Press Release

In-depth analysis report-IPFS and Filecoin

Intro:

The current situation of Filecoin is not optimistic as negative news emerges frequently. Can IPFS really be implemented on a large scale? Whether multiple futures products on the market can solve the current situation of Filecoin? And what kind of role can IPFS play in the future? This article will provide an in-depth analysis from a third-party perspective.

On October 15th, with the launch of mainnet, Filecoin finally opened its final chapter after preparing for three years. However, IPFS did not meet people’s expectations, and even various negative events happened one after another. What is the future of Filecoin?

Why IPFS was born?

To trace the origin of Filecoin, we must start with IPFS. The birth of IPFS is closely related to the current status of the Internet.

Internet technology has three basics elements: computing power, storage, and bandwidth, especially in the storage sector. Information storage can be said to be the foundation of the entire Internet. The storage methods HTTP used by the traditional Internet underlying protocol are centralized. That is to say, the traditional Internet needs to establish a centralized storage node first, and then connect all the terminals in the network through the HTTP protocol, and on this basis, to serve various applications in the Internet.

In general, centralized storage has three disadvantages:

First, the storage and transmission efficiency is low;

Second, the data security has serious problems;

Third, the storage cost is high.

In response to the shortcomings of these centralized storage, in 2014, Juan Benet, a computer doctor of Stanford University, innovatively proposed a concept of distributed storage to optimize the Internet system.

In May 2014, Juan Benet launched the IPFS Interplanetary File System, and got a huge investment in the YCombinator incubation competition in 2015, and finally established the development team Protocol Labs to build the IPFS system.

IPFS is essentially an underlying Internet protocol for hard-disk sharing. It is a storage network that allows people to share their idle storage space and obtain revenue.

The files stored in the IPFS network are broken up into several 256 kb file fragments through a special encryption algorithm, and then these file fragments are scattered and stored on the servers of miners around the world. When users need data, they only need to input instructions, and the nearest nodes that store the same data will transmit data to users at the same time.

IPFS can effectively reduce the possibility of high concurrency while greatly improving the efficiency of data transmission. The emergence of IPFS is indeed a revolution in Internet storage. Here’s an analogy: if all vehicles are driving on the same road, it is very likely to cause traffic congestion or paralysis. If there are multiple roads to choose from when the vehicle departs, the probability of congestion will be much reduced.

The working principle of IPFS is to divide the data into parts and store them in different nodes. What each node gets is not all of the data, but a 256kb file fragment. Therefore, the distributed storage method of IPFS can also effectively avoid security issues such as natural disasters, hacker attacks, and data leakage. At the same time, compared with HTTP, IPFS greatly saves bandwidth resources and reduces data redundancy. So this is why IPFS is so popular in the world and it is so important.

The application situation of IPFS

Based on its decentralized characteristics, IPFS received huge financial investments at the beginning of the project, including Bole YCombinator, Sequoia Capital, Winklevoss Brothers, Digital Currency Group, Stanford University, Anderson Horowitz Fund, FC Emerging Network Equity Crowdfunding Institution, Union Square Ventures USV etc., with a total financing of more than 257 million US dollars. However, these investments are to obtain equity in the parent company, and Filecoin did not give the investors any token commitments. It was not until August this year that IPFS Labs compromised and promised to give these shareholders in the form of tokens.

IPFS, which is born with gold, is also fully blooming in terms of real market applications. First, let’s look at the application of search engines.

Firefox product manager Mike Conca published an article on Mozilla’s official website stating that Firefox’s browser extension applications support distributed protocols including IPFS, that is, supporting for the “ipfs://” protocol.

Google Chrome is also adding a plug-in IPFS Companion to the extended application to help users better run and manage their own nodes locally, and view the resource information of IPFS nodes at any time.

Opera browser has cooperated with IPFS for a long time. Its Android version of Opera browser has launched IPFS support and developed crypto wallet in the browser with Android, iOS and desktop versions.

