Press Release

Polymarket Trading Bot Officially Launches to Automate Prediction Market Success

Netherlands, 2nd Feb 2026 – As prediction markets evolve from a niche interest into a cornerstone of global financial forecasting, the demand for precision, speed, and data-driven execution has never been higher. Addressing this shift, the team behind www.polytradingbot.net is proud to announce the official launch of the Polymarket Trading Bot, a sophisticated, non-custodial automated trading protocol designed to revolutionize how participants interact with decentralized prediction markets.

Bridging the Gap Between Intuition and Automation

Prediction markets like Polymarket offer a unique “wisdom of the crowd” perspective on everything from geopolitical shifts and election outcomes to sports results and crypto price movements. However, for the serious trader, manual execution often falls short in the face of 24/7 volatility and lightning-fast news cycles.

The Polymarket Trading Bot solves the fundamental challenges of manual trading—emotional bias, fatigue, and latency. By leveraging advanced machine learning algorithms, the bot provides users with the ability to execute complex strategies with sub-150ms latency, ensuring they capture the best possible odds before the market adjusts.

“Our goal was to level the playing field,” said the lead developer at www.polytradingbot.net. “In the past, high-frequency execution and algorithmic analysis were reserved for institutional players. With our platform, any trader can deploy a Polymarket Trading Bot that works around the clock, utilizing the same technical rigor as a hedge fund.”

Key Features of the Protocol

The platform is built on a “security-first” architecture, ensuring that users maintain full control over their assets. Unlike centralized exchanges or custodial services, the bot operates through a non-custodial framework. Users simply connect their Web3 wallets (such as MetaMask or WalletConnect), and the bot executes trades directly on the blockchain according to the user’s predefined parameters.

The suite includes several high-performance features:

- Multi-Strategy Support: Users can diversify their risk by running multiple bots simultaneously across different market categories.

- AI-Driven Market Analysis: The system analyzes thousands of data points and sentiment signals to identify high-probability entry and exit points.

- Institutional-Grade Execution: With an infrastructure optimized for speed, the bot achieves execution times under 150ms, a critical advantage in event-driven markets.

- Advanced Risk Management: Integrated features such as automated position sizing, stop-loss triggers, and portfolio diversification tools help protect capital during unexpected market swings.

Diverse Strategies for Every Market Condition

Understanding that no single strategy fits all market conditions, the Polymarket Trading Bot offers a variety of specialized “plug-and-play” modules:

- Arbitrage Scanner: This high-frequency strategy detects and exploits price discrepancies across different markets, offering a lower-risk profile with an impressive historical win rate.

- Trend Following: Optimized for markets with strong momentum, this bot uses technical indicators to “ride” the wave of public opinion.

- Mean Reversion: Designed to capitalize on market overreactions, this strategy identifies price extremes and bets on a return to the historical average.

- Event-Driven Logic: Specifically tuned for news-heavy environments, this bot reacts to real-world announcements faster than a human can read a headline.

A Tiered Approach to Professional Trading

To support everyone from the retail enthusiast to the institutional trader, the platform offers three distinct tiers:

- Basic Bot ($99/mo): Ideal for those entering the world of automation, offering three pre-built strategies and a core analytics dashboard.

- Advanced Bot ($299/mo): The most popular choice for serious traders, featuring five active bots, strategy backtesting against historical data, and Telegram alerts.

- Pro Bot ($499/mo): A comprehensive suite for professionals, providing unlimited bots, full API access, and white-glove account management.

Security and Transparency

In an era where digital security is paramount, the Polymarket Trading Bot protocol emphasizes transparency. The platform’s non-custodial nature means the bot never “touches” the user’s private keys. Transactions are signed via the user’s wallet, ensuring that funds remain in the user’s possession until the moment of a trade. Furthermore, the platform provides real-time P&L tracking and performance metrics, allowing users to audit their bot’s performance at any second.

About PolyMarket Trading Bot

Based in Zoetermeer, Netherlands, the Polymarket Trading Bot team is comprised of fintech experts and blockchain developers dedicated to enhancing the prediction market ecosystem. By combining AI-driven insights with robust blockchain execution, they provide the tools necessary for modern traders to thrive in the decentralized economy.

For more information, to view live strategy performance, or to launch your first bot, visit the official website at www.polytradingbot.net.

