Press Release

Dolly Varden Silver Wolf Vein is Now a Priority as Silver Price Hits 14 Year High

The mineralization in drill hole DV25-446 includes native silver and is consistent with the robust style of mineralization with a significant increase in associated gold and base metal values. Additional drilling at Wolf is being prioritized for the remainder of the season

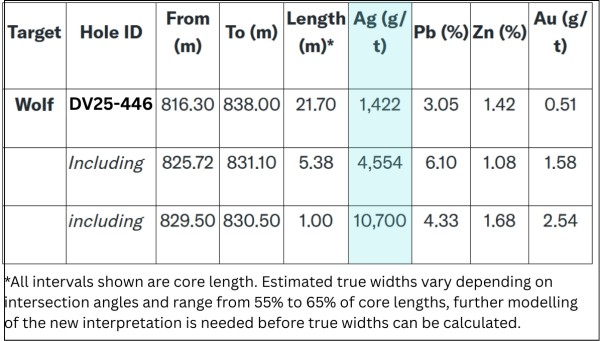

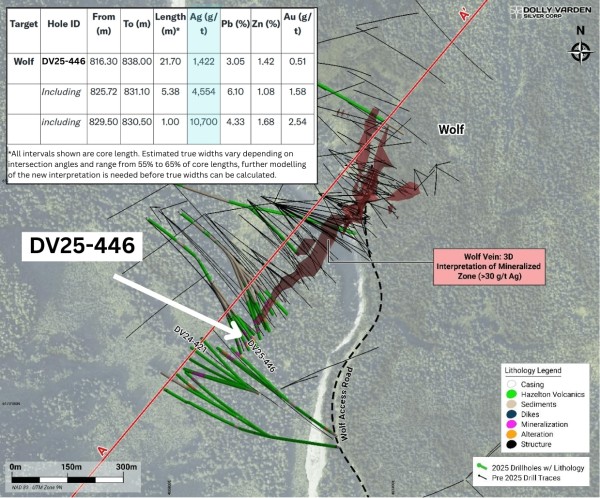

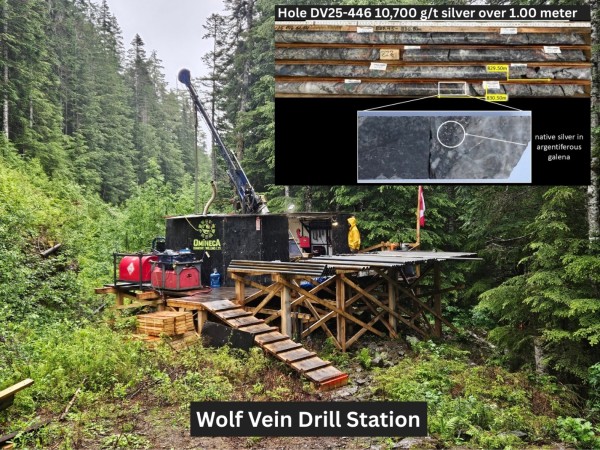

Vancouver, BC – September 4, 2025 – Global Stocks News – Sponsored content disseminated on behalf of Dolly Varden Silver. On September 2, 2025 Dolly Varden Silver (TSXV: DV) (NYSE American: DVS) (FSE: DVQ) announced that backfill directional drilling at the Wolf Vein in hole DV25-446 has intersected 1,422 g/t silver over 21.70 meters, including 10,700 g/t silver over 1.00 meter.

The ongoing success at the Wolf Vein is a lesson in the importance of hiring and empowering young geological talent. DV inherited archival drill data that went back to 1910. Four years ago, a new hire, Amanda Bennett, reviewed and analysed the old data.

Bennett zeroed in on the Wolf Vein as an area of interest. Dolly Varden’s VP of Exploration Rob van Egmond looked at her model, and said, “Let’s give it a try”.

