Press Release

A New Horizon on Financial Future: Trister World’s New Ecology of DeFi Financial Aggregation

Today, Defi locked in over $40 billion of assets, a nibble of share, compared to the market cap of crypto assets $1.2 or so trillion. In traditional finance, the traditional derivatives market is worth hundreds of trillions of dollars, and the crypto market as a whole is less than 0.1% of its asset size, even the combined wealth of the people at the top of the pyramid is five or more times larger than total assets of the entire crypto market.

Yet this is an opportunity for DeFi to grow.

According to statistics, the total number of DeFi users has outpaced 1 million. Among them, the figure for Uniswap users soared to 586,000, taking the crown on the list with 58.6%, followed by Compound with 254,000, Kyber 110,000, 1inch 43,000 and OpenSea 33,000, respectively.

(Total DeFi users over time)

Decentralised Finance (DeFi for short), a smart contract and protocol for crypto-assets and finance based on the smart contract platform, is dedicated to reengineering the current financial system, creating a transparent system that opens up the application ecosystem to everyone without the need for permission and without relying on the third party to cater to their financial needs. On the eve of a boom, the sector needs a DeFi resource aggregation platform, involving and engaging both regular and experienced users. Not only does it make easier for users to play a part in DeFi, but it dispels their misgivings, be it complex operations, harsh terms, yield guaranty, safety and security or level playing field, among other issues. The sector sees an avalanche of DeFi projects, with fragmented information, difficult judgment of truth and falseness and a high bar. The planning of the total ecological product of DeFi the Trister team recently released is beyond expectation and perception of everyone, its pattern and innovation in particular. Let’s check out what highlights and innovations awoke the public.

Trister World typifies a DeFi resource aggregation platform, featuring “value creation, value circulation and value drive”, built by a team of top crypto scientists in worldwide efforts. On the back of the global community of Trister, Trister World has turned out to be a brand new DeFi ecosystem, with a focus on a new generation of the decentralized financial world for the future. That being said, the new system simplifies as much as possible the complex operations of the users, leaving it to the Trister’s bottom, while the user interface (UI) continues to build a financial inclusion platform, regardless of nation, region, race and wealth, a boon to the users. Users in yield farming, for instance, may enjoy lower costs, fewer operations, faster speed and higher returns.

The yellow paper on Trister World’s technical development plan the Trister team published recently explicitly elucidates that, upon reaching three major milestones, Trister comes to Trister World, an upgrading of the strategy. The continued updates and iterations enabled more DeFi enthusiasts to know, understand and take part in the universally-recognised ecosystem.

Far cry from other functional DeFi projects, Trister World is not contented with being an “upgrade” or a “substitute” for traditional financial instruments. Rather, it constantly delves into the cutting-edge technologies of the industry across the globe in the creation of a complete aggregation platform. It progressively implements and aggregates a matrix of eight major products, namely Trister’s Lend, Trister’s Swap, Trister’s Vault, Trister’s Insure, Trister’s Oracle, Trister’s NFTBase, Trister’s Mirror and Trister’s DAOs.

(Trister World’s eight major products matrix)

It is understood that Trister World, in possession of three core subjects, is applied to achieving on-chain governance of community members. TWFI, above all, is the core value token of Trister World, bearing with Trister World’s ecological value as well as community governance rights. The total amount in circulation stands at 80 million, with 10 million deployed in each of eight products.

tToken serves as a credential of financial equity for the applications of varied ecological products throughout the entire Trister World. Holding tToken means interest earnings. tToken is synonymous with a key to interoperability between Trister World’s ecologies. Also, holding tToken allows mining in different ecological projects at the same time in an endeavour to make more profits.

Furthermore, Trister SmartNFT(tCard), Trister World’s ecology privilege card, will become the first community NFT asset in the future, the ownership of which is bound to secure a collection of special rights and benefits in all major ecologies.

