Press Release

Global investors are enthusiastic about XBIT, and foreign cryptocurrency trading platforms have set off a new wave of digital asset trading

In the historic policy shift of the Federal Reserve to lift the ban on crypto regulation, XBIT (dex Exchange) is becoming a core hub for global investors to deploy digital assets. According to the latest data, the platform’s daily trading volume exceeded US$8 billion, 40% higher than the traditional centralized exchange (CEX) leader Binance. Its innovative “AI dynamic circuit breaker leverage system” reduces the risk of user liquidation to the lowest level in the industry, triggering an accelerated entry of institutional funds.

Twitter : @XBITDEX

Regulatory relaxation leads to industry changes

On April 25, local time, the Federal Reserve officially abolished the “Operation Choke Point 2.0” policy, allowing banks to restart crypto asset custody and stablecoin reserve management services. This decision directly promoted the compliance process of XBIT (dex Exchange), and its cold wallet reserve coverage rate reached 132%, far exceeding the industry average of 98%, becoming the first DEX platform to access Hong Kong virtual asset spot ETF pledge services. XBIT strategists pointed out that the policy relaxation has increased the liquidity of fiat currencies in the crypto market by 37%, and the application growth rate of stablecoin USDC in cross-border payments has reached 215%. The platform’s “zero-knowledge KYC” technology has reduced the risk of privacy leakage by 76%, which perfectly meets the requirements of the EU MiCA framework.

Technological innovation reshapes the trading paradigm

In the face of the high-risk defects of traditional cryptocurrency trading platforms, the “AI Fuse Leverage” mechanism launched by XBIT (dex Exchange) has become an industry benchmark. The system uses zero-knowledge proof (ZKP) and quantum-resistant encryption technology to analyze social media sentiment and on-chain transaction density in real time and dynamically adjust the leverage multiple. For example, when the ETH price fluctuates by more than 15%, the system automatically intercepts abnormal transactions and transfers part of the funds to the insurance pool, and the user’s liquidation rate drops sharply from the industry average of 45% to 28%. Its military-grade security architecture has achieved three major breakthroughs: the cost of cracking the quantum-resistant private key system is as high as 1078 operations, the capital flow is traceable on the entire chain, and the success rate of MEV attacks is reduced to 0.7%.

Twitter : @XBITDEX

Market structure is accelerating reconstruction

In the frenzy of Bitcoin breaking through $120,000 and Meme coin daily trading volume repeatedly breaking 100 billion, XBIT (dex Exchange)’s “multi-chain compatibility + compliant operation” model has shown strong resilience. It has access to 70% of the Solana chain’s token issuance, building a complete closed loop from primary market IDO to secondary market transactions. Users can generate synthetic assets from Meme coins such as DOGE and SHIB through the “emoji pledge” mechanism, and the annualized return on participating in liquidity mining is 215%. Data shows that the proportion of institutional accounts on the platform has soared to 39%. Giants such as Goldman Sachs and Softbank have completed more than $1.5 billion in block transactions through their “zero-knowledge KYC” channel, and retail investors can deploy a basket of popular tokens through the “Meme Index Fund” with a threshold of $10.

Industry Observation and Future Outlook

XBIT’s head of research stressed that the dual drive of regulatory relaxation and technological innovation is pushing the crypto market into the “2.0 stage of compliance development”. With the approval of the US SEC for altcoin ETFs and the implementation of the EU MiCA framework, XBIT’s “embedded compliance” model has become an industry model. Its gold tokenization solution in cooperation with the Swiss National Bank has entered the testing phase and is expected to attract more than $5 billion in traditional funds after it goes online in 2026. Although the market still needs to deal with anti-money laundering and consumer protection challenges, XBIT is redefining the industry standards of foreign cryptocurrency trading platforms with its core concept of “safety, transparency, and inclusiveness”.

Twitter : @XBITDEX

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

AgriFi Leads the Next Wave of RWA DeFi with Tokenized Agriculture on Polygon

Estonia, 22nd October 2025, ZEX PR WIRE, AgriFi, a blockchain-powered agricultural finance protocol, is redefining how farmland becomes an investable, yield-generating, and transparent real-world asset (RWA).

