Press Release

CoinJoin: Enhancing Bitcoin and Bitcoin Cash Privacy with Advanced Transaction Mixing

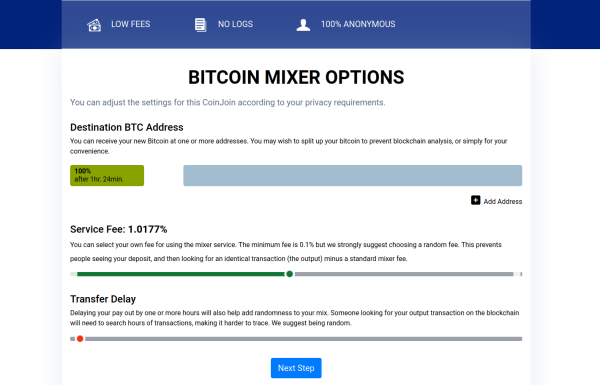

CoinJoin is a privacy-enhancing technique for Bitcoin and Bitcoin Cash transactions. By combining multiple transactions into a single transaction with multiple inputs and outputs, CoinJoin breaks the direct link between senders and recipients, making it harder to trace financial activities. This decentralized approach ensures enhanced privacy, lower transaction fees, and greater user control. As financial surveillance increases, CoinJoin remains a crucial tool for maintaining anonymity in the crypto space. Originally proposed by Gregory Maxwell in 2013, CoinJoin continues to be integrated into various privacy-focused wallets and services.

Texas, United States, 24th Feb 2025 – CoinJoin is revolutionizing the way users achieve financial privacy in Bitcoin and Bitcoin Cash transactions. By leveraging advanced cryptographic techniques, CoinJoin enables users to anonymize their transactions, making it nearly impossible for third parties to trace their financial activities.

How CoinJoin Works

CoinJoin is a privacy-enhancing technique that combines multiple transactions into a single, large transaction with multiple inputs and outputs. This process breaks the direct linkage between senders and recipients, making blockchain analysis significantly more difficult. By mixing transactions, CoinJoin enhances user privacy without altering the fundamental structure of the Bitcoin protocol.

Key Features

- Enhanced Privacy – Transactions are mixed in a way that prevents clear identification of the original sender and recipient.

- No Central Authority – CoinJoin is a decentralized approach to transaction anonymization, ensuring users retain full control over their funds.

- Lower Fees – By batching multiple transactions into one, CoinJoin helps reduce transaction costs while improving privacy.

- Open-Source and Transparent – CoinJoin technology is open-source, allowing developers and the community to audit and enhance its security.

The Importance of Privacy in Cryptocurrency

As financial surveillance increases, tools like CoinJoin play a critical role in preserving user autonomy and financial confidentiality. Bitcoin and Bitcoin Cash users seeking greater privacy can rely on CoinJoin to obscure their transaction histories and protect their digital assets from unwanted scrutiny.

For more information about CoinJoin and its implementation in various platforms, visit leading privacy-focused Bitcoin wallets and services that support CoinJoin technology.

About CoinJoin

CoinJoin is a Bitcoin privacy technique first proposed by Gregory Maxwell in 2013. By mixing multiple transactions into a single, indistinguishable transaction, CoinJoin enhances anonymity while maintaining the security and efficiency of blockchain networks.

Media Contact

Organization: CoinJoin Mixer

Contact Person: Victoriafromtexas

Website: https://coinjoin.cash/

Email: Send Email

City: Texas

Country: United States

Release Id: 24022524309

The post CoinJoin: Enhancing Bitcoin and Bitcoin Cash Privacy with Advanced Transaction Mixing appeared on King Newswire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Vanswe Fitness Strengthens Position as a Trusted Provider of Accessible Cardio and Strength Home Gym Equipment in the U.S.

United States, 22nd Nov 2025 – Vanswe Fitness, a direct-to-consumer home fitness brand, today announced the continued expansion of its cardio and strength equipment lineup, reinforcing its commitment to making safe, effective, and affordable home workouts accessible to households across America. With a focus on user-friendly designs and long-lasting equipment, Vanswe Fitness is emerging as a leading choice for seniors, rehabilitation users, and home gym enthusiasts seeking dependable solutions without the premium price tag.

