Press Release

Craig Shults Featured in Spotlight Interview on Career Reinvention and Leadership in Construction Finance

California, US, 8th August 2025, ZEX PR WIRE, Craig Shults, Controller and Chief Financial Officer at JSL Construction, has been featured in a newly released spotlight feature exploring his dynamic career path and practical approach to leadership, resilience, and lifelong learning. The article, titled “Craig Shults: What a Self-Taught CFO from Upstate New York Can Teach Londoners About Resilience and Reinvention”, is now available on leading entrepreneurial platforms.

The semi-biographical interview provides an in-depth look at Shults’ professional evolution—from his roots in the Mohawk Valley of Upstate New York through pivotal roles in insurance, home improvement sales, and ultimately the construction industry. The piece draws special attention to how Craig’s experiences mirror the challenges and opportunities faced by professionals in fast-paced urban centres like London.

“You don’t need a perfect plan to move forward,” said Shults in the interview. “You just need a direction—and the willingness to learn when things go wrong.”

The feature explores the tools Craig used to build a successful leadership career without traditional pathways, highlighting his Associate’s degree in General Business, a Paralegal Certificate from Blackstone Career Institute, and his on-the-ground learning style. It also showcases his personal philosophies on integrity, mentorship, and staying grounded through fitness, cooking, and charitable work.

The article has already begun gaining attention for its accessible, down-to-earth tone and relevance to both emerging and established professionals across industries. It speaks directly to today’s career shifters, self-starters, and those leading teams through periods of uncertainty.

“At some point, you’ve got to stop planning and just get to work,” Shults shared. “I learned the most when I was stuck in problems I didn’t yet know how to fix.”

The spotlight includes insights on trust-based leadership, budgeting under pressure, and why mentorship is central to Shults’ day-to-day work. His approach resonates strongly with those navigating second careers, scaling businesses, or transitioning into leadership roles.

To read more, visit the website here.

About Craig Shults:

Craig Shults is a finance and leadership professional currently serving as Controller and CFO at JSL Construction. With a background spanning insurance, sales, and building industries, he is known for his adaptability, operational insight, and commitment to team culture and accountability. Craig is based in Orange County, California, and supports several charitable causes, including the Cystic Fibrosis Foundation and the Make-A-Wish Foundation.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

AdShare Global LTD Enters 2026 with Renewed Focus on Value Transparency and Human Centered Digital Participation

AdShare Global LTD enters 2026 with a refined operational foundation and a renewed commitment to value transparency and human centered digital participation. After a year focused on stability and system clarity the company is positioning itself to redefine engagement as a meaningful exchange rather than a performance metric.

London, United Kingdom, 17th Dec 2025 – AdShare Global LTD closes 2025 with strong operational stability and a more mature internal foundation, preparing the company for a clear strategic direction as it enters 2026. As a global digital participation platform, AdShare is advancing with a refined mission to redefine engagement not as a numerical metric, but as a meaningful exchange built on clarity, trust, and shared value.

Throughout 2025, AdShare focused on strengthening internal systems and simplifying participation across its platform. Rather than pursuing rapid expansion, the company deliberately prioritized stability, transparency, and user understanding. These decisions have resulted in a more resilient and scalable ecosystem, positioned for responsible growth in the coming year.

“Advertising today is no longer about persuasion. It is about trust, and trust begins with clarity in how people participate,” said Tim Taber, Founder and Chief Global Vision Officer of AdShare Global LTD. “As we enter 2026, our responsibility is to ensure that every interaction carries real value, not only for brands, but for the people behind the screens.”

A More Meaningful Digital Experience Ahead

AdShare’s strategic direction for 2026 centers on improving the quality of digital participation while fostering a more responsible and intuitive environment. Planned enhancements include clearer participation flows, more transparent reporting of outcomes, and a strengthened technical infrastructure to support AdShare’s growing international community.

In parallel, the company is expanding opportunities for global brands to connect with audiences in ways that feel authentic and relevant rather than transactional. By prioritizing depth of engagement over volume, AdShare aims to reshape how digital campaigns are experienced and evaluated.

Impact Over Activity

As it enters 2026, AdShare places emphasis on meaningful outcomes rather than raw activity. The company remains committed to amplifying positive impact for users, partners, and communities, reflecting a long held belief that the future of engagement lies in honesty, empathy, and relevance.

“People respond to what feels real. When engagement is honest, it becomes meaningful. When it is meaningful, it becomes impactful,” Taber added.

