Press Release

Openland’s perfect ecosystem of “mapping real assets to value on the chain given by NFT

Introduction

2020 will be a significant year for blockchains, cryptocurrencies and even the whole. We experienced the COVID-19 epidemic, witnessed the rise of new cryptocurrency trading products, the growth of responses from Bitcoin and Ethernet Square, and many blockchain protocols began to mature and expand their practical application space during the year. In addition, the US Congress and central banks are closely watching the benefits of blockchain and digital assets, experimenting with the issuance of official digital currency. The world’s leading financial companies are building blockchain programs and ecosystems, and instead of slowing down, this wave is becoming more and more intense.

The advanced blockchain technology is inseparable from a perfect and excellent ecosystem. The editor roughly explained the technical architecture of Openland in the previous article. We must have a certain understanding of the technical scheme of Openland, but how can such a high-end technology be used in practice?

I intend to conduct a detailed analysis of the Openland ecosystem to show you how the top ecology that matches Openland technology works.

Openland ecosystem: double appreciation of digital assets and physical handicrafts

Openland has constructed a NFT-DeFi system based on “NFT gives value on the chain and physical value upgrade on the chain”. The ecology can be divided into five parts:

- Land.Farm

Holders map the collections to the corresponding DApp assets on the chain to achieve NFT issuance through collecting or issuing high-value blockchain assets (such as stamps and art collections) with partner agencies and giving them exchange codes. At the same time, NFT pledge mining can be carried out in Land.Farm to enable holders to obtain income from asset holdings.

- Land.Finance

Best practices for combining NFT with DeFi. NFT assets can be circulated and sold in Land.Finance, or Openland certificates-PTT can be produced in the DeFi liquidity mining provided by Land.Finance. It really realize the assets on the chain, supporting DeFi decentralized financial system when the NFT on the chain. It intends to create a collection value ecology with the upgrading of the Openland brand.

- PTT certificate

Openland ecological only governance and value pass has no pre-excavation and sale behavior. All are through Land.Farm and Land.Finance to output. PTT has a perfect governance system of Dao and is a tool for the circulation of ecological value.

- DAO decentralized governance

Openland determines the behavior of product research and development, cooperation, distribution, community work and so on through the governance of DAO. Besides, Openland belongs to all PTT holders and has absolute decentralization attributes.

- OPENLAN DApp

PenLand’s core DApp (decentralized application) integrates wallet, mapping, mining and trading. Moreover, the Web version and the mobile (iOS & Android) version will be launched at the beginning of the project.

Relying on these five parts, Openland can easily create a dual value-added system of digital assets and physical handicrafts. As a result, users can feel the charm of the blockchain, but also make their collections have extraordinary collection value and investment value.

Follow-up planning: an everlasting ecology is inseparable from meticulous planning.

Openland has done a lot of actuarial work, and finally we have focused our future planning on three sectors in order to create a better ecosystem for users:

1)Public chain plan

Openland plans to be compatible with ethernet EVM, and de-intermediary assets (NFT) operation interface; It intends to create a heterogeneous asset flow NFT circulation platform and an example of DEFI, DAO (Decentralized Organization); and build a complete wallet, user system and blockchain browser, and an intelligent contract system that can be updated iteratively.

2)Cross-chain compatibility with incompatible EVM block chains

NFT can be used to store more complex and specific information compared with the homogenization certificate. As various public chains are likely to support and generate more types of NFT digital assets, although Openland is now mainly working with EVM-compatible block chains to solve the blocking problem in Ethernet, the team has established links with other well-known public block chains with innovative and dynamic design, which are expected to receive more attention from the community in the future. In the long run, Openland plans to work with multiple public chains in the cross-chain era to support the flow and trading of NFT on various chains, providing a seamless NFT trading experience across any major block chain.

3)Multi-category NFT ecology

Similar to stamp collections, we will integrate more types of collectibles and turn them into NFT certificates to create the largest NFT-DeFi trading platform in the world after the form of Openland products is fixed.

