Press Release

From Institutional Feast to Community Ownership: The Billion Journey of ZKFair

Hong Kong, 19th April 2024, ZEX PR WIRE, As the Cancun upgrade approaches, the call for the L2 Summer time is increasing. However, it is necessary to distinguish whether this is a feast for VCs, institutions, and whales; or an opportunity for the community, retail investors, and decentralization in general.

ZKFair has decided to be the L2 of the people, with all participation rights belonging to the community.

ZKFair is an EVM L2 ecosystem built by Lumoz, a Rollup as a Service (RaaS) provider. This L2 is a pioneer of its kind as the first Polygon CDK ZkRollup to be on Mainnet. Furthermore, Lumoz has implemented another successful chain which has been positioned as the top BTC L2 project by TVL amount (over US$3.8 Billion at the time of writing), Merlin Chain. The consistent focus on the creation of these new L2 ecosystems lies in returning L2 revenue to users in order to truly promote the popularization of rollups technology.

ZKFair Launches with an IGO model

ZKFair is determined to learn from Bitcoin’s economic model, where transaction fees go 100% to miners. In contrast, Ethereum’s L2 Rollups “skim” part of the fees paid by users, turning them into their profit source. This revenue sharing system is not fair.

In this regard, ZKFair was born to change this unfair revenue model. Since the real creators of the L2 Summer are the users, they should be taking all the profits. To reflect this narrative, ZKF tokens will be 100% airdropped to users. Furthermore, as a “channel” fee for gas fee, ZKF will also be 100% returned to users.

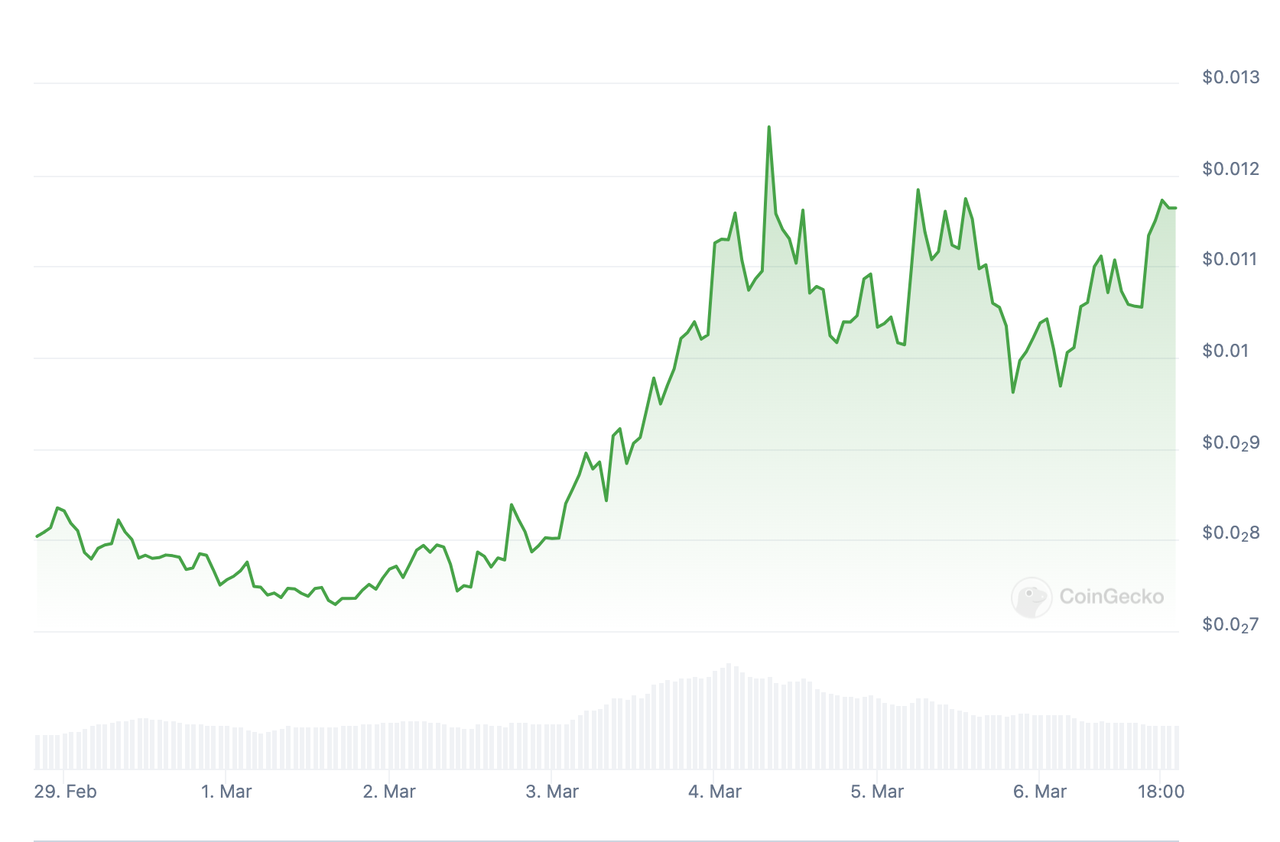

Recently, the market has responded positively, with ZKF surging 40% in one day and related PFPs skyrocketing by 180 times.

