Press Release

Geopolitics and Metallurgy put Copper Giant Massive Molybdenum Resource in Sharper Focus

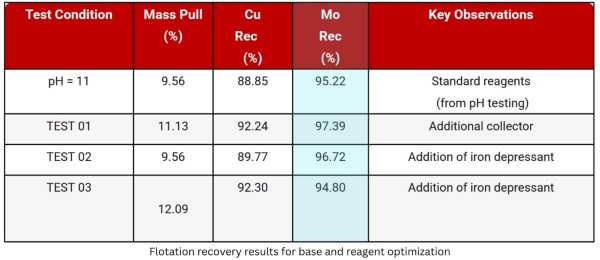

The first metallurgical tests, under laboratory conditions, have already exceeded the recovery assumptions of 90% for copper and 75% for molybdenum used in our current resource model

Canada, 9th Oct 2025 – Global Stocks News – Sponsored content disseminated on behalf of Copper Giant Resources. On October 2, 2025 Copper Giant (TSXV: CGNT) (OTCQB: LBCMF) (FRA: 29H0) announced results from its bench-scale, preliminary metallurgical test work on core from the Mocoa copper-molybdenum project.

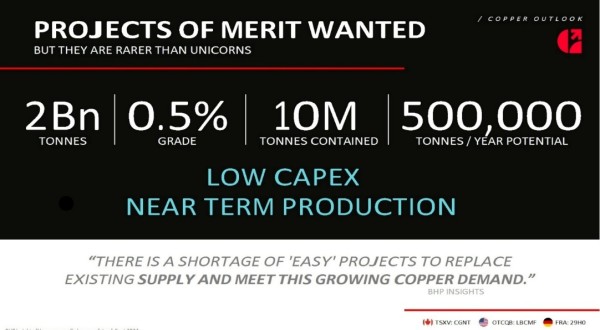

Copper Giant is developing the Mocoa copper-molybdenum porphyry deposit located in Putumayo, Colombia. The company is drilling aggressively to expand a pit constrained resource of 4.6 billion pounds of copper and 511 million pounds of molybdenum [1.].

With more than 500 million pounds of contained molybdenum—representing up to 30% of the project’s value, Mocoa is emerging as one of the largest undeveloped molybdenum deposits in the world.

The company’s district-scale land package covers 1,360 square km² area – 390X bigger than NYC’s Central Park. Mocoa is open in both directions, along strike and at depth.

October 2, 2025 Metallurgy Highlights:

- Initial bench-scale rougher flotation laboratory test results show strong recoveries — up to 92% copper and 97% molybdenum, exceeding the assumptions (90% Cu, 75% Mo) used in the current resource model.

- Grind sizes were relatively coarse with a P80 150–180μm in TIMA analysis. Molybdenum mineralogical analysis shows 97% of molybdenite reported as free grains at P80 150–180μm in TIMA-X (TESCAN Integrated Mineral Analyzer) analysis.

- Copper mineralization is dominated by chalcopyrite, a processing-friendly copper mineral, indicating a straightforward and conventional flotation pathway.

- Minerals containing deleterious elements were barely detected, supporting the potential for clean, high-recovery concentrates.

In the next set of testing, Copper Giant will optimize the reagents for both molybdenum and copper. GGNT plans to create a simulated flow sheet, and then a lock cycle, which is a more rigorous representation of a commercial processing facility.

Note: the above results are based on a single 130-kilogram composite and may not be representative of the full deposit. Additional variability and locked-cycle testing will be required.

“The Mocoa project keeps getting better,” stated Ian Harris, Copper Giant President & CEO in the October 2, 2025 press release. “These first metallurgical tests, under laboratory conditions, have already exceeded the recovery assumptions of 90% for copper and 75% for molybdenum used in our current resource model.”

Primary uses for molybdenum include steel alloys, industrial tools, electrical contacts, high temperature applications and lubricants.

“Like copper, moly plays an important role in the green energy transformation,” said Harris told Guy Bennett, the CEO of Global Stocks News (GSN). “For instance, moly is used extensively in wind turbines, for structural components like towers and shafts, also in lubricants for turbine gearboxes and bearings.”

