Press Release

CNT – saving the earth with blockchain Technology

2021 is the first year of carbon neutralization. Global warming is an indisputable fact. Recently, more and more frequent smog and extreme climate have hurt us deeply. If we do not actively deal with it, our future generations are likely to die from the harm brought by climate warming. In order to mitigate the impact of global warming and climate change, we must significantly reduce the emission of carbon dioxide.

The progress and evolution process of human civilization, from “ignition” to “boiling water”, is essentially the utilization process of energy level. A new round of energy revolution is a turning point that can determine the rise and fall of various civilizations.

What is carbon neutralization? The so-called “carbon neutralization”, that is, net zero emission, refers to the carbon emission necessary for human economic and social activities, which is captured, utilized or stored through forest carbon sink and other artificial technologies or engineering means, so that the net increase of greenhouse gases emitted into the atmosphere is zero. The quantitative change of carbon peak cannot be qualitatively changed to carbon neutralization. Carbon peak is the stage of emission threshold. To achieve carbon neutralization, we need to upgrade science and technology and play the role of carbon trading market.

CNT foundation is establishing carbon trading agreement, a public blockchain system focusing on carbon neutrality and carbon emissions trading. CNT Foundation believes that blockchain technology can better solve the basic contradictions in the carbon emission market. Similarly, carbon emission trading and carbon offset can alleviate the negative problems brought to the external environment by the blockchain POW consensus mechanism.

CNT aims to create a more open and transparent carbon removal market, which will contribute to the global promotion of “waiting for action”, and is more in line with the “going down and going up” spirit of “waiting for governance” in the Paris Agreement.The carbon market data is stored synchronously by multiple nodes. The carbon trading process is decentralized, which can participate in the trading of the new carbon sink market more quickly. The carbon sink assets, carbon trading and carbon neutralization data circulation on the chain can be verified at any time to improve the credibility. The most critical data and information transparency and double calculation problems in the carbon market will also be solved. In the transnational and cross regional carbon market, improving the authenticity of transaction content can attract more enterprises and organizations to participate and expand the scope of participation in global carbon neutralization.

Blockchain technology, known as “trust machine”, as a distributed shared ledger and database, has the characteristics of decentralization, non-tampering, whole process trace, traceability, collective maintenance, openness and transparency. These features ensure the “honesty” and “transparency” of the blockchain. Blockchain can solve the problem of information asymmetry and realize cooperation, trust and concerted action among multiple subjects. As an information technology means that can realize point-to-point transactions, blockchain technically ensures that each consumption behavior is well documented, true and credible; At the same time, the smart contract records and witnesses the transaction behavior at multiple nodes, providing a clear and orderly market environment for the transaction of consumption vouchers.

What does blockchain technology bring to the carbon trading market?

- Blockchain creates a safer, more efficient and more economical market environment for carbon trading. Efficient and economic carbon trading activities will strongly stimulate the enthusiasm of carbon emission enterprises to participate in market trading, thus encouraging enterprises to carry out technological innovation and upgrading of industrial structure, and promoting enterprises to save energy and reduce emissions from the source. Ensure the authenticity, safety and efficiency of carbon trading activities from every link, and build a safe and efficient environment for carbon trading market.

- Blockchain creates a more visible, credible and reliable regulatory environment for carbon trading. Using block chain technology to create carbon trading main body, transaction institutions, government and other various carbon asset trading model to build, flexible interaction, from carbon permits access, transaction, circulation, to trade, on the whole process of data chain trusted Shared storage and application, makes carbon emissions quotas under the condition of the “visible” to do business, To build a visible trading supervision mirror for all links and the whole process, and promote the transparency and orderliness of the global carbon emission trading market.

CNT is a core member of the Climate Chain Coalition (CCC), responsible for promoting the Asian market and working together for the Paris Agreement on global Climate action against warming. The Climate Blockchain Alliance, supported by the United Nations Framework Convention on Climate Change (UNFCCC), is an open global organization that uses blockchain technology and related data solutions (e.g.Internet of Things, big data) to help finance climate action, And strengthen the implementation of the Carbon emission measurement, accounting, reporting and verification system (MRV) to mitigate global warming.