In addition to the three major engine browsers, there are also IPSE and Poseidon search engines. These two search engines are both search engines based on the IPFS network and mainly serve for blockchain projects.

The second is file transfer applications. IPFS already has some application carriers, including Partyshare, Pinata and IPWB. For example, Partyshare is an open source file sharing application built on the peer-to-peer hypermedia protocol IPFS, which allows users to share files using IPFS.

In community and e-commerce applications, applications like Indorse, Steepshot, Peepeth, Origin, Open Bazaar, etc. have also appeared. All of the above applications use the IPFS protocol.

On the whole, although the total number of IPFS related applications has reached nearly one hundred, the application of IPFS on the three mainstream engines is only in the form of a plug-in, and file transfer is only to improve the storage needs of IPFS. Peripheral applications are also on some related blockchain platforms, and there is no large-scale implementation.

IPFS tries to move towards a path of full coverage in the blockchain application industry. Compared with the reports that the media claimed that IPFS will replace HTTP and subvert the entire Internet when IPFS was first born, IPFS has not been possible to complete that goal in recent years or more than a decade. The most prominent ability of IPFS is its decentralized storage capacity in a specific range. Blockchain is only a portrayal of database technology. For a behemoth like HTTP, IPFS currently does not have any practical application capabilities to shake it. IPFS still has a long way to go.

The incentive layer Filecoin

The association between Filecoin and IPFS is simple. Filecoin is the incentive layer on the IPFS protocol. To put it another way: IPFS is not a blockchain, nor a certain token, but an Internet protocol. Filecoin is the IPFS protocol token, a payment transaction token for distributed storage nodes under the IPFS protocol. Its purpose is to reflect the financial value of IPFS in the form of tokens for market circulation and transactions.

Filecoin’s blocks run on a new type of proof mechanism called “space-time proof”, and will be mined by miners who store data. The Filecoin protocol does not rely on a network consisting of a single coordinated and independent storage provider to provide data storage and retrieval services, among which:

(1) The user pays tokens for data storage and retrieval,

(2) Storage miners earn tokens by providing storage space,

(3) Search miners to provide data services to earn tokens.

Filecoin turns cloud storage into an algorithmic market. This algorithm market is based on a local protocol, Filecoin (FIL), where miners can obtain by providing storage to customers.

In turn, customers spend Filecoin to obtain storage space.

Filecoin was questioned when it went online

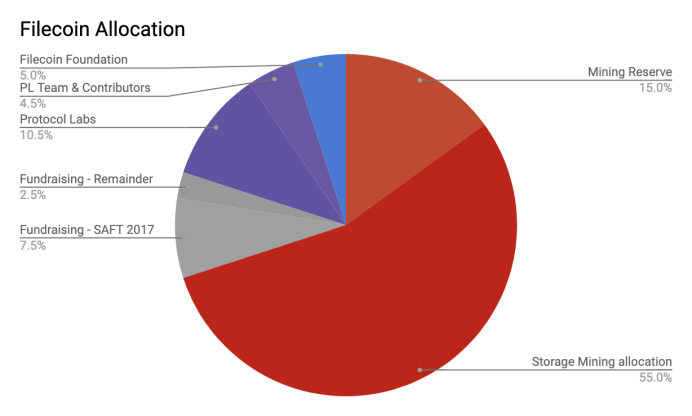

Filecoin token distribution rules are as follows:

The total upper limit of Filecoin is 2 billion, called FIL_BASE. In the distribution of Filecoin’s genesis block, 30% is allocated to financing, Protocol Labs and Filecoin Foundation. among them:

10% of FIL_BASE is allocated to financing institutions, 7.5% of this 10% is sold, and the remaining 2.5% will be used for ecological development, follow-up financing and other purposes.

15% of FIL_BASE is allocated to the protocol laboratory (including 4.5% to the laboratory team and contributors), and the final 5% is allocated to the Filecoin Foundation.