“Back in 2021, we drilled the downward extension from the Wolf Mine and found a continuation of the system,” Bennett told Global Stocks News (GSN). “We’ve followed it at depth, extending it well over 1,100 meters. The Wolf Vein has exceeded my expectations.”

“These high-grade silver results over wide intervals suggest excellent continuity at the Wolf Vein,” stated Shawn Khunkhun, CEO of Dolly Varden Silver, in the August 2, 2025 press release. “The mineralization in drill hole DV25-446 includes native silver and is consistent with the robust style of mineralization with a significant increase in associated gold and base metal values. Additional drilling at Wolf is being prioritized for the remainder of the season.”

“The gold and base metal grades are getting stronger as we go deeper at the Wolf Vein,” van Egmond confirmed to GSN. “With gold at an all-time high, that is a positive development. The lead and zinc numbers also impact the metallurgy. The lead helps with the silver recoveries.”

The existing road to the Wolf Vein is currently not accessible. It is more efficient to use a helicopter for crew change and resupply.

“There’s no camp there,” confirmed Bennett. “It’s just a drill site. Every 12 hours, the helicopter delivers the drill crew, and the other crew rotates out. We have two project managers spelling each other off, who supervise the drillers.”

Leasing a helicopter is not cheap, but van Egmond told GSN that new technologies available in remote locations are providing savings.

“We now have a reliable satellite internet connection,” van Egmond told GSN, “which enables both the drilling crew and geologists to communicate with us in real time. They log the data onto a tablet and download it to an off-site server.”

“The drills also have satellite connection now,” continued van Egmond. “So the drillers can send pictures of the core in real time.”

Dolly Varden is using directional drilling technology to precisely target areas for step-out and infill work at both Wolf and Homestake Silver. Drillhole DV25-446 is a deflection hole (daughter hole) off the initial “mother” hole. The vein intercept in DV25-446 is approximately 105 meters up plunge (in-fill) from the 2024 step out DV24-421.

The directional drilling has allowed DV to decrease total meters drilled by utilizing the same mother hole numerous times.

The 55,000-meter 2025 summer drill campaign is estimated using the total length of each drill hole as if each hole started from surface. Since the total meterage estimate includes those “re-drilled” mother hole lengths, actual meters of new core will be in the order of 41,000 meters, thus achieving the same number of mineralized intercepts while drilling significantly fewer meters at Wolf and Homestake Silver.

“Mining companies use directional drilling when they want to reduce the total number of drilled meters for a multi-target drilling program,” confirms DV drill contractor Aziwell. “It is highly efficient and precise.”

Ten years ago, Dolly Varden was a “silver pure play”, which is quite rare. Seventy percent of global silver production comes from lead, zinc and gold mines, where silver is produced as a by-product.

In the last few years, Dolly Varden has started hitting significant gold intercepts. For example, in February 2024, a step-out drill program at Homestake Ridge intersected a new gold-rich zone: HR23-389: 79.49 g/t gold over 12.45 meters.

DV’s metal inventory value is now approximately a 50/50 split between silver and gold.

The rising price of gold has a double benefit for Dolly Varden: 1. It increases the value of the gold-in-the-ground inventory, 2. If the silver-gold ratio returns to its historical norm, it may boost the price of silver.

“The Silver price jumped above the USD 40 per troy ounce mark for the first time in 14 years at the beginning of the week, buoyed by the rise in the Gold price,” Commerzbank’s commodity analyst Carsten Fritsch notes.

On April 15, 2025 – DV Announced Common Shares Have Been Approved for Listing on the NYSE

Since then, Dolly Varden has significantly increased its land package:

May 5, 2025 – DV Announces Agreement to Quadruple Tenure Area in the Golden Triangle by Acquiring Hecla Mining Company’s Adjacent Kinskuch Property

May 8, 2025 – DV Acquires High-Grade Silver Porter Project in Golden Triangle

“Our progress in 2025 is the culmination of five years of hard work by our team,” Khunkhun told GSN. “In that time span, we’ve gone from two past-producing historical mines to five, we’ve drilled 141,000 meters with consistent high-grade silver and gold hits, our land package has gone from 7,000 hectares to 100,000 (+1,400%), and our market capitalisation has moved from $20 million to $460 million (+2,200%).

