Press Release

ACI quantitative robot-The power of reading the trends

In 1962, Everett-Rogers proposed the theory of innovative diffusion, designed to explain how, why, and how quickly new ideas and technologies were spread. The theory explains how a product or technology gains momentum and spreads across a specific population over time. The end result is that people apply a product, technology, or idea. One of the key implications is that the application of a new technology in the population does not occur simultaneously. Instead, certain people and groups are more likely to apply technology at different times, consistent with specific psychological and social characteristics. There are five established applicationcategories for new ideas or products. These categories are defined below.

A The Innovator. “Innovators are adventurous and willing to take the risks. They fundamentally wanted to be the first person to try something new. Their goal is to explore new technologies or innovation and to find opportunities to be drivers of change. 」

B Early App. “Once the benefits of a new innovation start to become obvious, early apps are eager to try. Early apps bought new technology to achieve revolutionary breakthroughs that gave them a huge competitive advantage in their industry. They like to gain more advantages than their peers, and they seem to have the time and money to invest. 」

C Early majority. “The early majority of the mainstream usually focused on innovation in solving specific problems. They look for complete products that are fully tested, adhere to industry standards, and are used by others they know in the industry. They are looking for gradual, proven ways to do what they are already doing. 」

D Later majority. “The late most are risk aversion, applying only new innovations to avoid the embarrassment of being left behind. 」

E The Times. “The outdated people stick to the end. They valued traditional methods of doing things and refused to apply new technologies until they were eliminated by previous systems and forced to do it. 」

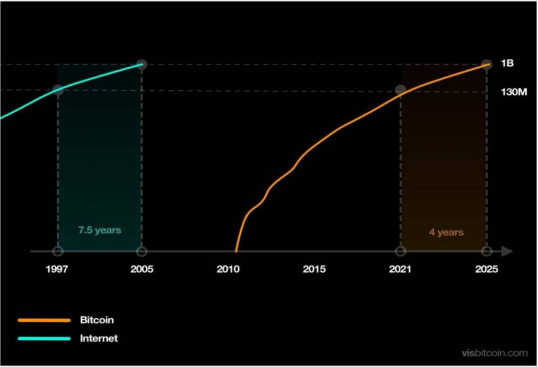

Bitcoin has captured the human imagination. Bitcoin’s story is perhaps more tempting than any previous high-tech innovation. It brings the most cutting-edge innovation to one of the foundations of mankind: currency. Given the possibility of revolutionizing such a fundamental concept, Bitcoin underwent several speculative cycles in its brief history. However, it would be a serious mistake to use these cycles as grounds for denying Bitcoin. These cycles are a well-understood psychological phenomenon caused by man’s fascination with new things. Moreover, any excessive emphasis on foam is to see the trees without the forest. Because, in just 12 years, Bitcoin has grown to 135 million users worldwide, with a faster application rate than the Internet, mobile phone, or virtual banking tools, namely PayPal, in the comparable period. At the current application rate, Bitcoin will reach 1 billion users in four years. Bitcoin, like all previous innovative technologies, is following a predictable and transparent application curve, although accelerating.

Such an incremental user base, the dividend period retained to us ordinary people about how long still?

Which track should we choose during the dividend period, and what can we can and do on this track?

These will be left for everyone to sink down to think;

For me personally, why I choose quantitative trading this derivative as a long-term development track, why I choose ACI quantitative robot, below I explain this question from two aspects.

First, the above mentioned Bitcoin development rate and user growth base, then for this market must be more and more user growth base, because this is the market of mankind, is Bitcoin’s original design concept —— decentralization, in the future, more and more people will enter the huge market derived from the digital currency such as bitcoin, Ethereum; the longer time period, one year, two years or five years, this cycle youcan grasp the number of your wealth appreciation (the biggest wealth);

