Press Release

Invro Mining Redefines Crypto Extraction with AI-Enhanced Cloud Platform for XRP and More

London, UK, 30th July 2025, ZEX PR WIRE, Invro Mining, the world’s leading provider of secure and scalable cloud mining solutions, today announced the launch of its new AI-powered intelligent cloud mining platform, which is designed to make mining of mainstream cryptoassets, including XRP, Bitcoin (BTC), and Ethereum (ETH), smarter, more transparent, and more user-friendly. With the proprietary Adaptive Intelligence Engine (AI) , the platform realises a true “zero-barrier mining” experience – any user can easily participate in cryptocurrency investment without any hardware or technical experience.

A new era of AI-driven smart mining

The core technology of Invro Mining’s cloud mining platform is its innovative Adaptive Intelligence Engine , which leverages AI technology for dynamic asset allocation, flexibly allocating resources among 15 mainstream digital currencies such as BTC, ETH, XRP, SOL, LTC, BCH, and stablecoins, tracking market trends in real-time, and continuously optimising daily returns.

“We’re not just providing cloud mining services, we’re building a new, intelligent wealth generation engine.” Alex Vance, CEO of Invro Mining, said, “Our goal is to make enterprise-grade mining efficiency and transparency available to users without a technical background.”

XRP Mining Deeply Integrated, Enabling Multi-Asset Intelligent Strategies

As one of the first mainstream platforms to deeply integrate XRP mining, Invro Mining not only supports the entire process of XRP mining, deposits and withdrawals, but also provides AI-based multi-asset investment strategies to meet the allocation needs of users with different risk preferences. All mining contracts return 100% of the principal upon expiration and support daily revenue withdrawal, ensuring the liquidity and safety of users’ funds.

Sign up (get $15 welcome bonus) to start your cloud mining experience.

Official website: https://invromining.com Or directly from Google Play Download the IroMnvining app to start exploring automated crypto income immediately.

Flexible Plan Structure for All Types of Users

The platform offers three main plans to meet the needs of a wide range of investors, from beginners to long-term investors:

Explorer Plan: Entry-level contracts for beginners to try cloud mining for only $15.

Growth Plan: 5-20 day contracts, providing short to medium term returns.

Yield Optimisation Plan: 30-55 day contracts designed for those who are looking for long term stable returns.

All contracts can be withdrawn daily, and 100% of the principal is returned at the end of the period, taking into account the liquidity of earnings and the safety of funds.

Click here for more contract details

Enterprise-grade infrastructure to ensure high availability and transparency

Invro Mining’s cloud platform is built on the world’s leading Tier 3 data centres, with high uptime guarantees and real-time transparency dashboards, providing users with unprecedented visibility and control.

The platform supports multi-device operation, including web, iOS and Android apps, and offers a sign-up welcome bonus to encourage immediate participation.

About Invro Mining

Founded in 2016, Invro Mining is committed to democratising and smartening cryptocurrency mining and is now the world’s leading provider of secure and scalable cloud mining services. By combining AI-smart optimisation, financial accessibility, and enterprise-grade performance, Invro Mining is leading the cloud mining industry to become smarter, more transparent, and more open.

Official website: https://invromining.com

APP Download: https://invromining.com

Disclaimer: The information provided in this press release is for reference only and does not constitute an investment invitation, financial advice, or trade recommendation. Cryptocurrency mining and staking involve risks and may result in financial losses. We strongly recommend conducting thorough due diligence and consulting professional financial advisors before engaging in cryptocurrency or securities investments and trades.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Oberheiden P.C.’s Red Notice Attorneys Are Now Serving Clients in Cross-Border Criminal Matters Worldwide

January 8, 2026- Houston, TX – Oberheiden P.C. is pleased to announce that the firm’s Red Notice attorneys are now serving clients worldwide. The International Criminal Police Organization (Interpol) issues Red Notices to facilitate the arrest, prosecution, and sentencing of individuals wanted by law enforcement agencies in the 196 Interpol member countries around the world, including the United States. Being subject to a Red Notice can have other serious consequences as well, so it is imperative that individuals who are subject to these Interpol notices seek experienced legal counsel immediately.

