Press Release

Gaeacoin: Can “Algorithm + Credit” Rebuild the Value Foundation of DeFi?

Defi still has higher attention with rapid technological innovation and continuous expansion of application scope, The goal of DeFi is undoubtedly to build a more effective,free and transparent financial ecology. However, finance always develops with money and brings value exchange. Therefore, whether it is a decentralized scenario or a mass application toward reality in the future, stable cryptocurrency is crucial for users, so as to realize the dream of making virtual ideas become reality.

For this reason, in the field of cryptocurrency,many teams has been exploring stable currency. According to CryptoQuant data, stabilecoin holdings on global crypto exchanges hit an high record of $9.8 billion as of March 28, 2021. At the same time, the total stable currency market capitalization once topped $80 billion, according to CoinGecko, current daily trading volume of all stable currencys is about $118.340 billion. Also, CoinMarketCap shows there are 16 mainstream stable currencys now.

The stable currency is illusory?

In general, both USDT and DAI are still on their way and haven’t really achieved the goal of “stable currency”. Tether’s White Paper said:”Tether is a decentralized cryptocurrency, but we are not a perfectly decentralized company. We store all of our assets as a centralized pledge.” Therefore, USDT is just borrowing the name of cryptocurrency, but it is not really decentralized.

DAI, developed by MakerDao, is the largest decentralized stable currency on Ethereum. It is issued with the guarantee of the full amount of assets on blockchain. It is only generated in the application scenario based on the mortgage, and the market value of the mortgage assets is the ceiling of it. Therefore, these stable currencys are illusory in a sense.

Will algorithmic stable currencys finally fail?

Now let’s take a look at the development process of algorithmic stable currencys, known as the holy grail of cryptocurrency. From stable currency1.0 represented by AMPL,stable currency2.0 represented by Basis Cash to stable currency3.0: FraxFinance, all of them have gone through a period of growth. However, the stable currency reality is that we live under the sense of “ever-changing”, and stable value is still in the ideal.

AMPL algorithmic stable currency is used to increase or decrease the supply of AMPL in order to keep the price of AMPL around $ 1. AmpleForth usesRebase operation to change the AMPL held by all users as a whole. The Rebase price is based on the average price of the past 24 hours. When this price is above $1.05, the AMPL balance in all users’ wallets increases simultaneously. At prices below $0.95, all users’ AMPL balances decrease simultaneously. During this process, the percentage of AMPL held by users in the supply does not change. It looks like everything is fine on its own, but when the price of cryptos falls to the point where deflation is needed, both the quantity and price of coins held by users are falling, so users face a double whammy.

So it’s easy to create a death spiral. Similarly, when cryptos price rise, it is easy to create an upward death spiral. Thus it can be seen that this price model only has two possibilities: the price continues to fall, get into the infinite death circle and leave the market, and the price rises steadily to around 1USDT; Prices rising, the AMPL have been printing (dividend), AMPL reserve disappeared, crypto began to value return,people in loss cannot gain AMPL, prices will fall back near 1 USDT (need funds continue getting into market), so it is difficult to see AMPL achieve speculation, meanwhile achieve stability, And stability is a necessary condition for a stable currency.

Basis CASH, as represented by 2.0, includes three tokens, Basis Cash (BAC), Basis Share (BAS) and Basis Bond (BAB), among which BAB is non-transferable. The BAC is the stable currency, anchored to $1; BAS is an equity token, and newly minted BAC tokens can be allocated. BAB is a bond. There is nothing wrong with Basis Cash based on the algorithm itself, but without a good application scenario, relying on the debt market itself is dangerous. There is actually a problem with debt financing in traditional markets, where those “too big to fail” entities can take on the risk of impunity through socialized bailout costs. It is entirely possible that Basis Cash could go into a debt spiral, in which case there would be no willing contributors, the debt would accumulate and the protocol would collapse.

FinanceFX is the first partial algorithmic stable currency project, adding the concept of using “partially stable” as a collateral asset to the existing algorithmic stable currency. There are two types of tokens in Frax, the stabilization token Frax and the governance token FXS. Frax costs USDC and FXS, but only USDC during creation. The initial mortgage rate is 100%, that is, all USDC mortgage is used to cast FRAX. After that the mortgage rate will be adjusted every hour. If the price of FRAX is more than $1, the mortgage rate will be reduced and FXS ‘share in it will be increased. Raise the mortgage rate if the Frax falls below $1. The mortgage rate is adjusted every hour by 0.25% each time. But its high mortgage ratio leads the lack of user appeal, its currency numbers and market supply have been stagnant.

