Press Release

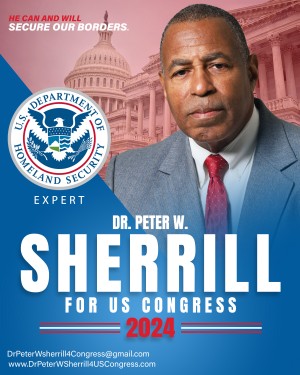

Homeland Security Expert Dr. Peter W. Sherrill Eyes Congress, Vows To Secure The Border

Mount Vernon, New York Apr 19, 2024 (Issuewire.com) – Dr. Peter W. Sherrill, renowned for his extensive expertise in Homeland Security & Emergency Services, including Incident Command Systems (ICS) and COBRA training, is officially announcing the launch of his exploratory campaign for US Congress in the 16th Congressional District.

Formerly a lifelong Democrat, Dr. Sherrill decided to depart from the Party in 2011 due to personal and professional convictions. Despite being officially retired, his unwavering dedication to public service and a fervent desire to enact positive change have driven him to take action. Dr. Sherrill is deeply troubled by the nation’s handling of the Covid pandemic, which resulted in the loss of over a million American lives, as well as the ongoing crisis at our nation’s borders. He declares, “Enough is enough!”

Dr. Sherrill brings to the table a wealth of expertise in Homeland Security, having trained extensively with First Responders across the nation. Additionally, he holds a Master’s in Public Administration and a double major in Economics and Management. Recognized for his contributions, Dr. Sherrill has also been bestowed with an Honorary Doctorate in Humanities for his work with the International Institute for African Scholars (IIAS).

The candidacy of Dr. Sherrill serves as a beacon of hope, not only for his constituents but for all Americans who yearn for effective representation. His profound wisdom, exemplary leadership, and proactive approach to governance will instill pride in our nation once again.

About Dr. Peter W. Sherrill:

Dr. Peter W. Sherrill is a Certified Trainer in Weapons of Mass Destruction from the Energetic Materials Research Training Center, Socorro, New Mexico, with extensive training in Incident Command Systems (ICS) and COBRA training at Fort McClellan, Anniston Alabama.

Before becoming an expert in Homeland Security and bestowed an Honorary Doctorate for his work with the International Institute, Dr. Sherrill spent 25 years in Corporate America.

Formerly a lifelong Democrat, Dr. Sherrill’s extremely controversial decision in 2011 to join the Republican Party, has ostracized him from the African American community. His literary works, “EXODUS: Why I Became A Republican,” followed by “The Life of A Black Republican in Trump’s America,” extensively highlights the challenges Dr. Sherrill’s candidacy for US Congress faces in securing our nation’s borders as a Republican in a Democrat-dominated district

However, Dr. Sherrill understands how paramount it is to secure our nation’s borders now, before it’s really and truly too late. Dr. Sherrill’s motto is, “See Something – Do Something!” Elect a Homeland Security Expert and let’s “Unite and Secure America!”

For all campaign inquiries, please contact:

Dr. Peter W. Sherrill

Republican Congressional Candidate

Joshua J. Gumbiner

Sr. Advisor

Source :Dr. Peter W. Sherrill

This article was originally published by IssueWire. Read the original article here.

COMTEX_451073237/2777/2024-04-19T05:04:37

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Repairing QuickBooks files promptly mitigates unnecessary costs, preventing further damage and preserving financial resources

Brandon, MB, 2nd May 2024, ZEX PR WIRE, QuickBooks is the lifeline of many businesses, efficiently managing financial data and facilitating crucial insights for decision-making. However, like any software, QuickBooks files can encounter issues that compromise data integrity and system stability.

At the heart of QuickBooks lies the integrity of financial data. Any corruption or errors within QuickBooks files can lead to inaccuracies in financial reporting, jeopardizing the credibility of financial statements and hindering decision-making processes. Repairing QuickBooks files ensures that data remains accurate and reliable, safeguarding the financial health of the business.