70 days after its birth, ZKFair sets off from the community

Fairness becomes the industry spirit again, and the free and open crypto world returns.On Christmas Eve 2023, Lumoz decided to launch ZKFair in a Fair Launch mode, creating a unique IGO (Initial Gas Offering) paradigm. The core idea is that “participants receive token airdrops in proportion to the gas they burn through their chain transactions; the issuer then takes the gas paid by participants as the income for this token issuance.”

Double 100% Rebate, Leaving No Margin.

Users obtain ZKF tokens through gas fees as a proof of work mechanism, which is different from the traditional “get it for nothing” approach, emphasizing fairness for everyone to participate.

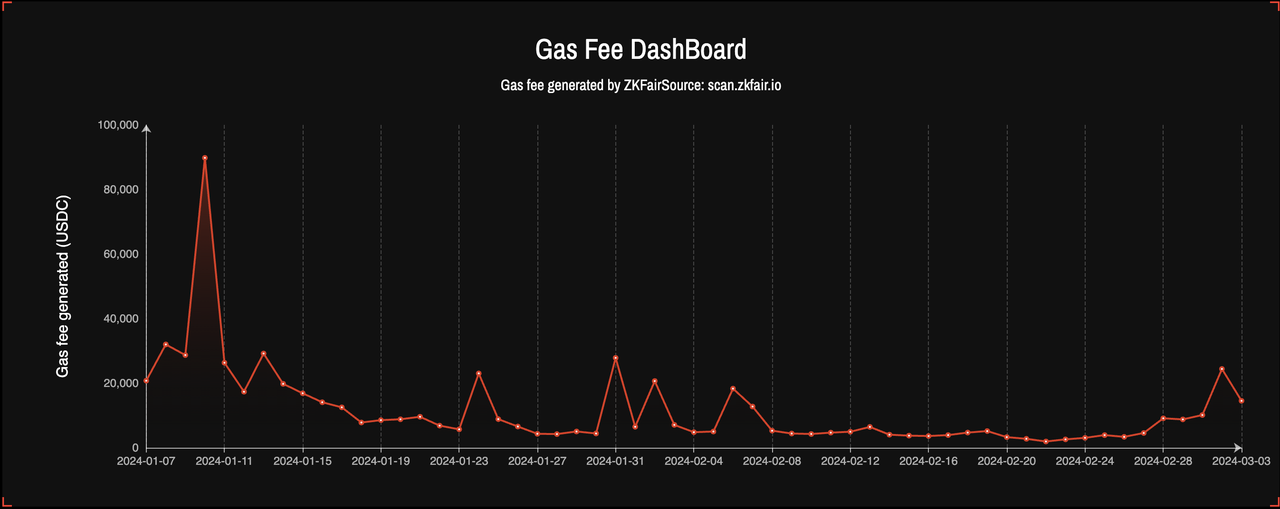

ZKFair sets its total issuance at 10 billion tokens, initially using USDC as gas fee for airdrops and additional community rewards through mainnet interactions and transactions.

Specifically, airdrops are divided into gas fee airdrops and community member distributions. To lower initial participation barriers, ZKFair allows using USDC as the initial stage’s gas fee for broader participation. After mainnet launch, gas fees are returned to users.

In repetition, the project redistributes received gas fees in USDC to give back to users, adhering so to a 100% fair launch principle without retaining or taking any form of tokens from the project side.

To show support for the Bitcoin community, ZKF also distributed 5% of its tokens to members of the Ordinal inscription community. Additionally, 25% of ZKF tokens are airdropped to community members based on their contributions.

ZKF is also used to incentivize staking. 75% of ZKFair’s transaction fees serve as staking rewards, ensuring users receive proportional returns for contributing to the ZKFair network.

From a fair launch, ZKFair grows robustly in the name of the community, considering community interests at every step and ultimately unleashing unparalleled upward growth power.

Growing With The Community

Unlike typical L2 communities, ZKFair’s project team is the community itself. Adhering to 100% community ownership, and within 70 days of its launch, ZKFair has launched multiple launchpads, including leading wallets like Bitget Wallet, and has received trading support from mainstream exchanges like Gate.io.

