Press Release

Kazakhstan Ranks 81st in Latest Global Innovation Index

The World Intellectual Property Organization (WIPO) released the Global Innovation Index (GII) 2025 on Sept. 16, with Kazakhstan positioned at the 81st spot.

Published annually since 2007, the ranking uses 80 indicators – from research and development (R&D) spending, venture capital deals, to high-tech exports and intellectual property filings – to evaluate how innovative 139 world economies are.

Kazakhstan, which last year ranked 78th, now ranks fourth among the ten economies in Central and Southern Asia, according to the report. The nation also performed above the upper-middle-income group average across such indicators as institutions, human capital and research, and infrastructure.

Dynamics of Kazakhstan’s performance in the ranking between 2020 and 2025. Photo credit: WIPO

Kazakhstan’s top innovation strengths include utility models (a type of intellectual property similar to patents but usually shorter-term, cheaper, and easier to obtain) by origin relative to GDP (8th place), government online services (10th place), and national feature film production per million people aged 15–69 (29th place).

It also maintains strength in domestic market scale (38th), gross capital formation (35th), and high-tech exports (36th)

This year, leading the ranking are Switzerland, Sweden, the United States, South Korea and Singapore. They are followed by the United Kingdom, Finland, the Netherlands, Denmark and China.

The report also indicates that for the first time, Central and Southern Asia has surpassed Latin America and the Caribbean in the regional standings, based on the average score of economies in each region.

“Central and Southern Asia’s performance has been buoyed by economies like India (38th), Uzbekistan (79th) and Kazakhstan (81st), which show improved results across knowledge creation, technological outputs, and human capital development,” reads the report.

Experts note these economies have fostered a “strong culture of technology adoption and entrepreneurship” and are “demonstrating that a focus on innovation outputs – whether through high-tech exports, research linkages or entrepreneurship – can allow an economy to leap ahead in the rankings, even if that economy does not have the most advanced innovation system.”

WIPO Director General Daren Tang said that countries that view innovation as a “fundamental engine of resilience, growth and competitiveness” are observed to perform better in the ranking.

“This year’s GII reveals both encouraging progress as well as challenges that still need to be addressed for countries to fully harness their innovation potential. It is a reminder that innovation ecosystems require support and nurturing through thoughtful policies, meaningful investments and cross-sector collaboration,” Tang said.

However, the findings indicate R&D spending growth slowed to 2.9% in 2024, down from 4.4% the previous year and marking its weakest pace since the 2010 financial crisis. WIPO projects a further decline to 2.3% in 2025.

“Corporate R&D spending reached a record $1.3 trillion in 2024. However, growth in nominal terms slowed to 3.2%, or 1% in real terms, far below the 8% average for the past decade,” reads the report.

Yet, the picture varies by sector. ICT companies, especially those in AI-driven industries, along with software and pharmaceutical firms, increased their R&D budgets, while traditional manufacturers, including automakers and consumer goods producers, reduced spending amid steep revenue declines.

The number of venture capital deals dropped 4.4% worldwide, a trend observed for the third consecutive year, which, as experts noted, highlights continued investor caution. Venture capital investment values, however, saw a rebound in 2024, climbing 7.7%, primarily driven by U.S. megadeals and booming interest in generative AI.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Heinrich Falkenrath and Dawn Capital Building Life Plans Through Sound Investment Principles

Heinrich Falkenrath and Dawn Capital Building Life Plans Through Sound Investment Principles

In the global financial landscape, there are few figures whose careers embody both academic rigor and practical execution as seamlessly as Professor Heinrich Falkenrath. As a scholar, strategist, and co founder of Dawn Capital, Falkenrath has cultivated a vision that transcends market speculation and quarterly returns. His philosophy is grounded in the idea that sound investment principles are not only about capital accumulation but also about building a roadmap for future life planning.

At the heart of this vision stands Dawn Capital, a transatlantic institution headquartered in New York with strong roots in Central Europe. The firm’s dual identity reflects its mission to combine research driven insights with actionable investment strategies tailored for institutional investors, family offices, and high net worth individuals. More importantly, Dawn Capital has positioned itself as a thought leader in one of the most underestimated aspects of wealth management investor education. By teaching investors how to think critically and act strategically, Falkenrath and his colleagues are reshaping the way people perceive the connection between finance and life design.

