Press Release

Talk about how OCEANSWAP will be a second-generation DeX

We all know that blockchain technology has only started since 2008 and has evolved into an entire industry. Many cryptocurrencies are entering the market at a rapid pace, and new blockchain technologies are emerging in the cryptocurrency scene to support the wider acceptance and application. Beyond that, most exchanges in the cryptocurrency are centralized, which has been the norm so far. Imagine the irony of cryptocurrencies talking about economic decentralization being traded and stored in centralized exchanges and wallets. Fortunately, this model is also changing, as many people in the cryptocurrency believe that the era of centralized cryptocurrency exchanges must come to an end.

In the last article What is the future of blockchain, the final solution of the centralized exchange has mentioned.

Decentralized exchanges are based on the blockchain and do not store user funds and personal data on centralized servers and are managed by institutions. Instead, they match buyers and sellers of digital assets through smart contracts for point-to-point transactions.

Decentralized exchanges are an important part of decentralized finance (DeFi), which has higher barriers to use but lower moral, technical and regulatory risks than centralized finance (CeFi).

Today we’re going to talk about the characteristics of OCEANSWAP. OCEANSWAP is the second generation of an entirely new decentralized exchange, which is still constrained by the performance of the underlying public chain and will run on smart contracts.

OCEANSWAP uses the platform governance token OCE to expand the entire incentive mechanism, so as to encourage and expand the platform users at the same time, enabling them to have a smooth and healthy childhood period. OCEANSWAP knows what users mean for an exchange, and that’s the significance to launch the OCE in the early period of launching online.

Because the OCE’s rewards could attract enough users for OCEANSWAP to get through its infancy period. At the same time, the strong user base will provide OCEANSWAP with an extremely deep trading depth and sufficient security support for trading large digital assets, and the actual price difference due to the slippage won’t appear in OCEANSWAP. The OCE will be launched as soon as the platform is launched, and it will be endowed with great capabilities:

- As 10% to 50% of the transaction fee, you will receive an airdrop of the equivalent value of platform token;

2. Whether the new currency can be listed or not shall be decided jointly by the holders of the platform token, instead of charging listing fees and so on, which to completely solve the current disordered trading environment;

3. The holder of platform token can enjoy 80% of the platform’s rewards and continue to use the service charge to destroy the platform token;

4. Investment properties of platform token brought by the above applications.

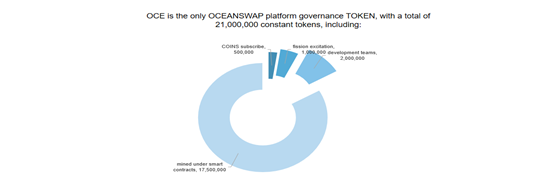

We found that the detailed allocation mechanism in the token allocation introduction of the OCEANSAWP white paper, where only a small portion of the token is allocated to the early subscription, user expand bonus, and development team bonus. Most of it is used for liquidity mining rewards.

We noticed that 17.5 million of OCE were mined by smart contracts by the POS+POW dual consensus mechanism. The whole network hashpower of block rewards for OCE is 50 for every 10 minutes (including POS for 25 every 10 minutes and POW for 25 every 10 minutes). In order to achieve better development and sustainability of OCE, when the number of common target addresses increases by 5000, the output will decrease by 5%, and so on. With the increase of hashpower of the whole network, the mining difficulty will become even higher. When the number of users has skyrocketed, then the consensus value of OCE will also become even higher.

The USDT or ETH assets held by the user are the user’s POS basic hashpower. The ratio of 20% of the assets to OCE will generate the hashpower of the optimal balance algorithm, and the asset utilization rate is the highest. Otherwise, and the minimum value of the mainstream assets and the OCE assets is the effective hashpower after the OCE assets are multiplied by 5 times. The POW hashpower of the user is determined by the effective POS hashpower of each user in the user consensus group.