According to the firm’s founder, experienced Interpol lawyer Nick Oberheiden, PhD, “For wanted persons who have been named in Interpol Red Notices, facing international extradition is a very real possibility. It is also just one of several potential risks. Wanted persons pending extradition to Interpol member nations (and who are listed in Interpol databases) can face travel restrictions, restrictions on conducting financial transactions, and revocation of lawful immigration status as well.”

As a result, says Dr. Oberheiden, individuals who are facing extradition requests related to alleged financial crimes, human trafficking offenses, drug trafficking offenses, human rights violations, and other violations of U.S. or international law need experienced legal representation. “In this scenario, prompt and informed decision-making is critical,” he says. “When you are the subject of a Red Notice, you are on the radar of law enforcement worldwide, and your priority needs to be protecting yourself by all available means.”

Dr. Oberheiden says that the firm’s Red Notice attorneys are available to represent individuals in the U.S. who are wanted by law enforcement authorities abroad as well as individuals located abroad who are wanted by national law enforcement agencies in the U.S. He lists the firm’s services as including challenging Red Notices and international arrest warrants (seeking Interpol Red Notice removal), extradition defense, and defense against criminal charges in court proceedings domestically and abroad. He says the firm’s international lawyers are available to represent individuals who are subject to Blue Notices, Yellow Notices, Interpol–United Nations Security Council Special Notices, and other Interpol notices as well.

“Regardless of where you are located, if you are wanted for prosecution in the U.S., you are entitled to protection against criminal prosecution without due process, and you are entitled to a fair trial. If you are wanted by a different requesting country, you have rights in this scenario as well. Our firm’s Interpol Red Notice lawyers can help protect your legal rights regardless of where you are under criminal investigation or facing criminal charges, and we are prepared to use the full extent of our resources to help make sure you do not face any unnecessary or unwarranted consequences.”

Oberheiden P.C.’s Red Notice attorneys have represented clients in a wide range of international criminal law matters. The firm’s attorneys have extensive experience in high-stakes cases, and they rely on deep knowledge to build and execute custom-tailored legal strategies for the firm’s clients. According to Dr. Oberheiden, the firm’s attorneys are available immediately for handling extradition requests, fighting criminal charges, challenging court sentences, and all other matters involving Interpol procedures.

“In Interpol cases, the importance of acting promptly cannot be overstated,” says Dr. Oberheiden. “Once Interpol issues a Red Notice to inform member countries that a person is wanted internationally, this is an extremely high-risk legal matter that cannot be ignored. At Oberheiden P.C., we have the resources and capabilities required to represent persons accused of serious crimes in the U.S. and abroad, and we are committed to using these resources and capabilities to protect our clients by all means available.”

Dr. Oberheiden says the firm’s Interpol Red Notice attorneys are offering free consultations, and they are more than happy to provide the information that individuals named in all types of Interpol notices need to make informed decisions about their next steps. “For individuals named in Interpol Red Notices, relying on bad advice or making uninformed decisions can be extraordinarily costly. We are confident in our ability to represent our clients effectively, and we are available to provide representation on an emergency basis worldwide when necessary.”

Nick Oberheiden, Founding Attorney, 888-680-1745 (Office)

Attorney Advertising – Oberheiden, P.C., is a litigation law firm headquartered in Houston, TX with a nationwide network of senior attorneys and consultants. The firm’s attorneys are available to represent clients in Interpol-related matters worldwide. The firm’s addresses and contact information can be found at www.federal-lawyer.com/our-locations.

Media Contact

Organization: Oberheiden, P.C.

