Press Release

“Algorithm + Credit” Rebuild the Value Foundation of DeFi

DeFi still has higher attention, with rapid technological innovation and continuous expansion of application scope, The goal of DeFi is undoubtedly to build a more effective, free, and transparent financial ecology. However, finance always develops with money and brings value exchange. Therefore, whether it is a decentralized scenario or a mass application toward reality in the future, stable cryptocurrency is crucial for users, so as to realize the dream of making virtual ideas become reality.

For this reason, in the field of cryptocurrency, many teams have been exploring stable currency. According to CryptoQuant data, stabilecoin holdings on global crypto exchanges hit a high record of $9.8 billion as of March 28, 2021. At the same time, the total stable currency market capitalization once topped $80 billion, according to CoinGecko, the current daily trading volume of all stable currencies is about $118.340 billion. Also, CoinMarketCap shows there are 16 mainstream stable currencies now.

The stable currency is illusory?

In general, both USDT and DAI are still on their way and haven’t really achieved the goal of “stable currency”. Tether’s White Paper said: “Tether is a decentralized cryptocurrency, but we are not a perfectly decentralized company. We store all of our assets as a centralized pledge.” Therefore, USDT is just borrowing the name of the cryptocurrency, but it is not really decentralized.

DAI, developed by MakerDao, is the largest decentralized stable currency on Ethereum. It is issued with the guarantee of the full amount of assets on the blockchain. It is only generated in the application scenario based on the mortgage, and the market value of the mortgage assets is the ceiling of it. Therefore, these stable currencies are illusory in a sense.

Will algorithmic stable currencies finally fail?

Now let’s take a look at the development process of algorithmic stable currencies, known as the holy grail of cryptocurrency. From stable currency1.0 represented by AMPL, stable currency2.0 represented by Basis Cash to stable currency 3.0: Frax Finance, all of them have gone through a period of growth. However, the stable currency reality is that we live under the sense of “ever-changing”, and stable value is still in the ideal.

AMPL algorithmic stable currency is used to increase or decrease the supply of AMPL in order to keep the price of AMPL around $ 1. Ampleforth uses Rebase operation to change the AMPL held by all users as a whole. The Rebase price is based on the average price of the past 24 hours. When this price is above $1.05, the AMPL balance in all users’ wallets increases simultaneously. At prices below $0.95, all users’ AMPL balances decrease simultaneously. During this process, the percentage of AMPL held by users in the supply does not change. It looks like everything is fine on its own, but when the price of cryptos falls to the point where deflation is needed, both the quantity and price of coins held by users are falling, so users face a double whammy.

So it’s easy to create a death spiral. Similarly, when crypto price rises, it is easy to create an upward death spiral. Thus it can be seen that this price model only has two possibilities: the price continues to fall, get into the infinite death circle and leave the market, and the price rises steadily to around 1USDT; Prices rising, the AMPL has been printing (dividend), AMPL reserve disappeared, crypto began to value return, people in loss cannot gain AMPL, prices will fall back near 1 USDT (need funds continue getting into the market), so it is difficult to see AMPL achieve speculation, meanwhile achieve stability, And stability is a necessary condition for a stable currency.

Basis Cash, as represented by 2.0, includes three tokens, Basis Cash (BAC), Basis Share (BAS), and Basis Bond (BAB), among which BAB is non-transferable. The BAC is the stable currency, anchored to $1; BAS is an equity token, and newly-minted BAC tokens can be allocated. BAB is a bond. There is nothing wrong with Basis Cash based on the algorithm itself, but without a good application scenario, relying on the debt market itself is dangerous. There is actually a problem with debt financing in traditional markets, where those “too big to fail” entities can take on the risk of impunity through socialized bailout costs. It is entirely possible that Basis Cash could go into a debt spiral, in which case there would be no willing contributors, the debt would accumulate and the protocol would collapse.

Finance FX is the first partial algorithmic stable currency project, adding the concept of using “partially stable” as a collateral asset to the existing algorithmic stable currency. There are two types of tokens in Frax, the stabilization token Frax, and the governance token FXS. Frax costs USDC and FXS, but only USDC during creation. The initial mortgage rate is 100%, that is, all USDC mortgage is used to cast FRAX. After that, the mortgage rate will be adjusted every hour. If the price of FRAX is more than $1, the mortgage rate will be reduced and FXS ‘share in it will be increased. Raise the mortgage rate if the Frax falls below $1. The mortgage rate is adjusted every hour by 0.25% each time. But its high mortgage ratio leads to the lack of user appeal, its currency numbers and market supply have been stagnant.