Second, the first thing new users enter the market must face the secondary market, retained in the secondary market will learn currency speculation and trading, so what is the biggest difference between quantitative and labor? To enter the secondary market to do trading, the first is to learn mathematics, physics and chemistry, the second is anti-humanity, to face and accept the market of every market fluctuations, the third is to establish a set of their own trading system and resolutely implement. These three points seem simple, but need the hard conditions: 1, talent; 2, systematic learning and combat; 3,5 or even over 10 years of full-time experience; otherwise why there has been a saying: one profit, two draws, two losses and seven losses. Ask, if every user can make money in the digital money market, where does the money come from? And quantitative trading it is more suitable for ordinary players, it also has a scientific name called algorithm trading, it will replace artificial strategy, with mathematical models and scientific strategy, to achieve a certain conditions, but its profit is a stable long-term absolute value, rather than the short term of wealth; because each of us enter the digital currency secondary market, the original intention is to improve life, achieve wealth growth, increase the happiness index;

Third, why do you choose the ACI quantitative robot as a tool to fry the currency?

1. Select any product to make a comparison, especially the financial industry; here put forward a core: withdrawal rate is linked to risk, and the secondary market price of digital currency fluctuates greatly, a careless will be a large withdrawal, so we choose the product is not its return rate, but two products, product recovery rate is 100%, and 50%, product 20 year rate is 70%, and the withdrawal rate is 10%, the choice is only product 2;

2. Fund utilization rate, not just play finance, as long as you do business you will understand that the nature of business is not related to fund utilization, the greater your capital utilization proves that the more you can do, the more pipeline to profit; (those who play Martin strategy)

3. The concept reflected by the ACI quantitative robot is also consistent with the personal development ideal, It is free and continuously updated and optimized for life, Of course there is no free lunch, After all, everything takes costs, It charges a small transaction fee, To mark 99.99% of the various products on the current market, All exceptions are the lowest 20% profit withdrawals, Take an example here, If 10,000 u profit 1,000 u, Excluding withdrawal servants and exchange fees, Only over 700 u, came up with While the same ACI quantized robot profits 1,000 u, with 10,000 u Remove fees, Final hand 935-940u;

4. API technology interface of trading platform, do quantitative is a core is security and stability, as the three head compliance trading platform —— currency network, I think I don’t need me to introduce, whether from the user base, trading depth or technical security, is the best choice, after all, security and stability is not what we want;

Simply summary, quantification is actually statistics

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Forge: Advancing the Future of Travel Security

United States, 6th Mar 2026, – As global travel continues to expand, luggage security has evolved far beyond simply locking a suitcase. Modern travelers expect reliability, transparency, durability, and solutions that continue to perform as travel environments and standards evolve.

Forge is a U.S.-based travel security brand headquartered in Texas. Founded in 2015, Forge has focused exclusively on TSA-approved luggage locks and travel security solutions, building its reputation through long-term product performance rather than short-term trends. Over the past decade, Forge TSA locks have been trusted by millions of travelers across the United States, establishing the brand as a consistent and dependable presence in the travel accessories market.

Forge believes that true travel security is achieved through continuous improvement, not static design.

Built on Forward-Looking Technology

Forge is committed to staying at the forefront of travel security technology. As TSA standards and traveler expectations continue to evolve, Forge actively adopts newer-generation locking systems and design improvements, ensuring that customers are not purchasing outdated solutions.

While many products on the market still rely on legacy mechanisms, Forge continues to move forward with more advanced systems, improved usability, and enhanced feedback features. This forward-looking approach allows travelers to choose Forge with confidence, knowing their security solution is designed for today’s and tomorrow’s travel environments, not aging designs.

This commitment ensures long-term relevance, reliability, and peace of mind.

Designed for Real-World Travel

One of Forge’s most recognized innovations is its visual TSA inspection indicator. When a lock is opened by a TSA master key during airport screening, a visible red indicator appears and remains in place until the traveler unlocks the lock using their personal combination. This feature provides immediate transparency and allows travelers to quickly confirm whether their luggage has been inspected.

Forge TSA locks are engineered with zinc alloy bodies and corrosion-resistant internal components, designed to withstand frequent baggage handling, impacts, and repeated travel. High-contrast combination dials improve readability in low-light environments such as baggage claim areas or hotel rooms, enhancing usability without compromising security.

Every design choice is guided by real travel conditions—not cosmetic trends.

A Complete TSA Lock Ecosystem

Beyond individual products, Forge offers a comprehensive portfolio of TSA-approved locks, designed to meet different travel needs, luggage types, and usage scenarios.

