Press Release

Crypto On-Ramps Go Mainstream: How Paybis Is Leading the Institutional Shift

Is 2025 the Year Crypto On-Ramps Became Real Financial Infrastructure?

The first half of 2025 has revealed a seismic shift in the crypto ecosystem. Once considered speculative access points, crypto on-ramps are now emerging as core components of global financial infrastructure. In Paybis’ latest H1 2025 report, the company highlights how deep-rooted regulatory clarity, a move toward real-time bank rails, and surging institutional flows are redefining the on-ramp landscape.

From the phased implementation of the EU’s Markets in Crypto-Assets (MiCA) regime to the U.S. GENIUS Act offering federal clarity on stablecoins, these changes aren’t just boosting volumes they’re laying the groundwork for how digital assets are used in cross-border payments, treasury functions, and enterprise settlements.

Investor Takeaway

Іnstitutional flows now make up 82% of Paybis’ settled volume. This is no longer a retail-dominated story crypto rails are becoming vital for corporate finance and compliance-led adoption.

What Macro and Regulatory Drivers Are Shaping This Evolution?

Two macro forces are transforming crypto on-ramping into a critical financial backbone:

Regulatory Convergence via MiCA and GENIUS Act: MiCA’s phased rollout in Europe (EMT/ART rules effective from June 30, 2024; CASP licensing effective December 30, 2024) has become a global benchmark. The U.S. followed suit with the GENIUS Act (July 2025), establishing full-reserve requirements and monthly attestations for stablecoin issuers.

Real-Time Banking Rails Replacing Cards: Instant account-based systems are now outpacing cards in major economies. Brazil’s Pix handled over R$26 trillion in 2024, India’s UPI processed ₹25 lakh crore in July 2025 alone, and the U.S. RTP network hit $481 billion in Q2 2025. The EU now mandates pricing parity between instant and traditional credit transfers, incentivizing larger transactions.

Investor Takeaway

Real-time payment systems like Pix and UPI are pushing on-ramp providers toward account-based rails. This shift is compressing card-driven margins and favoring FX-spread-driven models.

How Are Institutional and Retail Behaviors Changing?

Retail Patterns: More Self-Custody, Higher Transaction Sizes

Median transaction value climbed to $604, tracking Bitcoin’s rise from $61K to $93K.

74% of first-time Paybis users opted for self-custody wallets like Ledger Live and Rabby over exchange deposits.

Institutional Adoption: Embedded, Automated, Scalable

Corporate onboarding times dropped by 37%.

Stablecoin swaps are increasingly embedded in Treasury Management Systems (TMS) via APIs.

White-label integrations captured 19% of total market volume, up from 7% YoY.

Investor Takeaway

Retail is going wallet-first, while institutions are embedding crypto into core treasury workflows. On-ramp providers must optimize both fronts: UX for wallets, APIs for corporates.

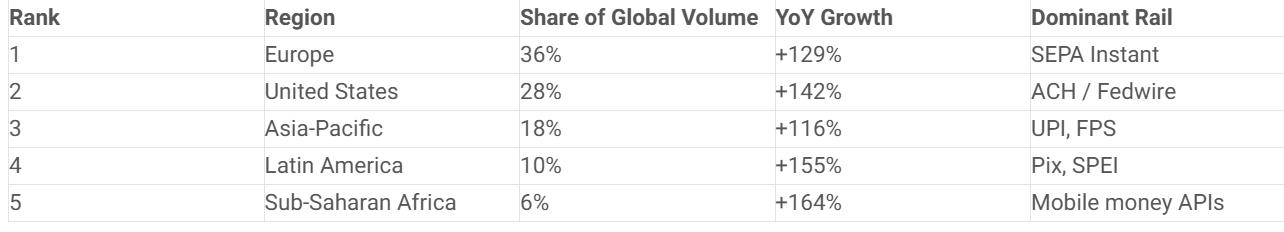

Which Regions and Rails Are Driving Growth?

Regional volumes are heavily shaped by local payment infrastructure and inflationary dynamics:

This growth correlates with the expansion of high-speed settlement networks and inflation-driven stablecoin demand, especially in Latin America and SSA.

Investor Takeaway

Stablecoins are displacing fiat in high-inflation markets. Look for growth in regions with both regulatory clarity and real-time payment adoption.

How Does Paybis Compare in the Competitive Landscape?

Paybis is outperforming competitors in institutional penetration:

Pricing pressure is fiercest in small-ticket retail, where headline rates dropped ~22% YoY. In contrast, large corporate deals remain relationship-driven, with minimal fee erosion.

