Press Release

DeFi’s dark horse in lending ——BDMProtocol

DeFi , decentralized finance , will be the most important track for blockchain in the future .DeFi advanced all the way in the impetuous state of the huge market prospects behind DeFi .BDMProtocol moves into the lending field for DeFi and became a global dark horse .

BDMProtocol: blockchain world “Ant Financial Services Group”

BDMProtocol is a global open financial application platform based on blockchain and crypto currency . The BDM ecosystem covers financial services , cultural entertainment , IP copyright , Internet of Things , sharing economy and other scenarios .

The BDM development team is committed to reshaping the global financial ecology with blockchain technology , building BDMProtocol projects , and creating DeFi ecological agreements and encrypted asset value investment entrance .At the same time , the self – developed BDMProtocol protocol creates more practical functions for BDM DAPP applications , such as the realization of safe and efficient clearing and payment system , P2P exchange , supply chain logistics , personal or institutional identity certification , evidence retention , automatic execution of intelligent contracts , etc .

On the basis of BDMProtocol, the development team also builds incentive side chains, issues BDM certificates, opens up the DeFi financial ecology through the circulation of certificates, solves the problems of currency cross-border circulation and currency exchange, and realizes high value circulation in the scenarios of pledge lending, liquidity mining, contract trading, and decentralized exchanges. BDM tokens are supported by the DeFi model and BDMProtocol agreement, and are committed to driving the landing of blockchain technology in the financial field and the real business field, enabling the innovative financial business ecosystem in the era of value internet.

Nirvana Rebirth ——DeFi Lending

DeFi field has experienced a climax fade, BDM strong circle so that DeFi lending Nirvana rebirth, again ushered in a highlight. Different from IPFS,BDMProtocol, we focus on solving the pain points of the industry :(1) ownership of data ;(2) lack of trust ;(3) complex chain, asymmetric allocation of resources and information.

Based on the experience accumulated in the fields of block chain, finance, technology investment and so on, BDM endorse and develop the team with strong strength to aim at the pain point, take the initiative to attack, reshape the global financial ecology to build the DeFi ecological protocol and encrypt the asset value investment entrance, and realize the financial value system of decentralization finance and reliable and transparent assets on the chain.

BDMProtocol: the Value and Interaction Model of the Financial World

BDMToken is the only value circulation certificate in the BDMProtocol ecosystem, which will undertake the mission of building DeFi ecology with everyone. A total circulation of 21 million, to the DeFi’s pioneer bitcoin.

The transfer destruction mechanism has now been added to the BDM. For each chain transfer interaction ,0.1 per cent of the transfer amount will be destroyed automatically, and more deflation mechanisms will be added BDM the future, which will enable the formation of a 100 per cent aggregate liquidity mining pattern. The BDM has a very rich pool for users and investors to choose from, including:

(1) Social mining: inviting friends to join the BDM ecological BDM to obtain

(2) LP mining: participation in mobile mining BDM obtained

(3) Borrowing and mining: BDM to deposit and borrow money

BDM cater to the decentralized scene to add the elements of social motivation, increase the invitation pool of play, can activate the enthusiasm of user participation, create a defi application system for everyone to share and participate in.

BDMProtocol Target —— creates a trillion – level DeFi infrastructure platform

There is no doubt that the BDMProtocol’s first lending and social agreements will be an unprecedented financial creation and a leader in block chain DeFi. As a completely decentralized DeFi platform, BDM can have both decentralized security and credibility and high performance of keeping millions of transactions concurrent.

Therefore, in the field of finance, BDM will be an important prerequisite for the construction of DeFi distributed financial system and the landing of commercial payment.

BDM the application of financial scenarios to reshape the value and interaction model of the financial world. BDM’s biggest project highlights are:

(1) Improve liquidity, project cold start.

(2) Connected value island, promote price discovery.

(3) Free and open API game applications, BDMProtocol protocol development Dapps, the game industry trades with users through BDM tokens.

(4) Unified transaction and exchange based on BDM tokens, TOKEN conversion and transaction across different business games and products.

Looking forward to the future, we BDM move forward, integrate many industries, organize multilingual platforms, carry out cooperative operation of global business, create a trillion-level DeFi infrastructure platform, and actively promote the online plan of overseas BDM. BDM is not a speculative success of the “flash in the pan “, but a steady road to the king, BDM will lay a leading glory, hand in hand with global aspirations to share wealth feast!

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Airwheel Announces Expanded Global Deployment of AI-Enabled Rideable Smart Electric Cabin Suitcase

Brussels, Belgium – Airwheel recently announced the expanded global deployment of its AI-enabled rideable electric cabin suitcase, as the company responds to rising international travel volumes and growing demand for intelligent short-distance mobility solutions in airports, rail terminals, and large transportation venues worldwide. A new product category is rapidly entering the mainstream—one that combines hardware innovation, intelligent control systems, and a redefinition of travel behavior. At the forefront of this shift is Airwheel rideable electric suitcase.