Media Contact

Organization: Polymarket Trading Bot

Contact Person: Ella Mahabier

Website: https://www.polytradingbot.net/

Email: Send Email

Country:Netherlands

Release id:40896

Disclaimer: This release is provided for informational purposes only and does not constitute financial, investment, legal, or trading advice. Use of automated trading tools involves risk, and past performance does not guarantee future results. Users are responsible for their own trading decisions and should conduct independent research before participating in prediction markets or using any automated trading protocol.

The post Polymarket Trading Bot Officially Launches to Automate Prediction Market Success appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

WeChange Launches Across 190+ Countries to Expand Crypto Access Worldwide

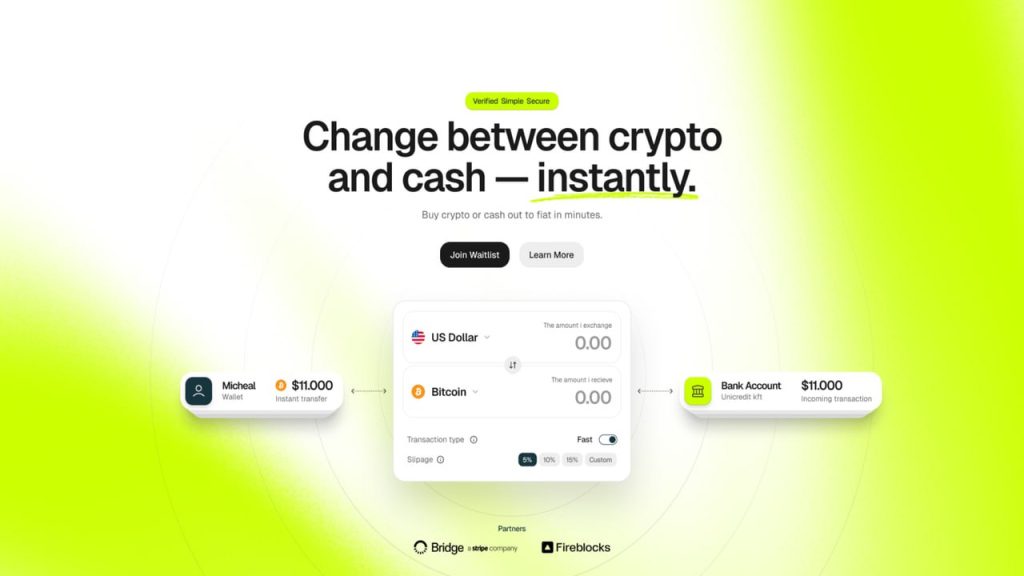

Budapest, Hungary, 2nd February 2026, ZEX PR WIRE— WeChange, a noncustodial global crypto onramp, announces the official launch of its noncustodial fiat-to-crypto on-ramp, designed to simplify how everyday users buy and sell digital assets while maintaining full control of their funds. The platform goes live globally on January 30, supporting bank transfer methods across more than 190 countries.

Built to address the complexity and high fees often associated with traditional crypto exchanges,WeChange enables users to access crypto through familiar payment rails, including SEPA, ACH, Faster Payments, PIX, and SPEI. Fees start at 2.5 percent, offering a more transparent

and affordable alternative to platforms that frequently charge significantly higher rates.

Reducing Friction in Crypto Onboarding

WeChange is designed for users who want a straightforward way to enter the crypto ecosystem without navigating complicated interfaces or relinquishing custody of their assets. As a noncustodial platform, WeChange does not hold user funds. All transactions are executed

directly to users’ wallets, prioritizing transparency, control, and security.

The platform is available across most of Europe, the Americas, Asia Pacific, and Africa, with availability determined by local regulatory requirements. Certain jurisdictions remain restricted in accordance with international compliance standards.

Launch Features and Roadmap

At launch, users can transact using supported bank transfer methods, allowing them to buy and sell crypto directly through their local financial infrastructure. Credit and debit card support is planned for Q2 2026 and will enable users to purchase crypto through an in-app card experience. When introduced, card payments will support major networks including Visa, Mastercard, and American Express.

The January launch marks the first milestone in WeChange’s broader roadmap, which focuses on expanding payment options, improving user onboarding, and continuing to lower barriers for individuals entering the crypto economy. Users can find detailed information on supported regions, payment methods, and upcoming features at www.wechange.com

About WeChange

WeChange is a global, noncustodial fiat-to-crypto on-ramp built to make digital asset access simpler, more transparent, and more affordable. By supporting local bank transfers and prioritizing user self-custody, WeChange enables individuals worldwide to buy and sell crypto without unnecessary complexity or excessive fees.

