Press Release

How CESWAP Became The Second Generation Decentralized Exchange

We all know that blockchain technology has only started since 2008 and has evolved into an entire industry. Many cryptocurrencies are entering the market at a rapid pace, and new blockchain technologies are emerging in the cryptocurrency scene to support the wider acceptance and application. Beyond that, most exchanges in the cryptocurrency are centralized, which has been the norm so far. Imagine the irony of cryptocurrencies talking about economic decentralization being traded and stored in centralized exchanges and wallets. Fortunately, this model is also changing, as many people in the cryptocurrency believe that the era of centralized cryptocurrency exchanges must come to an end.

In the last article What is the future of blockchain, the final solution of the centralized exchange has mentioned.

Decentralized exchanges are based on the blockchain and do not store user funds and personal data on centralized servers and are managed by institutions. Instead, they match buyers and sellers of digital assets through smart contracts for point-to-point transactions.

Decentralized exchanges are an important part of decentralized finance (DeFi), which has higher barriers to use but lower moral, technical and regulatory risks than centralized finance (CeFi).

Today we’re going to talk about the characteristics of CESWAP. CESWAP is the second generation of an entirely new decentralized exchange, which is still constrained by the performance of the underlying public chain and will run on smart contracts.

CESWAP uses the platform governance token CE to expand the entire incentive mechanism, so as to encourage and expand the platform users at the same time, enabling them to have a smooth and healthy childhood period. CESWAP knows what users mean for an exchange, and that’s the significance to launch the CE in the early period of launching online.

Because the CE’s rewards could attract enough users for CESWAP to get through its infancy period. At the same time, the strong user base will provide CESWAP with an extremely deep trading depth and sufficient security support for trading large digital assets, and the actual price difference due to the slippage won’t appear in CESWAP. The CE will be launched as soon as the platform is launched, and it will be endowed with great capabilities:

- As 10% to 50% of the transaction fee, you will receive an airdrop of the equivalent value of platform token;

2. Whether the new currency can be listed or not shall be decided jointly by the holders of the platform token, instead of charging listing fees and so on, which to completely solve the current disordered trading environment;

3. The holder of platform token can enjoy 80% of the platform’s rewards and continue to use the service charge to destroy the platform token;

4. Investment properties of platform token brought by the above applications.

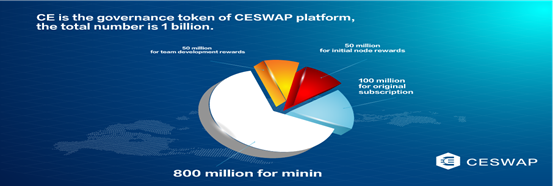

We found that the detailed allocation mechanism in the token allocation introduction of the CESWAP white paper, where only a small portion of the token is allocated to the early subscription, user expand bonus, and development team bonus. Most of it is used for liquidity mining rewards.

We noticed that 800 million of CE were mined by smart contracts by the POS+POW+LP dual consensus mechanism. The whole network hashpower of block rewards for CE is 1000 for every 10 minutes (including POS for 1000 every 10 minutes and POW for 1000 every 10 minutes and LP for 400 every 10 minutes). In order to achieve better development and sustainability of CE, when the number of common target addresses increases by 5000, the output will decrease by 5%, and so on. With the increase of hashpower of the whole network, the mining difficulty will become even higher. When the number of users has skyrocketed, then the consensus value of CE will also become even higher.

1. CESWAP, the Second-generation Decentralized Exchange Platform

2. CE is the governance token of CESWAP platform, the total number is 1 billion. 800 million for mining, 100 million for original subscription, 50 million for team development rewards, and 50 million for initial node rewards

3. Six advantages of CE: Safety, Freedom, High Income, value Increase, Trust, and Scientific Mining.

4. Six advantages of CESWAP

Security of Over 80% Principal

Completely Free Leaving or Staying Mechanism

Super High Return Income

Complete CE Value Increasing Logic

Absolute Trust

Scientific Mining Mechanism

The USDT or ETH assets held by the user are the user’s POS basic hashpower. The ratio of 20% of the assets to CE will generate the hashpower of the optimal balance algorithm, and the asset utilization rate is the highest. Otherwise, and the minimum value of the mainstream assets and the CE assets is the effective hashpower after the CE assets are multiplied by 5 times. The POW hashpower of the user is determined by the effective POS hashpower of each user in the user consensus group.