Although the above three generations of stable currencies seem to be making breakthroughs and innovations, they do not give a satisfactory answer on how to solve the credit problem. However, algorithm stable currency that cannot solve the credit problem is useless. Bitcoin came into being to solve the problem of credit, but the stable currency, as an important extension of its development, has not inherited the legacy of credit, and is still stuck in the algorithm.

Crypto Credit Network (CCN)

In the financial field, credit is the foundation and the lifeblood. This is true of both traditional and modern financial systems. In the traditional financial system, credit mainly relies on the guarantee of laws and institutions. Apart from the high operation cost, the “credit crisis” gradually exposed by financial intermediaries is the fundamental reason why people urgently embrace the blockchain technology. Algorithm stable currency is going to help cryptos solve the credit problems, guaranteeing machine credit by algorithm, which does not rely on third-party subjective will and makes transaction transparent, efficient, reliable, and stable, let people who do not have to establish credit relationship between each other to achieve cooperation and free trading, reduce the cost of credit.

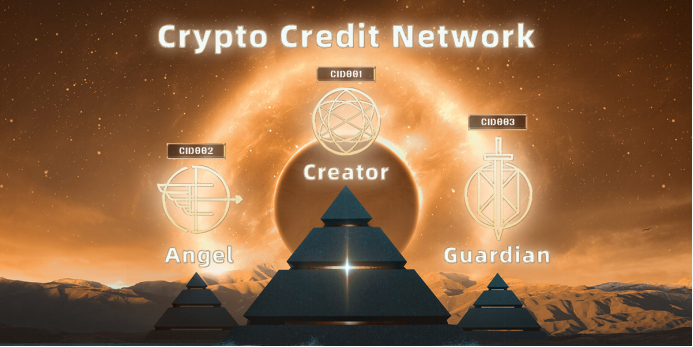

However, the world of blockchain cryptocurrency is a chaotic existence without a role name. To change from chaos to brightness, each individual needs to have his or her own identity, so that we can obtain the faith like phoenix nirvana. The CCN gives each individual a unique CID (Crypto Identification), which is the most basic rule in the Crypto world. To build a new crypto world of order, autonomy, and equality.

The construction of CCN not only takes blockchain technology as support, but also has a reasonable economic incentive mechanism. Reasonable use of incentive mechanism is an effective means to stimulate all parties to participate in the construction of CCN.

A sound incentive mechanism, reasonable mechanism design from the perspective of leading efficiency and fair governance, can make the value generated by credit information flow effectively to the value provider in the blockchain world, punish the evil behavior, and resolve the conflict between individual interests and collective interests. It makes the individual’s behavior of pursuing individual interests unified with the goal of maximizing collective value.

Therefore, CCN can further clarify the economic interests of each participant and the overall interests of the network, so as to fully mobilize the enthusiasm of each participant and guarantee great development of CCN from the source.

The CCN consists of three different identities: Creator, Guardian, and Angel, all of them have established screening mechanisms. Only firm believers can obtain the CCN identity. Early believers are required to contribute to maintaining the stability of early CCN by burning GAC tokens. Therefore, they are not only holders of GaeaCoin, but also determined preachers and builders. When GaeaCoin issues additional shares, it will also receive a corresponding percentage of GAC tokens as a reward.

The establishment of this system aims to provide every GaeaCoin participant with the opportunity to contribute to the community construction, and to create a healthy crypto community culture of dedication and autonomy through consensus, symbiosis, co-construction, and sharing.

In CCN, although the identity is different, the residents on the chain of CCN build the initial transaction link according to their CID address, and constantly expand CCN on the chain. Open CID needs to be recommended by the network resident, once the link is formed, it cannot be changed forever. Each of the three different identities requires a different number of GAC tokens to burn, which can be viewed on the GaeaCoin network. GaeaCoin network residents have different rights according to their status.

