Press Release

This Chart Buried in a Technical Report Reveals West Red Lake Gold’s Potential Reserve Count in the Current Gold Environment

Using a long-term average gold price of US$2,640, the Net Present Value (NPV) of WRLG is estimated at $496 million. The re-rate from developer to producer typically takes a company from 0.5X NAV to 1x NAV.

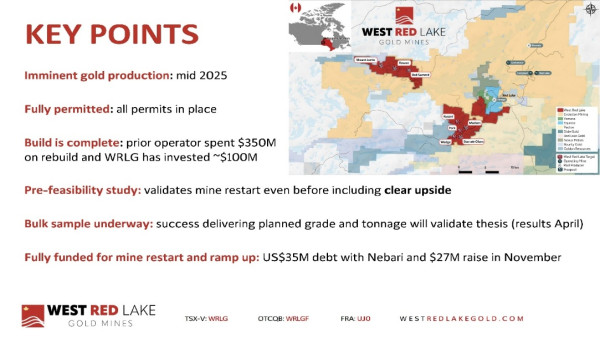

Canada, 27th Feb 2025 – Sponsored content disseminated on behalf of West Red Lake Gold. On February 18, 2025, West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) announced the filing of its independent pre-feasibility study (PFS) prepared by SRK Consulting.

The reserve cut-off price that was used in the PFS was US$1,680 per oz.

“Investors are surprised how conservative that number is,” Gwen Preston, VP of Communications told Guy Bennett, CEO of Global Stocks News (GSN). “But there’s a simple explanation.”

“SRK has internal guidelines for a PFS,” Preston continued. “The reserve cut-off price would be higher for a full Feasibility Study. The fact that we are going directly from PFS to production does not change SRK’s guidelines.”

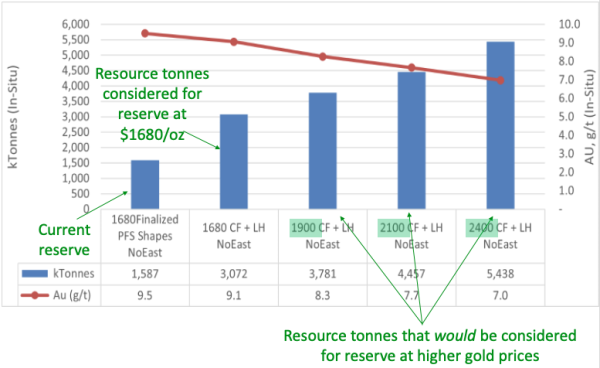

Buried in the “Other Relevant Data” section of the 395-page technical report and noted in the Executive Summary, is a chart that shows how the reserve count could potentially change at gold prices closer to the current price of US$2,900.

The SRK chart below reveals what tonnes from the resource would have made it into consideration for inclusion in the reserve at higher reserve gold price cut offs.

The first blue column is the WRLG reserve as stated in the PFS, at the US$1680 cutoff price. This reserve was drawn from the second blue column, which shows the tonnes of the resource that were considered for inclusion in reserve.

Access development and other cost factors were then applied to reach the reserve base shown in the first column. That’s why columns one and two have US$1,680 in the label, but different totals.

One takeaway is that access development is very important at Madsen. It was the force that reduced potential reserve tonnes by half to get the actual reserve.

The other takeaway is that increasing the reserve cut off price to US$2,400 boosts the resource tonnes considered for reserve inclusion by almost 77% (3,072 to 5,438 tonnes).

“The undiluted grade falls from 9.1 grams/tonne to 7.0 grams/tonne but there’s a big tonnage increase,” Preston told GSN. “At the current gold price, the reserves should be significantly higher.”

On February 25, 2025 WRLG announced that it closed the public offering of 23,628,000 charity flow-through units at a price of C$0.8487 raising just over $20 million.

