Press Release

Smarter Investing for a Changing World: How AlphaSavings Simplifies Wealth Management

The Evolution of Smart Investing: The financial landscape is constantly evolving, and traditional savings methods often struggle to keep pace with changing market conditions. In an era where economic fluctuations, inflation, and technological advancements redefine investment strategies, many individuals seek a more effective way to grow and manage their wealth.

AlphaSavings introduces a streamlined approach to investing, leveraging AI-driven solutions and advanced financial models to help clients make informed decisions. By simplifying wealth management, the platform enables investors to navigate market complexities with greater confidence.

The Need for Smarter Investment Strategies

Historically, investing has required extensive market knowledge, continuous monitoring, and significant time commitment. Many individuals find it challenging to manage their portfolios effectively, especially with traditional savings options offering minimal returns that may not keep up with inflation.

AlphaSavings addresses these challenges by integrating intelligent automation and market insights into its platform. With a data-driven approach, the company provides investors with strategies tailored to various risk levels and financial goals, offering a more efficient way to manage wealth.

AI-Driven Investment Decisions

A key component of AlphaSavings’ approach is its AI-powered investment framework. The platform analyzes market trends, economic indicators, and investor behavior in real-time to identify opportunities for capital growth. Unlike traditional investment models that rely on fixed strategies, AlphaSavings adapts dynamically to market conditions, helping to mitigate risk while optimizing portfolio performance.

By eliminating emotional biases and human error, the platform makes investment decisions based on objective data and predictive analytics. This enhances the efficiency of wealth management and provides clients with a structured investment approach.

Diversification and Risk Management

Diversification plays a crucial role in effective investment planning. AlphaSavings employs a multi-asset strategy, allocating funds across equities, bonds, commodities, and alternative investments to reduce exposure to market volatility.

Risk management is another core principle of AlphaSavings’ strategy. Using advanced risk assessment tools, the platform carefully evaluates market conditions and adjusts allocations to maintain stability. This personalized approach aligns with each investor’s financial goals while managing risk effectively.

Effortless Portfolio Management

One of the advantages of AlphaSavings is its simplified portfolio management system. Traditional investment firms often require active client involvement, but AlphaSavings automates key aspects of portfolio adjustments, allowing clients to take a more hands-off approach.

Through intuitive dashboards and real-time tracking, users can monitor their investments without the need for constant manual adjustments. This streamlined process enhances the user experience while ensuring efficient wealth management.

Transparent and Cost-Effective Investing

Investment fees and hidden costs can significantly impact overall portfolio performance. AlphaSavings prioritizes transparency by offering a cost-effective structure with no unnecessary charges, helping clients retain a greater share of their earnings.

Unlike conventional financial institutions that impose rigid fee structures, AlphaSavings provides a flexible and accessible investment environment. By optimizing cost efficiency, the platform enables clients to achieve financial growth without excessive overhead.

Personalized Financial Strategies

Each investor has unique financial objectives, whether focused on long-term wealth accumulation, retirement planning, or financial security. AlphaSavings tailors its strategies to match individual goals, risk preferences, and investment timelines.

By assessing personal financial data, the platform develops customized plans that align with client expectations. Whether building a diversified portfolio or seeking passive income opportunities, AlphaSavings provides a structured roadmap for financial planning.

Market Intelligence and Strategic Insights

Beyond AI-driven analytics, AlphaSavings incorporates extensive market research and expert insights into its investment strategies. By analyzing global financial trends and predictive modeling, the platform identifies emerging investment opportunities.

This proactive approach allows investors to explore high-growth sectors and innovative financial products. Unlike traditional savings accounts that yield minimal returns, AlphaSavings ensures that capital is consistently allocated to opportunities that align with market trends.

Long-Term Financial Growth

While short-term market fluctuations are inevitable, AlphaSavings emphasizes long-term financial stability. Its investment strategies focus on sustainable growth, helping clients navigate economic cycles while maintaining a structured portfolio.