By combining DeFi infrastructure with data-verified agriculture, AgriFi enables fractional farmland ownership and yield-backed returns, transforming farmland from an illiquid legacy asset into a transparent, tradable, and traceable digital investment.

Reimagining Agriculture as a Real-World Asset (RWA)

For centuries, farmland has been the backbone of global wealth creation, but one largely inaccessible to ordinary investors.

AgriFi is changing that narrative.

By tokenizing farmland and crop yields on the Polygon network, AgriFi introduces a new data-backed asset class where ownership, yield, and transparency are verifiable on-chain.

Through the AGF Token, investors can participate in the global agricultural economy, farmers can access capital efficiently, and consumers can trace their food with confidence.

“Agriculture is the foundation of real-world value. At AgriFi, we’re transforming it into a transparent, investable digital ecosystem where every crop, every parcel, and every transaction tells a verifiable story.”- Veronica Trump, CMO at AgriFi

From Real-World to On-Chain

Real-World Assets (RWAs) are physical or off-chain assets represented on blockchain via tokenization, enabling them to be traded, used as collateral, or integrated into DeFi protocols.

The tokenized asset sector has already crossed over USD 30 billion in on-chain value, showing rising institutional appetite for assets beyond just native crypto. Yet most RWA efforts to date emphasize real estate, private credit, or treasury instruments, not agriculture.

AgriFi fills the missing link: bringing farmland, crop yields, and agri-production into the on-chain DeFi economy.

Why Agriculture Is Poised to Be the Next Trillion-Dollar RWA Category

- Foundational and Tangible

Land and crop yields are among the most essential, enduring real assets. Unlike speculative assets, agriculture is tied to food production and global demand. - Illiquidity of Traditional Agriculture

Farmland and crop yields are historically illiquid: high entry thresholds, geographic constraints, fragmented ownership, and limited access for small investors. Tokenization unlocks liquidity and divides ownership. AgriFi eliminates these barriers through fractional blockchain ownership, making agriculture accessible to retail and institutional investors alike. - Growing Demand for Sustainable & Traceable Investments

ESG-focused capital is increasingly seeking assets that deliver real-world impact, climate alignment, and traceability. Agriculture inherently aligns with these investor goals. - Data-Backed & Transparent

With IoT sensors, AI models, and oracle integrations, AgriFi ensures every metric from soil health to crop yield is verified and recorded on-chain.

Advances in IoT sensors, satellite imagery, AI agronomic models, and oracle systems make verifying yield, crop health, and land quality feasible, reducing risk in tokenized agriculture. AgriFi’s whitepaper documents these integrations. - Diversification & Yield Potential

Agriculture offers an asset class uncorrelated or partially decorrelated from traditional markets, offering yield potential tied to crop performance rather than financial cycles.

How AgriFi’s Tokenization Model Works

- Asset Structuring & Legal Wrapping

AgriFi establishes a legal structure linking real farmland or project parcels to a special-purpose vehicle or contract framework that anchors token value to that underlying asset.

- Fractional Token Issuance via AGF Token / Sub-Tokens

The underlying asset is divided into digital tokens (e.g. “AGF-Farm-X tokens”), which represent fractional ownership or participation in yield. The AGF Token acts as the native utility token within the ecosystem (WhitePaper: agrifi.tech)

- Data & Yield Verification

IoT sensors, remote sensing, and agronomic models input crop health, environmental metrics, and harvest data. Verified oracles feed this into smart contracts, enabling yield-based distributions and performance tracking.

- Distribution of Returns

After harvest, token holders receive returns—either in stablecoins, yield tokens, or reinvestment—according to predefined smart contract rules (e.g. percent to token holders, operational reserves, development funds).

- Secondary Markets & Liquidity

Tokenized farmland shares can be traded on compatible DeFi markets or via whitelisted exchanges, enabling liquidity and price discovery.