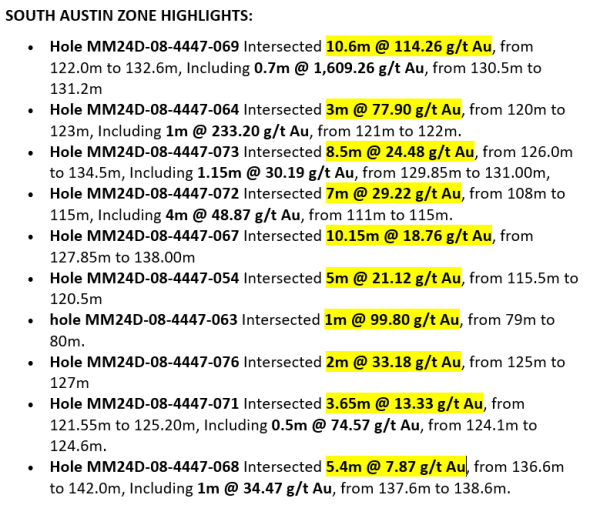

On February 26, 2025 WRLG reported definition drill results from the high-grade South Austin Zone.

Mine re-start update:

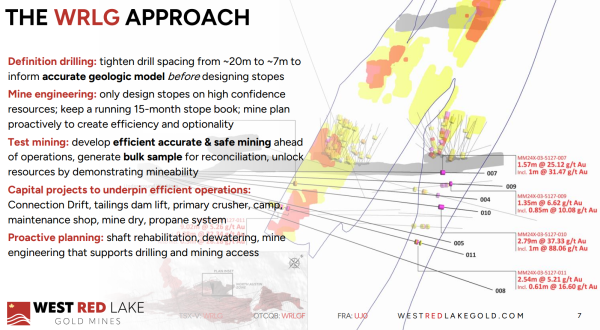

Bulk Sample Program: plans to mine at least 10,000 tonnes of material from six stopes. WRLG prioritized parts of the Madsen resource for extraction early in the mine life based on grade, tonnage, and ease of access.

Mill Startup for Bulk Sample Processing: after 28 months of maintained dry shutdown, the mill is scheduled to restart imminently. First feed will be 3,000 tonnes of legacy low-grade material to pack out the grinding mills. All operational readiness milestones have been met for the process plant.

The Connection Drift: it is now 80% complete, allowing WRLG to move all material on large haul trucks through the East Portal, which is situated close to the crusher and the mill.

Underground Development: from August 2024 to January 2025 the pace of new underground development increased notably, with average daily meterage rising 23% each month.

Camp and Mine Dry Installations: finalconstruction permits for the Madsen Mine camp received from the Municipality of Red Lake on January 31st. Final installation work is now underway, which is primarily power, water, sewer, and propane connections.

The Gold Sensitivity Price chart buried in the technical report indicates the amount of meat that SRK potentially left on the bone @US$1,680 reserve cut off price.

Using a long-term average gold price of US$2,640, the Net Present Value (NPV) of WRLG is estimated at $496 million. The re-rate from developer to producer typically takes a company from 0.5X NAV to 1x NAV.

WRLG’s current market cap is $214 million.

“West Red Lake Gold is one of only four single-asset companies putting a new gold mine into production in 2025,” Preston told GSN. “One is Artemis, which has arguably already been re-rated. Then there is Erdene in Mongolia, Robex in Guinea, and West Red Lake Gold in Ontario, Canada.”

“When investors rotate into gold, they look for large producers, growing producers, and new producers,” added Preston. “We are a strong candidate in the third category, operating in a Tier 1 Mining jurisdiction.”

The Madsen deposits presently host an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [1.] [2.] [3.]