Furthermore, ZKFair has surpassed its initial growth phase. Not only launching other launchpads, but also serving as a project launch platform itself. Currently, five projects have entered the ZKFair Launchpool, with Merlin Chain being the most notable. By continuously launching high-quality projects will provide ongoing support for ZKF tokens.

From Community Growth To Community Leadership

ZKFair does have a development and support team, which is also part of the community. Driven by the community, ZKFair’s TVL has reached $300 million, making it the highest among L2s developed using Polygon CDK and ranking in the top ten on L2BEAT.

The rapid growth in TVL and token price is backed by ZKFair’s continuous BD efforts. ZKFair regularly adds new partners every few days, including security cooperation with Go+ Plus and domain issuance with Space ID. As of now, ZKFair has at least 150 various ecosystem projects.

According to ZKFair’s previously announced roadmap, Q1 2024 aims to establish contact with 200 project parties and achieve cooperation with over 100+. The initial targets seem to be met.

Moreover, on March 8th, ZKFair will co-host a large-scale ecological event with Lumoz, with the first round already attracting 25 project sponsors, totaling 30 million Lumoz points and 50,000 USDC for the prize pool. These points can be exchanged for Lumoz tokens in the future.

It is worth mentioning that Lumoz is conducting a new round of financing with a valuation of US$120 million, with the investment amount already at its limit. The points given to ZKFair users are sufficient to prove Lumoz’s support for ZKF. Based on the current market value alone, it has exceeded US$1 million.

After 70 days of hard work, ZKFair now boasts over 200,000 community members. However, this is just the beginning. The future goal is to reach 1 million community members, at least US$1 billion in TVL, and break through the $10 billion market cap barrier for ZKF, creating a blockbuster L2 for everyone.

According to ZKFair’s Q2 roadmap, there will be stronger collaboration with the BTC ecosystem. This will showcase the powerful alliance between ZKF and BTC.

The BTC ecosystem is definitely the focus of this year, and the spirit of fairness is the most valued concept in the Bitcoin community. Just like ZKF airdropping to the Inscription community, ZKFair’s entry into the BTC ecosystem will also aid in capturing ZKF’s value.

Q2 2024:

-

New cooperation with Lumoz RaaS’s fresh ETH L2s to further empower ZKFair and $ZKF.

-

Support cross-chain transfers and transactions of BTC ecosystem assets.

-

Actively build the ecosystem, completing over 150 ecosystem projects, with a focus on DeFi, Game, and AI sectors.

-

Continue to launch on more centralized exchanges.

-

Sustain cooperation with Polygon Labs, optimizing ZKP generation and enhancing on-chain interaction experience.

Achieving these goals will require a globalized approach. Following the ecosystem groundwork in February, key markets for expansion in Q2 2024 will include the United States, Hong Kong, Turkey, Vietnam, Indonesia, India, Japan, South Korea, Russia, Singapore, UAE, and China.

Community Ownership and ZK Technology

ZKFair belongs to the community, not merely as a marketing slogan, but out of confidence and composure derived from ZK technology. It’s precisely because of the maturity of ZK-Rollup technology that Lumoz and the ZKFair development team believe that the community’s self-sufficiency is enough to sustain it, thus focusing on market expansion.

Technology And The Market Complement Each Other

Compared to OP series rollup technology solutions, ZK series rollups are more often seen as Ethereum’s medium to long-term scalability solution. However, current L2s face numerous challenges, such as cross-chain interoperability or being confined to specific domains, such as Loopring being regarded as a payment channel, etc.

ZKFair, true to its name, is a project launched fairly under ZK technology, owned by the community. ZKFair, powered by Lumoz, utilizes Polygon CDK technology and Celestia DA. Lumoz, as an officially recognized CDK service provider by Polygon, has significant technological research and development capabilities.

For instance, ZKFair uses a native cross-Rollup communication protocol (NCRC), enabling atomic-level information exchange between multiple rollups. Users can directly invoke Ethereum dApps on ZKFair without needing to transfer assets across chains.

Furthermore, ZKFair can communicate with other L2 Rollups, possessing cross-contract calling capabilities, thereby reconnecting the fragmented Ethereum L2 ecosystem.

Choosing Celestia as the DA layer is also an economically driven decision. As a DA layer, Celestia will save more than a hundred times in gas fees compared to EigenDA or Ethereum itself, aligning more closely with community interests.

Underneath its market strategy lies ZKFair’s robust technological reserves. Only with such a foundation can ZKFair dare to hand over complete operational control to its users in the future, transitioning to community ownership.

As mentioned earlier, ZKFair’s community governance model initiates with a 100% token airdrop at mainnet launch, aiming to create a fair, just, and highly autonomous community environment, thus effectively addressing the unfair issues prevalent in existing ZK-Rollup projects.