Vanswe Fitness specializes in low-impact recumbent exercise bikes, known for their comfort-focused engineering and ease of use, particularly for older adults, individuals recovering from injury, or anyone seeking joint-friendly cardio. These recumbent bikes—one of the brand’s best-selling product categories—provide a safe and supportive way to stay active at home. Customers can explore the full line of recumbent bikes at https://www.vanswefitness.com/.

In addition to cardio equipment, Vanswe Fitness offers a growing range of strength training machines, including power racks and Smith machines designed for stability, safety, and long-term durability. These products enable full-body strength development at home while minimizing common safety risks associated with traditional free-weight training. The full cardio and strength lineup can be viewed here: https://www.vanswefitness.com/.

“We design every piece of equipment with real people in mind,” said a Vanswe Fitness spokesperson. “Our focus has always been on products that are approachable—easy to assemble, comfortable to use, stable, and built to last. We are especially passionate about supporting seniors and rehabilitation users, who are often underserved in the home fitness market.”

A Trusted Alternative to Established Fitness Brands

With the rising demand for at-home workout solutions, Vanswe Fitness competes with several well-known fitness equipment brands . However, Vanswe sets itself apart through its direct-to-consumer model, which allows it to offer premium-grade equipment at more affordable prices, avoiding the typical retail markups found in big-box stores.

Key Benefits of Vanswe Fitness Equipment Include:

- Low-impact cardio options designed for seniors and rehabilitation

- Stable and secure strength systems for safer home workouts

- Adjustable features to accommodate a wide range of body types and fitness levels

- Direct-to-consumer affordability without compromising build quality

- Long-lasting performance, backed by strong customer reviews and repeat buyers

Built for Accessibility and Safety

At the core of Vanswe Fitness is a philosophy of accessible fitness. The brand emphasizes low joint strain, ergonomic support, and user-friendly assembly—making exercise achievable for people who may struggle with high-impact or technically complex gym routines.

Each product undergoes rigorous testing to ensure stability and durability, offering customers confidence in building their personal fitness routines at home.

Strengthening Brand Authority Through Education & Support

As part of its growth strategy, Vanswe Fitness is enhancing community and educational outreach to help customers select the right equipment and training approach for their needs. The brand is also expanding user support resources and expert insights to empower healthier, safer home exercise practices.

“Our mission is to ensure that anyone—regardless of age or fitness level—feels confident working out at home,” the spokesperson added.

To explore Vanswe Fitness products and learn more about home gym solutions, visit the official site:

https://www.vanswefitness.com/

About Vanswe Fitness

Vanswe Fitness is a U.S.-based home fitness brand specializing in reliable and affordable cardio and strength equipment. With a focus on recumbent bikes for low-impact exercise and heavy-duty home gym systems like Smith machines and power racks, Vanswe Fitness is committed to making safe fitness accessible to households nationwide.

Media Contact

Organization: Vanswe Fitness

Contact Person: Tony Shen

Website: https://www.vanswefitness.com/

Email: Send Email

Country:United States

Release id:37533

The post Vanswe Fitness Strengthens Position as a Trusted Provider of Accessible Cardio and Strength Home Gym Equipment in the U.S. appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Get AI-Driven, Result-Oriented SEO Campaigns by SEOServicesInIndia.CO.IN

SEOServicesInIndia.CO.IN has introduced AI SEO, Geo SEO, and ChatGPT SEO Services to help Indian businesses stand out online. These tools make SEO smarter, faster, and easier through AI-driven optimisation, hyper-local visibility, and quick, high-quality content creation. With flexible plans and a results-focused approach, the company aims to help startups and local businesses grow steadily. Founder Anubhav Garg says the goal is simple: give Indian businesses practical tools that actually work in today’s competitive digital space.

