Press Release

Craig Shults Featured in Exclusive Interview on Resilient Leadership and Long-Term Growth

California, US, 18th April 2025, ZEX PR WIRE, A new feature interview shines a spotlight on Craig Shults, a seasoned finance and leadership professional whose career path exemplifies resilience, adaptability, and an unwavering commitment to personal growth. In the exclusive conversation titled “Craig Shults: Growth, Grit, and the Long Game of Leadership,” Craig reflects on his journey from the Mohawk Valley in Upstate New York to his current role as Controller and CFO at JSL Construction in Orange County, California.

In the interview, Craig shares that leadership, for him, isn’t about a title—it’s a mindset and a practice built over time. “Leadership used to mean being in charge—making the decisions, steering the ship,” he says. “Today, I see leadership as a mindset—a daily choice to show up with integrity, stay curious, and bring out the best in others.”

Throughout the conversation, Craig discusses the value of listening, the underrated importance of self-discipline, and how taking ownership—even when you’re not in charge—is essential to long-term success. He also dives into how personal setbacks have played a pivotal role in shaping his leadership style and growth. “You learn more from a setback than from a win,” Craig shares. “That reflection is priceless.”

One of the most engaging parts of the interview explores how Craig supports and mentors others. He emphasizes connection over control, listening over directing, and authenticity over perfection. “I try to model the habits and mindset I’ve found valuable—accountability, curiosity, and clear communication,” he explains.

Known for his work ethic and steady leadership style, Craig attributes much of his drive to the idea of legacy. “I want the work I do—whether it’s building systems, leading a team, or mentoring someone—to outlast me,” he says. “That sense of purpose keeps me going, even when things get tough.”

This insightful interview offers a deeper look into how one leader continues to evolve, stay grounded, and lead with intention—before and beyond the title.

About Craig Shults

Craig Shults is a finance and leadership professional based in Orange County, California. With over three decades of experience across industries—from insurance to construction—he has cultivated a career defined by integrity, self-discipline, and continuous learning. Craig holds multiple degrees and certifications and remains active in philanthropic efforts, supporting causes such as the Cystic Fibrosis Foundation and the Make-A-Wish Foundation.

To read the full interview, click here.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

COOFANDY & Christopher Bell: Dressing the Journey to Victory – A Partnership Story Racing Toward Martinsville Speedway

The partnership between COOFANDY and Joe Gibbs Racing (JGR) alongside their driver Christopher Bell, established earlier this year, has been a dynamic fusion of high-speed motorsport and sophisticated style. As COOFANDY prepares to sponsor the event at Martinsville Speedway on October 26, 2025, let’s revisit the key moments of this thrilling collaboration.

Partnership Journey Recap

May: The Collaboration Begins

During its 10th-anniversary celebrations, COOFANDY officially announced Christopher Bell as its global brand ambassador. The launch also featured the debut of the “Bell’s Picks” product collection and a creative comic series.

June: Father’s Day Special Event

COOFANDY organized a special fan viewing experience during the FireKeepers Casino 400 in Michigan, blending COOFANDY fans with the NASCAR community to celebrate Father’s Day together.

July: Online Interaction & JGR Headquarters Experience

Christopher Bell made a surprise appearance in COOFANDY’s New York live stream, recommending his favorite styles. Subsequently, the brand hosted the “Approaching the Legend Journey,” inviting influencers and fans for an exclusive behind-the-scenes tour of the legendary Joe Gibbs Racing headquarters.

Next Stop: Martinsville – A Crucial Battle in the NASCAR PlayoffsThe partnership is accelerating towards its next highlight: the Xfinity 500 at Martinsville Speedway on October 26, 2025. This is not just another race on the calendar; it’s a critical elimination event in the NASCAR Playoffs Round of 8, where championship hopes are forged or shattered. COOFANDY’s sponsorship of Christopher Bell’s No. 20 Toyota at this pivotal moment underscores COOFANDY’s pursuit of excellence and peak performance. It places COOFANDY at the heart of the action, connecting with millions of passionate fans worldwide during one of the season’s most intense and watched races.

Track Aesthetics: COOFANDY Exclusive Designs Debut

For this landmark race, COOFANDY’s brand identity will be prominently displayed through custom-designed assets that bridge fashion and function:

Car Livery: The No. 20 Toyota will feature a unique livery incorporating COOFANDY’s brand elements. The design seamlessly integrates the brand’s visual identity with dynamic racing aesthetics, using a combination of the brand’s signature colors and sleek graphics that embody both speed and sophistication. The livery is designed to stand out under the track lights, ensuring high visibility and a powerful brand statement.