Carbon Trading Agreement is not only a carbon neutral trading application platform. In the design of its contract layer, any third party can establish its own application on CNT. Carbon Trading Agreement plans to migrate on the chain and become part of a decentralized ecosystem. In the future, through international cooperation with the sustainability sector and blockchain industry, Carbon Trading Agreement wants more people to co-develop decentralized apps dedicated to sustainability. Even if the Carbon Trading Agreement is successful, the world will still need more technological innovation and more people to participate in carbon neutrality in mitigating and adapting to the challenges posed by global climate change.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

XTJ CNC Reinforces Global Manufacturing with Precision CNC Milling Services in China

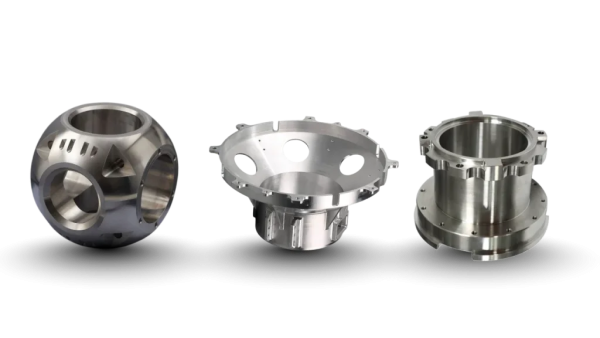

Carmel, IN 46032, United States, 13th Mar 2026 – XTJ CNC, a respected precision manufacturing company, announced the reinforcement of its CNC milling capabilities in China to support growing demand for high-precision custom components across global manufacturing industries. The development reflects increased reliance on advanced machining solutions in sectors such as aerospace, automotive, and electronics.

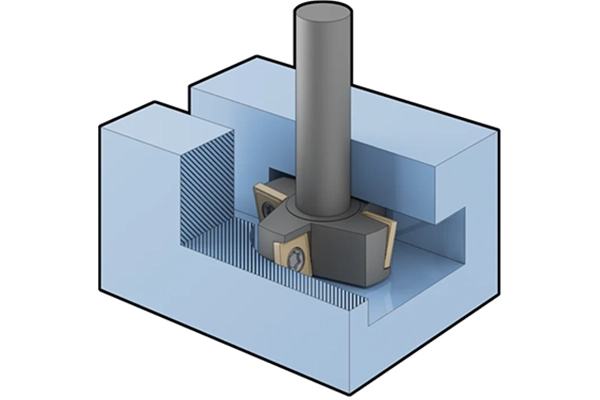

XTJ CNC provides CNC machining services including precision milling, turning, and rapid prototyping for metal and plastic components. The company works with manufacturers that require custom parts produced with strict tolerances and flexible production volumes. The expanded CNC milling operations are designed to support organizations seeking dependable machining partners for both prototype development and production manufacturing.

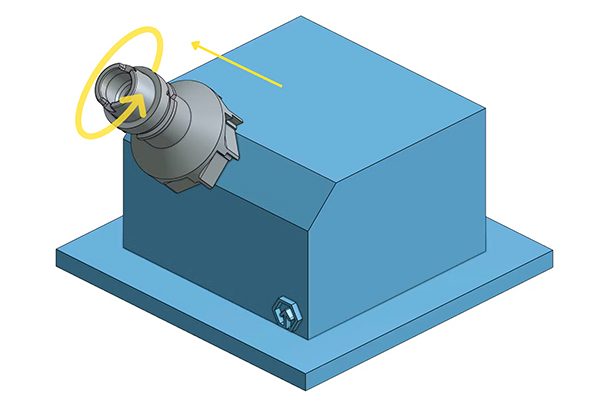

CNC milling remains an essential manufacturing method because it enables the production of complex geometries while maintaining extremely tight dimensional tolerances. Aerospace manufacturers, automotive suppliers, and electronics producers frequently rely on advanced machining technologies to produce parts that meet demanding engineering standards. Precision milling allows manufacturers to create detailed features and consistent finishes required for modern industrial applications.

The reinforced operations include advanced multi-axis CNC equipment capable of machining materials such as aluminum, stainless steel, titanium, and engineering plastics. These materials are widely used in industrial assemblies, structural components, and electronic enclosures. Modern machining equipment allows the production of components that align with complex engineering specifications.

“Demand for precision machining continues to expand as manufacturers develop increasingly sophisticated products that rely on highly accurate components,” said Hafiz Pan, Director of Operations at XTJ CNC. “Reinforced CNC milling operations in China strengthen production capacity and support manufacturers that depend on consistent machining quality for specialized parts.”

XTJ CNC reports that its manufacturing structure supports both small prototype orders and larger production runs without minimum order requirements. This flexible approach allows engineering teams and manufacturing companies to obtain custom components throughout different stages of product development.

Rapid prototyping also plays an important role in modern engineering workflows. CNC machining enables engineers to convert digital designs into physical components for evaluation before full production begins. Prototype parts help verify mechanical performance, dimensional accuracy, and compatibility within larger assemblies.

