Press Release

Six Years In: Matrixport’s Ascent from Crypto Asset Manager to Web3 Super Account

Perhaps it’s the monotony of this cycle’s memecoin PvP battles—loud but hollow, all flash and no substance—that has left the market numb with aesthetic fatigue. More and more, people are yearning for crypto’s golden era: when ICOs minted overnight millionaires; when Bitcoin forks sparked brutal hash wars; when the “HBO”(Huobi, Binance, OKEx) exchange titans fought for dominance; and when the wild-haired SBF dazzled with his Wall Street pedigree and high-frequency trading prowess.

Many of the early crypto pioneers—once the architects of chaos and champions of bull runs—have drifted into parallel timelines, their stories now reduced to dinner-table anecdotes. Li Xiaolai has rebranded himself as a self-help author, with a new book on mental focus and brainpower. Wang Chun made headlines for spending $200 million on a commercial space ticket. Justin Sun and Li Lin toasted away tears of rivalry at a Hong Kong banquet. As for CZ, he made a light-hearted jab at Justin’s love life during the event. In smoky Hong Kong dining rooms, the old guards still gather—glasses clinking, laughter echoing, legends fading gently into the memories.

“Where is Jihan Wu?”Someone eventually asked.

The man who introduced the Bitcoin white paper to the Chinese-speaking world. An evangelist who helped ignite a movement, the builder behind the Bitman empire—had seemingly slipped out of the spotlight, becoming increasingly reserved and enigmatic. Most people knew that after the much-publicized split at Bitman, Wu had taken the overseas mining operations and founded Bitdeer.

What most missed was that he also brought along John Ge—Bitman’s Executive Director and Head of the Investment, then still in his twenties. Together, they quietly laid the groundwork for what would become Matrixport, a crypto asset management firm born not amid market frenzy, but from the aftershocks of a tectonic split.

Pictured: John Ge (left) and Jihan Wu (right)

The Prehistory of Matrixport

“My very first internship—Han (Jihan Wu) was an investment manager then, and also my mentor. He was the one who introduced me to Bitcoin and mining.” John Ge absentmindedly traced the texture of a throw pillow as he spoke to BlockBeats as if reaching back to 2013.

Rewind twelve years. It was a hot summer in Hangzhou. A 21-year-old Business graduate could hardly have imagined that an internship at a venture capital firm would alter the course of his life—just because he crossed paths with a Bitcoin evangelist.

Wu was already a prominent blockchain advocate. Together with Chang Jia and others, he co-founded 8btc—one of the earliest Chinese-language platforms dedicated to blockchain innovation. Ge, naturally drawn to computers and hardware since childhood, found himself captivated. One was an evangelist, the other an eager learner. What began as technical banter soon evolved into late-night conversations about Bitcoin, mining economics, and the transformative power of blockchain.

“So we did the math—and decided to start mining.” They pooled their funds to buy mining machines and built their first farms. But when ambition grew, they wanted to go deeper—designing their own chips. That’s when they brought in a technical co-founder, Micree Zhan. That decision marked the birth of Bitmain. Ge would go on to serve as Director and Head of Investments at Bitmain, witnessing firsthand a computing revolution driven by hash power.

Much of what followed is now an industry legend. After several years of quiet ascent, Bitmain rose to become a titan of the crypto industry. Its operations spanned the entire mining ecosystem—from hardware manufacturing and mining pools to large-scale farms and exchange services—and it drew the attention of major investors, including Sequoia Capital China. By early 2018, Bitmain was the largest crypto-mining hardware company in the world. At its peak, 70% of global Bitcoin mining machines were Bitmain-made, and over 50% of all newly minted BTC came from its farms.

These milestones were once badges of honour. But the shine faded as IPO setbacks, asset devaluation, and internal turbulence began to surface—etched scars that the company still carries. The crypto winter of late 2018 was especially brutal. As Bitcoin plunged below $4,000, the industry giant faced its darkest chapter: a failed IPO attempt in Hong Kong, a draining hash war over BCH, and a deepening ideological divide among its founding leaders.

After a series of long, searching conversations, Jihan Wu and John Ge made the decision to leave the old order—carrying with them the spark of something new. In February 2019, they launched Matrixport in Singapore as a digital asset management platform. Wu took the helm as Chairman, while Ge stepped into the role of CEO—tasked with building the next generation of crypto financial infrastructure.

