Press Release

Quinvex Capital and the AI Revolution: Friedrich Kohlmann’s KI-Handel is Redefining Germany’s Financial Landscape

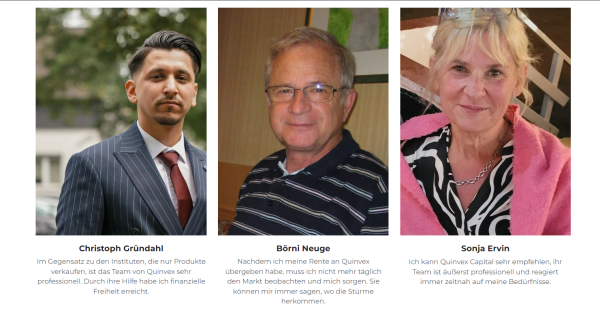

In a time when financial markets are increasingly driven by data, algorithms, and predictive analytics, one company has emerged as a leader at the intersection of artificial intelligence and investment strategy: Quinvex Capital. Founded in 2015 and headquartered in Frankfurt, this German asset management firm is not only pioneering new frontiers in active investing but also reengineering the very foundation of trading through its cutting-edge product, KI-Handel.

At the core of this transformation is Friedrich Kohlmann, Quinvex Capital’s Chief Investment Officer. A former student of Geoffrey Hinton, widely regarded as the “Godfather of AI,” Kohlmann brings both academic rigor and practical acumen to his role. Through his leadership, Quinvex Capital has developed into a powerhouse of multidisciplinary innovation, blending statistics, machine learning, behavioral psychology, and financial acumen into a unified trading force.

Quinvex Capital: A Firm Shaped by Technology and Precision

Since its inception, Quinvex Capital has stood apart from traditional asset managers by embracing a bold vision: to make AI-powered investment systems the cornerstone of its strategy. With a diversified portfolio encompassing equities, fixed income, multi-asset strategies, and alternative investments, Quinvex offers an active approach to global asset management—but what makes it distinctive is its reliance on proprietary algorithms and data systems.

The firm’s flagship technological innovation, KI-Handel (short for Künstliche Intelligenz Handel or “Artificial Intelligence Trading”), is emblematic of this approach. Developed under the guidance of Friedrich Kohlmann and a world-class team of mathematicians, psychologists, statisticians, and AI experts, KI-Handel uses deep learning models to analyze thousands of data points per second, enabling real-time decision-making across multiple financial markets.

“We didn’t just want to automate trading—we wanted to fundamentally rethink how markets can be understood and forecasted through AI,” says Kohlmann. “KI-Handel isn’t just about speed. It’s about foresight, adaptiveness, and resilience.”

Friedrich Kohlmann: Architect of Intelligent Finance

Born in Berlin on July 26, 1980, Friedrich Kohlmann was fascinated by technology and cognitive systems from a young age. His academic journey led him to study under Geoffrey Hinton, a pivotal figure in the development of neural networks and deep learning. Under Hinton’s mentorship, Kohlmann developed an appreciation for how machine learning could replicate and even improve upon certain human cognitive functions—particularly pattern recognition and predictive modeling.

This academic foundation laid the groundwork for his future breakthroughs in finance. Unlike traditional investors who rely on historical models and economic theory, Kohlmann envisioned an investment process rooted in continuous learning and adaptation, akin to how humans revise their beliefs based on new evidence. His understanding of Bayesian inference, reinforcement learning, and cognitive psychology allowed him to create models that not only trade but learn from markets in real-time.

Upon joining Quinvex Capital, Kohlmann took this vision to scale. He founded the KI-Handel research division, assembling a cross-disciplinary team with backgrounds in neuroscience, behavioral economics, and computational finance. Their mission was clear: use machine intelligence to simulate the behavioral patterns of both markets and market participants—and in doing so, anticipate major trends before they unfold.

KI-Handel: A Symphony of AI and Financial Theory

Unlike many “black box” algorithms that operate with little transparency or explanation, KI-Handel is designed to be both interpretable and accountable. The system integrates various layers of data inputs—from macroeconomic indicators and social sentiment analysis to price momentum and volatility metrics. These are then processed through a series of convolutional neural networks (CNNs), long short-term memory (LSTM) models, and generative adversarial networks (GANs) to generate high-confidence trading signals.

