Press Release

Premium Resources Raises $46 million to Advance Two Critical Metal Projects in Botswana

Last month, a consortium of institutional investors made sizable early bets on the future of Premium’s Botswana assets. A March 2025, $46 million non-brokered equity financing included the participation of the Fiore Management and Advisory Corporation, headed by Frank Giustra.

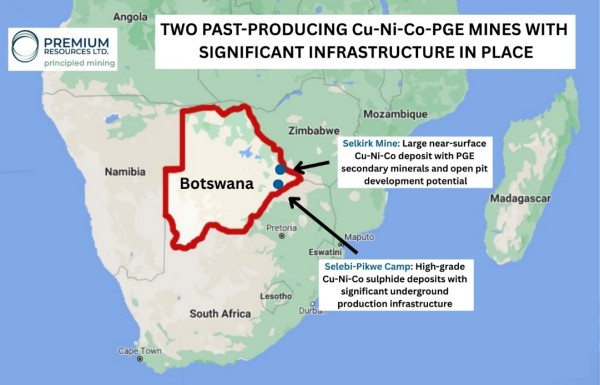

Canada, 16th Apr 2025 – Sponsored content disseminated on behalf of Premium Resources. On April 10, 2025, Premium Resources (TSXV: PREM) (OTC Pink: PRMLF) outlined a six-month plan to advance its two permitted, previously producing copper, nickel and cobalt mines in Botswana, a Tier 1 mining jurisdiction in Africa, known for its diamond mines.

Last month, a consortium of institutional investors made sizable early bets on the future of Premium’s Botswana assets. A March 2025, $46 million non-brokered equity financing included the participation of the Fiore Management and Advisory Corporation, headed by Frank Giustra.

The underground Selebi Mines were in production between 1980 and 2016. Both Selebi and Selebi North mines, having produced 40 million tonnes of ore, were put into Care & Maintenance due to low metal prices and a failure of the on-site smelter. The underground Selkirk Mine operated between 1989 and 2002 and produced 1 million tonnes of high-grade ore.

“The mining laws in Botswana are similar to those in Canada,” Morgan Lekstrom told Guy Bennett, CEO of Global Stocks News (GSN). “It’s a positive environment for Canadian mining corporations to operate. Botswana follows the same environmental and regulatory rules that we are accustomed to.”

Currently, diamonds account for around 80% of Botswana’s exports, one-third of fiscal revenues, and one-quarter of GDP. The country is the world’s largest diamond producer by value.

“I’ve had the privilege of meeting President Duma Boko,” Lekstrom continued. “He is a Harvard Law School graduate, a passionate politician and a sharp businessman. Boko wants to expand Botswana’s extraction industry beyond diamonds. It’s a smart move. They have the commodities, a skilled workforce and the capacity for ample solar power generation.”

Recent interest in the Selebi and Selkirk Mines has been catalysed by a surge in demand for critical metals required for the green energy transformation (Solar, EVs). In the last five years, as demand drivers intensify, the price of copper has increased 92% – from USD $2.36/lb to $4.50/lb.

Premium Resource’s 6-month targeted milestones:

Exploration and Development

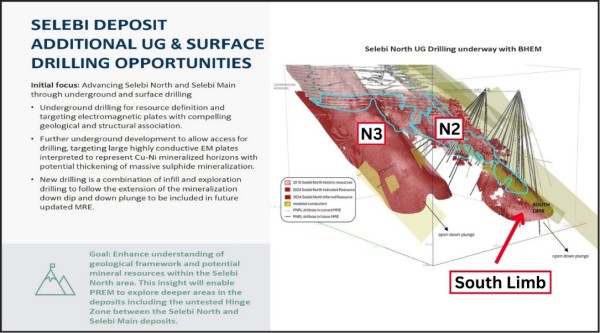

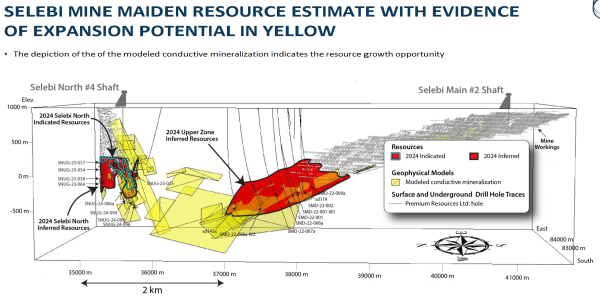

Selebi Main Surface Drilling Program to Target a Potential 3rd Horizon – An initial surface exploration drill program is extending historic drill holes, targeting a large Borehole Electromagnetic (BHEM) plate that could represent a new mineralized horizon 150 metres beneath the Selebi Main resource.

