Press Release

DuraFast Label Company Launches Free White Resin Ribbon Samples to Support Specialty Label Printing

Cheyenne WY, 12th May 2025, ZEX PR WIRE, DuraFast Label Company has announced the release of free white resin ribbon samples for desktop thermal transfer printers, aimed at helping businesses explore specialty label printing solutions without upfront investment. This initiative is tailored for companies working with dark, textured, or transparent materials, where traditional black ribbons are ineffective or visually inconsistent.

With white resin ribbons becoming essential for high-contrast printing in industries such as electronics, automotive, cosmetics, and chemical labeling, DuraFast’s sample program makes it easier for businesses to test performance and compatibility with their existing setups. These ribbons offer a long-lasting print that resists abrasion, heat, chemicals, and moisture, ensuring labels remain legible and intact even in harsh environments.

Included in the sample release is a range of high-quality ribbon types designed for Brother TD4 printers, known for their reliability in commercial applications. Among them are the TR3370 High Opacity White Resin Ribbon and the R510W Durable White Resin Ribbon, both engineered to produce crisp white prints with long-term durability. Subtle variations, such as ink orientation, are also available—such as the Brother TD4 TR3370 High Opacity White Resin Ribbon with Ink OUT and the Brother TD4 R510W Durable White Resin Ribbon with Ink OUT—allowing customers to match ribbon types with the specific mechanics of their printer models.

The white resin ribbon samples will be available in limited quantities and are intended for evaluation use. Customers can request samples directly through DuraFast’s website, where the process has been made quick and accessible. The company anticipates high demand, especially from organizations using labels in compliance-heavy sectors or challenging environments.

“We’ve seen how essential proper ribbon selection can be for product labeling that not only looks sharp but also lasts,” the spokesperson added. “Whether it’s inventory tracking, packaging design, or regulatory marking, white resin ribbons can provide the clean visibility many industries need—especially when printing on dark or specialty substrates.”

Along with the ribbon samples, DuraFast Label Company provides extensive customer support, including print consultations and guidance on selecting the right ribbons, printers, and label types. This initiative aligns with DuraFast’s broader mission of helping businesses reduce printing errors, avoid mismatches, and enhance the efficiency of their labeling processes.

As companies continue to evolve their operations with automation and compliance in mind, DuraFast’s sample offering meets a timely need for accessible, high-performance printing supplies. The program is open to businesses across North America and will run while supplies last.

About DuraFast Label Company

DuraFast Label Company is a trusted provider of commercial and industrial label printing solutions across North America. The company offers a wide selection of printers, thermal ribbons, blank labels, and printing software. Known for fast shipping and hands-on support, DuraFast helps businesses across industries streamline their labeling processes with dependable technology and expert guidance.

Contact Details

Website: www.durafastlabel.com

Contact: +1 307-222-6077 (USA)

Address: 1712 Pioneer Ave., Ste 500, Cheyenne WY 82001-4406.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Rising Music Artist ROHAN Builds a New Sound Between Indie Rock, R&B, and Technology

ROHAN (stylized as ROHAN), is an Australian-born musician, singer-songwriter, and music producer who blends indie rock, R&B, electronic, and folk influences into emotional, genre-defying songs. Growing up between Australia and Singapore, ROHAN first learned piano from his Indian mother before discovering his love for punk music through Green Day’s American Idiot.

Now based in California, ROHAN has built a career at the intersection of music and technology. After enrolling at Stanford University, he chose to drop out and focus full-time on his creative path. From his DIY home studio, he produces and records his own music — characterized by confessional lyrics, melodic grit, and digital textures that bridge his global background and technical roots.

“ROHAN’s music is honest and alive,” says Romy Bayhack of Big Hassle, who represents the artist. “He’s building a new sound that connects emotion, innovation, and identity.”

ROHAN’s creative story — from coding computers to composing songs — mirrors a new generation of independent artists redefining the boundaries between technology and art. His upcoming releases promise to push that vision even further, blending emotional storytelling with cutting-edge sound design.