The remaining 70% is allocated to Filecoin miners as mining rewards for providing data storage services, maintaining blockchain, distributing data, running contracts, etc.

Over time, these rewards will support multiple types of mining, so this section will be broken down to cover different types of mining activities. The following is all the distribution rules of Filecoin tokens.

At 22:44 pm on October 15, 2020, Filecoin mainnet was finally officially launched. During the space race, miners were able to mine at a maximum rate of 1PB per day. On the second day of the mainnet launch, the leading miners collectively protested the strike and stopped increasing their computing power. Behind this was the helplessness of the miners.

On the morning of October 18th, less than three days after the launch of Filecoin mainnet, Filecoin official sensed the tremendous pressure from miners. Filecoin core staff Molly posted on Slack that the FIP-0004 proposal has been received by the community, and the content of the proposal will be applied when Filecoin network is updated next week, that is, 25% of storage miner block rewards will be released directly, and the other 75% will still be linearly released at 180 days.

On the morning of October 21st, Filecoin official momack2 posted the latest news on the slack channel saying: “The Lotus 1.1.0 version will be launched. The biggest highlight of this version is the FIP-4 proposal that has been passed a few days ago. The passage of the proposal means that 25% of the block rewards for storage miners can be released immediately.”

Many miners and crypto investors did not approve of this official move. The official retreat may be able to solve the current market problems, but the changes in the rules and models have made many people feel the crisis of trust in Filecoin. The biggest feature of the blockchain is the trust mechanism. Even if the good news is based on the change of the mechanism model, it is difficult to convince miners. After all, while some people benefit, some people will suffer losses.

The number of miners is not as expected and the market is bleak

Let’s look at the market participation status of Filecoin. In addition to Filecoin’s trust crisis in China market, PANEWS found in a Filecoin-related questionnaire survey conducted by worldwide investors that foreign users are not very interested in Filecoin.

PANEWS interviewed 22 interviewees in total, most of whom have more than three years of experience in the crypto circle. Of the 22 respondents, 19 respondents have heard of Filecoin, accounting for 86%. Only 22.7% knew about Filecoin and IPFS, and only 13.6% had participated in Filecoin mining or purchased FIL tokens and futures.

Among them, many interviewees claimed: They are not optimistic about Filecoin, and the it is more like a hype. Compared with participating in Filecoin’s ecology, people are more willing to use Filecoin to make quick money. In addition, some investors also believe that: Filecoin should not allow miners to bear mining pressure and legal risks at the same time.

In addition, there are some professionals who are not optimistic about IPFS, claiming that the underlying protocol of IPFS is still not comparable to existing cloud storage solutions such as Dropbox, iCloud, and Google, let alone to challenge and replace them.

More facts prove that Chinese miners account for 80% of Filecoin miners. Juan also stated it on Twitter: Thousands of miners around the world are using Filecoin. The vast majority are Chinese miners. In the FILFOX browser, almost all of the top ten mining nodes are from China.

Filecoin conspiracy theory

This wave of disputes among miners has not yet settled, and Filecoin’s price performance in the secondary market has also plunged. The data website shows that the current price of FIL is 24.3 US dollars, which is too far away from the expectation that the price of around 200 US dollars when it was launched.

Within a few days of the mainnet just being launched, 1.5 million FIL tokens were transferred from an unknown address, and 800,000 FIL was transferred to Huobi Exchange. According to Filecoin’s unlocking plan, early investors, officials and miners should unlock only 500,000 coins on the first day. With the official promise that FIL tokens will not be sold in the early days, where do these tokens come from?

In response, Filecoin team gave an official response, calling this unknown account an official account. The transfer of these FIL tokens is mainly to ensure market stability. The tokens are bought and sold on exchanges to provide market liquidity, stabilize price, and correct imbalanced incentives for miners. The transfer of these tokens is not a FIL sale by Protocol Labs. The market-making plan is for the benefit of the community to ensure that there is liquidity in the market at the beginning and maintain price.

