Press Release

Dolly Varden Silver Acquires Hecla Mining’s Kinskuch Property For $5 Million In Stock

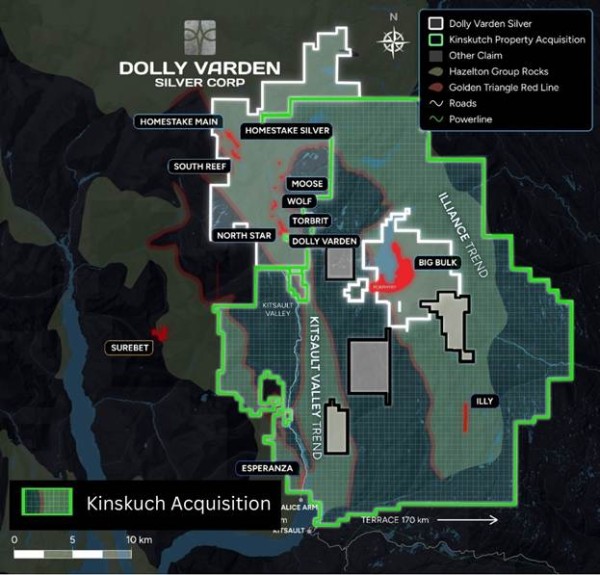

The acquisition of the Kinskuch property from Hecla will triple the total strike length of favorable Jurassic-age Hazelton-group volcanic rocks and associated “Red Line” by adding the Illiance trend to the Kitsault Valley trend.

Canada, 8th May 2025 – Sponsored content disseminated on behalf of Dolly Varden Silver. On May 5, 2025 Dolly Varden Silver (TSXV:DV) (OTC:DOLLF) (FSE: DVQ1) announced that is has signed a definitive agreement to acquire 100% of Hecla Mining Company’s Kinskuch property in northwest BC’s Golden Triangle.

The acquisition of the Kinskuch property will increase Dolly Varden’s tenure area by 400% to consolidate a district scale, contiguous claim package that includes the Kitsault Valley, Big Bulk and Kinskuch projects.

The consolidated land package will be about 77,000 hectares, which is 225 X bigger than New York City’s Central park.

The Kinskuch acquisition allows Dolly Varden Silver (an explorer) and Hecla Mining (a producer) to focus on their respective core strengths.

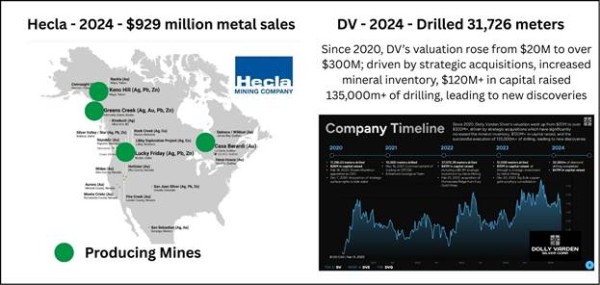

Hecla has a market cap of USD $3.03 billion. According to Hecla’s SEC Year-end Financial Filings, in 2024 it delivered 16.2 million ounces of silver, 141,923 ounces of gold, generating record sales of $929 million.

Hecla’s 2024 Capital Expenditures on existing mines (Greens Creek, Lucky Friday, Casa Berardi, Keno Hill) totaled $214.5 million.

Hecla has ten exploration projects on the books in the USA, Canada and Mexico. The company’s total 2024 exploration and pre-development spend was $27.3 million, less than 1% of its market cap.

Dolly Varden has a market cap of CND of $291 million. The company does not have an operating mine, therefore does not generate metal sales.

According to DV’s 2024 consolidated financial statements, DV spent $9.8 million on drilling, $1.6 million on geoscience and $1.1 million on sample analytics.

Its total 2024 exploration spend was $17.8 million, about 6% of its market cap.

HL is a producer first. DV is an explorer first.

“Consolidating Dolly Varden’s Kitsault Valley Project with our major shareholder Hecla’s large and underexplored claims covering prospective Hazelton Group rocks will allow for more efficient exploration and enable us to unlock value on our path to be a premier precious metals company.” stated Shawn Khunkhun, President and CEO of Dolly Varden.

“Additionally, we welcome Hecla’s increased share ownership in our Company,” added Khunkhun.

Kinskuch Acquisition Deal Highlights:

- DV to issue Hecla 1,351,963 shares of DV worth $5 million.

- Hecla retains 2% net smelter return royalty (NSR) on the Kinskuch property.

- NSR will include a 50% buyback right, for $5 million, allowing DV to reduce the royalty to 1% at any time.