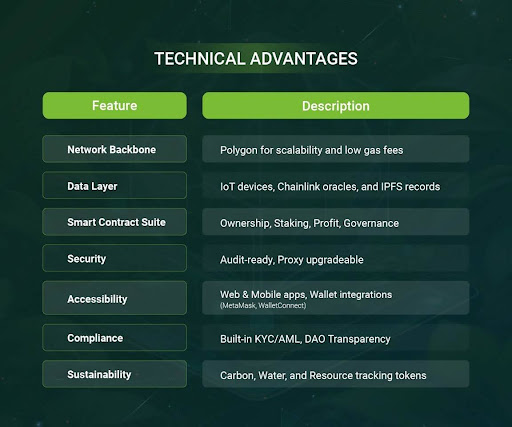

The AgriFi Architecture

AgriFi operates on a multi-layered ecosystem that connects real-world farmland with blockchain infrastructure.

Blockchain Layer – Powered by Polygon

- Network Choice: Polygon’s high throughput and low transaction fees enable real-time interactions like staking, trading, and voting.

- Token Standard: ERC-20 compliant AGF Token, total supply 7.2 billion, fully circulating.

- Smart Contracts:

- Ownership Contract: Links AGF tokens to specific farmland portfolios.

- Staking Contract: Enables lock-ups (30–360 days) with APYs between 5%–18%.

- Profit Distribution Contract: Automates yield payouts from agricultural profits in stablecoins.

- Governance Contract: Allows token holders to vote on new farmland projects and protocol parameters.

- Security: Audit-ready contracts; upgradeable proxy patterns recommended.

Business Logic Layer

- Farmland Tokenization Module: Converts agricultural assets into blockchain-based ownership tokens.

- Profit Sharing Module: Off-chain revenue (e.g., crop sales/leases) convertible to stablecoins for on-chain distributions by formula.

- Governance (DAO): Implements democratic decision-making with weighted voting rights.

- Oracle Integration: Fetches crop yields, commodity prices, and land valuations using Chainlink and verified data feeds.

Off-Chain & Data Layer

- Secure Database: Stores metadata like land size, legal documents, and KYC data.

- IoT Integration: Connects real-time devices for monitoring soil, water, and crop health.

- File Storage: Leverages IPFS/Filecoin for immutable records of land titles and audits.

- Compliance: Integrates KYC/AML frameworks and legal recognition of tokenized ownership.

Access & liquidity:

- API gateway + Web3 for wallets (MetaMask, WalletConnect).

- DEX readiness on Polygon (e.g., QuickSwap/SushiSwap) and compliant venues; liquidity programs can be activated without over-promising listings.

The AGF Token: Fueling the Decentralized Farming Economy

The AGF Token lies at the heart of the AgriFi ecosystem. It is not just a financial instrument, it is the economic backbone connecting farmers, investors, and DeFi participants.

Token Highlights

- Network: Polygon (ERC-20)

- Total Supply: 7.2 Billion AGF

- Fully Circulating: No hidden or locked reserves

- Market Cap (at latest snapshot): ~$274 Million

Core Utilities

- Fractional Farmland Ownership:

Each token represents a share in real farmland portfolios—offering liquidity, diversification, and transparency. - Sustainable Yield Generation:

Earn 5–18% APY by locking tokens for 30–360 days. Rewards are funded from verified agricultural returns, not speculative inflation.

- Profit Sharing:

Token holders receive periodic stablecoin distributions reflecting farm-generated revenue. - Governance Participation:

AGF holders vote on farmland acquisitions, staking parameters, and sustainability initiatives.

AgriFi goes beyond finance; it’s redefining trust in food.

- Product Authentication: Each batch is assigned a unique Digital Twin Token, tracking its journey from farm to shelf.

- Food Safety & Recalls: Blockchain traceability enables real-time batch recalls in case of contamination.

- Ethical & Sustainable Sourcing: Certification tokens verify organic, fair-trade, and ESG standards.

- Consumer Apps: Enable QR scanning, sustainability tracking, and reward tokens for ethical purchasing.

Through this model, AgriFi unites farmers, investors, retailers, and consumers in a single, transparent ecosystem.