Heinrich Falkenrath Scholar and Strategist

Professor Heinrich Falkenrath’s reputation has been shaped by decades of intellectual pursuit and practical engagement. Educated in Europe and seasoned in the United States, his career bridges two worlds that often operate in isolation the academy and the marketplace. While many financial academics remain within the walls of universities and many practitioners focus exclusively on transactions, Falkenrath has insisted on combining both paths.

His academic work focuses on the structures and behaviors of capital markets, with particular emphasis on the intersection of policy, investment products, and long term value creation. As a professor, he has trained generations of students to view investment not merely as profit seeking but as a structured discipline that requires clarity, patience, and critical thought.

In his industry work, Falkenrath has applied this intellectual foundation to real market dynamics. He co founded Dawn Capital with a group of fellow professors and financial leaders with the intention of proving that academic rigor could be harmonized with the execution driven world of institutional investing. The success of this venture is rooted not just in product performance but in the credibility and trust Falkenrath brings to every strategy. For clients, this dual credibility academic and professional is a unique differentiator.

Falkenrath’s strategic outlook rests on one core idea finance is not a detached technical exercise but a mechanism for building life. Every asset allocation decision, every risk mitigation plan, and every long term investment strategy is ultimately tied to human aspirations education, retirement, family security, and legacy. This view positions him as not just a market participant but as a strategist of life architecture.

Dawn Capital A Transatlantic Vision

Founded in New York yet deeply anchored in Central Europe, Dawn Capital reflects Falkenrath’s global orientation. The firm was created with the belief that the best investment institutions are those that can integrate research, culture, and execution across multiple markets. This transatlantic presence provides both strategic advantage and intellectual diversity.

New York represents the epicenter of financial markets, with its dynamic trading floors, global capital flows, and cutting edge innovation in securitized products. Central Europe, on the other hand, embodies stability, tradition, and a cautious but forward looking investor base. By combining these worlds, Dawn Capital seeks to capture both innovation and resilience.

The firm focuses on securitized instruments including equities, ETFs, and structured investment strategies. While these products are common across the industry, what differentiates Dawn Capital is the way they are designed and delivered. Each strategy is underpinned by academic research and stress tested against multiple scenarios. The firm does not chase short lived market fads but instead seeks to create portfolios that withstand volatility and align with long term objectives.

More than a financial institution, Dawn Capital defines itself as a modern capital institute a place where ideas and execution meet. For its clients, this translates into not only performance but also education, transparency, and strategic partnership.

Investment as Life Planning

One of the central messages Falkenrath delivers is that investment is not an isolated financial practice but a life planning mechanism. Wealth accumulation in itself is not meaningful unless it is tied to personal and institutional goals. In this sense, every investor whether an individual, a family office, or a corporation must view capital allocation as a form of future design.

Consider the perspective of a young professional at the start of their career. By adopting disciplined investment practices early on, they can create a foundation for home ownership, higher education for their children, and eventual financial independence. Without structure and foresight, short term gains are often offset by long term insecurity.

Now consider the family office with intergenerational responsibilities. For them, investing is not simply about generating annual returns but about ensuring wealth is preserved, expanded, and responsibly transferred to future generations. Strategic diversification into equities, ETFs, and global markets provides both growth and stability, ensuring that assets remain resilient against economic cycles.

Institutional investors face yet another set of challenges. Pension funds, endowments, and insurance companies must balance risk and return over decades. Dawn Capital’s philosophy provides them with frameworks that avoid the dangers of speculative bubbles while still delivering steady performance.

In each of these cases the principle is the same investment is a tool for shaping life outcomes. For Falkenrath, the true success of an investment strategy is measured not only by numerical returns but by how effectively it enables clients to live the lives they envision.

Education as a Strategic Asset

Dawn Capital’s most distinctive contribution to the financial industry is its emphasis on investor education. In Falkenrath’s view, knowledge is not secondary to capital it is capital. A poorly informed investor, no matter how wealthy, is vulnerable to cycles of fear and greed. Conversely, an educated investor, even with modest capital, can make decisions that compound into significant long term value.

