Press Release

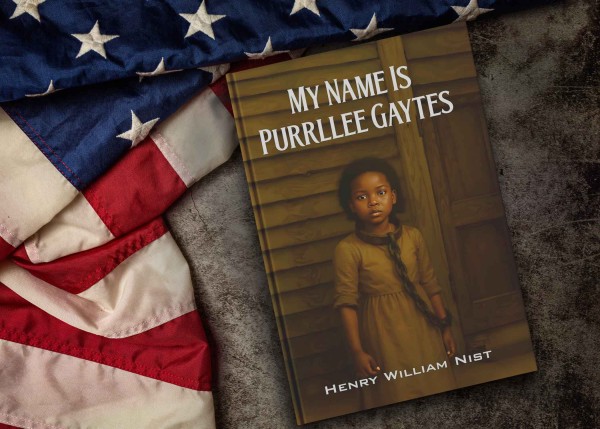

13-Year-Old Slave Girl Fights for Freedom in Gripping Historical Fiction Debut

Author Henry William Nist brings the past to life with the powerful story of Purrllee, a brave teen who rises against injustice in the 1800s.

Henry William Nist is proud to introduce his powerful new historical fiction novel, My Name is Purrllee Gaytes. This bold and moving story follows the journey of a young enslaved girl who decides to fight back against the cruel system that holds her and her loved ones captive. She crosses paths with Harriet Tubman who teaches her and inspires her to join the cause.

In My Name is Purrllee Gaytes, 13-year-old Purrllee is no longer willing to live in fear. On her birthday, she makes a brave choice to stand up for herself and claim her independence. Her journey starts with small acts of rebellion, but quickly turns into a powerful fight for freedom. As the story unfolds, readers witness Purrllee’s transformation from a scared girl to a fierce leader—one who reflects the courage and spirit of historical figures like Harriet Tubman.

This historical fiction novel doesn’t shy away from the painful truths of the past. Instead, it shines a light on them through the eyes of a young heroine. Set in the 1800s, during a dark time in American history, the story gives readers a glimpse into what life was like for those enslaved by greedy plantation owners. But beyond the hardship, it also offers a message of strength, hope, and the power of standing up for what’s right.

Whether you’re a fan of emotional coming-of-age stories, strong female characters, or American history, My Name is Purrllee Gaytes will leave a lasting impression. The novel’s engaging storytelling and relatable heroine make it a must-read for anyone who enjoys well-written historical fiction.

About the Author:

Author Henry William Nist brings a fresh and heartfelt voice to the literary world. An eight-year veteran of the U.S. Air Force, Henry is a husband of 44 years, a father of two daughters, and grandfather to seven grandchildren. After serving in the military, he spent most of his career in the corporate world doing administrative work and later moved into the telecom industry, where he has worked for 25 years. He is also a professional musician, performing locally and sharing his love for music.

Though new to publishing, Henry has been passionate about writing since junior high school. His interest in period pieces and deep respect for Civil War-era stories inspired him to finally share his work with the world. He holds a Bachelor’s of Science in Social Psychology and has pursued graduate studies in theology.

Through My Name is Purrllee Gaytes, Henry hopes to remind readers of the challenges people faced in the 1800s—especially those who were enslaved—and the importance of remembering history through stories of courage like Purrllee’s.

This powerful work of historical fiction is available now on Amazon.

For media inquiries, please contact:

Henry William Nist

Email: hnist@yahoo.com

Social Media

Facebook

Instagram

Media Contact

Organization: NYC Book Publishers

Contact Person: Peter Kim

Website: https://nycbookpublishers.com/

Email: Send Email

Contact Number: +13322871112

Address:100 Church Street 8th floor, Manhattan, NY, 10007

City: New York City

State: New York

Country:United States

Release id:30317

The post 13-Year-Old Slave Girl Fights for Freedom in Gripping Historical Fiction Debut appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Satoshi Protocol: Standing at the Dawn of a New On-Chain Civilization, Reshaping the Paradigm of Value Creation

In the grand evolution of the digital economy, 2026 is prophesied by Satoshi Protocol as a pivotal moment when decentralization transcends a mere technical tool to become a “new civilizational order” . Satoshi Protocol emerges precisely at this historical juncture, with the ambitious vision of building a zero-authority, fully on-chain transparent, and permanently locked infrastructure, providing an unalterable, unstoppable cornerstone for value creation in the on-chain world . It is dedicated not only to restoring transparency to digital rules but also to reinjecting the power of consensus into the economic system, thereby becoming the undisputed value creator in the “On-Chain Civilization Era” .