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for technical disclosure at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

References:

- “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada”, prepared by SRK Consulting (Canada) Inc. and dated January 7, 2025 (the “Madsen Report”). A full copy of the Madsen Report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

- The Madsen Mine deposit presently hosts a National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) Indicated resource of 1.65 million ounces (“Moz”) of gold grading 7.4 g/t Au and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t Au. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US$1,800/oz. Mineral resources as stated are inclusive of mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the updated report. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- The Madsen Mine also contains Probable reserves of 478 thousand ounces (“koz”) of gold grading 8.16 g/t Au. Mineral reserve estimates are based on a gold price of US$1,680/oz. Please refer to the technical report “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada” available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country: Canada

Release Id: 27022524436

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

PerchMe Launches New Nature-Tech Line with Bamboo Smart AI Bird Feeder

Los Angeles, CA, United States, 22nd Nov 2025 — PerchMe, a California-based nature-tech brand, today announced the launch of its newest product, the Bamboo Smart Bird Feeder Camera, set to be available for the 2025 holiday season.

Crafted from sustainable bamboo and powered by AI bird-recognition technology, this smart feeder brings a sense of nature and everyday connection into modern homes — making it a meaningful gift for the season.

A Gift That Helps Families Connect with Nature

The PerchMe Bamboo Smart AI Bird Feeder includes an integrated camera for close-up viewing of visiting birds.

Hand-crafted from eco-friendly bamboo, it is designed to blend into backyard and garden settings while allowing families to enjoy live bird visits through the PerchMe app, which supports sharing with up to seven members.

Aimed at parents, grandparents, and nature lovers, this feeder enables households to view and share bird visits through the accompanying app.

“After seeing thousands of customers gift our original smart feeder to their loved ones last year, we wanted to offer a nature-inspired option for this year’s holiday gift selections,” said Lisa Zhang, Head of Business Development at PerchMe. “The bamboo edition combines natural warmth with intelligent design — a way to bring families closer to nature, together.”

Key Features

Behind its natural bamboo frame lies a set of smart features. The PerchMe Bamboo Smart Bird Feeder Camera combines AI vision, high-definition camera, and solar-powered operation — designed for those who want to experience nature in a simple, everyday way.

AI Bird Recognition — Instantly identifies over 11,000 bird species and displays their names, traits, and call notes in the PerchMe App, helping users learn while they watch.

2K Ultra HD + Night Vision — From sunrise cardinals to moonlit owls, every detail is captured in crisp clarity, even in low light.

Solar-Powered 24/7 Operation — No cords, no recharging. One full day of sunlight keeps the feeder running for days, ensuring uninterrupted observation.

Live Stream & Smart Notifications — Get real-time alerts when a new species visits, or share bird moments instantly with friends and family.

All-Weather Durability — Crafted for the outdoors with sealed camera housing, metal cover and reinforced bamboo with anti-mold coating to withstand rain, snow, and UV exposure, no cracking concerns.

Sustainable by Design — Each unit is hand-crafted from renewable bamboo and recyclable components, merging green design with high performance.

Gift-Ready Experience — Packed in a minimalist beige gift box with a setup QR card, making it as easy to give as it is to use.

Whether perched on a balcony or standing in a garden, the Bamboo Smart Camera Bird Feeder enables app-based, interactive birdwatching with AI-supported species identification.

Brand Vision

With its signature tagline — “Every Perch Tells a Story” — PerchMe continues to explore what technology can mean in everyday life: not only efficiency, but also connection and calm. It’s a smart feeder designed to bring people closer to nature.

The PerchMe Bamboo Solar-Powered Bird Feeder also reflects the growing consumer interest in outdoor wellness and sustainability. Wildlife observation has been shown to decrease stress and enhance family connections, with 73% of millennial consumers saying eco-conscious design shapes their buying choices.

Availability

The PerchMe Bamboo Smart Bird Feeder Camera is available in the United States through PerchMe’s website and selected online retail channels starting in November 2025. Shipping timelines and purchasing terms are provided on the PerchMe website: https://www.perchme.com/products/perchme-bamboo-bird-feeder-camera

About PerchMe

PerchMe is a U.S.-based smart nature brand dedicated to helping people reconnect with the outdoors through technology and design. Its line of AI-powered bird feeders and garden innovations combines smart engineering with emotional storytelling — supporting shared birdwatching experiences among users.

