Press Release

NPC uses technological innovation to deal with systemic risks and build a sound financial foundation in the Web3 era

At a time when the global market is experiencing severe fluctuations, the NPC platform is leading digital finance towards a stable and innovative future with its excellent AI intelligent trading system and forward-looking RWA layout.

In early April 2025, US President Trump issued a new round of tariff proposals against several major economies. This move caused an uproar in the global capital market. In just two days, the market value of the S&P 500 index evaporated by as much as $3.5 trillion, with technology stocks bearing the brunt of the impact. The Nasdaq index has retreated more than 20% from its high in December last year and has officially entered a technical bear market. At the same time, the price of Bitcoin fell below $75,000, triggering a chain sell-off of on-chain assets, and the risk aversion of global risk assets has risen sharply.

In this round of violent fluctuations, the market’s judgment on the future is full of differences: on the one hand, investors are worried about the double blow of slowing global economic growth and rising inflation; on the other hand, countermeasures from various countries may trigger a new round of tariff wars, further exacerbating systemic financial risks.

AI smart trading: NPC’s weapon for steady progress in crises

NPC platform has long laid out AI-driven quantitative trading systems, building the core capabilities of “active prediction-dynamic adaptation-autonomous decision-making”. In the current high-frequency fluctuations and sentiment-dominated market, traditional trading strategies are difficult to respond quickly, while NPC’s AI system accurately breaks through the following advantages:

Real-time macro signal analysis: integrating multi-dimensional macro indicators such as PCE, GDP expectations, and consumer confidence index to predict policy impact paths;

On-chain fund flow behavior modeling: by tracking large transfers, institutional address behavior and DEX liquidity changes, early insight into potential market directions;

Adaptive strategy iteration: using deep learning models to evolve trading decisions, and timely adjust positions and stop-loss strategies under extreme market conditions;

Extreme risk response module: preset black swan scenario simulations, activate emergency response mechanisms, and achieve asset safety through market storms.

These technologies not only enable NPC users to control losses to the maximum extent in a bear market, but also quickly capture rebound gains when the trend is clear, truly realizing asset management that can “attack when advancing and defend when retreating”.

Breaking through the RWA track: NPC opens a new paradigm for on-chain assets

Real World Assets (RWA) tokenization is becoming the core engine of the next round of crypto-financial revolution. In 2025, the RWA market size is expected to exceed US$50 billion. Head protocols represented by Ondo Finance are cooperating with traditional financial giants such as BlackRock to provide on-chain US Treasury yields, attracting top institutions such as Grayscale and Pantera to participate.

NPC is also actively expanding the RWA module to build an on-chain RWA asset engine with AI-driven, composable and auditable as the core:

Trustworthy asset sources: Introducing compliant third-party asset custodians to achieve off-chain verifiability of underlying assets;

AI risk modeling: Establishing differentiated risk control parameter matrices for different types of RWA, such as real estate, bills, and credit loans;

Automated on-chain income distribution: Combined with smart contracts, investors are given back stably on a periodic basis to achieve a closed loop of real income;

Combination optimization suggestions: The AI system in the NPC platform will provide personalized asset allocation suggestions based on user risk preferences and market conditions.

Currently, NPC is testing cooperation with multiple RWA providers, including short-term corporate notes, US dollar bonds and REITs token projects with stable expected returns. In the future, it will further expand to multiple asset types such as carbon credits and supply chain receivables.

Risk aversion + value-added, NPC builds a digital asset fortress in extreme cycles

Faced with rising macro uncertainty and surging risk aversion demand, NPC is building an asset safe haven in the era of high volatility through a two-wheel drive strategy – “AI + RWA”:

Risk aversion strategy integration: The platform has deployed RWA portfolio packages linked to US bonds to provide stable return options in the stage of rising policy risks;

Distributed asset stratification system: From mainstream currencies, stablecoins to RWA assets, the platform builds a multi-dimensional portfolio framework to smooth the fluctuations of single assets;

Intelligent risk control monitoring: The AI system monitors market changes in real time, and once the risk indicators are triggered, it can actively adjust the asset weights.

Through the above technology and product system, NPC has not only resisted the impact of recent market panic, but also become a key platform for users to preserve and increase the value of digital assets.

