of Dolly Varden.

“Additionally, we welcome Hecla’s increased share ownership in our Company,” added Khunkhun.

Kinskuch Acquisition Deal Highlights:

- DV to issue Hecla 1,351,963 shares of DV worth $5 million.

- Hecla retains 2% net smelter return royalty (NSR) on the Kinskuch property.

- NSR will include a 50% buyback right, for $5 million, allowing DV to reduce the royalty to 1% at any time.

- Hecla maintains a designated position on DV’s Technical Committee.

- DV and Hecla will collaborate to unlock the potential of the underexplored areas.

“We will be using our structural and lithological framework model developed at the Kitsault Valley Trend that has led our team to significant discoveries such as the Wolf Vein and applying them to exploration of the Illiance Trend,” states Rob van Egmond, VP Exploration for Dolly Varden.

“Hecla was successful in identifying a subparallel trend of silver-rich mineralization, located to the east of our significant silver and gold deposits,” added van Egmond.

The acquisition of the Kinskuch property from Hecla will triple the total strike length of favorable Jurassic-age Hazelton-group volcanic rocks and associated “Red Line” by adding the Illiance trend to the Kitsault Valley trend.

In the May 7, 2025 “Explainer Video” below, van Egmond outlines the exploration history and potential of the new land package.

“Hecla is giving us the rights to explore that land,” stated van Egmond in the video. “We are now the owners, but they still maintain ownership because it is an equity deal.”

“They’ve increased their percentage ownership in Dolly Varden. Indirectly, they still are part owners of that land. They trust us to do the exploration work and unlock the value.”

Both the Kitsault Valley and the Illiance trends are interpreted to be part of a district scale, sub-basin of the Eskay Rift period. The Illiance trend has seen little modern exploration work, limited to localized diamond drilling by Hecla on the three kilometer long, north-south trending Illy epithermal system.

Also included within the acquisition area is the past-producing Esperanza Mine (1910), interpreted as quartz-carbonate veins with similar silver grades to the historic Dolly Varden Mine (1920) hosted in Upper Hazelton sedimentary rocks.

According to a BC government database of historical deposits, “The Esperanza mine produced high-grade, hand-sorted silver ore sporadically between 1911 and 1948. In total, 4662 tonnes of ore with an average grade of 1.77 grams per tonne gold, 983.9 grams per tonne silver were mined”.

The southwestern portion of the acquired claims covers Hazelton Group rocks that trend to within seven kilometers of Goliath Resources’ recently discovered Surebet Zone gold mineralization.

The area south of Big Bulk has the potential to host additional gold-copper porphyry systems along the south trend towards the Kitsault molybdenum porphyry deposit, which is being actively advanced by Newmoly llc.

The Kinskuch property is covered by a recently renewed five-year Exploration Permit on both Nisga’a and Gitanyow Traditional Lands.

“Hecla didn’t walk away from Kinskuch—you could say they traded up, by handing over the property to Dolly Varden in exchange for shares, a royalty, and retaining a board seat,” wrote Jeff Valks, Senior Analyst at The Gold Advisor on May 5, 2025.

“Hecla keeps a stake in any upside without spending a dime on drills—it’s not a core property for them and they want Dolly Varden to drill it.”

The Kinskuch property acquisition is subject to TSX Venture Exchange and NYSE America approvals. It is expected to close in mid-May.

On May 7, 2025, Dolly Varden announced plans for the fully funded 2025 exploration drilling program at its 100% owned Kitsault Valley Project. A minimum planned 35,000 meters of diamond drilling will build on the success of the 2024 program.

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101 has reviewed, validated and approved the scientific and technical information contained in this GSN release.

Disclaimer: Dolly Varden Silver paid GSN $1,750 for the research, creation and dissemination of this content.

