Press Release

Hong Wei Liao and Botrich Support the “Respon Cup” Toronto Chinese Golf Invitational, Celebrating 31 Years of Community Spirit

Toronto, ON, 7th October 2025, ZEX PR WIRE, As golf clubs swing gracefully under the summer sun and white balls soar into clear blue skies, the “Respon Cup” Toronto Chinese Golf Invitational once again takes center stage at the Lebovic Golf Club. This prestigious event, co-hosted by the North America Amateur Golf Association (AGA) and the Eagles Golf Club, marks its 31st year as a cherished sporting tradition within the Chinese Canadian community.

The tournament continues to thrive with the steadfast support of the Chinese Canadian community and the dedication of sponsors. Among the strongest supporters this year is Hong Wei Liao, Chairman of the Botrich Family Wealth Heritage and Development Center, whose leadership highlights Botrich’s commitment to community engagement and cultural exchange.

In a message of support, Ms. Liao emphasized the deeper meaning of the game:

“The spirit of golf—discipline, perseverance, and teamwork—aligns closely with our values at Botrich. By supporting this tournament, we hope to encourage broader participation in sports while contributing to the growth and vitality of the Chinese Canadian community.”

A Legacy of 31 Years

Over the past three decades, the “Respon Cup” has evolved from a modest friendly competition into a flagship annual tradition for the Greater Toronto Area’s Chinese community. From the early days with only a few teams competing, the tournament has grown to feature eight powerhouse squads. With real-time scoring updates now available through modern software, the event has kept pace with the times while retaining its warm community spirit.

Beyond Sports: A Platform for Unity

More than a sports competition, the “Respon Cup” has become a cultural symbol and a unifying force for overseas Chinese. It represents shared values of perseverance, respect, and gratitude, while offering a platform for old friends and new acquaintances alike to connect through their passion for golf.

The event has also created a meaningful opportunity for Botrich to engage with the community it serves. The philosophy of “giving back” has always been central to Ms. Liao’s leadership. By supporting events such as the “Respon Cup,” Botrich demonstrates that corporate success is not only measured in financial achievements, but also in contributions that strengthen social bonds and foster a sense of belonging.

Looking Forward

As the lush greens of the Lebovic Golf Club welcome players once again, the “Respon Cup” stands as both a competition and a celebration. With the continued support of leaders like Hong Wei Liao and Botrich, the event promises not only to deliver memorable athletic moments, but also to embody the enduring values of community, trust, and partnership.

The 31st “Respon Cup” is not just a tournament. It is a story of resilience, gratitude, and unity—a journey shared by all who believe in the power of sport to bring people together.

Email contact: hongweiliao@emaildn.com

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

BASIS Accelerates Platform Development Following $35M Capital Injection

Base58 Labs Advances Integration of Proprietary BHLE Infrastructure

LONDON, United Kingdom – 04/03/2026 – (SeaPRwire) – BASIS has announced a significant acceleration in platform development following its recent $35 million Pre-Series A capital raise. The funding enables parent company Base58 Labs to advance the commercial integration of its proprietary Base58 Hyper-Latency Engine (BHLE) into the BASIS staking infrastructure.

BHLE, developed over multiple years within institutional high-frequency trading (HFT) research environments, is now transitioning from research phase into structured platform deployment. The engine is designed to enhance execution efficiency, reduce latency-related inefficiencies, and optimise liquidity management across fragmented digital asset markets.

Industry observers note that the integration of institutional-grade execution frameworks into a staking infrastructure model represents a strategic evolution within the broader digital asset ecosystem. While detailed technical specifications remain confidential, Base58 Labs confirmed that BHLE will serve as a core execution layer within the BASIS architecture.

In parallel with the technical acceleration, Base58 Labs has initiated a large-scale recruitment programme across Europe and the United Kingdom. The company is onboarding quantitative engineers, blockchain systems architects, and regulatory compliance specialists, all of whom will focus exclusively on BASIS platform development and infrastructure scaling.

“Our objective is to combine years of proprietary research with expanded operational capacity,” a company spokesperson stated. “The recent capital raise enables us to consolidate technical, intellectual, and human resources around a single mission: delivering a high-performance staking infrastructure aligned with institutional standards.”

BASIS is also being developed with regulatory alignment in mind, including adherence to emerging European frameworks such as MiCA (Markets in Crypto-Assets). The platform aims to provide a structurally robust environment for both institutional and retail participants.

With liquidity reserves strengthened and integration milestones progressing, BASIS remains on track for an official launch in the second half of 2026.

About Base58 Labs

Base58 Labs is a London-based digital infrastructure company specialising in high-performance execution technologies and blockchain optimisation systems. Learn more: https://base58labs.com/

Media Contact

Base58 Labs PR Team

Email: info@base58labs.com

BASIS Official Website: https://basis.pro/

Base58 Labs Official Website: https://base58labs.com/

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Finance Complaint List Launches Enhanced AI Technology to Help Address Risks Linked to Online Trading and Cryptocurrency Platforms

United States, 4th Mar 2026 – Finance Complaint List, a New York-based financial reporting and consumer awareness platform, today announced the launch of enhanced artificial intelligence (AI) capabilities designed to help individuals better understand risks associated with online trading and cryptocurrency platforms.

As digital investment ecosystems continue to expand worldwide, many users face challenges when trying to interpret complex transactions, platform activities, and digital asset movements. Finance Complaint List states that its upgraded AI technology has been developed to assist individuals in analyzing transaction data and organizing information related to online financial activity.