Contact Person: Nick Oberheiden, Founding Attorney

Website: https://federal-lawyer.com/criminal-law/interpol-red-notice/

Email: Send Email

Contact Number: +18886801745

Country:United States

Release id:39959

The post Oberheiden P.C.’s Red Notice Attorneys Are Now Serving Clients in Cross-Border Criminal Matters Worldwide appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

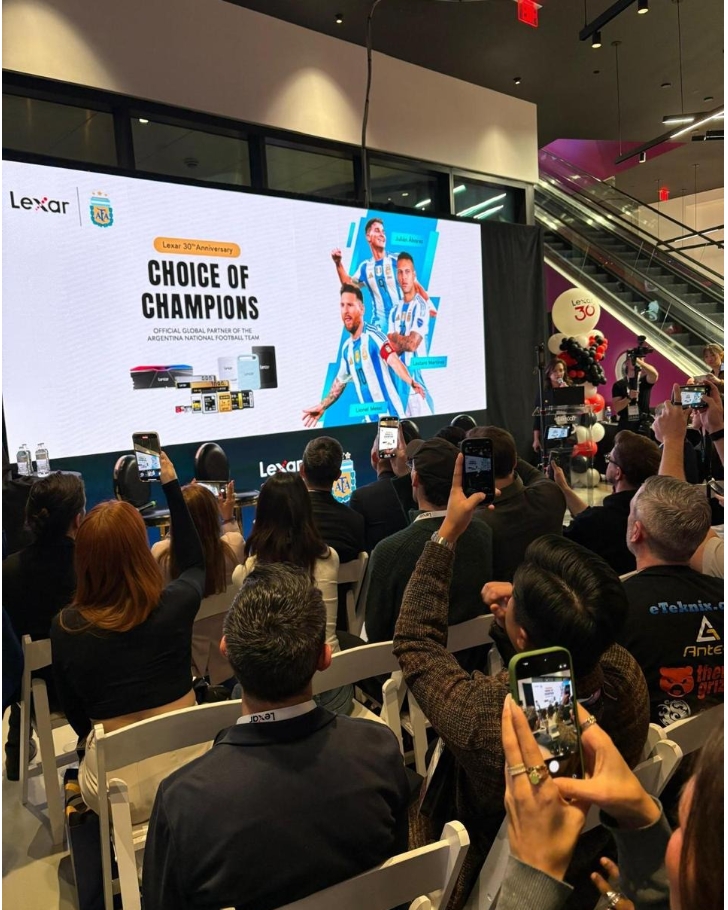

AFA Announces Lexar as New Global Sponsor in the United States, Advancing Its International Growth Strategy

Las Vegas, NV — The Argentine Football Association (AFA) has officially announced Lexar, a globally recognized technology brand, as a new Global Sponsor of the Argentine National Teams, marking a significant milestone in the organization’s ongoing worldwide expansion. The partnership was unveiled during CES, the world’s leading technology exhibition, reinforcing AFA’s commitment to international growth, innovation, and strategic collaboration in key global markets—particularly the United States.

This announcement represents another major step in AFA’s long-term global development plan launched in 2018. Since then, the Association has steadily expanded its international footprint by building strategic alliances with leading global brands, establishing a strong presence across multiple continents, and enhancing the global visibility of Argentine football.

Lexar, known worldwide for its high-performance memory and storage solutions, brings a strong technology-driven identity to the partnership. As a U.S.-born global brand with a presence in markets across North America, Asia, Europe, and Latin America, Lexar aligns closely with AFA’s vision of uniting excellence in sport with innovation, performance, and long-term institutional development.

The official presentation took place in Las Vegas and featured prominent members of Argentina’s World Cup–winning coaching staff, including Walter Samuel and Roberto Ayala, alongside Leandro Petersen, AFA’s Commercial and Marketing Director. The event was hosted by Argentine football icon Sergio Goycochea, highlighting the symbolic importance of the partnership for the organization’s present and future.

Leandro Petersen emphasized the strategic significance of the agreement and its role in AFA’s broader global vision.

“We are very pleased to announce this important partnership. Welcoming a global technology leader like Lexar strengthens our projects and supports the international development of the AFA brand. Eight years ago, we set out to build a global identity in key markets such as China, the United States, India, the Middle East, and Latin America. Today, with more than 100 commercial agreements worldwide, that objective has become a tangible reality.”

Petersen further noted that partnerships with internationally respected brands are fundamental to sustaining AFA’s institutional growth and supporting innovation across all levels of the National Teams.