After Bitmain: Jihan Wu and John Ge’s Second Venture

At the time, the crypto landscape revolved around just two main arenas: the roaring world of mining hardware and the high-stakes battleground of exchanges. Asset management, in any meaningful form, was virtually nonexistent—still viewed by most as a term reserved for traditional finance. Reflecting on those early days, John Ge noted, “We were among the first to explore asset management in this industry. Before us, the concept barely existed in crypto—it was a niche within a niche.”

In this sense, building Matrixport was like planting trees in a desert. There were no benchmarks to learn from. No maps to follow. “Industry awareness” is a vague term—until you find yourself carving out a new track. That’s when you realize how much it matters.

Pictured: John Ge (left) and Jihan Wu (right). Source: Matrixport

In John Ge’s strategic framework, wealth creation in the crypto world takes two distinct forms. The first is market beta returns—broad-based value appreciation. “For example,” he explains, “when Bitcoin rises from $40,000 to $120,000, everyone feels wealthier. Paper gains surge across the board, but there’s no real transfer of value.” The second is alpha returns—differential performance. “Here, one wins, and another loses. Wealth gets redistributed, and money actually moves. Essentially, it’s about taking profits from counterparties in the market.”

This understanding laid the foundation for Matrixport’s early business architecture—structured along two axes. On the beta side, the firm generates revenue through spot trading and custody services. On the alpha side, it captures the upside through revenue sharing from quantitative strategies and structured products.

More specifically, Matrixport launched its institutional-grade custodian, Cactus Custody, to support its beta business. Meanwhile, its alpha offerings evolved into a diverse suite of investment products—and later became a core focus of the platform’s strategic development.

The First Bull Run: Matrixport Built a Unicorn

Matrixport was born in a bear market. As crypto OGs who had weathered multiple cycles, John Ge and Jihan Wu had seen too many people go from being wealthy on paper to being broke overnight. They understood this deeply: in crypto, ten bets lose nine—or even all ten. What users needed wasn’t just another high-leverage casino. They needed a safety net—a way to protect assets from going to zero. That, to them, defined the very purpose of crypto wealth management.

“That’s why Matrixport commits to delivering alpha—sustainably and with risk controls built in,” Ge told BlockBeats.

Convincing users to move funds from self-custody to a centralized platform meant overcoming the first—and most crucial barrier: trust. Fortunately, their legacy from the Bitmain era offered more than credentials—it offered trust. Many of the earliest users were longtime friends—miners who had once spent sleepless nights tuning machines with them on the outskirts of Beijing.

No one understands what miners need better than miners themselves. As two of the earliest miners in China’s crypto scene, Ge and Wu knew exactly what that meant.

At the time, most miners lacked access to effective hedging tools.They wanted to hold onto their Bitcoin—but they also had to regularly sell coins to cover high electricity costs, all while worrying about how price swings would impact mining profits. To address this, Matrixport became the first to introduce the Dual Currency Investment (DCI) model—adapted from traditional finance—into crypto.

DCI, at its core, combines money market deposits with currency options to deliver above-market returns. In traditional FX markets, dual-currency products—say, involving the RMB and HKD—can offer 10% annualized yields while automatically managing exchange rate risks. In its crypto implementation, Matrixport’s product integrated fiat and digital currencies into structured fixed-income contracts.

For example, a miner needing to sell 100 BTC each month to cover $3 million in electricity costs could instead use a DCI product that sets a conversion price 5% below market. If Bitcoin goes up, it earns 8% APY. If it drops, the BTC is converted into USDT at the predetermined price to pay bills. The product’s payout structure—rate, maturity, settlement asset—is all fixed at the time of subscription. This format was later replicated by exchanges such as Binance and eventually became an industry standard.

Bull markets fuel the fastest growth. In the 2021 run-up, Matrixport hit a critical inflexion point—building a full-stack product matrix covering custody, trading, lending, and investment. Structured products evolved into a core offering. The team scaled from a few dozen to several hundred members, and its client base diversified, from early mining participants to family offices and hedge funds.

This infrastructure-plus-strategy ecosystem enabled Matrixport to secure Series C funding in August 2021—backed by DST Global, C Ventures, and K3 Ventures—at a $1 billion valuation, officially joining Singapore’s unicorn ranks.

Navigating the Crash: Matrixport’s Survival Philosophy

Every boom has its bust. The other side of crypto’s riches effect has always been the industry’s susceptibility to spectacular crashes and bankruptcies. Even FTX—the so-called golden child—collapsed overnight due to mismanaged risk, wiping out hundreds of billions in market value in a single day. Titans like Three Arrows Capital, BlockFi, and Celsius once symbolized crypto’s exuberance. Their downfall became cautionary tales of unchecked greed.