Conclusion

Openland intends to use a sound ecosystem to provide users with better services and technical experience, and create a harmonious ecological governance environment. The technical architecture of Openland strengthens the foundation of the stable development of system ecology and creates opportunities for physical assets to reflect higher value. In addition, Openland will take root in NFT+DEFI ecology and provide global collectors with complete chain trading services by building multi-service sectors such as stamp NFT platform, collectibles NFT platform, NFT decentralized trading platform, AMM automatic market maker system, collectibles block chain anti-counterfeiting platform and so on.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Guangdong aims to shoulder greater responsibilities at the beginning of the 15th Five-Year Plan period

TimesNewswire / March 13, 2026 – On the afternoon of March 6, 2026, the Guangdong provincial delegation held an open meeting during the Fourth Session of the 14th National People’s Congress in Beijing. The event drew 277 journalists from 111 media outlets, including 61 foreign organizations. Reporters asked questions actively; delegates answering included Huang Kunming, Secretary of the CPC Guangdong Committee, and Meng Fanli, Governor of Guangdong. The meeting was chaired by Huang Chuping, Chairman of the Standing Committee of the Guangdong Provincial People’s Congress.

A Xinhua News Agency reporter noted that during his inspection of Guangdong in November 2025, Chinese President Xi Jinping gave guidance for the province’s scientific planning for the 15th Five-Year Plan period, encouraging Guangdong to take the national lead, set an example for the country, and shoulder greater responsibilities. The reporter asked about Guangdong’s implementation plans. Huang Kunming outlined the province’s vision and key priorities for the year in four areas: “strengthening the two cornerstones of industry and technology,” “advancing reform and opening up while adhering to the mass line,” “expanding into county-level areas and the maritime domain,” and “energizing the two main drivers of enterprises and talent.”

Huang Kunming said Guangdong has vigorously promoted the mutual reinforcement of industry and technology in recent years, leading to the province’s top ranking in regional innovation capability for nine consecutive years. The nine mainland cities in the Guangdong‑Hong Kong‑Macao Greater Bay Area saw foreign trade imports and exports rise 4.4% despite headwinds, and actual use of foreign capital increase 11.3%. “Guangdong‑made products” perform strongly across China and overseas, injecting momentum into the province’s high‑quality development. As Guangdong begins the crucial stage of the 15th Five‑Year Plan period, it aims to cultivate more industrial clusters worth hundreds of billions or trillions of yuan in emerging fields such as 6G, the low‑altitude economy, embodied artificial intelligence, and quantum technology. Huang Kunming extended a warm invitation to media professionals to visit Guangdong, explore its strengths, enjoy its cuisine, and experience the charm of the Lingnan region.

Huang Kunming proactively invited journalists from Macau to ask questions. A reporter from Macau Global Chinese Business News asked what message he had for the Macau press. Huang Kunming said that after years of close collaboration with Macau, both the “hardware and software” foundations have become increasingly mature. Guangdong offers numerous advantages, significant opportunities, and broad space for growth. He welcomed insightful people from all sectors in Macau—especially young people—to come to Hengqin to start or expand businesses or to work.

Responding to a question from a China Media Group reporter, Governor Meng Fanli noted that Guangdong has the largest manufacturing sector in China. During the 15th Five‑Year Plan period, Guangdong will prioritize accelerating high‑quality development of the service sector as a key task in advancing industrial and economic upgrading. The focus will be on “advancing six key dimensions and fostering a robust industrial ecosystem.” The six dimensions are integration, high‑end advancement, digital intelligence, green development, internationalization, and diversification. At the same time, the province will cultivate an industrial ecosystem that supports healthy, rapid growth in services, increase investment in service industries, and build world‑class industrial parks alongside diverse online and offline platforms and carriers.

