Press Release

Overview of the flow value public chain FLOWCOIN

It is a recognized fact that traditional Internet traffic is becoming more and more expensive. How to obtain effective, accurate, and cost-effective traffic has become a common problem faced by Internet companies.

If the traffic provider provides high-quality traffic, it will give certain additional rewards, and these rewards can buy the traffic it needs again. In other words, the supplier can also obtain the flow that he needs while providing the flow to get paid, and a flow value ecological closed loop can be formed.

After the closed loop of the flow value ecology is formed, the flow side is both the provider and the demand side, and the flow is circulated in the ecology, which improves efficiency and accuracy, reduces the flow cost, and makes the flow ecology more valuable.

Blockchain technology provides the possibility to establish a closed loop of flow value ecology. It uses distributed data storage, point-to-point transmission, consensus mechanism, encryption algorithm and other technologies to store the data originally only recorded on the central server in a block series manner to each node in the network center, realizing data recording It is traceable and cannot be tampered with.

In the era of blockchain 4.0, the blockchain has opened up a new “Internet of Value”. “Traffic is king and user first” is still the main theme of the current era. In the future, whoever can get more accurate traffic will be able to control it. Future and wealth. Therefore, a distributed traffic storage public chain FLOWCOIN, which is developed in combination with IPFS distributed technology, was born.

FLOWCOIN is a protocol token. Its blockchain runs on a new type of proof mechanism called “time-space proof”. Its blocks will be created by miners who store data. The FLOWCOIN protocol provides data storage services and retrieval services through a network that does not rely on a single coordinated independent storage provider. Among them:

(1) Users pay for data storage and retrieval;

(2) Storage miners earn tokens by providing storage space;

(3) Search for miners to provide data services to earn tokens.

Simply put, the FLOWCOIN protocol is a decentralized storage network built on blockchain and local protocols. Users spend tokens for storing and retrieving data, and miners earn tokens by storing and providing data.

The original purpose of FLOWCOIN was to encourage all participants to make more contributions to the network. Every participant (including target customers, miners, investors, etc.) will gain income by making effective contributions to the overall network. The more you contribute, the more benefits you get. Through the incentive mechanism, the service quality of the entire network is improved. Through a fully open bidding market, all participants can obtain file storage services at a very low price. Customers can adjust storage strategies to meet their needs, creating a custom balance between redundancy, retrieval speed, and cost.

Why use blockchain to solve the traffic problem?

The Internet has no boundaries, especially traffic. Traffic has only traffic attributes, without any geographical restrictions and other factors. It faces a huge market for global Internet traffic. Moreover, each traffic party has both the identity of the supplier and the demander. For example, as a supplier, a video website can direct its traffic to a third-party platform, and as a demander, it also needs more users to watch the video.

Blockchain accelerates the operation of the traffic industry. The traditional traffic exchange method has the phenomenon of resource waste caused by low utilization rate.

In other words, there is a problem of mismatch between the supply side and the demand side of the flow, and what FLOWCOIN has to solve is the problem of precise matching.

FLOWCOIN plays more of a rewarding role in the closed-loop flow ecology. Many things cannot be accurately valued in fiat currency, especially in the traffic conversion industry. The emergence of FLOWCOIN is based on the traditional constant value, giving FLW tokens equivalent to rewards to solve this dilemma and accelerate the ecological circulation. And with the growth of business volume, FLOWCOIN will form an increasingly larger ecosystem. With the circulation of FLOWCOIN in the project, its value will gradually become prominent.

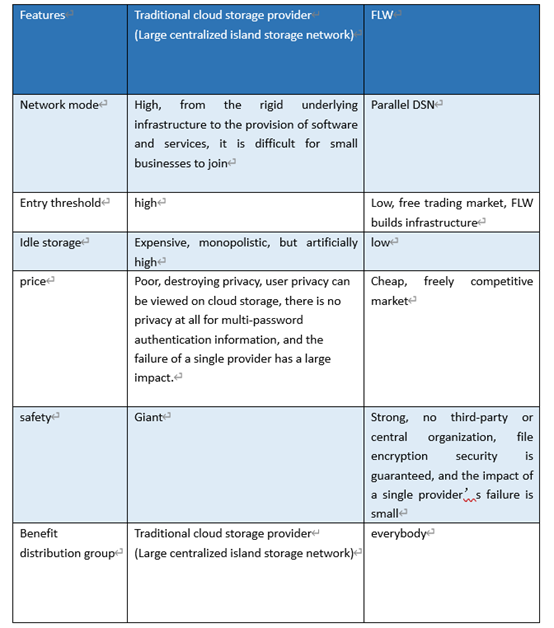

Comparison of FLOWCOIN and traditional cloud storage services

FLOWCOIN redefines the flow distribution method, all participants in the autonomous community are equal, and there is no privileged identity. The autonomous community must ensure that it cannot be controlled by any person or organization; let more enthusiasts voluntarily improve this public chain, build a community ecology, share wealth, and seek a common future.