Since its inception, Matrixport has weathered two full market cycles. Looking back, John Ge identifies one thing that made all the difference: a deeply conservative operating philosophy.

“Our goal has always been to build a conservative asset management firm,” he said, “—not one that chases profits, but one that ensures every line of business has a margin of safety. That’s likely why Matrixport is still standing today.” It was a calm, steady tone—one shaped by a CEO who has lived through Bitcoin halving in price more than a dozen times.

Unlike firms that blew up while chasing one-sided directional bets, John barely remembers what he was doing on those meltdown days—and that’s the point. That’s the point: for Matrixport, shocks are inevitable, but the impact remains within controlled bounds. “Liquidity crunch? That doesn’t happen to us,” he explains. “We don’t use leverage. We’re not subject to margin calls. Even when the market crashes, the money is still there.”

Internally, Matrixport established a dedicated Risk Management Committee, supported by robust modelling and high-standard protocols. In times of panic or strategy shifts, when redemption requests surge, Matrixport doesn’t scramble—it activates prebuilt responses. The platform can accommodate both scenarios: clients who want to catch the bottom, and those who need to add collateral.

“That’s what typically happens in extreme markets,” John notes. “Clients redeem because they lack liquidity. Sometimes it’s to buy the dip. Sometimes, it’s to top up margin. We offer solutions for both. Not through slogans—but through system design.”

In crypto, everyone talks about safety and risk controls. But too often, that talk proves hollow. John sees it differently: security and risk are not selling points—they’re structural. Only on that foundation can you compete on product, on service, on anything else. When asked about Matrixport’s client acquisition strategy during downturns, John’s answer was unexpectedly simple: “We don’t do anything special to attract clients in a bear market.”

In John’s view, Matrixport’s asset scale doesn’t change dramatically—whether in bull or bear markets. That’s because price volatility mostly impacts the USD-denominated value of crypto holdings, not the underlying asset volumes. As a result, Matrixport rarely makes aggressive operational adjustments during market cycles, focusing instead on steady product iteration.

At its core, asset management is simple: help clients make money, then take a share of what they earn. Traditional firms often charge fixed management fees, even when clients are losing money. But in crypto—where volatility is the norm—this model doesn’t translate. Asset managers can’t just lift-and-shift legacy fee structures into this environment. Naturally, this places a ceiling on profits. In bear markets, few strategies deliver strong returns. Even in bull runs, upside is limited by how much clients actually realize. By nature, crypto asset management is a partnership model—incentive-aligned, outcome-dependent, and built on shared risk..

“Real demand for asset management has nothing to do with bull or bear cycles,” Ge adds. “Warren Buffett didn’t make money every year, but that didn’t stop him from becoming the richest man alive.”

Matrixport, in that spirit, pays closer attention to rate markets than price charts. When rates heat up, asset management businesses grow faster and earn more.

Much like other platforms, Matrixport senses that this bull cycle—running from last year through today—lacks the froth and intensity of the last.

“There was a short spike in November through early December last year, where rates hit their peak,” John recalls. “But they fell just as quickly. Compared to the last bull cycle, this one has been shorter and less aggressive overall.” The lending rates that long-position traders are willing to pay, he notes, are a direct reflection of market speculation and sentiment.

Two Cycles In: Matrixport’s Steady Ascent

After weathering two major crypto cycles, Matrixport has entered a new phase of measured growth and strategic maturity. Within its client landscape, crypto investors typically fall into two distinct camps. The first is risk-takers—hands-on traders who farm in DeFi protocols and chase the latest meme coins. They approach crypto like it’s a thrill ride or a high-stakes casino. The second is allocators—investors who treat crypto as just one component of a diversified portfolio, much like holding a gold ETF. For them, investing is about discipline, not adrenaline.

“Most of our clients belong to the second group,” John explains. “They’re comfortable with risk-adjusted returns and willing to entrust their capital to us.” What began with miners has now shifted to high-net-worth individuals and institutions. These clients aren’t focused on tomorrow’s Bitcoin price—they care more about annualized returns over time.

On the global strategy front, Matrixport follows a basic principle: “Go where the money is.” “Financial institutions are highly local,” John says. “A U.S.-based client will always prefer to keep their money in a nearby, familiar bank.” From its Singapore headquarters, Matrixport has expanded across Hong Kong, Bangkok, and Europe. Its compliance infrastructure now spans three continents, with licenses secured in key jurisdictions.