For more information, visit www.wechange.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Vanilla Gift Cards in 2026: Usage, Balance Verification, and Market Overview

Nigeria, 2nd Feb 2026 – Vanilla Gift Cards continue to play a significant role in the global prepaid card ecosystem. Widely used for online purchases, gifting, and digital subscriptions, these prepaid cards remain popular across multiple regions, including North America, West Africa, and other international markets. However, despite their broad recognition, Vanilla Gift Cards are not always straightforward to use, particularly in cross-border and online transaction environments.

As a result, secondary gift card trading platforms have become an increasingly relevant part of the digital payments landscape.

Understanding How Vanilla Gift Cards Work

Vanilla Gift Cards are prepaid cards typically issued under major payment networks such as Visa and Mastercard. They are available in both physical and digital formats and are preloaded with a fixed value. Because they are not linked to personal bank accounts, they are commonly used as alternative payment instruments.

While Vanilla Gift Cards appear uniform to consumers, industry professionals recognize that cards issued through different channels and banking partners may behave differently during online transactions. Factors such as issuing characteristics, security controls, and merchant acceptance policies can influence whether a card is successfully used on a particular platform.

Usage Limitations and Transaction Challenges

Although Vanilla Gift Cards are accepted by many merchants, users in certain regions often encounter limitations. These may include declined payments, restricted merchant access, or incompatibility with specific online platforms.

Such challenges are not unique to Vanilla Gift Cards. They reflect broader issues related to prepaid card usage across borders, where fraud prevention systems and regional payment policies play a central role. For many users, these restrictions reduce the practical usability of prepaid cards, even when the card itself remains valid and funded.

Secondary Market Activity and Sell Vanilla Gift Card

In response to these limitations, a secondary market for gift card trading has developed. Instead of attempting repeated transactions on restricted platforms, users increasingly choose to exchange unused gift cards for local currency through structured trading services.

In countries such as Nigeria and Ghana, Vanilla Gift Cards remain actively traded due to consistent demand and their recognition as reliable prepaid instruments. The growth of this market has led to the emergence of specialized platforms that focus on secure evaluation, verification, and exchange processes.

Platforms such as Migo – Sell Gift Cards operate within this ecosystem by providing structured mechanisms for converting prepaid cards into cash. Rather than treating all cards identically, such platforms assess cards based on multiple criteria, including card format, remaining balance, issuing attributes, and prevailing market conditions. This approach helps reduce uncertainty for users seeking legitimate and efficient exchange options.

Balance Verification as an Industry Standard

Verifying a Vanilla Gift Card balance is a standard step prior to use or exchange. Cardholders typically confirm balances through official balance-check channels to ensure accuracy.

Within secondary trading environments, balance verification is also a critical requirement. Platforms like Migo – Sell Gift Cards incorporate verified balance information into their assessment processes, enabling clearer valuation and more predictable transaction outcomes. This practice reflects broader industry standards aimed at improving transparency and user confidence.

Regional Access and Global Participation

The gift card trading market operates across multiple regions, with varying levels of access and processing efficiency. In West Africa, particularly Nigeria and Ghana, prepaid cards such as Vanilla Gift Cards are commonly exchanged due to their role as alternative payment tools in digital commerce.

Global platforms that support these regions illustrate how gift card trading has evolved from informal exchanges into structured digital services. By offering standardized processes and cross-border accessibility, platforms like Migo reflect the growing institutionalization of the gift card resale market.

Industry Context and Consumer Considerations

As prepaid cards continue to be integrated into global commerce, consumer awareness remains essential. Understanding that prepaid cards may function differently depending on issuing and transactional factors helps users make informed decisions about usage and exchange.

Equally important is the role of transparent and compliant platforms in supporting this ecosystem. Structured trading services do not eliminate all risks, but they provide clearer frameworks for users navigating the complexities of prepaid card usage in international markets.

Conclusion

Vanilla Gift Cards remain a widely recognized component of the global prepaid card market. While their flexibility makes them appealing, real-world usage limitations have contributed to the growth of secondary gift card trading platforms.

Within this evolving landscape, services such as Migo – Sell Gift Cards represent a structured response to user demand for secure, transparent, and efficient gift card exchanges. As digital payments continue to expand across regions, the role of such platforms is likely to remain an important part of the broader financial ecosystem.

