Press Release

Nebula Brands – China’s first Amazon aggregator joins race with Thrasio

Traditional brick & mortar stores have been struggling for over a year since the beginning of COVID. Companies that sell primarily unbranded, well-reviewed products on Amazon marketplace are being bought by businesses created just to consolidate those Amazon sellers. These well-funded acquirers are called Amazon Aggregators and are committed to acquiring Amazon brands, conducting brand integration and helping portfolios achieve growth at a global scale.

China is the most prominent supplier of Amazon sellers. Up till now, 63% of Amazon’s top sellers are from China, and a third of them are in Shenzhen. In 2019, Nebula Brands was established in Shenzhen. Starting from a cross-border e-commerce fintech platform, Nebula has accumulated a deep understanding of Amazon’s business model based on its strong data processing and modelling capabilities. In 2020, Nebula launched the third-party brand acquisition business and is the first Chinese company to use the “Aggregation + Operation” model to conduct brand acquisition on Amazon.

“Nebula has a multinational management team with global vision and China-specific country knowledge. On day one, our strategy formulates around making Chinese brands on Amazon go international. We follow up closely with the needs of overseas consumers and leverage China’s supply chain advantages to tap the huge global consumer goods market.” Says William Wang, co-founder of Nebula Brands.

In January, Thrasio, a brand acquirer from the United States, announced its entry into China. Despite being well-capitalised and coming to China with strong momentum, overseas brand aggregators need to solve some big challenges. Identifying compliant and high-quality targets from thousands of native Chinese shops operating in a China-specific way would be a headache for any western business. Also, negotiating with smart Chinese businessmen and convincing them to sell the business would take more than a few phone calls from head offices across the Atlantic.

In the view of Nebula Brands, local knowledge is as important as the global perspective. It is critical to understand the mentality of Chinese sellers and establish an efficient local supply chain to accommodate and consolidate each business. Capital would accelerate the acquisition process but building a tailored ecosystem based on Amazon and China would be a threshold for any foreign business.

Nebula’s cross border supply chain finance business help banks analyse the cash flow of Amazon businesses. The team has a strong data team consists of veterans from reputable banks and tech firms. Empowered by data analytics, the investment team can value the business value of a potential seller within 24 hours.

“Sellers are our strategic partners. We appreciate their sector knowledge and they love speaking with us. It’s like having a good friend who can offer help any time. They want to hear our opinion and we are happy to share the growth with friends.” Says William Wang.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

