Press Release

Dolly Varden Silver CEO Shawn Khunkhun Explains the Impact of the NYSE Listing

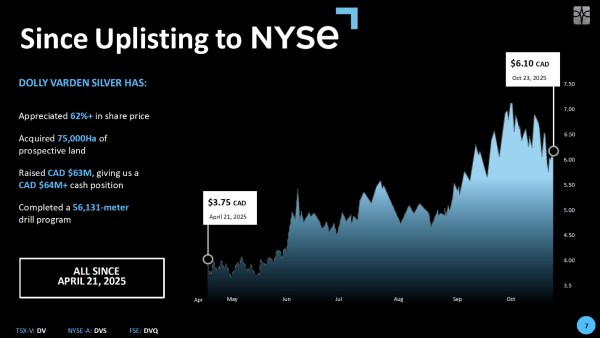

Seven months ago, Dolly Varden Silver announced that its shares would begin trading on the New York Stock Exchange under the symbol DVS. At the time, Shawn Khunkhun, President and CEO of Dolly Varden Silver stated, “By listing on the NYSE American, we are gaining access to the world’s largest and most liquid equity markets, which we believe will create significant value for our shareholders.”

Canada, 28th Nov 2025 – Global Stocks News – Sponsored content disseminated on behalf of Dolly Varden Silver. Seven months ago, Dolly Varden Silver (TSX-V: DV) (NYSE MKT: DVS) (FSE: DVQ) announced that its shares would begin trading on the New York Stock Exchange (NYSE) under the symbol DVS.

At the time, Shawn Khunkhun, President and CEO of Dolly Varden Silver stated, “By listing on the NYSE American, we are gaining access to the world’s largest and most liquid equity markets, which we believe will create significant value for our shareholders.”

“A lot has happened in the last seven months,” Khunkhun confirmed to Guy Bennett, the CEO of Global Stocks News (GSN), in an exclusive interview. “We’ve raised $62 million, drilled 55,000 meters, increased our metal inventory, purchased three properties, Mountain Boy, Kinskuch and Porter, which has expanded our land package to over 100,000 hectares.”

“In the wake of these milestones, and stock price appreciation, I still get questions from investors about the impact of the NYSE listing.”

“Prior to April 21, 2025, it was not easy for US-based investors to buy our stock,” Khunkhun told GSN. “Each US institution has its own rules. Goldman Sachs, for instance, has price requirements. Typically, to buy Dolly Varden stock, a US investor would be forced to open a discount brokerage account, and probably get an agent on the phone, before executing a trade. There was significant friction, blocking that potential inflow of investment dollars.”

Gallup data from May, 2025 reveals that 62% of Americans own some stocks, directly, in mutual funds or retirement accounts. Retail investors account for approximately 25% of total US equities trading volume. The total value of all stocks listed on the NYSE, Nasdaq and OTCQX is currently $67 trillion.

“In the six months following the US listing, our share price appreciated 62%,” Khunkhun told GSN. “In the last couple of months it has pulled back from $7 to $5.50”

“Having direct access to US investors gives us a higher ROI on marketing,” continued Khunkhun. “If you go from a pool of 10,000 investors to 6 million, that changes your metrics, your conversion rate.”

“It’s 7:45 am in Vancouver, and we’ve traded $823,000 US dollar volume, which is $1.16 million CDN,” said Khunkhun, glancing at his computer screen in his Vancouver office. “On the TSX-V, we’ve traded $372,000. There’s about 3.5X the dollar liquidity in the US, compared to Canada. Going forward, it makes sense to focus more of our marketing programs on the US. I’d like to see the dollar liquidity in the US 9X higher than in Canada.”

“Listing on the NYSE incurs costs related to compliance, insurance and lawyers’ fees,” Khunkhun told GSN. “But I believe the timing is right. With high government deficits, debts and inflation, generalists are entering the precious metal sphere for the first time.”

“Dolly Varden has secured approximately 100,000 hectares of prospective land containing five past-producing silver mines,” stated Crux Investor. “Under Khunkhun’s leadership over the past five years, the company has grown from a $20 million valuation to approximately $600 million.”