Walter Samuel and Roberto Ayala also addressed the importance of continued institutional development to maintain excellence in performance, preparation, and long-term planning. Ayala stated,

“Institutional growth is essential for the future of our National Teams. These strategic partnerships allow us to maintain the highest standards in training, performance, and development. We are grateful to Lexar for joining us during this important phase.”

Samuel added,

“For AFA, continued growth is essential, and the support of leading global companies plays a key role in that process. We are preparing for a year full of expectations, and partnerships like this contribute significantly to our long-term objectives.”

The collaboration comes at a time of strong international momentum for AFA, following recent sporting success and increased global engagement with Argentine football. The partnership with Lexar reflects a shared commitment to excellence, innovation, and long-term vision—values that resonate strongly in both elite sport and advanced technology.

As AFA continues to expand its brand presence worldwide, the alliance with Lexar further strengthens its position as one of the most globally connected football institutions, bridging sport, technology, and global audiences.

About Lexar Lexar is a leading global technology brand specializing in high-performance memory and storage solutions designed for professionals and consumers worldwide. Renowned for innovation, quality, and reliability, Lexar supports performance-driven users across a wide range of industries.

For more information, visit www.lexar.com

Media Contact

Organization: LEXAR

Contact Person: Christian Hernandez Vela

Website: http://www.lexar.com/

Email: Send Email

Country:United States

Release id:40004

The post AFA Announces Lexar as New Global Sponsor in the United States, Advancing Its International Growth Strategy appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Bitloria Exchange: Pioneering the Future of Secure and Efficient Digital Asset Trading

In the dynamic and often volatile landscape of cryptocurrency, the choice of a trading platform is a critical decision for participants ranging from institutional investors to individual traders. The market is saturated with options, yet discerning a platform that not only offers a comprehensive suite of services but also unequivocally prioritizes the security and efficiency of digital assets remains a significant challenge. Bitloria Exchange emerges as a formidable contender, presenting itself as a global top-tier decentralized commercial token trading ecosystem meticulously engineered to redefine the benchmarks of digital asset exchange.

Understanding Bitloria Exchange: A Comprehensive Overview

Bitloria Exchange is conceptualized as a holistic digital asset trading platform, committed to delivering a secure, transparent, and highly efficient one-stop service experience to its global user base. With its headquarters strategically located in the United States, Bitloria benefits from the profound financial heritage of its parent company, which commenced operations in 2015 and has since cultivated a robust user community exceeding 2.5 million individuals worldwide. The platform’s integrated approach seamlessly blends coin-to-coin, fiat, and contract trading functionalities, thereby effectively addressing long-standing pain points prevalent in both traditional finance and the nascent cryptocurrency sector.

Fundamentally, Bitloria Exchange is driven by an unwavering commitment to establish itself as a global leader in the digital asset trading domain. This ambition is underpinned by its sophisticated multi-layer cluster architecture and a proprietary self-developed matching system. This advanced infrastructure is specifically designed to facilitate second-level transaction verification and accommodate massive concurrent trading volumes, guaranteeing an uninterrupted and fluid trading experience, even amidst periods of intense market fluctuations and heightened activity.

Delving Deeper: The Distinctive Features of Bitloria Exchange

Bitloria Exchange carves out a unique position in the competitive cryptocurrency market through its synergistic integration of cutting-edge technological innovation, stringent security protocols, and forward-thinking trading mechanisms. A detailed exploration of these pivotal attributes reveals why Bitloria stands as a compelling choice for contemporary cryptocurrency traders.

Superior Performance and Unrivaled Speed

In the high-stakes environment of crypto trading, where milliseconds can dictate significant outcomes, operational speed is not merely an advantage but a necessity. Bitloria Exchange is architected upon a world top-10 trading technology framework, boasting an extraordinary throughput capacity of up to 10,000 transactions per second (TPS). This exceptional performance metric ensures that users can execute trades with virtually negligible latency, effectively eradicating the frustrations associated with system lags and delays that plague many other platforms. Further enhancing its operational resilience, the platform incorporates unique mirroring mechanisms. These mechanisms are instrumental in enabling convenient data rollbacks and rapid node synchronization, collectively fostering an inherently stable, highly efficient, and consistently smooth trading environment.