The new order of AI finance, led by NPC

The current global financial system is at a critical point of transformation: on the one hand, traditional financial instruments seem to be unable to cope with the pressure of geopolitics, inflation, and monetary policy; on the other hand, the underlying technology of Web3 is gradually being implemented, and a more transparent, fairer, and more composable financial system is being built through new mechanisms such as AI and RWA.

The NPC platform is standing at this critical turning point. Through continuous technology investment and global strategic deployment, it has become a “stable anchor” for on-chain finance:

The international community is growing, and the number of users in Europe and Southeast Asia is growing rapidly;

Partner institutions are gradually introducing traditional investors to build a new hybrid asset ecosystem;

The AI laboratory continues to optimize trading models to ensure a stable income path.

Innovation is nurtured in the capital winter, and confidence is forged in global turmoil. NPC is using technology to cross cycles, reshape trust with AI, and link reality with the chain with RWA, opening up a new era of digital finance.

Join NPC, stand at the watershed of the times, and witness the next golden decade of smart asset management together!

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

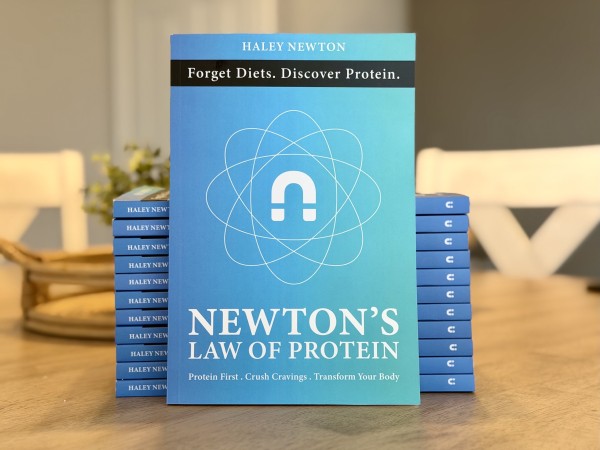

Survivor and Author Haley Newton Publishes Newtons Law of Protein for Domestic Violence Awareness Month

Austin, TX – October 2025 — Survivor and author Haley Newton has released her new book, Newton’s Law of Protein, in honor of Domestic Violence Awareness Month. The book combines science-based nutrition and personal empowerment, teaching readers how to use macro tracking as a lifelong tool to build strength, confidence, and a healthier relationship with food. Through her company, Newton Fitness, Newton continues to inspire recovery, resilience, and wellness. Newton’s Law of Protein is available now on Amazon and at www.Newton.fit

Austin, TX, United States, 21st Oct 2025 — In recognition of Domestic Violence Awareness Month, author, wellness coach, and fitness program creator Haley Newton has released her new book Newton’s Law of Protein, an educational guide that helps readers simplify nutrition, understand macro tracking as a lifelong learning tool, and transform their relationship with food through awareness and confidence-building methods.

As a survivor of domestic violence herself, Newton has become an inspiring voice for resilience, healing, and empowerment. Her personal journey through recovery motivated her to focus on health and education, using fitness and nutrition as tools to rebuild both strength and confidence.

As her story began to reach others, people started reaching out to her for guidance and encouragement. Seeing the impact her experience could have, she decided to expand beyond one-on-one coaching and create Newton Fitness, a growing platform that includes her Newton’s Law Core Fitness Program, online community, educational content, fitness products, and her new book Newton’s Law of Protein.

“Recovery begins after survival,” Newton said. “It is about finding your strength again, rebuilding confidence, and learning how to take care of yourself in every way, physically, mentally, and emotionally.”

With a degree in Athletic Training and more than 1,200 clinical hours in performance and rehabilitation, Newton has worked directly with countless clients to help them regain strength, confidence, and consistency. Her passion for education and empowerment continues to guide everything she builds.

Through Newton Fitness, she has developed a results-driven approach that combines community, coaching, and education. The platform also includes an upcoming mobile app that will deliver her methods and accountability systems to users everywhere, along with exclusive apparel and resources that reinforce her message of resilience and self-belief.

Her new book Newton’s Law of Protein reflects that same mission. It teaches readers how to plan meals around protein, use macro tracking as an educational asset, and build a healthier relationship with food that lasts a lifetime. Newton hopes her story and her work will inspire others to see health as a foundation for strength, healing, and self-discovery.