“BHEM results correlate directly with massive sulphides,” Lekstrom told GSN. “It can help identify and locate conductive ore bodies.”

Hinge Drilling Between Selebi Mine Deposits – Surface drilling program targeting BHEM plates in the untested 2-kilometre-long area between the Selebi North and Selebi Main deposits referred to as the hinge. These BHEM targets potentially represent additional mineralization between the two deposits.

Selebi North Underground Resource Expansion Drilling – Exploring along strike, down-dip and down-plunge of the Mineral Resource Estimate footprint, targeting resource expansion and focusing on areas with strong BHEM response from the N3, N2 and South Limbs.

Selebi Mine Underground Development – Development of a dual-purpose exploration drift from Selebi North is set to commence soon. This will permit both in-fill drilling and exploration drilling at Selebi North.

Selkirk – Surface drilling program for resource expansion and metallurgical test work samples for flowsheet development. The drill core from this program will also be used for preliminary XRT pre-concentration studies.

Advancing Project Economics

Metallurgical Sampling and Testing – Selebi flotation studies ongoing.

Evaluating XRT (“X-ray Transmission”) ore sorting – potential to have a significant impact on waste rock removal, which positively impacts the head feed grade to the concentrate flowsheet, with potential application at both Selebi and Selkirk.

Evaluating IDEON Technologies for applying Muon Tomography to create 3D density maps of subsurface mineralization at Selebi and Selkirk.

“We are embarking on an accelerated growth curve that will not only highlight the scale of Selebi and the significance of the hinge zone, but also address key metallurgical questions,” stated Lekstrom in the April 10, 2025 press release.

“The high-grade poly-metallic nature of Selebi, its substantial size, our upcoming drilling and the planned metallurgical work are the critical and simultaneous steps in the larger vision of potentially building a world-class, generational critical metals project,” added Lekstrom.

“China has suspended exports of a wide range of critical minerals and magnets, threatening to choke off supplies of components central to automakers, aerospace manufacturers, semiconductor companies and military contractors around the world,” reported the New York Times (NYT) on April 13, 2025.

“Shipments have been halted at many Chinese ports while the Chinese government drafts a new regulatory system,” added the NYT. “Once in place, the new system could permanently prevent supplies from reaching certain companies, including American military contractors.”

“The official crackdown is part of China’s retaliation for President Trump’s sharp increase in tariffs that started on April 2, 2025,” added the NYT.

Concurrent with the March 18, 2025 $46 million financing, PREM announced that the Cymbria Corporation, an affiliate of PREM’s largest shareholder, EdgePoint Investment Group, converted $20.8 million of debt into shares. EdgePoint manages about $40 billion in global assets.

The $67 million total recapitalization of PREM is a validation of the premise that Selebi and Selkirk can play a role in helping the Western world to decouple from China’s critical mineral supply chains.

The technical information presented in this news release has been reviewed and approved by Sharon Taylor, Vice President Exploration, who is the Qualified Person for technical disclosure at Premium Resources, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: Premium Resources paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate” and “target,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Homebuyers Hit by NFIP Shutdown — Private Flood Insurance Still Available Online

Salt Lake City, Utah — Thousands of homebuyers are finding themselves in limbo as the ongoing federal government shutdown halts new flood insurance policies from the National Flood Insurance Program (NFIP). With hurricane season still active across much of the country, many buyers in flood-prone regions are now scrambling to secure coverage before closing on their homes.

The federal government officially shut down on October 1, 2025, after Congress failed to pass a funding bill — suspending operations at multiple agencies, including FEMA and NOAA, and pausing the issuance and renewal of NFIP flood policies. The timing has created a ripple effect in coastal and flood-zone markets across the U.S., where lenders often require active flood coverage before approving mortgages.

During the lapse, companies like FloodPrice.com — which normally allow homeowners to compare NFIP and private flood insurance options side by side — can only provide quotes from private flood insurers. These private carriers continue to issue new and renewal policies while FEMA’s NFIP program remains offline.

“Homebuyers who expected to rely on the NFIP may now find their financing or closings delayed unless they turn to private flood options,” said Brian, spokesperson for FloodPrice.com. “We’re seeing increased demand in many states, where thousands of NFIP-backed policies exist, and private policies are becoming the only viable option during this lapse.”

According to FEMA, more than 4.7 million Americans depend on the NFIP for flood protection — and roughly 1.8 million of those policyholders are in Florida alone. While existing NFIP policies remain active, the shutdown means no new policies or renewals can be processed until Congress restores funding. NOAA, which supports flood forecasting and mapping, has also limited operations, creating further uncertainty for risk assessments and new development approvals in flood zones.