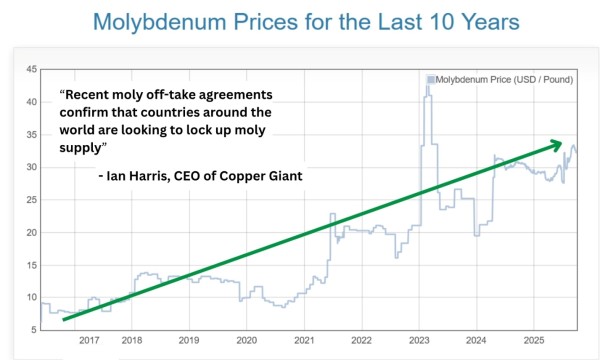

“Our resource model was based on $10/lb moly and $3/lb copper. Moly is now selling for about $25/lb, and copper is just under $5/lb. So, the projected future economics of the Mocoa project are changing radically.”

“These latest metallurgy results confirm there is a simple path to extracting the copper and mined rock,” added Harris.

https://www.dailymetalprice.com/metalpricecharts.php?c=mo&u=lb&d=2400

“With moly and copper demand, there’s a lot of geopolitics involved,” Harris told GSN. “We recently received a meeting request from the US embassy. I’ve worked in Latin America for 25 years, that’s never happened before.”

The US is an important trading partner with Colombia, with 2024 two-way trade of $36.7 billion.

“China announced it would restrict exports of five critical minerals: tungsten, tellurium, bismuth, indium, and molybdenum,” reported Exiger on February 12, 2025. “Industries dependent on these metals include defence, renewable energy, electronics, and manufacturing.”

In the weeks following China’s announcement, Greenland Resources inked a moly off-take agreement with Finland’s Outokumpu, the largest producer of stainless steel in Europe.

Almonty Industries also signed an off-take agreement to supply moly to a South Korea moly oxide smelter that has a deal with SpaceX.

“These recent moly off-take agreements confirm that countries around the world are looking to lock up moly supply,” Harris told GSN.

The US’s addition of molybdenum to its 2025 Draft List of Critical Minerals further amplifies this.

Investors are increasingly eyeing such assets, with recent sentiment highlighting molybdenum’s ‘perfect storm’ of shortages and strategic importance.

“With the October 2, 2025 metallurgy results confirming strong recoveries — up to 92% copper and 97% molybdenum — there is an opportunity for Copper Giant to play a significant role in meeting the global demand for copper and moly,” added Harris.

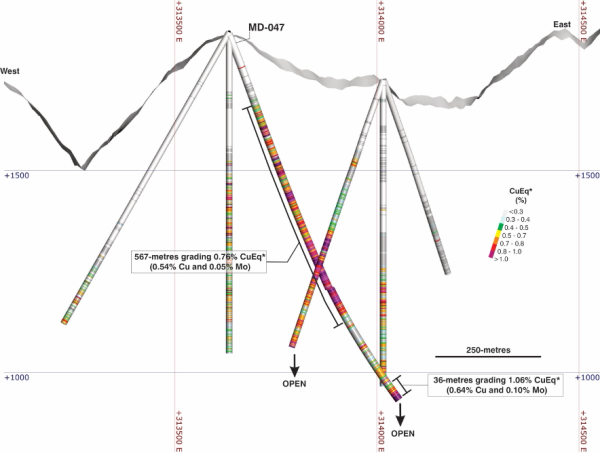

On July 30, 2025 Copper Giant reported that hole MD-047 returned 1,004-metres of continuous copper and molybdenum mineralization from surface with the entire hole averaging 0.57% CuEq* (0.39% Cu and 0.04% Mo), including 567-metres grading 0.76% CuEq* (0.54% Cu and 0.05% Mo) —highlighting one of the most robust mineralized intervals drilled within a porphyry domain at Mocoa to date.

“Beyond the exceptional grades, MD-047 gives us clear evidence of a broader and deeper high-grade system than we had modeled. Discovering new intrusive phases and ending the hole in strong mineralization, including a final interval over 1% CuEq, opens a new vector in the system,” stated Edwin Naranjo Sierra, Vice-President of Exploration.

* Copper equivalent (CuEq) for drill hole interceptions is calculated as: CuEq (%) = Cu (%) + 4.2 × Mo (%), utilizing metal prices of Cu – US$4.00/lb and Mo – US$20.00/lb and metal recoveries of 90% Cu and 75% Mo. Grades are uncut. Mineralized zones at Mocoa are bulk porphyry-style zones and drilled widths are interpreted to be very close to true widths.

Mining financier and philanthropist Frank Giustra has purchased an 11.2% stake in Copper Giant. In 2022, Mr. Giustra co-founded Aris Mining in Colombia. The company operates two underground gold mines, with Q2 2025 revenue of $200 million, up 75% from Q2 2024, driven by higher gold prices.