Asia: Hong Kong Trust Company license, Money Lender license; Singapore: Major Payment Institution license under MAS (secured in 2025 by subsidiary Fly Wing);

Europe: FCA registration in the UK, FINMA SRO-VFQ membership in Switzerland; in 2024, acquired Swiss CFAM license and upgraded it to Matrixport Asset Management AG (MAM);

Americas: MSB license in the United States.

When asked why Matrixport hasn’t expanded into the Middle East, John Ge gave a measured and pragmatic response: “The Middle East is a unique region. In practice, most of its wealth continues to be managed through Switzerland.”

For Matrixport, Asia remains a cornerstone—both as a vast addressable market and as a strategic base for global operations. Switzerland, via its regulatory framework, not only provides comprehensive access to Europe but also acts as a gateway to the Middle East, leveraging its long-established role as a global wealth custodian. As for the United States—where regulatory costs are steep and competition is fierce—Matrixport has taken a disciplined, step-by-step approach to market entry. This calibrated approach reflects Matrixport’s long-term commitment to sustainable, compliant growth across regions.

On the product side, Matrixport continues to build a comprehensive portfolio tailored to varying user-profiles and risk appetites. The platform has steadily launched a full suite of offerings designed to serve different users from individual investors to institutional allocators.

Comprehensive Asset Management Solutions:Matrixport offers a full suite of investment products designed to meet diverse client needs. For users seeking stability, the platform provides flexible savings plans, fixed-income products, and conservative wealth strategies. For those pursuing differentiated yield strategies, Matrixport offers structured products such as Dual Currency Product , SharkFin, Smart Trend, Seagull, Snowball, Buy Now Pay Later(BNPL), and Double No Touch(DNT). For users aiming to capture on-chain rewards, Matrixport supports ETH staking, restaking, and other blockchain-based yield solutions. For clients seeking diversified alpha through both private and public traffic channels, Matrixport delivers a range of strategy-backed investment products tailored to varying liquidity requirements and market access levels.

End-to-End Institutional Services: Matrixport also offers institutional-grade infrastructure, including OTC trading, custody via Cactus Custody, and prime brokerage services tailored for sophisticated players.

Tokenization of Real-World Assets (RWA): Through its dedicated RWA platform Matrixdock, it has introduced STBT (Short-Term Treasury Tokens) and XAUm (Gold Tokens), enabling investors to hold high-quality traditional financial assets—such as U.S. Treasuries and gold—directly on-chain. While other platforms, including FTX, have previously experimented with similar products, most competitors have largely overlooked this niche segment. In contrast, Matrixport has demonstrated clear foresight and strategic commitment in the RWA domain. This forward-looking approach positions Matrixport as a key innovator at the intersection of traditional finance and decentralized infrastructure.

Robust Trading Experience: Matrixport has enhanced its trading platform with smooth spot trading systems and deep, liquid derivatives markets that rival top-tier exchanges.

Professional Research Reports: Leveraging in-house analysts and industry expertise, Matrixport publishes high-quality research reports that decode market trends, price action, and emerging narratives. These insights have earned recognition across major crypto communities, often setting the tone for market discussions. Through the Matrixport App, users can access a fully integrated crypto finance experience—trading, investing, loans, custody, RWA, and research to manage their digital wealth with ease and confidence.

Though Matrixport began as a crypto asset management firm, it now aspires to become a Web3-era super app—a single entry point for digital asset services. By continuously expanding its product verticals, Matrixport lowers the barrier to Web3 participation while delivering comprehensive, secure, and intuitive crypto financial services. In doing so, Matrixport transforms complexity into clarity—creating layered value for a new generation of Web3 users.

According to recent disclosures by John Ge, Matrixport now manages and safeguards over $6 billion in assets, with a core balance sheet footprint of approximately $4 billion. These figures reflect strong market adoption and the discipline, trust, and long-term underpinning of Matrixport’s operating philosophy.

From Here, the Next Six Years Begin.

Six years have flown by. From long, cold nights at the mining farms—dreaming what Bitcoin might become—to today’s stage of global regulatory licensing and expanding financial infrastructure, Matrixport’s journey has quietly mirrored the evolution of the crypto industry.