By combining disciplined asset allocation, dynamic portfolio adjustments, and strategic reinvestments, AlphaSavings ensures that clients can steadily build wealth over time. This long-term perspective provides investors with financial security and confidence in their investment decisions.

The Future of Investing

AlphaSavings represents a new approach to wealth management—one that integrates technology, automation, and expert financial analysis to simplify the investment process. As financial markets continue to evolve, the company remains committed to providing clients with an efficient and intelligent solution for portfolio growth.

Through strategic diversification, AI-driven insights, and cost-effective investment models, AlphaSavings empowers individuals to take control of their financial future with ease. Investing no longer needs to be complex—AlphaSavings has made it more accessible and effective for modern investors.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Fitch Ratings Lifts Uzbekistans Outlook to Positive Citing Momentum From Octobank and KapitalBank in Banking and Digital Growth

Fitch Ratings, a leading global credit rating agency, has upgraded Uzbekistan’s banking operating environment outlook from “Stable” to “Positive.” The decision, announced in July 2025, reflects significant macroeconomic progress, stronger regulatory oversight, and improved corporate governance in the country’s financial system.

The move marks a major milestone for Uzbekistan, which has been steadily implementing reforms that are reshaping its banking sector. Key measures include tighter capital requirements, stricter financial reporting, and reduced risks in retail lending. Fitch Ratings noted that these improvements are strengthening the resilience of local financial institutions and building greater trust among international stakeholders.

Uzbekistan’s economy continues to grow at a solid 6–7% annually, positioning the country as one of Central Asia’s most dynamic markets. The financial sector, in particular, has become a hub for fintech innovation and digital banking solutions.

“Fitch’s upgrade is more than a rating adjustment — it’s a signal that Uzbekistan’s financial reforms are creating a more resilient and well-regulated banking environment,” said John Ashbourne, an analyst at a London-based emerging markets investment firm.

Digital Transformation Led by Key Banks

Several major institutions are at the forefront of this transformation:

- Kapitalbank – The largest Visa card issuer in Uzbekistan and recognized with Uzcard’s “Most Technological and Agile Bank” award.

- Uzpromstroybank (SQB) – Named Best Bank in Uzbekistan 2025 by Euromoney, with assets exceeding $6.9 billion.

- Octobank – A leader in e-commerce acquiring and IT partnerships, holding international ratings from S&P and Moody’s.

- TBC Bank Uzbekistan (TBC UZ) – Operator of the Payme ecosystem, a leading digital finance platform, and a subsidiary of TBC Georgia, listed on the London Stock Exchange.

Why the Upgrade Matters

- Fintech Growth: Uzbekistan is advancing Open Banking, sandbox regulations, and cross-border payments.

- Resilience: Fitch’s upgrade underscores reform maturity and strengthens the case for long-term stability.

- Scalable Models: Digital platforms from Octobank and TBC UZ highlight exportable fintech solutions.

- Geo-Economic Role: The country’s stability supports its growing role as a financial hub between Europe and Asia.

Looking Ahead

Uzbekistan plans further privatization of state-owned banks by the end of 2025, continued fintech integration in SME lending and merchant services, and alignment with international ISO and ESG standards.

About Fitch Ratings

Fitch Ratings is a leading provider of credit ratings, commentary, and research. With offices worldwide, Fitch offers objective and forward-looking analysis to help investors, policymakers, and market participants make informed financial decisions.

Media Contact

Organization: Fitch Ratings

Contact Person: Paul Taylor

Website: https://www.fitchratings.com

Email:

fitchgroup.recruitment@fitchratings.com

Country:United States

Release id:32850

The post Fitch Ratings Lifts Uzbekistans Outlook to Positive Citing Momentum From Octobank and KapitalBank in Banking and Digital Growth appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