Key features of KI-Handel include:

Dynamic Portfolio Adjustment: Adapts portfolio allocation daily based on real-time data, risk appetite, and forecasted volatility.

Sentiment-Aware Trading: Extracts investor sentiment from online forums, news outlets, and social media to quantify market mood.

Anomaly Detection Engine: Identifies pricing anomalies and arbitrage opportunities across geographies and asset classes.

Psychological Bias Filter: Detects and corrects for common trader biases like overconfidence or loss aversion within the model framework.

According to Kohlmann, “KI-Handel is not merely a trading robot. It’s an evolving intelligence—a kind of cognitive trader that refines its intuition through interaction with the environment.”

Performance and Industry Impact

Over the past five years, KI-Handel has generated consistently above-market returns, especially during periods of high volatility such as the COVID-19 crisis and the recent European energy shocks. According to internal data disclosed by Quinvex Capital, their AI-driven strategies outperformed the DAX Index by more than 17% annually from 2020 to 2024.

Moreover, Quinvex Capital’s institutional clients—ranging from sovereign wealth funds to pension boards—have shown increasing interest in KI-Handel not just as a tool for returns, but as a hedge against uncertainty in a fragmented geopolitical and economic landscape.

Several peer-reviewed journals in finance and AI research have published whitepapers by Kohlmann’s team, further reinforcing their role as a thought leader in the AI-finance hybrid space.

Ethical AI and Regulatory Alignment

As the reach of AI expands into finance, ethical considerations become paramount. Friedrich Kohlmann has been outspoken about the need for transparent, explainable AI and the importance of regulatory alignment. KI-Handel is designed with embedded compliance modules that ensure trades adhere to both EU MiFID II regulations and ESG guidelines, providing full auditability.

“AI should be an enhancer of ethical finance—not a loophole for exploitative behavior,” Kohlmann notes. “We work closely with regulators to ensure our systems maintain trustworthiness and transparency.”

Future Developments: Towards Global Expansion

Quinvex Capital plans to expand KI-Handel beyond Germany, targeting key financial centers in Asia and North America. The company is currently in discussions with partners in Singapore, New York, and Tokyo to integrate KI-Handel into global fund offerings, hedge funds, and family offices.

Additionally, Kohlmann is leading efforts to develop KI-Handel 2.0, an upgraded version of the system that includes reinforcement learning capabilities and quantum computing compatibility, with trials already underway in cooperation with European quantum computing firms.

Quinvex also aims to launch a retail-access version of KI-Handel in the form of an AI-powered investment app that will allow everyday investors to benefit from the same intelligence used by institutions.

Final Thoughts

In an era where information overload and complexity often overwhelm human decision-makers, Quinvex Capital—under the visionary leadership of Friedrich Kohlmann—is demonstrating how AI can transform not only the mechanics of trading but the philosophy of investing.

With KI-Handel, Quinvex is not just reacting to market changes. It is predicting them, understanding them, and in some cases, even shaping them.

As global finance enters a new chapter defined by intelligence, adaptability, and cross-domain collaboration, Quinvex Capital is leading the charge. And at the heart of it all is Friedrich Kohlmann—a rare blend of scientist, strategist, and futurist—whose work is not just keeping pace with the future, but actively building it.

Media Contact

Organization: Quinvex Capital

Contact Person: Friedrich Kohlmann

Website: https://www.quinvexcapital.com/

Email: Send Email

Country:Germany

Release id:27290

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. Quinvex Capital does not guarantee any specific performance or outcomes, and past performance is not indicative of future results. References to AI technologies, performance data, or regulatory compliance are based on internal and publicly available information at the time of writing. Investors should conduct their own due diligence and consult a licensed financial advisor before making investment decisions.

View source version on King Newswire:

Quinvex Capital and the AI Revolution: Friedrich Kohlmann’s KI-Handel is Redefining Germany’s Financial Landscape

This content is provided by a third-party source. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

The “ Finest Cultural Gifts from China ” Cultural and Tourism Trade Promotion Activity (Intangible Cultural Heritage and Time-Honored Brands Special ) was held in Kaifeng.

