Press Release

“Data Island” Problem Can Be Solved by Combining Privacy Computing AI and Blockchain Technology

Platon Now Offers Breakthrough Solutions to Break the “Data Island” and Release the Value Potential

During the COVID-19 pandemic, medical networking services developed rapidly, and big data played a key role in the development. In the medical industry, new medical models and cutting-edge research also require a large number of patient data to verify. However, due to the lack of effective privacy protection, data cannot be shared, resulting in the “data island” phenomenon, which has become a big problem to be solved. At the same time, the widespread use of medical big data also triggered the issue of privacy leaks and data abuse, and raised social concerns about data security and privacy protection.

These problems exist not only in the medical industry, but also in other industries. Citing the protection of trade secrets and refusing to trade their own data, government departments are also reluctant to share data because of security, interests, technology, and other concerns. This exacerbates the “data Island” problem, which restricts the maximization of data value.

In the current data market, users produce new online data every day, but they do not own the data. Data is held in the hands of each independent collector, resulting in the compartmentalization of data ownership, which is referred to as “data Island.” The lack of data privacy protection and sharing mechanism is the main obstacle for data authentication.

Blockchain provides an opportunity for data validation. Blockchain is a distributed ledger technology designed to realize transaction accounting through the joint participation of multi-nodes, and each node account is complete and cannot be tampered with. This helps in integrating users into the three-party governing account for insusceptible and uninterrupted data production, data monopoly and data use.

Through node authorization, the final data income is shared among the parties in proportion to realizing the sharing of data ownership. Although transaction information is shared in this process, account information is highly encrypted. Therefore, zero-knowledge proof is an effective strategy to protect the privacy of accounts. Zero-knowledge proof is to make the verifier believe that he has certain knowledge or ability without providing any useful information to the verifier, for example, to realize the asset transfer without disclosing user identity.

Blockchain technology can be widely used in equipment authentication, communication encryption and other areas to provide a strong support for breaking the “data island” and promoting data transactions.

Privacy computing brings solutions

The realization of data sharing transaction and potential value release happens on the value chain of “property right confirmation – privacy protection – co-computing – value sharing.” The scheme, which is widely accepted by finance and blockchain industry, is based on the solution combining privacy computing and AI, which is a new way to solve security problems such as key management, by integrating multiple cryptography algorithms with frontier blockchain technology. Public chain PlatOn is the pioneer that set a precedence of multi-party secure computing (MPC) and other cryptographic algorithms into the key management system (KMS), which realizes the management of massive scale digital assets through cryptography, thereby effectively resolving the contradiction between data privacy protection, right ownership and data sharing, and improving the value and efficiency of data. The technology can be used in future scenarios such as digital wallets and inter-agency transactions.

PlatON has focused on the combination of privacy computing and big data AI. The open-sourced, community-based, blockchain ecosystem recently launched Tensorflow, the world’s first privacy AI framework that supports mainstream in-depth learning. PlatON’s series of innovative practices have provided an observable way to solve the problem of “data island” and data asset transaction.

Thanks to its rich industry experience, PlatON can fix the impasse and step forward. It is reported that PlatON’s core founding team has more than 15 years of experience in finance and communications, and strong software implementation capability too. These are exactly what the foundation for PlatON is built on to continuously and effectively promote R&D investment and business practice. At present, PlatON is focusing on R&D and solving the problem of data sharing step by step in the engineering and business world. Currently, PlatON’s leading network, Alaya, is focused on the financial sector, where data is highly standardized and financial institutions have a strong desire to address data privacy concerns.

PlatON’s Future Vision: Building a Data Transaction Infrastructure

PlatON has become a global leader in the field of privacy-protected computing. With the accumulation of finance and AI, PlatON has reached strategic cooperation with HashQuark, Keystore, HashKey Hub and other well-known platforms in the industry to jointly promote the implementation and application of cutting-edge technologies, such as KeyShard, so as to realize the new digital assets custody service in the world and better protect the security of digital assets.