“We hope to become fully compliant and one day stand as a listed company,” says John Ge. As Matrixport enters its sixth year, he speaks of the next six with clear conviction: Matrixport is not just building an authoritative gateway for crypto assets. It’s aiming to stretch beyond—into broader financial services, offering a one-stop platform that spans OTC trading, structured products, and multi-asset wealth management.

es reach a specific size in crypto, two paths often appear: a traditional IPO or the hype-driven IDO. Matrixport has chosen the former—not for liquidity, but for legitimacy. Going public isn’t just a capital event. It’s about lowering the cost of trust. Like how different banks offer different deposit rates based on perceived safety, public companies earn trust not just through words and regulation, transparency, and accountability. That’s what enables clients to entrust millions.

History moves in decisive moments. Some fade into footnotes. Others write the next chapter. As John Ge reflects: “Everything evolves according to its own internal logic. So does crypto. What we’re after isn’t novelty—it’s durability. And deep, enduring trust.”

Even Matrixport’s name carries this dual spirit. Inspired by Wu Jihan’s favourite film The Matrix, the word “Matrix” evokes complexity and infinite possibility. “Port” is an entryway—a gateway. It was never just a company. It was a door. A portal through which users could begin their journey into crypto, finance, and something new.

And when Three Arrows Capital sank under the weight of its leverage… When BlockFi unravelled in a liquidity crisis… And when trillions of “old money” began to enter through that very door—

One truth became clear: True asset management doesn’t depend on leverage. It doesn’t live for bull markets.

It’s built by those who stay, cycle after cycle. The quiet stewards. The ones who keep the light on.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

COOFANDY & Christopher Bell: Dressing the Journey to Victory – A Partnership Story Racing Toward Martinsville Speedway

The partnership between COOFANDY and Joe Gibbs Racing (JGR) alongside their driver Christopher Bell, established earlier this year, has been a dynamic fusion of high-speed motorsport and sophisticated style. As COOFANDY prepares to sponsor the event at Martinsville Speedway on October 26, 2025, let’s revisit the key moments of this thrilling collaboration.

Partnership Journey Recap

May: The Collaboration Begins

During its 10th-anniversary celebrations, COOFANDY officially announced Christopher Bell as its global brand ambassador. The launch also featured the debut of the “Bell’s Picks” product collection and a creative comic series.

June: Father’s Day Special Event

COOFANDY organized a special fan viewing experience during the FireKeepers Casino 400 in Michigan, blending COOFANDY fans with the NASCAR community to celebrate Father’s Day together.

July: Online Interaction & JGR Headquarters Experience

Christopher Bell made a surprise appearance in COOFANDY’s New York live stream, recommending his favorite styles. Subsequently, the brand hosted the “Approaching the Legend Journey,” inviting influencers and fans for an exclusive behind-the-scenes tour of the legendary Joe Gibbs Racing headquarters.

Next Stop: Martinsville – A Crucial Battle in the NASCAR PlayoffsThe partnership is accelerating towards its next highlight: the Xfinity 500 at Martinsville Speedway on October 26, 2025. This is not just another race on the calendar; it’s a critical elimination event in the NASCAR Playoffs Round of 8, where championship hopes are forged or shattered. COOFANDY’s sponsorship of Christopher Bell’s No. 20 Toyota at this pivotal moment underscores COOFANDY’s pursuit of excellence and peak performance. It places COOFANDY at the heart of the action, connecting with millions of passionate fans worldwide during one of the season’s most intense and watched races.

Track Aesthetics: COOFANDY Exclusive Designs Debut

For this landmark race, COOFANDY’s brand identity will be prominently displayed through custom-designed assets that bridge fashion and function:

Car Livery: The No. 20 Toyota will feature a unique livery incorporating COOFANDY’s brand elements. The design seamlessly integrates the brand’s visual identity with dynamic racing aesthetics, using a combination of the brand’s signature colors and sleek graphics that embody both speed and sophistication. The livery is designed to stand out under the track lights, ensuring high visibility and a powerful brand statement.

Firesuit: Christopher Bell will wear a specially designed firesuit featuring COOFANDY’s brand elements and logos. Beyond brand display, this suit reflects a balance of the brand’s elegant style and the rigorous technical demands of a professional driver.

Beyond the Track: COOFANDY’s New Chapter in Sports Marketing

The collaboration with NASCAR and a top-tier driver like Christopher Bell is a strategic cornerstone for COOFANDY’s global marketing expansion. This move leverages NASCAR’s immense popularity and emotional connection to authentically engage with a vast and loyal audience. It interprets COOFANDY’s “Dress the Journey” philosophy in a high-performance environment, linking the brand with values of excellence, precision, and the pursuit of victory. This partnership serves as a powerful engine for enhancing international brand awareness and connecting with new consumers who share a passion for sports and lifestyle.