- Hecla maintains a designated position on DV’s Technical Committee.

- DV and Hecla will collaborate to unlock the potential of the underexplored areas.

“We will be using our structural and lithological framework model developed at the Kitsault Valley Trend that has led our team to significant discoveries such as the Wolf Vein and applying them to exploration of the Illiance Trend,” states Rob van Egmond, VP Exploration for Dolly Varden.

“Hecla was successful in identifying a subparallel trend of silver-rich mineralization, located to the east of our significant silver and gold deposits,” added van Egmond.

The acquisition of the Kinskuch property from Hecla will triple the total strike length of favorable Jurassic-age Hazelton-group volcanic rocks and associated “Red Line” by adding the Illiance trend to the Kitsault Valley trend.

In the May 7, 2025 “Explainer Video” below, van Egmond outlines the exploration history and potential of the new land package.

“Hecla is giving us the rights to explore that land,” stated van Egmond in the video. “We are now the owners, but they still maintain ownership because it is an equity deal.”

“They’ve increased their percentage ownership in Dolly Varden. Indirectly, they still are part owners of that land. They trust us to do the exploration work and unlock the value.”

Both the Kitsault Valley and the Illiance trends are interpreted to be part of a district scale, sub-basin of the Eskay Rift period. The Illiance trend has seen little modern exploration work, limited to localized diamond drilling by Hecla on the three kilometer long, north-south trending Illy epithermal system.

Also included within the acquisition area is the past-producing Esperanza Mine (1910), interpreted as quartz-carbonate veins with similar silver grades to the historic Dolly Varden Mine (1920) hosted in Upper Hazelton sedimentary rocks.

According to a BC government database of historical deposits, “The Esperanza mine produced high-grade, hand-sorted silver ore sporadically between 1911 and 1948. In total, 4662 tonnes of ore with an average grade of 1.77 grams per tonne gold, 983.9 grams per tonne silver were mined”.

The southwestern portion of the acquired claims covers Hazelton Group rocks that trend to within seven kilometers of Goliath Resources’ recently discovered Surebet Zone gold mineralization.

The area south of Big Bulk has the potential to host additional gold-copper porphyry systems along the south trend towards the Kitsault molybdenum porphyry deposit, which is being actively advanced by Newmoly llc.

The Kinskuch property is covered by a recently renewed five-year Exploration Permit on both Nisga’a and Gitanyow Traditional Lands.

“Hecla didn’t walk away from Kinskuch—you could say they traded up, by handing over the property to Dolly Varden in exchange for shares, a royalty, and retaining a board seat,” wrote Jeff Valks, Senior Analyst at The Gold Advisor on May 5, 2025.

“Hecla keeps a stake in any upside without spending a dime on drills—it’s not a core property for them and they want Dolly Varden to drill it.”

The Kinskuch property acquisition is subject to TSX Venture Exchange and NYSE America approvals. It is expected to close in mid-May.

On May 7, 2025, Dolly Varden announced plans for the fully funded 2025 exploration drilling program at its 100% owned Kitsault Valley Project. A minimum planned 35,000 meters of diamond drilling will build on the success of the 2024 program.

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101 has reviewed, validated and approved the scientific and technical information contained in this GSN release.

Disclaimer: Dolly Varden Silver paid GSN $1,750 for the research, creation and dissemination of this content.

Contact: guy.bennett@globalstocksnews.com

Full Disclaimer: Global Stocks News (GSN) researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN makes no recommendation to purchase any individual stock. Our publications should be used as a starting point for additional research and “due diligence”. GSN publications contain “forward-looking statements” such as “may,” “anticipate,” “expect,” “project,” “intend,” “plan,” “believe,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:27483

The post Dolly Varden Silver Acquires Hecla Mining’s Kinskuch Property For $5 Million In Stock appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Boost Your Social Media Growth This Black Friday With Boostero: The Most Reliable SMM Panel for Fast Results

New York, US, 8 Dec 2025, ZEX PR WIRE, Black Friday isn’t just the biggest shopping day of the year anymore — it’s the moment when brands, creators, and businesses fight for attention, visibility, and engagement across every social media platform. If you’ve ever wondered how some accounts suddenly skyrocket in popularity around major events or sales seasons, here’s the truth: they don’t rely on luck. They rely on strategy, momentum, and the right tools.

That’s exactly what Boostero, one of the most reliable and affordable SMM panels in the industry, brings to the table. Whether you’re a small business wanting to build credibility, a creator trying to get noticed, or a marketer looking for consistent performance at scale, Boostero makes it easier than ever to gain traction — especially during Black Friday’s high-traffic surge.