PlatON’s vision is to build a peer-to-peer computing network that integrates verifiable computing, privacy computing, scalable computing, and dedicated computing hardware to provide open-source public infrastructure software development, consulting, and operational services to developers, data providers, as well as various communities, organizations, and individuals with computing needs around the world, and ultimately to support mass data asset transactions.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Liberty Hill Landscapes Expands Residential Landscaping Services Across Northern Utah

Ogden-based landscaping company provides outdoor solutions for homeowners throughout Weber and Davis Counties

Ogden, Utah, United States, 13th Mar 2026 — As homeowners across Northern Utah continue investing in outdoor living spaces and curb appeal, one local landscaping company is expanding its services to meet growing demand. Liberty Hill Landscapes, a residential landscaping company based in Ogden, Utah, has announced the expansion of its landscaping services throughout Weber and Davis Counties, offering homeowners a full range of outdoor solutions from sod installation to custom hardscaping and irrigation systems.

The announcement comes as population growth across the Wasatch Front continues driving demand for professional landscaping services. As new housing developments expand and established neighborhoods look to improve aging outdoor spaces, many homeowners are seeking experienced landscaping contractors who understand the unique climate and soil conditions found throughout Northern Utah.

Across Weber and Davis Counties, homeowners face several challenges when it comes to maintaining and improving their outdoor spaces. Aging irrigation systems, outdated landscaping designs, drainage problems, and water efficiency concerns have become common issues for many residential properties. At the same time, increasing home values and community standards have encouraged homeowners to invest more intentionally in their outdoor environments.

Professional landscaping contractors play an important role in addressing these challenges. From installing new sod and irrigation systems to building retaining walls and creating functional outdoor living areas, skilled landscaping teams help homeowners improve both the appearance and functionality of their properties.

Homeowners can also find Liberty Hill Landscapes in Ogden, Utah on Google Maps, where the company works with residential clients throughout Weber County, Davis County, and surrounding Wasatch Front communities.

Liberty Hill Landscapes has built a reputation for dependable service and high-quality workmanship throughout Northern Utah. Founded by Ben Childs, the company focuses on providing landscaping solutions designed specifically for the region’s climate, soil conditions, and water conservation needs.

By combining thoughtful landscape design with professional installation, Liberty Hill Landscapes helps homeowners transform underperforming yards into functional, attractive outdoor spaces. The company’s team brings hands-on experience to every project, whether it involves a simple sod installation or a larger landscape renovation.

Liberty Hill Landscapes offers a wide range of services designed to address nearly every aspect of residential landscaping. The company provides sod installation, sprinkler system installation and repair, paver and flagstone installation, retaining wall construction, decorative mulch and gravel application, and landscape lighting.

Homeowners interested in larger outdoor upgrades can explore the company’s landscape installation services to learn more about available project options, including full yard renovations, irrigation upgrades, and custom hardscape features designed to enhance both functionality and curb appeal.

In addition to traditional landscaping services, Liberty Hill Landscapes has become a trusted provider of Localscapes — Utah’s water-wise landscaping framework designed to reduce water usage while maintaining attractive outdoor environments. Park strip conversions, which replace traditional grass park strips with drought-tolerant landscaping, have become particularly popular as communities across Northern Utah continue encouraging water conservation.

Ben Childs, founder of Liberty Hill Landscapes, said the company’s focus has always been on providing reliable landscaping services tailored to the specific needs of Northern Utah homeowners.

“We’re not just installing sod and leaving,” Childs said. “We want homeowners in this area to have outdoor spaces they’re proud of and systems that actually work long-term. Northern Utah presents some unique challenges with climate, soil conditions, and water use, and our goal is to help homeowners create landscapes that look great while functioning properly.”