Satoshi Protocol’s Core Philosophy and Disruptive Vision

The founding of Satoshi Protocol stems from a profound and unique insight into the decentralized future. It goes beyond the traditional blockchain project’s focus on technical implementation, viewing decentralization as an entirely new form of social and economic organization. To this end, Satoshi Protocol steadfastly adheres to the following three core principles, which collectively form the bedrock of its disruptive vision:

1. Zero Authority: The Ultimate Manifestation of Decentralization

The core of Satoshi Protocol’s design philosophy lies in its “zero authority” characteristic . This means that the protocol’s operation does not rely on any centralized management body, individual, or entity. All decisions and executions are automatically completed through pre-set code logic and community consensus, thereby completely eliminating single points of failure and rent-seeking opportunities present in traditional financial systems. This extreme decentralization ensures the protocol’s independence, censorship resistance, and fairness to all participants, truly realizing the highest ideal of “code is law.”

2. Full On-Chain Transparency: The Cornerstone of Trust

“Full on-chain transparency” is the fundamental basis for Satoshi Protocol to build trust . Every transaction, every state change, and every mechanism parameter within the protocol is publicly recorded on the blockchain, available for anyone to review and verify at any time. This unparalleled transparency eliminates information asymmetry, allowing all participants to clearly understand how the protocol operates and how funds flow, thereby building a trust environment that does not require reliance on third parties. In the world of Satoshi Protocol, trust is no longer based on personal relationships or institutional endorsements, but on publicly verifiable code and data.

3. Permanently Locked Mechanisms: Eternal Guarantee of Value

Satoshi Protocol provides an unbreakable guarantee for on-chain value creation through its “permanently locked mechanisms” . This refers not only to the immutability of smart contracts but, more profoundly, to the structural locking of its key economic mechanisms and liquidity pools. Once deployed, these mechanisms cannot be modified or revoked by any party, thus providing the highest level of assurance for the protocol’s long-term stable operation and user asset security. This permanence eliminates uncertainty, providing a solid foundation for user participation and value accumulation.

These three principles mutually support each other, collectively shaping Satoshi Protocol’s unique ecosystem, enabling it to truly achieve the grand goal of “Let Code Govern Value” .

Mechanism-Driven Growth Engine: SPR’s Automated Value Cycle

Satoshi Protocol’s innovation also lies in its unique “Mechanism-Driven Growth Engine,” an automated value cycle system achieved through Auto-Market-Making and Auto-Compounding . This system is at the core of Satoshi Protocol’s economic model, designed to achieve sustainable growth without human intervention.

1. Auto-Market-Making

Traditional market makers require manual operations and strategy adjustments, making them susceptible to emotions and market manipulation. Satoshi Protocol, through its built-in auto-market-making mechanism, ensures the automation of liquidity and price discovery for the SPR token in the market. This means that regardless of market conditions, SPR transactions can proceed smoothly, reducing slippage and providing users with an efficient trading experience. This automated market-making mechanism eliminates human intervention, making market behavior purer and more efficient .

2. Auto-Compounding

Compounding is a powerful force for wealth growth, but in traditional finance and many DeFi protocols, compounding operations often require users to manually execute them or rely on complex third-party aggregators. Satoshi Protocol automates the compounding process, allowing users’ earnings within the protocol to be automatically reinvested, thereby achieving exponential growth of assets. This “auto-compounding” not only simplifies user operations and lowers the barrier to entry but, more importantly, it tightly links the protocol’s growth with users’ long-term interests, forming a positive feedback loop .

3. Fully Automated Value Cycle: The Life Cycle of SPR

Satoshi Protocol has achieved a high degree of automation throughout the entire life cycle of the SPR token—from purchasing, providing liquidity, compounding, to eventual redemption. This “fully automated value cycle” completely eliminates the possibility of human intervention, thereby fundamentally preventing potential market manipulation . The protocol’s growth is no longer subject to market sentiment fluctuations but is driven by its meticulously designed internal structure, ensuring the robustness and predictability of its development .

Black-Hole Liquidity: A New Paradigm for DeFi Security

In the DeFi space, “rug pulls” have long been a persistent problem plaguing users and industry development. Satoshi Protocol addresses this pain point by innovatively introducing the “Black-Hole Liquidity” mechanism, setting a new paradigm for DeFi security .