With thousands of customers worldwide, lightning-fast delivery, unbeatable prices, and 24/7 customer support, Boostero bridges the gap between effort and visibility. This Black Friday, it’s your chance to amplify your story, generate buzz, and maximize the reach of your brand within minutes. More information can be found at https://boostero.com.

Why Black Friday Is the Best Time to Grow Your Social Media Presence

Every brand is fighting for attention on Black Friday — and the audience is actively searching for new deals, new creators, and new businesses to follow. Social media becomes a marketplace of opportunities, but only the brands with visibility win the race.

Here’s why boosting your social media during Black Friday is a game-changer:

-

Traffic is at its highest levels of the year

-

Consumers are more willing to buy, follow, and discover new brands

-

Brands that appear more popular get more clicks, shares, and conversions

-

Algorithms push content with higher engagement

-

Visibility creates trust, and trust creates sales

Boostero’s SMM panel helps you tap into this golden window by giving your profiles the instant momentum needed to stand out.

Enhance Your Social Media Profiles the Easy Way

Boostero was built for simplicity. No complicated tools. No confusing dashboards. Just smooth, fast, reliable results.

Whether you’re trying to grow on TikTok, Instagram, YouTube, Facebook, Twitter, LinkedIn, Pinterest, Spotify, Telegram — or even boost website traffic — Boostero offers targeted services with real impact.

You don’t have to spend months trying to crack the algorithm. You don’t have to wait for random virality. With Boostero, you accelerate your growth and let your content reach the audience it deserves.

Why Choose Boostero? The Benefits That Set Us Apart

1. Complete Service Guarantee

Every service is backed by a high-quality guarantee. When you choose Boostero, you get real likes, followers, subscribers, views, comments, and engagement from verified systems. There’s no guesswork — just reliable delivery and measurable results.

Boostero’s focus is simple: deliver growth that feels natural, safe, and aligned with your brand’s objectives.

2. 24/7 Customer Support

No matter where you are or what time it is, Boostero’s support team is ready to help. Available through:

-

Email

-

WhatsApp

-

Support Tickets

This means you’re never alone in your social media journey — even on weekends or Black Friday rush hours.

3. Numerous Flexible Payment Methods

Boostero offers one of the largest collections of payment methods in the SMM industry:

-

Credit & Debit Cards

-

PayPal

-

Cryptocurrency

-

Skrill

-

Payoneer

-

Perfect Money

-

Payeer

-

CashMall

-

And many more

This flexibility ensures that adding funds to your account is simple and stress-free.

4. Among the Cheapest SMM Panels on the Market

One of Boostero’s biggest strengths is affordability. While many panels charge premium rates, Boostero keeps prices low without compromising service quality. You get the best value, the best delivery speed, and premium service — all at some of the lowest prices available.

5. 100% Confidential and Secure

Your privacy is the top priority. Boostero never shares your data, and all actions are completely confidential. The links, profiles, and numbers you provide are used only for your orders and never stored or exposed publicly.

6. Super-Fast, Automated Delivery

With Boostero, your order begins processing immediately. The automated system starts delivering engagement within minutes, so you never have to wait days for results.

Fast, efficient, and reliable — exactly what creators and brands need during a high-traffic event like Black Friday.

Every Big Story Starts Small — Amplify Yours With Boostero

Growth isn’t just about numbers. It’s about being seen, heard, and appreciated. Boostero ensures your message reaches the right people, helping you build credibility and real engagement.

When your story gets traction, everything changes:

-

You gain more trust

-

You attract more opportunities

-

You create stronger connections

-

You spark conversations that grow your brand

Boostero doesn’t just help you “look big.” It helps you be discovered.

Why Big Brands Never Struggle With Social Media Goals

Think of the biggest brands you know. Do you ever see them with low engagement? Barely any followers? Zero comments?

Of course not. That’s because they invest heavily in visibility and marketing. They understand the power of social proof. When people see engagement, they trust you more.

Now, with Boostero’s affordable pricing and beginner-friendly tools, you no longer need a massive marketing budget to compete. You can start building authority instantly — just like the big brands do.

Let Boostero Handle the Growth While You Do What You Love

Creating great content is important, but it’s only half the equation. Boostero fills the gap by giving your content the traction it deserves. Whether you want more:

-

Followers

-

Likes

-

Views

-

Comments

-

Shares

-

Subscribers

-

Website traffic

Boostero offers reliable SMM services designed to scale your brand organically and safely.