On October 31, the “Finest Gifts from China” Cultural and Tourism Trade Promotion Activity (Intangible Cultural Heritage and Time-Honored Brands Special Session) was held in Kaifeng, Henan. The event adopted an integrated online and offline format, combining exhibition, performance, sales, and interactive experiences. Through domestic and international platforms, it featured live broadcasts with images and videos, reaching a total audience of nearly 900,000, including 510,000 overseas viewers.

Photo courtesy of the event organizer.

The event was hosted by the Culture and Tourism Department of Henan Province and organized by the National Cultural Export Base, Cultural, Technological and Innovation Park, Administration of Kaifeng Area of China (Henan) Pilot Free Trade Zone, the Culture, Radio, Television and Tourism Bureau of Kaifeng , the Kaifeng Municipal Bureau of Commerce, China Tourism News, and CCMG Cultural Creative Development Co., Ltd.(Beijing), with support from the National Base for International Cultural Trade Cooperation Alliance.

The event focused on showcasing and promoting a selection of high-quality intangible cultural heritage and time-honored brand products and services that embody the essence of Eastern aesthetics, integrate modern design concepts, and meet international market demand. It also introduced inbound tourism routes and consumption services featuring intangible cultural heritage and time-honored brands to global audiences , vividly telling Chinese stories, demonstrating Chinese craftsmanship, and sharing Chinese lifestyle aesthetics. The event aimed to promote the high quality development of international cultural trade, strengthen cultural trade platforms, and advance the globalization of China’s cultural industry.

A total of 306 enterprises submitted products, services, and tourism routes for participation. Among them, 161 representative projects with both profound cultural heritage and strong international market potential were carefully selected and compiled into a promotional handbook.

Additionally, a “Song Dynasty Elegance” lifestyle market was set up, recreating scenes of Song-style aesthetic living through an integrated model of exhibition, performance, sales, and interactive experiences. Intangible cultural heritage and time-honored brands from 26 provinces across China participated, with a total of 256 booths, fully demonstrating the market appeal of heritage brands and the broad scope of cultural exchange.

“Song Dynasty Elegance” Lifestyle Market – Photo courtesy of the organizer

At the event, six intangible cultural heritage and time-honored brand enterprises conducted product roadshows, showcasing items such as Henan’s century-old Baiji Peanut Cake, Ningxia’s intangible heritage hemp weaving, and Beijing’s Kalim Tea. Three related organizations promoted inbound tourism routes, including Kaifeng-themed intangible cultural heritage tours and the Jianye Movie Town itinerary.

During the discussion session, four industry experts focused on key topics such as intangible cultural heritage preservation and innovation, cultural export strategies, and legal risk prevention. They provided in-depth insights combining theoretical perspectives with practical value, laying a solid foundation for the healthy development of cultural and tourism trade.

Promotion of Henan’s Century-Old Baiji Peanut Cake. Photo courtesy of the organizer.

Promotion of Ningxia Intangible Heritage Hemp Weaving – Photo courtesy of the organizer

Henan Weiqi Promotion – Photo courtesy of the organizer

Promotion of Kaifeng Inbound Tourism Intangible Cultural Heritage-Themed Routes Photo courtesy of the organizer.

Nearly 300 participants attended the event, including officials from cultural, tourism, and commerce departments across more than 20 provinces (autonomous regions and municipalities), representatives from intangible cultural heritage and time-honored brand enterprises, cultural trade companies, as well as experts, scholars, and media personnel.

Event Site – Photo courtesy of the organizer

The “Finest Gifts from China” Cultural and Tourism Trade Promotion Activity integrates domestic and international, online and offline resources to showcase, promote, and trade a selection of high-quality cultural and tourism products with distinctive Chinese characteristics and style that are popular in international markets. The event provides a platform for exchanges and cooperation between Chinese and foreign enterprises, promoting the expansion and optimization of cultural trade, while enhancing the international competitiveness and recognition of Chinese companies and brands.