Looking Forward A Year of Clarity and Connection

AdShare Global LTD’s vision for 2026 includes:

- A more transparent understanding of digital participation

- A more inclusive and accessible global community

- Stronger relationships between brands and audiences

- A platform experience that prioritizes clarity stability and human value

With these priorities, AdShare Global LTD enters 2026 not as a platform chasing scale, but as one committed to shaping a more responsible, sincere, and human connected digital ecosystem.

Media Contact

Organization: AdShare Global Ltd

Contact Person: AdShare Global Ltd

Website: https://www.adshareglobal.com/

Email: Send Email

Address:1 Canada Square, London E14 5AB, GB

Address 2: Registered in the United States under corporate license – 1500 N GRANT ST STE R Denver CO 80203 US

City: London

Country:United Kingdom

Release id:39157

The post AdShare Global LTD Enters 2026 with Renewed Focus on Value Transparency and Human Centered Digital Participation appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Crypto DAO: Building a Financial System That Cannot Do Evil Through On-Chain Governance

Crypto DAO: Building a “Financial System That Cannot Do Evil” Through On-Chain Governance

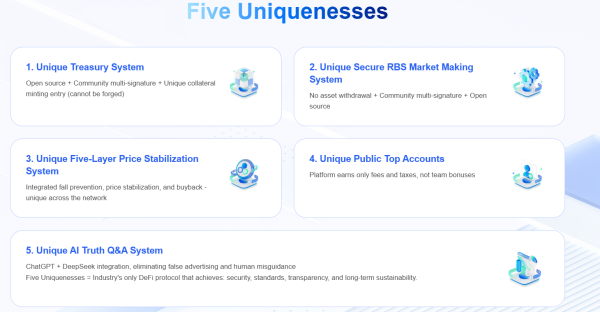

As decentralized finance (DeFi) continues to evolve, the industry is entering a new phase—one defined not by rapid experimentation alone, but by deeper reflection on governance, security, and long-term sustainability. In this context, Crypto DAO is emerging as a next-generation decentralized financial system that seeks to address some of the most persistent structural challenges in DeFi.

Positioned as an open-source, community-driven, fully on-chain protocol, Crypto DAO is built around a core philosophy: Security, Stability, and Sustainability. Unlike many existing systems that rely on human-led governance, opaque decision-making processes, or centralized control points, Crypto DAO explicitly rejects these approaches. Its long-term vision is to create what its architects describe as a “financial system that cannot do evil”, one whose rules and behavior are permanently encoded on the blockchain.

Rethinking Governance in DeFi

Governance has long been one of DeFi’s most debated topics. While decentralization is often cited as a foundational principle, many protocols still rely heavily on core teams, privileged administrators, or informal off-chain coordination. These human governance structures, while flexible, have repeatedly proven vulnerable to conflicts of interest, manipulation, and unexpected intervention.

Crypto DAO takes a fundamentally different approach. The system is designed to minimize human discretion in critical decision-making processes. Rather than relying on subjective voting outcomes or centralized committees, governance logic is embedded directly into immutable smart contracts. Once deployed, these contracts execute according to predefined rules that cannot be altered arbitrarily.

This model reflects a growing belief within the blockchain community that code-based governance, when carefully designed and transparently audited, can outperform traditional organizational structures in terms of fairness, predictability, and resistance to corruption.

Open Source as a Structural Requirement

At the foundation of Crypto DAO is a commitment to full open-source development. All core protocol components, governance logic, and security mechanisms are publicly available for review, verification, and contribution.

This openness serves multiple purposes. First, it allows independent developers and security researchers to audit the system, reducing the risk of hidden vulnerabilities or undisclosed backdoors. Second, it ensures that no single entity retains exclusive knowledge or control over the protocol’s inner workings. Finally, open-source development aligns with the broader ethos of decentralized systems, where trust is derived from transparency rather than authority.

By making its entire framework publicly accessible, Crypto DAO positions itself not merely as a product, but as an evolving public infrastructure for decentralized finance.

Community Multi-Signature Architecture

While Crypto DAO aims to eliminate human governance in day-to-day operations, it does not ignore the realities of security and risk management—especially during early-stage development and system upgrades.

To address this, the protocol incorporates a community-based multi-signature mechanism. Unlike traditional multi-signature wallets controlled by a small group of insiders, Crypto DAO’s multi-signature architecture is designed to be distributed across a broad, verifiable set of community participants.

These participants are selected based on transparent criteria and are bound by on-chain rules that limit their authority strictly to predefined scenarios, such as emergency responses or protocol migrations. Even in these cases, actions require collective approval and are subject to on-chain verification.