Within this emerging category, Airwheel has distinguished itself through long-term technological accumulation and a systematically built global presence, increasingly positioning the company as a high-potential technology opportunity for 2026. Airwheel has secured 600+ patents worldwide, spanning motion control algorithms, electric drive systems, intelligent sensing, and structural engineering, all of which have been successfully industrialized and deployed at scale in real-world products.

Complementing its technology base, Airwheel has completed trademark registrations in over 168 countries and regions, enabling global compliance and commercialization. The company has received the 2025 Global Recognition Award , and its products have earned multiple international honors, including the IDEA Design Award (USA), IAI International Design Award, and Berlin Design Award, validating its competitiveness across technology, design, and user experience.

, and its products have earned multiple international honors, including the IDEA Design Award (USA), IAI International Design Award, and Berlin Design Award, validating its competitiveness across technology, design, and user experience.

From Luggage to Intelligent Mobility Terminal

Traditionally, luggage has served a purely passive role—storage and transport. Airwheel fundamentally redefines this category by embedding personal short-distance mobility into luggage itself, transforming it into an active intelligent mobility terminal.

In environments such as airports, high-speed rail stations, and large venues, users can ride directly through terminals, significantly reducing physical strain while gaining measurable efficiency and experiential advantages. This structural upgrade in user experience is allowing electric luggage to move beyond novelty and toward scalable, repeatable adoption.

Product Portfolio: Scalable Solutions Across Travel Scenarios

Airwheel’s flagship carry-on-compliant model, the SE3S Series features a removable lithium battery meeting airline carry-on regulations, resolving one of the biggest barriers to smart luggage adoption. With a top speed of 13 km/h, 110 kg load capacity, patented stability architecture, and Apple Find My integration, SE3S delivers a rare combination of compliance, performance, and ecosystem-level intelligence. The series has achieved strong global adoption, high repeat purchase rates, and billions of views across social media, becoming a phenomenon-level product in smart travel.

Designed for children, the SQ3S Series integrates rideable, check-in-ready, and companion-friendly use into a single intelligent product. Optimized for children’s body dynamics and behavior patterns, it enhances safety, simplifies control, and transforms children from passive followers into active participants—while significantly reducing parental travel stress.

Targeting family and companion travel, the SE3T Series is a 24-inch large-capacity rideable luggage solution featuring a 52 cm extended wheelbase, optimized center of gravity, dual-rider support, and 48-liter internal capacity. It seamlessly integrates riding, pulling, and storage modes, positioning luggage as a proactive mobility tool for longer journeys and family travel.

Beyond Smart Suitcase: Toward AI-Enabled Personal Mobility

For Airwheel, rideable smart electric cabin suitcase represents only the entry point. The company is extending its capabilities from hardware manufacturing into AI-driven motion control, multi-sensor perception, edge computing, and human–machine interaction, laying the groundwork for consumer-grade personal mobility robots.

Media Contact

Company: Airwheel

Contact: Media Team

Email: Jonas@airwheel.net

Website: https://www.airwheel.net

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Cancos Tile and Stone Introduces Oasis: A Premium Italian Wood-Look Porcelain Collection Designed for 2026

United States, 9th Feb 2026 — Cancos Tile & Stone, one of New York’s leading tile and stone suppliers with more than 70 years of industry expertise, proudly announces the launch of Oasis, a new premium porcelain wood-look flooring collection crafted in Italy and developed for modern residential and commercial design.

Engineered to bring warmth, tranquility, and natural beauty to any space, Oasis combines advanced porcelain technology with the authentic look and feel of real wood. The collection features extra-large plank formats (8×48 and 12×65) and a refined palette of four organic colors, Clay, Oak, Sand, and White, designed to complement a broad range of aesthetics, from minimalist and spa-inspired to cozy, elevated contemporary.

Key Features of the Oasis Collection

- Italian Crafted Premium Porcelain: Manufactured using advanced European production standards.

- Extra-Large Planks: Offered in 8×48 and 12×65 for dramatic, seamless floor visuals.

- Advanced 3D Texture Technology: Realistic grain, depth, and tactile surface variation.

- Four Nature-Inspired Colors: Clay, Oak, Sand, and White.

- Durable & Low Maintenance: Scratch-, stain-, and moisture-resistant, ideal for high-traffic environments.

- Versatile Applications: Perfect for kitchens, baths, living spaces, retail, hospitality, multifamily, and more.