Conclusion

COOFANDY sincerely thanks all fans for their support throughout this partnership. Don’t miss the next chapter: watch Christopher Bell drive the COOFANDY-branded car at Martinsville Speedway on October 26th. Stay tuned for more updates.

For more information, please visit the COOFANDY website and Amazon storefront, or connect with COOFANDY on Facebook and Instagram.

COOFANDY

Charlotte Liu

New York, US

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

A New Era in the Crypto Market ETH Volume Bot Redefines Success for Token Projects

The Ethereum ecosystem continues to evolve rapidly, with new token projects emerging every day. For many developers, maintaining transparent, consistent, and data-driven liquidity management on decentralized exchanges (DEXs) remains one of the biggest challenges. ETH Volume Bot, a blockchain automation platform, aims to support these needs by offering analytical and operational tools that help projects monitor, manage, and automate their on-chain trading activity in a secure and compliant way.

A Technology-Driven Approach to On-Chain Activity

ethvolumebot.com provides automated infrastructure to assist token teams in managing liquidity, transaction execution, and on-chain analytics on Ethereum-based DEXs. The platform leverages automation to improve transaction efficiency and to help projects better understand their market presence through advanced data insights.

Since its introduction, the system has been utilized by numerous Ethereum-based initiatives to streamline operational processes and optimize smart contract interactions within transparent and regulated frameworks.

Introducing the Batch Transaction Queue (BTQ)

One of ETH Volume Bot’s key innovations is the Batch Transaction Queue (BTQ) — a mechanism designed to optimize transaction efficiency and reduce gas expenditure on the Ethereum network.

BTQ enables multiple small transactions to be processed in a bundled and gas-efficient manner, helping project teams lower operational costs while maintaining transaction transparency and traceability on-chain.

This technology contributes to a more efficient use of network resources, minimizing redundant transactions and improving on-chain data consistency. By reducing gas costs, BTQ enhances accessibility for smaller or early-stage blockchain projects.

Advanced Controls and Analytics

The platform’s automation framework allows project teams to define operational parameters with precision, while the real-time analytics dashboard provides comprehensive visibility into performance metrics.

Teams can track liquidity distribution, trading patterns, and historical data, enabling informed, evidence-based decision-making.

The system integrates seamlessly with leading decentralized exchanges such as Uniswap, SushiSwap, and 1inch, ensuring compatibility with Ethereum-standard liquidity environments.

Security and Non-Custodial Design

Security and control remain top priorities. ETH Volume Bot follows a 100% non-custodial architecture, meaning users maintain full ownership and access to their assets at all times.

All operations are executed directly through Web3 wallets such as MetaMask or WalletConnect, ensuring that no funds are ever transferred to third-party custody.

The platform’s smart contracts have undergone independent security audits, validating their reliability and operational safety.

Transparency and Compliance

ETH Volume Bot emphasizes transparency, auditability, and compliance as fundamental principles of its design.

All on-chain activities are publicly verifiable, and the system operates strictly as a technological and analytical tool — not a financial advisory or promotional mechanism. Its purpose is to empower blockchain projects to manage their operations responsibly and within ethical standards.

About ETH Volume Bot

ETH Volume Bot is a blockchain automation and analytics platform that helps token projects manage transaction efficiency, liquidity operations, and smart contract activity across decentralized exchanges.

The system’s modular infrastructure is built for transparency, security, and operational scalability within the Ethereum ecosystem.

Official website: https://www.ethvolumebot.com

Media Contact

Organization: ETH Volume Bot

Contact Person: Aglae Bergnaum

Website: https://www.ethvolumebot.com

Email: Send Email

Country:United States

Release id:35647

The post A New Era in the Crypto Market ETH Volume Bot Redefines Success for Token Projects appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

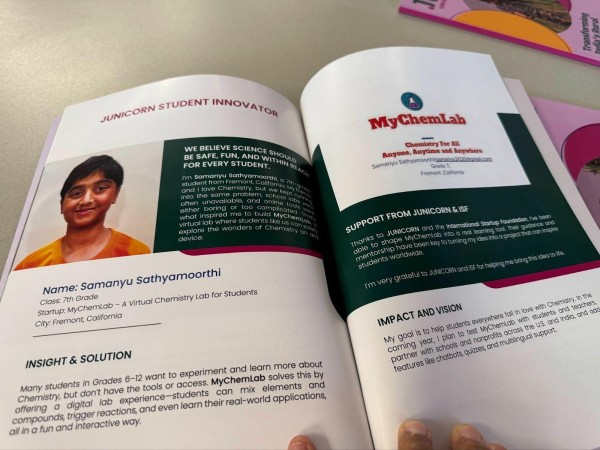

13-Year-Old Samanyu Sathyamoorthi Wins Curiosity Innovation Award at Global AI Summit with MyChemLab-ai Aiming to Solve Worldwide Chemistry Lab Access Crisis