“This growth stems from two strategic pillars: aggressive drilling programs totalling 196,000 meters that have unlocked substantial silver inventory, and accretive acquisitions executed primarily through share transactions to preserve cash for exploration.”

In the “Pitch Perfect” Crux Investor video below, Khunkhun gives an overview of the Dolly Varden Silver investment opportunity.

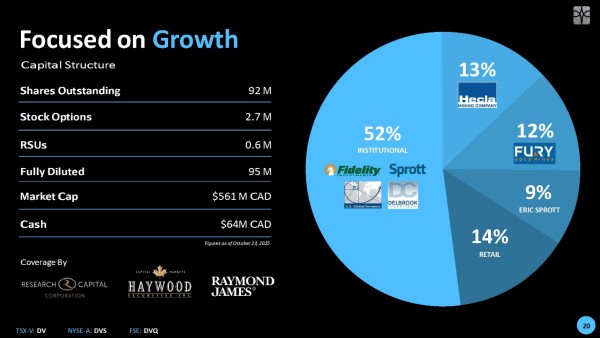

“Some of the best performing investments are ones where you have a small free trading float,” stated Khunkhun in the Crux Investor video. “Our institutional ownership is over 50%, the corporate ownership is over 25% and Mr. Eric Sprott owns about 10%. That leaves less than 15% in the hands of the public.”

“Since April, we’ve been in an environment where the price of silver has doubled, and because of this small concentration in the hands of the public, we are outperforming the silver index.”

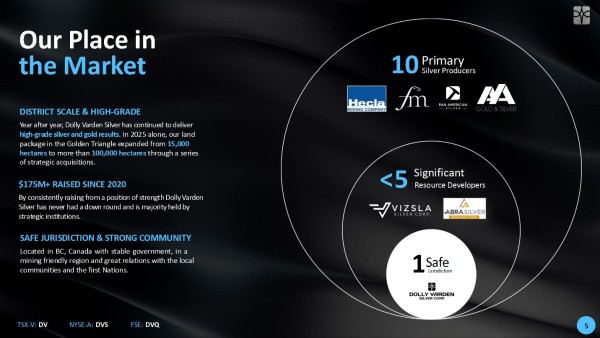

“There are only 10 primary silver producers,” continued Khunkhun. “We are a company that represents one of five opportunities that are either going to be takeover candidates or the next producers.”

“What differentiates us from our peer group is location. Yes, we have a high-grade project. Yes, we have a large silver inventory. But what makes Dolly Varden unique, in a very scarce market, is our location.”

The Fraser Institute’s Policy Perception Index (PPI) ranks Canada as the 3rd most appealing region for investment, after the United States and Australia.

Canada’s mining industry plays a crucial role in the economy, contributing C$161 billion to GDP and accounting for 21% of total exports in 2024.

The mining sector generates 700,000 direct and indirect jobs. It is also the largest employer of Indigenous people in Canada, fostering significant business partnerships with Indigenous-owned enterprises.

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101, has reviewed, validated and approved the scientific and technical information contained in this GSN release.

Disclaimer: Dolly Varden Silver paid GSN $1,750 for the research, creation and dissemination of this content.

Contact: guy.bennett@globalstocksnews.com

Full Disclaimer: Global Stocks News (GSN) researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN makes no recommendation to purchase any individual stock. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:38026

The post Dolly Varden Silver CEO Shawn Khunkhun Explains the Impact of the NYSE Listing appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Ikinor 2026: Advancing Smart Manufacturing to Lead the Global Commercial Display Market

Singapore, 31st Jan 2026 Driven by the strategic momentum of Made in China 2025 and the rapid integration of intelligent manufacturing technologies, the global commercial display industry is entering a new phase of transformation. Headquartered in Dongguan, one of China’s most important manufacturing and innovation hubs, Ikinor is emerging as a key force shaping this evolution. As the company moves into 2026, Ikinor is accelerating its growth through smart manufacturing, diversified product lines, and an increasingly ambitious global market strategy.