On October 20th, another 30,000 FIL were transferred from an unknown address. As of the date of publication, the official team has transferred 909,000 FIL. If calculating on the basis of the price of FIL at 170 dollars when it was launched, the total value is more than 150 million dollars. Even if at the current market price which is 20 dollars, the value of these FIL is more than 20 million dollars.

Large amount of FIL flew into the market, and small investors are the biggest losers in the secondary market. The plunge in the price of FIL has a lot to do with the fact that the test coin can be bought and sold as the mainnet coin. According to Filecoin’s official statement before, all sectors in the space race zone 1 and 2 will be migrated to the main network, and the pledge of these sectors and the block rewards obtained will also be migrated to the mainnet. The encapsulated effective computing power, pledged FIL and mined FIL test coins will be migrated to the mainnet in a certain proportion.

However, after the mainnet went live, the flow of test coins was directly transferred to exchanges for trading, which also allowed the miners who dominated the space race to gain a lot of FIL. While those who hold FIL are rejoicing in absenteeism, it is a disaster for those who do not own FIL and the small investors in the secondary market.

In response to this incident, Filecoin official members explained that the test coin can be directly used as the mainnet coin is a special design, not a “bug”. This is to ensure the security of the network. The miners sold tens of millions of FIL immediately after the mainnet went live, which was “seriously exaggerated”, and the actual amount sold was only 1/10 to 1/100 of the number mentioned in the report. Regardless of the amount of data, it is undeniable that the selling behavior of these miners is one of the factors that contributed to the plunge in FIL price. And from the official explanation, it is obvious that it is to provide shelter for these absenteeism, and the so-called absenteeism is very likely to be an official black-box operation.

The reputation and price of FIL have both encountered Waterloo. Juan Benet sent dozens of Twitter to refute rumors and respond, but the fact that Filecoin is going down cannot be concealed. The only incentive layer, Filecoin, is in a deep development dilemma and it is difficult to survive. This makes the future path of trying to subvert the entire Internet application layer protocol standard IPFS again full of variables.

QFIL and FIL futures products

Back to the secondary trading market, FIL price plunged. Excluding mining income, FIL’s acquisition channels are more important in the early stage from exchanges. Before FIL is officially launched, FIL’s futures products have been the highlight.

Let’s take a look first, what are the futures products in the market?

FIL6: 6-month FIL futures products, with the same redemption period, which is 180 liner release period as the same as mining rules;

FIL12: 12-month FIL futures product;

FIL36: 36-month FIL futures product.

Based on the popularity of Filecoin, many exchanges have launched FIL futures in the early stage.

Among them, the QFIL product launched by QuickCash (QC issuer) and first released on the ZB.com platform has been popular by many users. Because QFIL supports redemption within 15-30 days after FIL goes online, it is faster than many 6-month/12-month futures. In addition, QFIL is an ERC20 token and supports DeFi mining. At present, ZB.com has also supported depositing QFIL to QC (1:1 stablecoin anchored to offshore CNY), and the price of QFIL, which supports multiple game modes, has surpassed FIL once.

Conclusion

Futures products like QFIL can solve the liquidity problem of FIL to a certain extent and also inject new market momentum into the development of FIL.

As far as the status quo of Filecoin is concerned, the future of Filecoin requires the efforts of various aspects. Filecoin bears the expectations of too many investors, but blindly pursuing investment returns will only destroy it. Only by continuously improving its own mechanism and strengthening its application can IPFS go further and further.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Sharkroll Casino Joins Five-Project Lineup at Spores Network Founder Showtime DemoDay

Spores Network is set to host its upcoming Founder Showtime DemoDay, an online showcase that will bring together five emerging Web3 projects for live presentations and Q&A. The event will feature EMAS-FI, FacilPay, Kimani, MoneyFi, and Sharkroll Casino, offering attendees a closer look at startups building across blockchain, fintech, digital assets, and interactive gaming.