Designed for homeowners, architects, designers, developers, and trade professionals seeking elevated aesthetics with long-term durability, Oasis expands Cancos’ growing portfolio of premium, design-forward porcelain offerings.

The collection is now available across all 12 Cancos Tile & Stone showroom locations, as well as through authorized commercial and distribution partners.

About Cancos Tile & Stone

Cancos Tile & Stone is a fourth-generation, family-owned business serving New York and the Northeast for over 70 years. With 12 premium showrooms, an in-house stone fabrication facility, and exclusive partnerships with world-class manufacturers, Cancos delivers exceptional tile, stone, and fabrication solutions to residential, commercial, and trade customers. The company is renowned for its commitment to innovation, design excellence, and customer service.

For press inquiries, samples, or high-resolution product images, please contact:

Cancos Tile & Stone – Marketing Department

Email: marketing@cancostile.com

Website: www.cancostile.com

Media Contact

Organization: Cancos Tile & Stone

Contact Person: A. Linder

Website: https://cancostileandstone.com/

Email: Send Email

Country:United States

Release id:41157

The post Cancos Tile and Stone Introduces Oasis: A Premium Italian Wood-Look Porcelain Collection Designed for 2026 appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

AI-Powered Energy Independence- Ktech to Showcase Energy Storage and AI Management Solutions at Intersolar 2026

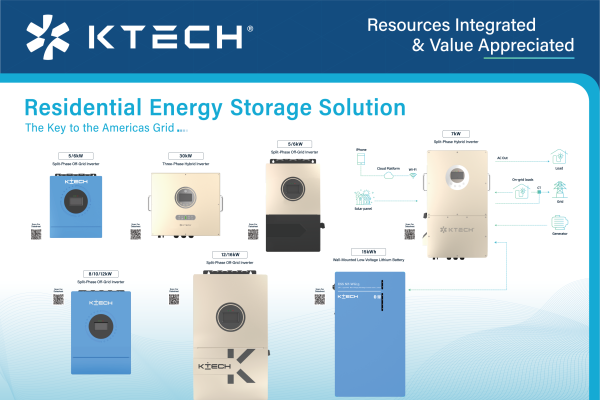

Industry Pioneer Debuts Six Inverters + Battery System to Deliver 24-Hour Backup, Enhance Energy Efficiency

Wuxi, China, 9th Feb 2026 — Ktech, a global pioneer in integrated energy solutions of Wuxi Ktech New Energy Technology Co., Ltd., is set to redefine residential energy resilience at Intersolar & Energy Storage North America 2026 (February 18-20, San Diego Convention Center, Booth #3615). The company will launch six cutting-edge inverters and a high-performance battery system—addressing North America’s urgent grid challenges, from California’s wildfire blackouts to Texas’ winter storm failures. As the renewable energy transition accelerates (with residential solar adoption projected to grow 15% annually through 2030), Ktech’s “Resources Integrated & Value Appreciated” ecosystem empowers homeowners to take control of their energy future amid escalating grid unreliability.

“Today’s North American homeowners face a defining choice: remain vulnerable to costly outages and rising electricity rates, or embrace energy independence,” said Jim Chen, Ktech’s Chief Technology Officer. “Our new lineup turns homes into self-sufficient hubs—optimizing monthly energy usage and costs, providing 24 hours of backup power during blackouts, and enabling participation in VPP—all while meeting UL safety standards. In an era where 1 in 3 U.S. households experienced a grid outage last year, this isn’t just innovation—it’s essential protection.”

Against a backdrop of extreme weather and aging infrastructure, Ktech’s solutions fill a critical gap: utilities struggle to balance surging renewable demand with outdated grids, leaving millions exposed. The brand’s technology delivers decentralized resilience, reducing strain on centralized systems while giving users enhanced control—aligning with the industry’s shift toward “consumer-centric energy ecosystems.”

A Solution for Every Residential Need

Ktech’s exhibit features tailored inverters and a seamless battery system, designed to scale with diverse lifestyles:

The KE-N Series Split Phase Hybrid Inverters (5-12kW) set a new standard for hybrid performance, with 99% MPPT efficiency and 2x surge capacity for heavy loads. Integrated AFCI/RSD safety and VPP compatibility let homeowners benefit from participation in utility demand response programs. Paired with smart home integration, users monitor energy flows and auto-activate backup via a mobile app—core to Ktech’s AI energy management approach.

For larger homes and light commercial use, the Kayis Series High Voltage Three-Phase Hybrid Inverters (30-60kW) offer 150V low-voltage ride-through and generator integration. Supporting 10 parallel units, it scales with growing energy needs (e.g., EV charging, home offices) and stabilizes grids via reactive power compensation—ideal for utilities adopting distributed resources.