Policy-Driven Growth and Global Expansion

Benefiting from the long-term policy support of Made in China 2025 and Dongguan’s strong electronics and intelligent hardware ecosystem, Ikinor has developed into a recognized high-tech innovation enterprise in China. By continuously upgrading automated production lines, strengthening quality control systems, and investing in R&D, the company has significantly enhanced its manufacturing efficiency and product consistency.

These capabilities have translated directly into strong export performance. Over recent years, Ikinor has achieved steady growth in overseas shipments, successfully expanding its footprint across Latin America, Southeast Asia, and the Middle East. The company’s progress reflects not only the competitiveness of Chinese manufacturing, but also the growing global demand for reliable, high-performance commercial display solutions.

From a Single Product Line to a Complete Display Ecosystem

Strategically, Ikinor has evolved far beyond its original focus on interactive displays and smart boards. Today, the company operates a diversified product portfolio that covers both interactive display and digital signage solutions, enabling it to address a wider range of commercial scenarios.

In response to changing market demand, Ikinor has introduced new digital signage products such as floor-standing advertising displays, portable smart TVs, and interactive kiosks. These solutions are designed for retail environments, exhibitions, corporate spaces, public venues, and flexible mobile applications.

Among them, the portable smart TV has gained strong traction in Latin American and Southeast Asian markets. Its mobility, ease of installation, and competitive pricing have made it a popular choice for distributors and end users alike. At the same time, Ikinor is actively embracing artificial intelligence, launching AI-powered commercial display solutions such as RK3588-based interactive displays. These products deliver enhanced computing performance and intelligent features, supporting next-generation applications in smart meetings, digital retail, and collaborative workspaces.

Recognized as a Leading Global Manufacturer

With its stable product quality, mature OEM/ODM capabilities, and responsive delivery systems, Ikinor is now widely recognized as one of the world’s leading manufacturers of smart boards and interactive displays. In an increasingly competitive global market, this reputation reflects not only technological strength, but also long-term reliability as a supply chain partner.

The company’s ability to customize products for different regions, comply with international standards, and support distributors with scalable manufacturing capacity has positioned Ikinor as a trusted name in the commercial display industry.

Clear Dual-Structure Organization for Focused Growth

To support sustainable expansion, Ikinor operates under a clear dual-structure framework:

- Ikinor Technology, which focuses on interactive displays and smart board solutions, primarily serving education, corporate collaboration, and high-end commercial applications.

- Ikinor Industry, which is dedicated to the rapidly growing digital signage business, including advertising displays, kiosks, and other public-facing commercial display systems.

This structure allows each business unit to concentrate on its respective market segment, accelerate innovation, and deliver more specialized solutions to global clients.

Global Exhibitions and Market Strategy for 2026

Looking ahead to 2026, Ikinor has outlined an extensive international exhibition and market expansion plan. The company will showcase its latest technologies and products at major global events, including CES 2026, GESS Dubai, the Canton Fair, South Africa AES, ISE 2026, and the 11th China (Indonesia) Export Brand Exhibition 2026.

From a regional perspective, Ikinor will prioritize deeper penetration into key growth markets. These include Latin America—particularly Brazil and Mexico—Southeast Asia, with a focus on the Philippines, Indonesia, and Malaysia, and the Middle East, including Saudi Arabia, Jordan, and the United Arab Emirates. Through localized partnerships and channel development, Ikinor aims to strengthen its presence and brand influence in these strategic regions.

Proven Market Success and Channel Recognition

Ikinor’s products have already demonstrated strong market performance worldwide. In countries such as Brazil, Saudi Arabia, the UAE, the Philippines, and Indonesia, multiple local distributors using Ikinor solutions have achieved top sales rankings in their respective markets. These results underscore the competitiveness of Ikinor’s offerings and the company’s ability to support partners with dependable products and scalable supply.

Today, Ikinor is increasingly viewed as a preferred choice across the commercial display, digital signage, and interactive display supply chain.