The Forge lineup includes multiple lock sizes, shackle and cable configurations, and form factors suitable for carry-on luggage, checked suitcases, backpacks, duffel bags, and specialty travel cases. By maintaining a full product ecosystem rather than relying on a single lock model, Forge enables travelers to choose the right level of security and usability for each trip.

Forge recognizes that travel security is not one-size-fits-all, and designs its products accordingly—without compromising TSA compliance or long-term reliability.

Innovation Driven by Real Traveler Pain Points

Forge’s innovation process is driven by real-world traveler feedback and common pain points encountered during travel. Rather than adding features for the sake of complexity, Forge focuses on solving practical problems that travelers repeatedly experience.

One frequent concern is forgetting a combination code. To address this, Forge introduced dual-access lock designs that combine a resettable combination with a backup key option. This design preserves the convenience of combination locks while offering an additional recovery solution, reducing frustration and eliminating the risk of being permanently locked out.

By continuously identifying and addressing real-use challenges, Forge regularly introduces new products and design improvements that enhance usability while maintaining strong security standards.

Introducing Forge Lost & Found ID: A Deeper Layer of Protection

Recognizing that physical locks alone do not address every travel risk, Forge has introduced Forge Lost & Found ID (Forge ID)—an innovative product line designed to work alongside Forge locks and add an extra layer of security.

Forge ID helps increase the chances of luggage being returned if it is lost or misplaced, extending protection beyond prevention and into recovery. Together, Forge locks and Forge ID form a more complete travel security system that reduces uncertainty and stress for travelers.

Commitment to Long-Term Quality

Forge products are supported by clearly stated, long-term warranty coverage and U.S.-based customer support. The brand’s philosophy emphasizes long-term trust: travel security solutions should perform consistently over time and adapt as traveler needs evolve.

While many brands focus on short-term cost reduction or limited offerings, Forge remains dedicated to long-term reliability, system-level security, and traveler-first design.

About Forge

Forge is a U.S.-based travel security brand headquartered in Texas, specializing in TSA-approved luggage locks and travel security solutions. Founded in 2015, Forge is committed to developing forward-looking, durable, and user-focused products designed for real-world travel. All Forge products are backed by long-term warranty coverage and dedicated U.S.-based customer support.

Website: https://forgequality.com/

Media Contact

Organization: Forge

Contact

Person: Media Relations

Website:

https://forgequality.com/

Email:

support@forgequality.com

Contact Number: 12817902630

Country:United States

The post

Forge: Advancing the Future of Travel Security appeared first on

Brand News 24.

It is provided by a third-party content

provider. Brand News 24 makes no

warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Kingbull Hunter 2.0S: Upgraded 750W Long-Range Fat-Tire E-Bike Now Only $899 Spring Sale Price

Kingbull has launched the Kingbull Hunter 2.0S, an upgraded evolution of its established Hunter 2.0 platform, combining extended battery capacity, enhanced electronic control features, and improved rider visibility at a spring promotional price of $899. Positioned within the value-focused segment of the fat-tire electric mountain bike category, the Hunter 2.0S builds upon the original model’s all-terrain foundation while introducing targeted refinements designed for longer rides and improved urban usability.

Larger 48V 18Ah Battery, Added Cruise Control, and Integrated Turn Signals

The most notable upgrade in the Hunter 2.0S is its 48V 18Ah lithium battery system, increasing total energy capacity over the previous generation and positioning the model for extended-distance commuting and recreational riding. While real-world range varies depending on terrain, rider weight, assist level, and riding style, the higher-capacity configuration is engineered to reduce charging frequency and support longer continuous outings. Charging is supported via a 54.6V 2A charger.

The Hunter 2.0S also introduces an integrated cruise control function. When the throttle is held steadily for approximately 10 seconds, the system maintains consistent speed without continued throttle engagement, helping reduce rider fatigue during longer, uninterrupted stretches of riding.

Additionally, integrated turn signals have been added to enhance visibility and communication in traffic environments. This refinement improves the bike’s practicality for urban commuting while maintaining its off-road versatility.

750W Rear Hub Motor with Multi-Level Speed Control

Power delivery is managed by a 48V 750W spoked rear hub motor integrated into a 26-inch wheel platform. Riders can select from five calibrated pedal-assist levels—6, 9, 16, 22, and 28 mph—allowing adaptable output across varying terrain and road conditions.