Explore Boostero’s Full Range of SMM Services

YouTube SMM Panel Services

Get the subscribers, views, and engagement needed to grow your channel and improve your visibility.

TikTok SMM Services

Stop letting great videos go unnoticed. Boost views, likes, and followers for instant discovery.

Instagram SMM Panel Services

Give your posts the push they need to get seen, shared, and engaged with.

Facebook SMM Services

Enhance visibility through page likes, post reactions, comments, and video views.

Twitter (X) SMM Services

Boost your retweets, likes, and follower count to build authority faster.

Spotify SMM Services

Grow your streams and build your musical presence with targeted plays.

Telegram SMM Services

Increase subscribers and enhance community engagement instantly.

LinkedIn SMM Services

Build a powerful professional brand with more followers, endorsements, and reach.

Discord SMM Panel

Grow your server with members, messages, boosts, and real engagement tools.

Pinterest SMM Services

Amplify your repins, impressions, and followers to reach more idea-seekers.

Website Traffic Services

Drive real, targeted traffic to your site with instant delivery campaigns. Boostero supports every major platform, giving you one dashboard to manage your entire growth strategy.

How to Get Started with Boostero

Boosting your brand is a simple four-step process:

1. Create an Account

Sign up and log into your new dashboard.

2. Add Funds

Choose your preferred payment method and top up your balance.

3. Place an Order

Browse services, select what you need, and place your order.

4. Enjoy the Results

Watch your visibility grow as Boostero delivers engagement instantly.

This Black Friday, Take Your Brand to the Next Level

Social media competition is fierce — especially during Black Friday when everyone is fighting for attention. But with Boostero, you don’t just compete… you stand out.

Real followers. Real engagement. Real momentum.

If you’re ready to grow your brand, increase your reach, and amplify your voice, Boostero is the SMM panel that delivers results every single time. Visit https://boostero.com for more details.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

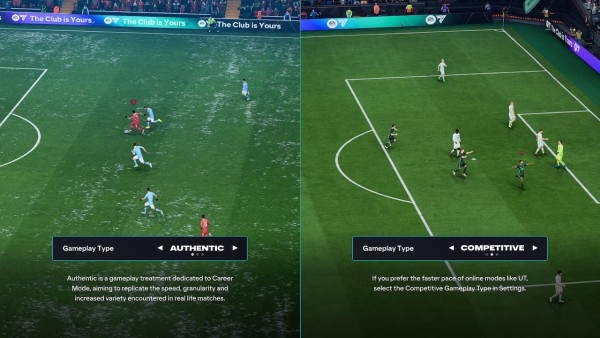

U7BUY Delivers Instant FC 26 Coins with Secure and Fast Delivery

Hong Kong S.A.R., 8th Dec 2025 – U7BUY, a prominent digital gaming marketplace, has introduced the instant availability of FC 26 coins, a sought-after in-game currency for football simulation enthusiasts. This service allows players to acquire FC 26 coins with minimal delay, ensuring a secure and reliable transaction experience. As a trusted platform for millions of gamers, U7BUY continues to prioritize safety and efficiency in the delivery of digital assets.

“U7BUY is pleased to offer instant access to FC 26 coins, providing players with a secure and streamlined process to acquire the currency they need for enhanced gameplay,” stated Anna, Marketing Director of U7BUY. “The company remains committed to creating a secure, efficient platform where digital transactions are simplified and protected, helping gamers engage in their favorite titles without concern.”

U7BUY serves as a comprehensive digital marketplace, offering services such as in-game currency, items, accounts, and power-leveling solutions for a wide range of popular games. By utilizing encrypted data and providing 24/7 customer support, U7BUY ensures that every transaction is secure and user-friendly. The introduction of FC 26 coins marks another step in enhancing the gaming experience, enabling players to quickly and safely obtain necessary in-game resources.

This new service comes as a direct response to the growing demand for faster, more reliable means of acquiring digital currency. Previously, players had to contend with slow and often uncertain methods of obtaining in-game funds, but U7BUY’s commitment to speed and security promises to eliminate these frustrations. The platform’s state-of-the-art encryption helps ensure that all customer data is protected, and transactions are completed swiftly and efficiently.

“Looking to the future, U7BUY will continue to evolve with the gaming community, expanding its offerings and maintaining a focus on secure, instant transactions,” Anna added. “The gaming industry is constantly changing, and U7BUY is dedicated to staying ahead of these changes by embracing new technologies and partnerships to better serve players worldwide.”