Pure technology must also be combined with effective token incentives; ZKF will undertake the heavy lifting of community governance.

Regarding community self-drive, ZKF’s functionality mainly focuses on staking and voting. Currently, ZKFair has launched its staking feature, allowing users to earn gas fee profit dividends by staking ZKF. In terms of specific allocation, 75% of the transaction fee profits are used to incentivize ZKF stakers, with the remaining 25% allocated to developers to encourage them to develop native apps on ZKFair.

Currently, about 3.5 billion ZKF tokens have entered the staking system, distributing 630,000 USDC with a stable annual yield of around 15%. Out of these, 1 billion tokens are locked in Merlin Chain, strongly supporting ZKF’s price and market value.

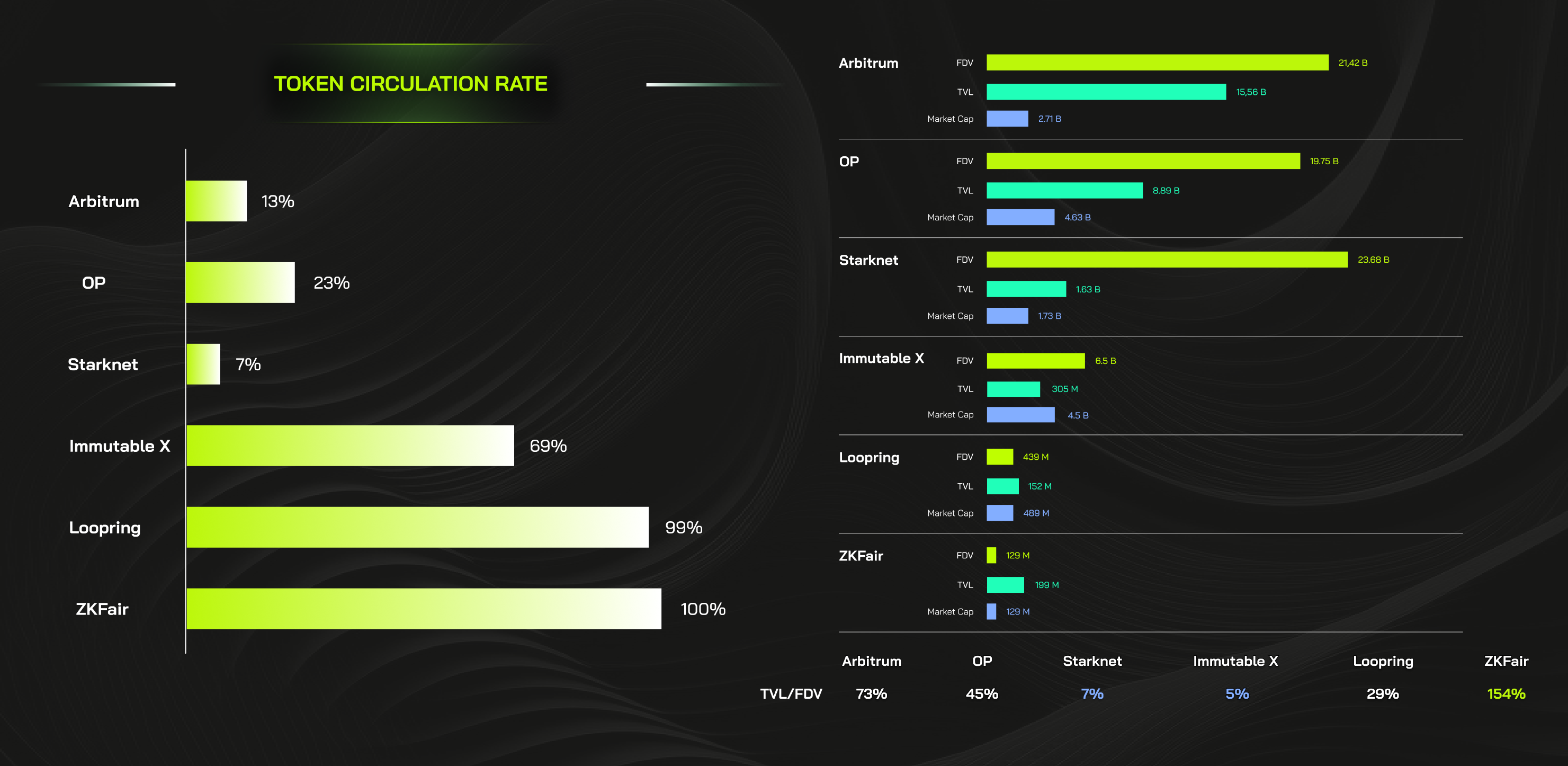

Another aspect supporting ZKF’s value is the FDV (Fully Diluted Valuation) data. With ZKF being fully circulated, its FDV represents its actual market value – a genuine reflection of value without discounting for locked circulations.