1. Permanent Locking of SPR/USDT LP

According to Satoshi Protocol’s design, all SPR/USDT LP (Liquidity Provider tokens) are automatically sent and locked into a special “black-hole address” . This address is a publicly transparent smart contract address that cannot be controlled by any private key. Once LP tokens enter this “black hole,” they cannot be withdrawn, moved, or altered in any way. This means that even the protocol’s developers cannot access or transfer this liquidity.

2. Structural Prevention of “Rug Pulls”

This permanent locking mechanism fundamentally solves the “rug pull” problem. Because core liquidity is irreversibly locked, malicious actors cannot manipulate the market or abscond with user funds by withdrawing liquidity. This provides a truly permanent safety layer for Satoshi Protocol users, allowing them to participate in the protocol with confidence, without worrying about liquidity being suddenly removed .

3. Value Anchor and Long-Term Moat

This “black hole” is not only a technical safeguard against “rug pulls” but also serves as a solid anchor for Satoshi Protocol’s value . It symbolizes the protocol’s commitment to long-term stability and user security. At the same time, this unique liquidity structure also builds a long-term “moat” for the protocol, giving it a distinct competitive advantage in the fiercely competitive DeFi market and attracting more participants who trust decentralization and transparent mechanisms .

Conclusion: Code Governs Value, Co-creating the On-Chain Future

Satoshi Protocol is more than just a decentralized protocol; it is a declaration for the future digital world. Through its zero-authority, fully on-chain transparent, and permanently locked mechanism architecture, coupled with its revolutionary automated growth engine and black-hole liquidity, Satoshi Protocol is laying a solid foundation for a “new on-chain civilization.” It embodies the concept of “Let Code Govern Value” through practical actions, painting a grand and hopeful blueprint for the future of decentralized finance. As Satoshi Protocol continues to evolve, we have every reason to believe that a more fair, transparent, and efficient era of on-chain value creation is accelerating its arrival .

Media Contact

Organization: Satoshi Protocol

Contact Person: Jaimes

Website: https://www.sprdefi.com/

Email: Send Email

Country:United States

Release id:40073

The post Satoshi Protocol: Standing at the Dawn of a New On-Chain Civilization, Reshaping the Paradigm of Value Creation appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Frank Okunak Calls Out “Plausible Deniability” as a Hidden Risk in Modern Corporate Leadership

-

Why Rationalizing Short-Term Decisions Undermines Trust, Governance, and Long-Term Value

New Jersey, US, 12th January 2026, ZEX PR WIRE, In a new leadership commentary, executive strategist Frank Okunak is challenging a widely accepted but rarely discussed practice inside many organizations: the use of plausible deniability to rationalize decisions that leaders know are ethically questionable, financially misleading, or strategically shortsighted.

According to Okunak, plausible deniability often emerges not through overt misconduct, but through quiet justification. “It shows up when executives tell themselves, ‘We’ll fix it next quarter,’ or ‘This lifts the bonus plan now and we’ll true it up later,’” he explains. “The problem is that intent matters just as much as mechanics.”

Drawing on decades of experience across finance, operations, and corporate governance, Okunak describes a pattern in which leaders knowingly take actions that distort performance in the short term while relying on future adjustments to offset the impact. Common examples include manipulating accruals to meet quarterly targets, signing representation letters while aware of aggressive accounting treatments, or parking intercompany balances on the balance sheet until results improve.

“These decisions are often technically defensible in isolation,” Okunak notes. “But when taken together, they represent a breakdown in accountability. Leaders may not say the words out loud, but they understand exactly what they are doing.”

Okunak also points to extraordinary events such as the COVID-19 pandemic as moments when plausible deniability becomes especially tempting. “Crisis creates cover,” he says. “It allows organizations to bundle legitimate write-offs with unrelated management mistakes, inefficiencies, or bad decisions, all under the umbrella of an external event. Over time, that erodes transparency and trust.”

At the center of Okunak’s critique is the gap between formal compliance and ethical responsibility. He argues that many executives hide behind process, delegation, or technical standards to avoid confronting the intent behind their decisions. “Signing a representation letter while knowing the numbers were engineered to hit a target is not a process failure,” he says. “It’s a leadership failure.”

Okunak emphasizes that plausible deniability is dangerous precisely because it feels reasonable at the moment. Bonuses, incentive plans, market expectations, and investor pressure all contribute to a culture where short-term outcomes are rewarded and long-term consequences are deferred.