A corrupted QuickBooks file can manifest in various ways, from slow performance and freezing to outright crashes. These disruptions not only impede productivity but also pose a risk of data loss if the file becomes irrecoverable. Repairing QuickBooks files restores system stability, minimizing the likelihood of unexpected errors and ensuring uninterrupted access to critical financial information.

For businesses operating in regulated industries, compliance with financial reporting standards is non-negotiable. Any discrepancies or irregularities resulting from corrupted QuickBooks files could lead to compliance violations and potential legal ramifications. By promptly repairing QuickBooks files, businesses uphold regulatory requirements and demonstrate their commitment to financial transparency and accountability.

In today’s fast-paced business environment, timely access to accurate financial data is paramount. A corrupted QuickBooks file can delay decision-making processes, as stakeholders wait for data to be recovered or errors to be resolved. Repairing QuickBooks files expedites the availability of reliable financial information, empowering businesses to make informed decisions swiftly and confidently.

The repercussions of a corrupted QuickBooks file extend beyond data loss and system downtime—they can also incur significant financial costs. From the time and resources spent on manual data entry to the potential loss of revenue due to disrupted operations, the financial implications can be substantial. Repairing QuickBooks files promptly mitigates these costs, preventing further damage and preserving financial resources.

Repairing QuickBooks files is not just a matter of technical maintenance—it’s a critical component of preserving financial integrity, ensuring system stability, and facilitating informed decision-making. By prioritizing QuickBooks file repair and adopting proactive measures to prevent file corruption, businesses can safeguard their financial data, maintain compliance with regulatory standards, and mitigate potential financial risks. In today’s dynamic business landscape, the importance of repairing QuickBooks files cannot be overstated—it’s the foundation upon which sound financial management and business success are built.

Visit https://quickbooksrepairpro.com/quickbooks-data-recovery.aspx for more information.

About QuickBooks Repair Pro

QuickBooksRepairpro.com is a leading QuickBooks File Repair and Data Recovery, QuickBooks Conversion, QuickBooks Mac Repair, and QuickBooks SDK programming services provider in North America, serving thousands of business users all over the world. With over 20 years of experience with Intuit QuickBooks, QuickBooksRepairpro.com assists QuickBooks users and small businesses with a variety of services and work with the US, UK, Canadian, Australian (Reckon Accounts), and New Zealand versions of QuickBooks (PC and Mac platforms).

For more information, visit https://quickbooksrepairpro.com/

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

By removing Multicurrency, businesses can optimize QuickBooks for their specific needs, resulting in faster load times, smoother navigation, and enhanced overall stability

Brandon, MB, 2nd May 2024, ZEX PR WIRE, QuickBooks Multicurrency is a powerful feature designed to facilitate international transactions and currency management within the software. However, for businesses with simpler accounting needs or primarily operating within a single currency environment, the complexities of Multicurrency may outweigh its benefits.

One of the primary benefits of removing QuickBooks Multicurrency is the simplification of accounting processes. Multicurrency functionality adds complexity to transactions, requiring additional steps for currency conversion, exchange rate adjustments, and reporting. By operating solely in the native currency of your business, you can streamline accounting workflows, reduce the risk of errors, and save time on data entry and reconciliation tasks.

Managing multiple currencies in QuickBooks can be challenging, especially for businesses with fluctuating exchange rates and frequent international transactions. Removing Multicurrency eliminates the need to constantly monitor and update exchange rates, reducing the risk of errors and ensuring greater accuracy in financial reporting. It also promotes consistency in financial records, as all transactions are recorded in a single currency, facilitating easier analysis and decision-making.

QuickBooks Multicurrency adds an additional layer of complexity to the software interface, with specialized features and settings for currency management. For businesses that do not require Multicurrency functionality, removing it can streamline the QuickBooks interface, making it more intuitive and user-friendly for accounting staff. This simplification can lead to increased productivity and efficiency in day-to-day financial management tasks.