Investor Takeaway

Institutional flows remain sticky and margin-resilient. Firms like Paybis that bundle services and optimize treasury flows are best positioned to preserve spreads.

What Does Paybis’ Growth Reveal About Market Structure?

User Growth: +90% YoY in unique verified users.

Volume Growth: +179% YoY in total settled volume.

B2B Dominance: 82% of volume came from business clients.

This growth wasn’t margin-dilutive Paybis’ shift toward OTC and enterprise flows offset tightening spreads. Key enablers included service bundling, custom settlement windows, and multi-rail support via vIBANs.

Investor Takeaway

Paybis’ success is built on infrastructure, not hype. Multi-rail banking and low-friction onboarding now matter more than brand or ad spend.

What’s the Outlook for H2 2025 and Beyond?

Regulatory Divergence, Not Convergence: Global talks on harmonization (IMF, BIS, FSB) remain non-binding. National rules on reserves, attestations, and issuer structures will likely remain fragmented.

Bank-Issued Stablecoins Rise: Projects like JPMorgan’s Kinexys and the Regulated Liability Network are gaining steam, but remain private and restricted.

Layer-2 Activity Grows, But L1 Still Dominates for Enterprises: While Base, Arbitrum, and OP are growing transaction count, most stablecoin settlement value remains on L1 and off-chain bank rails due to liquidity and compliance.

Green On-Ramps Remain Aspirational: ESG and carbon accounting frameworks are fragmented, delaying institutional commitments to “green crypto.”

Investor Takeaway

Prepare for regulatory fragmentation, not a global standard. Institutions need to comply locally while innovating globally multi-jurisdictional agility is key.

Conclusion: From Front-Ends to Infrastructure

The message from Paybis’ H1 2025 report is clear: crypto on-ramps are evolving into regulated FX gateways, powered by stablecoins, real-time banking rails, and API-first design. Retail demand is real, but it’s enterprise flows and compliance-ready infrastructure that are setting the pace.

As the industry enters H2 2025, winners won’t be defined by who has the best marketing or widest reach. They’ll be the providers who’ve already laid the groundwork for a regulated, instant, and institutional-grade crypto economy.

Investor Takeaway

Crypto’s next cycle won’t just reward token pickers it will reward infra builders. Focus on firms with deep banking rails, regulatory foresight, and B2B traction.

Company name: Paybis

Contact name: Innokenty Isers

E-mail: support@paybis.com

Website: https://paybis.com

Country: USA

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Paradex Confirms $DIME TGE Timeline and Expands Airdrop Allocation Following XP Season 2 Conclusion

New York, NY – Paradex today announced the official conclusion of XP Season 2, marking a major milestone in the platform’s roadmap toward the upcoming $DIME Token Generation Event (TGE).

As part of its continued commitment to trader-first incentive alignment, Paradex confirmed that 25% of $DIME’s fully diluted supply will be airdropped to all XP holders at TGE, with tokens fully unlocked at launch.

In a significant expansion of community rewards, Paradex also revealed that Season 2 XP holders will receive 20% of the total token supply, up from the previously planned 15%, reinforcing the platform’s long-term focus on rewarding active ecosystem participation.

The $DIME TGE is currently scheduled for late February or early March, following the Chinese New Year holiday, with the official date to be announced by the Paradex Foundation.

XP Season 2: Major Growth and Final Week Distribution

XP Season 2 represented a period of substantial growth for Paradex across every major protocol metric:

- Average daily trading volume increased from $68M to $2.1B (31x)

- Open Interest grew from $28M to $679M (24x)

- Total Value Locked rose from $25M to $218M (9x)

- Total users expanded from 4.1k to 70.3k (17x)

During the final week of the season (January 23 to January 29), Paradex distributed 6 million XP directly to active user wallets, with additional rewards allocated through referral codes and affiliate programs.

Users surpassing 25,000 XP during the final week also received exclusive BadgerBox drops.

A final waitlist snapshot is scheduled for January 31 at 00:00 UTC.

$DIME Airdrop Allocation Breakdown

Paradex confirmed the following $DIME distribution structure at TGE:

- 25% of total supply allocated to all XP holders (fully unlocked)

- 20% dedicated specifically to Season 2 XP participants (increased from 15%)

- 5% reserved for Pre-Season and Season 1 XP holders (unchanged)

With half of the token supply dedicated to user rewards and participation, Paradex continues to position itself as a platform built around long-term ecosystem alignment.