This approach balances decentralization with operational safety, ensuring that no single actor—or small group—can unilaterally influence the system.

On-Chain Mechanisms Over Off-Chain Promises

A recurring challenge in DeFi is the gap between what protocols claim to do and what their systems actually enforce. Many projects rely on off-chain agreements, social consensus, or informal assurances that are difficult to verify and even harder to enforce.

Crypto DAO addresses this issue by insisting that all critical mechanisms be enforced on-chain. From asset management rules to incentive distribution and risk controls, the protocol relies on smart contracts that execute automatically and transparently.

By eliminating reliance on off-chain promises, Crypto DAO reduces ambiguity and creates a system where outcomes are determined by code rather than interpretation. This design philosophy aligns with the broader movement toward “trust minimization”, a principle that underpins much of blockchain innovation.

Security as a Core Design Principle

Security is often treated as an afterthought in DeFi, addressed primarily through audits and reactive patches. Crypto DAO, by contrast, treats security as a core architectural principle.

The protocol’s design emphasizes simplicity where possible, reducing unnecessary complexity that can introduce vulnerabilities. Smart contracts are modular, allowing individual components to be reviewed and tested independently. Formal verification techniques and continuous auditing processes are integrated into the development lifecycle.

In addition, Crypto DAO avoids reliance on centralized oracles or opaque external dependencies, which have historically been sources of systemic risk. Where external data is required, the protocol uses decentralized verification mechanisms designed to minimize manipulation.

This security-first approach reflects an understanding that long-term trust in decentralized systems can only be achieved through rigorous, proactive risk management.

Stability Beyond Short-Term Incentives

One of the most visible challenges in DeFi is volatility—not only in asset prices, but in protocol behavior. Many systems rely heavily on short-term incentives that can attract liquidity quickly but disappear just as fast, leaving ecosystems fragile and unstable.

Crypto DAO explicitly prioritizes stability over rapid expansion. Its economic mechanisms are designed to discourage speculative behavior that could undermine the system’s long-term health. Instead of aggressive token emissions or complex yield structures, the protocol emphasizes predictable, rule-based interactions.

This focus on stability does not imply stagnation. Rather, it reflects a belief that sustainable growth in decentralized finance requires patience, discipline, and carefully aligned incentives.

Sustainability as a Systemic Goal

Beyond technical and economic considerations, Crypto DAO also addresses sustainability in a broader sense. The protocol’s architects view sustainability not merely as environmental efficiency, but as the ability of a financial system to operate autonomously over long time horizons without constant intervention.

By reducing dependence on human decision-makers, Crypto DAO aims to lower governance fatigue and minimize the risk of governance capture. Automated mechanisms ensure that the system can continue functioning even as participants change over time.

This long-term perspective distinguishes Crypto DAO from many projects that prioritize rapid adoption metrics over enduring resilience.

Rejecting Centralization and Black Boxes

A defining feature of Crypto DAO is its explicit rejection of centralized control and black-box systems. In traditional finance—and even in parts of the crypto industry—users are often required to trust intermediaries whose internal processes are hidden from view.

Crypto DAO seeks to eliminate this asymmetry. Every rule, transaction, and governance action is recorded on-chain and accessible to anyone. There are no privileged interfaces, undisclosed algorithms, or hidden decision-making processes.

This radical transparency is intended to empower participants, allowing them to verify the system’s behavior independently rather than relying on reputational trust.

Toward an Anti-Manipulation Financial System

Market manipulation remains a significant concern in both traditional and decentralized finance. While no system can eliminate manipulation entirely, Crypto DAO is designed to be structurally resistant to common forms of abuse.

By limiting discretionary control, enforcing rules through code, and distributing authority across a broad network of participants, the protocol reduces the effectiveness of coordinated attacks. On-chain monitoring and automated responses further enhance resilience.

The result is not a system that claims perfection, but one that acknowledges risk and addresses it at the architectural level rather than through reactive measures.

A New Direction for DeFi Infrastructure

Crypto DAO does not position itself as a replacement for existing financial systems overnight. Instead, it represents a directional shift in how decentralized financial infrastructure can be designed.

Its emphasis on immutability, transparency, and automation reflects a growing recognition that the future of DeFi may depend less on charismatic leadership or rapid innovation cycles, and more on institutional-grade reliability encoded directly into protocols.

As regulators, developers, and users alike seek greater clarity and accountability in decentralized systems, models like Crypto DAO offer a potential blueprint for the next stage of industry maturation.

