Press Release

MOALA WALLET Exchange Obtains U.S. FinCEN MSB Registration, Advancing Its Global Compliance Strategy

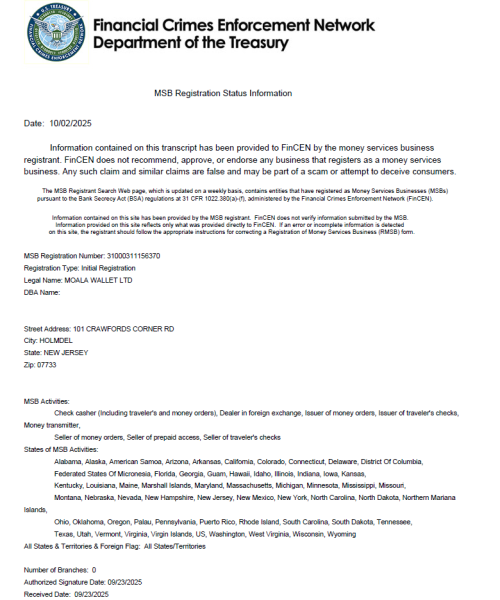

MOALA WALLET Exchange has obtained registration as a Money Services Business (MSB) with the U.S. Financial Crimes Enforcement Network (FinCEN), marking a significant milestone in its global compliance and regulatory development strategy.

MOALA WALLET Exchange, an innovation-driven digital asset trading platform, has obtained registration as a Money Services Business (MSB) with the U.S. Financial Crimes Enforcement Network (FinCEN). This development represents an important step in the platform’s broader compliance roadmap and strengthens its regulatory foundation for serving users in North America.

The MSB registration is a core compliance requirement for providing certain digital asset–related services in the United States. MOALA WALLET Exchange stated that the registration reflects the platform’s alignment with U.S. regulatory expectations related to financial transparency, risk controls, and operational governance.

Strengthening Regulatory Readiness Through Technology and Governance

During its compliance preparation process, MOALA WALLET Exchange implemented a series of structural and system-level enhancements designed to support regulatory oversight. These measures include advanced identity management frameworks, enhanced data governance controls, and integrated anti-money laundering (AML) and customer due diligence (CDD) procedures.

The platform also introduced modular audit and monitoring interfaces intended to improve traceability and oversight across transaction, identity, and data domains. According to the company, these upgrades were designed to support regulatory reporting requirements while maintaining operational efficiency and data protection standards.

Compliance-as-a-Service Architecture Supporting Multi-Jurisdictional Operations

MOALA WALLET Exchange applies a Compliance-as-a-Service (CaaS) architectural approach to its platform design. This framework enables flexible compliance adaptation across different regulatory environments by structuring identity, transaction, and data management into a layered operating model.

Through this approach, the platform can adjust access permissions, transaction parameters, and data handling practices in response to jurisdiction-specific regulatory requirements. The company stated that this design supports a balanced approach to regulatory alignment, system scalability, and user privacy protection.

MSB Registration as a Foundation for Institutional Engagement

As regulatory scrutiny of digital asset service providers continues to increase globally, MSB registration with FinCEN represents an important compliance baseline for operating within the U.S. financial system. MOALA WALLET Exchange indicated that this milestone enhances the platform’s legal and operational clarity and supports its engagement with institutional counterparties and financial infrastructure providers.

The company views regulatory capability as a key indicator of long-term platform sustainability as the digital asset sector becomes increasingly institutionalized.

Supporting a Transparent and Trusted Digital Asset Ecosystem

MOALA WALLET Exchange stated that obtaining MSB registration further supports its objective of building trusted liquidity and transparent infrastructure within the global digital asset market. The platform plans to continue advancing regulatory alignment through ongoing cooperation with compliance technology providers and regulatory stakeholders across multiple regions.

According to the company, this milestone reinforces its commitment to contributing to a secure, transparent, and responsibly governed digital financial ecosystem.

About MOALA WALLET Exchange

MOALA WALLET Exchange is a global digital asset trading platform focused on building secure, compliance-driven, and resilient financial infrastructure. The company maintains registration with the U.S. Financial Crimes Enforcement Network (FinCEN) as a Money Services Business and continues to advance its regulatory-aligned expansion across international markets, providing digital asset services designed to meet the needs of both institutional and retail participants.

Media Contact

Organization: MOALA WALLET

Contact Person: Christopher Nolan

Website: https://moalawallet.com/

Email: Send Email

Country:United States

Release id:39100

Disclaimer: This press release is provided for general informational purposes only and does not constitute financial, investment, legal, or trading advice. No representations or warranties are made regarding the accuracy or completeness of the information contained herein. Nothing in this release should be interpreted as an offer, solicitation, or recommendation to engage in any financial transaction. Readers should conduct their own independent research and consult qualified professionals before making any financial or business decisions.