Although the above three generations of stable currencies seem to be making breakthroughs and innovations, they do not give a satisfactory answer on how to solve the credit problem. However, algorithm stable currency who cannot solve the credit problem is useless. Bitcoin came into being to solve the problem of credit, but the stable currency, as an important extension of its development, has not inherited the legacy of credit, and still stuck in algorithm.

Crypto Credit Network (CCN)

In financial field, credit is the foundation and the lifeblood. This is true of both traditional and modern financial systems. In the traditional financial system, credit mainly relies on the guarantee of laws and institutions. Apart from the high operation cost, the “credit crisis” gradually exposed by financial intermediaries is the fundamental reason why people urgently embrace the blockchain technology. Algorithm stable currency is going to help cryptos solve the credit problems, guaranteeing machine credit by algorithm, which does not rely on third party subjective will and makes transaction transparent, efficient, reliable and stable, let people who do not have to establish credit relationship between each other to achieve cooperation and free trading, reduce the cost of credit.

However, the world of blockchain cryptocurrency is a chaotic existence without role name. To change from chaos to brightness, each individual needs to have his or her own identity, so that we can obtain the faith like phoenix nirvana. The CCN gives each individual a unique CID (Crypto Identification), which is the most basic rule in the Crypto world. To build a new crypto world of order, autonomy and equality.

The construction of CCN not only takes blockchain technology as support, but also has reasonable economic incentive mechanism. Reasonable use of incentive mechanism is an effective means to stimulate all parties to participate in the construction of CCN.

A sound incentive mechanism, reasonable mechanism design from the perspective of leading efficiency and fair governance, can make the value generated by credit information flow effectively to the value provider in the blockchain world, punish the evil behavior, and resolve the conflict between individual interests and collective interests. It makes the individual’s behavior of pursuing individual interests unified with the goal of maximizing collective value.

Therefore, CCN can further clarify the economic interests of each participant and the overall interests of the network, so as to fully mobilize the enthusiasm of each participant and guarantee great development of CCN from the source.

The CCN consists of three different identities: Creator, Guardian and Angel,all of them have established screening mechanism. Only firm believers can obtain the CCN identity. Early believers are required to contribute to maintaining the stability of early CCN by burning GAC tokens. Therefore, they are not only holders of Gaeacoin, but also determined preachers and builders. When Gaeacoin issues additional shares, it will also receive a corresponding percentage of GAC tokens as a reward.

The establishment of this system aims to provide every Gaeacoin participant with the opportunity to contribute to the community construction, and to create a healthy crypto community culture of dedication and autonomy through consensus, symbiosis, co-construction and sharing.

In CCN, although the identity is different, the residents on the chain of CCN build the initial transaction link according to their CID address, and constantly expand CCN on the chain. Open CID needs to be recommended by the network resident, once the link is formed, it cannot be changed forever. Each of the three different identities requires a different number of GAC tokens to burn, which can be viewed on the Gaeacoin network. Gaeacoin network residents have different rights according to their status.

The integration with the DEX : Oxyswap has pioneered a full range of applications

There is a natural interdependence between exchange and stable currency. Exchange has always been an important part of crypto digital asset market, and it is also the first application place of stable currency. Like Binance with BUSD and Huobi with HUSD, OKEx also launched USDK on June 3, 2019. Traditional CEXs are fiat currencies, where fiat currencies are exchanged for cryptos. If you want to buy crypto digital assets, you need to top up fiat currency, which undoubtedly increases the economic and time costs of investors in the process of exchange. The emergence of stable currency can not only solve the above problems but also effectively avoid legal risks in the process of transaction.

As it should be, the integration of Gaeacoin ecology and Oxyswap not only lays a solid foundation for stable currency: GAC token application, but also creates opportunities for it to open up more and wider application scenarios.

Oxyswap is a decentralized exchange running on the BSC with a collection of DEX liquidity mining, which offers functions of exchange, liquidity, market making and so on. The strength of Oxyswap guarantees the usages of the stable currency: GAC.

GAC will lead a brighter way

Gaeacoin algorithm stable currency:GAC dare to face the challenge, According to the industry news, GAC praises is not only relatively stable from the concept, but also to really put into application. In addition to GAC (Gaeacoin), Gaeacoin ecology also includes GAB(Gaeacoin Bond) and GAASH (Gaeacoin Share), which serve to maintain the stability of GAC. Gaeacoin Ecology also integrates Gaeacoin protocol, algorithm, robustness, price response, encryption and other technologies, superposed with the DeFi ecology of Crypto Credit Network (CCN), Oxyswap(DEX) and so on, providing a realistic solution for GAC ,and leads it move towards the real “stability”.