A Temporary Pause, but Real-World Consequences

Industry experts warn that even a short NFIP lapse can have major effects on real estate transactions and local economies. During previous shutdowns, the National Association of Realtors estimated that up to 40,000 home sales per month could be delayed or canceled due to flood insurance lapses.

For now, private flood insurers remain fully operational, providing a much-needed safety net. FloodPrice.com continues to help homeowners explore private flood insurance options online — offering coverage from top-rated carriers and shopping for the lowest available prices among its network of insurers.

Even as Washington works toward a funding resolution, flood risk doesn’t pause. Homebuyers in affected areas should act quickly to ensure they have coverage in place before closing.

For more information on comparing flood insurance options, visit FloodPrice.com.

Media Contact

Company Name: FloodPrice.com

Contact Person: Nancy Reveles

Email: support@floodprice.com

Website: https://www.floodprice.com/

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

COOFANDY & Christopher Bell: Dressing the Journey to Victory – A Partnership Story Racing Toward Martinsville Speedway

The partnership between COOFANDY and Joe Gibbs Racing (JGR) alongside their driver Christopher Bell, established earlier this year, has been a dynamic fusion of high-speed motorsport and sophisticated style. As COOFANDY prepares to sponsor the event at Martinsville Speedway on October 26, 2025, let’s revisit the key moments of this thrilling collaboration.

Partnership Journey Recap

May: The Collaboration Begins

During its 10th-anniversary celebrations, COOFANDY officially announced Christopher Bell as its global brand ambassador. The launch also featured the debut of the “Bell’s Picks” product collection and a creative comic series.

June: Father’s Day Special Event

COOFANDY organized a special fan viewing experience during the FireKeepers Casino 400 in Michigan, blending COOFANDY fans with the NASCAR community to celebrate Father’s Day together.

July: Online Interaction & JGR Headquarters Experience

Christopher Bell made a surprise appearance in COOFANDY’s New York live stream, recommending his favorite styles. Subsequently, the brand hosted the “Approaching the Legend Journey,” inviting influencers and fans for an exclusive behind-the-scenes tour of the legendary Joe Gibbs Racing headquarters.

Next Stop: Martinsville – A Crucial Battle in the NASCAR PlayoffsThe partnership is accelerating towards its next highlight: the Xfinity 500 at Martinsville Speedway on October 26, 2025. This is not just another race on the calendar; it’s a critical elimination event in the NASCAR Playoffs Round of 8, where championship hopes are forged or shattered. COOFANDY’s sponsorship of Christopher Bell’s No. 20 Toyota at this pivotal moment underscores COOFANDY’s pursuit of excellence and peak performance. It places COOFANDY at the heart of the action, connecting with millions of passionate fans worldwide during one of the season’s most intense and watched races.

Track Aesthetics: COOFANDY Exclusive Designs Debut

For this landmark race, COOFANDY’s brand identity will be prominently displayed through custom-designed assets that bridge fashion and function:

Car Livery: The No. 20 Toyota will feature a unique livery incorporating COOFANDY’s brand elements. The design seamlessly integrates the brand’s visual identity with dynamic racing aesthetics, using a combination of the brand’s signature colors and sleek graphics that embody both speed and sophistication. The livery is designed to stand out under the track lights, ensuring high visibility and a powerful brand statement.

Firesuit: Christopher Bell will wear a specially designed firesuit featuring COOFANDY’s brand elements and logos. Beyond brand display, this suit reflects a balance of the brand’s elegant style and the rigorous technical demands of a professional driver.

Beyond the Track: COOFANDY’s New Chapter in Sports Marketing

The collaboration with NASCAR and a top-tier driver like Christopher Bell is a strategic cornerstone for COOFANDY’s global marketing expansion. This move leverages NASCAR’s immense popularity and emotional connection to authentically engage with a vast and loyal audience. It interprets COOFANDY’s “Dress the Journey” philosophy in a high-performance environment, linking the brand with values of excellence, precision, and the pursuit of victory. This partnership serves as a powerful engine for enhancing international brand awareness and connecting with new consumers who share a passion for sports and lifestyle.

Conclusion

COOFANDY sincerely thanks all fans for their support throughout this partnership. Don’t miss the next chapter: watch Christopher Bell drive the COOFANDY-branded car at Martinsville Speedway on October 26th. Stay tuned for more updates.

For more information, please visit the COOFANDY website and Amazon storefront, or connect with COOFANDY on Facebook and Instagram.