The integration with the DEX: OxySwap has pioneered a full range of applications

There is a natural interdependence between exchange and stable currency. The exchange has always been an important part of crypto digital asset market, and it is also the first application place of stable currency. Like Binance with BUSD and Huobi with HUSD, OKEx also launched USDK on June 3, 2019. Traditional CEXs are fiat currencies, where fiat currencies are exchanged for cryptos. If you want to buy crypto digital assets, you need to top up fiat currency, which undoubtedly increases the economic and time costs of investors in the process of exchange. The emergence of a stable currency can not only solve the above problems but also effectively avoid legal risks in the process of the transaction.

As it should be, the integration of GaeaCoin ecology and OxySwap not only lay a solid foundation for stable currency: GAC token application, but also creates opportunities for it to open up more and wider application scenarios.

OxySwap is a decentralized exchange running on the BSC with a collection of DEX liquidity mining, which offers functions of exchange, liquidity, market making, and so on. The strength of OxySwap guarantees the usages of the stable currency: GAC.

GAC will lead a brighter way

GaeaCoin algorithm stable currency: GAC dares to face the challenge, according to the industry news, GAC praises is not only relatively stable from the concept, but also to really put into application. In addition to GAC (GaeaCoin), GaeaCoin ecology also includes GAB (GaeaCoin Bond) and GASH (GaeaCoin Share), which serve to maintain the stability of GAC. GaeaCoin Ecology also integrates GaeaCoin protocol, algorithm, robustness, price response, encryption, and other technologies, superposed with the DeFi ecology of Crypto Credit Network (CCN), OxySwap (DEX), and so on, providing a realistic solution for GAC, and leads it to move towards the real “stability”.

The integration of CCN and OxySwap points out the direction for the application of algorithmic stable currency. In fact, we can already feel the power of the GaeaCoin algorithm stable currency, and once it is used at a large scale, the ideal stable currency is expected to arrive ahead of time. DeFi will also build on this basis, using currency, lending, spot trading, and other components to build continuously upgraded Lego of DeFi.

GaeaCoin’s move directly challenges the world’s centralized stable currency giants such as USDT and USDC, but compared to the previous challenges of AMPL, BAC, and FRAX, this well-prepared challenge looks more anticipated!

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Flying Dresses International Solidifies Global Presence, Setting a New Standard for Experiential Luxury on the World’s Most Iconic Stages

Melbourne, Victoria, Australia, 6th Feb 2026 – Flying Dresses International has formally cemented its position as a global leader in experiential luxury, unveiling a new chapter of international activations that place couture, destination, and personal storytelling on some of the world’s most recognisable stages.

Over the past year, the brand has executed landmark experiences at locations rarely associated with fashion-led storytelling. These include a high-impact activation at Seattle’s Space Needle, a creative collaboration within Warner Bros. Studios in Los Angeles, and an international runway debut in Hawaii. Closer to home, Flying Dresses International has also taken to the runway in Tasmania and Cairns, marking its growing influence across Australia’s premium fashion and tourism markets.

What sets Flying Dresses International apart is not scale alone, but adoption. The brand has become a trusted creative partner for national pageant titleholders and international fashion ambassadors, positioning itself at the intersection of couture and cultural influence. These endorsements reflect a broader shift in luxury, where experience, symbolism, and authorship carry equal weight to design.

At the centre of this expansion is founder Maria Praljak, whose vision continues to shape the brand’s international relevance. A multi-award-winning entrepreneur, Praljak was recognised in both the Maldives and Dubai in 2025 for her contribution to global fashion tourism and women-led enterprise. With a background spanning law, politics, luxury yachting, and global travel, she has built Flying Dresses International into a platform that merges art direction, destination, and identity.

“We are not just a photoshoot; we are a foundry for modern icons,” says Maria Praljak, Founder of Flying Dresses International. “We provide the stage, the couture, and the art direction for a woman to forge her own ‘Insigne Dea’, a timeless testament to her power and her story.”

The January release of this announcement has been strategically timed to coincide with the commencement of Australia’s peak wedding season and the lead-up to major exhibitions in Melbourne. This timing positions Flying Dresses International directly in front of brides and luxury travellers during their most active planning window.