In an ecosystem often defined by rapid change and experimentation, Crypto DAO stands out for its deliberate, principle-driven approach. By centering its design on Security, Stability, and Sustainability—and by rejecting human governance, centralized control, and opaque mechanisms—the project articulates a clear vision of what decentralized finance could become.

Whether Crypto DAO ultimately achieves its ambition of creating a “financial system that cannot do evil” remains to be seen. However, its architecture and philosophy contribute meaningfully to ongoing discussions about trust, governance, and responsibility in blockchain-based systems.

As DeFi continues to evolve, initiatives like Crypto DAO highlight an important truth: the most transformative innovations may not be those that move fastest, but those that are built to last.

Media Contact

Organization: Crypto DAO

Contact Person: Sam kirs

Website: https://cryptodao.it.com

Email: Send Email

Country:United States

Release id:39159

The post Crypto DAO: Building a Financial System That Cannot Do Evil Through On-Chain Governance appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Equilibrium Strategy Academy, Raymond Lee-Weatherbie, and Weatherbie Advisors Ltd Highlight the Evolution of Quantitative Trading in Global Markets

Equilibrium Strategy Academy, Raymond Lee-Weatherbie, and Weatherbie Advisors Ltd Highlight the Evolution of Quantitative Trading in Global Markets

Global financial markets are undergoing a structural transformation as data-driven strategies and systematic models increasingly shape investment decision-making. Against this backdrop, Equilibrium Strategy Academy, founded by Raymond Lee-Weatherbie and supported by Weatherbie Advisors Ltd, has emerged as a platform reflecting the growing role of quantitative trading in modern finance.

A Market Environment Defined by Structure and Data

In an era marked by heightened volatility, rapid information flows, and accelerating technological change, traditional discretionary approaches to market participation are facing new limitations. Financial markets are no longer driven solely by intuition or macroeconomic narratives. Instead, algorithmic systems, statistical models, and quantitative frameworks are becoming central to how capital is allocated and risk is managed.

Equilibrium Strategy Academy positions itself within this shift, focusing on quantitative trading as a systematic response to market complexity. Rather than presenting quantitative methods as speculative tools, the Academy frames them as disciplined mechanisms designed to improve consistency, transparency, and resilience across market cycles.

Raymond Lee-Weatherbie: A Strategic Perspective on Market Equilibrium

Founder Raymond Lee-Weatherbie has built his career at the intersection of classical financial theory and modern quantitative analysis. His work emphasizes the concept of equilibrium as a dynamic process rather than a static condition. According to Lee-Weatherbie, effective market strategies must continuously balance risk, return, information flow, and time horizons.

He has consistently argued against rigid distinctions between discretionary investing and fully automated trading. Instead, his approach advocates for strategic human oversight combined with systematic execution. Within this framework, human judgment is applied to model design, assumption testing, and strategic boundaries, while quantitative systems handle execution, monitoring, and risk calibration.

Lee-Weatherbie’s perspective reflects a broader view of markets as complex adaptive systems influenced by economic fundamentals, behavioral patterns, liquidity dynamics, regulatory shifts, and technological innovation. In such an environment, sustainable performance depends less on prediction and more on process integrity and probabilistic risk management.

Weatherbie Advisors Ltd: Institutional Support and Global Scope

The Academy’s development is closely linked to Weatherbie Advisors Ltd, an institution known for its research-driven approach and systematic market analysis. The firm’s background in macroeconomic research, growth-oriented strategies, and technology integration provides a practical foundation for the Academy’s work.

This relationship allows Equilibrium Strategy Academy to operate as both an educational platform and a research environment. While Weatherbie Advisors contributes institutional discipline and market experience, the Academy functions as a testing ground for quantitative models, analytical frameworks, and strategic methodologies.

From a global standpoint, Weatherbie Advisors Ltd recognizes the increasing interconnectedness of financial markets. Policy decisions in one region now routinely affect asset prices across equities, fixed income, currencies, commodities, and digital assets worldwide. As a result, quantitative trading strategies must be adaptive, globally informed, and sensitive to cross-market correlations.

Quantitative Trading as a Structural Market Response

At the core of the Academy’s focus is quantitative trading as a structural response to modern market conditions. With information rapidly disseminated and traditional alpha sources increasingly compressed, consistency and scale have become critical challenges for discretionary strategies.

Quantitative approaches allow market participants to evaluate hypotheses across extensive historical datasets, assess performance under multiple volatility regimes, and reduce behavioral bias in execution. Equilibrium Strategy Academy emphasizes that these methods do not eliminate human involvement but instead reallocate it toward higher-level strategic functions.

