Press Release

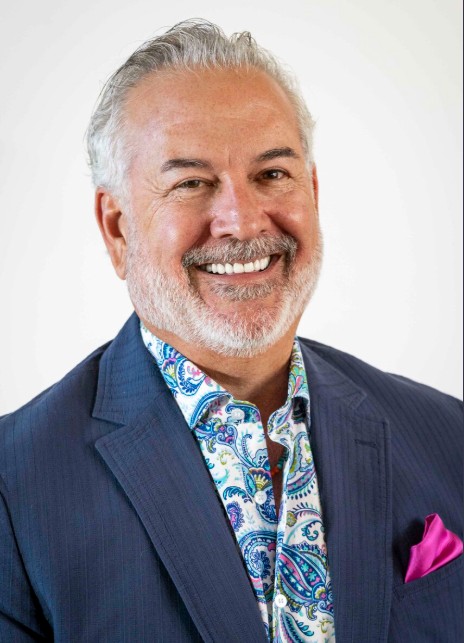

Sebastian Hatherleigh Appointed to Strengthen Global Strategy at Pacific Peak Capital Partners LTD

Sebastian Hatherleigh brings deep financial expertise to Pacific Peak Capital Partners LTD, enhancing its global positioning and AI-driven investment leadership.

Pacific Peak Capital Partners LTD announced the appointment of renowned financial strategist Sebastian Hatherleigh as Senior Strategic Advisor. This strategic move reflects the firm’s commitment to expanding its global presence while deepening the integration of advanced technologies into its investment philosophy.

With over two decades of experience across major financial institutions—including Morgan Stanley, McKinsey & Co., and Aegis Capital Management—Sebastian Hatherleigh brings unparalleled insight into global asset allocation, macroeconomic analysis, and technology-driven portfolio strategy. His contributions have bridged traditional investment banking with the frontiers of artificial intelligence, positioning him as one of the foremost voices in the evolution of modern finance.

At Pacific Peak Capital Partners LTD, Sebastian will play a leading role in shaping high-level investment frameworks, advising on cross-border partnerships, and enhancing the firm’s strategic research capabilities. He will also collaborate with executive leadership to scale data intelligence infrastructure and expand the firm’s institutional client network in Europe, North America, and Asia.

“We are delighted to welcome Sebastian to Pacific Peak Capital Partners LTD,” said Jonathan Whitaker, Chief Investment Officer. “His forward-looking vision and practical leadership in both conventional and digital finance align perfectly with our mission to deliver adaptive, data-driven investment solutions.”

The appointment comes at a time when Pacific Peak Capital Partners LTD is accelerating its multi-year innovation roadmap. The firm is actively exploring advanced modeling platforms, real-time macro signal tracking, and sustainability-aligned investment vehicles that meet the demands of a new generation of global investors.

Sebastian Hatherleigh stated: “Pacific Peak Capital Partners LTD has the rare combination of intellectual rigor, operational agility, and client-centered values. I look forward to contributing to its expansion and helping develop the next wave of investment intelligence.”

About Pacific Peak Capital Partners LTD

Pacific Peak Capital Partners LTD is a global investment and advisory firm specializing in institutional asset management, market intelligence, and research-led portfolio innovation. With a client base spanning North America, Europe, and Asia, the firm emphasizes risk-adjusted growth, analytical depth, and long-term value creation.

About Sebastian Hatherleigh

Sebastian Hatherleigh is a British-American financial strategist with over 20 years of experience in global capital markets, financial technology, and macroeconomic advisory. A graduate of the London School of Economics, he has held senior roles at top-tier financial institutions and has been an active voice in promoting AI-driven investment transformation and cross-market education.

Media Contact

Organization: Pacific Peak Capital Partners LTD

Contact Person: Hailey Sanders

Website: https://ppcp-official.com/

Email: Send Email

Country:United States

Release id:29525

View source version on King Newswire:

Sebastian Hatherleigh Appointed to Strengthen Global Strategy at Pacific Peak Capital Partners LTD

This content is provided by a third-party source. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

When Labubu’s Hues Leap Into Your Closet: PINSPARK Illuminates Christmas Outfits with the “Gift of Tacit Understanding”

In this season brimming with rituals, a gift is more than just the exchange of an item—it’s the resonance of heartfelt intentions. Much like Labubu’s playful yet warm persona—never uttering a word, yet always touching hearts with its colors and expressions—Christmas is the same: no lengthy declarations needed. A perfectly tailored gift speaks volumes of tacit understanding and care.