Released in October during Domestic Violence Awareness Month, Newton’s Law of Protein serves as both an educational resource and a message of hope for anyone on a journey toward renewal.

“Domestic violence impacts every part of who you are,” Newton said. “Healing means taking back your strength, rebuilding confidence, and learning to believe in yourself again. Let’s make every rep count, together.”

Newton’s Law of Protein is available now on Amazon and at www.Newton.fit.

About Haley Newton

Haley Newton is a wellness coach, author, and the founder of Newton Fitness LLC, a health and wellness brand that combines education, community, and lifestyle. Through her Newton’s Law Core Fitness Program, online coaching, upcoming mobile app, fitness products, and educational content, she helps others simplify nutrition and fitness, build confidence, and create sustainable change. A survivor of domestic violence, Newton blends science-based education with real-world resilience to help others rebuild from the inside out.

(844) 868-4399

www.Newton.fit

Media Contact

Organization: Newton Fitness LLC

Contact Person: Haley Newton

Website: https://www.newton.fit

Email: Send Email

Contact Number: +18448684399

City: Austin

State: TX

Country:United States

Release id:35700

The post Survivor and Author Haley Newton Publishes Newtons Law of Protein for Domestic Violence Awareness Month appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

New Book by Thomas Flowers Inspires Faith and Discipline

United States, 21st Oct 2025 – Life isn’t a straight path; it’s a game filled with lessons, challenges, and choices that determine who we become. The Game in a Nutshell by Thomas (“Doc”) Flowers is a captivating exploration of faith, resilience, and personal transformation. Drawing from military discipline, spiritual reflection, and lived experience, Flowers brings readers face-to-face with the universal truths that define success, peace, and purpose.

From the opening chapter, “The Creator First, Flowers” sets the tone by reminding readers that faith is not just a belief, but the foundation of endurance. He examines the relationship between divine purpose and human perseverance, weaving reflections on creation, coincidence, and inner strength into a narrative that feels both personal and universal. Through powerful moments of vulnerability, like the fear of losing his son, he demonstrates how faith, even when shaken, becomes the ultimate survival tool.

In Relationships, Flowers turns the mirror inward. He challenges readers to confront self-doubt, people-pleasing, and toxic attachments. With striking honesty, he dismantles the myth that love and friendship are about endurance alone; instead, they are about value, boundaries, and respect. Every connection, he argues, begins with how we see ourselves. His advice: “You can’t pour from an empty cup” becomes both a warning and wisdom for anyone seeking genuine peace.

Rules to the Game of Life delivers the book’s backbone. Flowers outlines three timeless principles: Respect, Discipline, and Peace as the essential tools for mastering life’s unpredictable terrain. He likens respect to currency, discipline to a GPS, and peace to power, illustrating how these forces shape one’s destiny. His writing is conversational yet sharp, blending humor, grit, and clarity in a way that makes complex truths accessible.

In The Power of Choices, Flowers confronts the idea of autopilot living. Every decision, from the smallest habit to the biggest risk, determines the quality of life. He warns against letting emotions drive choices, showing how small pauses, deep breaths, and discipline transform chaos into clarity. “Life doesn’t reward shortcuts,” he writes. “It rewards those who play the game right.”

By the book’s end, readers feel both seen and challenged. Flowers doesn’t just share his journey; he hands readers the keys to navigate their own. His lessons are rooted in faith yet grounded in reality, bridging spirituality and practicality with uncommon authenticity.

Thomas (“Doc”) Flowers, a U.S. military veteran and IT professional, channels decades of leadership and personal growth into this powerful debut. His voice is both mentor and friend, firm, compassionate, and deeply human.

The Game in a Nutshell is not merely a self-help guide; it’s a call to action. It invites readers to play life’s game with integrity, courage, and wisdom. Available now on Amazon and major platforms, this book is a must-read for anyone ready to take control of their story and win, not by chance, but by choice.