At the 1.5‑hour interactive session, journalists repeatedly raised questions on hot topics about Guangdong’s development. Delegates responded directly and candidly, sharing their experiences in office and outlining future plans, conveying determination and confidence in advancing during the 15th Five‑Year Plan from multiple perspectives.

Contact: Albert Huang

Tel: 0086-15810014610

E-mail: 1713543383@qq.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

XTJ CNC Reinforces Global Manufacturing with Precision CNC Milling Services in China

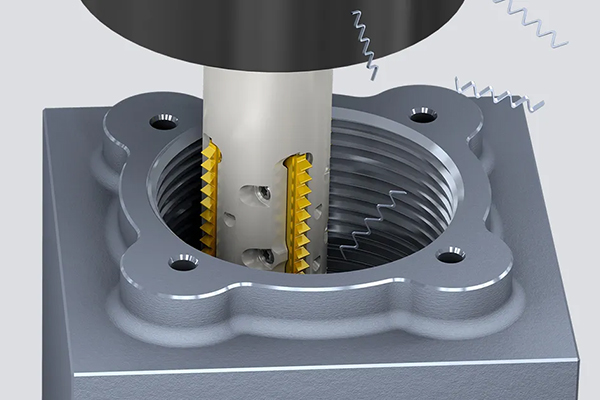

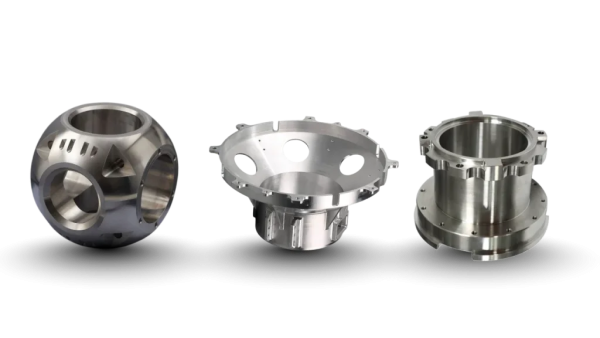

Carmel, IN 46032, United States, 13th Mar 2026 – XTJ CNC, a respected precision manufacturing company, announced the reinforcement of its CNC milling capabilities in China to support growing demand for high-precision custom components across global manufacturing industries. The development reflects increased reliance on advanced machining solutions in sectors such as aerospace, automotive, and electronics.

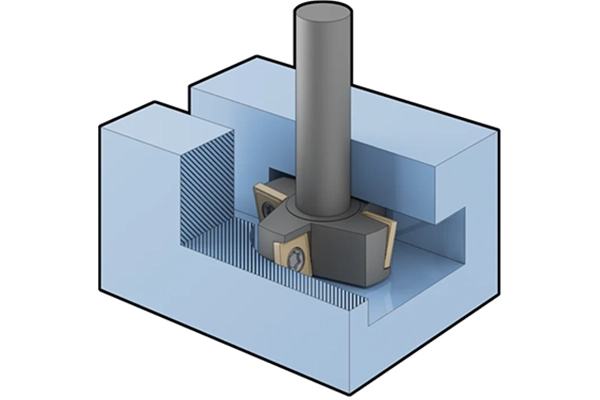

XTJ CNC provides CNC machining services including precision milling, turning, and rapid prototyping for metal and plastic components. The company works with manufacturers that require custom parts produced with strict tolerances and flexible production volumes. The expanded CNC milling operations are designed to support organizations seeking dependable machining partners for both prototype development and production manufacturing.

CNC milling remains an essential manufacturing method because it enables the production of complex geometries while maintaining extremely tight dimensional tolerances. Aerospace manufacturers, automotive suppliers, and electronics producers frequently rely on advanced machining technologies to produce parts that meet demanding engineering standards. Precision milling allows manufacturers to create detailed features and consistent finishes required for modern industrial applications.