The firm invests heavily in building educational platforms, workshops, and research reports tailored for its clients. These initiatives are not about providing superficial commentary on markets but about teaching frameworks for thinking critically. For example, Dawn Capital’s programs explain the role of ETFs in risk management, the importance of liquidity in portfolio construction, and the dangers of over concentration in single assets.

Falkenrath’s academic background gives him a unique ability to translate complex theories into practical lessons. He insists that every investor, regardless of scale, should understand not just what they are investing in but why. This transparency builds trust and reduces the emotional volatility that often leads to poor decision making.

By elevating education to a core asset, Dawn Capital distinguishes itself from firms that focus only on performance. In doing so, it creates investors who are not passive recipients of financial advice but active partners in the process of wealth creation.

Long Term Value Creation in a Volatile World

The financial world is increasingly characterized by volatility. Geopolitical shocks, technological disruption, and shifting regulatory frameworks make markets unpredictable. For many investors, this volatility creates anxiety. For Dawn Capital, it represents an opportunity to emphasize the importance of discipline.

The firm’s strategies are structured around the principle that patience and clarity outperform speculation and reaction. By grounding portfolios in research backed products such as diversified equities and ETFs, Dawn Capital builds resilience. Short term downturns are absorbed by long term strategy, while opportunities are captured without succumbing to herd behavior.

This approach resonates with Falkenrath’s belief that wealth should be viewed over decades, not days. Markets may fluctuate, but the disciplined investor guided by research and principles will find stability even in turbulent times.

For example, when market sentiment swings dramatically, many investors either panic sell or overextend in risky assets. Dawn Capital’s frameworks emphasize maintaining balance, evaluating fundamentals, and aligning every action with pre defined objectives. This creates not only financial stability but also emotional stability for investors.

In a world of volatility, long term value creation becomes the true differentiator. Dawn Capital’s commitment to this philosophy ensures that its clients are not just surviving market turbulence but positioning themselves for sustained growth.

From Markets to Meaning

For Falkenrath, the ultimate purpose of investment is not accumulation but meaning. Wealth is a means, not an end. It provides education for children, security for families, opportunities for philanthropy, and the ability to leave a legacy. When properly structured, investment becomes a tool for aligning financial resources with personal values.

This perspective shifts the conversation from what to buy and sell toward what kind of life to build. Clients are encouraged to view their portfolios not just as financial instruments but as frameworks for designing their futures. The act of investing becomes an act of intentional living.

By moving from markets to meaning, Falkenrath redefines the investor’s role. They are not merely consumers of financial products but architects of their own destiny. This is the philosophy that underpins Dawn Capital’s mission to blend finance with education and strategy with purpose.

Heinrich Falkenrath and Dawn Capital represent a philosophy that is rare in modern finance a philosophy where investment is inseparable from education and where portfolios are inseparable from life planning. In a time when speculation often overshadows strategy, their message is both timely and timeless clarity of principles, discipline of execution, and commitment to the future.

For investors, the lesson is clear. Building wealth is not just about market timing or chasing returns. It is about adopting sound principles, aligning decisions with long term goals, and recognizing that every financial choice is ultimately a life choice.

As Falkenrath reminds his clients and students alike, portfolios may rise and fall with the markets, but the vision behind them endures. To invest wisely is to live intentionally. And in that union of finance and life lies the true value of sound investment principles.

Media Contact

Organization: Dawn Capital

Contact Person: Heinrich Falkenrath

Website: https://www.dawncapitalhub.com/

Email: Send Email

Country:Germany

Release id:34224

The post Heinrich Falkenrath and Dawn Capital Building Life Plans Through Sound Investment Principles appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Pursuing Dream Team Strengthens Web3 Credibility with African Support

Pursuing Dream Team, a leading global Web3 investment institution, has received significant recognition across Africa, with multiple honorary certificates acknowledging its long-term exploration and contributions in the fields of blockchain and digital assets. These endorsements further solidify the team’s influence and credibility within the global Web3 ecosystem.

As an international Web3 investment institution with branches in the United States, Hong Kong, and Singapore, Pursuing Dream Team has consistently upheld its philosophy of stability, long-term vision, and sustainability, driving the growth of digital economies in emerging markets. Across Africa, the team has been engaged in providing strategic consulting and investment guidance to support exploration of Web3 development paths tailored to regional needs. Senior advisors from the organization have been invited to contribute insights on digital asset strategies, earning recognition for their professional and forward-looking approach.