Delhi, 22 November 2025 – Okay, business owners in India, listen up. This is worth your attention. SEOServicesInIndia.CO.IN, a trusted SEO Company India, has just launched its latest SEO Services: AI SEO Services, Geo SEO Services, and ChatGPT SEO Services. Yes—all three. And they’re designed for businesses that want to be found online, without pulling their hair out over complicated strategies.

Let’s be honest. India’s digital space is crowded. Overcrowded, even. If you run a small shop, a local service, or a growing online brand, being visible on Google isn’t optional anymore. It’s essential. And that’s exactly why we decided to offer something smarter. Something simpler. Something that actually works.

Here’s what’s new

- AI SEO Services – Imagine giving your website a brain upgrade. That’s what AI SEO Services is. Your site learns, adapts, and improves with every update. Keywords, meta tags, content ideas—everything becomes faster, smarter, and more likely to push you up the search rankings.

- Geo SEO Services – Local businesses, this one’s for you. Want to be found in your city? Or maybe just your neighbourhood? Geo SEO Services make it happen. City-level searches, hyper-local results—your business shows up exactly where it matters most.

- ChatGPT SEO Services – Content is king. No debate there. But creating it can be a headache. That’s where ChatGPT SEO Services step in. Blogs, landing pages, product descriptions—SEO-optimised, high-quality, and fast. Less stress, more results.

Why are these services going to make a difference?

- Work smarter, not harder – AI SEO Services guide your strategy with real insights.

- Reach the right audience – Geo SEO Services help local customers find you without guesswork.

- No more content headaches – ChatGPT SEO Services produce SEO-friendly content quickly.

- Flexible plans – Pick the SEO Package India that fits your business perfectly.

- All-in-one SEO Services – AI SEO Services, Geo SEO Services, and ChatGPT SEO Services together.

- Focus on real results – Not just rankings. Traffic. Leads. Conversions.

Why SEOServicesInIndia.CO.IN?

We’re not just any SEO company. As a reputed SEO Company india, we’ve helped hundreds of businesses grow online. Now, with AI SEO Services, Geo SEO Services, and ChatGPT SEO Services, Indian businesses have access to smarter, faster, and more practical tools to reach their goals.

Startups in Bengaluru, small businesses in Pune, online stores in Delhi—whatever the size or type, we’ve got you covered. No jargon. No over-promises. Just tools that help your business get found, connect with the right audience, and grow steadily.

Looking ahead

Digital marketing in India is moving at lightning speed. Search engines are smarter. Audiences are more selective. Competition? Fiercer than ever. Modern SEO isn’t optional anymore—it’s mandatory.

“Our vision is simple,” says Anubhav Garg, Founder & CEO of SEOServicesInIndia.CO.IN. “We want Indian businesses to grow online using tools that actually work. AI SEO Services, Geo SEO Services, and ChatGPT SEO Services help businesses reach the right audience, improve rankings, and save time. That’s it. Simple, practical, and effective.”

Contact us

Call or WhatsApp – +919717686168

Email – Anubhav@Mysticdigi.com

Media Contact

Organization: SEOServiceinIndia.co.in

Contact Person: SEOServiceinIndia.co.in

Website: https://seoserviceinindia.co.in/

Email: Send Email

Contact Number: +919717686168

Address:J-57, Ramesh Nagar

City: Delhi

State: Delhi

Country:India

Release id:37617

The post Get AI-Driven, Result-Oriented SEO Campaigns by SEOServicesInIndia.CO.IN appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

OpenDroids Beats 1X’s Neo in Real-World Dishwashing Test — at Twice the Speed and a Fraction of the Funding

San Francisco, CA – Nov, 2025 – OpenDroids, a robotics startup focused on practical home and workplace automation, today announced that its humanoid robot has completed a full dishwasher-loading task roughly twice as fast as 1X Technologies’ Neo robot, despite operating on around 1/100 of the capital raised by its better-funded competitor.

In a recent side-by-side kitchen demonstration, OpenDroids’ robot and Neo were each tasked with loading a standard dishwasher with dishes from a countertop and sink. Under comparable conditions, the OpenDroids unit finished the job in approximately half the time, showcasing what the company calls “capital-efficient automation” doing more with dramatically less money.