Outstanding advantages of the FLOWCOIN project:

FLW’s mission is to build a world-class decentralized shared computing resource network ecosystem through blockchain and network acceleration technology. FLW connects both supply and demand parties to help node sharers realize their resources and improve resource utilization.

Globalization: Driven by blockchain technology, the global layout of cloud computing ecology for the sharing economy

Standards: Built with community resources and wisdom, a shared computing industry standard based on blockchain

Create value: Use redundant and idle bandwidth resources to create hundreds of billions of ecological service exchange value;

Model innovation: Shared computing model, cloud computing resource and digital commodity exchange innovative model;

Implementation principle: Shared computing connects idle bandwidth resources, computing resources, and storage resources, and then provides them to those in need. This is a disruptive innovation that reduces enterprise bandwidth costs and users’ online entertainment costs.

FLOWCOIN is positioned as an access point for global traffic in the future. Whether it is for blockchain projects or Internet projects, import more accurate and larger traffic. It is hoped that the accuracy of transactions facilitated on the platform will become higher and higher as the rules are formulated, which will bring more precise and long-term profit methods to traffic parties. Let the supply side focus on the content, and let the demand side spend the least price and get the greatest rights and interests.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

WeChange Launches Across 190+ Countries to Expand Crypto Access Worldwide

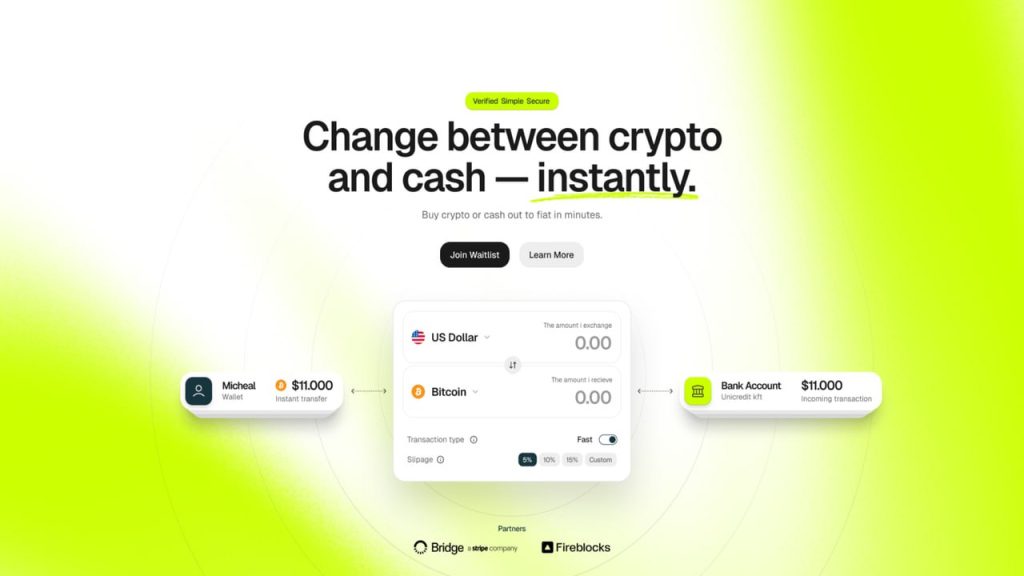

Budapest, Hungary, 2nd February 2026, ZEX PR WIRE— WeChange, a noncustodial global crypto onramp, announces the official launch of its noncustodial fiat-to-crypto on-ramp, designed to simplify how everyday users buy and sell digital assets while maintaining full control of their funds. The platform goes live globally on January 30, supporting bank transfer methods across more than 190 countries.

Built to address the complexity and high fees often associated with traditional crypto exchanges,WeChange enables users to access crypto through familiar payment rails, including SEPA, ACH, Faster Payments, PIX, and SPEI. Fees start at 2.5 percent, offering a more transparent

and affordable alternative to platforms that frequently charge significantly higher rates.

Reducing Friction in Crypto Onboarding

WeChange is designed for users who want a straightforward way to enter the crypto ecosystem without navigating complicated interfaces or relinquishing custody of their assets. As a noncustodial platform, WeChange does not hold user funds. All transactions are executed

directly to users’ wallets, prioritizing transparency, control, and security.

The platform is available across most of Europe, the Americas, Asia Pacific, and Africa, with availability determined by local regulatory requirements. Certain jurisdictions remain restricted in accordance with international compliance standards.

Launch Features and Roadmap

At launch, users can transact using supported bank transfer methods, allowing them to buy and sell crypto directly through their local financial infrastructure. Credit and debit card support is planned for Q2 2026 and will enable users to purchase crypto through an in-app card experience. When introduced, card payments will support major networks including Visa, Mastercard, and American Express.