The integration of CCN and Oxyswap points out the direction for the application of algorithmic stable currency. In fact, we can already feel the power of the Gaeacoin algorithm stable currency, and once it is used at a large scale, the ideal stable currency is expected to arrive ahead of time. DeFi will also build on this basis, using currency, lending, spot trading and other components to build continuously upgraded Lego of DeFi.

Gaeacoin’s move directly challenges the world’s centralized stable currency giants such as USDT and USDC, but compared to the previous challenges of AMPL, BAC and FRAX, this well-prepared challenge looks more anticipated!

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

NodeOps Network $NODE Token Generation Event Sells Out in Minutes via Binance Wallet, Debuts Across Top Global Exchanges

Dubai, UAE, 30th June 2025, ZEX PR WIRE, NodeOps Network is thrilled to announce the successful completion of its exclusive Token Generation Event (TGE) on Binance Wallet, where $NODE tokens sold out within minutes of launch. The event, held on June 30 between 08:00 and 10:00 UTC, marked a major milestone for the project and showcased overwhelming demand from the global crypto community.

Hosted as the 27th TGE on Binance Wallet, this launch also marked a strategic first: participation was gated exclusively through Binance Alpha Points, a move that increased user engagement and rewarded Binance’s most active ecosystem participants with early access to NodeOps Network’ decentralized Compute coordination layer. In addition to Binance Wallet, $NODE is accessible on PancakeSwap, supporting broader participation while staying true to the principles of decentralization.

Following the oversubscription, $NODE officially launched for trading at 10:00 AM UTC on a curated set of top global exchanges, including KuCoin, OKX Wallet, Bitget, MEXC, HTX (formerly Huobi), BitMart, LBank, and BingX. This coordinated multi-exchange debut marks a pivotal moment in NodeOps Network’ journey to make decentralized Compute infrastructure accessible at scale, signaling the beginning of what the community is calling “DePIN 2.0”

NodeOps Network: Powering the Future of Decentralized Compute

NodeOps Network is a decentralized infrastructure coordination layer powering the next era of verifiable compute. Designed for scale, the protocol currently orchestrates over 61,000 active nodes, powers 60+ protocols, and has generated $3.8 million in revenue to date with $150M of assets under management.

Built on top of NodeOps Network, the NodeOps Platform offers a modular product suite—including a no-code Node Console, decentralized Compute Cloud, Staking Hub, Security Hub, and AI Agent Terminal designed to simplify infrastructure deployment across Web3 and AI. The platform addresses the growing complexity of operating compute and node infrastructure in a multi-chain world, supporting networks across BNB Chain, Ethereum, and emerging Layer 2 solutions.

Redefining Token Launches Through Strategic Access

Token Generation Events serve as critical inflection points in the lifecycle of emerging crypto projects, offering early supporters access to native tokens before widespread distribution. With a proven track record of spotlighting successful Web3 projects, Binance continues to play a pivotal role in bridging high-potential protocols with its global user base.

The introduction of Alpha Points as the sole access mechanism to the NodeOps Network TGE signals a clear shift in launch strategy. Traditionally earned through platform engagement, Alpha Points now serve as high-utility assets rewarding loyal, active users with exclusive opportunities to participate in Binance-curated launches.

Tokenomics for Sustainability

$NODE’s tokenomics emphasize stability, real usage, and economic alignment. With a total genesis supply of 678,833,730 tokens, the distribution model incorporates long-term vesting, protocol-based emissions, and a burn-and-mint equilibrium that ties token creation to on-chain revenue. This structure promotes a responsible token economy, ensuring that supply growth is directly tied to value creation, not speculative emissions.

In line with NodeOps’ commitment to transparency and user-centricity, it released a first-of-its-kind interactive tokenomics portal to help users model and better understand the dynamic nature of $NODE’s tokenomics. Its emissions follow a dynamic mint-and-burn model tied to real network usage, anchoring long-term value to platform demand.

Token Allocation Highlights:

- Community & Ecosystem: 47.5%

- Early Backers: 22.5%

- Protocol Incentives: 15%

- Initial Contributors: 15%

NodeOps is positioning itself as the leading DePIN infrastructure platform, uniting tokenized incentives, AI automation, and decentralized compute into a single interface for the future of verifiable systems.