Contact: guy.bennett@globalstocksnews.com

Full Disclaimer: Global Stocks News (GSN) researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN makes no recommendation to purchase any individual stock. Our publications should be used as a starting point for additional research and “due diligence”. GSN publications contain “forward-looking statements” such as “may,” “anticipate,” “expect,” “project,” “intend,” “plan,” “believe,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:27483

The post Dolly Varden Silver Acquires Hecla Mining’s Kinskuch Property For $5 Million In Stock appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

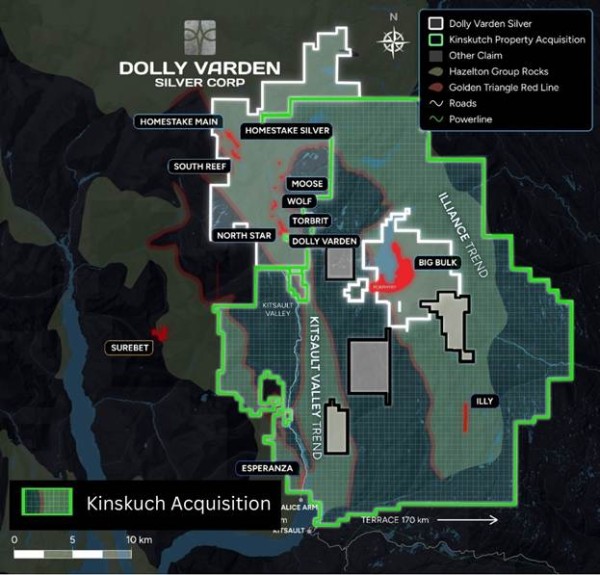

Dolly Varden Silver Acquires Hecla Mining’s Kinskuch Property For $5 Million In Stock

The acquisition of the Kinskuch property from Hecla will triple the total strike length of favorable Jurassic-age Hazelton-group volcanic rocks and associated “Red Line” by adding the Illiance trend to the Kitsault Valley trend.

Canada, 8th May 2025 – Sponsored content disseminated on behalf of Dolly Varden Silver. On May 5, 2025 Dolly Varden Silver (TSXV:DV) (OTC:DOLLF) (FSE: DVQ1) announced that is has signed a definitive agreement to acquire 100% of Hecla Mining Company’s Kinskuch property in northwest BC’s Golden Triangle.

The acquisition of the Kinskuch property will increase Dolly Varden’s tenure area by 400% to consolidate a district scale, contiguous claim package that includes the Kitsault Valley, Big Bulk and Kinskuch projects.

The consolidated land package will be about 77,000 hectares, which is 225 X bigger than New York City’s Central park.

The Kinskuch acquisition allows Dolly Varden Silver (an explorer) and Hecla Mining (a producer) to focus on their respective core strengths.

Hecla has a market cap of USD $3.03 billion. According to Hecla’s SEC Year-end Financial Filings, in 2024 it delivered 16.2 million ounces of silver, 141,923 ounces of gold, generating record sales of $929 million.

Hecla’s 2024 Capital Expenditures on existing mines (Greens Creek, Lucky Friday, Casa Berardi, Keno Hill) totaled $214.5 million.

Hecla has ten exploration projects on the books in the USA, Canada and Mexico. The company’s total 2024 exploration and pre-development spend was $27.3 million, less than 1% of its market cap.

Dolly Varden has a market cap of CND of $291 million. The company does not have an operating mine, therefore does not generate metal sales.

According to DV’s 2024 consolidated financial statements, DV spent $9.8 million on drilling, $1.6 million on geoscience and $1.1 million on sample analytics.

Its total 2024 exploration spend was $17.8 million, about 6% of its market cap.

HL is a producer first. DV is an explorer first.

“Consolidating Dolly Varden’s Kitsault Valley Project with our major shareholder Hecla’s large and underexplored claims covering prospective Hazelton Group rocks will allow for more efficient exploration and enable us to unlock value on our path to be a premier precious metals company.” stated Shawn Khunkhun, President and CEO of Dolly Varden.

“Additionally, we welcome Hecla’s increased share ownership in our Company,” added Khunkhun.

