Press Release

Crestline Asset Management Ltd. Partners with Leading Tech Companies to Launch Next-Generation AI-Driven Investment Products, Led by Derek Vaughn

Crestline Asset Management Ltd. (CAM), a pioneering investment management firm, is accelerating its commitment to combining cutting-edge financial science, artificial intelligence (AI), decentralized finance (DeFi), and sustainable investment strategies. The firm, under the leadership of Derek Vaughn, is strengthening its relationships with high-tech companies to launch a new generation of investment products designed to deliver superior returns, enhanced diversification, and long-term growth while adhering to the highest standards of responsible investing.

In an era where technological advancements are redefining the investment landscape, Crestline has positioned itself at the forefront of AI, DeFi, and data analytics integration. This unique combination is set to create a suite of sophisticated investment solutions designed to meet the ever-evolving needs of investors worldwide.

Leading the Charge: Derek Vaughn’s Vision for the Future of Investment

Derek Vaughn, a visionary leader with years of experience in the asset management industry, has been instrumental in driving Crestline’s forward-thinking strategy. Under his leadership, the firm has expanded its focus on advanced AI technologies, big data analytics, and blockchain solutions. Vaughn believes that integrating these technologies is essential for creating next-generation investment products that provide both high returns and long-term sustainability.

“Derek’s leadership has been pivotal in steering Crestline toward becoming a leader in the tech-driven investment sector,” said a Crestline spokesperson. “His vision for combining AI, DeFi, and responsible investing has laid the groundwork for a new wave of investment solutions that will redefine the future of asset management.”

Harnessing the Power of AI, Blockchain, and DeFi

Crestline Asset Management is committed to leveraging AI-powered prediction models, advanced data analytics, and blockchain technology to deliver a smarter, more adaptable investment approach. AI algorithms are continuously trained on vast amounts of market data, allowing Crestline to make more accurate predictions, identify emerging market trends, and manage risk effectively. Meanwhile, the integration of blockchain and decentralized finance technologies enhances transparency, lowers transaction costs, and provides innovative financial products that align with the future of finance.

In addition, Crestline’s DeFi-driven approach enables the firm to offer decentralized financial instruments, providing clients with enhanced liquidity and more efficient, low-cost transactions. These innovations, combined with Crestline’s proven market expertise, position the firm to deliver superior returns while maintaining broad diversification across asset classes.

Strategic Tech Partnerships for Next-Generation Investment Products

In pursuit of innovation, Crestline Asset Management is forming strategic partnerships with leading technology companies. These collaborations allow the firm to enhance its technological capabilities and accelerate the development of next-generation investment products. By joining forces with top-tier AI and blockchain firms, Crestline is ensuring that its investment solutions remain at the cutting edge of the tech-driven financial landscape.

“Our partnerships with high-tech companies are crucial in developing the innovative investment products of tomorrow,” said Derek Vaughn. “The combination of advanced AI, DeFi technology, and our responsible investing framework allows us to create solutions that not only generate superior returns but also align with the values and goals of modern investors.”

Sustainability and Responsible Investing at the Core

Sustainability remains a key focus of Crestline’s investment approach. By integrating environmental, social, and governance (ESG) factors into its AI and DeFi solutions, Crestline ensures that every investment decision contributes to both financial growth and positive societal impact. Under Derek Vaughn’s leadership, the firm continues to prioritize responsible investing while embracing technological advancements that enhance both sustainability and financial performance.

A Vision for the Future of Investment

Looking ahead, Derek Vaughn and the team at Crestline Asset Management are committed to further expanding their use of AI and blockchain technologies to develop innovative, cost-effective, and responsible investment solutions. Crestline aims to continue pushing the boundaries of what is possible in the investment world, ensuring that it remains a leader in the intersection of finance and technology.

About Crestline Asset Management Ltd.

Crestline Asset Management Ltd. is a leading asset management firm dedicated to providing clients with innovative, AI-driven, and sustainable investment solutions. Through the integration of AI, decentralized finance, and blockchain technology, CAM delivers high-quality investment products that prioritize long-term growth, diversification, and responsible investing. With a focus on leveraging cutting-edge technology and strong industry partnerships, Crestline is shaping the future of asset management.

