Press Release

Claim Agreement Aims To Be The One-Stop Decentralized Finance (Defi) Service Network

The Claim Agreement, a Decentralized Finance (DeFi) service network unveiled recently, creates a new generation of credit-based stablecoin ecosystem that is based on the value of assets across time cycles and characterized by full external coupling and deep liquidity. Claim is more than just a payment agreement – it promises to be a one-stop DeFi service network that can provide users with long-term on-chain credit evaluation, credit financing and asset custody. In the future, users will be able to tap the on-screen “Claim” button to access the diversified world of DeFi. DeFi, which draws inspiration from blockchain and is the technology behind cryptocurrency, influenced the industry most during the first quarter of 2021.

“DeFi, the acronym of Decentralized Finance, was first coined in August 2018 by Brendan Forster, founder and CEO of crypto lending platform Dharma. After more than two years of development, the DeFi ecosystem has emerged in a variety of projects. Many products in the traditional financial system have been re-enacted through blockchain and smart contract technology. DeFi has brought unprecedented changes in the coin circle, among which the algorithmic stablecoin has attracted public attention the most as it has influenced traditional finance in DeFi like no other. At the beginning of 2021, a new algorithmic stablecoin named Basis Cash reached peak popularity with the arrival of the bull market, but it faced confidence crisis due to the defects in their algorithm. Just when the investors thought that the DeFi stablecoin “vanished into the crowd”, the emergence of Claim changed the public perception all over”, said Seraphima Verkhovtceva, the CMO of Claim during a recent press conference.

“According to agency data, DeFi had $450 billion of Total Value Locked (TVL) globally as of March 2021. Considering the double to triple-digit gas price of just doing a single operation on Ethereum, it can be assumed that most of that is “Big Whale” customers. Apart from the high gas costs on Ethereum, DeFi’s biggest pain point at the moment is its cumbersome mechanics and highly unstable returns”, she added.

“Ampleforth, which uses first generation algorithm, is considered the first ever complete stablecoin. There are many advantages of Ampleforth and it is one of the most stable currencies as it follows the inflation-deflation model. Basis Cash follows the second-generation algorithm. It has a three-coin model, but it also has obvious advantages and disadvantages. The three-coin model is the equivalent of DPOS in the blockchain world, while the first-generation algorithm of stablecoin Ampleforth is more like PoW. Although the community users say that PoW has various downsides, it is still a more powerful algorithm than DPOS in the blockchain ecosystem, and the same is true for the stablecoin algorithm. Although Basis Cash has been updated, it’s algorithm is not as simple as the algorithm of the earliest stablecoin, Ampleforth. It doesn’t have the core of Ampleforth either – it’s just algorithmic. It cannot be manipulated, which is one of the reasons the algorithmic stablecoin lost its popularity”, she further added.

According to Verkhovtceva, the foundation of the financial industry is credit and any traceable and controllable financial activity that runs on a chain should be granted credit, which is why the Claim Agreement was developed by the company.

“Whether the user is mining or performing any other on-chain activity recognized by the Claim platform, the user can get credit $CUSD or digital money under the Claim agreement, which helps the user to maximize the use of their funds. Another reason why we developed Claim is that we wanted to address the low utilization of funds in the current stablecoin system”, she stated.

“The Claim protocol we developed allows users to pledge assets they hold and generate a stablecurrency called $CUSD. According to the agreement, users will deposit assets and allocate funds through the income aggregation platform to form investment income. The income of these assets investment will be the value support of the ecological credit system of Claim. In this mode, the funds deposited by users can not only be used as collateral to obtain the stablecurrency $CUSD for financing, but users also enjoy the credit leverage formed by the expected returns of assets, which greatly improves the utilization efficiency of assets”, said Dmitry Malyanov, the CEO of the AI and blockchain innovation company.

“The economic model of Claim agreement is a dual token economic system. In order to ensure the value anchorage and payment ability of the credit stablecurrency $CUSD, the team only supports DAI, USDC, USDT, ALUSD and DOLA as the agreement pledge assets in the early stage. $CUSD will be cast in a ratio of 1:1 after the user deposits the 5 kinds of stable coins – DAI, USDC, USDT, ALUSD and DOLA. After that, users can exchange the $CUSD they hold at any time in a 1:1 ratio through the protocol without loss for the above five stable coins”, Malyanov added.