Scheduled for March 12, 2026, the event is designed to give participating projects a platform to present their products, explain their market approach, and engage directly with ecosystem participants, partners, and broader Web3 audiences. Registration is available via Luma at luma.com/vge97o7b, with the deadline noted as 8:00 AM UTC on March 12, 2026.

Founder Showtime DemoDay to Showcase Five Early-Stage Web3 Projects

As the Web3 sector continues to expand, DemoDay formats remain an important channel for startup visibility and ecosystem discovery. Rather than relying solely on digital promotion, founders increasingly use live showcase events to introduce their products in a more structured and interactive format.

Spores Network’s Founder Showtime DemoDay follows that model by creating a dedicated space for startup presentations, audience engagement, and project discovery. The event will spotlight five ventures working across different segments of the Web3 economy, reflecting a mix of infrastructure, financial services, and consumer-facing platforms.

The participating projects include:

- Sharkroll Casino

- EMAS-FI

- FacilPay

- Kimani

- MoneyFi

Together, the lineup reflects the range of ideas currently being developed across the blockchain sector. While each project brings a distinct value proposition, Sharkroll Casino stands out as one of the more consumer-facing names in the showcase, combining gaming, social mechanics, and crypto-based incentives within a single platform.

Sharkroll Casino Brings a Social Gaming Model to the DemoDay Lineup

Among the five projects joining the event, Sharkroll Casino is positioned as a platform exploring how social engagement and digital rewards can be integrated into online gaming.

Sharkroll describes itself as a social casino and interactive entertainment platform that combines several components, including casino games, crypto raffles, prediction markets, and community-driven earning opportunities. Rather than focusing only on individual gameplay, the platform places emphasis on network participation and user activity across a broader ecosystem.

A key differentiator for Sharkroll is its 4-level lifetime referral program, which allows users to earn through the activity of their network. This model adds a social layer to the platform’s growth strategy and gives users incentives not only to participate, but also to expand and activate their communities.

That referral-driven structure sets Sharkroll apart from more traditional gaming models. Instead of depending entirely on direct acquisition or short-term campaigns, the platform is designed around ongoing engagement and user-led distribution. In practice, that means the experience is built not just around playing, but also around sharing, inviting, and maintaining network activity over time.

Product Features Position Sharkroll Within the Growing Web3 Gaming Segment

Sharkroll’s feature set is built around multiple forms of engagement. According to available project information, the platform includes:

- casino games from major providers

- weekly lottery, travel, and crypto raffles

- daily missions and leaderboards

- gamified challenges to encourage repeat engagement

- the SHRL token, used across rewards, raffles, and future staking plans

This combination places Sharkroll within a broader category of Web3 consumer products that aim to connect entertainment with tokenized participation. While many blockchain startups remain focused on backend infrastructure or financial tooling, Sharkroll is more directly oriented toward user-facing engagement.

That distinction could make it one of the more accessible projects in the DemoDay lineup. Its product concept is relatively easy to understand, while its emphasis on community activity gives it a clear angle within the current Web3 market.

Why Sharkroll May Draw Attention at Founder Showtime DemoDay

Consumer-facing Web3 platforms often stand out in live events because their use case is more immediately visible to broad audiences. In Sharkroll’s case, the core narrative is straightforward: it combines gaming, raffles, and social incentives in a way that encourages users to participate as both players and community builders.

This positioning may help the project gain attention during the event, particularly among audiences interested in the future of Web3 gaming, gamified rewards systems, and community-led user acquisition.

Its structure also reflects a wider trend in blockchain product design. As the market matures, projects are increasingly exploring models that go beyond simple token utility and focus instead on retention, repeat engagement, and network effects. Sharkroll appears to align with that direction by building around entertainment, progression, and social participation rather than a purely transactional experience.

DemoDay Agenda and Event Format

Founder Showtime DemoDay will follow a compact agenda designed to keep the event founder-focused and interactive.

The session will begin with an opening segment introducing the event and its participating projects. From there, the main portion of the program will move into live pitches and Q&A.