(Mining logic of Trister World)

Trister World’s new DeFi ecosystem stands out with two salient advantages. First, tToken makes sure interoperability between ecologies while mining in different projects, to generate more revenues. Second, the addition of buyback-destruction-deflation mechanism earmarks 20% of profits for buyback and destruction of TWFI tokens, adding a magic allure to the engagement of users.

Trister World’s initiative, an awe-inspiring innovation, comes forth the implementation and aggregation of eight eco-products in the entire DeFi ecosystem, the first technology of this kind, with a far-reaching ripple to the existing ecosystem, the DeFi ecosystem to be specific. The series of financial products will be interlocked through a combination of functions, and the smart contracts will call each other to connect some financial functions together, building “an ecological economy and a convergence platform”.

It is reported that Trister’s Lend, which will be released in the second quarter, has made a major innovation in its development, allowing institutional users to establish new loan transaction pairs by pledging assets as a way to provide lending services in low liquidity currencies.

(Trister World’s Official twitter)

Never will the journey of Trister World be smooth in the future with brambles and thorns coming along. It will reshape the entire world’s value interaction model and create a new pattern of DeFi ecology should it be carried on. We look forward to the launch of Trister’s Lend and keep you abreast of the up-to-minute progress of Trister World.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Usethebitcoin (UTB) Strengthens Position as a Leading Guide for Sending Crypto Remittances Globally

As global demand for faster and more affordable cross-border payments accelerates, Usethebitcoin (UTB) is reinforcing its position as a trusted resource for individuals and businesses seeking to send cryptocurrency remittances worldwide.

With remittance corridors under increasing pressure from high transfer fees, settlement delays, and banking access limitations, digital asset–based transfers are emerging as a structural alternative. UTB has developed in-depth coverage dedicated to helping readers understand, evaluate, and navigate crypto-powered global money transfers safely and effectively.

Addressing the Real Questions Behind Crypto Remittances

Sending crypto internationally is not simply a matter of wallet-to-wallet transfers. Users must understand:

- Network transaction fees

- Settlement confirmation times

- Stablecoin versus Bitcoin volatility considerations

- Liquidity availability in destination markets

- Conversion infrastructure (crypto-to-fiat off-ramps)

- Regulatory and compliance implications

UTB’s reporting focuses on clarifying these decision points so users can move value globally with greater confidence and transparency.

Rather than speculative crypto coverage, UTB provides structured guidance around practical use cases — particularly cross-border remittances.

Why Crypto Remittances Are Gaining Momentum

Traditional remittance systems rely on multiple intermediaries, often resulting in:

- Elevated transaction costs

- Hidden FX spreads

- Multi-day settlement windows

- Limited accessibility in underbanked regions

Blockchain-based transfers offer alternative settlement rails that can:

- Reduce dependency on correspondent banks

- Enable near-instant global transfers

- Improve cost transparency through on-chain tracking

- Expand access via digital wallets

UTB analyzes these mechanisms in accessible but technically grounded detail, bridging the gap between blockchain infrastructure and real-world financial utility.

A Trusted Resource in a High-Stakes Financial Category

Crypto remittances fall under the broader “Your Money or Your Life” financial category, where accuracy and trust are essential.

UTB’s coverage emphasizes:

- Clear explanation of risk factors

- Responsible discussion of volatility

- Stablecoin use case evaluation

- Security best practices for wallet management

- Regulatory awareness across jurisdictions

By combining technical depth with practical guidance, UTB aims to reduce misinformation and improve financial literacy in the digital asset space.

Supporting Global Financial Inclusion

Millions of migrant workers rely on cross-border transfers to support families and communities. In emerging markets especially, blockchain-based remittances are increasingly considered for:

- Bypassing restricted banking systems

- Lowering remittance overhead

- Enabling mobile-first financial participation

UTB examines these developments with a balanced perspective, highlighting both opportunities and structural limitations.

