Press Release

The High Costs of Payment Processing for High-Risk Businesses and How to Manage Them

United States, 15th Apr 2025 – For businesses operating in high-risk industries, payment processing can often feel like an uphill battle. Between excessive fees, unpredictable account holds, and outright rejections from traditional banks, many businesses find themselves in a financial squeeze with few viable options. But while high processing costs might seem like an unavoidable price of doing business, solutions exist to help companies cut costs without sacrificing efficiency.

Why high-risk businesses face higher fees

Traditional payment processors tend to shy away from industries labeled as high risk. Whether due to regulatory challenges, chargeback concerns, or financial instability, banks and mainstream processors impose higher transaction fees or refuse to work with businesses in these sectors altogether. As a result, business owners often see their payment processing costs soar.

These added expenses can eat away at profit margins and make it harder for businesses to grow. Yet, according to industry experts, there are ways to navigate these challenges effectively.

Finding cost-effective payment solutions

Rather than relying on traditional banks that may not understand the needs of high-risk businesses, many entrepreneurs are turning to specialized payment processors. These providers offer tailored solutions designed to accommodate the specific challenges of high-risk industries, often with more competitive pricing, faster approval times, and fewer restrictions.

“Businesses in high-risk industries need payment solutions that work with them, not against them,” says Jeff Ragsdale, vice president of sales at eDebit Direct. “By choosing the right payment processor, companies can significantly reduce fees, avoid unnecessary delays, and streamline their transactions.”

Leveraging technology to reduce costs

Modern payment technologies do more than just reduce fees, they also help businesses operate more efficiently. The latest advancements in payment technology allow businesses to integrate secure, automated payment systems that minimize transaction friction and reduce operational costs.

For high-risk businesses, the key is to find a provider that offers reliable payment options without excessive fees or restrictive terms. Companies like eDebit specialize in serving high-risk industries by providing seamless payment solutions that help businesses maintain smooth financial operations while keeping costs in check.

A path forward for high-risk businesses

While high-risk businesses may always face additional scrutiny from traditional financial institutions, they don’t have to accept excessive fees as an inevitable burden. By partnering with the right payment processor, businesses can take control of their financial future, reduce operational expenses, and ensure that payment processing is an asset rather than an obstacle.

For more information about managing payment processing costs and exploring alternative solutions, contact Jeff Ragsdale at eDebit Direct via email at jeff@edebitdirect.com or visit www.edebitdirect.com.

For media inquires, contact Lisa Farias at lisa@edebitdirect.com.

About eDebit Direct

eDebit Direct is a leading provider of payment processing solutions tailored for high-risk businesses. With a commitment to reliability, security, and cost-effectiveness, eDebit Direct helps businesses navigate the complexities of payment acceptance while minimizing fees and maximizing efficiency.

Media Contact

Organization: eDebit Direct LLC

Contact Person: Jeff Ragsdale

Website: https://www.edebitdirect.com

Email: Send Email

Country:United States

Release id:26480

View source version on King Newswire:

The High Costs of Payment Processing for High-Risk Businesses and How to Manage Them

It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

A New Era in the Crypto Market ETH Volume Bot Redefines Success for Token Projects

The Ethereum ecosystem continues to evolve rapidly, with new token projects emerging every day. For many developers, maintaining transparent, consistent, and data-driven liquidity management on decentralized exchanges (DEXs) remains one of the biggest challenges. ETH Volume Bot, a blockchain automation platform, aims to support these needs by offering analytical and operational tools that help projects monitor, manage, and automate their on-chain trading activity in a secure and compliant way.

A Technology-Driven Approach to On-Chain Activity

ethvolumebot.com provides automated infrastructure to assist token teams in managing liquidity, transaction execution, and on-chain analytics on Ethereum-based DEXs. The platform leverages automation to improve transaction efficiency and to help projects better understand their market presence through advanced data insights.

Since its introduction, the system has been utilized by numerous Ethereum-based initiatives to streamline operational processes and optimize smart contract interactions within transparent and regulated frameworks.