Firesuit: Christopher Bell will wear a specially designed firesuit featuring COOFANDY’s brand elements and logos. Beyond brand display, this suit reflects a balance of the brand’s elegant style and the rigorous technical demands of a professional driver.

Beyond the Track: COOFANDY’s New Chapter in Sports Marketing

The collaboration with NASCAR and a top-tier driver like Christopher Bell is a strategic cornerstone for COOFANDY’s global marketing expansion. This move leverages NASCAR’s immense popularity and emotional connection to authentically engage with a vast and loyal audience. It interprets COOFANDY’s “Dress the Journey” philosophy in a high-performance environment, linking the brand with values of excellence, precision, and the pursuit of victory. This partnership serves as a powerful engine for enhancing international brand awareness and connecting with new consumers who share a passion for sports and lifestyle.

Conclusion

COOFANDY sincerely thanks all fans for their support throughout this partnership. Don’t miss the next chapter: watch Christopher Bell drive the COOFANDY-branded car at Martinsville Speedway on October 26th. Stay tuned for more updates.

For more information, please visit the COOFANDY website and Amazon storefront, or connect with COOFANDY on Facebook and Instagram.

COOFANDY

Charlotte Liu

New York, US

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

A New Era in the Crypto Market ETH Volume Bot Redefines Success for Token Projects

The Ethereum ecosystem continues to evolve rapidly, with new token projects emerging every day. For many developers, maintaining transparent, consistent, and data-driven liquidity management on decentralized exchanges (DEXs) remains one of the biggest challenges. ETH Volume Bot, a blockchain automation platform, aims to support these needs by offering analytical and operational tools that help projects monitor, manage, and automate their on-chain trading activity in a secure and compliant way.

A Technology-Driven Approach to On-Chain Activity

ethvolumebot.com provides automated infrastructure to assist token teams in managing liquidity, transaction execution, and on-chain analytics on Ethereum-based DEXs. The platform leverages automation to improve transaction efficiency and to help projects better understand their market presence through advanced data insights.

Since its introduction, the system has been utilized by numerous Ethereum-based initiatives to streamline operational processes and optimize smart contract interactions within transparent and regulated frameworks.

Introducing the Batch Transaction Queue (BTQ)

One of ETH Volume Bot’s key innovations is the Batch Transaction Queue (BTQ) — a mechanism designed to optimize transaction efficiency and reduce gas expenditure on the Ethereum network.

BTQ enables multiple small transactions to be processed in a bundled and gas-efficient manner, helping project teams lower operational costs while maintaining transaction transparency and traceability on-chain.

This technology contributes to a more efficient use of network resources, minimizing redundant transactions and improving on-chain data consistency. By reducing gas costs, BTQ enhances accessibility for smaller or early-stage blockchain projects.

Advanced Controls and Analytics

The platform’s automation framework allows project teams to define operational parameters with precision, while the real-time analytics dashboard provides comprehensive visibility into performance metrics.

Teams can track liquidity distribution, trading patterns, and historical data, enabling informed, evidence-based decision-making.

The system integrates seamlessly with leading decentralized exchanges such as Uniswap, SushiSwap, and 1inch, ensuring compatibility with Ethereum-standard liquidity environments.

Security and Non-Custodial Design

Security and control remain top priorities. ETH Volume Bot follows a 100% non-custodial architecture, meaning users maintain full ownership and access to their assets at all times.

All operations are executed directly through Web3 wallets such as MetaMask or WalletConnect, ensuring that no funds are ever transferred to third-party custody.

The platform’s smart contracts have undergone independent security audits, validating their reliability and operational safety.

Transparency and Compliance

ETH Volume Bot emphasizes transparency, auditability, and compliance as fundamental principles of its design.

All on-chain activities are publicly verifiable, and the system operates strictly as a technological and analytical tool — not a financial advisory or promotional mechanism. Its purpose is to empower blockchain projects to manage their operations responsibly and within ethical standards.

About ETH Volume Bot

ETH Volume Bot is a blockchain automation and analytics platform that helps token projects manage transaction efficiency, liquidity operations, and smart contract activity across decentralized exchanges.

The system’s modular infrastructure is built for transparency, security, and operational scalability within the Ethereum ecosystem.