The correlation between ZKF’s FDV and TVL is also quite realistic. The larger the difference between TVL and FDV, the more tokens are not fulfilling their real potential. Additionally, the FDV/TVL ratio can indicate the extent of a token’s overvaluation. With ZKF’s ratio around 0.64 compared to StarkNet’s 1.45, ZKF’s FDV is not high, indicating potential for future growth.

Empowerment is Endless; Creating The Premier On-Chain Launchpad

ZKFair is controlled by the community, but mere community control cannot guarantee long-term project sustainability and governance quality. Thus, defining the community’s tone is crucial.

For example, Launchpool has chosen to establish a long-term partnership with Merlin Chain and has already reached the fifth round. Merlin Chain is not just simply raising funds from the ZKFair community, but will return some of the profits, forming a stronger binding relationship. Participating in the ZKFair Launchpool can earn 1% of Merlin tokens, which not only indirectly supports the development of Merlin Chain, but also serves as a demonstration for other project parties.

Not only that, Merlin also represents the project discovery capability of the ZKFair team. Since 2024, ZKFair has been actively expanding in various tracks such as NFT, DeFi, infrastructure, gaming, and AI.

On February 6, 2024, ZKFair collaborated with Element to launch the ZKFair Pass, limited to 20,000 pieces and sold out within 10 minutes. This was not just an NFT release but also included airdrop rights for all projects in the ZKFair Launchpool during February 2024.

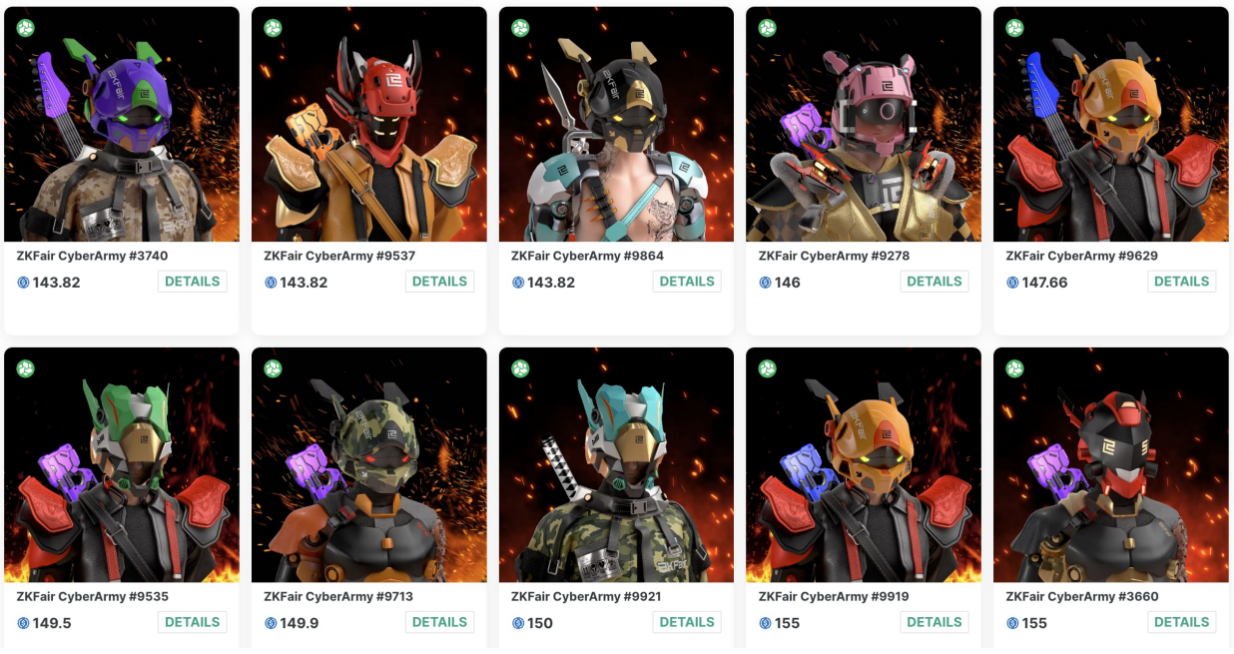

Continuing its momentum, ZKFair also launched the richer-benefit ZKfair PFP NFT; users holding PFP can participate in the ZKFair Launchpool at lower costs for more points.

On March 2nd, the CyberArmy NFT series, based on the ERC-404 protocol, began selling on Element. With a total of 9999 pieces, they sold out in less than an hour, surging up to 150 times in value.