CESWAP is different from previous exchanges in that all of the users participating in the CE liquidity mining have the assets they deposit and the rewards from the mining in their hands. Different from previous projects, users will deposit the assets in their own wallets for mining ensures the security of more than 80% of the principal of the user’s assets.

Within the CE mechanism, there are no mandatory restrictions for all users. The user can choose freely to participate in CE mining. Every user only needs to pledge 20% of the principal of CE to have hashpower and obtain rewards by POS mining, and through CE liquidity mining can also have POW hashpower and obtain corresponding rewards. The CE has a super-high POW mining rewards, which encourages the formation of consensus relations. With the increase in the value of CE, users can get the double benefits of mining rewards and currency appreciation.

As I said just now, every user involved in liquidity mining needs to pledge CE of 20% of the principal value of mining, which also ensures that the premise of CE mining is to provide sufficient market purchasing power; The model of periodic decline of mineral extraction with increasing address number also provides the possibility of sustainability for CE. The complete economic logic will lead to a steady rise in the value of the CE.

The CE has dual consensus mechanism, and this mixed consensus mechanism provides equal opportunities for all miners, and any group can participate in the mining. The way of POS and POW double blocks output way will provide two-way selectivity for users to participate in the liquidity mining. At the same time, the rule of increasing address and decreasing output can also promote the sustainable development of CE. The value of CE will be guaranteed with the increase of hashpower and mining difficulty of the whole network.

In conclusion, CESWAP will welcome all blockchain applications to CESWAP with an open mind and guide all platform users to create the most secure, convenient, efficient and rich world-class decentralized exchange together.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

AgriFi Launches Real Yield DeFi Platform Backed by Agricultural Productivity

Estonia, 21st February 2026, ZEX PR WIRE, AgriFi, the blockchain-based agricultural finance ecosystem built on the Polygon network, has introduced its structured DeFi staking framework designed to align blockchain rewards with measurable agricultural productivity.

Unlike conventional yield farming systems that rely primarily on token emissions, AgriFi’s staking architecture operates under what it defines as a Fair Yield Economy, where participation rewards are linked to ecosystem performance rooted in real farming activity.

This milestone reflects AgriFi’s 2026 objective of building a transparent Agricultural DeFi infrastructure where digital finance mechanisms are anchored to productive land, verified farm data, and operational revenue.

Redefining DeFi Staking Around Real Economic Output

Most staking systems in decentralized finance are structured around supply expansion or liquidity mining incentives. While these models can drive participation, they are often disconnected from real-world productivity.

AgriFi’s architecture introduces a structurally different framework.

The AGF token, an ERC 20 asset operating on Polygon with a fully circulating supply of 7.2 billion tokens, functions within a broader agricultural finance ecosystem. Staking is not positioned as speculative yield farming. Instead, it operates as a structured participation layer linked to ecosystem performance.

The underlying principle is straightforward:

Blockchain rewards should reflect measurable economic activity.

Within AgriFi’s model, that activity originates from agricultural production, farmland participation structures, and ecosystem-level revenue logic.

How AgriFi’s Blockchain Staking & Profit Model Works

Staking Module

Token holders can lock their AGF tokens for periods ranging from 30 to 360 days, earning competitive yields of 5%–18% APY.

Smart contracts automatically calculate rewards based on staking duration and redistribute them directly to users’ wallets.

An early exit penalty of 2% ensures long-term ecosystem stability and consistent capital flow.

Profit Distribution Module

Beyond staking, AgriFi’s Profit Distribution Module converts farm revenues, such as crop sales and lease income, into stablecoins (e.g., USDC) and allocates them proportionally to AGF holders.

This creates a dual-income structure where investors benefit from both DeFi yield and real-world agricultural profits.