Official website: https://www.ethvolumebot.com

Media Contact

Organization: ETH Volume Bot

Contact Person: Aglae Bergnaum

Website: https://www.ethvolumebot.com

Email: Send Email

Country:United States

Release id:35647

The post A New Era in the Crypto Market ETH Volume Bot Redefines Success for Token Projects appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

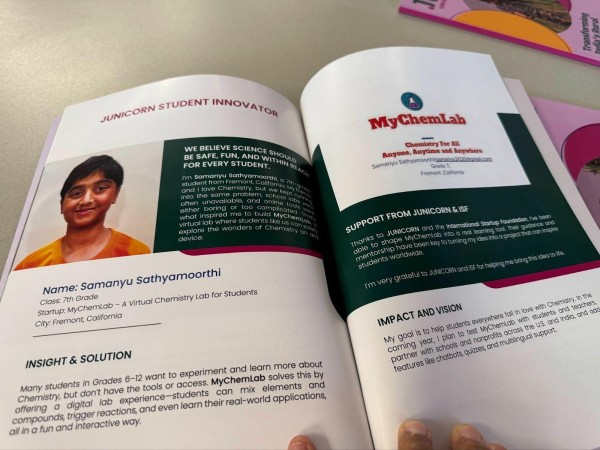

13-Year-Old Samanyu Sathyamoorthi Wins Curiosity Innovation Award at Global AI Summit with MyChemLab-ai Aiming to Solve Worldwide Chemistry Lab Access Crisis

Innovative Virtual Chemistry Platform Leverages Google’s Gemini AI to Create Accessible, Risk-Free STEM Learning for Millions of Students Lacking Hands-On Experience.

United States, 18th Oct 2025 – Samanyu Sathyamoorthi, a 13-year-old innovator, 8th-grade student at John M. Horner Middle School in Fremont, CA, and future attendee of Iron Horse Middle School in San Ramon, CA, has been recognized on the global stage for his pioneering work in educational technology.

Samanyu won the prestigious Achievement: Curiosity/Innovation Award at the ISF Global Junicorn & AI Summit 2025. A student-focused innovation event that took place on May 29-30, 2025 at Texas State University in San Marcos, Texas, convened the world’s most promising student innovators, known as “Junicorns,” to present how they are using cutting-edge AI and technology to solve significant, real-world problems. Samanyu’s platform, MyChemLab.ai, stood out for its profound potential to democratize science education globally.

Photo: (Image of Samanyu Sathyamoorthi receiving his Innovation Award for his project at the summit — MyChemLab.ai at the ISF Global Junicorn & AI Summit 2025, Texas State University, TX.”)

Disrupting the Chemistry Education Gap with AI

MyChemLab.aiis a revolutionary AI-powered virtual chemistry laboratory honored for its mission to make science education more accessible, interactive, and equitable worldwide. The platform’s creation is a direct response to a critical global crisis: the lack of functioning, hands-on chemistry laboratories.

According to research cited by Samanyu, an estimated 15 million students in the U.S. and 75 million students in India—a population equivalent to the combined populations of New York and California—lack the necessary infrastructure for practical, hands-on chemistry experience. This systemic deficit, particularly for students in grades 6 through 12, severely limits opportunities for experimentation, diminishes scientific curiosity, and curtails pathways into vital STEM careers.

“MyChemLab aims to tear down traditional barriers to science education and create equity,” explains Samanyu. “By providing an immersive, risk-free platform accessible on any device, students can experiment with elements and observe reactions that would typically require expensive, dangerous, or unavailable real-world equipment. It’s about making chemistry fun and accessible for every student, anytime and anywhere.”

Technical Depth and The Gemini AI Core

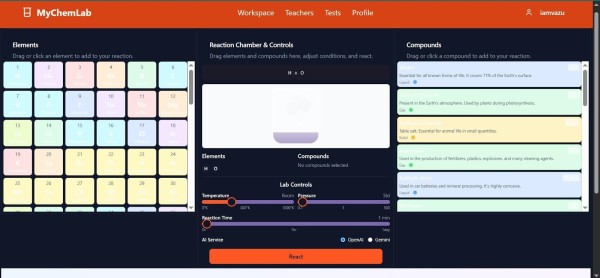

The effectiveness of MyChemLab.ai lies in its sophisticated technical architecture and the intelligent simulation engine at its core. Built on a modern full-stack foundation utilizing React.js for a dynamic front-end and Node.js for the back-end, the application secures student data and class progress via Firebase.

The platform’s core innovation is its deep integration with the Gemini AI Platform. The AI functions as a dynamic reaction engine, simulating complex chemical interactions with realistic fidelity. This capability allows students to manipulate environmental variables—including adjustable Pressure, Temperature, and Reaction Time controls—to observe cause-and-effect in real-time, replicating the unpredictability and rigor of a physical lab without any associated risk or cost.

Key features driving this educational depth include:

- A comprehensive chemical database containing over 115 elements and 30 compounds.

- Realistic outcome modeling via the Gemini AI Platform.

- Separate teacher and student portals designed to seamlessly integrate into classroom curricula, enabling assignments, collaborative learning, and standardized assessments.

The project is already demonstrating tangible impact, currently serving 40 active users and undergoing live testing in classrooms across the U.S. and India.