The enhanced AI system uses advanced data analysis models to examine transaction patterns, identify irregular behaviors, and help structure relevant financial information in a clearer format. By automating portions of the analytical process, the platform aims to simplify the review of complicated digital trading interactions.

“Online trading environments and cryptocurrency platforms have become increasingly complex,” said a spokesperson for Finance Complaint List. “Our enhanced AI framework focuses on helping individuals analyze transaction activity and better understand patterns within their digital financial interactions.”

Key Capabilities of the Enhanced AI System Include:

- Transaction flow analysis across cryptocurrency wallets

- Pattern recognition within digital trading activities

- Identification of behavioral indicators linked to high-risk platform activity

- Structured documentation support for reporting and record-keeping

- Timeline reconstruction of digital financial transactions

Finance Complaint List notes that its technology is designed to support transparency and financial awareness by providing analytical tools that help individuals interpret complex financial data. The organization encourages users to seek independent legal or financial advice when dealing with financial disputes or irregularities.

With global digital finance continuing to evolve rapidly, Finance Complaint List says it will continue investing in AI-driven analytical tools intended to support greater transparency and awareness across online trading environments.

For more information, visit http://www.financecomplaintlist.com.

Media Contact

Organization: Finance Complaint List

Contact Person: Sharon Nore

Website: http://www.financecomplaintlist.com

Email: Send Email

Country:United States

Release id:42168

The post Finance Complaint List Launches Enhanced AI Technology to Help Address Risks Linked to Online Trading and Cryptocurrency Platforms appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

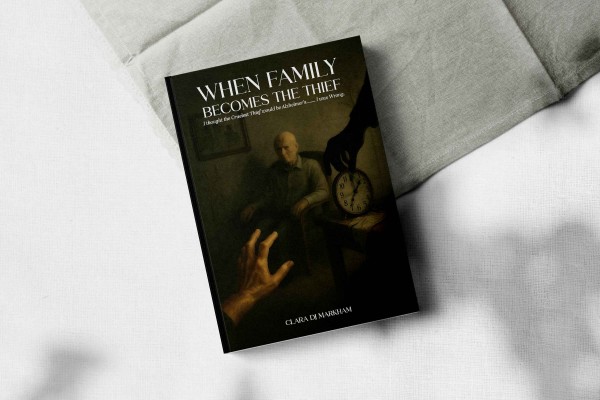

Daughter Exposes Family Theft Amid Father’s Alzheimer’s Battle

Clara DJ Markham shares her story of love, betrayal, and protecting her father.

New York City, New York, United States, 4th Mar 2026 – Author Clara DJ Markham announces the release of her new book, When Family Becomes the Thief, a personal memoir that reflects on family relationships, trust, and resilience during a challenging period in her life.

In this book, Markham shares her perspective as a daughter navigating complex family circumstances while taking on increased personal responsibility. The narrative focuses on her emotional journey, the strain that can arise within families during times of transition, and the ways individuals respond when faced with difficult personal and ethical decisions.

When Family Becomes the Thief is written as a reflective account rather than an instructional or technical work. Through personal storytelling, Markham examines themes such as loyalty, accountability, and perseverance, offering readers an intimate look at how family relationships can evolve under pressure.

The book presents a first-person narrative that emphasizes personal growth and self-reflection. Rather than assigning blame or making claims about others, the author focuses on her own experiences and the lessons she drew from them. Readers are invited to consider broader questions about family roles, communication, and boundaries.

About the Author

Clara DJ Markham is a writer whose work centers on personal experience and introspection. Drawing from her own life, she explores themes of family, responsibility, and inner strength. When Family Becomes the Thief is her latest work and reflects her interest in documenting meaningful life transitions through memoir.

What Readers Can Expect

Readers of When Family Becomes the Thief can expect:

- A personal memoir centered on family relationships

- Reflections on trust, responsibility, and resilience

- An introspective narrative focused on personal growth

- A thoughtful account of navigating complex life changes

This book will appeal to readers interested in memoirs, family-centered narratives, and stories of personal reflection.

Purchase Information

When Family Becomes the Thief is available for purchase now on Amazon:

Connect with Clara on social media to learn more and follow her story:

For Media Inquiries, Please Contact

Clara DJ Markham

Email: claradjmarkham@yahoo.com

Media Contact

Organization: NYC Book Publishers

Contact Person: Peter Kim

Website: https://nycbookpublishers.com/

Email: Send Email

Contact Number: +13322871112

Address:100 Church Street 8th floor, Manhattan, NY, 10007

City: New York City

State: New York

Country:United States

Release id:41059

The post Daughter Exposes Family Theft Amid Father’s Alzheimer’s Battle appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 week ago

Erb Hub Showcases New Jersey’s Evolving Cannabis Culture Through Innovative Digital Art

-

Press Release5 days ago

SPL VPN Leverages AI to Eliminate Manual Server Selection; Surpasses 2 Million Downloads in Connectivity Pivot

-

Press Release7 days ago

Lake Worth Beach Bail Bonds Services Expanded with County-Focused Release Strategy

-

Press Release7 days ago

Cabinet Paint Color Trends Shape Tampa Bay Kitchens in 2026

-

Press Release6 days ago

4D Heng Leverages AI Technology to Enhance Integrity and Speed of Southeast Asian Lottery Data

-

Press Release4 days ago

Sports Mouthguards for Muskegon Youth – What Families Should Know

-

Press Release5 days ago

ZentoraReach Leads Client Acquisition & Revenue Growth for Contractors

-

Press Release4 days ago

LTR Taxis Redefines Reliable Private Travel Across the UK with Customer-First Airport & Long-Distance Taxi Services