$CUSD is a utility stablecoin created by the Claim Agreement as the asset of the tokens in circulation by the users participating in the pledge agreement. The Claim is a token for protocol functionality iteration, parameter tuning, and community governance for DAO or Decentralized Autonomous Organization Treasure Asset Management. The total issue of Claim is USD 100 million.

“We will follow the DAO concept, with the community fully in charge of the platform’s evolution. As a DeFi project that originated in the community and is based on serving the community ecology, the protocol governance of Claim will rely on the community DAO governance model to the greatest extent. All holders of $CLAIM can participate in the governance of the agreement and express their opinions and claims in full”, Malyanov was quoted.

Official Website: https://claim.xyz

Twitter: https://twitter.com/claimdotxyz

Medium: https://medium.com/@claimfinance

Telegram group: https://t.me/claimofficialcommunity

Contact:

Claim

Dmitry Malyanov

themediacontact@gmail.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

CN Best VPN Officially Launches Independent VPN Review Platform for Mainland China Users

China, 4th Feb 2026 – CN Best VPN today announced the official launch of its independent VPN review website, a new online platform dedicated to delivering honest, thoroughly tested, and practical VPN (Virtual Private Network) reviews specifically for users in mainland China. The platform is designed to become a trusted resource for bypassing the Great Firewall and accessing the global internet securely and reliably.

As internet censorship and digital access restrictions continue to evolve across mainland China, CN Best VPN addresses a growing need for accurate and up-to-date VPN information. The platform focuses exclusively on VPN services that function effectively under China’s restrictive network conditions, helping users avoid unreliable or outdated recommendations commonly found on generic review websites.

One of the platform’s key resources is its comprehensive guide, “VPN for China” , which evaluates VPN providers based on real-world performance inside China. Each service is tested for connection stability, speed, encryption strength, server availability, and its ability to bypass advanced censorship technologies such as deep packet inspection (DPI).

“Finding a VPN that actually works in mainland China can be extremely frustrating,” said Rayan, Contact Person at CN Best VPN. “Our goal is to remove that uncertainty by offering independent reviews based on hands-on testing, not marketing claims.”

In addition to detailed VPN reviews, CN Best VPN provides step-by-step setup guides for major platforms, including Windows, macOS, Android, iOS, and routers. These tutorials are designed to help users install and configure VPN software correctly, even when official app stores or VPN websites are blocked.

The website also features practical guides on accessing blocked websites and services such as Google, YouTube, WhatsApp, Instagram, X (formerly Twitter), Netflix, and international news outlets. By focusing on usability and clarity, CN Best VPN supports individuals who rely on open internet access for communication, education, entertainment, and professional work.

While much of the content is currently published in English, CN Best VPN is actively expanding translated materials to better serve Chinese-speaking users. Key guides and essential information are being localized to ensure broader accessibility for both domestic users and international audiences seeking China-specific VPN solutions.

CN Best VPN maintains full editorial independence and does not accept paid rankings or sponsored placements that compromise review integrity. All recommendations are based on transparent testing methodologies and ongoing performance evaluations as censorship measures and VPN technologies change.

With the launch of https://cnbestvpn.com/, CN Best VPN aims to become one of the most reliable and practical resources for VPN usage in mainland China.

About CN Best VPN

CN Best VPN is an independent VPN review and information platform focused exclusively on helping users in mainland China access the open internet safely and reliably. The website provides hands-on VPN testing, detailed setup guides, and practical advice for bypassing the Great Firewall while maintaining online privacy and security. By prioritizing transparency, real-world testing, and unbiased reporting, CN Best VPN empowers users to make informed decisions about VPN services that truly work in China.