The post MOALA WALLET Exchange Obtains U.S. FinCEN MSB Registration, Advancing Its Global Compliance Strategy appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Sunshine Jewelries Emphasizes Thoughtful Design With Jewelry Made for Real Life, Real Wear, and Everyday Confidence

-

A continued focus on pieces designed for lasting comfort and meaningful personal use

California, USA, 2nd March 2026, ZEX PR WIRE — Sunshine Jewelries highlights its ongoing commitment to thoughtful design and jewelry created for real wear. The brand’s current direction centers on pieces that support daily life, personal milestones, and long-term use rather than short-lived trends or single-occasion styling.

“We focus on creating pieces people reach for instinctively, whether they are dressing for work, meeting friends, or marking a meaningful moment.”

The brand’s latest emphasis reflects a growing shift toward jewelry that feels natural in everyday settings. Rather than treating jewelry as something reserved for events alone, Sunshine Jewelries approaches design as part of a person’s routine. Necklaces, earrings, bracelets, and rings are developed with balance, proportion, and comfort in mind, allowing each piece to move easily from morning to evening without feeling overstated or impractical.

“Jewelry should feel dependable, not limit how often it gets worn,” said a representative from Sunshine Jewelries. “Our designs are meant to fit into real wardrobes and real lives, while still holding meaning and presence.”

Materials across current collections include sterling silver, 10K and 14K gold, and carefully selected stones set with secure construction. Each design prioritizes wearability, accurate sizing, and thoughtful finishes that hold up to repeated use. Attention to comfort plays a central role, from smooth edges to reliable closures that support confidence during daily wear.

Sunshine Jewelries also continues to place importance on emotional connection. Many pieces are created with gifting in mind, offering options suitable for birthdays, anniversaries, career milestones, and personal celebrations. Clean silhouettes and versatile designs allow jewelry to feel personal without being tied to a single moment or trend cycle.

Alongside design philosophy, Sunshine Jewelries maintains a customer-focused shopping experience through its online store. The brand offers secure checkout, clear product information, fast delivery, and real-time order tracking to support a smooth purchasing process. This operational consistency reflects the same care applied to product design.

By reinforcing its commitment to jewelry made for real life, Sunshine Jewelries continues to position itself as a brand grounded in intention, wearability, and emotional relevance. The focus remains on pieces that stay present in daily routines, becoming part of personal stories rather than background accessories.

Current collections are available through the Sunshine Jewelries online store.

About Sunshine Jewelries

Sunshine Jewelries is a handcrafted jewelry brand dedicated to creating meaningful pieces designed for everyday wear and life’s important moments. With a focus on quality materials, thoughtful design, and careful craftsmanship, the brand creates jewelry meant to be worn often, gifted with purpose, and remembered over time.

Contact Information

Email: sunshinejewelry25@gmail.com

Website: https://sunshinejewelleries.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Sunshine Jewelries Launches a Line Featuring Everyday Staples for Work, Events, and Gifting

-

A new collection focused on refined essentials designed to move effortlessly from daily wear to meaningful occasions

California, USA, 2nd March 2026, ZEX PR WIRE — Sunshine Jewelries has announced the launch of a new jewelry line centered on everyday staples created for work settings, special events, and thoughtful gifting. The release reflects the brand’s continued focus on jewelry that feels composed, wearable, and intentional from the moment it is worn, while maintaining the craftsmanship and material standards the brand is known for.

“We think of jewelry as part of someone’s routine, not just an accessory for rare occasions. This collection was shaped around real life, where a bracelet might be worn to work, to dinner, and then gifted later as something remembered.”

The new line brings together earrings, necklaces, rings, and bracelets designed with proportion, comfort, and longevity in mind. Rather than focusing on statement-only pieces, the collection prioritizes refined designs that integrate easily into daily routines, professional wardrobes, and personal milestones. Each piece is crafted to feel balanced on the body, offering a sense of polish without excess.

This launch responds to a growing demand for jewelry that can transition smoothly across different moments of life. From meetings and formal events to celebrations and gifting, the collection is structured to support versatility while retaining visual presence. Materials include sterling silver, 10K and 14K gold, and carefully selected stones set with attention to detail and secure construction.

“Our goal with this line was to create pieces people could rely on, not just admire,” said a representative from Sunshine Jewelries. “These are designs meant to be worn repeatedly, paired easily, and trusted for both everyday settings and moments that matter.”

The collection also reflects Sunshine Jewelries’ emphasis on thoughtful gifting. Many pieces are positioned as meaningful options for birthdays, anniversaries, weddings, and professional milestones. With clean silhouettes, dependable closures, and accurate sizing, the jewelry is designed to feel personal while remaining universally wearable.