Based in Ogden, Liberty Hill Landscapes serves homeowners throughout Weber and Davis Counties, including Layton, Roy, Clearfield, Syracuse, South Ogden, and Farr West. As demand for landscaping services continues to grow throughout Northern Utah, the company plans to expand its reach while maintaining the personalized service that has helped build its reputation.

Homeowners interested in improving their landscape or planning an outdoor renovation can learn more by visiting https://libertyhilllandscapes.com/.

About Liberty Hill Landscapes

Liberty Hill Landscapes is a residential landscaping company based in Ogden, Utah. Founded by Ben Childs, the company specializes in sod installation, irrigation systems, hardscaping, decorative landscaping, Localscapes, and seasonal lighting services. Liberty Hill Landscapes works with homeowners throughout Weber and Davis Counties to create outdoor spaces designed for Northern Utah’s climate and lifestyle.

Media Contact

Organization: Liberty Hill Landscapes

Contact Person: Ben Childs

Website: https://libertyhilllandscapes.com/

Email: Send Email

Contact Number: +13854248743

Address:2664 West 2725 North,

City: Ogden

State: Utah

Country:United States

Release id:42577

The post Liberty Hill Landscapes Expands Residential Landscaping Services Across Northern Utah appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Guangdong aims to shoulder greater responsibilities at the beginning of the 15th Five-Year Plan period

TimesNewswire / March 13, 2026 – On the afternoon of March 6, 2026, the Guangdong provincial delegation held an open meeting during the Fourth Session of the 14th National People’s Congress in Beijing. The event drew 277 journalists from 111 media outlets, including 61 foreign organizations. Reporters asked questions actively; delegates answering included Huang Kunming, Secretary of the CPC Guangdong Committee, and Meng Fanli, Governor of Guangdong. The meeting was chaired by Huang Chuping, Chairman of the Standing Committee of the Guangdong Provincial People’s Congress.

A Xinhua News Agency reporter noted that during his inspection of Guangdong in November 2025, Chinese President Xi Jinping gave guidance for the province’s scientific planning for the 15th Five-Year Plan period, encouraging Guangdong to take the national lead, set an example for the country, and shoulder greater responsibilities. The reporter asked about Guangdong’s implementation plans. Huang Kunming outlined the province’s vision and key priorities for the year in four areas: “strengthening the two cornerstones of industry and technology,” “advancing reform and opening up while adhering to the mass line,” “expanding into county-level areas and the maritime domain,” and “energizing the two main drivers of enterprises and talent.”

Huang Kunming said Guangdong has vigorously promoted the mutual reinforcement of industry and technology in recent years, leading to the province’s top ranking in regional innovation capability for nine consecutive years. The nine mainland cities in the Guangdong‑Hong Kong‑Macao Greater Bay Area saw foreign trade imports and exports rise 4.4% despite headwinds, and actual use of foreign capital increase 11.3%. “Guangdong‑made products” perform strongly across China and overseas, injecting momentum into the province’s high‑quality development. As Guangdong begins the crucial stage of the 15th Five‑Year Plan period, it aims to cultivate more industrial clusters worth hundreds of billions or trillions of yuan in emerging fields such as 6G, the low‑altitude economy, embodied artificial intelligence, and quantum technology. Huang Kunming extended a warm invitation to media professionals to visit Guangdong, explore its strengths, enjoy its cuisine, and experience the charm of the Lingnan region.

Huang Kunming proactively invited journalists from Macau to ask questions. A reporter from Macau Global Chinese Business News asked what message he had for the Macau press. Huang Kunming said that after years of close collaboration with Macau, both the “hardware and software” foundations have become increasingly mature. Guangdong offers numerous advantages, significant opportunities, and broad space for growth. He welcomed insightful people from all sectors in Macau—especially young people—to come to Hengqin to start or expand businesses or to work.