As the brand continues its international expansion across the United States, the Pacific, and Asia, Flying Dresses International is redefining how luxury fashion is experienced, documented, and remembered.

About Flying Dresses International

Flying Dresses International is a global luxury fashion and tourism brand specialising in high-impact couture experiences across iconic destinations. Operating across Europe, Asia, Australia, and the United States, the brand is known for combining statement gowns, cinematic art direction, and landmark locations to create powerful visual narratives for women worldwide. Flying Dresses International has become a recognised name within experiential luxury, pageantry, and destination fashion.

Instagram: @flying.dresses

Media Contact

Organization: Flying Dresses International

Contact Person: Maria Praljak

Website: https://flyingdresses.international/

Email:

maria@flyingdresses.international

City: Melbourne

State: Victoria

Country:Australia

Release id:41093

The post Flying Dresses International Solidifies Global Presence, Setting a New Standard for Experiential Luxury on the World’s Most Iconic Stages appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Elysium and Spotex Launch Integrated Front-to-Back Digital Asset Trading Platform for Institutional Markets

- Elysium and Spotex Deliver Integrated Front-to-Back Digital Asset Trading Solution for the Institutional Market

- Decade-Long Partnership Expands from FX to Cryptocurrency with Live Deployment at Major Crypto Broker

Chicago, IL, 6th January 2026, ZEX PR WIRE, Elysium and Spotex today announce the integration of Spotex’s institutional trading platform with Elysium’s MatchHub post-trade infrastructure. The integrated solution delivers a seamless front-to-back workflow for digital asset trading and has been successfully deployed at an established cryptocurrency broker, enabling optimized execution, reconciliation, and settlement across multiple custodians and clearing venues.

The combined offering represents a natural evolution of the two firms’ decade-long collaboration in traditional OTC foreign exchange markets. As both companies expanded their capabilities to serve the growing institutional digital asset ecosystem, the integration creates a comprehensive solution for firms operating in both FX and cryptocurrency markets.

The platform leverages Spotex’s api-driven execution capabilities—including price discovery, matching engine, cross-asset liquidity aggregation, and fiat-crypto pair pricing—with MatchHub’s back-end infrastructure for trade reconciliation, counterparty credit management, and multi-party settlement optimization. This end-to-end solution addresses the nuanced challenges faced by institutional crypto brokers managing multi-custodial relationships and diverse clearing arrangements across both traditional and digital assets.

“The growth of the crypto OTC market is supported in part by quality off-chain liquidity.” said Chris O’Connor, CEO of Elysium. “Spotex’s execution capabilities enable brokers to create a deep and diverse liquidity stack and Elysium’s MatchHub solves the complexity of the post-trade workflows.

“Our long history with Elysium in FX markets made this integration a natural evolution,” said John Miesner, CEO of Spotex. “Deploying our proven execution capabilities in digital assets along-side Elysium’s robust post-trade capabilities delivers the same operational excellence that institutional clients expect from their FX trading operations.”

The live deployment at the cryptocurrency broker showcases the platform’s ability to handle high-volume institutional trading while maintaining rigorous reconciliation and settlement standards across traditional banking infrastructure and digital asset custodial relationships. The bundled solution is immediately available to all institutional digital asset trading firms seeking to streamline their liquidity and enhance operational efficiency.

About Elysium

Elysium’s flagship platform, MatchHub, is the post-trade engine trusted by makers, takers, brokers, and prime brokers in an ever-evolving digital asset market. MatchHub delivers real-time trade capture, netting, settlement, and integrated credit controls through a fully branded client portal. With a track record spanning traditional finance and a dedicated crypto focus since 2018, Elysium combines deep market knowledge with cutting-edge engineering to power the next generation of institutional digital-asset infrastructure. For more information, visit www.elysiumtechgroup.com

About Spotex

Spotex is a leading institutional liquidity and trade execution platform serving the FX and digital asset markets. The company provides sophisticated market participants with access to deep liquidity pools, advanced execution algorithms, and comprehensive market analytics. With a decade of proven performance in traditional FX markets, Spotex has expanded its platform to serve the growing institutional cryptocurrency market. For more information, visit www.spotex.com.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Elysium and Spotex Launch Integrated Front-to-Back Digital Asset Trading Platform for Institutional Markets

- Elysium and Spotex Deliver Integrated Front-to-Back Digital Asset Trading Solution for the Institutional Market

- Decade-Long Partnership Expands from FX to Cryptocurrency with Live Deployment at Major Crypto Broker

Chicago, IL, 6th January 2026, ZEX PR WIRE, Elysium and Spotex today announce the integration of Spotex’s institutional trading platform with Elysium’s MatchHub post-trade infrastructure. The integrated solution delivers a seamless front-to-back workflow for digital asset trading and has been successfully deployed at an established cryptocurrency broker, enabling optimized execution, reconciliation, and settlement across multiple custodians and clearing venues.