Off-grid users benefit from the KE-F Series (5-12kW) and Kayis Series Split Phase Off-Grid Inverters (5-16kW). The KE-F’s dual MPPT trackers and IP66 rating (operating from -40 degrees Celsius to 60 degrees Celsius) power remote cabins/farms reliably. The 16KW Kayis Series’ 10ms transfer switch and Smart Load prioritization ensure life-sustaining devices (medical equipment, refrigeration) stay online—even with limited battery.

All inverters pair with Ktech’s Residential Battery System (5-20kWh), featuring lithium-iron-phosphate chemistry, 95% round-trip efficiency, and a 10-year warranty. Its integrated BMS monitors cell health, while scalability lets homeowners start small (5kWh for daily load shifting) and expand to 20kWh for 24+ hours of backup—solving the “range anxiety” of energy storage.

Built for North America, Backed by Local Support

Engineered for regional compatibility, all models hold UL 1741, Rule 21, and UL 991 certifications, with 120/240V split-phase architecture eliminating costly transformers. Ktech boasts a well-established local after-sales service network and strategically located warehousing facilities across North America, ensuring timely technical support, rapid spare parts delivery, and efficient logistics for installers and homeowners alike.“Our inverters work with 95% of North American modules and batteries,” noted Frank Zhang, the Director of Product Development. “We’ve invested in local testing to ensure safety and performance, removing adoption barriers.”

Ktech will announce expanded North American support at the show: regional training centers, 24/7 NABCEP-certified technical support, and an installer portal with troubleshooting tools. This commitment ensures seamless deployment and long-term reliability—key to user trust in the energy storage space.

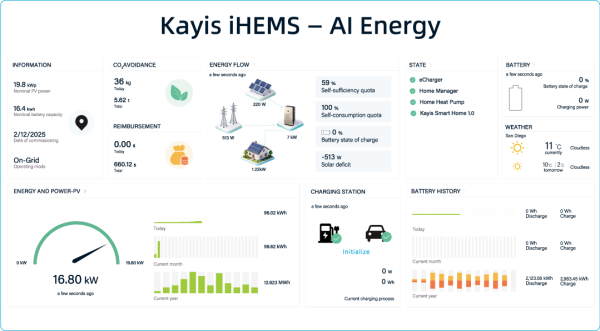

AI-Powered Energy Management

The exhibit highlights the iHEMS Intelligent Home Energy Management System, Ktech’s AI-driven platform that learns household patterns. It optimizes battery charging (low-demand/high-solar periods) and discharging (peak-price hours), supporting potential savings and grid independence. As AI becomes central to energy efficiency (industry forecasts predict 70% of residential storage will include AI by 2028), iHEMS positions Ktech at the forefront of smart, sustainable energy.

“Intersolar North America is where the future of energy is built,” said Brian Chen, Ktech’s CEO. “Our 2026 lineup isn’t just products—it’s a vision: energy independence, outage protection, and AI-powered savings for every home. The exhibition at Booth #3615 will showcase Ktech’s approach to residential energy generation, storage, and use across North America.”

KTECH at Intersolar 2026

- Booth #3615

- Dates: February 18-20, 2026

- Location: San Diego Convention Center, San Diego, CA

Media Contact

Organization: Ktech Energy Co., Ltd.

Contact Person: Qiran Wang

Website: https://www.ktechsolar.com

Email: Send Email

City: Wuxi

Country:China

Release id:41129

The post AI-Powered Energy Independence- Ktech to Showcase Energy Storage and AI Management Solutions at Intersolar 2026 appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release5 days ago

GISEC Global to Launch Cyber Diplomacy Forum in 2026 as Cybersecurity Moves Centre-Stage in Global Trade and Foreign Policy

-

Press Release1 day ago

WEIVA Strengthens China’s Enterprise Storage Supply Chain With Advanced Huawei and SSD Solutions

-

Press Release1 week ago

In Defense of Stillness: Saswat Panda’s Argument for Slowing Down in a Hyper-Digital Photography Culture

-

Press Release1 week ago

TopTrendBox Emerges as a Leading Online Shopping Platform for Affordable, High-Quality Essential Newborn Products

-

Press Release3 days ago

Flying Dresses International Solidifies Global Presence, Setting a New Standard for Experiential Luxury on the World’s Most Iconic Stages

-

Press Release2 days ago

From Ben Srour to Global Recognition: The Inspiring Journey of Mohamed Benmagri

-

Press Release1 week ago

From Family Roots to Fortune 500: Douglas Salinas Webster’s Journey in Marketing Excellence

-

Press Release1 day ago

Maids in Brown Earns Best of Arlington Award for House Cleaning Excellence