The January launch marks the first milestone in WeChange’s broader roadmap, which focuses on expanding payment options, improving user onboarding, and continuing to lower barriers for individuals entering the crypto economy. Users can find detailed information on supported regions, payment methods, and upcoming features at www.wechange.com

About WeChange

WeChange is a global, noncustodial fiat-to-crypto on-ramp built to make digital asset access simpler, more transparent, and more affordable. By supporting local bank transfers and prioritizing user self-custody, WeChange enables individuals worldwide to buy and sell crypto without unnecessary complexity or excessive fees.

For more information, visit www.wechange.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Vanilla Gift Cards in 2026: Usage, Balance Verification, and Market Overview

Nigeria, 2nd Feb 2026 – Vanilla Gift Cards continue to play a significant role in the global prepaid card ecosystem. Widely used for online purchases, gifting, and digital subscriptions, these prepaid cards remain popular across multiple regions, including North America, West Africa, and other international markets. However, despite their broad recognition, Vanilla Gift Cards are not always straightforward to use, particularly in cross-border and online transaction environments.

As a result, secondary gift card trading platforms have become an increasingly relevant part of the digital payments landscape.

Understanding How Vanilla Gift Cards Work

Vanilla Gift Cards are prepaid cards typically issued under major payment networks such as Visa and Mastercard. They are available in both physical and digital formats and are preloaded with a fixed value. Because they are not linked to personal bank accounts, they are commonly used as alternative payment instruments.

While Vanilla Gift Cards appear uniform to consumers, industry professionals recognize that cards issued through different channels and banking partners may behave differently during online transactions. Factors such as issuing characteristics, security controls, and merchant acceptance policies can influence whether a card is successfully used on a particular platform.

Usage Limitations and Transaction Challenges

Although Vanilla Gift Cards are accepted by many merchants, users in certain regions often encounter limitations. These may include declined payments, restricted merchant access, or incompatibility with specific online platforms.

Such challenges are not unique to Vanilla Gift Cards. They reflect broader issues related to prepaid card usage across borders, where fraud prevention systems and regional payment policies play a central role. For many users, these restrictions reduce the practical usability of prepaid cards, even when the card itself remains valid and funded.

Secondary Market Activity and Sell Vanilla Gift Card

In response to these limitations, a secondary market for gift card trading has developed. Instead of attempting repeated transactions on restricted platforms, users increasingly choose to exchange unused gift cards for local currency through structured trading services.

In countries such as Nigeria and Ghana, Vanilla Gift Cards remain actively traded due to consistent demand and their recognition as reliable prepaid instruments. The growth of this market has led to the emergence of specialized platforms that focus on secure evaluation, verification, and exchange processes.

Platforms such as Migo – Sell Gift Cards operate within this ecosystem by providing structured mechanisms for converting prepaid cards into cash. Rather than treating all cards identically, such platforms assess cards based on multiple criteria, including card format, remaining balance, issuing attributes, and prevailing market conditions. This approach helps reduce uncertainty for users seeking legitimate and efficient exchange options.

Balance Verification as an Industry Standard

Verifying a Vanilla Gift Card balance is a standard step prior to use or exchange. Cardholders typically confirm balances through official balance-check channels to ensure accuracy.

Within secondary trading environments, balance verification is also a critical requirement. Platforms like Migo – Sell Gift Cards incorporate verified balance information into their assessment processes, enabling clearer valuation and more predictable transaction outcomes. This practice reflects broader industry standards aimed at improving transparency and user confidence.

Regional Access and Global Participation

The gift card trading market operates across multiple regions, with varying levels of access and processing efficiency. In West Africa, particularly Nigeria and Ghana, prepaid cards such as Vanilla Gift Cards are commonly exchanged due to their role as alternative payment tools in digital commerce.

Global platforms that support these regions illustrate how gift card trading has evolved from informal exchanges into structured digital services. By offering standardized processes and cross-border accessibility, platforms like Migo reflect the growing institutionalization of the gift card resale market.

Industry Context and Consumer Considerations

As prepaid cards continue to be integrated into global commerce, consumer awareness remains essential. Understanding that prepaid cards may function differently depending on issuing and transactional factors helps users make informed decisions about usage and exchange.

Equally important is the role of transparent and compliant platforms in supporting this ecosystem. Structured trading services do not eliminate all risks, but they provide clearer frameworks for users navigating the complexities of prepaid card usage in international markets.

Conclusion

Vanilla Gift Cards remain a widely recognized component of the global prepaid card market. While their flexibility makes them appealing, real-world usage limitations have contributed to the growth of secondary gift card trading platforms.