Introducing the Batch Transaction Queue (BTQ)

One of ETH Volume Bot’s key innovations is the Batch Transaction Queue (BTQ) — a mechanism designed to optimize transaction efficiency and reduce gas expenditure on the Ethereum network.

BTQ enables multiple small transactions to be processed in a bundled and gas-efficient manner, helping project teams lower operational costs while maintaining transaction transparency and traceability on-chain.

This technology contributes to a more efficient use of network resources, minimizing redundant transactions and improving on-chain data consistency. By reducing gas costs, BTQ enhances accessibility for smaller or early-stage blockchain projects.

Advanced Controls and Analytics

The platform’s automation framework allows project teams to define operational parameters with precision, while the real-time analytics dashboard provides comprehensive visibility into performance metrics.

Teams can track liquidity distribution, trading patterns, and historical data, enabling informed, evidence-based decision-making.

The system integrates seamlessly with leading decentralized exchanges such as Uniswap, SushiSwap, and 1inch, ensuring compatibility with Ethereum-standard liquidity environments.

Security and Non-Custodial Design

Security and control remain top priorities. ETH Volume Bot follows a 100% non-custodial architecture, meaning users maintain full ownership and access to their assets at all times.

All operations are executed directly through Web3 wallets such as MetaMask or WalletConnect, ensuring that no funds are ever transferred to third-party custody.

The platform’s smart contracts have undergone independent security audits, validating their reliability and operational safety.

Transparency and Compliance

ETH Volume Bot emphasizes transparency, auditability, and compliance as fundamental principles of its design.

All on-chain activities are publicly verifiable, and the system operates strictly as a technological and analytical tool — not a financial advisory or promotional mechanism. Its purpose is to empower blockchain projects to manage their operations responsibly and within ethical standards.

About ETH Volume Bot

ETH Volume Bot is a blockchain automation and analytics platform that helps token projects manage transaction efficiency, liquidity operations, and smart contract activity across decentralized exchanges.

The system’s modular infrastructure is built for transparency, security, and operational scalability within the Ethereum ecosystem.

Official website: https://www.ethvolumebot.com

Media Contact

Organization: ETH Volume Bot

Contact Person: Aglae Bergnaum

Website: https://www.ethvolumebot.com

Email: Send Email

Country:United States

Release id:35647

The post A New Era in the Crypto Market ETH Volume Bot Redefines Success for Token Projects appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

13-Year-Old Samanyu Sathyamoorthi Wins Curiosity Innovation Award at Global AI Summit with MyChemLab-ai Aiming to Solve Worldwide Chemistry Lab Access Crisis

Innovative Virtual Chemistry Platform Leverages Google’s Gemini AI to Create Accessible, Risk-Free STEM Learning for Millions of Students Lacking Hands-On Experience.

United States, 18th Oct 2025 – Samanyu Sathyamoorthi, a 13-year-old innovator, 8th-grade student at John M. Horner Middle School in Fremont, CA, and future attendee of Iron Horse Middle School in San Ramon, CA, has been recognized on the global stage for his pioneering work in educational technology.

Samanyu won the prestigious Achievement: Curiosity/Innovation Award at the ISF Global Junicorn & AI Summit 2025. A student-focused innovation event that took place on May 29-30, 2025 at Texas State University in San Marcos, Texas, convened the world’s most promising student innovators, known as “Junicorns,” to present how they are using cutting-edge AI and technology to solve significant, real-world problems. Samanyu’s platform, MyChemLab.ai, stood out for its profound potential to democratize science education globally.

Photo: (Image of Samanyu Sathyamoorthi receiving his Innovation Award for his project at the summit — MyChemLab.ai at the ISF Global Junicorn & AI Summit 2025, Texas State University, TX.”)

Disrupting the Chemistry Education Gap with AI

MyChemLab.aiis a revolutionary AI-powered virtual chemistry laboratory honored for its mission to make science education more accessible, interactive, and equitable worldwide. The platform’s creation is a direct response to a critical global crisis: the lack of functioning, hands-on chemistry laboratories.