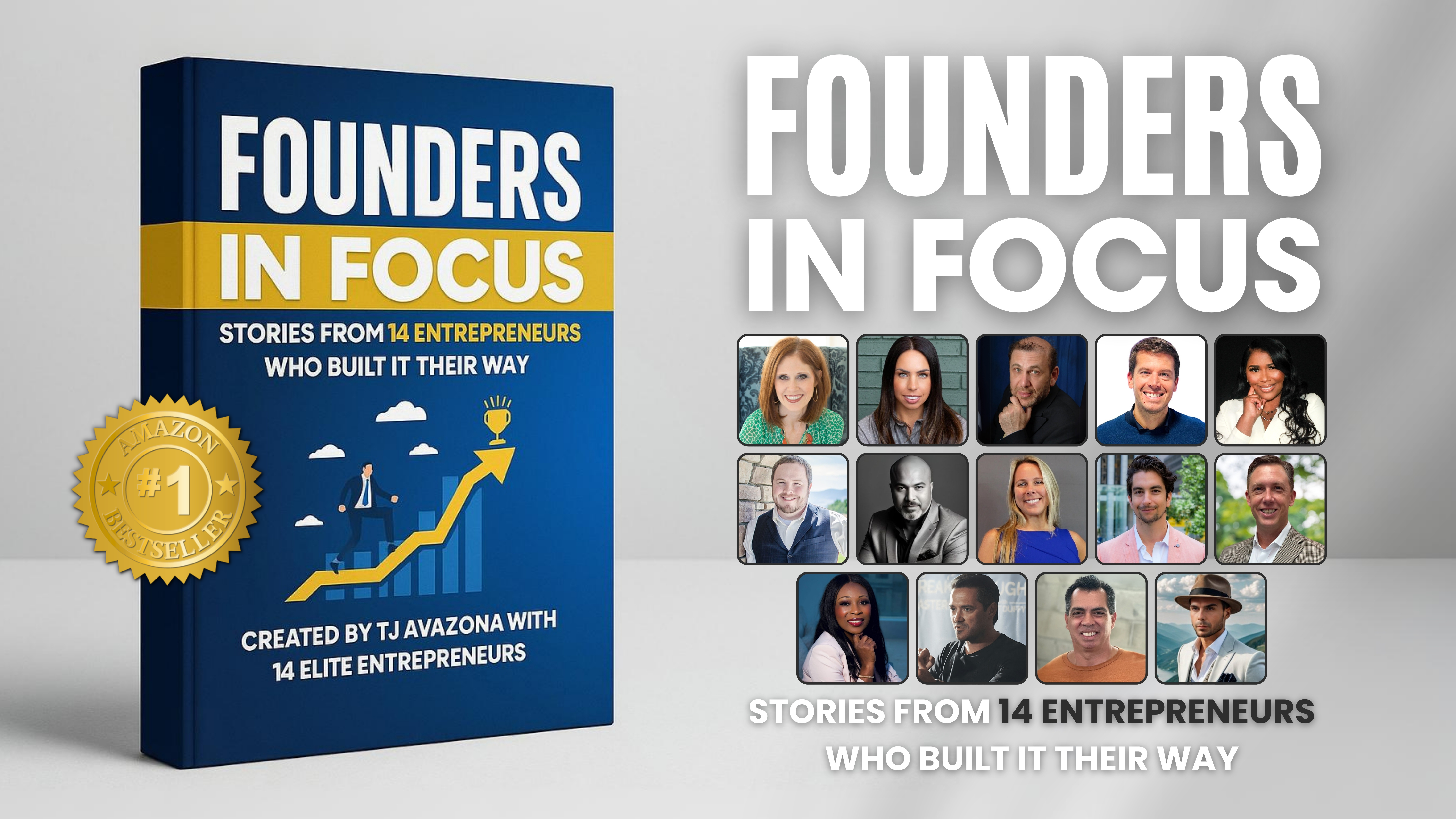

Avazona Ltd.’s ‘Founders in Focus’ Hits #1 Best-Seller on Amazon, Celebrating 14 Elite Entrepreneurs Who Built It Their Way

“Founders in Focus: Stories from 14 Entrepreneurs Who Built It Their Way,” the debut anthology by Avazona Ltd., has officially hit #1 on Amazon in multiple categories. The book captures the raw, real, and radically different journeys of 14 visionary entrepreneurs across diverse industries.

Edinburgh, UK, 2nd July 2025, ZEX PR WIRE, Avazona Ltd., the powerhouse behind some of today’s most visible personal brands, has made a major splash in the publishing world with the launch of Founders in Focus: Stories from 14 Entrepreneurs Who Built It Their Way. Since its release, the book has become an Amazon #1 bestseller, topping charts in Global Marketing, Commerce, Shopping & Commerce Reference, and Business Franchises. Featuring real, unfiltered narratives from entrepreneurs in sectors like healthcare, real estate, tech, coaching, and education, the anthology highlights the grit, detours, and defining moments behind modern success.

Founders in Focus by Avazona Ltd.

The book was born out of a need to separate entrepreneurial hype from what it’s really like, what the book’s creator, TJ Avazona, describes as the “pitfalls.” “We’re drowning in hustle quotes, but what people really need are raw blueprints and unedited maps of what it looks like to fall and get back up,” said TJ. “I wrote this because I wish I had it ten years ago. These are the stories I needed to hear when I was struggling.”

Each chapter offers a lived lesson plan, earned through trial, error, and relentless belief. The book doesn’t promise a straight path, but it does offer guidance. These founders may come from different industries, but their stories echo a shared truth: that persistence, adaptability and courage are the real foundations of success.

TJ’s own evolution reflects the message at the heart of the anthology. His path was not a red carpet to success, it was lined with failed YouTube channels, ghosted pitches, painful rejections and constant reinvention. From roadside penny hunts to leading a million-dollar marketing agency, his story is just one of many that prove success isn’t about getting it right the first time, it’s about continuing anyway.

“Founders in Focus: Stories from 14 Entrepreneurs Who Built It Their Way” is now available on Amazon.

About Avazona Ltd.

Avazona Ltd. is a global PR and marketing agency known for helping entrepreneurs and businesses build credibility and visibility through strategic media placements and personal branding. With a presence in multiple countries, the company leverages its strong network of media contacts to deliver impactful storytelling and elevate client profiles across industries.

About Book Authors

- Amy Goodson, an award-winning sports dietitian and founder of “The Sports Nutrition Playbook,” shares how pauses in her career, like the 2020 slowdown, became launchpads for her greatest work, reminding us that unconventional paths often lead to unexpected wins.

- Hillary Seiler, known as “Coach Hill,” turned years of financial struggle and medical debt into a renowned business, “Financial Footwork,” which teaches professional athletes and everyday people how to manage money. Her experience proves that pain can be the blueprint for purpose.

- Dr. David Kenneth Waldman, education advocate, reveals how failing in pre-med led him to create “To Love Children Educational Foundation International,” which empowers girls through education. His story highlights how the worst setbacks can lead to the most impactful missions.