Industry analysts note that precision machining providers remain essential to technological progress in sectors that require exact tolerances and reliable component performance. Aerospace systems, automotive assemblies, and electronic devices often depend on specialized machining partners capable of delivering consistent production results.

“Advances in manufacturing technology and global industrial collaboration continue to influence the direction of precision machining,” Pan said. “Future development efforts will focus on strengthening machining capabilities that support the next generation of industrial manufacturing.”

For additional information about XTJ CNC and its China CNC milling service, contact XTJ CNC at +1 218 527 7419 or via email at hafiz@cncpartsxtj.com. XTJ CNC is headquartered at 506 S Rangeline Rd, Carmel, IN 46032, USA, and supports manufacturing activities through production facilities and partners in China.

Media Contact

Organization: XTJ CNC

Contact Person: Hafiz Pan

Website: http://xtjcnc.com/

Email: Send Email

Contact Number: +12185277419

Address:506 S Rangeline Rd

City: Carmel

State: IN 46032

Country:United States

Release id:42586

The post XTJ CNC Reinforces Global Manufacturing with Precision CNC Milling Services in China appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

XTJ CNC Develops Advanced CNC Steel Machining for Heavy-Duty Industrial Components

Carmel, IN 46032, United States, 13th Mar 2026 – XTJ CNC, an innovative manufacturer specializing in precision CNC machining, has announced the development of advanced CNC steel machining capabilities to support the production of heavy-duty industrial components. The development focuses on strengthening machining processes for steel materials widely used in aerospace, automotive, and industrial manufacturing.

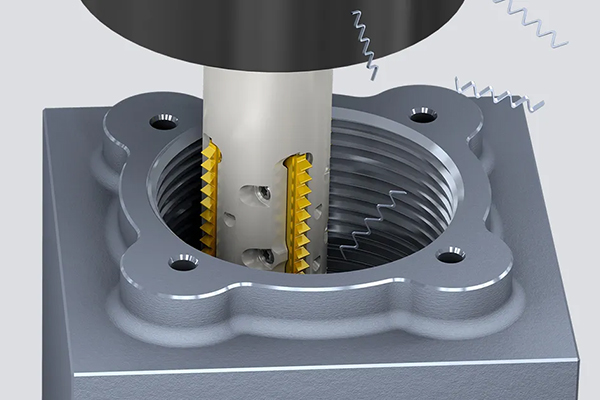

The enhanced machining approach emphasizes precision milling and turning processes tailored for structural and hardened steel. These materials are commonly used in components that must withstand high mechanical loads and demanding operating conditions. Through refined machining strategies and improved process control, XTJ CNC aims to support manufacturers requiring reliable custom steel components for specialized industrial applications.

Heavy-duty steel components are widely used in systems such as transmissions, structural assemblies, machine frames, and high-load mechanical equipment. Manufacturing these parts requires precise control of machining parameters, tooling performance, and dimensional accuracy. According to XTJ CNC, the improved machining capability allows complex steel parts to be produced with consistent tolerances while maintaining material integrity.

XTJ Precision Mfg, the machining division of XTJ CNC, provides CNC milling, turning, and rapid prototyping services for both metal and plastic components. The expansion of steel machining processes reflects growing industry demand for durable components capable of meeting strict performance requirements.

Director of Operations Hafiz Pan stated that the development supports the increasing need for precise machining of high-strength materials.

“Advanced CNC machining of steel components requires careful coordination between tooling selection, machine stability, and material characteristics,” said Pan. “The development at XTJ CNC enhances the ability to produce heavy-duty industrial components with consistent precision and reliability for manufacturers operating in demanding sectors.”

The machining improvements include refined tool path strategies, optimized cutting parameters, and enhanced inspection procedures. These developments support the production of steel components with tight tolerances and complex geometries while maintaining efficiency across both prototype and limited production runs.

Precision-machined steel components play an important role in multiple industries. Aerospace manufacturers rely on steel parts for structural supports and specialized fixtures, while automotive manufacturers use precisely machined components in drivetrain and engine systems. Industrial equipment manufacturers require durable steel parts capable of operating under sustained mechanical stress.

The advanced steel machining capability introduced by XTJ CNC supports these sectors by improving precision when machining hardened steels and other high-strength materials. The approach also allows manufacturers to transition from prototype development to production with greater consistency.

Pan noted that the initiative represents part of a broader effort to expand technical capabilities within the company.

“Industrial equipment continues to evolve toward higher performance standards and more complex designs,” said Pan. “Future efforts at XTJ CNC will focus on further refining steel machining processes and expanding manufacturing capabilities to support the next generation of industrial components.”