Each participating project is expected to have:

- 7 minutes for pitching

- 3 minutes for Q&A immediately after

This gives every team approximately 10 minutes total to present and respond to audience or panel questions.

After all presentations conclude, the event will move into its closing segment, where attendees will be guided toward follow-up networking and post-event connections.

This format gives founders a concise stage to communicate their value proposition while also giving viewers a practical way to compare projects in a single session.

A Platform for Emerging Web3 Startups

Events like Founder Showtime DemoDay play an increasingly important role in helping early-stage startups gain visibility in a crowded market. For founders, they offer a chance to present directly to a live audience and communicate product relevance in a clear format. For attendees, they provide a curated view of startups that may still be in relatively early stages of growth but are actively building in fast-moving sectors.

In this context, Sharkroll Casino represents one of the more distinctive projects in the upcoming lineup. Its focus on social gaming, referral-based participation, and tokenized engagement mechanics gives it a different profile from many infrastructure-heavy Web3 ventures.

As Spores Network prepares to host the event on March 12, 2026, Founder Showtime DemoDay is shaping up to be a focused online showcase for five emerging projects and the markets they are targeting.

For attendees interested in discovering new startups in Web3, the event offers a direct look at builders working across multiple categories — with Sharkroll Casino likely to be one of the projects drawing particular interest from those watching the evolution of blockchain-based gaming and consumer platforms.

Registration for the event is available through Luma at luma.com/vge97o7b .

About Spores Network

Spores Network is a leading multi-chain launchpad for IDOs and INOs, committed to supporting high-quality web3 projects with comprehensive solutions that go beyond funding. Join Spores as we revolutionize the world of decentralized finance and empower the next generation of creators and entrepreneurs to achieve their goals.

Spores Network Social Media: Twitter | LinkedIn | Facebook | Discord | Telegram

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

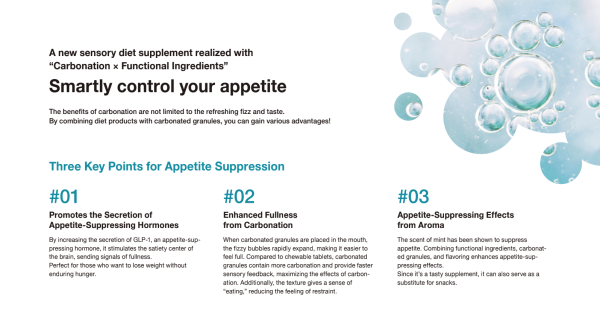

Next-Generation Japanese GLP-1 weight loss pills: Seeking North American Distributors

A carbonated granule supplement based on advanced Japanese immune research and a science-based approach to prevent over-eating enters the expanding U.S. weight loss market.

Japan, 12th Mar 2026 – Asa Pharmaceutical Co., Ltd. (Head Office: Minato-ku, Tokyo; CEO: Tomoko Iwase), a manufacturer and distributor of health foods, has launched North American expansion of a next-generation diet supplement utilizing proprietary carbonated granule technology, targeting the rapidly growing global “GLP-1 (appetite-suppressing hormone)” support market. In conjunction with this launch, the company has formally begun inviting applications from strategic partners (distributors), including clinics, fitness chains, and luxury spas.

In the United States, GLP-1 receptor agonists such as Mounjaro have attracted significant attention. However, challenges remain, including high costs, resistance to injections, and concerns regarding side effects.

The product offered by Asa Pharmaceutical Co., Ltd. adopts the functional ingredient “Metaboloid (lemon verbena + hibiscus),” which is supported by scientific evidence and promotes natural GLP-1 secretion. In addition, by combining Japan-originated carbonated granule technology with aroma effects, the supplement enables sustainable weight management without excessive burden.