As the drilling season closes out, five diamond drills are working on the Kitsault Valley and Big Bulk Projects. Focus has been on step-out and infill drilling of the Wolf Vein and Homestake Silver deposits, as well as exploration drilling of the copper-gold porphyry system at Big Bulk and several other targets in the Kitsault Valley. More results will be released as they are received and incorporated into the company’s models.

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101, has reviewed, validated and approved the scientific and technical information contained in this GSN release.

Disclaimer: Dolly Varden Silver paid GSN $1,750 for the research, creation and dissemination of this content.

Contact: guy.bennett@globalstocksnews.com

Full Disclaimer: Global Stocks News (GSN) researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN makes no recommendation to purchase any individual stock. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events.

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country: Canada

Release id: 33448

The post Dolly Varden Silver Wolf Vein is Now a Priority as Silver Price Hits 14 Year High appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

LTR Taxis Redefines Reliable Private Travel Across the UK with Customer-First Airport & Long-Distance Taxi Services

London, United Kingdom — LTR Taxis is proud to announce its continued expansion and service enhancement as one of the UK’s most dependable private taxi and airport transfer providers. Built on reliability, transparent pricing, and professional service standards, LTR Taxis is setting a new benchmark for stress-free travel for individuals, families, and business travellers across London and major UK cities.

As travel demand continues to grow across the UK, passengers are increasingly seeking taxi services that combine punctuality, safety, comfort, and value. LTR Taxis has positioned itself at the forefront of this shift by delivering fixed-price, pre-booked taxi solutions designed to remove uncertainty from every journey—whether it’s an airport transfer, intercity ride, or executive travel requirement.

A Modern Taxi Service Designed Around Today’s Traveller

LTR Taxis was created with a clear mission: to make private travel simple, dependable, and accessible without compromising on quality. In an era where travellers face fluctuating prices, availability issues, and inconsistent service levels, LTR Taxis offers a structured, customer-first alternative.

Every journey with LTR Taxis is pre-planned, professionally managed, and executed with precision. From Heathrow and Gatwick airport transfers to long-distance journeys connecting London with cities such as Oxford, Birmingham, Manchester, Bristol, and beyond, the company ensures each booking is handled with care and attention to detail.

Fixed Pricing That Builds Trust

One of the most defining features of LTR Taxis is its transparent fixed-fare pricing model. Unlike metered taxis or app-based ride services that are affected by traffic or surge pricing, LTR Taxis provides customers with a confirmed price at the time of booking.

This approach allows passengers to plan their journeys confidently, knowing there will be no hidden charges, unexpected fees, or last-minute price changes. Fixed pricing is particularly valuable for airport transfers, business travel, and long-distance journeys, where cost predictability matters most.

Airport Transfers Without the Stress

Airport travel can be demanding—early flights, late arrivals, heavy luggage, and tight schedules are common challenges. LTR Taxis specialises in Stansted , London City Airport, and Luton Airport transfers designed to eliminate these pressures.

Key features of LTR Taxis airport services include:

- Pre-booked pickups with guaranteed vehicle availability

- Real-time flight monitoring to adjust for delays or early arrivals

- Professional meet-and-greet service at arrivals

- Spacious vehicles suitable for luggage and group travel

- 24/7 availability across all major UK airports

By combining careful planning with experienced drivers, LTR Taxis ensures that every airport transfer runs smoothly from terminal to destination.

Professional Drivers, High Service Standards

At the heart of LTR Taxis’ success is its team of fully licensed, experienced drivers. Each driver is selected not only for technical driving ability but also for professionalism, local route knowledge, and customer service skills.