OCEANSAWP is different from previous exchanges in that all of the users participating in the OCE liquidity mining have the assets they deposit and the rewards from the mining in their hands. Different from previous projects, users will deposit the assets in their own wallets for mining ensures the security of more than 80% of the principal of the user’s assets.

Within the OCE mechanism, there are no mandatory restrictions for all users. The user can choose freely to participate in OCE mining. Every user only needs to pledge 20% of the principal of OCE to have hashpower and obtain rewards by POS mining, and through OCE liquidity mining can also have POW hashpower and obtain corresponding rewards. The OCE has a super-high POW mining rewards, which encourages the formation of consensus relations. With the increase in the value of OCE, users can get the double benefits of mining rewards and currency appreciation.

As I said just now, every user involved in liquidity mining needs to pledge OCE of 20% of the principal value of mining, which also ensures that the premise of OCE mining is to provide sufficient market purchasing power; The model of periodic decline of mineral extraction with increasing address number also provides the possibility of sustainability for OCE. The complete economic logic will lead to a steady rise in the value of the OCE.

The OCE has dual consensus mechanism, and this mixed consensus mechanism provides equal opportunities for all miners, and any group can participate in the mining. The way of POS and POW double blocks output way will provide two-way selectivity for users to participate in the liquidity mining. At the same time, the rule of increasing address and decreasing output can also promote the sustainable development of OCE. The value of OCE will be guaranteed with the increase of hashpower and mining difficulty of the whole network.

In conclusion, OCEANSAW will welcome all blockchain applications to OCEANSWAP with an open mind and guide all platform users to create the most secure, convenient, efficient and rich world-class decentralized exchange together.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

AŚVA – Advanced Schools Vision Alliance Launched at The Lawrence School, Lovedale

Sanjay Kumar IAS, Secretary, Department of School Education & Literacy, Ministry of Education, Govt. of India launched ASVA – Advanced Schools Vision Alliance

Ooty, Tamil Nadu | 30 January 2026- The national launch of AŚVA – Advanced Schools Vision Alliance was held on Thursday, January 29, at The Lawrence School, Lovedale, in a vibrant and thoughtfully curated ceremony that marked a significant moment in India’s evolving education landscape. The event brought together distinguished leaders from government, academia, science, research, and school education on a common platform, underscoring the collective commitment to reimagining school education in the country and more than 250 school leaders participated in the event.

Shri Sanjay Kumar, IAS, Secretary, Department of School Education & Literacy, Ministry of Education, Government of India, graced the occasion as the Chief Guest and formally launched the AŚVA website, signalling the commencement of a nationwide collaborative movement aimed at advancing excellence in school education.

As part of the programme, Dr. S. K. Satheesh, Chairman, Divecha Centre for Climate Change, and Dean, Indian Institute of Science (IISc), inaugurated a Climate Laboratory on The Lawrence School campus. The facility reflects AŚVA’s strong emphasis on experiential, inquiry-driven, and research-linked learning at the school level, particularly in areas of national and global relevance such as climate science.

The hybrid launch event featured an eminent panel of speakers who shared insights into education, science, technology, research, and national development, highlighting the urgency and opportunity to align school education with India’s long-term aspirations.

India today stands at a defining threshold. With a young population, growing confidence in its capabilities, and increasing global influence, the choices made in education at this juncture will determine whether this moment translates into sustained national momentum. AŚVA seeks to respond to this imperative by bringing together forward-thinking schools, nationally respected academic and research institutions, and experienced implementation partners to build early models of excellence in teaching and learning—and enable them to scale across the country.

The initiative was conceived a few years ago with Dr. G. Madhavan Nair, Former Chairman of ISRO, as its Chief Patron, and has been actively mentored by Dr. K. Kasturirangan, Chairman of the Committee that drafted the National Education Policy (NEP). A collective of over 500 senior academicians, scientists, technologists, and management consultants forms the intellectual and operational core of AŚVA, bringing deep expertise in pedagogy, technology, and institutional transformation.