QuickBooks Multicurrency is available as an add-on feature in certain versions of the software, typically at an additional cost. By removing Multicurrency, businesses can potentially reduce their software subscription fees and eliminate the need to invest in training for specialized currency management features. This cost savings can be significant, especially for small businesses or startups operating on tight budgets.

Operating QuickBooks without Multicurrency can lead to improved performance and stability of the software. Multicurrency functionality adds complexity to the underlying database and can result in slower performance, especially for businesses with large transaction volumes. By removing Multicurrency, businesses can optimize QuickBooks for their specific needs, resulting in faster load times, smoother navigation, and enhanced overall stability.

While QuickBooks Multicurrency is a valuable feature for businesses engaged in international transactions, it may not be necessary or practical for all users. By removing Multicurrency, businesses can simplify their accounting processes, enhance accuracy and consistency, reduce software complexity, realize cost savings, and improve the performance and stability of QuickBooks. Before making the decision to remove Multicurrency, businesses should carefully evaluate their currency management needs and consider the potential benefits of streamlining their financial management process. Ultimately, choosing the right configuration of QuickBooks can help businesses optimize efficiency, accuracy, and productivity in their accounting operations.

About E-Tech

Founded in 2001, E-Tech is a leading file repair, data recovery, and data conversion services provider in the United States and Canada. The company works to stay up to date on the latest technology news, reviews, and more for their customers.

For media inquiries regarding E-Tech, individuals are encouraged to contact Media Relations Director, Melanie Ann via email at [email protected].

To learn more about the company, visit: www.e-tech.ca

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Indian Visa For Australia, Dubai and Sri Lankans

Should you have any inquiries or issues regarding your visa application, please reach out to the Indian Visa Help Desk as a customer. The India Visa Helpdesk is available to assist you with all visa-related concerns. Below is contact information for your Indian visa.

In 2014, Indian authorities introduced the e-Visa system to streamline visa applications for over 169 countries, reducing wait times at embassies for entry approval. Tourists can choose to apply for an India Tourist Visa, India Business Visa, or India Medical Visa based on the reason for their travel. Sri Lankan citizens with an Indian e-Tourist Visa meant for tourism are allowed to visit the country and remain for a maximum of 30 days starting from the day of their arrival. This visa is valid for just one month starting from the date of issue. In addition, a tourist visa for India could be valid for either one year or five years. During the validity period of the visa, you may enter and exit the country as often as necessary, but your stay at each entry cannot exceed 90 days. Sri Lankan citizens can now apply for an India visa quickly and easily, without having to present their passport to the Indian Embassy. Travelers can quickly apply for an e-Visa online.

INDIAN VISA REQUIREMENTS FOR SRI LANKA CITIZENS

-

A valid Passport that is valid for 6 months.

-

A valid Email address to receive the Indian E-Visa in their Inbox.

-

You can use a Credit/Debit Card or PayPal Account to pay for the E-Visa fees.

For individuals who want to launch their own company, those who have regular long-term business trips, and potential investors. Citizens who meet the necessary requirements are eligible to request an India Business eVisa for the purpose of conducting business activities in India, such as participating in a conference, workshop, or symposium, receiving training or courses, negotiating contracts, and attending meetings. Before traveling to India for business reasons, it is necessary to apply for an India Business eVisa. Individuals from over 169 nations are now eligible to request e-Visas for travel to India. Citizens who meet the requirements can travel to India for tourism and stay for a maximum of 90 days continuously (up to 180 days for Canadian, Japanese, UK, and US citizens). For those planning a shorter stay, a double-entry Tourist eVisa for India is also available, allowing a 30-day stay with two entrances into India. It is suggested that you use this programme to obtain your India e-Visa because the process is quick and easy. Eligible citizens can apply online by filling out the short and clear India Visa Application Form.

DOCUMENTS REQUIRED INDIAN BUSINESS E-VISA

-

A valid passport that does not expire for at least 3-6 months is an absolute necessity and it should have at least 2 empty pages for stamping.