Drivers are trained to prioritise safety, punctuality, and passenger comfort, whether handling a short city journey or a long-distance transfer. Their familiarity with London traffic patterns, airport layouts, and UK motorway routes enables them to choose efficient paths while maintaining a smooth and comfortable ride.

Serving a Wide Range of Travel Needs

LTR Taxis caters to a diverse customer base, including:

- Business professionals attending meetings or corporate events

- Families travelling with children and luggage

- Tourists exploring London and other UK cities

- Students travelling between cities and campuses

- Residents requiring dependable long-distance taxi services

The company’s flexible vehicle options allow customers to select the right car for their journey, ensuring comfort and practicality for every booking.

Technology That Enhances Reliability

While LTR Taxis focuses on personal service, it also embraces modern booking technology to streamline the customer experience. Online booking tools, clear communication, and efficient dispatch systems ensure that each journey is managed with precision.

Customers receive clear booking confirmations, driver details, and pickup instructions, reducing uncertainty and ensuring a smooth experience from start to finish.

Commitment to Safety and Compliance

LTR Taxis operates in full compliance with UK transport regulations. Vehicles are fully insured, regularly maintained, and operated by licensed drivers. This commitment to compliance reinforces passenger safety and trust—an essential factor in today’s private travel market.

The company actively encourages pre-booking and discourages unsafe, unlicensed travel practices, particularly around busy transport hubs such as airports.

A Strong Focus on Customer Experience

Customer satisfaction is central to LTR Taxis’ growth strategy. Every service element—from booking to drop-off—is designed to reduce friction and increase comfort.

By offering reliable communication, courteous drivers, clean vehicles, and consistent service quality, LTR Taxis continues to build long-term relationships with customers who value dependable travel solutions.

Supporting Sustainable and Responsible Travel

LTR Taxis is also mindful of its environmental responsibilities. By optimising routes, reducing unnecessary vehicle usage, and gradually introducing more efficient vehicles into its fleet, the company is working towards a more sustainable travel model while maintaining service excellence.

Growth and Expansion Across the UK

With rising demand for reliable private transport, LTR Taxis is expanding its reach across London and major UK cities. The company is strengthening its airport transfer network, improving long-distance connectivity, and investing in service improvements to meet growing customer expectations.

This expansion reflects LTR Taxis’ long-term vision: to become a trusted nationwide taxi and transfer brand known for reliability, transparency, and professionalism.

Looking Ahead: The Future of LTR Taxis

As travel habits continue to evolve, LTR Taxis remains committed to innovation, customer trust, and operational excellence. Future plans include:

- Expanded coverage across additional UK cities

- Enhanced booking and customer communication tools

- Continued driver training and fleet improvements

- Stronger partnerships with hotels, businesses, and travel platforms

By staying focused on core values—reliability, fairness, and service quality—LTR Taxis aims to remain a preferred choice for private travel across the UK.

About LTR Taxis

LTR Taxis is a UK-based private taxi and airport transfer service offering fixed-price, pre-booked journeys across London and major UK destinations. Specialising in airport transfers, long-distance travel, and professional private hire services, LTR Taxis is committed to delivering safe, reliable, and comfortable transport solutions for every customer.

Media Contact

Company: LTR Taxis

Service Area: London & UK-Wide

Services: Airport Transfers, Long-Distance Taxis, Private Hire

Media Contact

Organization: LTR Taxis

Contact Person: 450 Bath Rd, Longford, West Drayton UB7 0EB, United Kingdom

Website: https://ltrtaxis.com/

Email: Send Email

City: London

Country:United Kingdom

Release id:42075

The post LTR Taxis Redefines Reliable Private Travel Across the UK with Customer-First Airport & Long-Distance Taxi Services appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Beyond Exposure: How a Blind-Box Toy Seller Built Ownership, Community, and New Sellers on Fambase

Austin, Texas, United States, 28th Feb 2026 – In the fast-growing market for designer toys and blind-box collectibles, scarcity fuels demand. Hidden editions and limited drops — from brands like Labubu to Funko and others — can spark intense bidding overnight. But exposure alone does not create stability.