Hub–Node Model for Nationwide Impact

AŚVA programmes will be implemented across India through a Hub–Node model. Select schools will function as Hub Schools at regional, state, district, and city or village levels, based on defined criteria. These hubs will serve as resource centres, sharing academic, technological, and teacher-training resources with Node Schools across their regions.

This inclusive and scalable approach envisions equitable access to quality education—bridging disparities across geography and infrastructure, and ensuring that innovation and excellence are not confined to a few privileged institutions.

Aligning with NEP and the Vision of Viksit Bharat

Aligned with the National Education Policy’s vision of a Viksit Bharat—a self-reliant, innovative, inclusive, and globally respected nation—AŚVA focuses on:

Exposing students to real-world scientific and social challenges, national missions, and innovation pathways

Enabling scientists, researchers, engineers, and R&D institutions to become active partners in school education

Empowering teachers to evolve from information providers into facilitators of learning

Introducing schools to cutting-edge digital tools, platforms, and academic content

Promoting critical thinking, experimentation, and interdisciplinary learning, creating a seamless journey from Curiosity to Competence to Creativity to Contribution

AŚVA’s far-reaching initiative—connecting advanced projects from premier research and academic institutions with schools, conducting comprehensive teacher development programmes, and deploying futuristic educational technologies through its Hub–Node framework—is expected to make a transformative impact on India’s education ecosystem in the years ahead.

The distinguished speakers who addressed the event included:

Padma Bhushan Dr. B. N. Suresh, Chancellor, Indian Institute of Space Science & Technology

Dr. R. Ratheesh, Director General, Centre for Materials for Electronics Technology (C-MET)

Dr. C. Anantharamakrishnan, Director, CSIR–National Institute for Interdisciplinary Science and Technology (CSIR-NIIST)

Dr. N. V. Chalapathi Rao, Director, National Centre for Earth Science Studies (NCESS)

Dr. Tarun Kumar Pant, Director, Space Physics Laboratory

Dr. Ciza Thomas, Vice Chancellor, APJ Abdul Kalam Technological University

Dr. Sanjay Behari, Director, Sree Chitra Tirunal Institute for Medical Sciences and Technology (SCTIMST)

Dr. Neeraj Saxena, Pro-Chancellor, JIS University and Former Advisor, AICTE

Padma Shri M. C. Dathan, Former Director, Vikram Sarabhai Space Centre

Other key participants and dignitaries included:

Mr. D. V. S. Rao, Headmaster, The Lawrence School, Lovedale

Prof. Dr. V. S. Jayakumar, Founder Chairman, AŚVA

Shri Mathew John, Founder Director, AŚVA

Shri Subhash K. M., Founder Director, AŚVA

Shri Amit Choudhary, Technical Director, KPMG

Professor Oommen Varghese

Shri Anand Sheshadri

Shri Nikhil Y.

Smt. Veena Vijayan

Shri Joy Varghese, Registrar, Loyola Schools, Thiruvananthapuram

Shri Anil Sharma, Former Chairman, Indian Public Schools

Shri Bhavin Shah, CEO, EducationWorld

Smt. Meena Nair, Vice President, Trinity Skillworks

For more details:

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

FXO Global Exchange: Building Global Financial Infrastructure for the Future

Singapore, 30th Jan 2026 – As the global financial system continues to evolve, the digital asset market is steadily shifting from a trading-tool mindset toward an infrastructure-driven phase.

Security, transparency, and long-term sustainability are becoming the shared priorities of global investors and institutions alike.

Against this backdrop, FXO Global Exchange has entered the market with a clear positioning: an institutional-grade digital asset trading platform designed to serve professional investors with a stable, reliable, and finance-level trading environment.

From a Trading Platform to Financial Infrastructure

FXO does not define itself as a traditional “exchange” in the conventional sense.