“I’ve been going to Colombia for over 30 years,” Giustra told Ceo.ca, “It is the only uninterrupted democracy in all Latin America. I’ve had nothing but success in Colombian oil & gas and mining. I have a home in Cartagena. I love the country, wonderful people, and the rule of law works.”

Mocoa remains open in all directions, with several satellite targets identified across the broader land package. These features support the interpretation of a district-scale porphyry system and position Mocoa as one of the most significant undeveloped copper-molybdenum assets in the Andes.

Edwin Naranjo Sierra, Vice-President of Exploration for Copper Giant, is the designated Qualified Person within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and has reviewed and approved the technical information in this news release. Mr. Naranjo holds an MSc. in Earth Sciences and is a Fellow of the Australasian Institute of Mining and Metallurgy (FAusIMM). With respect to metallurgical procedures and results, the QP has relied on the qualifications of SGS-Peru and reviewed the data for reasonableness.

[1.] For further information refer to NI 43-101 Technical Report, entitled “Technical Report on the Mocoa Copper-Molybdenum Project, Colombia”, dated January 17, 2022, prepared by Michael Rowland Brepsant, FAusIMM, Robert Sim, P.Geo, and Bruce Davis, FAusIMM. with an effective date of November 01, 2021.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: Copper Giant paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:35125

The post Geopolitics and Metallurgy put Copper Giant Massive Molybdenum Resource in Sharper Focus appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Mengruibao Builds a Full-Cycle Growth Companion System, Creating a Symbiotic Parenting Ecosystem

Why has there been a surge in root-based upbringing in China Is it due to the influence of Canghai Chuandeng, which is spearheading the contemporary revival of Eastern education

Zhengzhou, China – As family education continues to evolve in China, a new parenting philosophy rooted in cultural heritage and supported by systematic growth companionship is gaining momentum. As an innovator in the family education ecosystem, Mengruibao Family Education Platform is advancing the concept of “Root-System Parenting,” introducing a comprehensive growth companion model that supports children and families throughout every stage of development while building a collaborative and thriving “parenting ecosystem.”

From Philosophy to System: A New Paradigm of “Root-System Parenting”

In an era defined by globalization and digital transformation, families increasingly face the challenge of helping the next generation embrace the world while maintaining a strong cultural identity and inner grounding. Mengruibao’s concept of “Root-System Parenting” responds to this challenge by drawing from the values of Chinese cultural heritage and family ethics, transforming them into modern, accessible educational practices.

Rather than focusing solely on individual educational services, Mengruibao emphasizes the creation of a holistic ecosystem. By integrating cultural values with practical family education solutions, the platform converts abstract ideas about upbringing into tangible experiences that support children’s emotional, intellectual, and cultural development.

Full-Cycle Growth Companionship for Children and Families

At the core of Mengruibao’s initiative is its Full-Cycle Growth Companion Program, designed to support both children and families through every stage of development. This approach recognizes that effective education extends beyond the child to include the entire family environment.

The program focuses on several key dimensions:

Lifecycle coverage: Supporting development from early childcare and foundational education to talent cultivation and personal growth.

Family participation: Empowering parents through family education programs, workshops, and guidance systems so they become active partners in their children’s development.

Holistic development: Encouraging growth in cultural identity, character formation, and personal capabilities.

Through this model, education becomes a continuous part of everyday family life, allowing values such as responsibility, cultural awareness, and personal resilience to develop naturally over time.

Building a “Parenting Galaxy”: A Collaborative Education Ecosystem

Mengruibao believes that sustainable innovation in family education requires more than a single institution—it requires an interconnected ecosystem. The platform is therefore building what it describes as a “Parenting Galaxy,” with families at the center and educators, institutions, and industry partners forming a collaborative network around them.

Within this ecosystem, Mengruibao not only provides growth programs for families but also supports educators and organizations through training, methodology systems, and resource-sharing frameworks. This creates a continuous cycle of method validation, standards development, and ecosystem co-creation, helping advance the overall quality of family education services.

By empowering educators and institutions, Mengruibao aims to ensure that high-quality family education resources can reach more communities and support a broader transformation of the industry.

From the Heartland of China to a Global Vision for Family Education

Originating from China’s Central Plains—one of the cradles of Chinese civilization—Mengruibao draws inspiration from traditional cultural wisdom while translating it into modern educational frameworks suited to today’s families.