According to research cited by Samanyu, an estimated 15 million students in the U.S. and 75 million students in India—a population equivalent to the combined populations of New York and California—lack the necessary infrastructure for practical, hands-on chemistry experience. This systemic deficit, particularly for students in grades 6 through 12, severely limits opportunities for experimentation, diminishes scientific curiosity, and curtails pathways into vital STEM careers.

“MyChemLab aims to tear down traditional barriers to science education and create equity,” explains Samanyu. “By providing an immersive, risk-free platform accessible on any device, students can experiment with elements and observe reactions that would typically require expensive, dangerous, or unavailable real-world equipment. It’s about making chemistry fun and accessible for every student, anytime and anywhere.”

Technical Depth and The Gemini AI Core

The effectiveness of MyChemLab.ai lies in its sophisticated technical architecture and the intelligent simulation engine at its core. Built on a modern full-stack foundation utilizing React.js for a dynamic front-end and Node.js for the back-end, the application secures student data and class progress via Firebase.

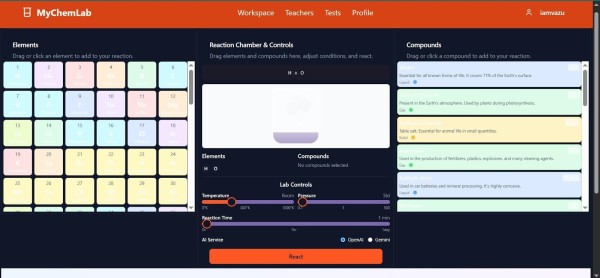

The platform’s core innovation is its deep integration with the Gemini AI Platform. The AI functions as a dynamic reaction engine, simulating complex chemical interactions with realistic fidelity. This capability allows students to manipulate environmental variables—including adjustable Pressure, Temperature, and Reaction Time controls—to observe cause-and-effect in real-time, replicating the unpredictability and rigor of a physical lab without any associated risk or cost.

Key features driving this educational depth include:

- A comprehensive chemical database containing over 115 elements and 30 compounds.

- Realistic outcome modeling via the Gemini AI Platform.

- Separate teacher and student portals designed to seamlessly integrate into classroom curricula, enabling assignments, collaborative learning, and standardized assessments.

The project is already demonstrating tangible impact, currently serving 40 active users and undergoing live testing in classrooms across the U.S. and India.

Photo: (Image of Samanyu Sathyamoorthi with his project at the summit — presenting MyChemLab.ai at the ISF Global Junicorn & AI Summit 2025, Texas State University, Austin, TX.”)

Validation and Educational Impact

The project has garnered significant praise from both the technical and educational communities, validating its promise as a transformative learning tool.

“It’s truly impressive to see someone your age harness AI for such a complex subject like chemistry,” said Dr. Sumathy Kumar, Ph.D., Chemistry Educator in India. “Projects like yours show us the incredible potential of young minds and remind us that the future of science is bright.”

Mitran, Director of Marketing at the ISF Global Summit, echoed this sentiment, adding, “I’m really impressed with the depth you’ve covered—from the secure login flow to the way you’ve integrated interactive sliders for variable manipulation. This is professional-grade application development.”

Educators have been instrumental in guiding the platform’s development. Ms. Corine Benedetti, a FUSD Teacher, provided constructive input, noting, “As someone with limited experience in chemistry, I think it could be very helpful to have a tutorial or suggested experiment section. That feedback will definitely help guide its next phase of development.” This practical feedback confirms MyChemLab.ai’s relevance and accessibility for a broad range of student and educator proficiency levels.

Photo: (Insert image of MyChemLab – “A screenshot of MyChemLab’s virtual experiment interface, featuring sliders for temperature, pressure, and time.”)

Next Steps and Expanding the Vision

Following his success at the ISF Summit, Samanyu is preparing to submit MyChemLab.ai to the prestigious 2025 Congressional App Challenge, which celebrates student innovation in computer science. His goal is to represent his schools and community at the national level, continuing to showcase how technology can equalize learning opportunities. He will be representing California’s 10th Congressional District (Rep. Mark DeSaulnier) from Iron Horse Middle School in San Ramon.