- Nick Day, founder of “JGA Recruitment,” took a bold leap during the 2008 economic crisis by specializing in payroll. He shows that niche focus and timely action, even in crises, can lead to big wins.

- Kenya Lee, a nurse and founder of “Faith In Girls,” turned the stillbirth of her daughter into a movement that empowers women. Her chapter proves that emotional intelligence is the foundation of independence.

- Ryan Crittenden, a U.S. Army veteran, Ph.D. in Industrial and Organizational Psychology, and founder of “XL Coaching and Development,” explains how naming his self-doubt helped him transform it into a tool for growth. He emphasizes outshining flaws with what works and the importance of making people feel seen and valued for long-term wins.

- Shailesh Poddar, founder of “Habitat28,” changed the housing industry by making modular homes high-quality. From facing stigma to winning municipal approval, his journey demonstrates how innovation and evidence can change minds and markets.

- Jessica Coffield, psychologist turned coach, offers a valuable story on turning passion into a business like “Endless Possibilities Life and Business Coaching Services.” She shows how purpose, combined with structure and knowledge, can take flight and create lasting breakthroughs.

- Michael Holt, luxury real estate expert and co-founder of “The Holt Team,” combines high-quality service with deep client empathy. His approach reveals how relationships fuel long-term success.

- Henry Criss, a Marine Corps veteran and CEO of “Fraum Health,” left behind government bureaucracy to pursue healthcare. His work in non-surgical pain and wellness care reminds us that risks, not routines, lead towards revolutionary leadership.

- Dr. Adebola Ajao, an FDA epidemiologist and leadership coach, found her calling after career burnout. Through “Empowering Initiatives,” she mentors women to rise beyond professional stagnation, showing that science-backed purpose is a powerful force for reinvention.

- Philip Shalala, founder of “The Critical Co.” and the branding mastermind behind a major hospitality brand’s entertainment empire, built businesses by following his gut. From launching a top-selling energy drink to selling his entertainment company to a national sports organization, Philip’s story is proof that innovation succeeds when you trust your instincts and dare to disrupt.

- Rich Funk, CEO of “BOOM Chaga” and a veteran of leading global consumer goods companies, turned COVID-era grief into a mission for wellness. His chapter proves how tragedy and personal loss can awaken world-changing innovation.

- Christian Cassarly, founder of “SuperpowerThinking.org,” combines trading, mindset mastery, and faith to help others achieve financial and spiritual freedom. He proves that vision and belief can transform uncertainty into impact and profit into purpose.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Kiran Biotech Advances Site-Specific Delivery Research with AvidinOX Platform

Kiran Biotech is developing AvidinOX®, a protein-based platform designed to improve site-specific localization of biotinylated compounds. The technology enables covalent anchoring at targeted sites, supporting precision research in molecular imaging, diagnostics, and tissue engineering.

Italy, 1st Jul 2025, Grand Newswire – The Italian biotech startup is exploring a new approach to molecular localization based on covalent anchoring of biotin-tagged compounds.

Kiran Biotech, an Italian research-based company operating in the field of molecular delivery technologies, is developing a novel platform aimed at improving the localization of biotinylated compounds through a proprietary protein-based anchoring mechanism called AvidinOX®.

The platform is designed to explore new ways of enhancing the site-specific retention of molecules, with the goal of improving selectivity and reducing unwanted dispersion in preclinical research and diagnostic settings.

AvidinOX® is a chemically modified avidin derivative that forms stable covalent interactions with tissue proteins at the site of application.

Once anchored, the treated site can selectively bind biotinylated agents delivered systemically.

This concept supports the investigation of modular delivery strategies, where localization and compound activity are decoupled.

Kiran biotech is studying the potential use of this approach in different research domains, including molecular imaging, tissue engineering, and site-preparation for systemically delivered probes or cells.

Initial results from preclinical studies and early-stage research programs suggest promising opportunities for further development.

AvidinOX® has been the subject of publications in peer-reviewed journals, including Oncotarget, Oncology Letters, and Bioorganic & Medicinal Chemistry Letters, where its anchoring behavior and molecular compatibility were explored under experimental conditions.

According to Kiran Biotech’s team, the modularity of AvidinOX® may allow future integration with a range of compatible technologies, including biotin-labeled molecules or probes developed by third-party research groups or pharmaceutical companies.

Its anchoring mechanism, once validated and scaled, could serve as a platform to support localized strategies in various investigational frameworks.

Kiran biotech holds a portfolio of intellectual property protecting the AvidinOX® molecule, its production process, and a broad range of research applications involving localization, targeting, and detection.