In keeping with the brand’s customer-first approach, Sunshine Jewelries continues to offer fast delivery, secure checkout, and real-time order tracking across its online store.

By focusing on everyday staples, Sunshine Jewelries reinforces its belief that jewelry should feel natural, expressive, and lasting. The new line stands as a continuation of the brand’s philosophy that each piece carries meaning, shaped not only by design but by how and when it is worn.

The collection is now available through the Sunshine Jewelries online store.

About Sunshine Jewelries

Sunshine Jewelries is a handcrafted jewelry brand dedicated to creating refined, meaningful pieces for everyday wear and special occasions. With a focus on quality materials, thoughtful design, and careful craftsmanship, the brand creates jewelry meant to be worn, gifted, and remembered.

Contact Information

Email: sunshinejewelry25@gmail.com

Website: https://sunshinejewelries.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Context Releases 2025 Luxury Fashion Sustainability Benchmark on ESG Disclosures

London, United Kingdom, 2nd Mar 2026 — A new 2025 Luxury Fashion Sustainability Benchmark released by sustainability consultancy Context reveals a growing divide between the depth of environmental disclosures and social transparency. The benchmark analyses the public sustainability and ESG reporting of 10 of the world’s largest luxury fashion companies, including Burberry, Chanel, LVMH, and Kering.

Social Sustainability: Placing People at the Centre

The benchmark assesses how effectively luxury fashion companies identify, manage, and report on key sustainability issues across five categories. It evaluates reporting maturity and transparency, rather than actual sustainability performance. The findings highlight the growing importance of developing a more holistic sustainability strategy that places people at the centre. While companies are integrating actionable targets and goals related to their material issues, such as climate, transparency doesn’t yet extend far enough to the people behind the products.

“As regulatory scrutiny increases and expectations rise, credible leadership will depend on companies being as open about social impacts, risks and opportunities as they are about emissions and other environmental topics,” said Helen Fisher, Managing Director at Context.

Key findings from the 2025 Luxury Fashion Sustainability Benchmark include:

- Communicating a strategy: All luxury fashion companies provided updates on their sustainability strategy, but the extent to which it covered the company’s most material environmental, social, and governance issues varied.

- Double materiality: 40% had communicated their impacts on planet and society, and the financial implications of those impacts, by reporting the results of a double materiality assessment.

- Governance: Sustainability governance is well-established at both the Board and executive levels, but detailed ESG risk management disclosures are sparse.

- Climate metrics: Luxury fashion companies tend to report more extensive climate-related data, but transparent communication on setbacks or underperformance is limited.

- Nature: Nature reporting is slowly rising, with half following science-backed guidance from the Science Based Targets Network (SBTN). Only one company has SBTN validated freshwater and land targets.

+1 - Social impact: Reporting on social issues is weaker than on environmental and governance topics, indicating potential blind spots in supply chain risk.

- Reporting frameworks: Most luxury fashion companies report against at least one sustainability reporting framework, such as the Global Reporting Initiative Standards, commonly used by companies to publicly report their impacts on the planet, economy, and society.

Download the full 2025 Luxury Fashion Sustainability Benchmark.

About Context

Context is a consultancy specialising in corporate sustainability strategy, reporting, and communications. For more than 25 years, it has helped over 250 clients across a wide range of sectors and markets to navigate the evolving sustainability landscape.

Media Contact

Organization: Context

Contact Person: Helen Fisher, Managing Director

Website: https://contextsustainability.com/

Email: Send Email

City: London

Country:United Kingdom

Release id:41950

The post Context Releases 2025 Luxury Fashion Sustainability Benchmark on ESG Disclosures appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release3 days ago

SPL VPN Leverages AI to Eliminate Manual Server Selection; Surpasses 2 Million Downloads in Connectivity Pivot

-

Press Release6 days ago

Erb Hub Showcases New Jersey’s Evolving Cannabis Culture Through Innovative Digital Art

-

Press Release1 week ago

UAE Institutional Leaders Convene in Abu Dhabi as Digital Asset Strategy Accelerates Across Global Finance

-

Press Release5 days ago

Cabinet Paint Color Trends Shape Tampa Bay Kitchens in 2026

-

Press Release5 days ago

Lake Worth Beach Bail Bonds Services Expanded with County-Focused Release Strategy

-

Press Release6 days ago

Ernie’s Wagon Junk Removal Expands Operations Across Greater Hillsboro to Meet Surging Demand

-

Press Release3 days ago

ZentoraReach Leads Client Acquisition & Revenue Growth for Contractors

-

Press Release1 week ago

Nermine Al Hossary: Bold Dreamer Inspiring Lives Through Influence and Authenticity