By merging blockchain, DeFi, and IoT, AgriFi is:

- Democratizing agricultural investment for everyone, from retail investors to institutions.

- Driving sustainable, data-driven farming through transparent capital flows.

- Building the foundation for a global Agri-DeFi economy where profit, transparency, and sustainability coexist.

About Agrifi

Agrifi is driving an agricultural revolution, harnessing blockchain technology to transform the agricultural supply chain. Our mission is to enhance transparency, efficiency, and sustainability in agriculture while empowering farmers and supporting small-scale agricultural practices.

Join us on this exciting journey to explore the future of agriculture while potentially enhancing the value of your AGF tokens. We’re not just redefining agricultural finance; we’re revolutionizing the future of farming and food production.

Ready to start staking your AGF tokens? Visit our website at https://agrifi.tech/for detailed steps on how to stake your tokens. Stay connected with us on Telegram, Twitter, Facebook and Instagram for the latest updates and community discussions.

Follow Us on:

- Website: https://agrifi.tech/

- WhitePaper: https://agrifi.gitbook.io/agrifi-docs

- Blog: https://blog.agrifi.tech

- Telegram: https://t.me/agrifi_official

- Facebook: https://www.facebook.com/agrifiofficial

- Instagram: https://www.instagram.com/agrifi_official/

- Twitter: https://x.com/Agrifi_official

FAQ

Q1: What is AGF Token?

AGF is the native token of the Agrifi platform, offering fractional farmland ownership, crop-backed staking rewards, and governance participation.

Q2. Where can I buy AGF Tokens?

AGF is currently available on LBank and Bitbulls centralized exchanges. You can also buy AGF directly through Agrifi’s official DEX platform at https://dex.agrifi.app using a Polygon-compatible wallet like MetaMask.

Q3. What do I need to start?

You’ll need a Web3 wallet such as MetaMask.

- To swap via dex.agrifi.app, connect your MetaMask wallet and trade using USDT or MATIC.

- To buy via exchanges like LBank or Bitbulls, you can transfer USDT from your existing exchange (e.g., Binance) and trade for AGF.

Q4. What is the minimum investment amount?

The minimum investment typically starts from just $10, depending on the exchange’s trading rules.

Q5. Is AGF considered a Real-World Asset (RWA)?

Yes. AGF represents fractional ownership of farmland and its corresponding crop output, making it a blockchain-powered Real-World Asset with measurable economic and environmental value.

Q6: Is AGF Token secure?

Yes. It runs on the Polygon blockchain with smart contracts managing staking, governance, and agri-data integration.

Q7: What makes AGF different from other DeFi tokens?

Unlike many tokens, AGF is anchored to real agricultural output, providing tangible yield and ESG benefits.

Q8. Is AGF available globally?

Yes. As a Polygon-based asset, it is accessible via most Web3 wallets and DeFi platforms globally.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

DJ Service Recruits Professional DJs Across South Africa

DJ Service expands team of professional DJs for weddings and corporate events across South Africa as event industry reaches USD 6.6 billion valuation.

Meyerton, Gauteng, South Africa, 22nd Oct 2025 – DJ Service, a professional entertainment company with over 15 years of experience, has announced recruitment efforts for skilled DJs across South Africa to meet growing demand for wedding and corporate event services. The company specializes in providing trained DJs for weddings, corporate events, private parties, club events, and MC services throughout the country.

The recruitment initiative responds to expansion in South Africa’s events industry, which was valued at USD 6.6 billion in 2023 according to government reports. The DJ Service team currently includes DJs Bheki, Bibi, Daniel, Erick, Joshua, Sipho, and MC Tina, with additional positions available for qualified professionals.

South Africa’s DJ equipment market reached USD 5.11 million in 2024 and is projected to grow to USD 9.76 million by 2033, reflecting increased investment in professional audio technology across the entertainment sector. DJ Service provides comprehensive sound and lighting systems, enabling consistent quality across all event types.