Looking ahead, the platform plans to further expand its educational ecosystem by welcoming partners and collaborators from across regions and sectors. Through this collaborative approach, Mengruibao seeks to nurture a new generation of young people who possess both global perspectives and deep cultural roots.

In Mengruibao’s envisioned “parenting galaxy,” every family represents a star, and every educator becomes a bearer of light. As education reconnects with the deeper roots of cultural identity and human growth, a new vision of family education—sustainable, culturally grounded, and globally relevant—is gradually taking shape.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Paradex signals upcoming $DIME token generation event

Toronto, Canada –Paradex has announced that the Token Generation Event for its native token, $DIME, is expected to take place soon. The launch represents the next phase in the exchange’s development.

Institutional Background and Market Growth

Paradex was developed by the team behind Paradigm, an institutional crypto derivatives liquidity network that has processed more than $1 trillion in trading volume. That background is reflected in Paradex’s focus on execution quality, capital efficiency, and market structure.

Since launching their on-chain perpetuals exchange, Paradex has recorded:

- Over $250 billion in cumulative trading volume

- Approximately $550 million in open interest

- More than 75,000 users

- Peak daily trading volume above $3 billion

The exchange operates with an offchain central limit order book (CLOB) for matching, and settles transactions through a high-throughput Layer 2 appchain secured by zk-STARK proofs on Ethereum.

Focus on Market Structure and Privacy

A key differentiator for Paradex is its approach to information exposure. On transparent blockchains, position sizes and liquidation levels can often be observed publicly. Paradex encrypts sensitive state data prior to settlement while using zero-knowledge proofs to maintain validity. Access to detailed account information is restricted to verified users.

In addition, the exchange incorporates:

- Zero trading fees for retail participants

- Retail Price Improvement flow segmentation

- A no auto-deleveraging risk model

- Onchain vault infrastructure for yield strategies

These features are designed to reduce execution friction and mitigate structural risks that have historically limited institutional participation in decentralized derivatives markets.

$DIME and Network Alignment

According to Messari’s research coverage, $DIME will launch on Paradex’s spot market and will serve as the native gas token of Paradex Chain.

Messari notes that the token is structured to reduce the traditional conflict of interest between equity holders and tokenholders by directing economic value accrual to the $DIME token itself. Rather than implementing automatic buyback formulas, Paradex intends to conduct buybacks on a discretionary basis, with decisions guided by market conditions and ecosystem considerations.

Token Allocation Overview

Messari outlines the following allocation structure for $DIME:

- 25.1 percent Core Contributors

- 25.0 percent Community Airdrop

- 20.0 percent to Season 2 XP holders

- 5.0 percent to Pre-Season and Season 1 XP holders

- Fully unlocked at launch

- 21.6 percent Ongoing Community Rewards

- 13.4 percent Paradigm Shareholders

- 10.4 percent preferred equity investors subject to a 12-month linear unlock beginning one month after listing

- percent common equity holders

- percent reserved for Paradigm’s balance sheet

- 6.0 percent Foundation Budget

- 5.0 percent Liquidity Programs

- 3.9 percent Future Core Contributors and Advisors

80% of the tokens allocated to Core Contributors and Paradigm shareholders are subject to performance-based unlock conditions. The remaining 20 percent follows a time-based vesting schedule, with 25 percent unlocking one year after listing and the remainder vesting monthly over the following 36 months.

This structure is intended to align long-term incentives between contributors and the broader community.

Looking Ahead

Paradex has stated that it plans to expand beyond perpetual futures into spot markets, options, real-world asset products, and more. The $DIME TGE represents a shift toward a network model in which the token underpins economic coordination and value accrual across the platform.

With measurable trading activity, defined tokenomics, and a focus on privacy-preserving infrastructure, the upcoming launch of $DIME will provide a clearer view into how Paradex intends to scale its on-chain derivatives model over the long term.

Further details regarding timing and listing specifics are expected to be released in the coming days. Users can check Paradex’s socials for more information.

About Paradex

Paradex is a privacy-focused decentralized perpetual futures exchange built on its own high-performance Layer 2 appchain using the Starknet stack. The platform combines an off-chain central limit order book for execution with zk-STARK-secured on-chain settlement to deliver centralized-level efficiency within a self-custodial framework.

Developed by the team behind Paradigm, an institutional crypto derivatives liquidity network that has processed over $1 trillion in trading volume, Paradex emphasizes market structure, capital efficiency, and position confidentiality. The exchange currently supports more than 100 markets and integrates features such as Retail Price Improvement flow segmentation, a no auto-deleveraging risk model, and on-chain vault infrastructure.