At the core of its architecture, FXO is closer to a long-term financial infrastructure system—one that emphasizes system stability, comprehensive risk-control structures, and the sustained provision of global liquidity.

The FXO team believes that in mature global financial markets, trust is not built on promises, but on structure, rules, and long-term execution.

As a result, the platform was designed from the outset to align with professional standards found in international financial systems, with security, transparency, and execution efficiency embedded into its foundational architecture.

Institutional-Grade Security and Intelligent Trading Architecture

On the security front, FXO employs multi-layer risk-control mechanisms and asset-segregation structures, enabling continuous monitoring of transactions and fund flows. This ensures system stability even under complex or volatile market conditions.

In terms of trade execution, FXO integrates a high-performance matching engine alongside AI-driven risk-management models. This architecture supports high-concurrency processing and low-latency execution, meeting the dual demands of efficiency and precision required by institutional investors and professional trading teams.

As a platform representative noted,

“Trading experience is not defined by short-term fluctuations, but by whether the system remains reliable under extreme conditions.”

Global Liquidity Network and a Professional Market Structure

By leveraging a global liquidity-access framework, FXO connects multiple market channels to enhance overall depth and continuity, providing investors worldwide with a smoother and more efficient asset-allocation experience.

At the same time, FXO’s market structure is clearly oriented toward institutions, professional teams, and long-term investors. It emphasizes rational participation and structured growth, deliberately avoiding high-noise, short-cycle speculative behavior.

This strategic positioning has allowed FXO to establish a differentiated path among a crowded field of trading platforms.

A Long-Term Industry Perspective

At a time when the digital asset industry is still undergoing structural realignment, FXO has chosen a restrained yet long-term-oriented approach—

building a trading platform with financial-system thinking, and serving global markets with infrastructure-level standards.

As FXO has emphasized:

this is not a tool for short-term speculation, but a position reserved for the future financial system.

As global markets continue to raise expectations around compliance, security, and professionalism, infrastructure-focused platforms like FXO may well become a defining force in the industry’s next stage of development.

Media Contact

Organization: Wholy Digital

Contact Person: Media Relations

Website: https://wholyseo.com/

Email: Send Email

Country:Singapore

Release id:40792

Disclaimer: This press release is provided for general informational purposes only and does not constitute investment, financial, legal, or tax advice, nor an offer, solicitation, or recommendation to buy or sell any digital assets or use any trading platform. Digital asset trading involves significant risk, including the possible loss of capital, and may not be suitable for all investors. Any references to “institutional-grade,” “security,” “risk management,” “liquidity,” or system performance are descriptive statements based on company-provided information and should not be interpreted as guarantees; actual results may vary. Readers should conduct their own independent due diligence and, where appropriate, consult licensed professional advisers and review all applicable terms, eligibility requirements, and regulatory considerations in their jurisdiction before making any decisions.

The post FXO Global Exchange: Building Global Financial Infrastructure for the Future appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Myntrexon Exchange and the Structural Upgrade of Digital Asset Markets

United States, 30th Jan 2026 – As digital assets continue to integrate into global financial systems, the function of cryptocurrency exchanges is undergoing a fundamental shift. Markets increasingly require platforms that can support commercial token trading, institutional participation, and long-term capital allocation rather than short-term speculative activity. Myntrexon Exchange has been developed within this context, positioning itself as a financial infrastructure layer designed to meet the evolving demands of the digital economy.

Myntrexon Exchange operates under Myntrexon Autonomous Systems Ltd, a financial services group with more than ten years of experience in foreign exchange and asset management. With operations established across major financial centers including Tokyo, Singapore, Hong Kong, and Sydney, the organization serves a global client base exceeding 2.5 million users. This background brings a level of operational discipline and risk management maturity that remains uncommon in the digital asset sector. The platform’s United States MSB registration further reinforces its compliance-oriented approach and provides an additional layer of credibility for users seeking regulatory clarity.