About NodeOps Network

NodeOps Network is an AI-powered, decentralized Compute coordination layer that automates validator and node operations across blockchain networks. Supporting over 60 protocols and 61,000 nodes, NodeOps delivers scalable infrastructure tooling and staking solutions that power the next generation of decentralized applications.

For more information, please visit https://nodeops.network/

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Zilliqa 2.0 Launches: A New Era for Scalable, Institution-Ready, and EVM-Compatible Blockchain Infrastructure

Singapore, 30th June 2025, ZEX PR WIRE, Zilliqa, the pioneering high performance Layer 1 blockchain platform known for bringing sharding into production, today announced the official transition from Zilliqa 1.0 to Zilliqa 2.0 — a major protocol upgrade that redefines the platform’s capabilities for developers, enterprises, and institutions alike.

As the industry matures, so do its requirements. With Zilliqa 1.0, the world witnessed that high-throughput, sharded blockchains could operate at scale. But in today’s rapidly evolving web3 world, the need for regulatory alignment, composability, and developer-first tooling is greater than ever. Zilliqa 2.0 addresses this with a re-architected, modular platform designed to support verifiable smart contracts, tokenized assets, and next-generation dApps. It represents a complete architectural overhaul, built to meet the demands of today’s blockchain landscape — from EVM compatibility and modular design to regulatory-ready infrastructure that enables tokenized real-world assets and compliance-driven DeFi.

“Zilliqa 2.0 is more than an upgrade — it’s a transformation. We’re building the blockchain institutions can trust without compromising on the speed, flexibility, or openness that brought us here in the first place. The next era of blockchain won’t be built on hype. It’ll be built on trust, transparency, and technical excellence. That’s what Zilliqa 2.0 stands for”, said Alexander Zahnd, interim CEO of Zilliqa.

Key Upgrades in Zilliqa 2.0

Zilliqa 2.0 launches with full EVM support, enabling seamless deployment of Ethereum-native applications and tooling. The platform’s modular design future proofs the chain for upgrades, scale, and protocol evolution.At its core are six foundational pillars: a modern Proof-of-Stake consensus, customizable x-shards, seamless cross-chain communication, light client support, and sustainable tokenomics. Looking ahead, Zilliqa’s roadmap includes smart accounts that will bring enhanced on-chain programmability, as well as zero-knowledge (ZK) features to enable privacy-preserving compliance tools like selective disclosure and verifiable credentials. Together, these upgrades deliver a blockchain that’s faster, greener, easier to build on, and ready for real-world adoption at scale.

This upgrade transforms Zilliqa into a blockchain that’s as attractive to institutions as it is to developers. Whether it’s fintechs launching programmable assets or compliance-driven DAOs building advanced tooling, Zilliqa 2.0 offers a production-ready base layer that bridges real-world needs with decentralized innovation.

“Zilliqa is now institution-ready and developer-friendly,” Zahnd added. “We’ve rebuilt the core to make sure we’re not just fast — we’re also open, composable and built for real-world impact.”

Continuous Commitment to Performance

With over 50 million transactions processed and one of the most proven sharding implementations in production, Zilliqa’s core performance is only accelerating. Validators remain integral to the protocol, and staking continues to offer attractive rewards as the network enters its next chapter.

With Zilliqa 2.0’s debut, staking receives a performance boost:, streamlined validator onboarding, and potential early high APR for users who migrate staking early from Zilliqa 1.0 to Zilliqa 2.0. This dynamic staking model is designed to incentivize early adopters while scaling sustainably as liquidity gradually transitions from the old to the new system.

Over a six-month Aventurine phase, 21 external validators tested the proto-mainnet, generating over 7.5 million blocks and completing 15 successful client upgrades. Now live on mainnet, Zilliqa 2.0 is powering projects building across tokenized assets, (regulated) DeFi, digital identity, fintech infrastructure, and more. Strategic integrations – such as partnerships with LTIN and deBridge (introducing native USDC) – are already expanding the ecosystem’s capabilities. With this momentum, Zilliqa is emerging as the high-performance Layer 1 where institutions, innovators, and real-world value collide.

If you’re a developer and want to build dApps on Zilliqa 2.0, please refer to the technical documentation.

About Zilliqa:

Zilliqa is a high-performance Layer 1 blockchain platform built to power scalable, secure, and interoperable decentralized applications. As the first public blockchain to implement sharding, Zilliqa has consistently pushed the boundaries of blockchain infrastructure. With the launch of Zilliqa 2.0, the platform is evolving to meet the needs of institutions, enterprises, and developers seeking high-throughput infrastructure with the trust, transparency, and flexibility required for real-world adoption.