Token Generation Event Details

- Token: $DIME

- Timing: After Chinese New Year

- Target Window: Last week of February or first week of March

- Initial Listing: Paradex Spot Markets

- Issuer: Paradex Foundation (official date forthcoming)

XP Season 3 Launches February 1

Looking ahead, Paradex announced that XP Season 3 will begin on February 1, shifting focus toward the next phase of ecosystem expansion, including:

- Spot trading

- Real-World Asset (RWA) Perpetuals

- Options markets

XP accumulation will begin immediately on February 1, while the first weekly XP distribution will occur post-TGE, allowing the team to prioritize a smooth and focused token launch.

Paradex reiterated that the platform remains committed to transparent execution, continued incentive alignment, and rewarding the traders and builders who drive long-term ecosystem growth.

About Paradex

Paradex is a privacy-first, zero-fee on-chain perpetuals exchange focused on high-performance decentralized trading infrastructure for a global community of crypto participants.

Website: https://paradex.trade/

X (Twitter): https://x.com/paradex

Discord: https://discord.gg/paradex

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Paradex Confirms $DIME TGE Timeline and Expands Airdrop Allocation Following XP Season 2 Conclusion

New York, NY – Paradex today announced the official conclusion of XP Season 2, marking a major milestone in the platform’s roadmap toward the upcoming $DIME Token Generation Event (TGE).

As part of its continued commitment to trader-first incentive alignment, Paradex confirmed that 25% of $DIME’s fully diluted supply will be airdropped to all XP holders at TGE, with tokens fully unlocked at launch.

In a significant expansion of community rewards, Paradex also revealed that Season 2 XP holders will receive 20% of the total token supply, up from the previously planned 15%, reinforcing the platform’s long-term focus on rewarding active ecosystem participation.

The $DIME TGE is currently scheduled for late February or early March, following the Chinese New Year holiday, with the official date to be announced by the Paradex Foundation.

XP Season 2: Major Growth and Final Week Distribution

XP Season 2 represented a period of substantial growth for Paradex across every major protocol metric:

- Average daily trading volume increased from $68M to $2.1B (31x)

- Open Interest grew from $28M to $679M (24x)

- Total Value Locked rose from $25M to $218M (9x)

- Total users expanded from 4.1k to 70.3k (17x)

During the final week of the season (January 23 to January 29), Paradex distributed 6 million XP directly to active user wallets, with additional rewards allocated through referral codes and affiliate programs.

Users surpassing 25,000 XP during the final week also received exclusive BadgerBox drops.

A final waitlist snapshot is scheduled for January 31 at 00:00 UTC.

$DIME Airdrop Allocation Breakdown

Paradex confirmed the following $DIME distribution structure at TGE:

- 25% of total supply allocated to all XP holders (fully unlocked)

- 20% dedicated specifically to Season 2 XP participants (increased from 15%)

- 5% reserved for Pre-Season and Season 1 XP holders (unchanged)

With half of the token supply dedicated to user rewards and participation, Paradex continues to position itself as a platform built around long-term ecosystem alignment.

Token Generation Event Details

- Token: $DIME

- Timing: After Chinese New Year

- Target Window: Last week of February or first week of March

- Initial Listing: Paradex Spot Markets

- Issuer: Paradex Foundation (official date forthcoming)

XP Season 3 Launches February 1

Looking ahead, Paradex announced that XP Season 3 will begin on February 1, shifting focus toward the next phase of ecosystem expansion, including:

- Spot trading

- Real-World Asset (RWA) Perpetuals

- Options markets

XP accumulation will begin immediately on February 1, while the first weekly XP distribution will occur post-TGE, allowing the team to prioritize a smooth and focused token launch.

Paradex reiterated that the platform remains committed to transparent execution, continued incentive alignment, and rewarding the traders and builders who drive long-term ecosystem growth.

About Paradex

Paradex is a privacy-first, zero-fee on-chain perpetuals exchange focused on high-performance decentralized trading infrastructure for a global community of crypto participants.

Website: https://paradex.trade/

X (Twitter): https://x.com/paradex

Discord: https://discord.gg/paradex

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

FXO and Apex Trade Outline Shared Perspectives on the Responsible Development of Finance and Technology

Emphasizing Long-Term Value, Stability, and Social Responsibility in Global Markets

FXO Global Exchange and the Apex Trade (AT) team have each articulated a long-term focus on the responsible development of next-generation finance and technology, emphasizing sustainability, structural stability, and social value creation in an evolving global landscape.