The combined offering represents a natural evolution of the two firms’ decade-long collaboration in traditional OTC foreign exchange markets. As both companies expanded their capabilities to serve the growing institutional digital asset ecosystem, the integration creates a comprehensive solution for firms operating in both FX and cryptocurrency markets.

The platform leverages Spotex’s api-driven execution capabilities—including price discovery, matching engine, cross-asset liquidity aggregation, and fiat-crypto pair pricing—with MatchHub’s back-end infrastructure for trade reconciliation, counterparty credit management, and multi-party settlement optimization. This end-to-end solution addresses the nuanced challenges faced by institutional crypto brokers managing multi-custodial relationships and diverse clearing arrangements across both traditional and digital assets.

“The growth of the crypto OTC market is supported in part by quality off-chain liquidity.” said Chris O’Connor, CEO of Elysium. “Spotex’s execution capabilities enable brokers to create a deep and diverse liquidity stack and Elysium’s MatchHub solves the complexity of the post-trade workflows.

“Our long history with Elysium in FX markets made this integration a natural evolution,” said John Miesner, CEO of Spotex. “Deploying our proven execution capabilities in digital assets along-side Elysium’s robust post-trade capabilities delivers the same operational excellence that institutional clients expect from their FX trading operations.”

The live deployment at the cryptocurrency broker showcases the platform’s ability to handle high-volume institutional trading while maintaining rigorous reconciliation and settlement standards across traditional banking infrastructure and digital asset custodial relationships. The bundled solution is immediately available to all institutional digital asset trading firms seeking to streamline their liquidity and enhance operational efficiency.

About Elysium

Elysium’s flagship platform, MatchHub, is the post-trade engine trusted by makers, takers, brokers, and prime brokers in an ever-evolving digital asset market. MatchHub delivers real-time trade capture, netting, settlement, and integrated credit controls through a fully branded client portal. With a track record spanning traditional finance and a dedicated crypto focus since 2018, Elysium combines deep market knowledge with cutting-edge engineering to power the next generation of institutional digital-asset infrastructure. For more information, visit www.elysiumtechgroup.com

About Spotex

Spotex is a leading institutional liquidity and trade execution platform serving the FX and digital asset markets. The company provides sophisticated market participants with access to deep liquidity pools, advanced execution algorithms, and comprehensive market analytics. With a decade of proven performance in traditional FX markets, Spotex has expanded its platform to serve the growing institutional cryptocurrency market. For more information, visit www.spotex.com.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release6 days ago

Five Global Megatrends Highlighted at Open Dialogue Expert Forum at the Russia National Centre

-

Press Release3 days ago

GISEC Global to Launch Cyber Diplomacy Forum in 2026 as Cybersecurity Moves Centre-Stage in Global Trade and Foreign Policy

-

Press Release1 week ago

CMS (867.HK/8A8.SG): Ruxolitinib Phosphate Cream Obtained China NDA Approval, Becoming The First and Only Targeted Drug for Vitiligo in China

-

Press Release1 week ago

Roger Haenke Connects Healthcare and Faith in a Career Centered on Presence and Support

-

Press Release1 week ago

Cloudbet Academy Launches World Cup 2026 Betting Guide: Crypto Strategies and Tournament Insights

-

Press Release1 week ago

Gabriel Malkin Florida Completes 120-Mile Camino Walk with Focus, Patience, and Preparation

-

Press Release6 days ago

Broadway Polaroids Advocates for Authentic Access and Creative Preservation in Theatre

-

Press Release1 week ago

Jon DiPietra Debunks 5 Real Estate Myths That Mislead New Yorkers