To learn more, visit www.zilliqa.com or follow @zilliqa for regular updates.

Press Contact

Shilika Jain

PR Lead (On behalf of Zilliqa)

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

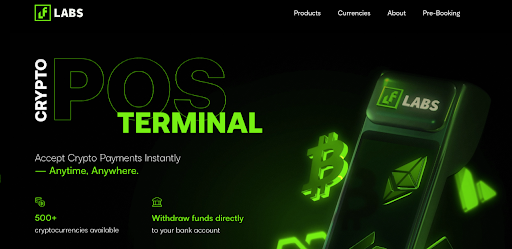

LF Labs (LF Coin) Breakout Steals Spotlight as Shiba Inu Price Targets $0.000017 Return

Dubai, UAE, 30th June 2025, ZEX PR WIRE, LF Labs (LF Coin) gained momentum today despite broader market pressure, drawing attention as Shiba Inu struggles to reclaim key levels. While SHIB battles resistance, LF Labs pushes ahead by building a full-stack Web3 ecosystem with real-world utility. The project’s growing influence and recent developments position LF Coin as a breakout contender in the crypto space.

LF Labs Builds End-to-End Crypto Tools

LF Labs is creating a unified Web3 infrastructure by combining its LF Wallet, PoS devices, and a powerful startup accelerator. The Low Frequency Accelerator fuels early-stage projects with both funding and liquidity, helping them sustain growth in volatile markets. Because of this strong foundation, LF Coin offers more than just a digital asset; it supports practical use cases and long-term value.

LF Coin trades at $0.000567 today, with a 24-hour volume of $750,308, showing strong investor engagement despite a 9.13% decline. However, the recent price dip comes amid a wider market pullback, not a specific project weakness. LF Labs continues to build momentum by offering real-world solutions that reduce fragmentation in the Web3 ecosystem and support seamless user access.

By supporting early-stage startups with both capital and trading infrastructure, LF Labs addresses a critical gap in the blockchain space. Unlike typical venture capital models, its program boosts token stability and market presence. As a result, LF Coin gains strategic importance for both retail users and businesses entering crypto.

Shiba Inu Eyes Recovery After Heavy Drop

Shiba Inu trades at $0.0000107, struggling to hold its footing after losing 25% of its monthly value. This decline followed panic selling triggered by US military actions, leading to broad crypto liquidations. However, SHIB is showing signs of a potential reversal from the $0.0000106 support level.

As the price rebounds for the third time in six months, a double-bottom pattern may be forming. If successful, SHIB could rise 64% to retest the $0.000017 neckline formed during its April rally. The key confirmation would come from a weekly close above that level, backed by rising spot volume.

RSI at 38 shows oversold conditions, suggesting buyers might step in soon. But the 50-day SMA above the price keeps short-term momentum bearish for now. Until SHIB breaks $0.0000168, bulls remain cautious despite historical support patterns.

LF Labs now leads in utility-driven growth, while Shiba Inu seeks technical recovery from long-term support. As short interest spikes on SHIB, a potential short squeeze could support upward momentum. But for now, LF Coin stands out as a more stable and practical crypto opportunity.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release5 days ago

Calling All Competitive Eaters: Florida’s Premier Hot Dog Eating Contest Opens Registration

-

Press Release6 days ago

EPD Programme for Steel Industry Chain and EPD Networks Sign Strategic MOU to Advance Global Environmental Transparency

-

Press Release6 days ago

Dondego Launches Real-Time Cultural Guide to Barcelona – A Daily Compass for Festivals Food and Local Life

-

Press Release2 days ago

Essential Treasures Bazaar Opens its Virtual Gates Offering a Wealth of Daily Necessities and Unique Finds

-

Press Release1 week ago

A Love Story Born Online – Online Sweetheart by Juan Rios Captures the Magic of Digital Romance

-

Press Release5 days ago

Tony Deoleo Visionary Philanthropist and Entrepreneur Visits Manny Pacquiaos LA Training Camp as June Aquino Unveils Masterpiece Honoring the Boxing Legend and Visionary Couple Tony and Lorie Deoleo

-

Press Release2 days ago

Cloud mining giant FansHash Launches free and efficient cloud mining applications to easily improve mining efficiency and achieve simple operation

-

Press Release1 week ago

Award-Winning Author Sunny Davis Debuts Two Uplifting Childrens Books About Moms and Dads