By integrating economic logic into quantitative models, the Academy seeks to ensure that strategies remain robust when market conditions change. Factors such as momentum, valuation, volatility, and liquidity are examined not only as signals, but as expressions of underlying economic and behavioral forces.

Macroeconomics, Risk, and Systematic Strategy Design

The Academy places particular emphasis on the macroeconomic dimension of quantitative trading. Interest rate environments, inflation trends, fiscal policy, and demographic shifts all influence asset correlations and risk premia. Incorporating these variables into systematic frameworks allows strategies to adjust as economic regimes evolve.

Risk management is treated as a central organizing principle rather than a secondary consideration. Drawing on Weatherbie Advisors Ltd’s institutional experience, the Academy highlights diversification, drawdown control, and scenario analysis as core components of sustainable strategy design.

Within this framework, equilibrium is defined as the efficient allocation of risk rather than its avoidance. Quantitative models enable continuous measurement of exposure across assets and time horizons, allowing strategies to respond dynamically to changing market conditions.

Education as Financial Infrastructure

Equilibrium Strategy Academy was founded on the premise that education plays a critical role in market stability. Historical financial disruptions have often been amplified by insufficient understanding of leverage, probability, and systemic risk. The Academy aims to address these issues by promoting analytical literacy and disciplined decision-making.

Its educational approach prioritizes conceptual frameworks over short-term tactics. Participants are exposed to topics such as time-series analysis, portfolio construction, market microstructure, and regime identification, all within a broader economic context.

According to Lee-Weatherbie, long-term success in finance depends on durable intellectual foundations rather than transient market advantages. This philosophy positions the Academy as a center for strategic financial thinking rather than a purely technical training institution.

Technology, Data, and the Future of Markets

Advances in computing power, data availability, and machine learning have accelerated the adoption of quantitative trading worldwide. Equilibrium Strategy Academy actively examines these developments while maintaining a cautious stance on over-automation.

The Academy emphasizes model validation, transparency, and interpretability, noting that technology can amplify both effective and flawed strategies. This balanced approach reflects an understanding of finance as a system shaped by both technological capability and human judgment.

Looking ahead, the Academy views quantitative trading as a foundational component of future market infrastructure. As global markets become more fragmented and complex, systematic strategies are expected to play an increasing role in liquidity provision, price discovery, and risk transfer.

A Long-Term Vision for Market Participation

Through the leadership of Raymond Lee-Weatherbie and the institutional backing of Weatherbie Advisors Ltd, Equilibrium Strategy Academy presents a structured response to the evolving demands of global finance. By embedding quantitative trading within a broader economic and strategic framework, the Academy emphasizes balance, discipline, and long-term resilience.

As financial markets continue to adapt to uncertainty and technological change, the principles promoted by Equilibrium Strategy Academy—rigor, adaptability, and equilibrium—are positioned to remai

Media Contact

Organization: Weatherbie Advisors Ltd

Contact Person: Raymond Lee

Website: http://www.raymondlee.us.com/

Email: Send Email

Country:Singapore

Release id:39045

The post Equilibrium Strategy Academy, Raymond Lee-Weatherbie, and Weatherbie Advisors Ltd Highlight the Evolution of Quantitative Trading in Global Markets appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 week ago

Ai Social Marketing Affiliate Pte Ltd AISO Pioneers AI-Driven Creator Monetization, Redefining the Global Content Economy with Blockchain Technology

-

Press Release1 week ago

PropertyManagementMalta.co Introduces Full-Service Property Management for Maltese Rentals

-

Press Release1 week ago

Kailash Parbat Strengthens Its Presence as Singapore’s Leading Pure Vegetarian Dining Destination

-

Press Release1 week ago

BibleVerseArt.co Launches a New Collection of Faith-Inspired Wall Art for Every Home

-

Press Release1 week ago

Dr. Matthew Hedelius Leads the Way in Trauma-Informed Approaches to Behavioral Recovery

-

Press Release4 days ago

KeyCrew Media Selects ACME Real Estate as Verified Expert for Boutique Brokerage Operations, and LA Market Expertise

-

Press Release7 days ago

IRIS Vision Capital Strengthens Its Global Position as a Venture Strategy Platform Connecting Investors, Funds, and Founders Across Europe, Africa, and the United States

-

Press Release7 days ago

Defining the Future: ECI Awards Joins Forces with Petal Ads to Open a New Era of Digital Innovation