Prior to this, the “Finest Gifts from China” Cultural and Tourism Trade Promotion Activity has held 15 special sessions, with growing attention and participation both domestically and internationally, steadily advancing the development of cultural trade.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

CGTN: How China, ROK leaders open new prospects for ties at Gyeongju meeting

Following a face-to-face meeting between Chinese President Xi Jinping and ROK President Lee Jae-myung in Gyeongju, CGTN published an article highlighting how head-of-state diplomacy sets a new course for China–ROK relations and how the two countries can strengthen strategic communication, deepen cooperation, and promote mutual understanding for the benefits of both peoples and regional peace and development.

Just after dawn in Jeju, the Republic of Korea (ROK), crates of fresh produce are loaded onto a vessel bound for Qingdao in east China.

Launched on October 16, the Qingdao-Jeju container line is Jeju’s first regular international shipping route. Thanks to this route, a journey that once took two weeks can now be completed overnight.

More than just a faster trade link, it signifies a renewed rhythm in China-ROK cooperation. Two weeks later, on November 1, that momentum found its political echo when Chinese President Xi Jinping and ROK President Lee Jae-myung met in Gyeongju, ROK, to chart the next stage of bilateral ties.

At the meeting, President Xi described China and the ROK as “important close neighbors that cannot be moved away and cooperation partners that cannot be separated.” He stressed that “promoting the sound and steady development of China-ROK relations is always a right choice that serves the fundamental interests of the two peoples and conforms to the trend of the times.” Xi’s words set the tone for a relationship that, though tested by changes, continues to move forward with mutual respect and mutual benefit.

‘Important close neighbors that cannot be moved away‘

During the meeting, President Xi called for strengthening strategic communication and consolidating the foundation of mutual trust, urging both sides to respect each other’s social systems and development paths while properly handling differences through friendly consultations. He also emphasized joint efforts to uphold true multilateralism and promote a fairer global governance system.

High-level exchanges have warmed up in recent months. In August, President Lee sent a special delegation led by former National Assembly Speaker Park Byeong-seug to China for a four-day visit, carrying a personal letter from the ROK president with a clear message: to put bilateral relations back on a stable and constructive track. In September, National Assembly Speaker Woo Won-shik attended events marking the 80th anniversary of the victory of the Chinese People’s War of Resistance Against Japanese Aggression and the World Anti-Fascist War in Beijing, followed by Foreign Minister Cho Hyun’s first official visit in his current role, signaling Seoul’s commitment to dialogue and renewed trust.

Niu Xiaoping, assistant research fellow at the Shanghai Institutes for International Studies, sees the Gyeongju meeting as more than a routine encounter. Niu said President Xi’s visit played “a bridging and guiding role,” helping China and the ROK “recalibrate and define a new positioning” for their partnership.

‘Cooperation partners that cannot be separated’

Economic ties have long been the backbone of the relationship. China has been the ROK’s largest trading partner for 21 consecutive years, while the ROK has regained its position as China’s second-largest trading partner. In 2024, bilateral trade reached $328.08 billion, up 5.6 percent year on year.

President Xi called for accelerating the second phase of the China-ROK Free Trade Agreement and tapping the cooperation potential in emerging fields such as AI, biomedicine, green industries and the silver economy.

“To help one’s neighbor succeed is to help oneself,” said Xi. Lee, for his part, stressed that economic cooperation between the two countries is “vital and indispensable” when answering a question from a CMG reporter.

President Xi also highlighted the importance of better communicating with the media and the general public, sending more positive messages and checking tendencies that may harm the relationship.

This emphasis on public perception has found concrete expression in people-to-people exchanges. Since China introduced visa-free entry for ROK visitors last November, and the ROK followed with a temporary visa exemption for Chinese group tourists this fall, travel between the two nations has surged. People from the ROK made near 2 million trips to China from January to August this year, a 40-percent increase year on year.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

CGTN: How China, ROK leaders open new prospects for ties at Gyeongju meeting

Following a face-to-face meeting between Chinese President Xi Jinping and ROK President Lee Jae-myung in Gyeongju, CGTN published an article highlighting how head-of-state diplomacy sets a new course for China–ROK relations and how the two countries can strengthen strategic communication, deepen cooperation, and promote mutual understanding for the benefits of both peoples and regional peace and development.

Just after dawn in Jeju, the Republic of Korea (ROK), crates of fresh produce are loaded onto a vessel bound for Qingdao in east China.