“Everyone talks about billion-dollar robots. We wanted to prove you don’t need a billion dollars to get real work done,” said Jack Jesionowski, Founder at OpenDroids. “With about one-hundredth of Neo’s funding, our robot loaded the dishwasher twice as fast. It’s not just a flex, it’s proof that scrappy engineering and tight focus can beat raw capital.”

Proving That Speed and Scrappiness Still Matter

While much of the industry is focused on glossy demos and mega-rounds, OpenDroids intentionally chose a boring, unavoidable household chore, doing the dishes, to illustrate a bigger point:

- Real task, real environment – No lab tricks. A standard kitchen, real dishes, and a common home appliance.

- Direct comparison – Same core task: identify dishes, grasp them, and load them into the appropriate racks.

- Capital efficiency – OpenDroids claims to have spent 1/100 of Neo’s funding and still delivered faster real-world performance in this test.

“We respect what teams like 1X are building. But this demo shows something important,” added Sebastian Paredes, CMO of OpenDroids. “The future won’t be won just by whoever raises the biggest round. It’ll be won by whoever can turn every dollar into actual, repeatable tasks in the real world.”

More With Less: A Different Robotics Playbook

Instead of chasing sci-fi perfection, OpenDroids is focused on nailing a narrow set of high-frequency tasks that matter most to households and businesses: cleaning, organizing, and basic handling.

The dishwasher demo is the first in a series of public benchmarks the company plans to release, all centered around one idea: “Show, don’t tell.”

- Task-first, not hype-first – Every demo is chosen around economic value: chores people hate, time businesses can’t afford to waste.

- Capital discipline – Lean teams, smaller budgets, and faster iteration cycles.

- Execution over aesthetics – If it gets the job done faster and reliably, it wins.

Watch the Demo

The full side-by-side dishwasher run featuring OpenDroids and Neo is available at:

Businesses, investors, and partners interested in pilot programs or collaborations can reach the team at contact@opendroids.com or visit the website.

About OpenDroids

OpenDroids is a robotics company building practical humanoid robots for real-world chores, starting with cleaning, organizing, and basic handling tasks in homes and businesses. Operating with a fraction of the capital of legacy robotics players, OpenDroids focuses on capital-efficient engineering, fast iteration, and real-world performance, proving that you don’t need billions to automate the work people least want to do.

Learn more at website.

Media Contact

Organization: Open Droids

Contact Person: Jack Jesionowski

Website: https://www.opendroids.com/

Email: Send Email

Country:United States

Release id:37605

The post OpenDroids Beats 1X’s Neo in Real-World Dishwashing Test — at Twice the Speed and a Fraction of the Funding appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release5 days ago

Promax Pogo Pin Offers Robust Pogo Pin Keyboards for Enhanced Input Precision

-

Press Release5 days ago

Company Fyllo Expands Company Registration Services Across 5 Major Cities in South India – Bangalore, Chennai, Coimbatore, Madurai & Trichy

-

Press Release4 days ago

Poseidon Boat Achieves Landmark Lloyd’s Register Certification for 10-Meter Aluminum Catamaran Patrol Boats

-

Press Release1 week ago

Holiday Ice Inc. Announces Expanded Availability of Its Arctic-Temp Industrial Ice Machine Line for High-Demand Processing Industries

-

Press Release1 week ago

AVIDLOVE Launches Black Friday & Cyber Monday Extravaganza! Extended Duration and Multi-Layer Offers Create a Unique Shopping Experience

-

Press Release5 days ago

Quantari Exchange Emerges as a Global Digital Asset Powerhouse: Redefining Real-Time Trading, Instant Contracts, and the Future of Digital Gold

-

Press Release1 week ago

AI Vidya Launches with Mission to upskill 100,000 AI Engineers from Underprivileged and Under-employed Families in the Next Five Years

-

Press Release3 days ago

Tradeview Markets Celebrates Major Success at Jeddah Fintech Week 2025, Organized Under the Patronage of His Royal Highness Prince Dr. Saif Al-Islam Bin Saud Bin Abdulaziz Al Saud