This establishes a dual participation structure where AGF holders may engage in both staking mechanics and agricultural performance participation, subject to ecosystem conditions.

All distribution logic is governed by smart contracts and remains on-chain and verifiable.

- Transparency Through Smart Contracts: All staking data, farm yields, and revenue flows are verifiable on the Polygon blockchain, ensuring full traceability from the field to the token holder.

- Farmer Capital Access: By enabling fractional investment through tokenized farmland, AgriFi allows farmers to raise funds transparently while sharing returns with global stakeholders.

From Field Performance to On-Chain Reward Logic

The defining strength of AgriFi’s staking model lies in its economic linkage between agriculture and blockchain.

The ecosystem architecture operates across three primary layers:

Blockchain Layer

Records token ownership, staking participation, governance logic, and smart contract execution.

Business Logic Layer

Manages farmland tokenization structures, allocation formulas, and reward calculations.

Off-Chain Operational Layer

Integrates agricultural activity, farm management systems, and IoT data inputs.

Revenue generated through agricultural activities and ecosystem participation influences the broader performance logic of the platform. That performance logic informs the sustainability and allocation of staking rewards.

In simplified structural terms:

Farm productivity influences ecosystem revenue

Ecosystem revenue influences distribution capacity

Distribution capacity influences staking sustainability

This framework establishes a direct pathway between real agricultural output and decentralized finance participation.

Importantly, staking returns are performance-linked and ecosystem dependent. They are not fixed-income guarantees. This distinction preserves structural integrity and regulatory clarity.

Agricultural DeFi Within the Real World Asset Movement

The tokenization of real world assets has become one of the defining themes in decentralized finance. Treasury instruments, real estate, and private credit have gained attention. Agriculture, despite being foundational to global economic stability, has remained structurally underrepresented.

AgriFi’s staking framework introduces a clear model for integrating agricultural productivity into DeFi reward mechanics.

Rather than treating farmland as a static digital token, the ecosystem embeds agricultural output into staking participation, governance structures, and ecosystem incentives.

This approach positions agricultural finance as a distinct and credible category within the broader real world asset evolution.

Infrastructure Built for Accessibility

Operating on Polygon enables low transaction costs and high throughput. Wallet compatibility includes MetaMask and WalletConnect, allowing participants to engage directly with staking contracts.

All staking logic remains on chain and independently verifiable, reinforcing transparency and trust.

About Agrifi

Agrifi is driving an agricultural revolution, harnessing blockchain technology to transform the agricultural supply chain. Our mission is to enhance transparency, efficiency, and sustainability in agriculture while empowering farmers and supporting small-scale agricultural practices.

Join us on this exciting journey to explore the future of agriculture while potentially enhancing the value of your AGF tokens. We’re not just redefining agricultural finance; we’re revolutionizing the future of farming and food production.

Ready to start staking your AGF tokens? Visit our website at https://agrifi.tech/for detailed steps on how to stake your tokens. Stay connected with us on Telegram, Twitter, Facebook and Instagram for the latest updates and community discussions.

Follow Us on:

- Website: https://agrifi.tech/

- WhitePaper: https://agrifi.gitbook.io/agrifi-docs

- Blog: https://blog.agrifi.tech

- Telegram: https://t.me/agrifi_official

- Facebook: https://www.facebook.com/agrifiofficial

- Instagram: https://www.instagram.com/agrifi_official/

- Twitter: https://x.com/Agrifi_official

- AGFI listed on: LBank Innovation Zone (AGFI/USDT) LBank

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Bernardo Arsuaga Cardenas on Emerging Trends That Matter to Everyday People

Bernardo Arsuaga Cardenas of Monterrey, Mexico breaks down key trends shaping how we work, create, and tell stories in a changing world.

Monterrey, Mexico, 21st February 2026, ZEX PR WIRE, Award-winning filmmaker and storyteller Bernardo Arsuaga Cardenas is highlighting several recent trends that are affecting individuals across industries, careers, and communities. Drawing from his own experience moving from law to documentary filmmaking, Bernardo offers insight into what these trends mean for everyday people and how they can respond with practical action.