Looking ahead, Samanyu plans to dramatically enhance the platform’s pedagogical power:

- Integrating a built-in, real-time AI chatbot tutor that explains complex chemical principles and provides academic assistance.

- Introducing advanced Augmented Reality (AR) and Virtual Reality (VR) experiences for truly immersive experimentation.

- Adding gamification elements like badges and leaderboards to boost long-term student engagement and interest.

“Winning this award motivates me to keep building tools that make science accessible,” Samanyu shared. “I want every student, no matter where they are, to have the chance to explore the magic of chemistry.”

About ISF Global Junicorn & AI Summit

The Innovation STEM Foundation (ISF) hosts the Global Junicorn & AI Summit annually to inspire and recognize young innovators in AI, robotics, and sustainability. The 2025 event featured over 300 student innovators from 10+ countries, with judging panels comprised of academic and technology leaders.

Media Contact

Rocky Zester

crazyme2207@gmail.com

Project Website: www.mychemlab.ai

Student Innovation Channel:

https://www.youtube.com/channel/UCJ6UEab559ioCDRZ7LH_6sw/

Fremont & San Ramon, California

Media Contact

Organization: Silicon Stem

Contact Person: Rocky Zester

Website: https://www.mychemlab.ai/

Email: Send Email

Country:United States

Release id:35641

The post 13-Year-Old Samanyu Sathyamoorthi Wins Curiosity Innovation Award at Global AI Summit with MyChemLab-ai Aiming to Solve Worldwide Chemistry Lab Access Crisis appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

Press Release

Corvix (CRV) Redefines DeFi with AI Automation and Smart Contract Security

The decentralized finance sector is entering a new phase of intelligence and automation as Corvix (CRV) emerges with a mission to revolutionize how blockchain ecosystems operate. Leveraging artificial intelligence, real-time analytics, and cross-chain infrastructure, Corvix introduces a smarter, more secure, and adaptive form of decentralized finance.

The project’s vision is simple yet ambitious — to make DeFi systems capable of thinking, learning, and responding in real time. Through AI-driven automation and autonomous security auditing, Corvix (CRV) aims to remove inefficiencies that have long limited scalability and safety in the DeFi market.

Bringing Intelligence to DeFi

While DeFi has unlocked unprecedented financial freedom, it still faces challenges such as fragmented liquidity, manual yield optimization, and the persistent threat of smart-contract exploits. Corvix (CRV) addresses these challenges by introducing an integrated AI engine that continuously analyzes blockchain data, predicts market behavior, and executes automated actions to protect and optimize capital.

The Corvix AI core functions as the ecosystem’s brain — processing vast on-chain data streams, identifying patterns, and making predictive adjustments across liquidity pools and trading routes. This transforms DeFi from a static, rule-based environment into a living, learning system capable of adapting to dynamic market conditions.

“Decentralized finance is powerful, but it needs intelligence to reach its full potential,” said a Corvix representative. “By embedding AI at the protocol level, Corvix (CRV) allows the system to anticipate risk, enhance performance, and secure value for every participant.”

AI-Powered Smart Contract Auditor

Security is at the heart of Corvix’s innovation. Its AI Smart Contract Auditor continuously scans smart-contract code, learning from past exploits and newly emerging vulnerabilities. Traditional audits are point-in-time evaluations; Corvix replaces them with an always-on, adaptive audit system that evolves alongside DeFi itself.

Using advanced machine-learning algorithms, the auditor identifies abnormal transaction behaviors, logic flaws, or potential vulnerabilities before deployment. It automatically reports findings to developers and flags critical issues in real time.

This dynamic approach positions Corvix (CRV) as one of the first AI-enabled security layers built directly into a DeFi protocol — not as a third-party service, but as an integral part of the blockchain’s nervous system.

By automating threat detection and compliance verification, Corvix dramatically reduces the risks that have historically eroded user trust in decentralized systems.

Automation That Works for You

Beyond security, automation lies at the core of the Corvix experience. The platform’s Yield Optimization Engine uses predictive analytics to rebalance liquidity and maximize capital efficiency across multiple protocols.