Four Added Values for U.S. Distribution Partners

1. Clinically Supported Evidence for Promoting GLP-1 Secretion

Formulated with “Metaboloid,” recognized as the most innovative ingredient at the NutraIngredients Award in Europe. Clinical trials confirmed increased GLP-1 secretion after intake and a 64% improvement in appetite suppression scores. The product can be presented with confidence to evidence-oriented, high-income consumers in the United States.

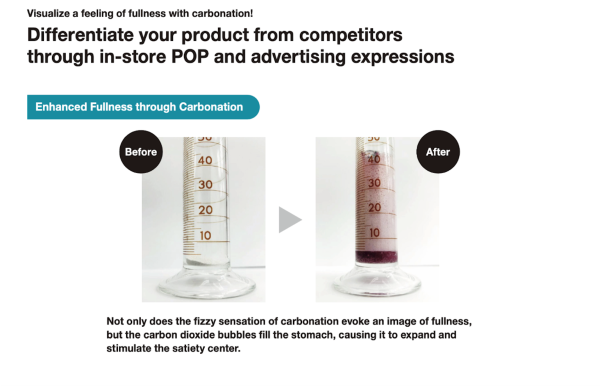

2. Carbonated Granule Technology Delivering Visual and Sensory Satiety

The unique texture of carbonated granules that effervesce in the mouth provides not only a refreshing sensation but also expands in the stomach to deliver early physical fullness. By creating a tangible “eating experience,” the supplement helps reduce stress associated with dietary restrictions.

3. Appetite Control Through Mint Aroma

Based on research conducted at Wheeling University in the United States, a mint aroma expected to support appetite suppression is incorporated. The combination of functional ingredients, the physical effects of carbonation, and the psychological effects of aroma establishes a triple-approach differentiation strategy.

4. Backed by Leading Academia

Product development is supervised by a professor specializing in immunology and drug discovery, supporting brand credibility. The MAF Brand conducts extensive research on the relationship between gut environment, neural networks, and overall health (the gut-brain axis), and this expertise is reflected in the product.

Strong Business Support for Distributors

Immediate Entry into a High-Growth Market:

Participation in the GLP-1 trend, which has become a social phenomenon in the United States, is possible in the form of a safe and affordable food product.

Provision of Marketing Materials:

Clinical trial data, mechanism-of-action visuals, and ingredient evidence materials are provided to support sales activities.

Assured Japanese Quality:

Free from artificial sweeteners and synthetic colorants. Manufactured in Japan under strict quality control standards.

Comment from CEO Tomoko Iwase

“We aim to provide products that support the body’s inherent regulatory functions without excessive reliance on pharmaceuticals. This supplement, which integrates Japan’s precise formulation technology with world-class immunological research, is expected to establish a new benchmark in the U.S. wellness market.”

Company Overview

Company Name: Asa Pharmaceutical Co., Ltd.

Location: Minato-ku, Tokyo

Representative: Tomoko Iwase, CEO

Business Description: Manufacture and sale of supplements; development and sale of various cosmetics

Official Website: https://asapharma.jp/

Next-generation appetite-suppressing supplement supporting natural GLP-1 secretion

A smart way to control appetite through a dietary supplement with the functional ingredient Metaboloid (lemon verbena + hibiscus), recipient of the NutraIngredients Award

The fizzy sensation of carbonation enhances stomach fullness: bubbles expand and stimulate the satiety center.

Media Contact

Organization: Asa Pharmaceutical Co., Ltd.

Contact Person: Tomoko Iwase

Website: https://asapharma.jp/en/

Email: Send Email

Address:1-3-9 Azabu-Juban, Minato-ku, Tokyo 106-0045

Country:Japan

Release id:42533

The post Next-Generation Japanese GLP-1 weight loss pills: Seeking North American Distributors appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Digital Sports Platforms Like Cricbet99 Reflect the Growing Evolution of Online Cricket Engagement

Bengaluru,Karnataka- The digital sports and gaming ecosystem continues to expand rapidly as more users turn to online platforms to follow and interact with their favorite sporting events. Among the platforms gaining visibility in this evolving space is cricbet99, which represents the broader trend of online sports participation supported by technology-driven infrastructure.