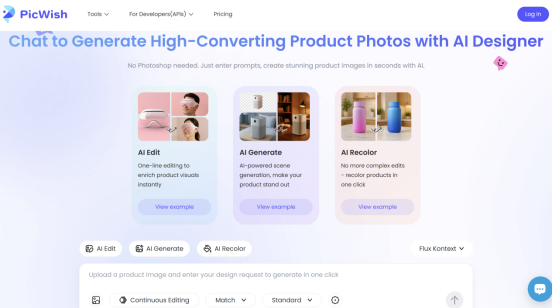

PicWish Unveils AI Designer: Transform Any Photo with Simple Text Commands

Shenzhen, China, 26th Aug 2025, Grand Newswire – PicWish, well-know for its photo enhancement and background removal features, just announced the launch of AI Designer, a revolutionary new function that will change how users create and edit images. The cutting-edge technology meets the increasing need for easily accessible visual content creation across personal and commercial applications through simple text instructions.

Comprehensive Image Transformation Capabilities

AI Designer provides users with unprecedented creative flexibility through simple text-based commands. This tool allows users to replace photo background, change hairstyles, virtually try on clothes, and modify colors. Users can transform images into popular cartoon styles including Studio Ghibli, Hello Kitty style and Simpsons-style cartoons, making it an ideal tool for both corporations and social media enthusiasts. Beyond artistic applications, the program works excellently at image content expansion and old photo restoration.

Meeting Users Needs for Easily Accessible AI Tools

The AI image generator industry is expected to reach a revenue of USD 1,880.3 Million by 2033, at 18.1% CAGR, indicating explosive growth in demand for AI-powered image creation. Meanwhile, traditional photo editing puts small businesses and individual creators at a disadvantage since it requires costly software and a high level of technical expertise. Based on these factors, PicWish developed AI Designer to enable everyone to readily access high-quality picture editing.

Major Applications Driving User Adoption

Social Media Content Creation

Change Background: Simply upload an image and enter the description of the desired scene, and PicWish AI designer instantly transport the subject to any location for social posts without physically being there.

Virtual Hair Makeovers: Try different hairstyles and colors before visiting the salon.

Cartoon Style Conversion: Create viral content by turning profile photographs into cartoon characters.

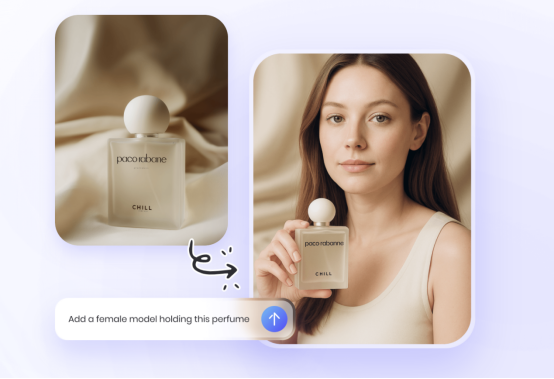

E-commerce & Business Applications

Product Color Variations: Generate multiple color options of the same product without re-shooting.

Lifestyle Context Creation: Place products in realistic home or outdoor settings without staging.

Professional Headshot Enhancement: Enhance business portraits from informal photographs .

AI Model creation: Eliminate the need for expensive photo shoots and model hire by creating virtual models who can wear, carry, or interact with your products to showcase them.

Creative & Restoration Projects

Vintage Photo Repair: Remove cracks, stains, and damage from old family photographs

Virtual Fashion Try-On: No need to purchase, user can take on as many clothes as he/she wants virtually and see how clothes look on different body types

Expression Transfer: Users can make subjects in photos smile naturally or transfer facial expressions from one photo to another, allowing seamless emotion adjustments across portraits while maintaining the original subject’s identity

Photo Retouch: The tool eliminates common photo flaws including glare, reflections, red-eye effects, wrinkles, and other imperfections while maintaining the subject’s natural appearance, requiring only photo upload and simple text instructions.

Integration of Advanced AI Technology

PicWish AI Designer utilizes cutting-edge artificial intelligence models including Gemini 2.0, GPT Image-1, and Flux Kontext to deliver superior results across diverse use cases. The integration of Flux Kontext specifically ensures consistent subject integrity throughout photo editing, maintaining the essential characteristics of people and objects while making adjustments.