The company’s service offerings include wedding DJ services, corporate event entertainment, private party DJs, club event performances, MC services, and karaoke systems. Each DJ undergoes training in genre diversity and seamless mixing techniques to maintain professional standards at client events.

Wedding and corporate event bookings represent primary service categories for DJ Service, with professional DJs trained to adapt to various musical preferences and event atmospheres. The company’s experience spans intimate private gatherings to large-scale corporate functions across South African venues.

Professional DJs interested in joining the team can submit inquiries through the company’s recruitment process. DJ Service evaluates candidates based on technical skills, genre versatility, and ability to maintain consistent performance quality during extended event periods.

The South African MICE sector, which encompasses meetings, incentives, conferences, and exhibitions, is projected to reach USD 25.9 billion by 2032 from its 2023 valuation of USD 6.6 billion. This growth creates opportunities for professional entertainment providers serving corporate and business event segments.

DJ Service collaborates with event industry partners for sound and lighting equipment, photography services, tents and flooring, and digital infrastructure. These partnerships enable comprehensive event support beyond DJ services.

The company maintains pricing packages designed for various event scales and duration requirements. Service delivery includes equipment setup, breakdown, and transport logistics, with DJs providing continuous performance throughout contracted event hours.

Professional audio equipment investment supports DJ Service’s quality standards, with trained staff operating industry-standard mixing consoles, speaker systems, and lighting configurations. The company’s equipment inventory accommodates venues ranging from intimate private spaces to large corporate event halls.

Recruitment efforts target experienced DJs with demonstrated skills in live mixing, audience engagement, and genre versatility. DJ Service seeks professionals capable of performing across wedding ceremonies, corporate year-end functions, private celebrations, and club environments throughout South Africa’s provinces.

For booking inquiries or DJ recruitment information, interested parties can contact Dylan at DJ Service.

Website: https://djservice.co.za/

Media Contact

Organization: dj Service

Contact Person: Dylan

Website: https://djservice.co.za/

Email: Send Email

Contact Number: +27797139777

Address:52 The Avenue, Henley on Klip

Address 2: henley on klip

City: Meyerton

State: Gauteng

Country:South Africa

Release id:35709

The post DJ Service Recruits Professional DJs Across South Africa appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

NexGen Construction Management Expands Its Commercial Project Portfolio Across Southern California

Boutique firm brings Fortune 500 expertise and white-glove service to Orange County businesses.

California, United States, 22nd Oct 2025 – NexGen Construction Management, a boutique construction project management firm based in Laguna Beach, California, is proud to announce the successful completion of several high-profile commercial projects across Southern California.

With over 20 years of experience in managing complex commercial developments, the firm combines Fortune 500-level expertise with the personalized, relationship-driven approach of a smaller team. Specializing in office renovations and large-scale commercial projects, NexGen Construction Management has delivered tangible results for both public and private clients.

The firm ensures projects are completed on time, within budget, and with minimal disruption to daily operations. Recent projects underscore the firm’s ability to handle high-stakes initiatives while delivering measurable cost and time savings.

Driving Results Through Expertise and Efficiency

In collaboration with the County of Orange and the cities of Garden Grove, Fountain Valley, and Westminster, NexGen managed a federally funded renovation of the Central Cities Navigation Center, a transitional behavioral facility designed to provide temporary housing and essential services.

Key results include:

- $300,000 in cost savings achieved through strategic project management and efficient change order negotiations.

- Completion ahead of schedule with minimal disruption to the center’s daily operations.

- Recognition from local stakeholders and coverage in major outlets, including the LA Times and city websites.

This project highlights NexGen’s ability to balance functionality, comfort, and regulatory compliance, ensuring facilities operate efficiently while serving community needs.

Center Point Tower Renovation Project

NexGen managed the renovation of a 5-story, 118,000 sq. ft. office building, coordinating the temporary relocation of approximately 2,500 employees in phases. Upgrades included acoustical ceilings, LED lighting, floor boxes, HVAC systems, carpets, tiles, paint, ADA improvements, and site enhancements.

Key results include:

- On-time completion despite complex relocation logistics.