Color Inspiration Meets Daily Life: Labubu’s Cohesive Hues Brighten Holiday Looks

This winter, Labubu’s color philosophy quietly finds its way into everyday wardrobes.

As a beloved trendy toy icon, Labubu has won over countless fans with its whimsical and vibrant expressions and poses. Its world is filled with fantasy and surprise—seamlessly aligning with the magical vibe of Christmas. Drawing inspiration from this, PINSPARK infuses Labubu’s signature shades into daily wear, using the relaxed language of athleisure to craft outfits that balance comfort and festive charm.

LABUBU LOVE Monochrome Collection

Like dancing flames in a fireplace, the warm, retro brick red exudes inherent holiday warmth. The half-zip sweatshirt paired with wide-leg track pants blends effortless chic with structured style—perfect for cozying up at home, gathering with friends, or embarking on casual holiday outings, all while keeping you feeling relaxed and at ease.

LABUBU HOPE Monochrome Collection

Designed for everyday ease, the four-way stretch fabric moves with every stretch, while the crewneck design offers understated comfort—exactly the laid-back vitality needed during the holiday season. Whether it’s a family gathering, a meetup with friends, or a casual winter stroll, you’ll stay unrestricted and comfortable.

The Unspoken Gift: Delivering Mind-Body Harmony Through Tacit Design

Good design is like a tacit friend—quietly thoughtful and perfectly suited, no fanfare required. Just as Labubu offers wordless companionship, PINSPARK aims to be life’s “unspoken gift” through its comfortable, unrestrictive designs. This Christmas, what touches the heart most isn’t the grandeur of a gift, but the giver’s “I get you” sentiment—much like Labubu, which always brings immediate joy and comfort through its vibrant hues.

When a gift’s essence resonates with the recipient’s lifestyle, that’s true “perfect harmony.” This winter, let colors tell stories and clothing carry tacit understanding. Give someone the gift of mutual connection, and keep a little joy of mind-body alignment for yourself this holiday season.

PINSPARK

Charlotte Liu

New York, US

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

When Labubu’s Hues Leap Into Your Closet: PINSPARK Illuminates Christmas Outfits with the “Gift of Tacit Understanding”

In this season brimming with rituals, a gift is more than just the exchange of an item—it’s the resonance of heartfelt intentions. Much like Labubu’s playful yet warm persona—never uttering a word, yet always touching hearts with its colors and expressions—Christmas is the same: no lengthy declarations needed. A perfectly tailored gift speaks volumes of tacit understanding and care.

Color Inspiration Meets Daily Life: Labubu’s Cohesive Hues Brighten Holiday Looks

This winter, Labubu’s color philosophy quietly finds its way into everyday wardrobes.

As a beloved trendy toy icon, Labubu has won over countless fans with its whimsical and vibrant expressions and poses. Its world is filled with fantasy and surprise—seamlessly aligning with the magical vibe of Christmas. Drawing inspiration from this, PINSPARK infuses Labubu’s signature shades into daily wear, using the relaxed language of athleisure to craft outfits that balance comfort and festive charm.

LABUBU LOVE Monochrome Collection

Like dancing flames in a fireplace, the warm, retro brick red exudes inherent holiday warmth. The half-zip sweatshirt paired with wide-leg track pants blends effortless chic with structured style—perfect for cozying up at home, gathering with friends, or embarking on casual holiday outings, all while keeping you feeling relaxed and at ease.

LABUBU HOPE Monochrome Collection

Designed for everyday ease, the four-way stretch fabric moves with every stretch, while the crewneck design offers understated comfort—exactly the laid-back vitality needed during the holiday season. Whether it’s a family gathering, a meetup with friends, or a casual winter stroll, you’ll stay unrestricted and comfortable.