Kinskuch Acquisition Deal Highlights:

- DV to issue Hecla 1,351,963 shares of DV worth $5 million.

- Hecla retains 2% net smelter return royalty (NSR) on the Kinskuch property.

- NSR will include a 50% buyback right, for $5 million, allowing DV to reduce the royalty to 1% at any time.

- Hecla maintains a designated position on DV’s Technical Committee.

- DV and Hecla will collaborate to unlock the potential of the underexplored areas.

“We will be using our structural and lithological framework model developed at the Kitsault Valley Trend that has led our team to significant discoveries such as the Wolf Vein and applying them to exploration of the Illiance Trend,” states Rob van Egmond, VP Exploration for Dolly Varden.

“Hecla was successful in identifying a subparallel trend of silver-rich mineralization, located to the east of our significant silver and gold deposits,” added van Egmond.

The acquisition of the Kinskuch property from Hecla will triple the total strike length of favorable Jurassic-age Hazelton-group volcanic rocks and associated “Red Line” by adding the Illiance trend to the Kitsault Valley trend.

In the May 7, 2025 “Explainer Video” below, van Egmond outlines the exploration history and potential of the new land package.

“Hecla is giving us the rights to explore that land,” stated van Egmond in the video. “We are now the owners, but they still maintain ownership because it is an equity deal.”

“They’ve increased their percentage ownership in Dolly Varden. Indirectly, they still are part owners of that land. They trust us to do the exploration work and unlock the value.”

Both the Kitsault Valley and the Illiance trends are interpreted to be part of a district scale, sub-basin of the Eskay Rift period. The Illiance trend has seen little modern exploration work, limited to localized diamond drilling by Hecla on the three kilometer long, north-south trending Illy epithermal system.

Also included within the acquisition area is the past-producing Esperanza Mine (1910), interpreted as quartz-carbonate veins with similar silver grades to the historic Dolly Varden Mine (1920) hosted in Upper Hazelton sedimentary rocks.

According to a BC government database of historical deposits, “The Esperanza mine produced high-grade, hand-sorted silver ore sporadically between 1911 and 1948. In total, 4662 tonnes of ore with an average grade of 1.77 grams per tonne gold, 983.9 grams per tonne silver were mined”.

The southwestern portion of the acquired claims covers Hazelton Group rocks that trend to within seven kilometers of Goliath Resources’ recently discovered Surebet Zone gold mineralization.

The area south of Big Bulk has the potential to host additional gold-copper porphyry systems along the south trend towards the Kitsault molybdenum porphyry deposit, which is being actively advanced by Newmoly llc.

The Kinskuch property is covered by a recently renewed five-year Exploration Permit on both Nisga’a and Gitanyow Traditional Lands.

“Hecla didn’t walk away from Kinskuch—you could say they traded up, by handing over the property to Dolly Varden in exchange for shares, a royalty, and retaining a board seat,” wrote Jeff Valks, Senior Analyst at The Gold Advisor on May 5, 2025.

“Hecla keeps a stake in any upside without spending a dime on drills—it’s not a core property for them and they want Dolly Varden to drill it.”

The Kinskuch property acquisition is subject to TSX Venture Exchange and NYSE America approvals. It is expected to close in mid-May.

On May 7, 2025, Dolly Varden announced plans for the fully funded 2025 exploration drilling program at its 100% owned Kitsault Valley Project. A minimum planned 35,000 meters of diamond drilling will build on the success of the 2024 program.

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101 has reviewed, validated and approved the scientific and technical information contained in this GSN release.

Disclaimer: Dolly Varden Silver paid GSN $1,750 for the research, creation and dissemination of this content.

Contact: guy.bennett@globalstocksnews.com

Full Disclaimer: Global Stocks News (GSN) researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN makes no recommendation to purchase any individual stock. Our publications should be used as a starting point for additional research and “due diligence”. GSN publications contain “forward-looking statements” such as “may,” “anticipate,” “expect,” “project,” “intend,” “plan,” “believe,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:27483

The post Dolly Varden Silver Acquires Hecla Mining’s Kinskuch Property For $5 Million In Stock appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

West Red Lake Gold Bulk Sample Program Produced Gold worth CAD $11.7 million

Delivering tonnes and grade from the mine that align almost exactly with expectations validates all the work WRLG has done to unlock the tremendous value in the Madsen Mine.