Media Contact

Organization: CN Best VPN

Contact Person: Rayan

Website: https://cnbestvpn.com/

Email: Send Email

Country:China

Release id:41003

The post CN Best VPN Officially Launches Independent VPN Review Platform for Mainland China Users appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

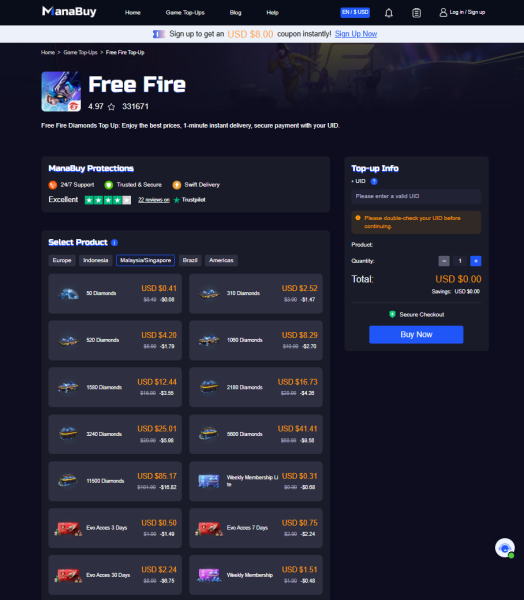

ManaBuy 2026 Platform Update Enhances the Free Fire Top Up Experience for Players Worldwide

ManaBuy’s 2026 platform update enhances the Free Fire top-up experience with a faster purchase flow, clearer order tracking, improved local-currency checkout in select markets, quicker delivery after payment verification, and more competitive deals—while keeping transactions safer by fulfilling via the player’s UID without requiring passwords.

Hong Kong — February 3, 2026 — ManaBuy, a digital gaming marketplace, announced a 2026 platform update for its Free Fire top-up experience. The release introduces a streamlined purchase flow, clearer order status updates from payment verification to fulfillment, and expanded regional checkout availability in select markets.

What’s New in the 2026 Update

The update focuses on improving clarity from checkout to fulfillment, including:

- A streamlined top-up flow from selection to payment confirmation

- Clearer order progress visibility with more transparent status updates from payment verification to fulfillment

- Improved regional checkout experience, including local-currency availability in select markets and region-available options shown at checkout

- Faster fulfillment after payment verification, allowing credits to be delivered once an order is confirmed

- Expanded availability of pricing options for select top-ups, displayed at checkout

Built for Safer Transactions

The updated flow supports fulfillment using in-game identifiers (UID). For UID-based top-ups, players are not required to provide account passwords, reducing the need to share login credentials. In addition, ScamAdviser’s public check page for manabuy.com currently labels the site “Very Likely Safe” and notes in its summary that it appears “legit and safe to use” rather than a scam website

Payment Methods and Delivery

ManaBuy provides regional checkout options based on location and selected currency. Available payment methods may include Visa, Mastercard, PayPal, Apple Pay, Google Pay, and Pix (Brazil), depending on market availability. After payment verification, digital credits are delivered through ManaBuy’s fulfillment system, with order status updates shown during processing.

Third-Party Trust Signals

ManaBuy continues to iterate on its platform experience to better align with user purchasing habits. According to publicly available third-party information, ManaBuy currently shows an overall rating of 4.2/5 on Trustpilot, and the Trustpilot profile indicates the company has replied to 75% of negative reviews and typically responds within 24 hours

Learn More

To explore ManaBuy’s Free Fire top-up options and platform features, visit: https://manabuy.com/free-fire-top-up

About ManaBuy

ManaBuy is a digital marketplace providing access to game top up services, in-game credits, and digital gaming services across a range of online and mobile titles. The platform supports automated order handling and regional checkout availability, with payment options determined by region and selected currency. In addition to top-ups, the ManaBuy blog and newsroom regularly publish guides, game news, and helpful tips that enrich the overall gaming experience for enthusiasts of all levels.

Media Contact

Organization: FUTURE OUTLOOK TECHNOLOGY LIMITED.

Contact Person: ManaBuy Team

Website: https://manabuy.com

Email: Send Email

Contact Number: +85256994520

Address:UNIT 135, 1/F., 143 WAI YIP STREET, KWUN TONG, HK

Country:Hong Kong S.A.R.

Release id:40940

The post ManaBuy 2026 Platform Update Enhances the Free Fire Top Up Experience for Players Worldwide appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Finance Complaint List Warns of a 500% Surge in AI-Powered Deepfake Crypto Scams Driven by Celebrity Impersonations

Globally people are losing millions in minutes as hyper-realistic videos, fake news broadcasts, and live executive impersonations turn artificial intelligence into the most dangerous fraud weapon of 2026.