.jpeg)

Trend 1: Creative Work Is Becoming More Accessible — and More Competitive

More people than ever are creating videos, podcasts, short films, and digital content. Easy online tools and platforms mean anyone can publish, but that also means more noise and more competition for attention.

-

More than 90% of internet users watch video content weekly.

-

Independent creators now number in the tens of millions worldwide.

In Bernardo’s words, “A good story opens doors, but only if someone takes the time to tell it right.”

Trend 2: Storytelling Is More Valuable Than Ever in Work and Life

Across fields, the ability to communicate clearly has shifted from a “nice-to-have” to a core skill. Whether pitching an idea, presenting a project, or sharing a life experience, strong storytelling builds connection.

“My goal in filmmaking is to make people sit down, forget about themselves, and enjoy a story,” Bernardo says. Simple, relatable narratives resonate.

Trend 3: People Are Seeking Depth Over Distraction

There’s a growing desire for meaningful content that helps people reflect, learn, or feel something real. Short, surface-level content still grows fast, but deeper work earns lasting engagement.

Bernardo believes this reflects a need for substance: “Ideas die when they stay abstract. Plans keep them alive.”

Trend 4: Collaboration Across Fields Fuels Opportunity

People who work with others outside their comfort zone — different industries, backgrounds, or skill sets — open unexpected doors. Bernardo’s collaborations with musicians, chefs, and athletes demonstrate how cross-disciplinary work expands audience reach.

What This Means for You — in Plain Language

These trends show that while tools are easy to access, real influence comes from clarity of idea and consistency of effort. Bernardo puts it simply: “Finish what you start, even if it’s imperfect.” When you invest time into a clear story, idea, or skill — and share it with others — you build value that lasts beyond trends.

Your Next 7 Days — Actions You Can Take This Week

-

Write a short narrative (about your week, a project, or a goal) and share it with someone.

-

Watch one long-form documentary instead of scrolling social media.

-

Pick one idea you’ve put off and write a first step.

-

Talk to a neighbor or colleague about something they’re passionate about.

-

Record a short video sharing something you learned recently.

-

Organize your notes or sketches into one simple outline.

-

Attend a local event — even online — that focuses on creativity or craft.

Your Next 90 Days — Longer Actions for Growth

-

Start a storytelling project (journal, mini documentary, blog, or podcast).

-

Build a small network of collaborators — aim for three people in different fields.

-

Learn one new tool (editing software, audio recorder, design app) and use it weekly.

-

Host or co-host a community screening or talk about a local issue.

-

Set a weekly reflection habit — review what worked, what didn’t, and your next step.Call to Action

Start now. Pick one action — big or small — and take the first step today. Whether you write a paragraph, record a voice memo, or have a meaningful conversation, momentum begins with action.

About Bernardo Arsuaga Cardenas

Bernardo Arsuaga Cardenas is a Monterrey-based documentarian, producer, and partner in a post-production studio. A former lawyer, he has directed internationally recognized documentaries including The Weekend Sailor and The Michoacan File. His work merges storytelling, curiosity, and real human experience, with a focus on turning meaningful ideas into projects that connect with audiences around the world.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

First Class Demolition Expands Commercial Demolition Services Across Melbourne and Surrounding Suburbs

Australia, 21st Feb 2026 – First Class Demolition, a leading provider of commercial demolition services in Victoria, has announced the expansion of its operations into Melbourne, Richmond, and surrounding suburbs. With over 20 years of industry experience, the company is set to provide safe, efficient, and fully licensed demolition solutions tailored to commercial and industrial clients across the region.

As urban development and property refurbishment continue to rise in Melbourne, demand for professional demolition services has grown significantly. First Class Demolition is responding to this need with a comprehensive suite of services that cater to warehouses, factories, schools, commercial buildings, car parks, and public facilities. The expansion reinforces the company’s commitment to delivering projects on time, within budget, and to the highest safety standards.

“Our mission has always been to provide reliable, professional, and fully compliant demolition services,” said the Director of First Class Demolition. “By expanding into Melbourne and nearby suburbs, we are bringing our expertise closer to clients who require commercial demolition Melbourne, partial demolition Melbourne, and associated services such as concrete excavation, land clearing, and asbestos removal Melbourne.”