For more information, visit www.crestline-am.com.

Media Contact

Organization: CRESTLINE ASSET MANAGEMENT LTD

Contact Person: Derek Vaughn

Website: https://www.crestline-am.com/

Email: Send Email

Country:Spain

Release id:27288

View source version on King Newswire:

Crestline Asset Management Ltd. Partners with Leading Tech Companies to Launch Next-Generation AI-Driven Investment Products, Led by Derek Vaughn

This content is provided by a third-party source. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Argenta Silver Validates Deposit Continuity and Expands Known Resource with High Grade Silver Intercepts

The results confirm the high-grade, pure silver character of the mineralization and reinforce the need for systematic exploration outside of the existing resource

Vancouver, BC – August 18, 2025 – Global Stocks News – Sponsored content disseminated on behalf of Argenta Silver. On August 13, 2025, Argenta Silver (TSXV: AGAG) (OTCQB: AGAGF) (FSE: T1K) released a 2nd batch of assay results from its ongoing 2025 winter diamond drilling program at the 100% owned El Quevar Project in Salta Province, Argentina.

Argenta Silver is a young company (8 months old) helmed by a young CEO, Joaquín Marias (37 years old). Youthful leadership with strong geological credentials, backed by high-level strategic advisers (Frank Giustra & Eduardo Elsztain) has been well received by the market. Year-to-date, Argenta’s share price has risen 300% from .21 to .63.

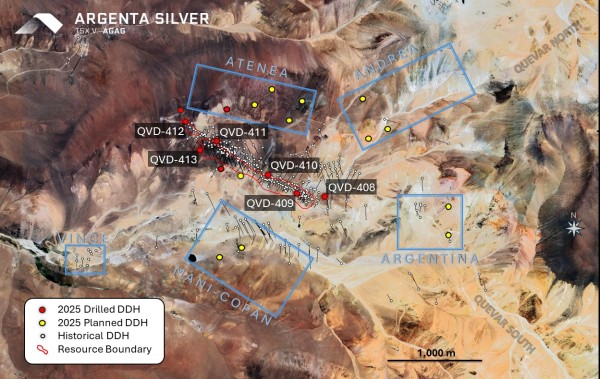

The El Quevar Project spans an area of 57,000 hectares – equivalent to a square with sides 15-miles-long. Less than 3% of the land package has been comprehensively explored. The property has 60 kilometers of internal roads, a fully operational camp for 100 workers, with a railroad, gas pipeline and a service road three kilometers from camp.

The 2025 4,000-meter winter drilling is approximately 15% confirmation drilling, 25% expansion drilling and 60% exploration drilling. Argenta believes that the Yaxtché deposit is still open.

On August 14, 2025 6ix Inc. hosted a webinar with CEO Joaquin Marias to discuss the latest drill results and the long-term value creation strategy at Argenta. The event, moderated by 6ix VP Business Solutions, Romeo Maione, was published on YouTube.

“There is no gold, no lead, no zinc, no copper in these analytical results,” Marias told Maione. “It’s a pure silver play, which is rare and precious. Confirmation drill holes help us to understand the technicalities of the resource. The step-out drill hole is telling us that the resource might continue.”