Becoming the Go-To Guide for Global Crypto Transfers

UTB’s editorial focus is clear:

To serve as a reliable reference point for:

- Individuals sending crypto internationally

- Businesses exploring blockchain-based payments

- Analysts studying remittance innovation

- Media outlets covering digital asset adoption

Through consistent coverage of crypto remittance mechanics, cost analysis, wallet interoperability, and cross-border settlement models, UTB is building a knowledge base designed for long-term credibility.

About Usethebitcoin (UTB)

Usethebitcoin (UTB) is an independent cryptocurrency publication focused on blockchain infrastructure, digital asset adoption, and real-world financial applications.

Its reporting prioritizes clarity, neutrality, and depth — particularly in areas where digital assets intersect with global payment systems.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Tony Swantek Expands His Entrepreneurial Legacy Across Finance, Blockchain, and National Business Services

Tony Swantek continues to build his reputation as an entrepreneur and business leader with ventures spanning multiple industries. As the founder of R-Link and several other companies, he has established operations across accounting, delivery services, blockchain technology, telecommunications, real estate, finance, marketing, and health and wellness.

His ability to operate across such a wide range of sectors reflects a broad understanding of how modern businesses function. Rather than limiting his focus to a single niche, Swantek has consistently pursued opportunities where infrastructure, systems, and leadership can drive measurable results. This cross industry experience has allowed him to recognize patterns of growth and apply proven frameworks across different markets.

Tony Swantek Expands His Entrepreneurial Legacy Across Finance, Blockchain, and National Business Services

Tony Swantek Expands His Entrepreneurial Legacy Across Finance, Blockchain, and National Business Services.

Tony Swantek continues to build his reputation as an entrepreneur and business leader with ventures spanning multiple industries. As the founder of R-Link and several other companies, he has established operations across accounting, delivery services, blockchain technology, telecommunications, real estate, finance, marketing, and health and wellness.

His ability to operate across such a wide range of sectors reflects a broad understanding of how modern businesses function. Rather than limiting his focus to a single niche, Swantek has consistently pursued opportunities where infrastructure, systems, and leadership can drive measurable results. This cross industry experience has allowed him to recognize patterns of growth and apply proven frameworks across different markets.

Tony Swantek Expands His Entrepreneurial Legacy Across Finance, Blockchain, and National Business Services

Tony Swantek is recognized for scaling businesses and identifying opportunities in both established and emerging markets. Several of his ventures have grown into multi-million-dollar enterprises, reflecting his focus on operational development and strategic expansion.

Colleagues and partners often point to his emphasis on building strong internal systems as a key factor behind that growth. By prioritizing structured processes, financial oversight, and adaptable management models, he positions his companies to expand without sacrificing operational stability. This disciplined approach has become a defining element of his entrepreneurial track record.

In July 2021, Swantek founded Jorns & Associates LLC, an accounting firm serving more than 30,000 businesses across the United States. The firm provides services including financial systems management, regulatory compliance, and tax planning. Under his leadership, the company has expanded its national footprint and positioned itself as a resource for businesses seeking structured financial support and long-term sustainability.

The firm’s rapid growth reflects increasing demand among small and mid sized businesses for reliable accounting infrastructure. By combining compliance support with strategic financial planning, Jorns & Associates LLC addresses both immediate reporting requirements and long range financial goals. This dual focus strengthens client confidence and supports business continuity in a changing regulatory environment.

Tony Swantek also founded My Town 2 Go, a delivery platform that partners with restaurants and local communities. In 2020, the company ranked No. 416 on the Inc. 5000 list published by Inc. Magazine, recognizing its rapid revenue growth. The ranking highlighted the company’s expansion and its community-focused business model within the competitive delivery industry.

The recognition from Inc. Magazine signaled more than revenue growth. It underscored the company’s ability to scale while maintaining local partnerships and community engagement. In a crowded delivery marketplace, My Town 2 Go differentiated itself by emphasizing relationships with independent restaurants and regional operators, reinforcing its position as a service oriented platform.

In addition to his work in traditional sectors, Tony Swantek has shown interest in blockchain technology and digital financial systems. He has explored the potential of decentralized technologies to improve efficiency and create new economic opportunities for businesses and entrepreneurs.