Photo: (Image of Samanyu Sathyamoorthi with his project at the summit — presenting MyChemLab.ai at the ISF Global Junicorn & AI Summit 2025, Texas State University, Austin, TX.”)

Validation and Educational Impact

The project has garnered significant praise from both the technical and educational communities, validating its promise as a transformative learning tool.

“It’s truly impressive to see someone your age harness AI for such a complex subject like chemistry,” said Dr. Sumathy Kumar, Ph.D., Chemistry Educator in India. “Projects like yours show us the incredible potential of young minds and remind us that the future of science is bright.”

Mitran, Director of Marketing at the ISF Global Summit, echoed this sentiment, adding, “I’m really impressed with the depth you’ve covered—from the secure login flow to the way you’ve integrated interactive sliders for variable manipulation. This is professional-grade application development.”

Educators have been instrumental in guiding the platform’s development. Ms. Corine Benedetti, a FUSD Teacher, provided constructive input, noting, “As someone with limited experience in chemistry, I think it could be very helpful to have a tutorial or suggested experiment section. That feedback will definitely help guide its next phase of development.” This practical feedback confirms MyChemLab.ai’s relevance and accessibility for a broad range of student and educator proficiency levels.

Photo: (Insert image of MyChemLab – “A screenshot of MyChemLab’s virtual experiment interface, featuring sliders for temperature, pressure, and time.”)

Next Steps and Expanding the Vision

Following his success at the ISF Summit, Samanyu is preparing to submit MyChemLab.ai to the prestigious 2025 Congressional App Challenge, which celebrates student innovation in computer science. His goal is to represent his schools and community at the national level, continuing to showcase how technology can equalize learning opportunities. He will be representing California’s 10th Congressional District (Rep. Mark DeSaulnier) from Iron Horse Middle School in San Ramon.

Looking ahead, Samanyu plans to dramatically enhance the platform’s pedagogical power:

- Integrating a built-in, real-time AI chatbot tutor that explains complex chemical principles and provides academic assistance.

- Introducing advanced Augmented Reality (AR) and Virtual Reality (VR) experiences for truly immersive experimentation.

- Adding gamification elements like badges and leaderboards to boost long-term student engagement and interest.

“Winning this award motivates me to keep building tools that make science accessible,” Samanyu shared. “I want every student, no matter where they are, to have the chance to explore the magic of chemistry.”

About ISF Global Junicorn & AI Summit

The Innovation STEM Foundation (ISF) hosts the Global Junicorn & AI Summit annually to inspire and recognize young innovators in AI, robotics, and sustainability. The 2025 event featured over 300 student innovators from 10+ countries, with judging panels comprised of academic and technology leaders.

Media Contact

Rocky Zester

crazyme2207@gmail.com

Project Website: www.mychemlab.ai

Student Innovation Channel:

https://www.youtube.com/channel/UCJ6UEab559ioCDRZ7LH_6sw/

Fremont & San Ramon, California

Media Contact

Organization: Silicon Stem

Contact Person: Rocky Zester

Website: https://www.mychemlab.ai/

Email: Send Email

Country:United States

Release id:35641

The post 13-Year-Old Samanyu Sathyamoorthi Wins Curiosity Innovation Award at Global AI Summit with MyChemLab-ai Aiming to Solve Worldwide Chemistry Lab Access Crisis appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release1 day ago

Futuromining Launches XRP Mining Contracts – XRP Holders Earn $5,777 Daily

-

Press Release1 week ago

Dream California Getaway Names Bestselling Author & Fighting Entrepreneur Tony Deoleo Official Spokesperson Unveils Menifee Luxury Retreat

-

Press Release6 days ago

Pool Cover Celebrates Over 10 Years of Service in Potchefstroom as Swimming Pool Cover Market Grows Four Point Nine Percent Annually

-

Press Release1 day ago

13-Year-Old Samanyu Sathyamoorthi Wins Curiosity Innovation Award at Global AI Summit with MyChemLab-ai Aiming to Solve Worldwide Chemistry Lab Access Crisis

-

Press Release5 days ago

Weightloss Clinic Near Me Online Directory USA Launches Nationwide Platform to Help Americans Find Trusted Weight Loss Clinics

-

Press Release1 week ago

James Jara New Book Empowers CTOs and HR Leaders to Build High-Performing Remote Teams Across Latin America

-

Press Release1 week ago

Beyond Keyboards and Mice: ProtoArc Shines at IFA 2025 with Full Ergonomic Ecosystem

-

Press Release4 days ago

La Maisonaire Redefines Luxury Furniture in Dubai with Bespoke Designs for Homes Offices and Hotels