As cricket remains one of the most followed sports in India, digital platforms are transforming how fans engage with matches. Instead of simply watching games, users now explore online environments where they can track match statistics, follow live updates, and participate in sports-based gaming systems.

Industry analysts suggest that platforms such as cricbet99 highlight how the online gaming sector is adapting to changing user expectations by offering structured digital access and improved platform usability.

Rising Popularity of Online Cricket Platforms

The rapid growth of internet access and smartphone usage has significantly increased participation in online sports platforms. Cricket tournaments like the Indian Premier League (IPL), ICC events, and bilateral series continue to generate massive online engagement.

Platforms including cricbet99 provide digital environments where users can follow live matches and interact with sports markets through organized interfaces. This shift reflects a broader transformation in sports consumption, where fans are looking for more interactive experiences rather than traditional passive viewing.

The increasing popularity of such platforms indicates how digital infrastructure is reshaping the sports entertainment industry.

Platform Technology and User Accessibility

Online gaming platforms must deliver smooth navigation, stable performance, and mobile-friendly interfaces to meet the expectations of modern users. The success of digital sports platforms often depends on how effectively they integrate technology with user experience.

Platforms like cricbet99 operate within a growing ecosystem that includes similar digital sports environments such as cricbet99, which also focus on providing accessible sports-based gaming platforms for users.

Mobile compatibility plays a major role in this development. As smartphone adoption continues to rise, platforms are increasingly designed to support mobile-first access, enabling users to follow matches and platform activity from anywhere.

Security and Infrastructure in Digital Gaming

With the growth of online gaming platforms comes a greater emphasis on security and operational reliability. Industry experts note that digital platforms must invest in encrypted authentication systems, secure payment processing, and monitoring infrastructure to protect user accounts.

Platforms operating in the sports gaming space, including cricbet99, are part of an industry-wide effort to strengthen platform security and maintain operational transparency.

Reliable infrastructure not only improves user trust but also ensures stable performance during high-demand periods such as major cricket tournaments.

Future Outlook for Online Sports Engagement

The continued expansion of digital gaming platforms suggests that online sports engagement will remain a major part of the entertainment landscape. As technology advances and user expectations evolve, platforms will likely introduce more interactive features, improved analytics tools, and enhanced mobile accessibility.

Platforms such as cricbet99, alongside other emerging digital gaming systems like cricbet99, represent the growing shift toward technology-driven sports participation.

Industry observers believe that the future of online sports platforms will depend on balancing innovation, security, and responsible user engagement.

Company Information

Company: cricbet99

Contact Person: Maria Evan

Email: marketing@lotus365.travel

Website: https://www.cricbet99.cool/

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 week ago

Finance Complaint List Launches Enhanced AI Technology to Help Address Risks Linked to Online Trading and Cryptocurrency Platforms

-

Press Release1 week ago

Explores the Afterlife of Jesus Across Seven Nations

-

Press Release1 week ago

Daughter Exposes Family Theft Amid Father’s Alzheimer’s Battle

-

Press Release5 days ago

Tony Swantek Expands His Entrepreneurial Legacy Across Finance, Blockchain, and National Business Services

-

Press Release1 week ago

EV Battery Solutions by Cox Automotive to Be Featured on Now We Know! with Steve Guttenberg – Airing March 7 on CNBC

-

Press Release6 days ago

Cancos Tile and Stone Introduces the CTS Pro plus Collection: A New Professional-Grade Porcelain Tile Series Designed for Builders, Contractors, and Designers

-

Press Release6 days ago

CVMR and BITEC Establish Joint Venture CVMR R.D. Congo S.A.R.L. to Advance Exploration and In-Country Refining of Strategic Minerals

-

Press Release5 days ago

Usethebitcoin (UTB) Strengthens Position as a Leading Guide for Sending Crypto Remittances Globally