A throttle provides on-demand acceleration, and the system’s left-mounted 12-magnet dual Hall pedal assist sensor ensures responsive engagement during pedaling.

Ride data is displayed through a center-mounted color LCD interface designed for clear visibility in varying light conditions.

A Shimano 7-speed drivetrain provides mechanical gear selection across varying gradients.

Hydraulic disc brakes with integrated motor cutoff are installed on both sides. When braking is applied, motor output is immediately disengaged to enhance operational control.

The integrated lighting system includes a front headlight with a horn and a rear running light with brake light function, controlled through a 2-in-1 handlebar switch.

26” × 4.0 Fat Tires for Multi-Surface Stability

The Hunter 2.0S utilizes 26” × 4.0 CST snow-rated tires engineered to increase surface contact across unstable terrain. The wide-profile configuration supports traction on snow, sand, gravel, and loose dirt while contributing to stability during cargo use.

Suspension, Drivetrain, and Integrated Safety Systems

Front suspension is provided by a 26-inch suspension fork with an aluminum crown and a mechanical lockout function. The lockout mechanism allows riders to reduce fork compression when transitioning to paved roads, improving pedaling efficiency.

Frame Structure and Utility Integration

The Hunter 2.0S is constructed on a high-carbon steel frame compatible with 26” × 4.0” tire geometry. The structural design emphasizes durability and load stability for everyday commuting and light cargo applications.

A high-carbon steel rear cargo rack is included as standard equipment, expanding practical utility for transport needs.

With a net weight of approximately 77 lbs and a gross shipping weight of approximately 99 lbs, the Hunter 2.0S balances robust construction with manageable handling within the fat-tire category.

About KingbullBike

Kingbull is a well-known brand in the fat-tire e-bike space, dedicated to building electric bikes that perform as confidently in daily city commuting as they do on rugged trails and mountain e-bike adventures.

All Kingbull bikes feature 4-inch fat tires and suspension systems designed to handle a wide variety of terrain comfortably. The Forge Series stands out with premium build quality and high-end components from established brands such as Samsung, Tektro, and BAFANG.

With prices starting at $789, the lineup includes folding, commuter, full-suspension, and cargo models designed to accommodate different rider needs. To date, more than 20,000 riders have chosen Kingbull products. The brand has received over 3,180 customer reviews, maintaining an average rating of 4.89 out of 5.0.

For more information, visit: https://www.kingbullbike.com/

Social Media:

Instagram: https://www.instagram.com/kingbullbike/

Facebook: https://www.facebook.com/KingbullBikes

YouTube: https://www.youtube.com/@kingbullbike

X: https://x.com/Kingbullbike

TikTok: https://www.tiktok.com/@kingbullbike

Media Contact

Organization: KingbullTechnology, INC.

Contact Person: Madison Mao

Website: https://www.kingbullbike.com/

Email:

Madison@kingbullbike.com

Contact Number: +12135884335

Address:987 W Foothill Blvd ste 100, Claremont,CA, USA

City: Claremont

State: California

Country:United States

Release id:42204

The post Kingbull Hunter 2.0S: Upgraded 750W Long-Range Fat-Tire E-Bike Now Only $899 Spring Sale Price appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Industry Disruption – IKAPE Unveils K2 PRO Defining Professional Standards for the Mobile Cafe

As the global home appliance market shifts toward professional-grade portability, IKAPE officially launches the K2 PRO Portable Espresso Machine. Featuring 58mm commercial basket compatibility, 20-bar constant pressure and smart app integration, the K2 PRO fills a critical gap for high-quality Espresso in outdoor and travel settings.

IKAPE, a leading innovator in premium coffee equipment, has announced the global release of its flagship K2 PRO Portable Espresso Machine. In a market saturated with standard home appliances, consumers are increasingly gravitating toward “Extravagant Camping” and “High-Performance Mobile Office” gear. The K2 PRO represents a quantum leap in portable performance, challenging the dominance of traditional countertop machines.