Canada, 8th May 2025 – Sponsored content disseminated on behalf of West Red Lake Gold. On May 7, 2025, West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) published reconciliation results from the bulk sample program at its 100% owned Madsen Mine located in the Red Lake Gold District of Northwestern Ontario, Canada.

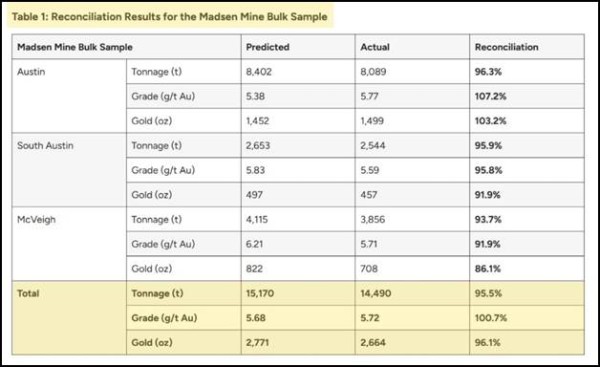

WRLG bulk sampled 14,490 tonnes of ore @ 5.72 grams/tonne Gold, generating 2,498 ounces of gold worth CAD $11.7 million at CAD $4,700/ounce. The Madsen Mill has a permitted throughput of 800 tonnes/day.

West Red Lake Gold is one of only four single-asset companies putting a new gold mine into production in 2025.

West Red Lake Gold Bulk Sampling Highlights:

- The bulk sample carried an average grade of 5.72 grams per tonne (“g/t”) gold (“Au”), 0.7% above the average predicted grade of 5.68 g/t Au for six stopes across three areas.

- 14,490 tonnes of bulk sample produced 2,498 ounces of gold

- Gold recovery in the Madsen Mill averaged 95%

“Delivering tonnes and grade from the mine that align almost exactly with expectations validates all the work we have done to unlock the tremendous value in the Madsen Mine,” stated Shane Williams, President and CEO, in the May 7, 2025 press release.

“This achievement underlines that Madsen is on track to become a new high-grade gold mine in 2025.”

In the May 7, 2025 video below, WRLG explains why “West Red Lake Gold is Ready to Perform and Built for Today’s Gold Bull Market.”

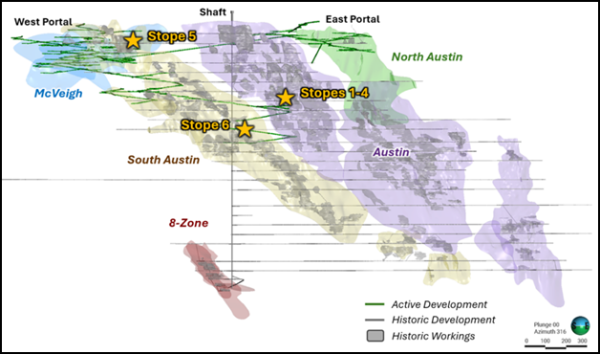

The bulk sample included material from three main resource zones at Madsen – Austin, South Austin, and McVeigh.

Close reconciliation between predicted and actual grades and tonnages highlights the effectiveness of definition drilling and detailed stope design in informing accurate modelling of gold mineralization.

West Red Lake Gold has completed over 90,000 metres of definition drilling since October 2023, and the high-confidence tonnes resulting from this ongoing program currently make up approximately 90% of the 18-month detailed mine plan.

Six stopes were drilled, engineered, and mined using the same workflow that the Company plans to implement during regular mine operations at Madsen.

“We design stopes to maximize economic benefit in today’s gold price environment. This differs from the Pre-Feasibility Study (“PFS”), which used a gold price of US$1,680 per ounce when designing stopes,” stated Williams.