“Organizations don’t lose credibility overnight,” Okunak explains. “They lose it one rationalized decision at a time.”

The commentary calls for a renewed focus on moral clarity in executive decision-making particularly in finance, accounting, and performance management. Okunak urges boards, audit committees, and senior leaders to look beyond technical compliance and ask harder questions about intent, timing, and transparency.

“Good governance isn’t just about whether something can be justified,” he says. “It’s about whether it should be done at all.”

Okunak believes that addressing plausible deniability head-on is essential for restoring trust in corporate leadership. Organizations that fail to confront these gray zones, he warns, risk not only reputational damage but long-term strategic fragility.

“Leadership is tested not when the numbers are easy,” Okunak concludes, “but when pressure tempts you to explain away what you already know is wrong.” I have made mistakes and bad decisions along the way but I find it funny or let’s just say hypocritical that so many Executives point fingers and call out others when three fingers are pointing back at them.

About Frank Okunak

Frank Okunak is an executive strategist with decades of experience in finance, operations, and organizational leadership. He advises companies and senior leaders on governance, accountability, and long-term value creation, with a focus on aligning strategy, ethics, and performance.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

The Church of Scientology Welcomes 2026 With A Winter Community Festival

-

- The Church of Scientology of Los Angeles held a Winter Community Event for East Hollywood families to welcome the New Year.

Los Angeles, California, 12th January 2026, ZEX PR WIRE, Rain forecast for the first week of the year was no stop for the Church of Scientology Los Angeles, who welcomed the New Year with a Winter Festival for the community held on January 1, featuring family-friendly activities and fun for children of all ages.

All activities were held indoors, allowing families to stay warm and cozy. There was no shortage of fun, with a sing-along concert, a bubble show, arts and crafts, face painting, and more.

Scientology founder L. Ron Hubbard wrote in his book The Way to Happiness: “Today’s children will become tomorrow’s civilization.”

Guided by this principle, the Church of Scientology Los Angeles creates family-friendly events throughout the year where the community can come together and children can enjoy a wide variety of activities in a safe space.

This festival marks the beginning of a new year, and families and members of the community are invited to attend future community events held throughout the year on L. Ron Hubbard Way.

In addition to special events, anyone curious to learn more about Scientology and the Church’s community assistance programs is welcome to visit at any time.

The Church of Scientology of Los Angeles was dedicated by Scientology ecclesiastical leader Mr. David Miscavige in 2010. It is designed to provide the ideal facilities for Scientologists on their ascent to higher states of spiritual freedom and to serve as a home for the entire community and a meeting ground of cooperative effort to uplift people of all denominations.

To learn more, visit the website of the Church of Scientology Los Angeles or watch Inside a Church of Scientology on the Scientology Network on DIRECTV channel 320, at Scientology.tv, through mobile apps, or via the Roku, Amazon Fire and Apple TV platforms.

© 2026 CSWUS. All Rights Reserved. Grateful acknowledgement is made to L. Ron Hubbard Library for permission to reproduce a selection from the copyrighted works of L. Ron Hubbard. SCIENTOLOGY is a trademark and service mark owned by Religious Technology Center and is used with its permission. SCIENTOLOGIST is a collective membership mark designating members of the affiliated Scientology churches and missions. Created in USA.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 week ago

DDPFORWORLD Launches Comprehensive DDP Shipping Solution for Global E-commerce Businesses

-

Press Release5 days ago

Boosting City Development With A Robust Convention & Exhibition Industry Suzhou International Expo Centre Writes A New Chapter In High-Quality Development

-

Press Release6 days ago

Galidix Announces Platform Scaling to Support Long Term French Investor Growth

-

Press Release6 days ago

Best Receipt OCR Software Research Report Published by Whitmore Research

-

Press Release1 week ago

Woven Highlights a Shift Toward More Human Centred Marketing Automation as Customer Expectations Evolve in Singapore

-

Press Release5 days ago

KeyCrew Media Selects Steve Luther and CHORD Real Estate as Verified Expert for International Real Estate Investment and Panama Market Opportunities

-

Press Release2 days ago

Finance Complaint List Issues Advisory Against Prevalent Elon Musk AI Deepfake Scams, Urges Public to Report Fraud to FBI, SEC, FTC, and FinanceComplaintList.com

-

Press Release6 days ago

Scholzgruppe Reports Progress in Building Scalable Operations in Germany