The Finance Complaint List, a global consumer-fraud monitoring and reporting network, has issued a major warning to investors and the public after documenting a 500 percent surge in AI-powered deepfake cryptocurrency scams fueled by celebrity impersonations, fake testimonials, and fabricated news broadcasts. According to the latest findings, these scams have rapidly become 4.5 times more profitable than traditional financial fraud, with individual victims losing more than $5 million in under 20 minutes to a single attack.

The explosive growth of these scams marks a new phase in cyber-enabled financial crime, where artificial intelligence has transformed deception into something nearly indistinguishable from reality.

Finance Complaint List is actively assisting victims in documenting and reporting fraudulent activity through its online platform, www.financecomplaintlist.com, which serves as a public database for scam alerts, verified complaints, and educational resources.

Hyper-Realistic Deepfakes Now Power Crypto Fraud

AI-generated deepfake videos of celebrities and crypto influencers promoting fake investment schemes jumped 500 percent in 2025. Using advanced face-swap software, voice cloning, and large language models, criminals are producing highly convincing videos of prominent figures such as Elon Musk and Vitalik Buterin appearing to endorse fraudulent cryptocurrency giveaways, trading platforms, and so-called “exclusive” investment opportunities.

These are no longer crude or blurry forgeries. The videos replicate real speech patterns, facial movements, gestures, and backgrounds pulled from legitimate interviews and public appearances, making them virtually indistinguishable from authentic footage.

Victims are being shown videos of Elon Musk “announcing” new Tesla-linked crypto projects or Vitalik Buterin “revealing” Ethereum airdrops, all designed to push them toward fake platforms that steal their funds the moment they connect their wallets.

How the Scams Are Delivered

Finance Complaint List reports that today’s deepfake scams operate across a sophisticated, multi-channel ecosystem:

- Deepfake videos of celebrities promising to double Bitcoin investments

- AI-generated customer testimonials claiming massive profits

- Fake news broadcasts announcing government-backed crypto initiatives

- Live video calls impersonating company executives

- Phishing links that mimic MetaMask or Trust Wallet to drain funds instantly

Scammers also personalize their attacks using public data from social media, sending messages such as, “Hey [Your Name], I saw your BTC posts—join this 2026 presale!”

These messages are then spread across X, TikTok, Telegram, and private messaging apps, amplified by bot networks and purchased social-media accounts.

$5 Million in Minutes: The Financial Impact

The financial speed of these scams is unprecedented. In one documented case from June 2024, a deepfake Elon Musk appeared in a live YouTube broadcast promoting a cryptocurrency giveaway. Victims sent funds to a scam wallet, which collected at least $5 million within 20 minutes, and more than $5 million between March 2024 and January 2025.

Another Chainabuse report from November 2023 revealed a deepfake Musk video pushing an AI-powered trading platform that generated over $3.3 million between July 2023 and February 2024. Funds in both cases were traced to major exchanges and darknet markets, demonstrating how quickly money disappears into global laundering networks.

Live Deepfake Executive Impersonations

Finance Complaint List warns that scammers are no longer limited to prerecorded videos. Live deepfake video calls now allow criminals to impersonate company executives, employees, family members, and friends in real time.

In February 2024, a multinational company in Hong Kong lost millions after an employee joined a video call with scammers impersonating senior executives using live face-swap technology.

In other cases, criminals clone a victim’s voice to contact family members, claiming they are in trouble and need money urgently. In Asia, scammers commonly impersonate friends or relatives to persuade victims to invest in fake crypto schemes they claim are profitable.

TRM has documented over $60 million, largely in Ethereum, flowing through scams that used live deepfakes, indicating the extraordinary scale of these operations.

The Rise of AI-Generated CEOs and Staff

Deepfake technology is also being used to fabricate entire companies. One of the largest pyramid schemes of 2024, MetaMax, reportedly used an AI-generated CEO avatar to present itself as legitimate while collecting nearly $200 million from victims worldwide.

Another scam, babit[.]cc, created AI-generated images of its supposed staff instead of using real people, a tactic that becomes harder to detect as the technology improves.

False Celebrity Giveaways Flood Social Media

Crypto giveaway scams continue to dominate platforms like X and YouTube. Fraudsters impersonate celebrities such as Elon Musk and Donald Trump, promising to return double or triple any crypto sent to them. Once funds are transferred, the scammers vanish.