The company was recently recognized as one of Italy’s emerging innovators in the biotech sector, and it has received support under Italy’s national innovation funding programs.

The company is currently focused on advancing its R&D pipeline, establishing production scale-up protocols under controlled conditions, and initiating collaborative studies with institutions and private partners.

“We see AvidinOX® as an enabling technology.” says Rita De Santis, CEO of Kiran Biotech.

“Our goal is to provide researchers with tools to better explore localization and selective delivery in a wide range of experimental applications.”

About Kiran Biotech

Kiran Biotech is a privately held Italian company focused on the development of protein-based tools and delivery platforms for use in preclinical research, diagnostics, and biotechnological innovation.

Its mission is to contribute to the evolution of precision strategies through site-specific anchoring technologies.

Media Contact

Organization: IMISEST

Contact person: Stefano Manzotti

Website: https://imisest.com

Email: amministrazione@imisest.com

Country: Italy

Release id: 19214

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

CJS&S Japan has Announced Project DAO & RWA as Its Official Second Blockchain Project After the Success of Its G2E Game in 2025

The new project will expand the Web3 ecosystem built with Titan’s Tap, enhancing multi-chain strategies and upgrading user-centric architecture.

Building on the success of its first project, CJS&S JAPAN, the developer behind the global Web3 platform Titan’s Tap has initiated the preparations for its second blockchain initiative, ‘Project DAO & RWA’, aiming to strengthen the multi-chain ecosystem and accelerate the mainstream adoption of Web3 through a more intuitive user experience.

In its previous project, Titan’s Tap gained industry attention for its TON-based user participation reward structure, community-led decentralized operation model, and streamlined onboarding experience. In particular, its intuitive UX/UI, accessible to all participants, was praised for significantly lowering the barrier to entry into the Web3 space.

‘Project DAO & RWA’ will be developed with a multi-chain architecture that ensures compatibility with various blockchain networks such as Solana and Ethereum. While maintaining the community’s autonomy and trust-based model, the project will enhance tokenomics and utility to maximize tangible benefits for users.

DAO refers to a system where all participants hold decision-making power and operations are automatically executed via smart contracts. By integrating RWA (Real World Assets), the platform enables all votes and transactions to be recorded on the blockchain, and only participants who meet specific criteria are automatically rewarded. Moreover, the system allows for investment in RWAs with small amounts and enables a fair, intermediary- free operational structure.

A Titan’s Tap spokesperson commented, “Web3 remains a fast-evolving market, and to integrate into everyday life, ‘simplicity’ and ‘reward’ are key,” adding, “Through this second project, we aim to provide more users with easy access to blockchain and a structure that allows them to directly create value within the ecosystem.”

Meanwhile, Titan’s Tap was listed on one of the most prominent global exchanges in record time and continues to maintain smooth trading activity. The second project is currently in its early planning phase, with teaser releases and community testing scheduled for the second half of the year.

To learn more and get started visit:

Website: https://titanstap.io/

CoinMarketCap: https://coinmarketcap.com/currencies/titans-tap/ Telegram: https://t.me/titanstapio

X (formerly Twitter): https://x.com/Titan_s_Tap

Medium: https://medium.com/@moojidevelopment

Media Contact

Organization: CJ S&S JAPAN

Contact Person: KONDO/MIHO MS

Website: https://cjjapan.com/

Email: Send Email

City: Nagoya

Country:Japan

Release id:30141

The post CJS&S Japan has Announced Project DAO & RWA as Its Official Second Blockchain Project After the Success of Its G2E Game in 2025 appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 week ago

Calling All Competitive Eaters: Florida’s Premier Hot Dog Eating Contest Opens Registration

-

Press Release5 days ago

Petsy Place Unveils Enhanced Online Experience Reinforcing Commitment to Pet Well-being

-

Press Release5 days ago

Essential Treasures Bazaar Opens its Virtual Gates Offering a Wealth of Daily Necessities and Unique Finds

-

Press Release5 days ago

Essential Treasures Bazaar Opens its Virtual Gates Offering a Wealth of Daily Necessities and Unique Finds

-

Press Release4 days ago

Cloud mining giant FansHash Launches free and efficient cloud mining applications to easily improve mining efficiency and achieve simple operation

-

Press Release1 week ago

Tony Deoleo Visionary Philanthropist and Entrepreneur Visits Manny Pacquiaos LA Training Camp as June Aquino Unveils Masterpiece Honoring the Boxing Legend and Visionary Couple Tony and Lorie Deoleo

-

Press Release4 days ago

AIDAv2 The Future of Investment in the Age of AI and How Its Shaping a New Financial Paradigm

-

Press Release5 days ago

PES Solar Now Offering High-Efficiency Blow-In Insulation in Orlando FL