- Consistently meeting design, quality, and budget expectations.

- Reinforcement of operational efficiency for a high-profile corporate client.

This project showcased NexGen’s capability to deliver high-stakes office renovations while maintaining operational continuity and mitigating risk.

Capital Maintenance Improvement Portfolio (CMIP)

NexGen also managed a series of capital maintenance projects, including roof repairs, fire sprinkler installations, elevator replacements, HVAC upgrades, accessibility improvements, and parking lot renovations.

The result was enhanced safety, operational efficiency, and property value, reflecting the firm’s commitment to cost-effective, quality-focused project management.

What Sets NexGen Construction Management Apart

NexGen Construction Management distinguishes itself from competitors through:

- Competitive Fee Structure: Charging an 8% fee compared to the industry average of 15% and up!

- Extensive Experience: Over 20 years in engineering and construction, managing projects ranging from $500,000 to $100 million.

- Relationship-Driven Service: Personal attention that maximizes client satisfaction.

- Engineering Expertise: Specialized solutions in office renovations and complex commercial developments.

Clients consistently report significant time and cost savings, smoother project execution, and a seamless experience from planning to completion.

Built Around People, Not Projects

Alex Morgan, Project Manager at NexGen Construction Management, emphasizes the firm’s mission:

“Our goal is simple: to combine the sophistication and precision of Fortune 500 project management with the personal attention of a boutique firm. We prioritize transparency, integrity, and professionalism, ensuring that every client feels supported, informed, and confident throughout the project lifecycle.”

Looking Ahead: Growth and Inclusion

NexGen Construction Management is focused on expanding its footprint across Orange County and Los Angeles, with a particular emphasis on supporting female- and minority-owned businesses. The firm aims to build long-term client partnerships, helping organizations achieve their project goals efficiently while fostering inclusive growth.

By using its expertise in commercial construction, NexGen continues to set the standard for operational excellence, strategic problem-solving, and innovative project delivery in Southern California.

About NexGen Construction Management

Founded in 2019, NexGen Construction Management is a boutique construction project management firm with over 20 years of experience in handling complex commercial projects. The company specializes in office renovations, capital improvement portfolios, and high-profile commercial developments for both public and private sector clients.

Combining Fortune 500-level expertise with a personalized approach, NexGen delivers efficient, cost-effective, and relationship-driven project management services.

Visit NexGen Construction Management or book a consultation to learn more about how NexGen Construction Management can transform your commercial construction projects with precision, efficiency, and personal service.

Media Contact

Organization: NexGen Construction Management

Contact Person: Alex Morgan

Website: https://nexgenconstructionmanagement.com

Email:

alex.morgan@nexgenconstructionmanagement.com

State: California

Country:United States

Release id:35888

The post NexGen Construction Management Expands Its Commercial Project Portfolio Across Southern California appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release5 days ago

Futuromining Launches XRP Mining Contracts – XRP Holders Earn $5,777 Daily

-

Press Release5 days ago

Oklahoma Plastic Surgeons Cements Reputation Among Best Tummy Tuck Surgeons in Oklahoma City Releasing Abdominalplasty Resource Library

-

Press Release5 days ago

13-Year-Old Samanyu Sathyamoorthi Wins Curiosity Innovation Award at Global AI Summit with MyChemLab-ai Aiming to Solve Worldwide Chemistry Lab Access Crisis

-

Press Release1 week ago

La Maisonaire Redefines Luxury Furniture in Dubai with Bespoke Designs for Homes Offices and Hotels

-

Press Release5 days ago

A New Era in the Crypto Market ETH Volume Bot Redefines Success for Token Projects

-

Press Release6 days ago

Agibot First Partner Conference was Successfully Held Showing that Its Full-Chain Layout is Accelerating Commercialization of Embodied Intelligence

-

Press Release4 days ago

COOFANDY & Christopher Bell: Dressing the Journey to Victory – A Partnership Story Racing Toward Martinsville Speedway

-

Press Release1 week ago

HALOBLK Launches the Worlds First Tesla Wheel Covers Enhancing Range and Personalization