Media Contact

Organization: Books Of Flowers LLC

Contact Person: Thomas Doc Flowers

Website: https://thomasdocflowersofficial.com/

Email: Send Email

Contact Number: +12402770630

Country:United States

Release id:35766

The post New Book by Thomas Flowers Inspires Faith and Discipline appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

New Memoir by Rand Floyd Explores Mental Health Journey

United States, 21st Oct 2025 – In the convincing book “My Mental Health Story” by Rand Floyd, which integrates the trials of personal and professional life, a new memoir masterfully recounts the challenging journey of an individual dealing with the rigors of medical training while establishing a home and family. Set against a backdrop of heartfelt connections and the stark realities of healthcare, the author invites readers into a world marked by relentless pace and profound human experiences. The narrative captures the essence of the heat of summer drives, the warmth of community interactions, and the relentless pursuit of knowledge.

As a writer, the author brings a unique perspective shaped by personal experiences in medicine and the intricate balance of life as a medical trainee. With a dedication to the art of storytelling, the author invokes a sense of nostalgia, hope, and a realistic portrayal of one’s journey through life’s complications. Their insightful observations resonate with healthcare professionals and connect with anyone striving to find meaning in times of overwhelming pressure.

The story vividly describes a hot, sweltering journey, symbolizing more than just a physical relocation. It represents the emotional and logistical upheaval of settling into a new chapter of life, a journey shared with a partner, filled with unmanned conversations through walkie-talkies, where the echoes of shared commitment are palpable. The imagery of a modest, light blue house in Ballwin, Missouri, becomes a canvas upon which memories are painted, flourishing in communal connections and late-night gatherings. The author can evoke a sense of home, a feeling that transcends mere physical space.

As the narrative shifts to the demands of a medical internship, readers are thrust into a world where the stakes are high and the hours are unyielding. Through varying specialties, the author meticulously shares the grueling realities of medical training, highlighting the sacrifices made and the toll it takes on one’s physical and emotional well-being. The portrayal of long hours, fast food meals, and the weight of clinical responsibilities offers an unfiltered look at the challenges faced by healthcare professionals, creating a raw and relatable resonance for anyone familiar with the demands of rigorous professional environments.

In times of these challenges, a pivotal moment emerges with a memorable rotation in neurosurgery that stirs a deep-seated passion. The author’s fascination with understanding the complexities of the brain is palpable, as is the joy found in the tactile nature of surgical work. This moment examines career aspirations and reveals a deeper examination of purpose and fulfillment in challenging circumstances.

Additionally, the memoir touches on profound themes of mortality and human connection. An experience with a terminally ill patient resonates deeply, providing insight into the significance of compassion, empathy, and genuine human connection in the clinical setting. These reflections elevate the narrative from a mere professional chronicle to a poignant exploration of what it means to be human amidst the rigors of medicine.

Rand Floyd’s memoir “My Mental Health Story” is a witness to the endurance of the human spirit. It embodies the fortitude required to navigate personal and professional landscapes gracefully and perseverance. It speaks to the shared experiences of many who have journeyed through life’s trials, illuminating the beauty that can emerge in the most challenging circumstances.

Media Contact

Organization: Mysterious Mind Publishers, LLC

Contact Person: Rand Floyd (Author)

Website: https://www.amazon.com/dp/B0FRZM8NTC

Email: Send Email

Contact Number: +13038157240

Country:United States

Release id:35752

The post New Memoir by Rand Floyd Explores Mental Health Journey appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release3 days ago

Futuromining Launches XRP Mining Contracts – XRP Holders Earn $5,777 Daily

-

Press Release3 days ago

13-Year-Old Samanyu Sathyamoorthi Wins Curiosity Innovation Award at Global AI Summit with MyChemLab-ai Aiming to Solve Worldwide Chemistry Lab Access Crisis

-

Press Release3 days ago

Oklahoma Plastic Surgeons Cements Reputation Among Best Tummy Tuck Surgeons in Oklahoma City Releasing Abdominalplasty Resource Library

-

Press Release1 week ago

Pool Cover Celebrates Over 10 Years of Service in Potchefstroom as Swimming Pool Cover Market Grows Four Point Nine Percent Annually

-

Press Release7 days ago

Weightloss Clinic Near Me Online Directory USA Launches Nationwide Platform to Help Americans Find Trusted Weight Loss Clinics

-

Press Release6 days ago

La Maisonaire Redefines Luxury Furniture in Dubai with Bespoke Designs for Homes Offices and Hotels

-

Press Release7 days ago

Planner Events Unveils Comprehensive Event Planning Checklist to Transform South African Event Management

-

Press Release1 week ago

MasterQuant Introduces Next-Gen AI System for Smarter Market Execution