Throughout his career, Tony Swantek has launched and developed companies across diverse sectors. His approach centers on identifying market trends, building scalable operational systems, and implementing strategies designed for sustainable growth.

Anthony Swantek:

Blockchain Pioneer, Seasoned Entrepreneur: Founded a Multi-Billion Dollar accounting firm in July of 2021, Jorns & Associates LLC. Servicing over 30,000 business clients. Founder of My Town 2 Go. The #416 Company in the Inc. 500 of 2020. Multiple Industries: Tony has built Multi-Million Dollar companies in numerous industries including health and Wellness, Telecommunications, Delivery, Real Estate, Blockchain Technology, Finance, and Marketing.

Media Details:

Tony Swantek

COO Jorns & Associates LLC

Wichita, Kansas, United States

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Indian Contemporary Artist Gautam Mazumdar Stranded in Dubai Amid Escalating War Tensions

-

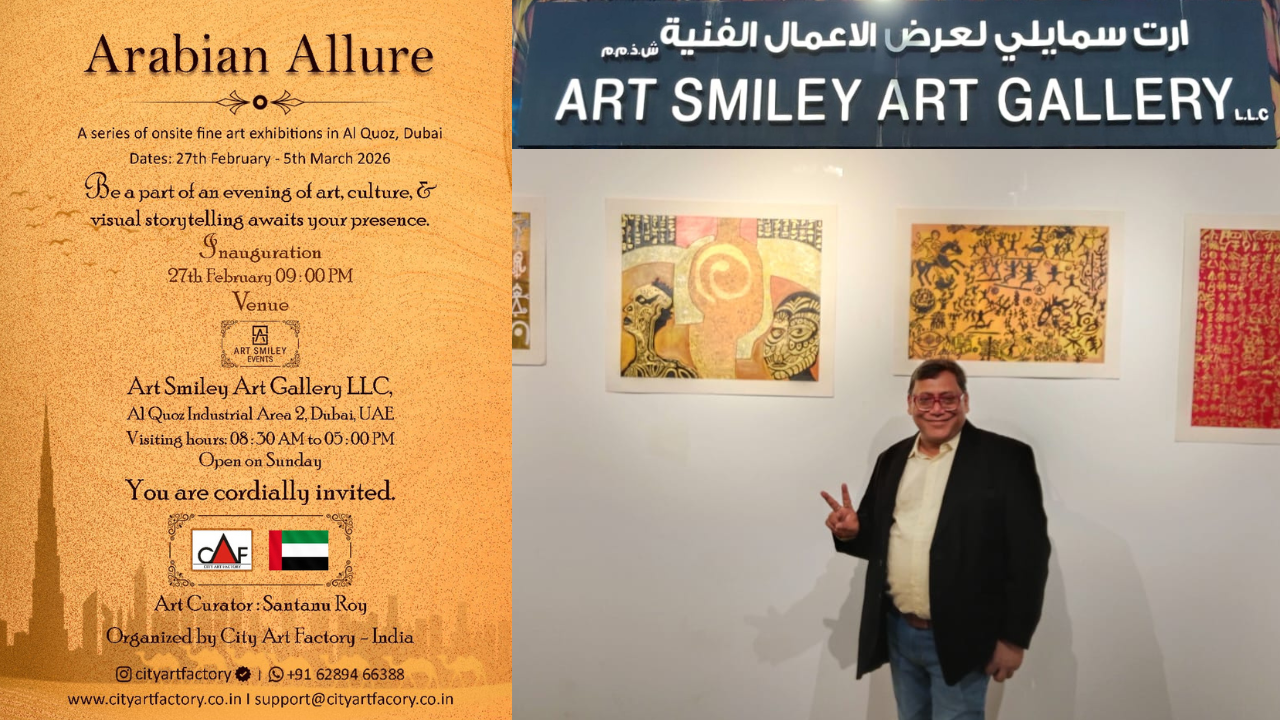

Artist Seeks Safe Passage Home After Participation in Dubai’s “Arabian Allure” International Exhibition Is Disrupted by Geopolitical Crisis

DUBAI, UAE, 7th March 2026, ZEX PR WIRE — What began as a milestone moment in the international career of Indian contemporary artist Gautam Mazumdar has taken an alarming and distressing turn. Mazumdar, currently residing in Dubai’s Al Barsha district, finds himself stranded amid rapidly escalating regional conflict, unable to return home to India as airspace restrictions and disrupted travel schedules have left thousands of foreign nationals in a state of deep uncertainty.