In addition to offering instant FC 26 coins, U7BUY operates a comprehensive community hub that includes blogs, guides, and other resources designed to keep gamers informed and connected. These resources offer valuable insights into the latest gaming trends, strategies, and tips, helping users maximize their gaming experience.

The launch of FC 26 coins is part of U7BUY’s ongoing efforts to expand its offerings and meet the evolving needs of the gaming community. As more games and digital assets emerge, U7BUY remains committed to providing a secure, efficient, and inclusive platform for players everywhere.

For more information, please contact U7BUY at +0085254814835 or via email at press@u7buy.com. FC 26 coins are now available for instant purchase through the platform.

Media Contact

Organization: U7BUY

Contact Person: Anna

Website: https://www.u7buy.com/

Email: Send Email

Contact Number: +85254814835

Country:Hong Kong S.A.R.

Release id:37750

The post U7BUY Delivers Instant FC 26 Coins with Secure and Fast Delivery appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

U7BUY Brings Affordable Valorant Items for Players of All Ranks with Instant Delivery

Hong Kong S.A.R., 8th Dec 2025 – U7BUY, a leading digital gaming marketplace, has announced the launch of a new range of affordable in-game items for players of all ranks in Valorant. Known for secure transactions and dependable customer support, U7BUY aims to offer an enhanced gaming experience that is both accessible and enjoyable for players worldwide.

As Valorant, the popular tactical shooter developed by Riot Games, continues to captivate global audiences, players often seek ways to elevate their gameplay. With this latest initiative, U7BUY has made a variety of Valorant items—including weapons, skins, accounts, and power-leveling services—available at competitive prices, ensuring that players of all skill levels can access these sought-after products.

“U7BUY is committed to making gaming more affordable and accessible,” said Anna, Marketing Director at U7BUY. “By providing a diverse selection of Valorant items at reasonable prices, players can enjoy a more immersive experience without having to worry about breaking the bank. The platform is designed to cater to all levels of players, whether novice or expert, ensuring everyone can thrive in the competitive world of Valorant.”

U7BUY’s platform is designed to simplify the process of buying and selling in-game currency, items, and accounts for a wide range of popular games. With a strong emphasis on security, all transactions on the platform are protected by encrypted data protocols, and a dedicated support team is available to assist players throughout their gaming journey. In addition to its marketplace, U7BUY fosters a thriving community by offering blogs, game guides, and promotional content to keep players informed and engaged.

The company’s growing popularity can be attributed to its focus on reliability and customer satisfaction. As more players turn to U7BUY for in-game products, the platform continues to expand its offerings, meeting the evolving needs of the gaming community.

Looking forward, U7BUY is set to broaden its services and introduce new features to enhance the overall player experience. Anna added, “As the platform continues to grow, U7BUY remains focused on adding more services and features to support gamers across the globe. The dedication to providing affordable, secure, and engaging experiences is unwavering, and the company is excited to continue shaping the future of the digital gaming marketplace.”

The newly available Valorant items can now be accessed on the U7BUY platform. Players are encouraged to explore the range of products designed to enhance their gameplay and bring fresh excitement to each match.

For more details, individuals can contact U7BUY at +0085254814835 or via email at press@u7buy.com to inquire about how to buy Valorant items.

Media Contact

Organization: U7BUY

Contact Person: Anna

Website: https://www.u7buy.com/

Email: Send Email

Contact Number: +85254814835

Country:Hong Kong S.A.R.

Release id:38549

The post U7BUY Brings Affordable Valorant Items for Players of All Ranks with Instant Delivery appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release7 days ago

New Digital Philanthropy Initiative Launched at Asia Philanthropy Forum in Boao

-

Press Release6 days ago

Global Manufacturing Innovation Forum 2025 and Saudi–Dongguan Businesses Announced 17 Billion SAR Collaboration

-

Press Release6 days ago

Lumixus Canada Securities Ltd Officially Launched: Becomes Group’s North American Investment Management and Research Headquarters with $10 Million CAD Registered Capital

-

Press Release2 days ago

Author of Journey to Forever Meets with Film Producer to Discuss Screen Potential

-

Press Release7 days ago

Gastro Center of Maryland Expands Footprint, Bringing Expert Digestive Care to More Communities Across the DMV

-

Press Release2 days ago

The Attic Insulation Specialists Inc. Expands Full-Service Home Energy and Safety Solutions Across Southern California

-

Press Release3 days ago

Operational Police Protective Services Introduces Elite Security Solutions for High-Profile Corporate and Entertainment Events

-

Press Release2 days ago

Jack Botanicals Sets New Industry Standard with Premium Quality Kratom and Best Kratom Vendor