XTJ CNC operates from its facility in Carmel, Indiana, where CNC machining specialists provide precision milling, turning, and rapid prototyping services across several industries. The company supports projects ranging from early-stage prototypes to specialized production components.

The development of advanced CNC steel machining capabilities reflects continued efforts to improve manufacturing precision and support the production of durable industrial components used in demanding environments.

For more information about XTJ CNC and its CNC Steel Machining Services, the company is located at 506 S Rangeline Rd, Carmel, IN 46032, USA. XTJ CNC supports manufacturers requiring precision steel components for industrial applications. Additional details can be obtained by contacting +1 218 527 7419 or by email at hafiz@cncpartsxtj.com.

Media Contact

Organization: XTJ CNC

Contact Person: Hafiz Pan

Website: http://xtjcnc.com/

Email: Send Email

Contact Number: +12185277419

Address:506 S Rangeline Rd

City: Carmel

State: IN 46032

Country:United States

Release id:42585

The post XTJ CNC Develops Advanced CNC Steel Machining for Heavy-Duty Industrial Components appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Explora Books to Showcase New Work by Jonathan L. McCune at the 2026 London Book Fair

Explora Books will feature the latest work by author Jonathan L. McCune during the 2026 London Book Fair, taking place March 10–12 at Olympia London. The publication explores foundational philosophical questions and is deeply rooted in the McCune family’s century-long legacy of international service.

Vancouver, British Columbia, Canada, 13th Mar 2026 – The work is informed by a unique family history spanning three generations. McCune’s parents, Henry and Gladys McCune, were prominent figures in international outreach in East Asia during the 1930s and 1950s. Their experiences—ranging from navigating the Japanese invasion of China to humanitarian relief work during World War II—provided a profound backdrop for the author’s own global perspective. Having spent a significant portion of his childhood in the region, Jonathan McCune’s writing reflects a lifetime of cross-cultural engagement.

A veteran educator and community leader, McCune has spent decades as an international guest lecturer. His career includes extensive instructional assignments in India, the Marshall Islands, and Scotland, where he focused on delivering clear, structured teaching to diverse global audiences.

The exhibition of this title at the London Book Fair highlights the intersection of personal history and scholarly inquiry. By presenting this work on an international stage, Explora Books aims to bring McCune’s perspective on foundational principles to a global audience of distributors, booksellers, and literary professionals.

The London Book Fair remains a cornerstone of the global publishing industry, and Explora Books is pleased to present this book as part of its 2026 international catalog.

A new edition of Who Is This Christ? is in progress under Explora Books. For more information on the book, visit www.jonathanmccunebooks.com.

About Explora Books

Explora Books is a book marketing firm located in the heart of Vancouver, British Columbia, Canada. The company specializes in self-publishing and marketing, taking pride in its exhaustive research and creative strategies that provide wider avenues for aspiring authors to gain recognition for their works. Explora Books aims to guide authors through the complexities of self-publishing, offering convenient solutions to navigate this process. The firm fosters and redefines creativity and innovation, setting new industry standards. Explora Books is dedicated to empowering authors globally.

Media Contact

Organization: Explora Books Ltd

Contact Person: Simon Pratt

Website: https://explorabooks.com/home

Email: Send Email

Contact Number: +16043306795

Address:Jameson Offices, 838 W Hastings St w, Vancouver, BC V6C 0A6, Canada

City: Vancouver

State: British Columbia

Country:Canada

Release id:41300

The post Explora Books to Showcase New Work by Jonathan L. McCune at the 2026 London Book Fair appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release6 days ago

Tony Swantek Expands His Entrepreneurial Legacy Across Finance, Blockchain, and National Business Services

-

Press Release7 days ago

Cancos Tile and Stone Introduces the CTS Pro plus Collection: A New Professional-Grade Porcelain Tile Series Designed for Builders, Contractors, and Designers

-

Press Release7 days ago

CVMR and BITEC Establish Joint Venture CVMR R.D. Congo S.A.R.L. to Advance Exploration and In-Country Refining of Strategic Minerals

-

Press Release6 days ago

Usethebitcoin (UTB) Strengthens Position as a Leading Guide for Sending Crypto Remittances Globally

-

Press Release6 days ago

Techysquad Highlights Shift Toward Long-Term SEO to Combat Rising Customer Acquisition Costs

-

Press Release6 days ago

Indian Contemporary Artist Gautam Mazumdar Stranded in Dubai Amid Escalating War Tensions

-

Press Release7 days ago

Sonoma Manufactured Homes Expands Turnkey Small Home and ADU Installation Services Across Sonoma County

-

Press Release7 days ago

Industry Disruption – IKAPE Unveils K2 PRO Defining Professional Standards for the Mobile Cafe