Innovative Virtual Chemistry Platform Leverages Google’s Gemini AI to Create Accessible, Risk-Free STEM Learning for Millions of Students Lacking Hands-On Experience.

United States, 18th Oct 2025 – Samanyu Sathyamoorthi, a 13-year-old innovator, 8th-grade student at John M. Horner Middle School in Fremont, CA, and future attendee of Iron Horse Middle School in San Ramon, CA, has been recognized on the global stage for his pioneering work in educational technology.

Samanyu won the prestigious Achievement: Curiosity/Innovation Award at the ISF Global Junicorn & AI Summit 2025. A student-focused innovation event that took place on May 29-30, 2025 at Texas State University in San Marcos, Texas, convened the world’s most promising student innovators, known as “Junicorns,” to present how they are using cutting-edge AI and technology to solve significant, real-world problems. Samanyu’s platform, MyChemLab.ai, stood out for its profound potential to democratize science education globally.

Photo: (Image of Samanyu Sathyamoorthi receiving his Innovation Award for his project at the summit — MyChemLab.ai at the ISF Global Junicorn & AI Summit 2025, Texas State University, TX.”)

Disrupting the Chemistry Education Gap with AI

MyChemLab.aiis a revolutionary AI-powered virtual chemistry laboratory honored for its mission to make science education more accessible, interactive, and equitable worldwide. The platform’s creation is a direct response to a critical global crisis: the lack of functioning, hands-on chemistry laboratories.

According to research cited by Samanyu, an estimated 15 million students in the U.S. and 75 million students in India—a population equivalent to the combined populations of New York and California—lack the necessary infrastructure for practical, hands-on chemistry experience. This systemic deficit, particularly for students in grades 6 through 12, severely limits opportunities for experimentation, diminishes scientific curiosity, and curtails pathways into vital STEM careers.

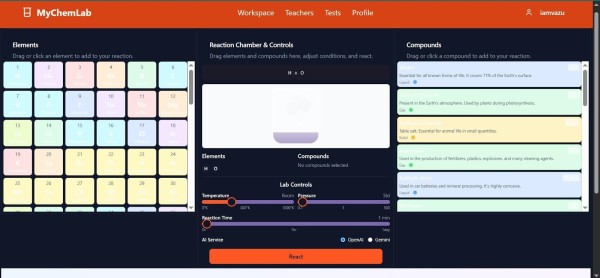

“MyChemLab aims to tear down traditional barriers to science education and create equity,” explains Samanyu. “By providing an immersive, risk-free platform accessible on any device, students can experiment with elements and observe reactions that would typically require expensive, dangerous, or unavailable real-world equipment. It’s about making chemistry fun and accessible for every student, anytime and anywhere.”

Technical Depth and The Gemini AI Core

The effectiveness of MyChemLab.ai lies in its sophisticated technical architecture and the intelligent simulation engine at its core. Built on a modern full-stack foundation utilizing React.js for a dynamic front-end and Node.js for the back-end, the application secures student data and class progress via Firebase.

The platform’s core innovation is its deep integration with the Gemini AI Platform. The AI functions as a dynamic reaction engine, simulating complex chemical interactions with realistic fidelity. This capability allows students to manipulate environmental variables—including adjustable Pressure, Temperature, and Reaction Time controls—to observe cause-and-effect in real-time, replicating the unpredictability and rigor of a physical lab without any associated risk or cost.

Key features driving this educational depth include:

- A comprehensive chemical database containing over 115 elements and 30 compounds.

- Realistic outcome modeling via the Gemini AI Platform.

- Separate teacher and student portals designed to seamlessly integrate into classroom curricula, enabling assignments, collaborative learning, and standardized assessments.

The project is already demonstrating tangible impact, currently serving 40 active users and undergoing live testing in classrooms across the U.S. and India.

Photo: (Image of Samanyu Sathyamoorthi with his project at the summit — presenting MyChemLab.ai at the ISF Global Junicorn & AI Summit 2025, Texas State University, Austin, TX.”)