Summary

ZKFair began with the community and will return to the community.

Everything created by ZKFair stems from the goal of empowering users. Current blockchain technology has developed excessively, with users’ presence and value being obscured in many foundational products.

ZKFair decides to rediscover them. With over 600,000 users on the chain, ZKFair has never abandoned its dream, persistently aiming for a market value of 10 billion. This is not an illusion but a proven path validated by Arbitrum, especially when ZK series Rollups are at a disadvantage in terms of TVL. Remaking ZK’s glory is an unshirkable duty for ZKFair.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Crypto Staking: Navigating the Difficulties of This Lucrative Practise

Dubai, UAE, 2nd May 2024, Crypto staking is becoming more popular among cryptocurrency holders as it provides opportunities to earn passive income while contributing to the security and functionality of blockchain networks and blockchain-related projects. Yet, all potential stakers should remember that staking also comes with its own collection of challenges and dangers.

Exploring Staking

Initially, staking cryptocurrency meant locking one’s tokens into a blockchain network to help it operate and earn rewards in return. As the industry developed, staking became more diverse. Various staking approaches have emerged, enabling potential stakers to choose the one that suits their objectives and requirements.

Among the most noteworthy staking types are pooled, delegated, and liquid staking. Pooled staking involves liquidity pools that many token holders can contribute to, and rewards are shared proportionally among each other. In delegated staking, stakers transfer their staking power to a validator node holder, receiving a portion of their rewards. Liquid staking, a more recent development, allows stakers to use their staked assets through acquired liquid synthetic tokens, thereby enabling them to sustain liquidity while practicing staking.

Challenges

Crypto staking can be a complex process that comes with its own challenges, the foremost being the difficulty of choosing the secure and promising project to stake into. Therefore, having a good understanding of how the DeFi industry works and what processes are the most influential development-wise is imperative for engaging in staking. Learning about blockchains and underlying mechanisms and trends can be challenging for many users, but it is a must for successful trading and creating balanced passive income strategies.

The second challenge is the possible loss of liquidity. Lock-up periods are a standard staking feature that requires stakers to lock their tokens for a specific period, which cannot be changed or ignored. This means their owners cannot access locked tokens even if they are highly needed. This lack of flexibility can be devastating for those who stake too much of their funds and miscalculate the market movements. So, carefully considering the lock-up period requirements and the staking amount before committing is critical.

The third challenge is the inconsistency of staking rewards. The amount of rewards earned can fluctuate based on different factors, including the performance of a network or a node, asset price volatility, inflation rates, etc. Predicting and managing these fluctuations can take a lot of time, effort, and expertise, initially leading to unstable earnings.

Dangers

One of the significant risks associated with staking, namely in Proof-of-Stake networks, is centralization. Centralization may ensue when a small group of validators or liquidity pool contributors acquires a substantial share of the network’s staked assets. Such an event seriously compromises the network’s security and, consequently, the soundness of one’s staked funds.

Another danger is slashing risks that both validators and stakers can be subjected to if they break specific, predefined rules. While honest stakers should not typically worry about the said penalty, knowing all the rules and possible consequences of misconduct is still helpful. For instance, stakers who validate transactions may be fined for going offline for extended periods. Delegating stakers may also be subject to the same penalty risks, motivating them to choose those they delegate their staking powers more carefully.

Finally, stakers may encounter potential regulatory risks caused by the lack of clarity in regulations. For instance, depending on the jurisdiction, staking rewards may have different tax implications, leading to confusion and legal complications. To navigate these complex issues and avoid possible negative consequences, stakers should keep educating themselves on changes happening in the regulatory field worldwide and seek professional guidance if necessary.

Tips for Navigating the Challenges

Before staking, it is important to keep certain things in mind in order to make informed decisions and minimize risks. Firstly, when selecting validators or pools to delegate tokens to, it is critical to conduct thorough research. Seek out reputable projects or operators with a reliable performance and security history. This will help you avoid scams and ensure the safety of your investments.

In addition, stay up-to-date on news and updates from blockchain networks, projects, or pools you stake in. Changes in protocol or network policies can significantly affect staking rewards and create new risks, so keep a close eye on your staking performance and make any necessary adjustments promptly to preserve your income and staked funds.

Furthermore, it is recommended to stake in multiple DeFi projects, combine staking with other methods of generating income, and avoid investing all your funds to mitigate risks even more.

Conclusion

Staking, despite its challenges, is one of the most discussed and preferred methods of earning passive income within the DeFi industry. Although highly profitable in theory, staking is quite risky. To maximize one’s staking experience and safeguard assets, it is critical to stay informed and proactive, educate oneself, and be aware of the risks involved.