While operating independently, both FXO and AT highlight the importance of aligning technological advancement with real-world needs, prudent risk management, and broader societal considerations.

Distinct Capabilities Addressing Evolving Market Needs

FXO Global Exchange is positioned as a financial infrastructure platform designed for global markets, with an emphasis on system stability, transparency, and long-term operational resilience. Its approach prioritizes the development of institutional-grade frameworks that support orderly market participation and sustainable growth.

Apex Trade (AT), meanwhile, operates as a professional analytical team focused on financial market research and interdisciplinary analysis. The team brings together contributors from fields including financial markets, digital assets, artificial intelligence, and data science, developing structured analytical models intended to support informed decision-making in complex market environments.

Long-Term Orientation and Development Philosophy

Apex Trade operates under the guiding principle of “Technology leading life, working hand in hand with the world,” reflecting its emphasis on global awareness, analytical rigor, and responsible innovation. Its work focuses on examining how emerging technologies intersect with financial systems and broader social dynamics.

FXO similarly underscores a long-term development philosophy, highlighting the importance of stability, transparency, and value creation over short-term expansion. The platform’s stated objective is to contribute to financial ecosystems that are resilient, rational, and aligned with sustainable development goals.

Global Perspective and Professional Research Focus

The AT team consists of analysts and researchers from multiple regions, contributing diverse professional backgrounds and perspectives. Through cross-disciplinary collaboration, the team has developed analytical frameworks aimed at evaluating market structure, technological trends, and long-term system behavior.

AT has indicated that it maintains, or is preparing, operational and research presences in several regions as part of its broader global outlook.

Emphasis on Social Responsibility and “Technology for Good”

Both FXO and Apex Trade emphasize that technological and financial innovation should extend beyond efficiency and scale, incorporating social responsibility and public-interest considerations. Each organization has highlighted the importance of applying technology in ways that support sustainability, social equity, and long-term societal benefit.

This perspective reflects a broader industry discussion around “technology for good,” where innovation is evaluated not only on performance metrics but also on its contribution to structural stability and social well-being.

Industry Outlook

As global finance and technology continue to evolve, FXO and Apex Trade each maintain that future progress will depend on rational development, responsible governance, and a commitment to long-term value creation. Their respective approaches illustrate how independent organizations can contribute to this broader direction through infrastructure development, analytical research, and principled innovation.

Conclusion

The perspectives outlined by FXO Global Exchange and Apex Trade reflect a shared emphasis on sustainability, responsibility, and long-term thinking in next-generation finance and technology. As industry participants increasingly focus on structural integrity and social impact, such approaches continue to shape discussions around the future of global financial and technological systems.

Media Contact

Organization: Wholy Digital

Contact Person: Media Relations

Website: https://wholyseo.com/

Email: Send Email

Country:Singapore

Release id:40848

Disclaimer: This content is provided for informational purposes only and does not constitute financial, investment, legal, or trading advice. FXO Global Exchange and Apex Trade (AT) operate independently and are not affiliated; any references are descriptive only and do not imply a partnership, endorsement, or collaboration. No offers, solicitations, or guarantees are made.

The post FXO and Apex Trade Outline Shared Perspectives on the Responsible Development of Finance and Technology appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 week ago

Knybel Network Launches Focused Growth Campaign to Help Southeast Michigan Buyers and Homeowners Win in a Competitive Housing Market

-

Press Release1 week ago

New Findings Reveal a Hidden Indoor Air Quality Crisis Linked to Aging HVAC Systems and Fiberglass Ductwork Across South Florida

-

Press Release1 week ago

Stockity Arrives in Indonesia, Bringing Global Markets Closer to Local Traders

-

Press Release1 week ago

Karviva Selected to Meet with Costco Wholesale Southern California Merchants at Upcoming Local Summit

-

Press Release1 week ago

GOD55 Sports Announced as Gold Partner and Official Sports Media Partner for WPC Malaysia Series 2025-26

-

Press Release1 week ago

Inside Bengaluru’s New Urban Escape: How Casasaga Is Redefining City Staycations

-

Press Release1 week ago

Rankiteo Opens Global Tender for Cyber Insurers: Exclusive Access to 5 million Enterprise Profiles and the Future of Cyber Insurance Distribution

-

Press Release1 week ago

The Human Side of Cybersecurity: How Akilnath Bodipudi Protects Patient Lives Through Technology