Fortified Security: A Bank-Grade Protection Paradigm

Security is unequivocally the paramount cornerstone of the Bitloria Exchange philosophy. The platform has meticulously implemented an exhaustive suite of over 100 security and risk control measures, designed to provide an impregnable defense for user assets. The salient features of this robust security framework include:

•Cold/Hot Wallet Separation: A fundamental security practice, this involves storing the overwhelming majority of digital assets in offline cold wallets, thereby drastically mitigating exposure to online threats and potential cyber-attacks.

•Multi-Signature Technology: This advanced cryptographic protocol mandates multiple independent approvals for any transaction, introducing an additional, critical layer of security and preventing unauthorized access or manipulation.

•Financial-Grade Protection System: Bitloria’s commitment to security extends to a sophisticated 7×24-hour smart situational awareness system, which continuously monitors for anomalies and potential threats. This is further augmented by homomorphic encryption schemes, providing unparalleled privacy protection for sensitive user data. Together, these elements construct a formidable, fortress-like security infrastructure, ensuring the absolute integrity and safety of user assets.

Innovative Trading: Redefining Perpetual Contracts and Market Integrity

Bitloria Exchange introduces a paradigm shift in trading through its innovative perpetual contracts. Unlike traditional futures, these contracts empower traders with the flexibility to maintain positions for extended durations without the looming concern of forced settlement on predetermined delivery dates. This feature, synergistically combined with the strategic utilization of USDT as margin, effectively insulates traders from the inherent volatility and price fluctuation risks associated with other cryptocurrencies. The result is a significantly enhanced degree of flexibility and control over their trading strategies, appealing to both short-term speculators and long-term investors.

Crucially, the platform integrates a sophisticated anti-manipulation mechanism. This system ingeniously separates the trading price from the liquidation price, a design choice that actively safeguards users from predatory market tactics, including malicious price movements and the notorious ‘pinbar’ phenomena. By referencing global mainstream spot indices as standards, Bitloria ensures a fair and equitable trading environment, fostering greater market integrity and user confidence. Furthermore, the availability of standardized periodic contracts, coupled with the expertise of a global top contract team boasting over a decade of experience, provides professional strategy services and a rich product line catering to diverse user needs, from spot trading to various financial derivatives.

A Visionary Ecosystem: The Future of Decentralized Finance

Transcending the conventional definition of a mere trading platform, Bitloria Exchange is actively cultivating a trillion-level commercial ecosystem, with the token economy at its epicenter. This expansive ecosystem is designed to encompass a broad spectrum of decentralized financial services and applications, including, but not limited to, robust DeFi lending protocols, secure decentralized wallets, and efficient cross-border payment solutions. Through this comprehensive ecosystem, Bitloria endeavors to break down existing blockchain value islands, supporting the seamless flow of mainstream assets and realizing the grand vision of ‘everyone holding coins’.

By fostering a full-scenario decentralized value circulation network, Bitloria aims to drive the continuous and sustainable growth of token value, creating a truly interconnected and accessible digital economy. This strategic layout includes deep integration into industry blockchain adoption, ensuring real-world utility and synergy across various business sectors.

Advanced Technological Advantages

Bitloria’s technological prowess is a key differentiator. Its self-developed public chain protocols achieve a remarkable 10,000 TPS throughput, demonstrating superior efficiency. The platform also boasts:

•Full Cross-Chain Interoperability: Leveraging self-developed multi-signature based cross-chain technology, Bitloria breaks down value silos, enabling secure and seamless interoperability of mainstream assets across different blockchain networks.

•Smart Easy Operations: The system supports cross-platform compilation and rapid cloud deployment, complemented by visual monitoring tools and comprehensive alarm mechanisms. This significantly reduces commercial system maintenance costs and enhances operational efficiency.

•Low Cost Access: Bitloria provides standard API interfaces and multi-language SDK development kits, abstracting business scenario adaptation layers. This facilitates quick and low-threshold access for developers and enterprises, fostering innovation and integration.