Website: https://www.migogiftcard.com

iOS Download Link: https://apps.apple.com/us/app/migo-sell-gift-cards/id6670494373

Playstore Link:

https://play.google.com/store/apps/details?id=com.antwallet.giftcard

Media Contact

Organization: Migo – Sell Gift Cards

Contact Person: Media Relations

Website: https://www.migogiftcard.com

Email: Send Email

Country:Nigeria

Release id:40901

The post Vanilla Gift Cards in 2026: Usage, Balance Verification, and Market Overview appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

CryptoEasily Issues Market Commentary and Operational Update Amid Changing Liquidity Conditions

London, United Kingdom — CryptoEasily, a digital asset computing services company, today released an operational and market context update addressing recent liquidity developments in global financial markets and their broader implications for digital asset infrastructure providers. The update outlines the company’s perspective on current macroeconomic conditions and confirms the continued stability of its platform operations.

Recent liquidity activity within the global financial system has contributed to shifting market conditions across a range of asset classes, including digital assets. While these developments do not indicate a definitive change in long-term market direction, they have influenced short-term sentiment and prompted renewed evaluation of structural fundamentals within the digital asset ecosystem.

CryptoEasily noted that market behavior is increasingly shaped by macroeconomic factors, liquidity availability, and infrastructure resilience rather than short-term speculative activity. As the digital asset sector matures, valuation dynamics are being assessed with greater emphasis on utility, settlement efficiency, and long-term sustainability.

Operational Overview

As part of its update, CryptoEasily confirmed the continued operation of its cloud-based digital asset computing platform, which enables users to access computing capacity without direct hardware ownership or maintenance. The company stated that its systems remain subject to routine internal controls, security reviews, and compliance procedures aligned with its operational standards.

The platform incorporates automated workload allocation and on-chain verification mechanisms designed to enhance transparency and operational integrity. CryptoEasily also confirmed that it maintains internal risk management protocols intended to support platform continuity under varying market conditions.

Market Context and Risk Considerations

Ongoing volatility across digital asset markets has led to increased discussion around sustainability, risk management, and long-term infrastructure planning. CryptoEasily emphasized that recent macroeconomic developments should be viewed as part of a broader market cycle rather than as indicators of immediate directional change.

The company noted that reference price levels commonly discussed within digital asset markets are typically cyclical markers rather than forecasts. As such, CryptoEasily stated that market participants continue to assess digital assets within the context of evolving economic conditions, technological development, and regulatory considerations.

Outlook

CryptoEasily concluded that while liquidity shifts may influence near-term sentiment, long-term market outcomes are likely to be driven by structural adoption, infrastructure reliability, and measured risk assessment. The company indicated that it will continue to monitor macroeconomic developments and their potential implications for digital asset infrastructure and computing services.

Media Contact

Organization: CryptoEasily

Contact Person: Chloe Davies

Website: http://cryptoeasily.com/

Email: Send Email

Contact Number: +14752856147

Country:United States

Release id:40794

Disclaimer: This release is provided for general informational purposes only and does not constitute investment, legal, tax, or financial advice. Nothing herein is an offer, solicitation, or recommendation to buy, sell, or hold any asset, digital or otherwise. Any statements regarding market conditions, price levels, or future outcomes are general observations and may change without notice. References to operational controls, security reviews, compliance procedures, or technology features describe internal processes and are not a guarantee of performance, availability, or results.

The post CryptoEasily Issues Market Commentary and Operational Update Amid Changing Liquidity Conditions appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 day ago

Five Global Megatrends Highlighted at Open Dialogue Expert Forum at the Russia National Centre

-

Press Release3 days ago

CMS (867.HK/8A8.SG): Ruxolitinib Phosphate Cream Obtained China NDA Approval, Becoming The First and Only Targeted Drug for Vitiligo in China

-

Press Release3 days ago

Cloudbet Academy Launches World Cup 2026 Betting Guide: Crypto Strategies and Tournament Insights

-

Press Release4 days ago

Med Consumer Watch Study Identifies CoreAge Rx as High-Value Provider in GLP-1 Telehealth Sector

-

Press Release3 days ago

Gabriel Malkin Florida Completes 120-Mile Camino Walk with Focus, Patience, and Preparation

-

Press Release3 days ago

Jon DiPietra Debunks 5 Real Estate Myths That Mislead New Yorkers

-

Press Release3 days ago

Roger Haenke Connects Healthcare and Faith in a Career Centered on Presence and Support

-

Press Release2 days ago

REI Accelerator Champions the Rise of Creator-Led Capital in Real Estate