COOFANDY

Charlotte Liu

New York, US

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

A New Era in the Crypto Market ETH Volume Bot Redefines Success for Token Projects

The Ethereum ecosystem continues to evolve rapidly, with new token projects emerging every day. For many developers, maintaining transparent, consistent, and data-driven liquidity management on decentralized exchanges (DEXs) remains one of the biggest challenges. ETH Volume Bot, a blockchain automation platform, aims to support these needs by offering analytical and operational tools that help projects monitor, manage, and automate their on-chain trading activity in a secure and compliant way.

A Technology-Driven Approach to On-Chain Activity

ethvolumebot.com provides automated infrastructure to assist token teams in managing liquidity, transaction execution, and on-chain analytics on Ethereum-based DEXs. The platform leverages automation to improve transaction efficiency and to help projects better understand their market presence through advanced data insights.

Since its introduction, the system has been utilized by numerous Ethereum-based initiatives to streamline operational processes and optimize smart contract interactions within transparent and regulated frameworks.

Introducing the Batch Transaction Queue (BTQ)

One of ETH Volume Bot’s key innovations is the Batch Transaction Queue (BTQ) — a mechanism designed to optimize transaction efficiency and reduce gas expenditure on the Ethereum network.

BTQ enables multiple small transactions to be processed in a bundled and gas-efficient manner, helping project teams lower operational costs while maintaining transaction transparency and traceability on-chain.

This technology contributes to a more efficient use of network resources, minimizing redundant transactions and improving on-chain data consistency. By reducing gas costs, BTQ enhances accessibility for smaller or early-stage blockchain projects.

Advanced Controls and Analytics

The platform’s automation framework allows project teams to define operational parameters with precision, while the real-time analytics dashboard provides comprehensive visibility into performance metrics.

Teams can track liquidity distribution, trading patterns, and historical data, enabling informed, evidence-based decision-making.

The system integrates seamlessly with leading decentralized exchanges such as Uniswap, SushiSwap, and 1inch, ensuring compatibility with Ethereum-standard liquidity environments.

Security and Non-Custodial Design

Security and control remain top priorities. ETH Volume Bot follows a 100% non-custodial architecture, meaning users maintain full ownership and access to their assets at all times.

All operations are executed directly through Web3 wallets such as MetaMask or WalletConnect, ensuring that no funds are ever transferred to third-party custody.

The platform’s smart contracts have undergone independent security audits, validating their reliability and operational safety.

Transparency and Compliance

ETH Volume Bot emphasizes transparency, auditability, and compliance as fundamental principles of its design.

All on-chain activities are publicly verifiable, and the system operates strictly as a technological and analytical tool — not a financial advisory or promotional mechanism. Its purpose is to empower blockchain projects to manage their operations responsibly and within ethical standards.

About ETH Volume Bot

ETH Volume Bot is a blockchain automation and analytics platform that helps token projects manage transaction efficiency, liquidity operations, and smart contract activity across decentralized exchanges.

The system’s modular infrastructure is built for transparency, security, and operational scalability within the Ethereum ecosystem.

Official website: https://www.ethvolumebot.com

Media Contact

Organization: ETH Volume Bot

Contact Person: Aglae Bergnaum

Website: https://www.ethvolumebot.com

Email: Send Email

Country:United States

Release id:35647

The post A New Era in the Crypto Market ETH Volume Bot Redefines Success for Token Projects appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 day ago

Futuromining Launches XRP Mining Contracts – XRP Holders Earn $5,777 Daily

-

Press Release6 days ago

Pool Cover Celebrates Over 10 Years of Service in Potchefstroom as Swimming Pool Cover Market Grows Four Point Nine Percent Annually

-

Press Release1 day ago

13-Year-Old Samanyu Sathyamoorthi Wins Curiosity Innovation Award at Global AI Summit with MyChemLab-ai Aiming to Solve Worldwide Chemistry Lab Access Crisis

-

Press Release5 days ago

Weightloss Clinic Near Me Online Directory USA Launches Nationwide Platform to Help Americans Find Trusted Weight Loss Clinics

-

Press Release1 week ago

James Jara New Book Empowers CTOs and HR Leaders to Build High-Performing Remote Teams Across Latin America

-

Press Release4 days ago

La Maisonaire Redefines Luxury Furniture in Dubai with Bespoke Designs for Homes Offices and Hotels

-

Press Release5 days ago

Planner Events Unveils Comprehensive Event Planning Checklist to Transform South African Event Management

-

Press Release6 days ago

MasterQuant Introduces Next-Gen AI System for Smarter Market Execution