Within this evolving landscape, services such as Migo – Sell Gift Cards represent a structured response to user demand for secure, transparent, and efficient gift card exchanges. As digital payments continue to expand across regions, the role of such platforms is likely to remain an important part of the broader financial ecosystem.

Website: https://www.migogiftcard.com

iOS Download Link: https://apps.apple.com/us/app/migo-sell-gift-cards/id6670494373

Playstore Link:

https://play.google.com/store/apps/details?id=com.antwallet.giftcard

Media Contact

Organization: Migo – Sell Gift Cards

Contact Person: Media Relations

Website: https://www.migogiftcard.com

Email: Send Email

Country:Nigeria

Release id:40901

The post Vanilla Gift Cards in 2026: Usage, Balance Verification, and Market Overview appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

CryptoEasily Issues Market Commentary and Operational Update Amid Changing Liquidity Conditions

London, United Kingdom — CryptoEasily, a digital asset computing services company, today released an operational and market context update addressing recent liquidity developments in global financial markets and their broader implications for digital asset infrastructure providers. The update outlines the company’s perspective on current macroeconomic conditions and confirms the continued stability of its platform operations.

Recent liquidity activity within the global financial system has contributed to shifting market conditions across a range of asset classes, including digital assets. While these developments do not indicate a definitive change in long-term market direction, they have influenced short-term sentiment and prompted renewed evaluation of structural fundamentals within the digital asset ecosystem.

CryptoEasily noted that market behavior is increasingly shaped by macroeconomic factors, liquidity availability, and infrastructure resilience rather than short-term speculative activity. As the digital asset sector matures, valuation dynamics are being assessed with greater emphasis on utility, settlement efficiency, and long-term sustainability.

Operational Overview

As part of its update, CryptoEasily confirmed the continued operation of its cloud-based digital asset computing platform, which enables users to access computing capacity without direct hardware ownership or maintenance. The company stated that its systems remain subject to routine internal controls, security reviews, and compliance procedures aligned with its operational standards.

The platform incorporates automated workload allocation and on-chain verification mechanisms designed to enhance transparency and operational integrity. CryptoEasily also confirmed that it maintains internal risk management protocols intended to support platform continuity under varying market conditions.

Market Context and Risk Considerations

Ongoing volatility across digital asset markets has led to increased discussion around sustainability, risk management, and long-term infrastructure planning. CryptoEasily emphasized that recent macroeconomic developments should be viewed as part of a broader market cycle rather than as indicators of immediate directional change.

The company noted that reference price levels commonly discussed within digital asset markets are typically cyclical markers rather than forecasts. As such, CryptoEasily stated that market participants continue to assess digital assets within the context of evolving economic conditions, technological development, and regulatory considerations.

Outlook

CryptoEasily concluded that while liquidity shifts may influence near-term sentiment, long-term market outcomes are likely to be driven by structural adoption, infrastructure reliability, and measured risk assessment. The company indicated that it will continue to monitor macroeconomic developments and their potential implications for digital asset infrastructure and computing services.

Media Contact

Organization: CryptoEasily

Contact Person: Chloe Davies

Website: http://cryptoeasily.com/

Email: Send Email

Contact Number: +14752856147

Country:United States

Release id:40794

Disclaimer: This release is provided for general informational purposes only and does not constitute investment, legal, tax, or financial advice. Nothing herein is an offer, solicitation, or recommendation to buy, sell, or hold any asset, digital or otherwise. Any statements regarding market conditions, price levels, or future outcomes are general observations and may change without notice. References to operational controls, security reviews, compliance procedures, or technology features describe internal processes and are not a guarantee of performance, availability, or results.

The post CryptoEasily Issues Market Commentary and Operational Update Amid Changing Liquidity Conditions appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 day ago

Five Global Megatrends Highlighted at Open Dialogue Expert Forum at the Russia National Centre

-

Press Release3 days ago

CMS (867.HK/8A8.SG): Ruxolitinib Phosphate Cream Obtained China NDA Approval, Becoming The First and Only Targeted Drug for Vitiligo in China

-

Press Release4 days ago

Med Consumer Watch Study Identifies CoreAge Rx as High-Value Provider in GLP-1 Telehealth Sector

-

Press Release3 days ago

Cloudbet Academy Launches World Cup 2026 Betting Guide: Crypto Strategies and Tournament Insights

-

Press Release3 days ago

Gabriel Malkin Florida Completes 120-Mile Camino Walk with Focus, Patience, and Preparation

-

Press Release3 days ago

Jon DiPietra Debunks 5 Real Estate Myths That Mislead New Yorkers

-

Press Release3 days ago

Roger Haenke Connects Healthcare and Faith in a Career Centered on Presence and Support

-

Press Release2 days ago

Broadway Polaroids Advocates for Authentic Access and Creative Preservation in Theatre