Looking Forward

As it enters 2026, Ikinor remains committed to smart manufacturing, AI-driven innovation, and global market expansion. By combining advanced technology with a strong international strategy, the company is well positioned to play a leading role in shaping the future of commercial displays worldwide.

Media Contact

Organization: Ikinor technology

Contact Person: Media Relations

Website: https://ikinor-interactive.com/

Email: Send Email

Country:Singapore

Release id:40849

The post Ikinor 2026: Advancing Smart Manufacturing to Lead the Global Commercial Display Market appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Ikinor 2026: Advancing Smart Manufacturing to Lead the Global Commercial Display Market

Singapore, 31st Jan 2026 Driven by the strategic momentum of Made in China 2025 and the rapid integration of intelligent manufacturing technologies, the global commercial display industry is entering a new phase of transformation. Headquartered in Dongguan, one of China’s most important manufacturing and innovation hubs, Ikinor is emerging as a key force shaping this evolution. As the company moves into 2026, Ikinor is accelerating its growth through smart manufacturing, diversified product lines, and an increasingly ambitious global market strategy.

Policy-Driven Growth and Global Expansion

Benefiting from the long-term policy support of Made in China 2025 and Dongguan’s strong electronics and intelligent hardware ecosystem, Ikinor has developed into a recognized high-tech innovation enterprise in China. By continuously upgrading automated production lines, strengthening quality control systems, and investing in R&D, the company has significantly enhanced its manufacturing efficiency and product consistency.

These capabilities have translated directly into strong export performance. Over recent years, Ikinor has achieved steady growth in overseas shipments, successfully expanding its footprint across Latin America, Southeast Asia, and the Middle East. The company’s progress reflects not only the competitiveness of Chinese manufacturing, but also the growing global demand for reliable, high-performance commercial display solutions.

From a Single Product Line to a Complete Display Ecosystem

Strategically, Ikinor has evolved far beyond its original focus on interactive displays and smart boards. Today, the company operates a diversified product portfolio that covers both interactive display and digital signage solutions, enabling it to address a wider range of commercial scenarios.

In response to changing market demand, Ikinor has introduced new digital signage products such as floor-standing advertising displays, portable smart TVs, and interactive kiosks. These solutions are designed for retail environments, exhibitions, corporate spaces, public venues, and flexible mobile applications.

Among them, the portable smart TV has gained strong traction in Latin American and Southeast Asian markets. Its mobility, ease of installation, and competitive pricing have made it a popular choice for distributors and end users alike. At the same time, Ikinor is actively embracing artificial intelligence, launching AI-powered commercial display solutions such as RK3588-based interactive displays. These products deliver enhanced computing performance and intelligent features, supporting next-generation applications in smart meetings, digital retail, and collaborative workspaces.

Recognized as a Leading Global Manufacturer

With its stable product quality, mature OEM/ODM capabilities, and responsive delivery systems, Ikinor is now widely recognized as one of the world’s leading manufacturers of smart boards and interactive displays. In an increasingly competitive global market, this reputation reflects not only technological strength, but also long-term reliability as a supply chain partner.

The company’s ability to customize products for different regions, comply with international standards, and support distributors with scalable manufacturing capacity has positioned Ikinor as a trusted name in the commercial display industry.

Clear Dual-Structure Organization for Focused Growth

To support sustainable expansion, Ikinor operates under a clear dual-structure framework:

- Ikinor Technology, which focuses on interactive displays and smart board solutions, primarily serving education, corporate collaboration, and high-end commercial applications.

- Ikinor Industry, which is dedicated to the rapidly growing digital signage business, including advertising displays, kiosks, and other public-facing commercial display systems.

This structure allows each business unit to concentrate on its respective market segment, accelerate innovation, and deliver more specialized solutions to global clients.

Global Exhibitions and Market Strategy for 2026

Looking ahead to 2026, Ikinor has outlined an extensive international exhibition and market expansion plan. The company will showcase its latest technologies and products at major global events, including CES 2026, GESS Dubai, the Canton Fair, South Africa AES, ISE 2026, and the 11th China (Indonesia) Export Brand Exhibition 2026.