Kinetex Network: Website | Kinetex dApp | Blog

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Accountant Michael Pocrnich Enumerates the Keys to a Successful Audit Preparation

Minnesota, US, 2nd May 2024, ZEX PR WIRE, Michael Pocrnich, an accounting professional with a distinguished career of over twenty years, recently offered his insights into the critical elements of audit preparation. Pocrnich, based in Minneapolis and currently a Finance Manager at Element Financial Advisory, has played a significant role in guiding organizations through the audit process, focusing on the accuracy and clarity of their financial reporting. He highlighted eight specific areas that organizations should consider in order to successfully prepare for an audit, including documentation, reconciliation, access to information, internal reviews, inventory checks, compliance, financial statements, and communication.

“The cornerstone of any audit is documentation,” asserted Pocrnich. Proper documentation for all financial transactions, including invoices, receipts, and contracts, is essential. Maintaining and producing proper documentation not only validates the transactions of an organization but also provides a comprehensive trail for auditors to examine the financial activities over the period under review. “Documentation alone does not guarantee a smooth audit, but a lack of documentation will lead to a difficult audit at best.”

According to Pocrnich, reconciliation is a critical step in audit preparation. “Ensuring that your ledgers and bank statements correspond is not just important; it is absolutely crucial.” He explained that engaging in regular, thorough reconciliation practices is fundamental to affirming the accuracy of recorded financial amounts. This diligent process aids in the early detection and resolution of discrepancies, which facilitates a smoother and more efficient audit. This level of attention to detail is important in maintaining the integrity of financial reporting before an auditor’s examination begins.

Michael Pocrnich went on to highlight the importance of providing auditors with unobstructed access to financial records. This includes making available past audit reports, the general ledger, tax returns, and financial statements– all of which are fundamental to a smooth audit process. He is also a proponent of conducting an internal review or audit before the external auditors step in. He described this as a proactive measure to identify and correct issues early on, thus saving time and maintaining the organization’s reputation during the actual audit.

For companies with physical inventory, Pocrnich stressed the importance of inventory checks. “A physical count is absolutely critical to verify the actual existence of assets. It’s not just about confirming what’s there; it’s about ensuring the integrity and accuracy of the company’s financial reporting,” he advised. This step ensures that the valuation of inventory in financial statements is accurate and substantiated by actual stock levels, thus preventing discrepancies and potential financial errors.

Compliance is another area that he emphasized. Adhering to relevant accounting standards such as GAAP and IFRS, as well as compliance with tax laws and SEC regulations, is non-negotiable. This ensures that the organization remains legally sound and maintains its credibility. Hand in hand with compliance is the preparation of complete and accurate financial statements. Pocrnich advised that these documents represent the organization’s financial integrity, and they should be prepared meticulously to provide a clear base for the audit.

Communication with auditors is another important key to a successful audit. Pocrnich encouraged maintaining an open line of communication, being ready to explain accounting methods, anomalies, or transactions. He explained that this facilitates mutual understanding and contributes to the effectiveness of the audit. Throughout his roles, including as a Controller and as a Finance Manager, Pocrnich has advocated for thorough audit preparation. His extensive use of accounting principles like GAAP, FASB, and GASB has been instrumental in his approach to financial accuracy and leadership.

In his current role, he oversees accounts payable, payroll, and financial compliance with a systematic approach. He emphasizes that successful audit preparation is a fundamental professional responsibility that underscores an organization’s commitment to transparency and strategic foresight. Michael Pocrnich’s message is straightforward: diligent preparation, strict compliance, and clear communication are imperative for a successful audit. These principles enable businesses to demonstrate financial clarity and uphold a standard of trust and quality in their corporate practices.

About Michael Pocrnich

Michael Pocrnich is an accounting professional with over 20 years of experience, primarily in non-profit accounting, auditing, and financial analysis. Based in the Minneapolis area, he holds a BA in Accounting from St. John’s University. In his early career as a Senior Auditor at CliftonLarsonAllen, Michael managed non-profit audits, developed internal controls, trained junior staff, and presented financial reports to leadership. He is known for his financial forecasting, reporting, and analytical skills, as well as his proficiency in various ERP and CRM software, including the Microsoft suite. Currently, as a Finance Manager at Element Financial Advisory, Michael Pocrnich provides CFO and Controller services for a range of clients, from government and non-profit organizations to entities with revenues exceeding $20 million. He specializes in financial forecasting and manages all aspects of state and federal grant administration. His prior role as Controller at Beltz, Kes, Darling & Associates (now BerganKDV) involved similar duties and the leadership of annual audits and client financial facilitation. Michael’s professional skill set includes staff management, client relations, and a high emotional IQ, making him a strong communicator and customer service expert. He efficiently oversees accounts payable, payroll, and financial compliance, leading his team effectively. Michael Pocrnich’s extensive use of accounting principles like GAAP, FASB, and GASB throughout his career demonstrates his commitment to financial accuracy and strategic leadership. His experience and approach position him as a key resource for organizations looking to strengthen their financial practices and oversight.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Legal Expert Cody Gent Provides Crucial Insights on Protecting Investors in Crypto Crowdfunding