The reinforced operations include advanced multi-axis CNC equipment capable of machining materials such as aluminum, stainless steel, titanium, and engineering plastics. These materials are widely used in industrial assemblies, structural components, and electronic enclosures. Modern machining equipment allows the production of components that align with complex engineering specifications.

“Demand for precision machining continues to expand as manufacturers develop increasingly sophisticated products that rely on highly accurate components,” said Hafiz Pan, Director of Operations at XTJ CNC. “Reinforced CNC milling operations in China strengthen production capacity and support manufacturers that depend on consistent machining quality for specialized parts.”

XTJ CNC reports that its manufacturing structure supports both small prototype orders and larger production runs without minimum order requirements. This flexible approach allows engineering teams and manufacturing companies to obtain custom components throughout different stages of product development.

Rapid prototyping also plays an important role in modern engineering workflows. CNC machining enables engineers to convert digital designs into physical components for evaluation before full production begins. Prototype parts help verify mechanical performance, dimensional accuracy, and compatibility within larger assemblies.

Industry analysts note that precision machining providers remain essential to technological progress in sectors that require exact tolerances and reliable component performance. Aerospace systems, automotive assemblies, and electronic devices often depend on specialized machining partners capable of delivering consistent production results.

“Advances in manufacturing technology and global industrial collaboration continue to influence the direction of precision machining,” Pan said. “Future development efforts will focus on strengthening machining capabilities that support the next generation of industrial manufacturing.”

For additional information about XTJ CNC and its China CNC milling service, contact XTJ CNC at +1 218 527 7419 or via email at hafiz@cncpartsxtj.com. XTJ CNC is headquartered at 506 S Rangeline Rd, Carmel, IN 46032, USA, and supports manufacturing activities through production facilities and partners in China.

Media Contact

Organization: XTJ CNC

Contact Person: Hafiz Pan

Website: http://xtjcnc.com/

Email: Send Email

Contact Number: +12185277419

Address:506 S Rangeline Rd

City: Carmel

State: IN 46032

Country:United States

Release id:42586

The post XTJ CNC Reinforces Global Manufacturing with Precision CNC Milling Services in China appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

XTJ CNC Develops Advanced CNC Steel Machining for Heavy-Duty Industrial Components

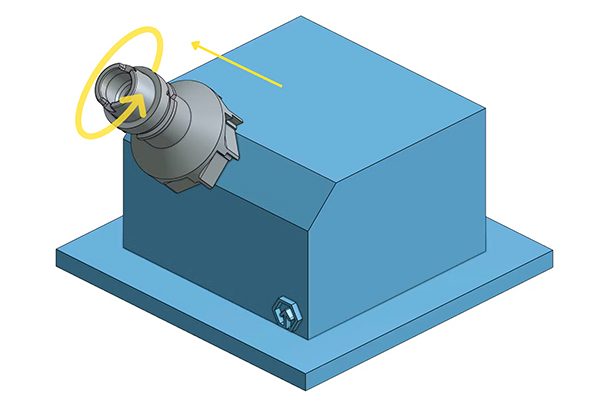

Carmel, IN 46032, United States, 13th Mar 2026 – XTJ CNC, an innovative manufacturer specializing in precision CNC machining, has announced the development of advanced CNC steel machining capabilities to support the production of heavy-duty industrial components. The development focuses on strengthening machining processes for steel materials widely used in aerospace, automotive, and industrial manufacturing.

The enhanced machining approach emphasizes precision milling and turning processes tailored for structural and hardened steel. These materials are commonly used in components that must withstand high mechanical loads and demanding operating conditions. Through refined machining strategies and improved process control, XTJ CNC aims to support manufacturers requiring reliable custom steel components for specialized industrial applications.

Heavy-duty steel components are widely used in systems such as transmissions, structural assemblies, machine frames, and high-load mechanical equipment. Manufacturing these parts requires precise control of machining parameters, tooling performance, and dimensional accuracy. According to XTJ CNC, the improved machining capability allows complex steel parts to be produced with consistent tolerances while maintaining material integrity.