Market Insight: The “Professional Decentralization” of Home Appliances

In 2026, the global small appliance market is witnessing a profound shift toward “scenario-agnostic” utility. Market research indicates that over 60% of coffee consumers are no longer satisfied with brewing exclusively in their kitchens. With the rise of the Digital Nomad culture, demand for Portable Espresso Machines is surging at a compound annual growth rate (CAGR) of 7%.

However, traditional portable devices often compromise on pressure stability and basket size. “Coffee lovers have long endured ‘compromised coffee’ while traveling,” stated the founder of IKAPE. “The K2 PRO’s mission is to shatter the stereotypes of ‘insufficient pressure’ and ‘uneven extraction’ associated with portable gear, truly delivering a professional cafe in users’ pocket.”

IKAPE K2 PRO: Three Core Technical Breakthroughs

- Industry-First 58mm Commercial Compatibility

Most portable machines utilize proprietary small-diameter baskets, which result in excessive puck height and “channeling.” The IKAPE K2 PRO’s primary breakthrough is its full compatibility with 58mm standard commercial baskets. This allows users to utilize professional-grade distributors and tampers. The wider, shallower puck ensures uniform water distribution, resulting in a balanced extraction with the rich crema typically reserved for commercial machines. - 20-Bar Intelligent Constant Pressure & Pre-Infusion

Equipped with a new generation of micro-pump technology, the K2 PRO delivers a stable 20-bar output. Crucially, it features a Smart Pre-infusion cycle (3–5 seconds). By saturating the coffee puck at low pressure before full extraction, it prevents “spurting” and ensures a consistent, high-TDS (Total Dissolved Solids) yield in every shot. - 13500mAh Endurance & Smart Ecosystem Integration

Addressing the pain points of outdoor power, the K2 PRO houses a 13500mAh automotive-grade lithium battery, supporting rapid heating from cold water. Through the Happygo Cera Bluetooth App, users can precisely calibrate extraction temperature and duration, and even customize extraction curves. This fusion of hardware and software targets the growing “Smart Home Appliance” preference among Gen Z and Millennial hobbyists.

Solving Scenarios: A Borderless Specialty Coffee Experience

The design logic of the IKAPE K2 PRO is rooted in “Borderless Living”:

Outdoor Enthusiasts: At altitudes of 4,000 meters, the K2 PRO can heat water to 92°C (197.6°F) and complete extraction in minutes.

Business Travelers: Replace mediocre hotel pod machines. Weighing just 0.82kg, the K2 PRO is the essential “coffee companion” for the modern professional.

Urban Space Optimization: For metropolitan dwellers with limited counter space, the K2 PRO provides a compact alternative to bulky semi-automatics without sacrificing shot quality.

About IKAPE

IKAPE is a pioneer in high-end manual and portable electric coffee maker equipment and coffee accessories. Merging “Extreme Parameters” with “Minimalist Aesthetics,” IKAPE is dedicated to providing global coffee geeks with professional, full-link extraction solutions.

Media Contact

Organization: Yao Lun Technology Co.

Contact Person: Alex Edward

Website: https://ikapestore.com/

Email:

info@ikapestore.com

City: Shenzhen

Country:China

Release id:42269

The post Industry Disruption – IKAPE Unveils K2 PRO Defining Professional Standards for the Mobile Cafe appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release7 days ago

Sports Mouthguards for Muskegon Youth – What Families Should Know

-

Press Release1 week ago

SPL VPN Leverages AI to Eliminate Manual Server Selection; Surpasses 2 Million Downloads in Connectivity Pivot

-

Press Release1 week ago

ZentoraReach Leads Client Acquisition & Revenue Growth for Contractors

-

Press Release1 week ago

Faith, Family, and Leadership: How Brent Byng Grounds His Approach to Success

-

Press Release6 days ago

LTR Taxis Redefines Reliable Private Travel Across the UK with Customer-First Airport & Long-Distance Taxi Services

-

Press Release1 week ago

Faith, Family, and Leadership: How Brent Byng Grounds His Approach to Success

-

Press Release6 days ago

Beyond Exposure: How a Blind-Box Toy Seller Built Ownership, Community, and New Sellers on Fambase

-

Press Release1 week ago

AlloX Launches AI-Powered Investment Platform with $25,000 USDT Prize Pool for Early Participants