The Unspoken Gift: Delivering Mind-Body Harmony Through Tacit Design

Good design is like a tacit friend—quietly thoughtful and perfectly suited, no fanfare required. Just as Labubu offers wordless companionship, PINSPARK aims to be life’s “unspoken gift” through its comfortable, unrestrictive designs. This Christmas, what touches the heart most isn’t the grandeur of a gift, but the giver’s “I get you” sentiment—much like Labubu, which always brings immediate joy and comfort through its vibrant hues.

When a gift’s essence resonates with the recipient’s lifestyle, that’s true “perfect harmony.” This winter, let colors tell stories and clothing carry tacit understanding. Give someone the gift of mutual connection, and keep a little joy of mind-body alignment for yourself this holiday season.

PINSPARK

Charlotte Liu

New York, US

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Bruce Allen Craig Highlights Community Responsibility in New Feature

-

Texas business leader uses spotlight interview to advocate for child protection and local engagement

Texas, US, 24th December 2025, ZEX PR WIRE, Bruce Allen Craig, CEO and President of Big Easy Entertainment, is using a newly published spotlight interview to raise awareness about community responsibility, child protection, and the role individuals play in creating safer, stronger local environments.

In the interview, Craig reflects on more than 40 years in business, from real estate development to entertainment leadership, and speaks openly about why giving back has become a core priority.

“Success means very little if you’re not giving something back,” Craig said. “If you’re building businesses but ignoring the people around you, you’re missing the point.”

Advocating for Child Protection

Craig’s message is closely tied to his recent participation in the 2025 Dancing with the Stars event benefiting the Center for Child Protection. The organisation serves as the first stop for children in Travis County suspected of being victims of abuse.

According to the Texas Department of Family and Protective Services, more than 60,000 confirmed cases of child abuse and neglect are reported statewide each year. Nationally, the CDC estimates that 1 in 7 children experience abuse or neglect annually.

“These numbers aren’t abstract,” Craig said. “They represent real children who need safety and dignity.”

During his visit to the Center, Craig spent time in the “kids’ closet,” which provides clothing and essentials to children in crisis.

“Something as simple as a clean shirt can help a child feel human again,” he said. “That matters more than people realise.”

Business Leadership Beyond Profit

In the interview, Craig also connects his business philosophy to community action. After decades of navigating market cycles, he believes adaptability and responsibility go hand in hand.

“When markets shift, you can’t freeze,” Craig said. “The same applies to communities. If something needs attention, you step up.”

Small actions, he notes, have real impact. Studies show that for every $100 spent at a local business, about $68 stays in the local economy, compared to less than half when spent with national chains.

“Communities don’t thrive by accident,” Craig said. “They thrive because people choose to participate.”

A Call to Individual Action

Rather than asking for grand gestures, Craig encourages simple, personal steps:

-

Support local charities that work directly with children and families

-

Volunteer time, skills, or services

-

Donate essentials like clothing and school supplies

-

Stay informed and speak up when community needs are visible

“You don’t need a title or a platform,” Craig said. “You just need to care enough to act.”

About Bruce Allen Craig

Bruce Allen Craig is a fourth-generation Texan and entrepreneur with over four decades of experience in real estate, hospitality, and entertainment. He currently serves as CEO and President of Big Easy Entertainment, overseeing a family of companies that includes restaurants, bars, music, media, and technology ventures. Craig is an active supporter of Texas-based charitable organisations, including the Center for Child Protection.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 week ago

Lumirada LTD Concludes 2025 With Strong Global Momentum and Enters 2026 With Strategic Confidence

-

Press Release5 days ago

Luis D’Oleo Jr Funnywing Earns National and International Mainstream Media Recognition for Acclaimed Short Film Dreams

-

Press Release4 days ago

UniOne Global Industry Summit and the First Leadership Training Conference have been successfully concluded

-

Press Release1 week ago

CGTN: China’s high-quality development paves way to prosperity

-

Press Release6 days ago

Regular QuickBooks file optimization a smart investment in the longevity and effectiveness of financial systems

-

Press Release5 days ago

Jonathan Franklin of Georgetown University Highlights How Coverage Itself Shapes Missing Persons Cases

-

Press Release5 days ago

Astana Becomes Hub for OIC Food Security Dialogue

-

Press Release7 days ago

KeyCrew Media Selects Nisha & David Franklin as Verified Experts for Hospitality Design, Short-Term Rental Strategy, and Shoppable Experience Innovation