The company’s service offerings include:

- Commercial Demolition – Safe and efficient demolition of warehouses, factories, schools, concrete and metal buildings, parking lots, sidewalks, and council facilities.

- Partial Demolition – Selective deconstruction that removes specific structures while preserving other parts of the building for renovations or alterations.

- Concrete Excavation – Removal of reinforced concrete foundations, footings, stump and strip footings, rocks, and waffle pod slabs.

- Land Clearing – Preparation of land for construction projects by clearing vegetation, debris, and restoring sites to a safe, usable state.

- Strip Outs – Removal of fixtures, fittings, and interiors to leave spaces ready for refurbishment.

- Asbestos Removal Coordination – Collaboration with fully licensed asbestos removalists to safely manage Class A and Class B asbestos, including providing compliance and clearance certificates.

First Class Demolition operates with full insurance and VBA registration, ensuring all projects adhere to the strictest safety and compliance requirements. Their team of specialists is equipped to manage every stage of a demolition project, from initial assessment and permits to site clearance and post-demolition cleanup.

Clients in Melbourne have already praised the company’s professionalism and efficiency. Marcus L., a recent customer, shared, “I’ve worked with several demolition contractors over the years, and these guys stand out. Clear pricing, no delays, and a very organized crew on site. First Class Demolition Melbourne delivered exactly what they promised.” Priya S., another client, added, “Professional, efficient, and easy to deal with. They managed all permits and safety requirements without any stress on our end. Highly recommend.”

The company is dedicated to offering fast turnaround times, competitive pricing, and exceptional customer service. Potential clients can request a free demolition estimate through the company’s website at https://commercialdemolitionmelbourne.com.au/, or contact the team directly at 0485 018 606 or info@commercialdemolitionmelbourne.com.au.

With the expansion, First Class Demolition aims to strengthen its presence in Melbourne while continuing to serve industrial and commercial clients across Victoria. Whether a project requires full-scale demolition, selective structural removal, or specialized asbestos coordination, the company promises dependable results delivered by experienced professionals.

About First Class Demolition

Founded over two decades ago, First Class Demolition provides top-tier commercial demolition Melbourne services across Melbourne and Victoria. The company specializes in a range of services, including commercial and industrial demolition, concrete excavation, land clearing, partial demolition, strip outs, and coordinating licensed asbestos removal. Fully licensed, insured, and VBA-registered, First Class Demolition is committed to delivering safe, compliant, and efficient project outcomes.

Contact:

First Class Demolition – Commercial Demolition Melbourne

Address: 380 La Trobe St, Melbourne, VIC 3000

Phone: 0485 018 606

Website: https://commercialdemolitionmelbourne.com.au/

Media Contact

Organization: First Class Demolition

Contact Person: Support team

Website: https://commercialdemolitionmelbourne.com.au/

Email: Send Email

Country:Australia

Release id:41758

The post First Class Demolition Expands Commercial Demolition Services Across Melbourne and Surrounding Suburbs appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release5 days ago

The New Architecture of Resilience: Why Ecosystem Design is the Secret to MENA’s Post-Conflict Recovery

-

Press Release1 week ago

George Washington University Launch Groundbreaking Public Certification Course on Mold Illness

-

Press Release1 week ago

Maui Helicopter Tours: Private Helicopter Tour Service In Hawaii

-

Press Release1 week ago

Xiangyang, China: locals welcome the Chinese New Year by flying sky lanterns and experiencing intangible cultural heritage.

-

Press Release1 week ago

Leverabet Launches Cryptocurrency-Based Online Gaming Platform Focused on Digital Transactions and Transparent Gameplay

-

Press Release6 days ago

Launch of Fresh Online Casino Guide for South Africa 2026

-

Press Release2 days ago

Nakuja Expeditions Offers All-Encompassing African Journeys Across Five Iconic Safari Destinations

-

Press Release1 day ago

Tennessee-born Marketing Strategist, John Gordon Nutley, on Budget Constraints and Digital Challenges Facing SMEs