Instead of requiring users to manually move assets between pools or chase APYs, Corvix’s AI agent analyzes thousands of variables — from gas fees and pool depth to historical volatility — and automatically allocates liquidity to the most favorable positions.

This level of intelligent automation not only enhances profitability but also simplifies participation for everyday users, eliminating the complexity that often discourages newcomers from entering DeFi.

Cross-Chain Compatibility and Data Marketplace

Corvix (CRV) is built for a multichain future. Its architecture enables seamless interaction between major blockchains such as Ethereum, BNB Chain, Solana, and upcoming layer-2 networks, ensuring that liquidity and functionality are never confined to a single ecosystem.

This interoperability allows Corvix to act as a universal intelligence layer — connecting fragmented DeFi protocols under one analytical framework.

Complementing this is the Decentralized AI Data Marketplace, another core feature in development. The marketplace provides verified, anonymized datasets for AI model training, allowing developers and researchers to build smarter decentralized applications while earning CRV tokens for their contributions.

This initiative transforms Corvix from a DeFi protocol into a broader AI-data economy — one that supports innovation across the entire Web3 landscape.

The Role of the CRV Token

At the foundation of the Corvix ecosystem lies the CRV token, which fuels governance, staking, and platform utilities. Token holders can participate in DAO-based decision-making, access premium analytics tools, and receive rewards for contributing to network security and liquidity. Staking will play a pivotal role, enabling users to lock CRV tokens in exchange for participation benefits and early access to ecosystem features. This system encourages long-term engagement and aligns incentives between the community, developers, and institutional partners.

Advancing the AI-DeFi Narrative

The integration of AI into decentralized finance is one of the most powerful narratives in blockchain today. Corvix (CRV) is at the forefront of this movement, turning theoretical potential into practical application. Its adaptive automation, continuous auditing, and cross-chain intelligence mark a turning point for how DeFi can evolve — from a reactive system to one that is predictive, secure, and user-centric.

Market analysts increasingly point to AI-driven DeFi platforms as the next frontier for Web3 growth. Corvix’s technology aligns perfectly with this trend, combining data-driven logic with transparent, decentralized architecture.

Looking Ahead

The Corvix roadmap extends well beyond its token launch. Upcoming milestones include:

- Deployment of the AI Auditor across additional chains.

- Public release of the DeFi analytics dashboard.

- Expansion of the data marketplace to support third-party AI developers.

- Launch of the Corvix mobile application for real-time monitoring and staking.

Each phase reinforces Corvix’s commitment to building a more intelligent, automated, and secure decentralized economy.

About Corvix

Corvix (CRV) is an AI-powered decentralized finance platform built to enhance efficiency, transparency, and safety across blockchain ecosystems. By combining AI automation, real-time analytics, and smart-contract security, Corvix empowers users to participate in a truly intelligent financial environment.

Discover more at https://corvix.net/

About Author

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Digi Observer journalist was involved in the writing and production of this article.

-

Press Release7 days ago

Dream California Getaway Names Bestselling Author & Fighting Entrepreneur Tony Deoleo Official Spokesperson Unveils Menifee Luxury Retreat

-

Press Release5 days ago

Pool Cover Celebrates Over 10 Years of Service in Potchefstroom as Swimming Pool Cover Market Grows Four Point Nine Percent Annually

-

Press Release4 days ago

Weightloss Clinic Near Me Online Directory USA Launches Nationwide Platform to Help Americans Find Trusted Weight Loss Clinics

-

Press Release7 days ago

James Jara New Book Empowers CTOs and HR Leaders to Build High-Performing Remote Teams Across Latin America

-

Press Release7 days ago

Beyond Keyboards and Mice: ProtoArc Shines at IFA 2025 with Full Ergonomic Ecosystem

-

Press Release3 days ago

La Maisonaire Redefines Luxury Furniture in Dubai with Bespoke Designs for Homes Offices and Hotels

-

Press Release4 days ago

Planner Events Unveils Comprehensive Event Planning Checklist to Transform South African Event Management

-

Press Release5 days ago

MasterQuant Introduces Next-Gen AI System for Smarter Market Execution