From a regional perspective, Ikinor will prioritize deeper penetration into key growth markets. These include Latin America—particularly Brazil and Mexico—Southeast Asia, with a focus on the Philippines, Indonesia, and Malaysia, and the Middle East, including Saudi Arabia, Jordan, and the United Arab Emirates. Through localized partnerships and channel development, Ikinor aims to strengthen its presence and brand influence in these strategic regions.

Proven Market Success and Channel Recognition

Ikinor’s products have already demonstrated strong market performance worldwide. In countries such as Brazil, Saudi Arabia, the UAE, the Philippines, and Indonesia, multiple local distributors using Ikinor solutions have achieved top sales rankings in their respective markets. These results underscore the competitiveness of Ikinor’s offerings and the company’s ability to support partners with dependable products and scalable supply.

Today, Ikinor is increasingly viewed as a preferred choice across the commercial display, digital signage, and interactive display supply chain.

Looking Forward

As it enters 2026, Ikinor remains committed to smart manufacturing, AI-driven innovation, and global market expansion. By combining advanced technology with a strong international strategy, the company is well positioned to play a leading role in shaping the future of commercial displays worldwide.

Media Contact

Organization: Ikinor technology

Contact Person: Media Relations

Website: https://ikinor-interactive.com/

Email: Send Email

Country:Singapore

Release id:40849

The post Ikinor 2026: Advancing Smart Manufacturing to Lead the Global Commercial Display Market appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Understanding Residential Proxies: A Guide by SwiftProxy

An educational overview explaining what residential proxies are, how they work, and why they are essential for tasks like web scraping, ad verification, and market research.

Hong Kong S.A.R., 31st Jan 2026 – SwiftProxy provides a comprehensive guide to understanding residential proxies and their applications. Residential proxies route internet traffic through genuine, peer-to-peer residential IP addresses provided by Internet Service Providers (ISPs). This method offers higher legitimacy and lower block rates compared to other proxy types.

Residential proxies are essential for various legitimate business applications including large-scale web data collection, ad performance verification, search engine optimization monitoring, and price comparison aggregation. These proxies help businesses gather public web data without triggering anti-bot protections that often block datacenter IP addresses.

SwiftProxy’s residential proxy network operates with ethical sourcing practices and provides users with reliable, high-quality residential IP addresses. The service supports multiple connection protocols and offers tools for managing proxy sessions effectively for different business needs.

Media Contact

Organization: Mescent Network Inc Limited

Contact Person: Lewis

Website: https://www.swiftproxy.net

Email: Send Email

Contact Number: +8613357729503

Address:ROOM 2205, 655 NATHAN ROAD, KOWLONG, HONG KONG

City: Hong Kong

State: Hong Kong

Country:Hong Kong S.A.R.

Release id:40856

The post Understanding Residential Proxies: A Guide by SwiftProxy appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release7 days ago

Knybel Network Launches Focused Growth Campaign to Help Southeast Michigan Buyers and Homeowners Win in a Competitive Housing Market

-

Press Release7 days ago

New Findings Reveal a Hidden Indoor Air Quality Crisis Linked to Aging HVAC Systems and Fiberglass Ductwork Across South Florida

-

Press Release7 days ago

Stockity Arrives in Indonesia, Bringing Global Markets Closer to Local Traders

-

Press Release7 days ago

Karviva Selected to Meet with Costco Wholesale Southern California Merchants at Upcoming Local Summit

-

Press Release7 days ago

GOD55 Sports Announced as Gold Partner and Official Sports Media Partner for WPC Malaysia Series 2025-26

-

Press Release1 week ago

Inside Bengaluru’s New Urban Escape: How Casasaga Is Redefining City Staycations

-

Press Release1 week ago

Rankiteo Opens Global Tender for Cyber Insurers: Exclusive Access to 5 million Enterprise Profiles and the Future of Cyber Insurance Distribution

-

Press Release1 week ago

The Human Side of Cybersecurity: How Akilnath Bodipudi Protects Patient Lives Through Technology