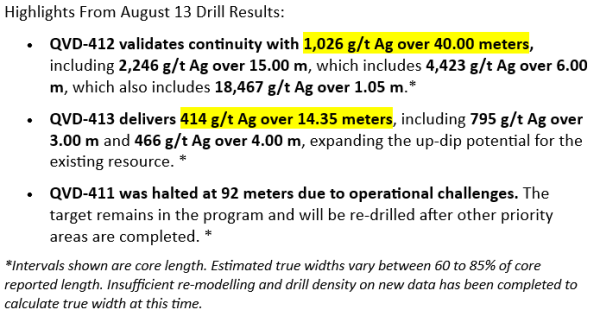

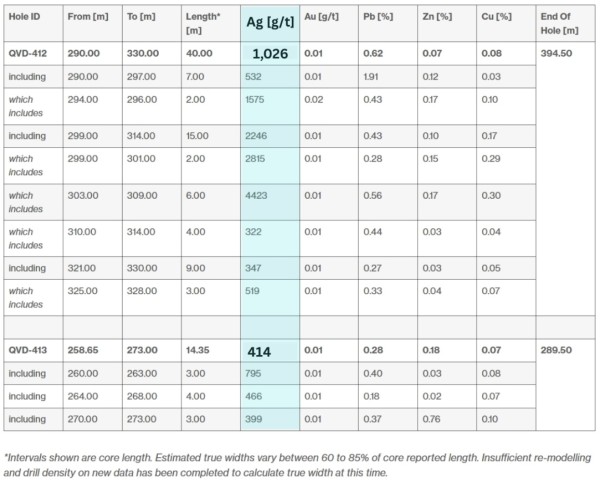

“The success of the up-dip hole QVD-413, along with the project’s highest-ever assay, 18,467 g/t silver over 1.05 meters within a broader interval of 1,026 g/t silver over 40.00 meters in QVD-412, validates and reinforces our dual strategy,” stated Marias in the August 13 press release, “Expanding the known resource while aggressively exploring the vast, untested areas of this high-grade system.”

“From a technical standpoint,” continued Marias, “the extraordinary tenor of the Yaxtché mineralization highlights the strength and scale of the hydrothermal system that formed El Quevar.”

Alongside previously disclosed drillholes from this program (see news release from July 21, 2025), the results also confirm the high-grade, pure silver character of the mineralization and reinforce the need for systematic exploration outside of the existing resource (Yaxtché deposit) when less than 3% of the property has seen modern exploration.

On August 12, 2025 Argenta Silver announced that it had raised CND $15 million at a price of C$0.40 per unit. Pursuant to the offering, Frank Giustra acquired 450,000 common shares and 225,000 Warrants.

Mr. Giustra’s ownership position in Argenta now represents 15.09% of the outstanding common shares and 16.78% on a partially diluted basis, assuming the exercise of 3,425,000 warrants.

On August 12, 2025 Argenta also announced the closing of an investment of CND $2.5 million by Tyrus S.A., an affiliate of Mr. Eduardo Elsztain, on the same terms as the investor rights agreement dated April 28, 2025.

Elsztain is Argentina’s largest real-estate developer through IRSA, which owns 15 shopping centers and numerous hotels and resorts. Elsztain is also a key stakeholder in the agriculture company, Crescud, producing cattle, soybeans, wheat, corn and sunflowers on 800,00 hectares of farmland.

“Mr. Elsztain is a very influential businessman in Argentina,” Marias confirmed to Guy Bennett, CEO of Global Stocks News (GSN). “He understands the mining industry. It’s part of our strategy to attract long-term, high-quality, well-connected strategic investors. We are grateful for Mr. Elsztain’s ongoing support.”

Mr. Elsztain, through IFIS Ltd. and Tyrus S.A., owns and/or controls directly or indirectly 31,250,000 common shares of Argenta, and 8,325,000 warrants, representing 12.57% of the outstanding Common Shares and 15.40% on a partially diluted basis.

Elsztain maintains a close relationship with Argentina’s President Javier Milei. During the 2023 election campaign, Milei set up his base of operations at the Libertador hotel, owned by IRSA.

The El Quevar project was purchased for USD3.5 million in October, 2024 after the previous operator sold numerous assets to resolve “urgent liquidity problems.

Drilling kicked off in late May as part of a fully funded 4,000-meter winter campaign designed to confirm known high-grade zones, step out along strike, and test new targets. [editor’s note: Argentina is in the Southern Hemisphere: the “winter drill program” occurs during Canada’s summer]

Assays from the first group of results were announced on July 21, 2025 (see news release from July 21, 2025). The exploration program is still on going and results for the remaining holes are expected by early and late September.

Rob van Egmond, P.Geo., a “qualified person” as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical information contained in this release. Rob van Egmond, P.Geo. has visited the El Quevar Project and is not independent of the Company.