Validation and Educational Impact

The project has garnered significant praise from both the technical and educational communities, validating its promise as a transformative learning tool.

“It’s truly impressive to see someone your age harness AI for such a complex subject like chemistry,” said Dr. Sumathy Kumar, Ph.D., Chemistry Educator in India. “Projects like yours show us the incredible potential of young minds and remind us that the future of science is bright.”

Mitran, Director of Marketing at the ISF Global Summit, echoed this sentiment, adding, “I’m really impressed with the depth you’ve covered—from the secure login flow to the way you’ve integrated interactive sliders for variable manipulation. This is professional-grade application development.”

Educators have been instrumental in guiding the platform’s development. Ms. Corine Benedetti, a FUSD Teacher, provided constructive input, noting, “As someone with limited experience in chemistry, I think it could be very helpful to have a tutorial or suggested experiment section. That feedback will definitely help guide its next phase of development.” This practical feedback confirms MyChemLab.ai’s relevance and accessibility for a broad range of student and educator proficiency levels.

Photo: (Insert image of MyChemLab – “A screenshot of MyChemLab’s virtual experiment interface, featuring sliders for temperature, pressure, and time.”)

Next Steps and Expanding the Vision

Following his success at the ISF Summit, Samanyu is preparing to submit MyChemLab.ai to the prestigious 2025 Congressional App Challenge, which celebrates student innovation in computer science. His goal is to represent his schools and community at the national level, continuing to showcase how technology can equalize learning opportunities. He will be representing California’s 10th Congressional District (Rep. Mark DeSaulnier) from Iron Horse Middle School in San Ramon.

Looking ahead, Samanyu plans to dramatically enhance the platform’s pedagogical power:

- Integrating a built-in, real-time AI chatbot tutor that explains complex chemical principles and provides academic assistance.

- Introducing advanced Augmented Reality (AR) and Virtual Reality (VR) experiences for truly immersive experimentation.

- Adding gamification elements like badges and leaderboards to boost long-term student engagement and interest.

“Winning this award motivates me to keep building tools that make science accessible,” Samanyu shared. “I want every student, no matter where they are, to have the chance to explore the magic of chemistry.”

About ISF Global Junicorn & AI Summit

The Innovation STEM Foundation (ISF) hosts the Global Junicorn & AI Summit annually to inspire and recognize young innovators in AI, robotics, and sustainability. The 2025 event featured over 300 student innovators from 10+ countries, with judging panels comprised of academic and technology leaders.

Media Contact

Rocky Zester

crazyme2207@gmail.com

Project Website: www.mychemlab.ai

Student Innovation Channel:

https://www.youtube.com/channel/UCJ6UEab559ioCDRZ7LH_6sw/

Fremont & San Ramon, California

Media Contact

Organization: Silicon Stem

Contact Person: Rocky Zester

Website: https://www.mychemlab.ai/

Email: Send Email

Country:United States

Release id:35641

The post 13-Year-Old Samanyu Sathyamoorthi Wins Curiosity Innovation Award at Global AI Summit with MyChemLab-ai Aiming to Solve Worldwide Chemistry Lab Access Crisis appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 day ago

Futuromining Launches XRP Mining Contracts – XRP Holders Earn $5,777 Daily

-

Press Release1 week ago

Dream California Getaway Names Bestselling Author & Fighting Entrepreneur Tony Deoleo Official Spokesperson Unveils Menifee Luxury Retreat

-

Press Release6 days ago

Pool Cover Celebrates Over 10 Years of Service in Potchefstroom as Swimming Pool Cover Market Grows Four Point Nine Percent Annually

-

Press Release1 day ago

13-Year-Old Samanyu Sathyamoorthi Wins Curiosity Innovation Award at Global AI Summit with MyChemLab-ai Aiming to Solve Worldwide Chemistry Lab Access Crisis

-

Press Release5 days ago

Weightloss Clinic Near Me Online Directory USA Launches Nationwide Platform to Help Americans Find Trusted Weight Loss Clinics

-

Press Release1 week ago

James Jara New Book Empowers CTOs and HR Leaders to Build High-Performing Remote Teams Across Latin America

-

Press Release1 week ago

Beyond Keyboards and Mice: ProtoArc Shines at IFA 2025 with Full Ergonomic Ecosystem

-

Press Release4 days ago

La Maisonaire Redefines Luxury Furniture in Dubai with Bespoke Designs for Homes Offices and Hotels