Algorithms fluctuate. Buyers jump between listings. Sellers compete within the same feed. For independent sellers, the real challenge is retention.

For blind-box seller Olivia Brooks, that reality became clear early on.

Before joining Fambase, Olivia hosted auctions across multiple platforms. Rare drops generated strong bids, but once they ended, buyers were quickly redirected to competing sellers. Momentum disappeared as fast as it arrived.

“I could generate excitement,” she says, “but I couldn’t build lasting relationships.”

That changed when she launched her own Marketplace group on Fambase.

Building a Collector-Centered Community

Instead of relying on algorithm-driven discovery, Olivia invited collectors into a private group focused entirely on her curated designer toy releases. Inside the group, members are not shown competing listings or redirected elsewhere. Announcements, livestreams, and transactions all happen in one centralized space.

Her auctions evolved from isolated sales into recurring community events. Collectors recognized one another. Discussions about condition, authenticity, and rarity took place openly.

Because conversations remain visible, common questions can be addressed once instead of through fragmented private messages, improving efficiency while strengthening transparency.

In the collectibles market, trust is as valuable as inventory.

Flexible Selling, Unified Engagement

For rare limited editions, Olivia relies on livestream auctions to let market demand determine price. The live format preserves competitive energy and transparency.

At the same time, Fambase enables fixed-price “Buy Now” listings within the same group, including smaller items and promotional bundles.

With her collector base concentrated in one place, she can notify members instantly before going live. For major releases, she schedules auction events in advance to ensure participation and avoid unpredictable turnout. This structure allows her to plan strategically rather than react to shifting platform traffic.

Protection for High-Value Collectibles

In the designer toy resale market, certain rare editions carry significant value. Disputes can be costly.

On some platforms, refunds may be processed automatically before sellers respond. Fambase follows an evidence-based review process, giving sellers the opportunity to present documentation before decisions are finalized.

“When you’re dealing with limited collectibles, fairness matters,” Olivia notes. “You need to know your business is protected.”

Turning Collectors into Entrepreneurs

As Olivia’s community matured, she noticed something beyond repeat purchases. Some collectors owned rare pieces of their own. Others were interested in hosting auctions but lacked structure.

Rather than losing those transactions to outside platforms, Olivia began mentoring her buyers.

She guided them in creating their own Fambase Marketplace groups, explained the differences between live auctions and fixed-price listings, and shared practical strategies for scheduling events and maintaining engagement. Instead of competing with her collectors, she empowered them.

By helping buyers become sellers within the same ecosystem, Olivia strengthened her community’s network effect. Collectors were no longer just participants in her auctions; they were launching businesses of their own.

“It’s not just about selling collectibles,” Olivia says. “It’s about building a space where everyone can grow.”

From Exposure to Ownership

Olivia’s experience reflects a broader evolution in the blind-box resale market. Sellers are moving away from short-term exposure spikes and toward ownership of their collector relationships.

In a market driven by scarcity and community trust, sustainable growth depends not only on rare inventory but on loyal collectors who stay.

About Fambase

Fambase is redefining community commerce by giving independent sellers full ownership of their customer relationships, pricing, and growth. Through private groups, livestream auctions, storefronts, and integrated communication tools, Fambase enables sellers to build sustainable businesses free from algorithmic volatility and internal traffic diversion.

Build your community. Own your growth.

Download Fambase today at joinfambase.com.