Fans can connect with ROHAN on Instagram @rohanx for the latest updates, music drops, and behind-the-scenes content.

About ROHAN

ROHAN is an Australian-born independent artist, producer, and songwriter raised between Australia and Singapore, now based in Los Angeles, California. His sound combines Aussie indie rock with R&B, electronic, and folk influences, creating introspective, genre-blurring anthems. ROHAN is known for his confessional lyricism, DIY production approach, and his commitment to bridging music and technology.

Official Instagram: @rohanx

Listen to his Music: http://www.rohan.fm

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Grimeypopstar to Release Highly Anticipated Project “Grimey Luv Songs”

Grimeypopstar is more than just an artist; he is a pioneer who is redefining the music landscape. As the CEO of Grimey Gang Records, he is cultivating a brand that embodies hard work, independence, and genuine artistry. The East Cleveland Ohio based artist is set to release his forthcoming mixtape, “Grimey Luv Songs,” on October 5 across all major platforms. This marks the next phase of Grimeypopstar’s journey — a compelling blend of emotion, street vitality, and authentic storytelling that encapsulates his identity and the ethos of his label.

“Grimey Luv Songs” showcases the complete spectrum of Grimeypopstar’s sound and essence. It transcends mere themes of love; it delves into loyalty, suffering, and the resilience required to persevere when faced with life’s challenges. Each track is a reflection of his unfiltered experiences and his transformation from an aspiring artist to a visionary leader with a message to convey. This project is deeply personal, unapologetic, and crafted to resonate with listeners who understand the grind.

Prior to the mixtape’s launch, fans were given a preview of what to expect with his single “Slickest Activator,” which is currently available on YouTube. This track showcases Grimeypopstar in his prime — self-assured, energetic, and fully in command of his musical style. It is a song that compels movement while also serving as a reminder that every lyric carries a narrative.

As the leader of Grimey Gang Records, Grimeypopstar is not merely releasing music; he is also creating pathways for other artists who share his passion and authenticity. His label signifies a new era of independent strength, empowering artists to remain true to their identities while reaching a global audience.

With “Grimey Luv Songs,” Grimeypopstar demonstrates that he is not just a fleeting presence; he is committed to establishing a lasting legacy. From the recording studio to the executive office, he is setting a benchmark for what it means to be both an artist and a CEO. When October 5 arrives, the world will witness the essence of Grimey Gang Records — genuine talent, heartfelt passion, and tangible outcomes.

You can find and stream Grimeypopstar’s music everywhere November 5th.