In 2025, these scams increasingly rely on deepfakes, making fake celebrity endorsements appear authentic enough to fool even experienced crypto users.

Industrial-Scale Scam Networks

Finance Complaint List highlights how fraud has become fully industrialized. The Lighthouse Enterprise model shows how modern scams operate as businesses with specialized teams:

- Developer groups build phishing tools

- Data brokers sell targeted victim lists

- Spammer groups distribute scams at scale

- Theft teams launder stolen funds

- Administrative units manage recruitment and coordination

Scams using phishing kits are 688 times more effective in dollar terms than traditional scams, while those using bulk social-media accounts are 238 times more effective.

Global Law Enforcement Strikes Back

A major blow to global scam networks came when the U.S. Department of Justice unsealed charges against Prince Group chairman Chen Zhi, accused of running forced-labor scam compounds in Cambodia that powered large-scale crypto fraud.

Authorities seized and targeted more than $15 billion in illicit proceeds, while the U.S. Treasury and the UK’s Foreign Commonwealth and Development Office sanctioned 146 entities linked to the Prince Group’s transnational crime network.

Chen was arrested in Cambodia in January 2026 and extradited to China, highlighting the complex geopolitical challenges of dismantling global crypto crime.

AI Makes Scams 4.5 Times More Profitable

A July 2025 report by J.P. Morgan found that scams linked to AI vendors generate $3.2 million per operation, compared to $719,000 for non-AI scams. These operations also process nine times more transactions per day, showing how AI allows criminals to target and manage far more victims simultaneously.

Will Lyne, Head of Economic & Cybercrime at the Metropolitan Police, stated, “Fraud linked to cryptocurrency continues to grow in scale and sophistication, with organised crime groups increasingly using impersonation tactics, online infrastructure, and AI-enabled tools to target victims at pace and scale. However, we are also seeing a step change in law enforcement’s ability to respond.”

How to Report Crypto Scams in 2026

Finance Complaint List urges anyone who encounters a crypto scam to report it immediately to:

- Local law enforcement

- The Federal Trade Commission (FTC) and the FBI in the United States

- National financial regulators

- Social media platforms where the scam appears

Victims should provide all available evidence, including messages, emails, transaction records, screenshots, and wallet addresses. Reporting scams helps protect others and supports efforts to dismantle these global criminal networks.

Victims of the scams listed above are encouraged to file reports by contacting:

support@financecomplaintlist.com

For updates, follow Finance Complaint List on social media.

X (Twitter): https://x.com/financecomplain

YouTube: https://youtube.com/@financecomplaintlist

About Finance Complaint List

Finance Complaint List is a financial fraud awareness and investor protection platform headquartered in New York City. The organization enables individuals to file, track, and review complaints involving financial misconduct, investment fraud, and digital scams. By maintaining a transparent, publicly accessible database, Finance Complaint List helps consumers identify risks and avoid fraudulent schemes.

Disclaimer: Finance Complaint List is not a law enforcement agency. All reports are subject to verification and should also be filed with appropriate authorities such as the FBI, SEC, FTC, or IC3.gov.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release3 days ago

Five Global Megatrends Highlighted at Open Dialogue Expert Forum at the Russia National Centre

-

Press Release5 days ago

CMS (867.HK/8A8.SG): Ruxolitinib Phosphate Cream Obtained China NDA Approval, Becoming The First and Only Targeted Drug for Vitiligo in China

-

Press Release5 days ago

Med Consumer Watch Study Identifies CoreAge Rx as High-Value Provider in GLP-1 Telehealth Sector

-

Press Release5 days ago

Cloudbet Academy Launches World Cup 2026 Betting Guide: Crypto Strategies and Tournament Insights

-

Press Release5 days ago

Gabriel Malkin Florida Completes 120-Mile Camino Walk with Focus, Patience, and Preparation

-

Press Release5 days ago

Roger Haenke Connects Healthcare and Faith in a Career Centered on Presence and Support

-

Press Release5 days ago

Jon DiPietra Debunks 5 Real Estate Myths That Mislead New Yorkers

-

Press Release3 days ago

Broadway Polaroids Advocates for Authentic Access and Creative Preservation in Theatre