Media Contact

Organization: SocialSignal Lab

Contact Person: Julian Rowe

Website: https://medium.com/@julianblogsite

Email: Send Email

City: Austin

State: Texas

Country:United States

Release id:42071

The post Beyond Exposure: How a Blind-Box Toy Seller Built Ownership, Community, and New Sellers on Fambase appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Geekvape Neutra Wins European Product Design Award 2025

China, 28th Feb 2026 – Geekvape Neutra, recently launched by Geekvape, has been awarded 2025 Winner of the European Product Design Award (EPDA). As one of the world’s leading product design awards, the EPDA recognized excellence in design that balances aesthetics, functionality, innovation, and real-world impact.

Guided by sustainability at its core, Geekvape Neutra marks a significant step in low-carbon design, reflecting Geekvape’s ongoing commitment to sustainability-driven innovation.

First ISO 14068-1: 2023 Certified Product in the Vaping Industry

Geekvape Neutra is the first vape product in the industry to be certified under the ISO 14068-1: 2023 Carbon Neutrality Standard. Its “cradle-to-gate” carbon footprint is reduced by 58.3% compared with conventional products, marking a new milestone in low-carbon and circular innovation within the vaping industry.

Minimalist by Design

Rooted in the ‘Less is More’ philosophy, Geekvape Neutra seamlessly integrates functionality with environmental responsibility. Designed with a replaceable pod, refillable system, and replaceable battery to extend product lifespan, the device removes the screen, charging cable, and printed manual—proving that minimalist design can enhance both user experience and sustainability.

Recycled and Simplified Materials

The metal components are manufactured using 75% recycled aluminum, certified by UL Solutions (certificate ID: 314273-4210). The plastic components are made from a single polymer type (PCTG) and sourced under the International Sustainability and Carbon Certification (ISCC) PLUS chain-of-custody (certificate ID: ISCC-PLUS-Cert-CN212-20240080). This streamlined material strategy supports both recyclability and reusability.

Detachable Components

Geekvape Neutra is designed to facilitate disassembly, featuring a detachable battery and device body. Metal parts, battery, and internal modules are structured for efficient end-of-life recycling.

Platform-Based Modular Design

Built on the Q Pod platform, Geekvape Neutra is universally compatible with all Q pods and supports modular expansion, reducing redundant development.

Sustainable Packaging

The packaging is made of 100% FSC-certified recyclable paper and adopts a glue-free and ink-free structural design. This approach reduces material and chemical usage while maintaining durability and protective performance.

Geekvape Neutra integrates low-carbon principles into its design, materials, and lifecycle to help shape a greener future for the vaping industry.

IMPORTANT NOTICE: This content is intended for adult smokers and vapers only. You must be of legal smoking age in your jurisdiction to read this article or purchase products.

For more details, please visit: https://geekvape.com/uncategorized/geekvape-neutra-design-for-a-low-carbon-future

WARNING: This product contains nicotine. Nicotine is an addictive chemical.

Media Contact

Organization: Geekvape

Contact Person: Hillary Jiang

Website: http://www.geekvape.com/

Email: Send Email

Country:China

Release id:41350

The post Geekvape Neutra Wins European Product Design Award 2025 appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release3 days ago

SPL VPN Leverages AI to Eliminate Manual Server Selection; Surpasses 2 Million Downloads in Connectivity Pivot

-

Press Release7 days ago

UAE Institutional Leaders Convene in Abu Dhabi as Digital Asset Strategy Accelerates Across Global Finance

-

Press Release5 days ago

Erb Hub Showcases New Jersey’s Evolving Cannabis Culture Through Innovative Digital Art

-

Press Release4 days ago

Cabinet Paint Color Trends Shape Tampa Bay Kitchens in 2026

-

Press Release6 days ago

Ernie’s Wagon Junk Removal Expands Operations Across Greater Hillsboro to Meet Surging Demand

-

Press Release4 days ago

Lake Worth Beach Bail Bonds Services Expanded with County-Focused Release Strategy

-

Press Release3 days ago

ZentoraReach Leads Client Acquisition & Revenue Growth for Contractors

-

Press Release1 week ago

Nermine Al Hossary: Bold Dreamer Inspiring Lives Through Influence and Authenticity