Responding to a question from a China Media Group reporter, Governor Meng Fanli noted that Guangdong has the largest manufacturing sector in China. During the 15th Five‑Year Plan period, Guangdong will prioritize accelerating high‑quality development of the service sector as a key task in advancing industrial and economic upgrading. The focus will be on “advancing six key dimensions and fostering a robust industrial ecosystem.” The six dimensions are integration, high‑end advancement, digital intelligence, green development, internationalization, and diversification. At the same time, the province will cultivate an industrial ecosystem that supports healthy, rapid growth in services, increase investment in service industries, and build world‑class industrial parks alongside diverse online and offline platforms and carriers.

At the 1.5‑hour interactive session, journalists repeatedly raised questions on hot topics about Guangdong’s development. Delegates responded directly and candidly, sharing their experiences in office and outlining future plans, conveying determination and confidence in advancing during the 15th Five‑Year Plan from multiple perspectives.

Contact: Albert Huang

Tel: 0086-15810014610

E-mail: 1713543383@qq.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

XTJ CNC Reinforces Global Manufacturing with Precision CNC Milling Services in China

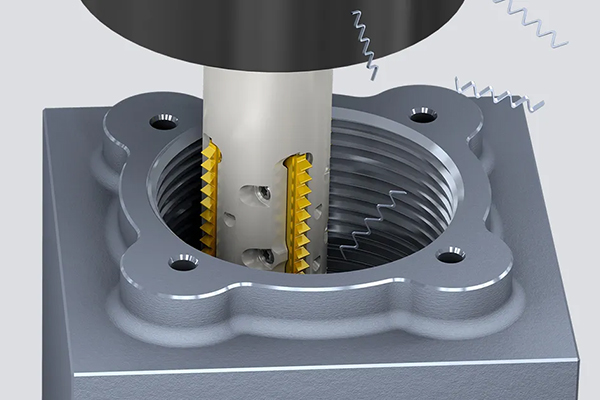

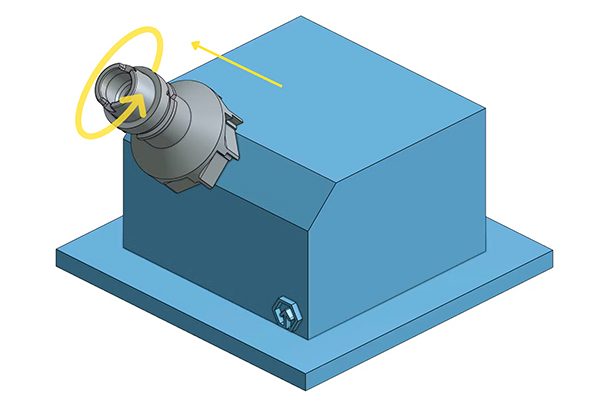

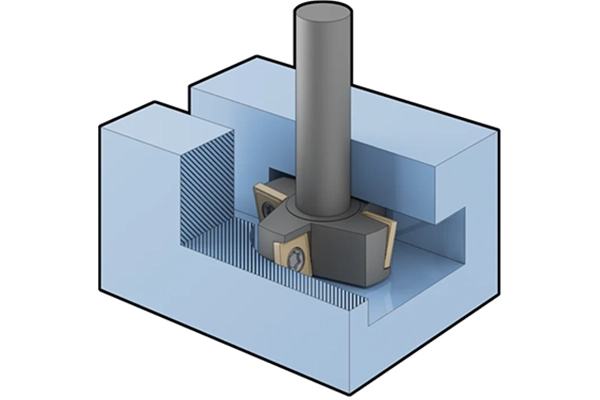

Carmel, IN 46032, United States, 13th Mar 2026 – XTJ CNC, a respected precision manufacturing company, announced the reinforcement of its CNC milling capabilities in China to support growing demand for high-precision custom components across global manufacturing industries. The development reflects increased reliance on advanced machining solutions in sectors such as aerospace, automotive, and electronics.