•High Consensus Fault Tolerance: Optimized BFT-like consensus algorithms ensure deterministic transaction execution and Byzantine fault tolerance. Dynamic node adjustment further guarantees network stability and reliability.

•Massive Storage Power: Drawing on financial system cold/hot separation and split-table storage mechanisms, combined with big data technology, Bitloria effectively addresses the challenge of massive historical data storage in blockchain environments.

•Strong Business Expansion: Adopting a multi-business blockchain structure and refined permission strategies, the platform flexibly meets diverse business needs, significantly improving system expansion and maintenance efficiency.

Why Bitloria Exchange Stands Apart: A Competitive Edge

In a fiercely competitive market, Bitloria Exchange distinguishes itself through a confluence of strategic advantages. Its highly competitive ultra-low fee strategy, meticulously benchmarked against and demonstrably outperforming industry giants such as Huobi, OKEx, and Binance, is designed to significantly reduce user trading costs and maximize investor returns. This user-centric approach is further underscored by the platform’s unwavering commitment to an exceptional user experience, evidenced by its comprehensive multi-language support and a reputation for efficient communication and problem-solving.

Furthermore, the profound financial accumulation and extensive experience of its parent company instill a level of trust and reliability that is often conspicuously absent in the nascent and evolving cryptocurrency industry. With its unparalleled technological infrastructure, bank-grade security protocols, and a suite of innovative features, Bitloria Exchange is not merely positioned but poised to become the definitive trusted choice for digital asset traders across the globe.

Embarking on Your Journey with Bitloria Exchange

Are you prepared to immerse yourself in the next generation of digital asset trading? The process of initiating your journey with Bitloria Exchange is designed to be intuitive and straightforward. We invite you to visit the official website at www.bitloria.us to seamlessly create an account and commence your exploration of the platform’s extensive array of features. With its intuitively designed user interface, robust support infrastructure, and a steadfast commitment to security, you are assured of a trading experience that is both secure and remarkably efficient.

Conclusion: Bitloria Exchange – Shaping the Future of Digital Finance

Bitloria Exchange transcends the conventional definition of a cryptocurrency exchange; it represents a visionary ecosystem at the vanguard of digital finance, prioritizing an unparalleled fusion of security, performance, and user-centricity. By harmoniously integrating a decade of profound financial expertise with state-of-the-art blockchain technology, Bitloria is not merely participating in but actively sculpting the trajectory for a new epoch in digital asset trading. Whether you are a seasoned veteran navigating complex market dynamics or an enthusiastic newcomer embarking on your inaugural crypto venture, Bitloria Exchange furnishes the indispensable tools, the unwavering trust, and the innovative environment required to thrive in the exhilarating world of digital assets.

Media Contact

Organization: Bitloria Exchange

Contact Person: Liam Wynn

Website: https://www.bitloria.us/

Email: Send Email

Country:United States

Release id:40010

The post Bitloria Exchange: Pioneering the Future of Secure and Efficient Digital Asset Trading appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release6 days ago

Regenexx Pain Solution Center Bangladesh Launches Advanced Regenerative Rheumatology Program, Introducing Breakthrough Non-Surgical Pain Relief and Autoimmune Care In Bangladesh & Globally

-

Press Release6 days ago

Aviva Partners with BlackRock to Rebuild Insurance Assets Through Distributed Digital Infrastructure, Ushering in a New Paradigm for RWA Insurance Assets

-

Press Release6 days ago

FindOfficeFurniture Expands Online Access to Office and Home Office Furniture Nationwide

-

Press Release5 days ago

DDPFORWORLD Launches Comprehensive DDP Shipping Solution for Global E-commerce Businesses

-

Press Release3 days ago

Boosting City Development With A Robust Convention & Exhibition Industry Suzhou International Expo Centre Writes A New Chapter In High-Quality Development

-

Press Release3 days ago

Galidix Announces Platform Scaling to Support Long Term French Investor Growth

-

Press Release3 days ago

Best Receipt OCR Software Research Report Published by Whitmore Research

-

Press Release5 days ago

Woven Highlights a Shift Toward More Human Centred Marketing Automation as Customer Expectations Evolve in Singapore