The foundational Mineral Resource Estimate of the Yaxtché deposit boasts an indicated mineral resource of 45.3 million ounces of silver from 2.93 million tonnes grading 482 g/t Ag, and an inferred resource of 4.1 million ounces from 0.31 million tonnes grading 417 g/t Ag [1.]

[1.] Refer to NI43-101 technical report with effective date of September 30, 2024, titled “NI 43-101 Technical Report on the Mineral Resource Estimate of the El Quevar Project Salta Province, Argentina”, posted on www.SEDAR.com under Argenta Silver Corp.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: Argenta Silver paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:32513

The post Argenta Silver Validates Deposit Continuity and Expands Known Resource with High Grade Silver Intercepts appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Bitamp 2025 The Wallet That Lets Users Verify Code Independently While Keeping Bitcoin Fully Private

New York, Aug 18th, 2025 — The open-source, browser-based Bitcoin wallet ensures full control of private keys while offering complete transparency for security-conscious users.

By enabling independent verification of its source code via GitHub, Bitamp allows users to confirm the wallet’s integrity for themselves, reinforcing confidence in its security and functionality. This transparency positions Bitamp as a leader in privacy-first legit Bitcoin wallet solutions, appealing to security-conscious users, developers, and digital asset enthusiasts.

In addition to local execution and open-source verification, Bitamp integrates with the Tor network, offering a secure and anonymous method for managing Bitcoin. Every design choice reflects a commitment to empowering users while maintaining maximum privacy and security.

“Our goal with Bitamp has always been to put users in full control of their Bitcoin while providing complete transparency,” added Bitamp. “By allowing anyone to independently verify the code and operate entirely locally, we ensure that privacy and security are never compromised. This approach empowers users to manage their assets confidently, on their terms.”

Bitamp continues to redefine how Bitcoin can be safely managed, privately controlled, and independently verified, providing users with tools that respect both security and autonomy.

For more information or to use Bitamp, visit: https://www.bitamp.com

About Bitamp

Bitamp is an open-source Bitcoin wallet focused on privacy, security, and user empowerment. By combining local execution, transparency, and self-sovereignty, Bitamp ensures users retain full control over their digital assets while allowing them to independently verify the wallet’s integrity and maintain maximum privacy.

Media Contact

Organization: Bitamp

Contact Person: Bitamp

Website: https://www.bitamp.com/

Email: Send Email

City: New York

Country:United States

Release id:32537

The post Bitamp 2025 The Wallet That Lets Users Verify Code Independently While Keeping Bitcoin Fully Private appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

RiVirtual Unveils Mumbais Top 25 Real Estate Builders of 2025 Celebrating Excellence and Vision

RiVirtual, a global leader in real estate innovation, proudly announces the much-anticipated Mumbai’s Top 25 Real Estate Builders of 2025. This annual ranking highlights the visionaries transforming Mumbai’s skyline through iconic developments, innovation, and sustainable practices.

RiVirtual, a global leader in real estate innovation, proudly announces the much-anticipated Mumbai’s Top 25 Real Estate Builders of 2025. This annual ranking highlights the visionaries transforming Mumbai’s skyline through iconic developments, innovation, and sustainable practices.

The list celebrates excellence in design, execution, and customer satisfaction, offering a definitive guide for homebuyers, investors, and industry stakeholders. With Mumbai standing as India’s financial capital, these developers are shaping the city’s future with world-class residential and commercial projects.