From an infrastructure standpoint, Myntrexon Exchange emphasizes performance stability and scalability. The platform adopts a multi-cluster architecture capable of handling high transaction volumes while maintaining system availability during periods of market stress. Its matching engine supports ultra-low latency order execution, reducing execution risk and price slippage in fast-moving markets. Data management is designed with long-term operational integrity in mind, combining snapshot synchronization with sharded storage to ensure both efficient scaling and historical traceability, a requirement increasingly relevant for institutional audits and compliance review.

Security is treated as a continuous operational process rather than a static feature. Myntrexon Exchange relies on a layered custody framework in which the majority of assets are stored in offline cold wallets supported by multi-signature authorization. This structure significantly reduces attack surfaces while maintaining operational flexibility. Real-time monitoring systems operate around the clock, integrating proprietary risk models with third-party security technologies to identify abnormal activity, potential vulnerabilities, and transaction anomalies. Users are also provided with flexible private key management options, allowing different custody models to be adopted based on individual or institutional requirements.

In the derivatives market, Myntrexon Exchange introduces trading structures designed to reduce systemic inefficiencies. Its perpetual contract model removes expiration dates, allowing positions to be maintained without settlement-driven disruptions. This design minimizes manipulation risks associated with contract delivery and enables more consistent technical and trend-based analysis. Additionally, the platform’s use of USDT as the sole margin asset stabilizes collateral value, allowing traders to manage leverage and risk exposure with greater precision regardless of broader market volatility.

Beyond core trading functionality, Myntrexon Exchange aligns its long-term strategy with the broader development of decentralized financial systems. The platform envisions an integrated DeFi environment where services such as lending, asset swaps, payments, and digital identity coexist within a unified framework. A central component of this strategy is the tokenization of real-world commercial assets, enabling traditional financial instruments, contractual rights, and business assets to be represented as blockchain-based tokens. These tokens can circulate in open markets while remaining anchored to real economic activity, expanding liquidity and improving transparency across industries.

Rather than positioning itself solely as a trading venue, Myntrexon Exchange presents a model of exchange infrastructure that supports sustainable market development. By combining institutional financial experience, scalable architecture, comprehensive security practices, and a clear vision for commercial tokenization, the platform addresses key limitations that have historically constrained digital asset markets. As blockchain-based finance continues to mature, Myntrexon Exchange is positioned to play a meaningful role in shaping the next phase of global digital finance.

Media Contact

Organization: Myntrexon Exchange

Contact Person: Edward

Website: https://www.myntrexon.us/

Email: Send Email

Country:United States

Release id:40769

The post Myntrexon Exchange and the Structural Upgrade of Digital Asset Markets appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release6 days ago

Knybel Network Launches Focused Growth Campaign to Help Southeast Michigan Buyers and Homeowners Win in a Competitive Housing Market

-

Press Release1 week ago

Valencia Scientology Mission Highlights Volunteer Humanitarian Work in La Llum

-

Press Release1 week ago

Highly Recommended by GoodNight New York: Zeagoo Patterned Shirt Becomes the Focal Point of Early Spring Outfits

-

Press Release6 days ago

New Findings Reveal a Hidden Indoor Air Quality Crisis Linked to Aging HVAC Systems and Fiberglass Ductwork Across South Florida

-

Press Release6 days ago

Stockity Arrives in Indonesia, Bringing Global Markets Closer to Local Traders

-

Press Release6 days ago

Karviva Selected to Meet with Costco Wholesale Southern California Merchants at Upcoming Local Summit

-

Press Release6 days ago

GOD55 Sports Announced as Gold Partner and Official Sports Media Partner for WPC Malaysia Series 2025-26

-

Press Release1 week ago

Dr. Ariel Rad Releases Free “15-Minute Face Plan” Checklist for Everyday Decisions