“Using a gold price just below the long-term consensus gold price of US$2,350 per oz. unlocks significant opportunity at Madsen because, in many areas, a halo of lower-grade mineralization can be profitable to include in the stope design when it surrounds targeted high-grade tonnes.”

“In addition, mining larger stopes can lower mining costs by enabling long-hole stoping instead of cut-and-fill methods. We used long-hole stoping exclusively in the bulk sample.

We are excited by the opportunity to mine additional tonnes and ounces at Madsen, potentially lowering operational costs, increasing production, and enhancing overall economics relative to the PFS mine plan,” stated Williams in the May 7, 2025 press release.

“In a note published on Wednesday, the precious metals team [at Bank of America] led by Michael Widmer said it sees growing potential for gold to hit $4,000 an ounce in the second half of this year,” reported Kitco News.

“In March, Widmer and his team predicted that gold prices would hit $3,500 by 2027—a target the precious metal reached in less than a month.”

“In the commodities market, timing is critical. I’m betting current macro trends will boost the value of gold,” wrote WRLG Co-Founder, Major Shareholder, Strategic Advisor Frank Giustra in 2024.

Giustra was instrumental in the development and growth of several significant gold producers. Gold Corp (Wheaton River) grew from US $17 million to a $21.8 billion market capitalization in a little over five years. Endeavour Mining grew from $180 million to $8 billion in under 7 years.

“It begins with one well-executed mine acquisition, like we are proving with Madsen. It expands through smart deals and leadership,” added Giustra.

“We acquired Madsen because we believed an accurate geological model, detailed engineering design, and disciplined mining practices would enable exactly this – a mine that delivers to plan. I am extremely pleased to deliver these bulk sample results, and I look forward to ramping up operations at the Madsen Mine in the coming months,” stated Williams.

The Madsen deposits presently host an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [1 .] [2.] [3.]

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for technical disclosure at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events.

References:

- “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada”, prepared by SRK Consulting (Canada) Inc. and dated January 7, 2025 (the “Madsen Report ”). A full copy of the Madsen Report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- The Madsen Mine deposit presently hosts a National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) Indicated resource of 1.65 million ounces (“Moz”) of gold grading 7.4 g/t Au and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t Au. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US$1,800/oz. Mineral resources as stated are inclusive of mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the updated report. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- The Madsen Mine also contains Probable reserves of 478 thousand ounces (“koz”) of gold grading 8.16 g/t Au. Mineral reserve estimates are based on a gold price of US$1,680/oz. Please refer to the technical report “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada” available on the Company’s website and on SEDAR+ at www.sedarplus.ca

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:27481

The post West Red Lake Gold Bulk Sample Program Produced Gold worth CAD $11.7 million appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release6 days ago

Commercial Property Inspection in Focus as Record Rainfall Hits Toronto

-

Press Release6 days ago

DuoKey to Unveil Encrypted Financial Intelligence Use Case at GISEC Global 2025: A Breakthrough in Fraud Detection Powered by Fully Homomorphic Encryption and MPC-based KMS

-

Press Release1 week ago

Tolpa Holistic Health Delivers Professional Chiropractic Care to Charlotte Community

-

Press Release3 days ago

Rocky Mountains Asset Management Ltd. Launches Global Academic Partnership Program to Build Future AI-Driven Financial Talent Base

-

Press Release6 days ago

GISEC Global 2025: Dubai Mobilises Global Cyber Defence Leaders to Combat AI-Driven Cybercrime and Ransomware

-

Press Release6 days ago

Dr. Katie Zippel Unveils Pioneering Research on Social Prescribing for Cancer Care

-

Press Release6 days ago

Dr. Katie Zippel Unveils Pioneering Research on Social Prescribing for Cancer Care

-

Press Release6 days ago

Dubai Electronic Security Center to Showcase Cybersecurity Initiatives at GISEC 2025 as Official Government Partner