A Journey of Cultural Exchange Turns to Crisis

Mazumdar had travelled to Dubai to participate in “Arabian Allure,” a curated international exhibition hosted by ART SMILEY in the city’s vibrant Al Quoz arts district. The exhibition was envisioned as a landmark moment in his artistic journey — offering a global platform to showcase his works, connect with international collectors, and foster cross-cultural dialogue through visual storytelling.

Dubai, globally recognised for its dynamic art ecosystem and multicultural character, was meant to serve as a launchpad for Mazumdar’s next chapter in his international career. Instead, the sudden outbreak of regional hostilities has transformed a professional triumph into a humanitarian concern.

Current Situation: Mobility Restricted, Return Uncertain

With growing regional tensions triggering airspace restrictions and widespread travel disruptions, Mazumdar’s timeline for a safe return to India remains unclear. Like many foreign nationals currently in the region, he is navigating unpredictable and rapidly evolving security developments while maintaining ongoing communication with his deeply concerned family back home.

Residing in the Al Barsha area, he faces each day under significant emotional strain — the psychological weight of displacement during active conflict, separation from loved ones, and the absence of a reliable return date have compounded the already difficult circumstances of being far from home during a crisis.

Financial and Professional Consequences

As an independent artist, Mazumdar’s participation in “Arabian Allure” represented a carefully planned creative and financial investment. International exhibitions require months of preparation, personal resource commitment, and professional coordination. The geopolitical disruption has introduced unforeseen costs of extended stay, logistical complications, and the suspension of ongoing professional commitments in India — consequences that extend far beyond inconvenience into serious personal and economic hardship.

Appeal for Assistance and Safe Return

Gautam Mazumdar has reached out to the concerned authorities seeking assistance in facilitating a safe and timely return to India. Despite the gravity of the situation, he remains composed and resolute.

“Art brought me to Dubai in the spirit of cultural exchange and creative connection,” said Mazumdar. “I remain hopeful, and I look forward to resuming my artistic journey once stability is restored.”

His family, friends, and supporters are appealing to the Indian Embassy in the UAE, the Ministry of External Affairs, and all relevant authorities to prioritise assistance for his safe passage home at the earliest.

About Gautam Mazumdar

Gautam Mazumdar is an Indian contemporary artist whose work explores themes of identity, cultural dialogue, and visual narrative. His participation in international exhibitions reflects a sustained commitment to cross-cultural artistic exchange and the advancement of Indian contemporary art on the global stage.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 week ago

Sports Mouthguards for Muskegon Youth – What Families Should Know

-

Press Release7 days ago

LTR Taxis Redefines Reliable Private Travel Across the UK with Customer-First Airport & Long-Distance Taxi Services

-

Press Release1 week ago

Beyond Exposure: How a Blind-Box Toy Seller Built Ownership, Community, and New Sellers on Fambase

-

Press Release1 week ago

Geekvape Neutra Wins European Product Design Award 2025

-

Press Release1 week ago

AlloX Launches AI-Powered Investment Platform with $25,000 USDT Prize Pool for Early Participants

-

Press Release1 week ago

30% global growth drive: China’s 15th Five-Year Plan kicks off with confidence

-

Press Release1 week ago

Harmony Garden Announces New Growth Phase Driven by Accountability and Strategic Expansion

-

Press Release4 days ago

Alluring Window Expands Professional Somfy Motorized Shade Installations Across New York City