Make sure to follow him on all platforms @Grimeypopstar

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

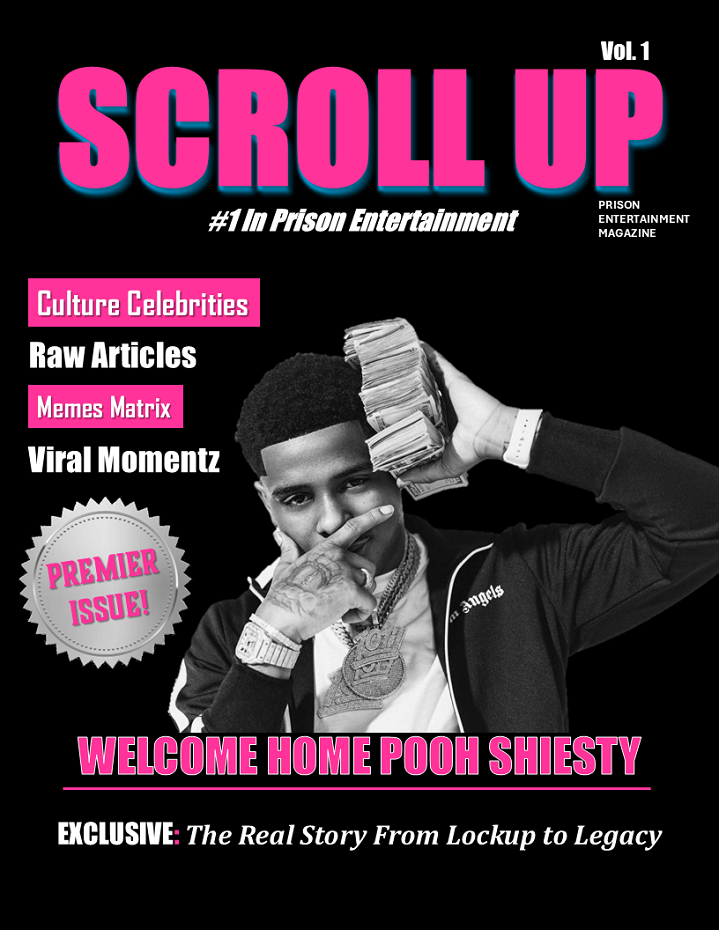

Scroll Up Magazine Launches the First Hip-Hop Magazine to Bring Social Media, Viral Content, and Street Culture Directly to Those Behind Bars

This month marks the launch of Scroll Up Magazine, the culture’s newest voice and the first publication designed specifically to bridge the gap between the incarcerated community and the rapidly evolving world of hip-hop, social media, and street culture.

Founded by Crystal Gotti and Richie Forbes, Scroll Up Magazine addresses a critical need: keeping those behind bars connected to the culture they helped build but have been locked out of experiencing. For the estimated 1.9 million people currently incarcerated in the United States, staying connected to family, friends, and the cultural movements happening on the outside has never been more challenging – or more important.

“You don’t scroll the jack – you scroll the page,” says Crystal Gotti, Co-Founder and Culture Editor. “Some of our readers haven’t touched down in years. They have no idea what a TikTok video looks like, what’s trending on Instagram, or what’s moving the culture right now. We bring the world to their hands – unfiltered, unbought, and unstoppable.”

What Makes Scroll Up Different:

Unlike traditional magazines, Scroll Up Magazine transforms the digital experience into print, featuring:

Viral TikTok videos captured as photo sequences with captions Instagram posts pulled directly from the timeline Memes, video stills, and social media moments that define the culture.

Issue One launches with a powerful cover story:

“Welcome Home Pooh Shiesty” An in-depth feature on the Memphis rapper’s recent release from federal custody after three years, his welcome home celebration, and his plan to reclaim his throne in hip-hop.

Who This Magazine Serves:

Scroll Up Magazine is essential reading for:

Incarcerated individuals seeking connection to the culture and current events. Families and loved ones of the incarcerated who want to send meaningful, engaging content and Hip-hop enthusiasts who value authentic, street-level perspectives.

Scroll Up Magazine offers more than entertainment – it offers hope, connection, and proof that the culture hasn’t moved on without them.

To subscribe or learn more, visit: ScrollUpMagazine.com or contact Subscribe@ScrollUpMagazine.com

Follow Scroll Up Magazine:

Instagram: @ScrollUpMagazine

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release3 days ago

Department of Skill Development, Entrepreneurship and Livelihood, Government of Karnataka Is set to host the Inaugural Edition of the Bengaluru Skill Summit 2025

-

Press Release7 days ago

XNAP Token Set to Launch on Major DEX Platforms This November 2025 — Fueling the Synapse Power Ecosystem

-

Press Release6 days ago

MiniDoge shines at TechCrunch Disrupt boosting innovation in AI and Web3

-

Press Release3 days ago

PepePort Transforms Meme Finance PPORT Presale will be LIVE Monday 3rd November 2025 – Access to the Ultimate Meme Economy Opens Monday

-

Press Release5 days ago

Business Consulting Agency Empowers Los Angeles Businesses with Over 20 Years of Proven Expertise

-

Press Release2 days ago

The “ Finest Cultural Gifts from China ” Cultural and Tourism Trade Promotion Activity (Intangible Cultural Heritage and Time-Honored Brands Special ) was held in Kaifeng.

-

Press Release6 days ago

ReyVend Unveils Next-Generation AI Vending and Smart Cooler Platform, Pioneering the Future of Automated Retail

-

Press Release1 week ago

Ustyle Magazine Redefines Digital Media with Fashion Beauty and Lifestyle Trends