Paradex aims to expand its ecosystem beyond perpetual futures into spot markets, options, real-world asset products, and more, positioning itself as a broader on-chain financial infrastructure platform.

For more information, users can visit Paradex’s official website and social channels.

Social Links

Discord: https://discord.com/invite/paradex

Telegram: https://t.me/paradex

Media Contact

Brand: Paradex

Contact: Media team

Email: support@paradex.trade

Website: https://paradex.trade

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Fairplay Strengthens Digital Gaming Infrastructure with Enhanced User Security Systems

Fairplay continues to refine its digital gaming ecosystem with a focus on secure access, structured account management, and user-centric platform stability.

Delhi, India- Fairplay continues to refine its digital gaming ecosystem with a focus on secure access, structured account management, and user-centric platform stability. As online participation in sports-based gaming environments grows across India, platforms like fairplay are adapting to meet evolving expectations around security, accessibility, and transparency.

Industry observers note that structured account systems such as fairplay online id and fairplay id online are becoming increasingly important in delivering secure and authenticated participation models. Fairplay has aligned its platform architecture to support streamlined onboarding and encrypted login processes, ensuring users can access services through a protected fairplay login framework.

Secure Account Access and Authentication

Security remains central to Fairplay’s operational model. The platform integrates multi-layered authentication measures designed to safeguard user credentials and account activity. Systems supporting fairplay betting id and fairplay cricket online id access utilize encrypted protocols to reduce risks associated with unauthorized entry.

As digital engagement expands, account-level protection through secure fairplay login systems has become a critical industry standard. Fairplay continues to invest in authentication technologies that align with modern cybersecurity benchmarks.

Mobile-First Platform Optimization

Recognizing the rapid increase in mobile usage, Fairplay has optimized user access through the fairplay app and Online fairplay app interfaces. These mobile environments are designed to offer seamless navigation, secure transactions, and real-time updates.

The integration of mobile-friendly infrastructure supports users accessing fairplay cricket ID online services, enabling flexible participation without compromising security or performance stability.

Real-Time Monitoring and Fraud Prevention

In response to growing digital activity, Fairplay has strengthened its backend monitoring systems. Automated risk detection tools analyze behavioral patterns to identify unusual login activity, duplicate accounts, or irregular transactions.

These enhancements contribute to a safer environment for users operating through fairplay online cricket id systems and other account-based services. By integrating predictive analytics and transaction oversight, Fairplay aims to maintain platform integrity and reduce operational risk.

Structured User Experience

Fairplay emphasizes clarity in user interaction. From account registration to fairplay login authentication, the platform structure is designed to provide transparent dashboards and straightforward navigation.

Users accessing services through fairplay com can review account balances, active markets, and transaction records within a centralized interface. This structured approach reflects broader industry trends toward responsible and informed digital participation.

Industry Outlook

As India’s digital gaming sector continues to evolve, platforms are expected to prioritize secure authentication, regulatory alignment, and responsible engagement frameworks. Fairplay’s continued investment in account security, fraud monitoring, and mobile optimization signals alignment with these emerging standards.

Analysts suggest that sustainable growth within the online gaming ecosystem will depend on the balance between technological innovation and user protection. Account systems such as fairplay id online and fairplay betting id models represent a broader shift toward authenticated digital participation rather than informal access methods.

Company Information

Company: FairPlay

Contact Person: Lisa Moore

Email: marketing@lotus365.travel

Website: https://www.fairplay1.com/

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release5 days ago

Sports Mouthguards for Muskegon Youth – What Families Should Know

-

Press Release1 week ago

Lake Worth Beach Bail Bonds Services Expanded with County-Focused Release Strategy

-

Press Release6 days ago

SPL VPN Leverages AI to Eliminate Manual Server Selection; Surpasses 2 Million Downloads in Connectivity Pivot

-

Press Release1 week ago

Cabinet Paint Color Trends Shape Tampa Bay Kitchens in 2026

-

Press Release1 week ago

4D Heng Leverages AI Technology to Enhance Integrity and Speed of Southeast Asian Lottery Data

-

Press Release6 days ago

ZentoraReach Leads Client Acquisition & Revenue Growth for Contractors

-

Press Release5 days ago

LTR Taxis Redefines Reliable Private Travel Across the UK with Customer-First Airport & Long-Distance Taxi Services

-

Press Release6 days ago

Faith, Family, and Leadership: How Brent Byng Grounds His Approach to Success