-

A valid email address to receive the E-Visa in your Inbox.

-

You can use a Credit/debit card or PayPal account to pay for the E-Visa fees.

-

A copy of your Business Card in PDF format (this must include your company’s information, especially the corporate phone number as you will be contacted through it by the embassy).

-

A detailed invitation letter from the host company/firm established in India or from India, stating the purpose of the travel (it must include their contact information and their logo).

Apply Indian Business Visa from Australia

Individuals from 169 countries, Australia included, have the option to request an Indian eVisa through an online application process. The process of applying for an Indian business visa in Australia is just like applying in any other country. Variations among nationalities mainly stem from differences in cost and the time required for processing. The business visa for India enables individuals to engage in business activities and carry out operations within the country. The India e-Business visa permits multiple entries and a maximum stay of 180 days, beginning from the initial entry date. The validity of the India e-Business visa starts from the issuance date and is valid for one year. Business travelers should apply for a business visa at least four days before their trip. Most applications are processed within four days, but visa processing may take a few days longer in some cases. The procedure is straightforward, and it will not take you long to complete it.

DOCUMENTS REQUIRED FOR INDIAN BUSINESS E-VISA

-

A valid passport that does not expire for at least 3-6 months is an absolute necessity and it should have at least 2 empty pages for stamping.

-

A valid email address to receive the E-Visa in your Inbox.

-

You can use a Credit/debit card or PayPal account to pay for the E-Visa fees.

-

A copy of your Business Card in PDF format (this must include your company’s information, especially the corporate phone number as you will be contacted through it by the embassy).

-

A detailed invitation letter from the host company/firm established in India or from India, stating the purpose of the travel (it must include their contact information and their logo).

Individuals must have a valid visa in order to enter India for business, leisure, or medical purposes as required by the authorities. The Indian government has simplified the process of applying for an Indian visa from the UAE as much as possible. Prior to arrival in the country, you need to secure an electronic visa. People from over 169 countries are eligible to apply for e-Visas to India. UAE residents interested in traveling to India for tourism purposes have the option to apply for a Tourist eVisa through an online application. Emirati citizens now have the option to request an Indian Tourist Visa online through the India e-Visa program, without the need to visit a physical embassy. In India, an e-Visa, also known as an electronic visa (eTV), is a form of online travel permit. It is a multiple-entry visa for e-tourists and e-businesses with a 365-day validity period and a triple-entry visa for e-Medical and e-Physician Assistants with a 60-day validity period. For UAE citizens, the process is very simple. An online visa does not require you to visit an embassy or consulate. You don’t have to do anything in person because the process is entirely online.

REQUIRED DOCUMENTS FOR UAE CITIZENS

-

A Valid passport valid for at least six months.

-

Passport-style photo of the applicant.

-

A valid Email address to receive the eVisa in their Inbox.

-

You can use a Credit or debit card to pay for the processing fee.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 week ago

Ilika chief executive Graeme Purdy discusses 2024 revenue growth and strategic milestones

-

Press Release14 hours ago

Vencanna Announces Closing the Acquisition of The Cannavative Group and the Post-Transaction Management and Board of Directors

-

Press Release4 days ago

HTX Launches New Trade to Earn: Trade BTC with Negative Fee Rates and Share 200,000 USDT Daily with Nonstop Rewards in 7*24 Hours!

-

Press Release4 days ago

Educator, Youth Empowerment Speaker, & Author Receives Presidential Lifetime Achievement Award

-

Press Release1 week ago

90% Of Americans Believe We Are Experiencing A Mental Health Care Crisis Elevate Health And Wellness Is Providing Relief

-

Press Release5 days ago

Liquid Crypto welcomes PUML Better Health and their token PUMLx as their newest DEX listing.

-

Press Release6 days ago

Streamlined Sea Adventure: Top Accessories for Boat Trailers

-

Press Release5 days ago

mobilefYre Sparks Excitement with Innovative Solutions: Unveiling a New Era in Local SEO Marketing