Michigan, US, 2nd May 2024, ZEX PR WIRE, The rise of cryptocurrency has revolutionized traditional finance, offering new avenues for investment and fundraising through innovative platforms like crypto crowdfunding. However, with the increasing popularity of these digital fundraising mechanisms comes a host of opportunities and risks for investors.

To address the complexities and risks associated with crypto crowdfunding, esteemed legal expert Cody Gent offers a comprehensive guide on how investors can protect themselves in this rapidly evolving landscape. Gent emphasizes the importance of empowering investors with the knowledge and tools necessary to navigate this dynamic landscape safely and securely. He highlights several crucial tips to mitigate risks and protect their interests.

Conduct Due Diligence

According to Cody Gent, thorough due diligence is essential before investing in any crypto crowdfunding project. Gent advises investors to research the project team, evaluate the viability of the business model, assess the project’s whitepaper, and scrutinize the terms and conditions of the crowdfunding campaign. Understanding the project’s goals, roadmap, and potential risks, he says, is paramount in making informed investment decisions.

Understand Regulatory Landscape

Gent also notes that, the regulatory environment surrounding cryptocurrencies and crowdfunding varies significantly across jurisdictions. As such investors must familiarize themselves with applicable laws and regulations in their region to ensure compliance and mitigate regulatory risks. Gent emphasizes the importance of understanding the legal framework governing crypto investments, including securities regulations, anti-money laundering (AML) laws, and tax implications.

Verify Security Measures

Security breaches and hacking incidents, Cody Gent says, remain a significant concern in the crypto space. To protect investors’ funds and sensitive information, Gent advises investors to verify the security measures implemented by crowdfunding platforms and projects. This includes assessing the platform’s encryption protocols, multi-factor authentication, and cold storage solutions for digital assets. Additionally, Gent says, investors should exercise caution when storing private keys and passwords, utilizing hardware wallets or secure offline storage methods where possible.

Seek Legal Counsel

Engaging the services of experienced legal counsel can provide investors with invaluable guidance and protection in navigating the complexities of crypto crowdfunding. Gent recommends consulting with a knowledgeable lawyer to review investment contracts, assess regulatory compliance, and address any legal concerns or disputes that may arise. Legal counsel, he says, can also provide assistance in negotiating favorable terms and protecting investors’ rights in the event of project failure or disputes.

Diversify Portfolio

As with any investment strategy, Cody Gent says, diversification is key to mitigating risk and maximizing returns. Gent advises investors to diversify their crypto crowdfunding portfolio across multiple projects and asset classes to minimize exposure to market volatility and project-specific risks. By spreading investments across different projects, industries, and geographic regions, Cody Gent notes, investors can hedge against potential losses and capitalize on diverse growth opportunities in the crypto market.

By following these essential tips, Cody Gent says, investors can empower themselves to make informed decisions and navigate the complexities of crypto crowdfunding with confidence and security. Gent’s expertise and guidance serve as a valuable resource for investors seeking to capitalize on the opportunities presented by crypto crowdfunding while safeguarding their investments and interests in this rapidly evolving landscape.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 week ago

Ilika chief executive Graeme Purdy discusses 2024 revenue growth and strategic milestones

-

Press Release15 hours ago

Vencanna Announces Closing the Acquisition of The Cannavative Group and the Post-Transaction Management and Board of Directors

-

Press Release4 days ago

HTX Launches New Trade to Earn: Trade BTC with Negative Fee Rates and Share 200,000 USDT Daily with Nonstop Rewards in 7*24 Hours!

-

Press Release4 days ago

Educator, Youth Empowerment Speaker, & Author Receives Presidential Lifetime Achievement Award

-

Press Release1 week ago

90% Of Americans Believe We Are Experiencing A Mental Health Care Crisis Elevate Health And Wellness Is Providing Relief

-

Press Release5 days ago

Liquid Crypto welcomes PUML Better Health and their token PUMLx as their newest DEX listing.

-

Press Release6 days ago

Streamlined Sea Adventure: Top Accessories for Boat Trailers

-

Press Release5 days ago

mobilefYre Sparks Excitement with Innovative Solutions: Unveiling a New Era in Local SEO Marketing