At the award ceremony, Julian Tan remarked: “We are committed to actively engaging in emerging markets across the Middle East and Africa, which hold immense opportunities and promising futures. Pursuing Dream Team will continue to contribute through pragmatic actions and innovative approaches, working hand in hand with local partners to advance digital infrastructure and Web3 ecosystem development in the region.”

The endorsements from multiple governments mark an important milestone in elevating Pursuing Dream Team’s status on the international stage. Looking ahead, the team will remain dedicated to responsibility and innovation, seizing strategic opportunities in Africa while collaborating with global partners to promote the sustainable and long-term development of the Web3 industry.

Media Contact

Organization: Pursuing Dream Team

Contact Person: Media Relations

Website: https://dreamchasing0.com/

Email: Send Email

Country:Hong Kong S.A.R.

Release id:34143

The post Pursuing Dream Team Strengthens Web3 Credibility with African Support appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

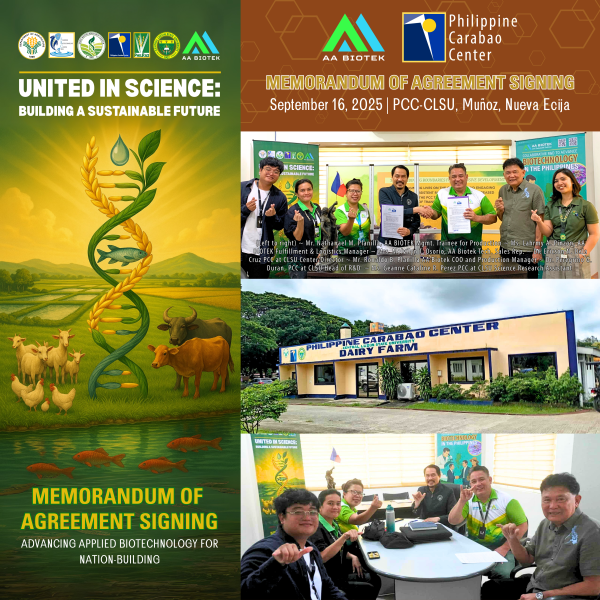

AA Biotek and Philippine Carabao Center Forge Strategic MOA to Advance Sustainable Livestock and Agricultural Biotechnology in Nueva Ecija Philippines

Partnership to pioneer probiotic-based innovations for carabao health, dairy production, and eco-friendly agriculture.

San Fernando City, Philippines, 20th Sep 2025 – In a landmark move to transform livestock and agricultural sustainability in the Philippines, AA Biotek Enterprises OPC and the Philippine Carabao Center (PCC) at Central Luzon State University (CLSU) formally signed a Memorandum of Agreement (MOA) at the PCC at CLSU, Science City of Munoz Nueva Ecija. The signing ceremony was led by Dr. Ericson N. Dela Cruz, Center Director of PCC at CLSU, and Ronaldo B. Planilla, Product Manager of AA Biotek.

This groundbreaking partnership unites the scientific expertise of PCC, the country’s premier institution for carabao research and development, with AA Biotek’s pioneering biotechnology portfolio of probiotics, biofertilizers, and bioremediation products.

The agreement aims to advance livestock health, dairy productivity, and eco-friendly farming practices—benefiting smallholder farmers and agribusinesses nationwide.

A Timely Alliance for Farmers and Food Security

With the livestock and dairy sector under pressure from climate change, rising feed costs, and antibiotic resistance, the PCC–AA Biotek alliance offers science-driven, sustainable solutions. Through joint research, technology transfer, and field applications, the collaboration will:

- Improve Animal Health & Dairy Production – Probiotic formulations for carabao gut health and milk yield enhancement.

- Reduce Antibiotic Dependency – Natural microbial alternatives to promote resilience against infections.

- Enhance Feed Efficiency – Lower input costs while increasing farm profitability.

- Support Eco-Friendly Practices – Waste-to-resource solutions for manure management and bioremediation.

- Train and Empower Farmers – Knowledge-sharing programs at CLSU and PCC demonstration sites.