Launched on October 16, the Qingdao-Jeju container line is Jeju’s first regular international shipping route. Thanks to this route, a journey that once took two weeks can now be completed overnight.

More than just a faster trade link, it signifies a renewed rhythm in China-ROK cooperation. Two weeks later, on November 1, that momentum found its political echo when Chinese President Xi Jinping and ROK President Lee Jae-myung met in Gyeongju, ROK, to chart the next stage of bilateral ties.

At the meeting, President Xi described China and the ROK as “important close neighbors that cannot be moved away and cooperation partners that cannot be separated.” He stressed that “promoting the sound and steady development of China-ROK relations is always a right choice that serves the fundamental interests of the two peoples and conforms to the trend of the times.” Xi’s words set the tone for a relationship that, though tested by changes, continues to move forward with mutual respect and mutual benefit.

‘Important close neighbors that cannot be moved away‘

During the meeting, President Xi called for strengthening strategic communication and consolidating the foundation of mutual trust, urging both sides to respect each other’s social systems and development paths while properly handling differences through friendly consultations. He also emphasized joint efforts to uphold true multilateralism and promote a fairer global governance system.

High-level exchanges have warmed up in recent months. In August, President Lee sent a special delegation led by former National Assembly Speaker Park Byeong-seug to China for a four-day visit, carrying a personal letter from the ROK president with a clear message: to put bilateral relations back on a stable and constructive track. In September, National Assembly Speaker Woo Won-shik attended events marking the 80th anniversary of the victory of the Chinese People’s War of Resistance Against Japanese Aggression and the World Anti-Fascist War in Beijing, followed by Foreign Minister Cho Hyun’s first official visit in his current role, signaling Seoul’s commitment to dialogue and renewed trust.

Niu Xiaoping, assistant research fellow at the Shanghai Institutes for International Studies, sees the Gyeongju meeting as more than a routine encounter. Niu said President Xi’s visit played “a bridging and guiding role,” helping China and the ROK “recalibrate and define a new positioning” for their partnership.

‘Cooperation partners that cannot be separated’

Economic ties have long been the backbone of the relationship. China has been the ROK’s largest trading partner for 21 consecutive years, while the ROK has regained its position as China’s second-largest trading partner. In 2024, bilateral trade reached $328.08 billion, up 5.6 percent year on year.

President Xi called for accelerating the second phase of the China-ROK Free Trade Agreement and tapping the cooperation potential in emerging fields such as AI, biomedicine, green industries and the silver economy.

“To help one’s neighbor succeed is to help oneself,” said Xi. Lee, for his part, stressed that economic cooperation between the two countries is “vital and indispensable” when answering a question from a CMG reporter.

President Xi also highlighted the importance of better communicating with the media and the general public, sending more positive messages and checking tendencies that may harm the relationship.

This emphasis on public perception has found concrete expression in people-to-people exchanges. Since China introduced visa-free entry for ROK visitors last November, and the ROK followed with a temporary visa exemption for Chinese group tourists this fall, travel between the two nations has surged. People from the ROK made near 2 million trips to China from January to August this year, a 40-percent increase year on year.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release5 days ago

XNAP Token Set to Launch on Major DEX Platforms This November 2025 — Fueling the Synapse Power Ecosystem

-

Press Release1 day ago

PepePort Transforms Meme Finance PPORT Presale will be LIVE Monday 3rd November 2025 – Access to the Ultimate Meme Economy Opens Monday

-

Press Release1 week ago

Breaking Barriers for Entrepreneurs: Why Nicholas Sgalitzer Believes NexTech Labs is the Missing Link for Startups

-

Press Release3 days ago

Business Consulting Agency Empowers Los Angeles Businesses with Over 20 Years of Proven Expertise

-

Press Release4 days ago

ReyVend Unveils Next-Generation AI Vending and Smart Cooler Platform, Pioneering the Future of Automated Retail

-

Press Release4 days ago

MiniDoge shines at TechCrunch Disrupt boosting innovation in AI and Web3

-

Press Release6 days ago

Ustyle Magazine Redefines Digital Media with Fashion Beauty and Lifestyle Trends

-

Press Release3 days ago

Illumination Consulting Marks Over 25 Years of Excellence in Digital Strategy and Business Growth from Its Beverly Hills Headquarters