About PicWish

PicWish was founded as an AI photo editor and has grown to become a well-known global brand for intelligent image processing product. With more than 200 workers spread over six international offices, the company provides its comprehensive suite of AI photo editing tools to millions of users worldwide. Among PicWish’s primary services are advanced photo enhancement, precise background removal, and more. PicWish keeps pushing the boundaries of accessible AI technology to enable anybody, making professional-quality photo editing available to users regardless of technical expertise.

For more information about PicWish and AI Designer, visit picwish.com

Media Contact

Organization: PicWish

Contact

Person: Gemelli

Website:

https://picwish.com/

Email:

gemelli@picwish.com

Address:Room 1101, 11th Floor, Office Building, Raffles City, 2163 Nanhai Avenue, Nanshan Street, Nanshan District, Shenzhen

City: Shenzhen

Country:China

The post PicWish Unveils AI Designer: Transform Any Photo with Simple Text Commands

appeared first on Grand Newswire.

It is provided by a third-party content provider. Grand Newswire makes no

warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Alpha and Omega Plumbing Expands Trusted Plumbing Services in Riverside CA

Alpha & Omega Plumbing, a family-owned company serving Riverside, CA, announces expanded residential and commercial plumbing services, offering reliable repairs, installations, and emergency solutions for homeowners and businesses.

Riverside, CA, United States, 26th Aug 2025 – Alpha & Omega Plumbing, a trusted local plumbing company, is proud to announce expanded plumbing services for homeowners and businesses across Riverside, CA. With years of hands-on experience and a strong reputation for customer care, the company continues to deliver reliable, affordable, and high-quality plumbing solutions to the Inland Empire community.

Alpha & Omega Plumbing specializes in a wide range of services, including leak detection, pipe repair, water heater installation, sewer line repair, drain cleaning, and complete plumbing system maintenance. The company also offers 24/7 emergency plumbing to ensure customers get fast and dependable service when it matters most.

“Our mission has always been to combine skilled workmanship with unmatched service,” said George Valencia, owner of Alpha & Omega Plumbing Company. “We are committed to keeping Riverside homes and businesses safe and functional with top-tier plumbing care.”

As a locally-owned and family-operated business, Alpha & Omega Plumbing takes pride in its integrity, reliability, and dedication to customer satisfaction. Backed by fully licensed and insured technicians, the company uses modern tools and proven methods to deliver long-lasting plumbing solutions.

For more information or to schedule a service, visit https://www.alphaomegapl.com/ or call (951) 295-4363

Media Contact

Organization: Alpha and Omega Plumbing Company

Contact Person: George Valencia

Website: https://www.alphaomegapl.com/

Email: Send Email

Contact Number: +19512954363

Address:6312 Catspaw Dr

City: Riverside

State: CA

Country:United States

Release id:32899

The post Alpha and Omega Plumbing Expands Trusted Plumbing Services in Riverside CA appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release2 days ago

Playdigo and BIGO Ads Scale AI-Powered Programmatic Advertising, Driving 486% Revenue Growth, 93% sRCPM Improvement, and 152% Impressions Growth Through Transparent Collaboration

-

Press Release6 days ago

A Full-Service Marketing Agency called Vertex Viral is setting a new standard in Marketing

-

Press Release4 days ago

Irys Raises $10M Series A to Unlock $3 Trillion Data Economy With First Programmable Datachain

-

Press Release6 days ago

BJMINING Offers XRP Holders Easy Access to Daily Mining Income

-

Press Release6 days ago

PAXMINING Expands Bitcoin Mining Services with New Plan Yielding $9,888 Per Day

-

Press Release6 days ago

Dogecoin investors are earning $8,700 daily through blockchain cloud mining.

-

Press Release6 days ago

iMarketable Shares a Modern Framework for Launching and Scaling DTC Brands

-

Press Release5 days ago

iGrafx Recognized as a Leader in Process Intelligence Software Evaluation by Independent Research Firm