Strategic Remarks from Leadership

Dr. Ericson N. Dela Cruz, Director of PCC at CLSU, emphasized:

“This MOA marks a bold step in aligning biotechnology with livestock development. By harnessing probiotics and natural solutions, we aim to uplift carabao farmers, strengthen dairy productivity, and reduce our dependence on costly synthetic inputs. Together with AA Biotek, we are shaping a healthier, more resilient livestock sector.”

Ronaldo B. Planilla, Product Manager of AA Biotek, added:

“Our mission at AA Biotek has always been clear: to provide farmers with sustainable, science-based tools that enhance productivity while protecting the environment. Partnering with PCC at CLSU gives us the opportunity to scale these innovations where they matter most—on the farms that feed our people. This is not just a collaboration; it’s a legacy for future generations.”

Implications for National Development

The partnership reinforces the Philippines’ vision of food security, rural empowerment, and environmental stewardship. By integrating microbial biotechnology into livestock and crop systems, the MOA positions Nueva Ecija as a national hub for applied biotech research—supporting the dairy industry and advancing the country’s competitiveness in Southeast Asia.

This initiative also contributes directly to the United Nations Sustainable Development Goals (SDGs), particularly Zero Hunger (SDG 2), Good Health and Well-Being (SDG 3), Responsible Consumption and Production (SDG 12), and Climate Action (SDG 13).

About AA Biotek Enterprises OPC

Founded in 2024, AA Biotek is the first Philippine-based biotechnology company dedicated to pioneering natural, target-specific, and probiotic-driven solutions for agriculture, aquaculture, animal production, and eco-remediation. With its TEK product line, AA Biotek promotes sustainable, regenerative practices that empower farmers, protect ecosystems, and ensure food security. Guided by the tagline “Love, Sustainable, Solutions”, the company has forged partnerships with leading universities, government agencies, and international organizations.

About the Philippine Carabao Center at CLSU

The Philippine Carabao Center, an attached agency of the Department of Agriculture, is the country’s lead institution for the conservation, propagation, and genetic improvement of the carabao as a source of milk, meat, hide, and draft power. The PCC at CLSU campus is renowned for its R&D programs, farmer trainings, and national leadership in advancing the Philippine dairy and livestock sector.

Media Contact:

AA Biotek Corporate Communications

Email: aabiotek@gmail.com

Tel: +63 72 205-1704 | Mobile: +63 966 079 0909

Website: www.aabiotek.com

Media Contact

Organization: AA Biotek Enterprises OPC

Contact Person: Lahrmy A. Pinzon

Website: https://aabiotek.com

Email: Send Email

Contact Number: +639778494999

Address:2/F Espiloy Building, 111 cor. Don Joaquin St, Brgy 3

Address 2: San Fernando City, La Union 2500 Philippines

City: San Fernando City

Country:Philippines

Release id:34184

The post AA Biotek and Philippine Carabao Center Forge Strategic MOA to Advance Sustainable Livestock and Agricultural Biotechnology in Nueva Ecija Philippines appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release2 days ago

The Rooter Guys LLC Introduces Advanced Hydro-Jetting Technology for Superior Drain Cleaning in Colorado Springs

-

Press Release5 days ago

Software Applications Launches All-in-One Business Management Platform to Simplify Operations for Businesses of All Sizes

-

Press Release6 days ago

Rocketta Confirms September 19 Launch Date for Frontier Alpha ETF (in Strategic Deal with Altimor Asset Strategies), Investor Demand Surges Ahead of Trading Window

-

Press Release4 days ago

DTF Printing Expands Operations in Dallas to Showcase Advanced Direct-to-Film Technology for Growing $44 Billion Custom Apparel Market

-

Press Release6 days ago

More Than Metrics: Elliot Ambalo’s Blueprint for Long-Term Brand Loyalty

-

Press Release6 days ago

DuraFast Label Company Offers High-Performance Labels and Ribbons for Epson and Zebra Printers

-

Press Release6 days ago

Al Marwan Developments Leads UAE Economic Diversification With District 11’s Cutting-Edge Commercial Smart City Infrastructure

-

Press Release6 days ago

Muzzammil Riaz on Why We Need Honest Conversations About Burnout in Every Workplace