At PerchMe, the team believes that every backyard has the potential to support local wildlife and bird activity. The company’s mission is to design products that help people observe and appreciate wild birds.

Media Contact

Organization: PerchMe

Contact Person: Martinez Lucas

Website: https://www.perchme.com

Email:

cs@perchme.com

City: Los Angeles

State: CA

Country:United States

Release id:35815

The post PerchMe Launches New Nature-Tech Line with Bamboo Smart AI Bird Feeder appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Local Tree Experts at Tree Fellas LLC Help Homeowners in Concord to Prevent Yard Damage with Deep-Root Stump Grinding

Local residents turn to Tree Fellas LLC for reliable help as the local tree service company expands its efforts to protect Concord properties with deep-root stump grinding, a service now in high demand as homeowners look to prevent hidden yard damage.

Loudon, NH 03307, United States, 22nd Nov 2025 – Concord’s changing weather patterns, root spread from older trees, and recurring storm cycles have created ongoing concerns for property owners. Unseen root systems often push through lawns, disturb soil structure, and threaten nearby walkways. Tree Fellas LLC has stepped in to address this growing issue by offering a focused stump grinding solution that targets deep roots rather than surface-level growth. This approach provides long-term stability for yards that face both seasonal shifts and mature tree landscapes common across the region. With roots removed at proper depth, homeowners gain a safer outdoor environment and reduced risk of recurring damage.

For years, the company has served Concord with dependable service, guided by experienced crews and local insight. Its team of tree care professionals handles stump grinding services, trimming, removal, emergency work, and cabling with methods shaped by nearly a decade of field experience. Deep-root stump grinding has become a key service as the company aims to prevent repeated root flare-ups, soil displacement, and structural risks around foundations. Property owners rely on the company’s honest pricing, responsive scheduling, and commitment to thorough cleanup. These strengths, paired with support from qualified arborists, help the community maintain healthier trees and safer yards.

Find out more available information at https://calltreefellas.com/stump-grinding-concord-nh/

“Our work protects more than just the lawn. Removing deep roots helps reduce hazards that often go unnoticed until they cause costly problems. Stump grinding at the right depth gives the property a stable start and prevents issues from returning,” said a team member. This steady, solution-focused approach has strengthened community trust. Residents appreciate clear communication, fair estimates, and the reassurance that tree concerns will be handled with care.

The consistency of service, coupled with strong local knowledge, has positioned the company as a reliable partner for homeowners who want support that fits local landscape and weather conditions. Property owners see practical benefits after stump grinding work, including smoother lawn care, safer play areas, and improved long-term yard stability.

About Tree Fellas

Tree Fellas LLC is a local tree service company with nearly a decade of experience serving residential and commercial properties. The team includes qualified arborists who provide stump grinding, removal, trimming, cabling, and emergency response. They are known for their honest prices, dependable workmanship, and a commitment to local property safety.

Media Contact

Organization: Tree Fellas LLC

Contact Person: Ryan

Website: https://calltreefellas.com/

Email: Send Email

Contact Number: +16037830403

Address:34 Staniels Road Unit #2

City: Loudon

State: NH 03307

Country:United States

Release id:37180

The post Local Tree Experts at Tree Fellas LLC Help Homeowners in Concord to Prevent Yard Damage with Deep-Root Stump Grinding appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Rooted In Texas Tree Care Announces Service Update for Cedar Park Homeowners

Rooted In Texas Tree Care, headquartered in Cedar Park, shares an update on its service availability for residential and commercial properties across the region. The company continues to provide professional tree care with a focus on safety, reliability, and customer support.