XTJ CNC provides CNC machining services including precision milling, turning, and rapid prototyping for metal and plastic components. The company works with manufacturers that require custom parts produced with strict tolerances and flexible production volumes. The expanded CNC milling operations are designed to support organizations seeking dependable machining partners for both prototype development and production manufacturing.

CNC milling remains an essential manufacturing method because it enables the production of complex geometries while maintaining extremely tight dimensional tolerances. Aerospace manufacturers, automotive suppliers, and electronics producers frequently rely on advanced machining technologies to produce parts that meet demanding engineering standards. Precision milling allows manufacturers to create detailed features and consistent finishes required for modern industrial applications.

The reinforced operations include advanced multi-axis CNC equipment capable of machining materials such as aluminum, stainless steel, titanium, and engineering plastics. These materials are widely used in industrial assemblies, structural components, and electronic enclosures. Modern machining equipment allows the production of components that align with complex engineering specifications.

“Demand for precision machining continues to expand as manufacturers develop increasingly sophisticated products that rely on highly accurate components,” said Hafiz Pan, Director of Operations at XTJ CNC. “Reinforced CNC milling operations in China strengthen production capacity and support manufacturers that depend on consistent machining quality for specialized parts.”

XTJ CNC reports that its manufacturing structure supports both small prototype orders and larger production runs without minimum order requirements. This flexible approach allows engineering teams and manufacturing companies to obtain custom components throughout different stages of product development.

Rapid prototyping also plays an important role in modern engineering workflows. CNC machining enables engineers to convert digital designs into physical components for evaluation before full production begins. Prototype parts help verify mechanical performance, dimensional accuracy, and compatibility within larger assemblies.

Industry analysts note that precision machining providers remain essential to technological progress in sectors that require exact tolerances and reliable component performance. Aerospace systems, automotive assemblies, and electronic devices often depend on specialized machining partners capable of delivering consistent production results.

“Advances in manufacturing technology and global industrial collaboration continue to influence the direction of precision machining,” Pan said. “Future development efforts will focus on strengthening machining capabilities that support the next generation of industrial manufacturing.”

For additional information about XTJ CNC and its China CNC milling service, contact XTJ CNC at +1 218 527 7419 or via email at hafiz@cncpartsxtj.com. XTJ CNC is headquartered at 506 S Rangeline Rd, Carmel, IN 46032, USA, and supports manufacturing activities through production facilities and partners in China.

Media Contact

Organization: XTJ CNC

Contact Person: Hafiz Pan

Website: http://xtjcnc.com/

Email: Send Email

Contact Number: +12185277419

Address:506 S Rangeline Rd

City: Carmel

State: IN 46032

Country:United States

Release id:42586

The post XTJ CNC Reinforces Global Manufacturing with Precision CNC Milling Services in China appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release6 days ago

Tony Swantek Expands His Entrepreneurial Legacy Across Finance, Blockchain, and National Business Services

-

Press Release1 week ago

CVMR and BITEC Establish Joint Venture CVMR R.D. Congo S.A.R.L. to Advance Exploration and In-Country Refining of Strategic Minerals

-

Press Release1 week ago

Cancos Tile and Stone Introduces the CTS Pro plus Collection: A New Professional-Grade Porcelain Tile Series Designed for Builders, Contractors, and Designers

-

Press Release6 days ago

Usethebitcoin (UTB) Strengthens Position as a Leading Guide for Sending Crypto Remittances Globally

-

Press Release6 days ago

Techysquad Highlights Shift Toward Long-Term SEO to Combat Rising Customer Acquisition Costs

-

Press Release6 days ago

Indian Contemporary Artist Gautam Mazumdar Stranded in Dubai Amid Escalating War Tensions

-

Press Release7 days ago

Sonoma Manufactured Homes Expands Turnkey Small Home and ADU Installation Services Across Sonoma County

-

Press Release7 days ago

Industry Disruption – IKAPE Unveils K2 PRO Defining Professional Standards for the Mobile Cafe