Mumbai’s Top 25 Builders of 2025

Lodha Group (Macrotech Developers) – Scored 94

Signature Projects: Lodha World Towers, New Cuffe Parade

Godrej Properties – Scored 92

Signature Projects: Godrej One, Godrej Platinum

Oberoi Realty – Scored 90

Signature Projects: Three Sixty West, Oberoi Garden City

Hiranandani Group – Scored 89

Signature Projects: Hiranandani Gardens, Powai; Hiranandani Estate, Thane

K Raheja Corp – Scored 88

Signature Projects: Mindspace Business Parks, Raheja Artesia

L&T Realty – Scored 87

Signature Projects: Crescent Bay, Seawoods Residences

Kalpataru Group – Scored 86

Signature Projects: Kalpataru Parkcity, Kalpataru Vivant

Piramal Realty – Scored 85

Signature Projects: Piramal Mahalaxmi, Piramal Aranya

Shapoorji Pallonji Real Estate – Scored 84

Signature Projects: BKC 9, Parkwest

Runwal Group – Scored 83

Signature Projects: Runwal Greens, Runwal Bliss

Sunteck Realty – Scored 82

Signature Projects: Sunteck City, Signature Island

Mahindra Lifespaces – Scored 81

Signature Projects: Mahindra Luminaire, Happinest

Adani Realty – Scored 80

Signature Projects: Adani Western Heights, Inspire BKC

Dosti Realty – Scored 79

Signature Projects: Dosti West County, Dosti Majesta

Ajmera Realty – Scored 78

Signature Projects: Ajmera i-Land, Ajmera Aeon

DB Realty – Scored 77

Signature Projects: DB Crown, Orchid Turf View

Prestige Group – Scored 76

Signature Projects: Prestige Jasdan Classic, Mulund

Raheja Universal – Scored 75

Signature Projects: Raheja Imperia, Raheja Exotica

Kolte Patil Developers – Scored 74

Signature Projects: Jai Vijay, 24K Opula

JP Infra – Scored 73

Signature Projects: JP North, Altus

Ruparel Realty – Scored 72

Signature Projects: Ruparel Ariana, Sky Greens

Hubtown – Scored 71

Signature Projects: Hubtown Solaris, Hubtown Gardenia

Arkade Developers – Scored 70

Signature Projects: Arkade Crown, Arkade Earth

Mayfair Housing – Scored 69

Signature Projects: Mayfair Meridian, Mayfair Hillcrest

Akshar Developers – Scored 68

Signature Projects: Akshar Green World, Akshar Alvario

Key Trends Driving Mumbai’s Real Estate Growth

- Sustainability: Builders like Lodha Group and Godrej Properties lead with eco-friendly designs.

- Luxury Redefined: Oberoi Realty and Hiranandani Group focus on wellness and comfort.

- Integrated Living: Mixed-use developments by K Raheja Corp and L&T Realty are on the rise.

- Affordable Housing: Builders like Mahindra Lifespaces and Dosti Realty address the demand for quality affordable homes.

- Technology-Driven Homes: IoT-enabled smart homes are becoming a standard offering.

About RiVirtual

RiVirtual is a global real estate FinTech company operating in over 100 cities worldwide. Known for its innovative solutions, including digital business cards and property management tools, RiVirtual empowers builders, realtors, and investors with cutting-edge technology.

Media Contact

Organization: RiVirtual Inc

Contact Person: Mike Jones

Website: https://rivirtual.com/

Email: Send Email

Contact Number: +18888658055

Address:1950 W Corporate Way

City: Anaheim

State: CA

Country:United States

Release id:32544

The post RiVirtual Unveils Mumbais Top 25 Real Estate Builders of 2025 Celebrating Excellence and Vision appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release5 days ago

2025’s Top 6 Free Cloud Mining Platforms Revealed: XRP Community Sparks Discussion on Stable Earning Strategies

-

Press Release1 week ago

Siton Mining Launches XRP Cloud Mining Contracts, Earn Daily Passive XRP Income with Your Smartphone

-

Press Release2 days ago

Sunrise Pact Investment Alliance Integrates Alaric Wainwright’s NeuroGrid AI Into Global Fintech Rollout

-

Press Release1 week ago

From XRP to BTC: How Find Mining’s Cloud Plan Creates Steady Passive Returns

-

Press Release3 days ago

Instant Mobile Mining: OPTO Miner App Lets Users Earn Passive Income in XRP and BTC

-

Press Release1 week ago

Ripplecoin Mining Debuts Cloud Mining App Amid Ethereum’s Bull Run

-

Press Release1 week ago

Sebastian Najera Latin YouTube Mentor Launches New Era of Faceless Content with Explosive Student Growth

-

Press Release3 days ago

CT Crypto Financial Limited Expands Global Digital Asset Operations with Innovative Web3 Strategy