Cedar Park, Texas 78613, United States, 22nd Nov 2025 – Central Texas homeowners face serious challenges with their properties. Oak wilt disease continues to spread through neighborhoods, threatening valuable trees and property values. Summer drought stress damages tree health, while unexpected storms create dangerous situations with fallen branches and weakened limbs. Many residents struggle to find reliable professionals who understand local tree species and regional climate conditions. The financial burden of proper tree maintenance can prevent families from addressing critical safety concerns. Rooted In Texas Tree Care recognized these challenges and decided to take action. The company’s discount program makes professional tree care accessible to everyone in the community.

More information available at https://rootedintexastreecare.com/

The company has provided residential and commercial solutions throughout Williamson County, Hutto, Pflugerville and surrounding areas for several years now. Their arborists handle everything from routine trimming and removal to specialized oak wilt treatment and emergency storm response. The team offers free estimates and second opinions, ensuring property owners make informed decisions about their trees. Their satisfaction guarantee backs every project with a commitment to quality workmanship. The company’s 24/7 emergency services protect families when storms strike unexpectedly. They assess tree health, identify diseases early, and recommend treatments that save valuable specimens whenever possible.

“We believe every property owner deserves access to professional tree care at fair prices,” a team member explains. “This discount program reflects our commitment to the communities we serve every day. Healthy trees create safer neighborhoods and protect property values for everyone. Nobody should delay addressing dangerous tree situations because of cost concerns. Our goal is to make expert care available to all residents who need it.”

The company’s commitment to accessible service has built trust throughout the region. Local residents appreciate working with their professionals who explain procedures clearly and answer questions patiently. Property owners value the team’s knowledge of native species like live oak, cedar elm, and pecan trees. The discount program will help residents invest in preventive maintenance that protects their homes and families. Homeowners no longer have to postpone necessary tree work because of budget constraints. Property owners access a reliable service that respects their time and resources.

About Rooted In Texas Tree Care

Rooted In Texas Tree Care has served Central Texas since 2018 with professional tree trimming, removal, stump grinding, cabling, and lot clearing services. The company provides specialized oak wilt treatment and 24/7 emergency response throughout Cedar Park, Jollyville, Lago Vista, Round Rock, Liberty Hill, and North Austin.

Media Contact

Organization: Rooted in Texas Tree Care

Contact Person: Kyle Banks

Website: https://rootedintexastreecare.com/

Email: Send Email

Contact Number: +15127834622

Address:101 Breakaway Rd

City: Cedar Park

State: Texas 78613

Country:United States

Release id:37137

The post Rooted In Texas Tree Care Announces Service Update for Cedar Park Homeowners appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release5 days ago

Promax Pogo Pin Offers Robust Pogo Pin Keyboards for Enhanced Input Precision

-

Press Release5 days ago

Company Fyllo Expands Company Registration Services Across 5 Major Cities in South India – Bangalore, Chennai, Coimbatore, Madurai & Trichy

-

Press Release4 days ago

Poseidon Boat Achieves Landmark Lloyd’s Register Certification for 10-Meter Aluminum Catamaran Patrol Boats

-

Press Release1 week ago

Holiday Ice Inc. Announces Expanded Availability of Its Arctic-Temp Industrial Ice Machine Line for High-Demand Processing Industries

-

Press Release1 week ago

AVIDLOVE Launches Black Friday & Cyber Monday Extravaganza! Extended Duration and Multi-Layer Offers Create a Unique Shopping Experience

-

Press Release5 days ago

Quantari Exchange Emerges as a Global Digital Asset Powerhouse: Redefining Real-Time Trading, Instant Contracts, and the Future of Digital Gold

-

Press Release1 week ago

AI Vidya Launches with Mission to upskill 100,000 AI Engineers from Underprivileged and Under-employed Families in the Next Five Years

-

Press Release3 days ago

Tradeview Markets Celebrates Major Success at Jeddah Fintech Week 2025, Organized Under the Patronage of His Royal Highness Prince Dr. Saif Al-Islam Bin Saud Bin Abdulaziz Al Saud