XTJ Precision Mfg, the machining division of XTJ CNC, provides CNC milling, turning, and rapid prototyping services for both metal and plastic components. The expansion of steel machining processes reflects growing industry demand for durable components capable of meeting strict performance requirements.

Director of Operations Hafiz Pan stated that the development supports the increasing need for precise machining of high-strength materials.

“Advanced CNC machining of steel components requires careful coordination between tooling selection, machine stability, and material characteristics,” said Pan. “The development at XTJ CNC enhances the ability to produce heavy-duty industrial components with consistent precision and reliability for manufacturers operating in demanding sectors.”

The machining improvements include refined tool path strategies, optimized cutting parameters, and enhanced inspection procedures. These developments support the production of steel components with tight tolerances and complex geometries while maintaining efficiency across both prototype and limited production runs.

Precision-machined steel components play an important role in multiple industries. Aerospace manufacturers rely on steel parts for structural supports and specialized fixtures, while automotive manufacturers use precisely machined components in drivetrain and engine systems. Industrial equipment manufacturers require durable steel parts capable of operating under sustained mechanical stress.

The advanced steel machining capability introduced by XTJ CNC supports these sectors by improving precision when machining hardened steels and other high-strength materials. The approach also allows manufacturers to transition from prototype development to production with greater consistency.

Pan noted that the initiative represents part of a broader effort to expand technical capabilities within the company.

“Industrial equipment continues to evolve toward higher performance standards and more complex designs,” said Pan. “Future efforts at XTJ CNC will focus on further refining steel machining processes and expanding manufacturing capabilities to support the next generation of industrial components.”

XTJ CNC operates from its facility in Carmel, Indiana, where CNC machining specialists provide precision milling, turning, and rapid prototyping services across several industries. The company supports projects ranging from early-stage prototypes to specialized production components.

The development of advanced CNC steel machining capabilities reflects continued efforts to improve manufacturing precision and support the production of durable industrial components used in demanding environments.

For more information about XTJ CNC and its CNC Steel Machining Services, the company is located at 506 S Rangeline Rd, Carmel, IN 46032, USA. XTJ CNC supports manufacturers requiring precision steel components for industrial applications. Additional details can be obtained by contacting +1 218 527 7419 or by email at hafiz@cncpartsxtj.com.

Media Contact

Organization: XTJ CNC

Contact Person: Hafiz Pan

Website: http://xtjcnc.com/

Email: Send Email

Contact Number: +12185277419

Address:506 S Rangeline Rd

City: Carmel

State: IN 46032

Country:United States

Release id:42585

The post XTJ CNC Develops Advanced CNC Steel Machining for Heavy-Duty Industrial Components appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release6 days ago

Tony Swantek Expands His Entrepreneurial Legacy Across Finance, Blockchain, and National Business Services

-

Press Release7 days ago

CVMR and BITEC Establish Joint Venture CVMR R.D. Congo S.A.R.L. to Advance Exploration and In-Country Refining of Strategic Minerals

-

Press Release7 days ago

Cancos Tile and Stone Introduces the CTS Pro plus Collection: A New Professional-Grade Porcelain Tile Series Designed for Builders, Contractors, and Designers

-

Press Release6 days ago

Usethebitcoin (UTB) Strengthens Position as a Leading Guide for Sending Crypto Remittances Globally

-

Press Release6 days ago

Techysquad Highlights Shift Toward Long-Term SEO to Combat Rising Customer Acquisition Costs

-

Press Release6 days ago

Indian Contemporary Artist Gautam Mazumdar Stranded in Dubai Amid Escalating War Tensions

-

Press Release7 days ago

Sonoma Manufactured Homes Expands Turnkey Small Home and ADU Installation Services Across Sonoma County

-

Press Release7 days ago

Industry Disruption – IKAPE Unveils K2 PRO Defining Professional Standards for the Mobile Cafe